Professional Documents

Culture Documents

Estimate

Uploaded by

Himali BarmanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Estimate

Uploaded by

Himali BarmanCopyright:

Available Formats

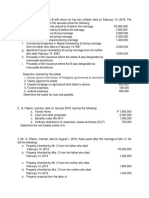

Basic Information

Assessment Year * Taxpayer Category

2024-25 Individual

Residential Status *

RES (Resident)

Your Age

Below 60 years Between 60 - 79 years 80 and above

(Regular Citizen) (Senior Citizen) (Super Senior Citizen)

Due Date for Submission of Return * Actual Date for Submission of Return *

31-Jul-2024 01-Apr-2024

Estimated Tax

View Comparison

Income Detail

(as per old Tax regime) (as per new Tax regime)

Income under the head Salaries 1165650 1205000

Gross Salary 1255000 1255000

Exemption claimed u/s 10 36850 N/A

Deduction u/s 16(ia) 50000 50000

Deduction u/s 16(ii) N/A

Deduction u/s 16(iii) 2500 N/A

Income under the head House Property 0 0

a. Income from self occupied house property 0 0

Interest on Borrowed Capital N/A

b. Income from Let-out Property

1. Annual Letable Value/ Rent Received or Receivable 0 0

2. Less: Municipal Taxes Paid During the Year

3. Less:Unrealized Rent

Net Annual Value u/s 23 [1-(2+3)] 0 0

Less: Standard Deduction u/s 24(a) 0 0

Less: Interest Payable on Borrowed Capital u/s 24(b)

Income under the head Capital Gains 0 0

Short Term Capital Gains (Other than covered under section 111A) Total 0 0

From 01-Apr to 15-Jun

From 16-Jun to 15-Sep

From 16-Sep to 15-Dec

From 16-Dec to 15-Mar

From 16-Mar to 31-Mar

Short Term Capital Gains (Covered under section 111A) Total 0 0

From 01-Apr to 15-Jun

From 16-Jun to 15-Sep

From 16-Sep to 15-Dec

From 16-Dec to 15-Mar

From 16-Mar to 31-Mar

Long Term Capital Gains (Charged to tax @ 20%) Total 0 0

From 01-Apr to 15-Jun

From 16-Jun to 15-Sep

From 16-Sep to 15-Dec

From 16-Dec to 15-Mar

From 16-Mar to 31-Mar

Long Term Capital Gains (Charged to tax @ 10%, other than LTCG u/s 112A) Total 0 0

From 01-Apr to 15-Jun

From 16-Jun to 15-Sep

From 16-Sep to 15-Dec

From 16-Dec to 15-Mar

From 16-Mar to 31-Mar

Long Term Capital Gains u/s 112A(Charged to tax @ 10%) Total 0 0

From 01-Apr-to 15-Jun

From 16-Jun to 15-Sep

From 16-Sep to 15-Dec

From 16-Dec to 15-Mar

From 16-Mar to 31-Mar

Income under the head Business or Profession 0 0

Presumptive Income u/s 44AD,44ADA

Other income from Business or Profession. 0 0

Income under the head Other Sources 0 0

(i) Interest from Savings bank account

(ii) Other Interest Income 0 0

(iii) Winning from Lottery, crossword puzzles etc. 0 0

(iv) Any other income 0 0

Gross Total Income 1165650 1205000

Deduction Details

(as per old Tax regime) (as per new Tax regime)

Deductions u/s 80C(LIC, PF, PPF, NSC, Repayment of Housing Loan, etc.) 135000 N/A

Deduction u/s 80CCC(Payment in respect Pension Fund) N/A

Deductions u/s 80CCD(1)(Employees / Self-employed contribution N/A

Deductions u/s 80CCD (1B)(Additional Employees contribution towards NPS) N/A

Deductions u/s 80CCD (2)(Employers contribution towards NPS)

Total Deductions 135000 0

Deductions u/s 80D(MediClaim Premium) 18385 N/A

Deductions u/s 80G(Donations) N/A

Deductions u/s 80E(Interest on Loan for Higher Education) N/A

Deductions u/s 80EE(Interest on Loan taken for Residential House) N/A

Deductions u/s 80TTA(Interest on Savings Bank Account) N/A

Deductions u/s 80TTB(Interest on Deposits) 0 N/A

Any other deduction 0 N/A

Tax Details

(as per old Tax regime) (as per new Tax regime)

Taxable Income 1012265 1205000

1. Tax at Normal Rates 116179 91000

2. Tax at Special Rates (Capital Gains, Lottery, etc.) 0 0

Short Term Capital Gains (Covered u/s 111A) 0 0

Long Term Capital Gains (Charged to Tax @20%) 0 0

Long Term Capital Gains (Charged to tax @ 10%, other than LTCG u/s 112A) 0 0

Long Term Capital Gains u/s 112A(Charged to tax @ 10%) 0 0

Winnings (from Lottery, Crossword Puzzles, etc.) 0 0

Total Tax before Rebate 116179 91000

Less: Tax Rebate u/s 87A 0 0

Total Tax before Rebate 116179 91000

Surcharge 0 0

Add: Health & Education Cess 4647 3640

Total Tax on Income 120826 94640

TDS/TCS 0 0

Self-Assessment Tax / Advance Tax 0 0

Balance Tax Payable / Refundable 120830 94640

Add: Interest u/s 234A 0 0

Add: Interest u/s 234B 1208 946

Add: Interest u/s 234C 6098 4771

Add: Fees for late filing of return u/s 234F 0 0

Total Tax and Interest payable 128130 100360

You might also like

- J6Hooo009310710000r0313131DE64F521 PDFDocument1 pageJ6Hooo009310710000r0313131DE64F521 PDFRoll KingsNo ratings yet

- CPA Taxation by Ampongan - Principles of TaxationDocument43 pagesCPA Taxation by Ampongan - Principles of TaxationVictor Tuco100% (1)

- Employee Salary Slip For August, 2022: Lucky Cement LimitedDocument124 pagesEmployee Salary Slip For August, 2022: Lucky Cement LimitedAdeen MohsinNo ratings yet

- MR A, Filipino, Married To B With Whom He Has Two Children Died On February 14, 2018. TheDocument3 pagesMR A, Filipino, Married To B With Whom He Has Two Children Died On February 14, 2018. TheSharjaaah100% (2)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- FA Question Bank TT1-1Document14 pagesFA Question Bank TT1-1rock SINGHALNo ratings yet

- Latest Tax CalculatIor 3.3.2Document16 pagesLatest Tax CalculatIor 3.3.2Bijender Pal Choudhary100% (3)

- Computation of Total Income Income From Business or Profession (Chapter IV D) 273151Document3 pagesComputation of Total Income Income From Business or Profession (Chapter IV D) 273151AVINASH TIWASKARNo ratings yet

- EstimateDocument1 pageEstimateshrikrishnapunjabNo ratings yet

- EstimateDocument1 pageEstimateikan flyNo ratings yet

- EstimateDocument1 pageEstimatesandeep sandyNo ratings yet

- EstimateDocument1 pageEstimateAtulPalNo ratings yet

- Income Tax Computation: Less: Standard Deduction U/S 16Document10 pagesIncome Tax Computation: Less: Standard Deduction U/S 16sidrijegnoNo ratings yet

- EstimateDocument1 pageEstimateSrinivasarao ObillaNo ratings yet

- CalculateDocument1 pageCalculateanurag tiwariNo ratings yet

- CalculateDocument1 pageCalculateJaya Prakash ReddyNo ratings yet

- IT Computation Sheet - 2019 - 20Document13 pagesIT Computation Sheet - 2019 - 20muthum44499335No ratings yet

- Summary 1689086671Document4 pagesSummary 1689086671Akshay SharmaNo ratings yet

- Tax Calculator - Indian Income Tax 2008-09Document7 pagesTax Calculator - Indian Income Tax 2008-09Jayamohan100% (29)

- CalculateDocument1 pageCalculateSneha dhakoliyaNo ratings yet

- Calculation FormatDocument13 pagesCalculation FormatSahil Swaynshree SahooNo ratings yet

- Itr-1 Sahaj Individual Income Tax Return: Part A General InformationDocument5 pagesItr-1 Sahaj Individual Income Tax Return: Part A General InformationLala SachinNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21Raj KatochNo ratings yet

- Revised Estimation - FY 2023-24Document1 pageRevised Estimation - FY 2023-24Debojyoti MukherjeeNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21शुभम निकमNo ratings yet

- Calculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10Document10 pagesCalculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10api-19754583No ratings yet

- Itr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 657677800180618 Assessment Year: 2018-19Document5 pagesItr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 657677800180618 Assessment Year: 2018-19P SaravanababuNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 187409060100121 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 187409060100121 Assessment Year: 2020-21MOHAN KORA GOVINDARAJULUNo ratings yet

- Income Tax Calculator Fy 2020 21 v1Document8 pagesIncome Tax Calculator Fy 2020 21 v1Yogesh BajajNo ratings yet

- Itr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 640703040090618 Assessment Year: 2018-19Document5 pagesItr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 640703040090618 Assessment Year: 2018-19Lokesh Ujjainia UjjainiaNo ratings yet

- Itr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 805020150170718 Assessment Year: 2018-19Document5 pagesItr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 805020150170718 Assessment Year: 2018-19nassarkiNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 371707780280620 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 371707780280620 Assessment Year: 2020-21Upen PalNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsRyan VillamorNo ratings yet

- Case Study 2Document2 pagesCase Study 2Anil NagarajNo ratings yet

- Income Tax Calculator Fy 2020 21 v2Document12 pagesIncome Tax Calculator Fy 2020 21 v2Anonymous Clm40C1No ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsmelanie vistalNo ratings yet

- ITR-1 Form PDFDocument3 pagesITR-1 Form PDFAravind S NarayanNo ratings yet

- GAMDOORDocument2 pagesGAMDOORRashpreet PandiNo ratings yet

- Page 4Document1 pagePage 4Carol MNo ratings yet

- JonnyDocument3 pagesJonnyAbid AliNo ratings yet

- Page 4 ItrDocument1 pagePage 4 ItrariannemungcalcpaNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 244195670070221 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 244195670070221 Assessment Year: 2020-21Simran Jeet SinghNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument2 pages1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsrj aNo ratings yet

- Tax Calculator Version 2Document4 pagesTax Calculator Version 2SoikotNo ratings yet

- Free Auto Tax Calculator FY-09-10 Version 4 (1) After Budget 06-07-2009Document16 pagesFree Auto Tax Calculator FY-09-10 Version 4 (1) After Budget 06-07-2009Bijender Pal ChoudharyNo ratings yet

- Submitted Status:: Sales Tax Credit Gross Value Taxable Value Sales TaxDocument4 pagesSubmitted Status:: Sales Tax Credit Gross Value Taxable Value Sales TaxaizazbarkiNo ratings yet

- Form PDF 762728030311221Document6 pagesForm PDF 762728030311221AKASH SINGHNo ratings yet

- Karmi Devi - ITR 22 23Document3 pagesKarmi Devi - ITR 22 23R C SHARMANo ratings yet

- Form PDF 471387520080921Document6 pagesForm PDF 471387520080921PriyanshuNo ratings yet

- Coi 23-24 Lalu YadavDocument2 pagesCoi 23-24 Lalu Yadavtejpalsinghyadav786No ratings yet

- IT Calculator 2018 LiteDocument6 pagesIT Calculator 2018 LiteHr PoonamNo ratings yet

- Sample ITR Page 4Document1 pageSample ITR Page 4Eduardo BallesterNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 927956830281220 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 927956830281220 Assessment Year: 2020-21Nannuri KrishnaNo ratings yet

- Transactions Assets Liabilities + Patent $120,000 + Cash 80,000 - Cash $2,500Document10 pagesTransactions Assets Liabilities + Patent $120,000 + Cash 80,000 - Cash $2,500abhishauryaNo ratings yet

- Form PDF 979375070110323Document11 pagesForm PDF 979375070110323Aditi GoelNo ratings yet

- Form PDF 927448140281220Document7 pagesForm PDF 927448140281220Arvind KumarNo ratings yet

- Form PDF 927448140281220Document7 pagesForm PDF 927448140281220Arvind KumarNo ratings yet

- Income Tax Calculator FY 2016 17Document11 pagesIncome Tax Calculator FY 2016 17JITENDRA SHERKHANENo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2019-20Document6 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2019-20Paramjeet KontNo ratings yet

- Computation 21 22Document1 pageComputation 21 22aarushi singhNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Capital BudgettingDocument9 pagesCapital BudgettingRussel BarquinNo ratings yet

- CIR Vs Philam Life G.R. No. 175124Document5 pagesCIR Vs Philam Life G.R. No. 175124Ian Kenneth MangkitNo ratings yet

- INDIVIDUALSDocument6 pagesINDIVIDUALSAnne KimNo ratings yet

- The Calculating A Fair Price For You and Your Students WorkbookDocument5 pagesThe Calculating A Fair Price For You and Your Students WorkbookEmmanuella ConteNo ratings yet

- Guest Group Contract Rate TemplateDocument7 pagesGuest Group Contract Rate TemplateAgustinus Agus Purwanto100% (7)

- 60,000,000.00 CHF 12,000,000.00 CHF 10,000,000.00 CHF Units Price Revenue Cost Fixed Cost Total Cost Ebitda Dep Ebit Interest NopatDocument5 pages60,000,000.00 CHF 12,000,000.00 CHF 10,000,000.00 CHF Units Price Revenue Cost Fixed Cost Total Cost Ebitda Dep Ebit Interest NopatAkshay KothariNo ratings yet

- Tax-Free Returns: Life's Journey Needs Milestones, Not Tax HurdlesDocument16 pagesTax-Free Returns: Life's Journey Needs Milestones, Not Tax HurdlesAdvocate JaniNo ratings yet

- Advance TaxDocument2 pagesAdvance TaxVachanamrutha R.VNo ratings yet

- Mock Sep 2023 - Question PaperDocument8 pagesMock Sep 2023 - Question Paperfahadkhn871No ratings yet

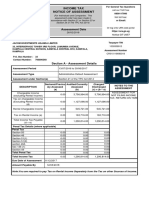

- Assessment Date: Income Tax Notice of AssessmentDocument2 pagesAssessment Date: Income Tax Notice of AssessmentBwana KuubwaNo ratings yet

- Income Tax Question BankDocument8 pagesIncome Tax Question Banksurya.notes19No ratings yet

- Important Theory Qutions Income TaxDocument9 pagesImportant Theory Qutions Income TaxPRANARITA BHOLNo ratings yet

- Taxflash: New Foreign Tax Credit RulesDocument6 pagesTaxflash: New Foreign Tax Credit RulesKojiro FuumaNo ratings yet

- Homestead DR 501Document2 pagesHomestead DR 501RaviNo ratings yet

- Old Tax Regime Vis-A - Vis New Tax Regime Final 010323Document22 pagesOld Tax Regime Vis-A - Vis New Tax Regime Final 010323Amisha KhannaNo ratings yet

- Form 9465-PDF Reader ProDocument2 pagesForm 9465-PDF Reader ProEdward FederisoNo ratings yet

- Income Taxation - Class Standing - Docx-2Document1 pageIncome Taxation - Class Standing - Docx-2Shannon ElizaldeNo ratings yet

- Graduated Income Tax Rates: Effective January 1, 2018 Until December 31, 2022Document3 pagesGraduated Income Tax Rates: Effective January 1, 2018 Until December 31, 2022Jecah May R. RiegoNo ratings yet

- Appendix-I Application Form For Empanelment of Valuers PDFDocument2 pagesAppendix-I Application Form For Empanelment of Valuers PDFSanskar GuptaNo ratings yet

- Taxation Treaties of India With Different Countries: Master of Business AdministrationDocument12 pagesTaxation Treaties of India With Different Countries: Master of Business AdministrationHarjot SandhayNo ratings yet

- Income Tax June 2023-Dec 2020Document116 pagesIncome Tax June 2023-Dec 2020binuNo ratings yet

- TDS-on Prize Awarded On-Competence and MeritDocument6 pagesTDS-on Prize Awarded On-Competence and MeritsachinvoraNo ratings yet

- General Ledger After ClosingDocument8 pagesGeneral Ledger After ClosingYOHANANo ratings yet

- Business Math Report On TaxDocument23 pagesBusiness Math Report On TaxJustine Kaye PorcadillaNo ratings yet

- Chapter 5 Accrual Accounting Adjustments: Discussion QuestionsDocument7 pagesChapter 5 Accrual Accounting Adjustments: Discussion QuestionskietNo ratings yet