Professional Documents

Culture Documents

Estimate

Uploaded by

sandeep sandyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Estimate

Uploaded by

sandeep sandyCopyright:

Available Formats

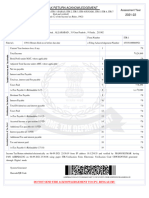

Basic Information

Assessment Year *

2023-2024

Taxpayer Category*

Individual

Residential Status *

RES (Resident)

Your Age *

Below Between 60 80 and

60 years - 79 years above

(Regular (Senior (Super

Citizen) Citizen) Senior

Due Date for Submission of

Return *

31-Jul-2023

Actual Date for Submission of

Return *

02-Feb-2023

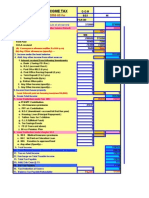

Estimated Tax

View Comparison

Income Detail

(as per

old Tax

regime)

Income under the head 0

Salaries

Gross Salary

Exemption claimed

u/s 10

Deduction u/s 16(ia)

Deduction u/s 16(ii)

Deduction u/s 16(iii)

Income under the head 0

House Property

a. Income from self 0

occupied house

property

Interest on

Borrowed

Capital

b. Income from Let-

out Property

1. Annual

Letable Value/

Rent Received

or Receivable

2. Less:

Municipal

Taxes Paid

During the Year

3.

Less:Unrealized

Rent

Net Annual Value 0

u/s 23 [1-(2+3)]

Less: Standard 0

Deduction u/s 24(a)

Less: Interest

Payable on

Borrowed Capital

u/s 24(b)

Income under the head 0

Capital Gains

Short Term Capital 0

Gains (Other than

covered under

section 111A) Total

From 01-Apr to

15-Jun

From 16-Jun to

15-Sep

From 16-Sep to

15-Dec

From 16-Dec to

15-Mar

From 16-Mar to

31-Mar

Short Term Capital 0

Gains (Covered

under section 111A)

Total

From 01-Apr to

15-Jun

From 16-Jun to

15-Sep

From 16-Sep to

15-Dec

From 16-Dec to

15-Mar

From 16-Mar to

31-Mar

Long Term Capital 0

Gains (Charged to

tax @ 20%) Total

From 01-Apr to

15-Jun

From 16-Jun to

15-Sep

From 16-Sep to

15-Dec

From 16-Dec to

15-Mar

From 16-Mar to

31-Mar

Long Term Capital 0

Gains (Charged to

tax @ 10%, other

than LTCG u/s 112A)

Total

From 01-Apr to

15-Jun

From 16-Jun to

15-Sep

From 16-Sep to

15-Dec

From 16-Dec to

15-Mar

From 16-Mar to

31-Mar

Long Term Capital 0

Gains u/s

112A(Charged to tax

@ 10%) Total

From 01-Apr-to

15-Jun

From 16-Jun to

15-Sep

From 16-Sep to

15-Dec

From 16-Dec to

15-Mar

From 16-Mar to

31-Mar

Income under the head 0

Business or Profession

Presumptive Income

u/s 44AD, 44AE,

44ADA

Other income from 0

Business or

Profession.

Income under the head 0

Other Sources

(i) Interest from

Savings bank

account

(ii) Other Interest 0

Income

(iii) Winning from 0

Lottery, crossword

puzzles etc.

(iv) Any other 0

income

Gross Total Income 0

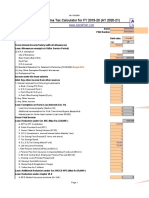

Deduction Details

(as per (as per

old Tax

regime)

regime)

Deductions u/s

80C(LIC, PF,

PPF, NSC,

Repayment of

Housing Loan,

etc.)

Deduction u/s

80CCC(Payment

in respect

Pension Fund)

Deductions u/s

80CCD(1)

(Employees /

Self-employed

contribution

Deductions u/s

80CCD (1B)

(Additional

Employees

contribution

towards NPS)

Deductions u/s

80CCD (2)

(Employers

contribution

towards NPS)

Total 0

Deductions

Deductions u/s

80D(MediClaim

Premium)

Deductions u/s

80G(Donations)

Deductions u/s

80E(Interest on

Loan for Higher

Education)

Deductions u/s

80EE(Interest

on Loan taken

for Residential

House)

Deductions u/s

80TTA(Interest

on Savings Bank

Account)

Deductions u/s 0

80TTB(Interest

on Deposits)

Any other 0

deduction

Tax Details

(as per (as per

old Tax new

regime)

regime)

/th>

Taxable Income 0

1. Tax at Normal 0

Rates

2. Tax at Special 0

Rates (Capital

Gains, Lottery,

etc.)

Short Term 0

Capital Gains

(Covered u/s

111A)

Long Term 0

Capital Gains

(Charged to

Tax @20%)

Long Term 0

Capital Gains

(Charged to

tax @ 10%,

other than

LTCG u/s

112A)

Long Term 0

Capital Gains

u/s

112A(Charged

to tax @ 10%)

Winnings 0

(from Lottery,

Crossword

Puzzles, etc.)

Total Tax before 0

Rebate

Less: Tax Rebate 0

u/s 87A

Total Tax before 0

Rebate

Surcharge 0

Add: Health & 0

Education Cess

Total Tax on 0

Income

TDS/TCS 0

Self-Assessment 0

Tax / Advance

Tax

Date of Payment 0

Self-Assessment

Tax/Advance

Tax Paid

Balance Tax 0

Payable /

Refundable

Add: Interest u/s 0

234A

Add: Interest u/s 0

234B

Add: Interest u/s 0

234C

Add: Fees for 0

late filing of

return u/s 234F

Total Tax and 0

Interest payable

You might also like

- EstimateDocument1 pageEstimateAtulPalNo ratings yet

- EstimateDocument1 pageEstimateSrinivasarao ObillaNo ratings yet

- CalculateDocument1 pageCalculateSneha dhakoliyaNo ratings yet

- CalculateDocument1 pageCalculateanurag tiwariNo ratings yet

- EstimateDocument1 pageEstimateHimali BarmanNo ratings yet

- EstimateDocument1 pageEstimateikan flyNo ratings yet

- EstimateDocument1 pageEstimateshrikrishnapunjabNo ratings yet

- Income Tax Computation: Less: Standard Deduction U/S 16Document10 pagesIncome Tax Computation: Less: Standard Deduction U/S 16sidrijegnoNo ratings yet

- Calculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10Document10 pagesCalculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10api-19754583No ratings yet

- Latest Tax CalculatIor 3.3.2Document16 pagesLatest Tax CalculatIor 3.3.2Bijender Pal Choudhary100% (3)

- Income Tax Calculator FY 2016 17Document11 pagesIncome Tax Calculator FY 2016 17JITENDRA SHERKHANENo ratings yet

- Tax Calculator - Indian Income Tax 2008-09Document7 pagesTax Calculator - Indian Income Tax 2008-09Jayamohan100% (29)

- Free Auto Tax Calculator FY-09-10 Version 4 (1) After Budget 06-07-2009Document16 pagesFree Auto Tax Calculator FY-09-10 Version 4 (1) After Budget 06-07-2009Bijender Pal ChoudharyNo ratings yet

- Income TaxDocument11 pagesIncome Taxci_balaNo ratings yet

- Old vs New Income Tax CalculatorDocument14 pagesOld vs New Income Tax Calculatorsebastianharry49No ratings yet

- AutoTax Calculator Version 14.1 FY 2019-20Document17 pagesAutoTax Calculator Version 14.1 FY 2019-20Nihit SandNo ratings yet

- Income Tax Calculator Fy 2020 21 v2Document12 pagesIncome Tax Calculator Fy 2020 21 v2Anonymous Clm40C1No ratings yet

- Inter CA DT Revision Notes For Nov 21Document126 pagesInter CA DT Revision Notes For Nov 21chalu account100% (2)

- Directors' Manual 2012Document54 pagesDirectors' Manual 2012harshagarwal5No ratings yet

- Income Tax Basics Short NotesDocument5 pagesIncome Tax Basics Short Notesgdmurugan2k7No ratings yet

- Income Tax Calculator 2018-19Document15 pagesIncome Tax Calculator 2018-19Raju Ranjan SinghNo ratings yet

- IT Calculator 2018 LiteDocument6 pagesIT Calculator 2018 LiteHr PoonamNo ratings yet

- By B.P.CHOUDHARY (Tax Consultant) (CA Associate)Document17 pagesBy B.P.CHOUDHARY (Tax Consultant) (CA Associate)Hiren ShahNo ratings yet

- Auto Income Tax Calculator: Calculate Your Tax in Just 5 MinutesDocument6 pagesAuto Income Tax Calculator: Calculate Your Tax in Just 5 MinutesashutoshbinduNo ratings yet

- Student Handout - Income Tax (Part 2) - 1Document4 pagesStudent Handout - Income Tax (Part 2) - 1debNo ratings yet

- Answer 1Document5 pagesAnswer 1mayetteNo ratings yet

- Computation of Total Income Income From Business or Profession (Chapter IV D) 273151Document3 pagesComputation of Total Income Income From Business or Profession (Chapter IV D) 273151AVINASH TIWASKARNo ratings yet

- Enter Necessary Data For Income Tax CalculationDocument12 pagesEnter Necessary Data For Income Tax CalculationAnzi25No ratings yet

- Income Tax 2019-2020Document49 pagesIncome Tax 2019-2020myjioNo ratings yet

- Chapter-1 Basic Concepts PDFDocument11 pagesChapter-1 Basic Concepts PDFBrinda RNo ratings yet

- Revised Estimation - FY 2023-24Document1 pageRevised Estimation - FY 2023-24Debojyoti MukherjeeNo ratings yet

- Complete Book P4 UDCDocument145 pagesComplete Book P4 UDCshubham0% (1)

- Less: Deductions (U/s 80C To 80U) 3 80C (Investment in Specified Schemes) 4 80CCC (Pension Fund) 5 80CCD (New Pension Scheme) 6 80D (Mediclaim) 7Document2 pagesLess: Deductions (U/s 80C To 80U) 3 80C (Investment in Specified Schemes) 4 80CCC (Pension Fund) 5 80CCD (New Pension Scheme) 6 80D (Mediclaim) 7rohitdarksNo ratings yet

- Income Tax Ready Reckoner - Budget 2023-1Document14 pagesIncome Tax Ready Reckoner - Budget 2023-1ಸೊಹನ್ ಕಲಂಗುಟ್ಕರ್No ratings yet

- Income Tax Calculator For FY 2022-23 & 2023-24 AY 2023-24 & 2024-25Document134 pagesIncome Tax Calculator For FY 2022-23 & 2023-24 AY 2023-24 & 2024-25Vipul SharmaNo ratings yet

- ACC2001 Lecture 4Document53 pagesACC2001 Lecture 4michael krueseiNo ratings yet

- BiyaniSir-Amendments For CAInter Tax - Nov20Document51 pagesBiyaniSir-Amendments For CAInter Tax - Nov20shri jeetNo ratings yet

- DT Simplified Part IDocument79 pagesDT Simplified Part IPradeep MohantyNo ratings yet

- Individual Tax Payer - Part 2Document18 pagesIndividual Tax Payer - Part 2Ems TeopeNo ratings yet

- Lumbera The Tax QueenDocument29 pagesLumbera The Tax QueenKristine MagbojosNo ratings yet

- Direct Tax Chapter 1 To 10 AmendedDocument45 pagesDirect Tax Chapter 1 To 10 AmendedAsad RizviNo ratings yet

- Income Tax Calculator Fy 2020 21 v1Document8 pagesIncome Tax Calculator Fy 2020 21 v1Yogesh BajajNo ratings yet

- Income TaxDocument244 pagesIncome TaxAnil AsNo ratings yet

- Income Tax Calculator Fy 2019 20 v4Document9 pagesIncome Tax Calculator Fy 2019 20 v4Anil KesarkarNo ratings yet

- IT Computation Sheet - 2019 - 20Document13 pagesIT Computation Sheet - 2019 - 20muthum44499335No ratings yet

- QB - ATC TemplateDocument11 pagesQB - ATC TemplateJoseph EnriquezNo ratings yet

- RC Nirc, Ra, Nra-Etb Nra-Netb: Taxpayer Tax Base Source of Taxable IncomeDocument7 pagesRC Nirc, Ra, Nra-Etb Nra-Netb: Taxpayer Tax Base Source of Taxable IncomeGwyneth GloriaNo ratings yet

- CA Inter Short Notes 2019 20 PDFDocument89 pagesCA Inter Short Notes 2019 20 PDFPrashant KumarNo ratings yet

- PDF 453351000060921Document1 pagePDF 453351000060921Kartikeya KumarNo ratings yet

- 1h DT Revision Short Notes Selected Chapters Cma Inter Dec 2023Document109 pages1h DT Revision Short Notes Selected Chapters Cma Inter Dec 2023Vaheed AliNo ratings yet

- Tax Calculator 7.1 (T) 2012 13Document17 pagesTax Calculator 7.1 (T) 2012 13karthickNo ratings yet

- TDS (Tax Deducted at Source) : ST STDocument6 pagesTDS (Tax Deducted at Source) : ST STRuchiRangariNo ratings yet

- Tax Liab. of Ind.Document13 pagesTax Liab. of Ind.Arun SwamiNo ratings yet

- Salary and Tax DetailsDocument1,320 pagesSalary and Tax DetailsAnonymous pKsr5vNo ratings yet

- Unit 4 Return FillingDocument71 pagesUnit 4 Return FillingAnshu kumarNo ratings yet

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryFrom EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- 1 Basic SardaDocument12 pages1 Basic Sardaniko.tpNo ratings yet

- Research On Taxation of Urban and Agricultural LandDocument2 pagesResearch On Taxation of Urban and Agricultural LandAnushka SharmaNo ratings yet

- Incotax MaterialsDocument6 pagesIncotax MaterialsPeachy CamNo ratings yet

- Powers and Duties of The BirDocument17 pagesPowers and Duties of The BirJoy Ben-atNo ratings yet

- CAPITAL GAINS TAX RULESDocument13 pagesCAPITAL GAINS TAX RULESSaurav MedhiNo ratings yet

- PKF WWTG 2020 2021 OnlineDocument1,207 pagesPKF WWTG 2020 2021 OnlineHussain MunshiNo ratings yet

- KPMG Taxation Handbook - Finance Act 2019Document85 pagesKPMG Taxation Handbook - Finance Act 2019Fatema JidnaNo ratings yet

- .Part - II - Sec.I - Direct TaxesDocument235 pages.Part - II - Sec.I - Direct TaxesJay Sangoi71% (7)

- Income Tax II Illustration Computation of Total Income PDFDocument7 pagesIncome Tax II Illustration Computation of Total Income PDFSubramanian SenthilNo ratings yet

- Multiple Choice Questions CPA Reviewer in Taxation Income Taxation of Individuals & CorporationDocument34 pagesMultiple Choice Questions CPA Reviewer in Taxation Income Taxation of Individuals & CorporationJay GalleroNo ratings yet

- URA Tax Glosary 2020Document114 pagesURA Tax Glosary 2020NGANJANI WALTERNo ratings yet

- Unit 2 - Capital GainsDocument16 pagesUnit 2 - Capital GainsRakhi DhamijaNo ratings yet

- Tx-Uk Mock 1Document20 pagesTx-Uk Mock 1Lalan JaiswalNo ratings yet

- Ra 8424 - NircDocument123 pagesRa 8424 - NircJOHAYNIENo ratings yet

- Tax Rebyuwer MidtermDocument12 pagesTax Rebyuwer MidtermChua chua100% (1)

- Income Taxation Solution Manual 2019 ED Income Taxation Solution Manual 2019 EDDocument40 pagesIncome Taxation Solution Manual 2019 ED Income Taxation Solution Manual 2019 EDSha Leen100% (2)

- Vodafone International Holdings B.V. vs. Union of India 1. About Hutchision Essar LimitedDocument6 pagesVodafone International Holdings B.V. vs. Union of India 1. About Hutchision Essar LimitedasdfqwerasdNo ratings yet

- Overview Property SalesDocument43 pagesOverview Property Salesgaret matsileleNo ratings yet

- Regular Income Tax Inclusion RulesDocument33 pagesRegular Income Tax Inclusion RulesAaron BuendiaNo ratings yet

- Compilation of MCQDocument34 pagesCompilation of MCQDaphnie Bolo100% (1)

- Bir Ruling No. 013-05Document3 pagesBir Ruling No. 013-05Anonymous gyYqhBhCvsNo ratings yet

- AICO Notice of Extraordinary General MeetingDocument4 pagesAICO Notice of Extraordinary General MeetingBusiness Daily ZimbabweNo ratings yet

- Republic v. SorianoDocument3 pagesRepublic v. SorianoEllis LagascaNo ratings yet

- Income Taxes For CorporationsDocument35 pagesIncome Taxes For CorporationsKurt SoriaoNo ratings yet

- General Principles SEC. 23. General Principles of Income Taxation in The Philippines-Except When Otherwise Provided in ThisDocument22 pagesGeneral Principles SEC. 23. General Principles of Income Taxation in The Philippines-Except When Otherwise Provided in ThisAnonymous bdm1KYJttNo ratings yet

- Deed of Cancellation of Contract of SaleDocument3 pagesDeed of Cancellation of Contract of SaleD.F. de Lira0% (1)

- Final Test 1 Sol.Document3 pagesFinal Test 1 Sol.Akanksha UpadhyayNo ratings yet

- CRV Sir's DT Material May 2022Document293 pagesCRV Sir's DT Material May 2022esaiinternalauditNo ratings yet

- Residential Status Scope of Total IncomeDocument4 pagesResidential Status Scope of Total IncomedeepakadhanaNo ratings yet

- Income Taxation Capital AssetDocument93 pagesIncome Taxation Capital AssetGelyn Cruz100% (1)