Professional Documents

Culture Documents

Adjusting Entries PETA 3

Uploaded by

Whotfis Maysie0 ratings0% found this document useful (0 votes)

27 views1 pageMatata Posna Co. provides accounting services and has various account balances before adjustments for year-end closing. The document lists the account balances and provides additional information needed for adjustments, including unbilled fees, supplies on hand, expired rent, equipment depreciation, unearned fees, accrued wages, and estimated bad debts. The required tasks are to prepare adjusting journal entries, an adjusted trial balance, and the income statement and balance sheet.

Original Description:

this is an adjusting entries 3

Original Title

Adjusting Entries PETA 3 (1)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMatata Posna Co. provides accounting services and has various account balances before adjustments for year-end closing. The document lists the account balances and provides additional information needed for adjustments, including unbilled fees, supplies on hand, expired rent, equipment depreciation, unearned fees, accrued wages, and estimated bad debts. The required tasks are to prepare adjusting journal entries, an adjusted trial balance, and the income statement and balance sheet.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

27 views1 pageAdjusting Entries PETA 3

Uploaded by

Whotfis MaysieMatata Posna Co. provides accounting services and has various account balances before adjustments for year-end closing. The document lists the account balances and provides additional information needed for adjustments, including unbilled fees, supplies on hand, expired rent, equipment depreciation, unearned fees, accrued wages, and estimated bad debts. The required tasks are to prepare adjusting journal entries, an adjusted trial balance, and the income statement and balance sheet.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

PETA 3: Worksheet

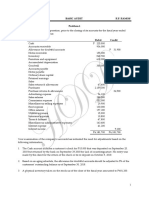

Matata Posna Co., a company engaged in rendering accounting services, has the following

account balances before adjustment for December 31, 2018:

Account Title Debit Credit

Cash PhP 36,500

Accounts Receivable 26,375

Allowance for Bad Debts

Supplies

Prepaid Rent

Equipment 16,225

Accumulated Depreciation PhP 4,450

Accounts Payable 13,000

Notes Payable 10,250

Wages Payable

Capital 35,000

Unearned Fees 3,500

Fees Earned 48,975

Wages Expense 19,700

Rent Expense 15,000

Depreciation Expense

Supplies Expense 1,375

Bad Debts Expense

Total 115,175 115,175

Data needed for year-end adjustments are as follows:

1. Unbilled fees at December 31, P1,575.

2. Supplies on hand at December 31, P278

3. Rent expired during the year, P9,000.

4. The equipment is expected to be sold at P2,875 at the end of its 3-year useful life.

5. Unearned Fees at December 31, P2,700.

6. Wages accrued but unpaid at December 31, P438.

7. Bad debts is estimated to be at 5% of credit service fees. The company renders all

services of account.

Required:

a. Prepare the adjusting journal entries on December 31, 2018.

b. Prepare the adjusted trial balance.

c. Based on the adjusted trial balance, prepare the income statement and balance sheet

for the company.

You might also like

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Task Description: Design A Poster/slogan of Philippine HistoryDocument1 pageTask Description: Design A Poster/slogan of Philippine HistoryWhotfis Maysie100% (2)

- BKNC3 - Activity 1 - Review ExamDocument3 pagesBKNC3 - Activity 1 - Review ExamDhel Cahilig0% (1)

- Closing EntriesDocument10 pagesClosing EntriesFranco DexterNo ratings yet

- Journal Entries ServiceDocument4 pagesJournal Entries ServiceJasmine ActaNo ratings yet

- ABM - 111 - Final ExaminationDocument2 pagesABM - 111 - Final ExaminationTimothy JamesNo ratings yet

- Compre Audit Cieloflawless Q PDFDocument3 pagesCompre Audit Cieloflawless Q PDFCarina Mae Valdez ValenciaNo ratings yet

- The Balance of Prepaid Expenses On January 1, 2018 Is P24,675. What Is The Balance of Prepaid Expense As of December 31, 2018?Document3 pagesThe Balance of Prepaid Expenses On January 1, 2018 Is P24,675. What Is The Balance of Prepaid Expense As of December 31, 2018?Tahani Awar Gurar0% (1)

- Tutorial 3Document14 pagesTutorial 3NURSUHAILI IZZATI ABU BAKARNo ratings yet

- Answer (Question) MODULE 4 - Quiz 2Document2 pagesAnswer (Question) MODULE 4 - Quiz 2kakaoNo ratings yet

- Class Question (Accounting Cycle)Document2 pagesClass Question (Accounting Cycle)Iqra AliNo ratings yet

- Go-Figure WorksheetDocument2 pagesGo-Figure WorksheetChris Marasigan0% (1)

- Module 1 Key To CorrectionsDocument7 pagesModule 1 Key To CorrectionsPlame GaseroNo ratings yet

- ACC101 - Accounting CycleDocument3 pagesACC101 - Accounting CycleJade PielNo ratings yet

- Institute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartDocument3 pagesInstitute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartSafi SheikhNo ratings yet

- Class Exercise Session 5 and 6Document8 pagesClass Exercise Session 5 and 6Sumeet KumarNo ratings yet

- Seatwork #6Document5 pagesSeatwork #6Jasmine Maningo100% (1)

- Chapter 3 Practice KEYDocument19 pagesChapter 3 Practice KEYmartinmuebejayiNo ratings yet

- Class ExerciseDocument14 pagesClass ExerciseAbdul Basit MalikNo ratings yet

- KVVNBSIT1-2 RecordingbusinesstransactionsDocument6 pagesKVVNBSIT1-2 Recordingbusinesstransactionsdevora aveNo ratings yet

- Final BASIC AcctgDocument3 pagesFinal BASIC AcctgFiona Concepcion100% (1)

- PracticeDocument1 pagePracticeNana CatNo ratings yet

- Accounting Level IV Coc: Project OneDocument5 pagesAccounting Level IV Coc: Project OneTewodros BekeleNo ratings yet

- Answer 1Document7 pagesAnswer 1Mylene HeragaNo ratings yet

- Financial Statement ExamDocument2 pagesFinancial Statement ExamTam TamNo ratings yet

- Sample Problems Part FormDocument4 pagesSample Problems Part FormkenivanabejuelaNo ratings yet

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- Module 2 Key To CorrectionsDocument5 pagesModule 2 Key To CorrectionsPlame GaseroNo ratings yet

- January 31: Birendra Mahato Adjusting Entries and WorksheetDocument17 pagesJanuary 31: Birendra Mahato Adjusting Entries and WorksheetAjit UpretyNo ratings yet

- ACCT 2105 Tutorial Exercises - Topic 4 - Income StatementDocument8 pagesACCT 2105 Tutorial Exercises - Topic 4 - Income StatementHoàng Trọng HiếuNo ratings yet

- Dot Printing Narioazelleah B.Document12 pagesDot Printing Narioazelleah B.Aizha NarioNo ratings yet

- Accounting Assignment 04A 207Document10 pagesAccounting Assignment 04A 207Aniyah's RanticsNo ratings yet

- Accounting Week13 Lec01 & Lec02 NotesDocument3 pagesAccounting Week13 Lec01 & Lec02 NotesABUBAKAR FawadNo ratings yet

- ACP314 Competency PracticeDocument1 pageACP314 Competency PracticeJastine Rose CañeteNo ratings yet

- Business TransactionsDocument6 pagesBusiness TransactionsMarlyn Joy Yacon100% (1)

- Account Titles Debit Credit: Set BDocument1 pageAccount Titles Debit Credit: Set BAngel TabuenaNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- BUS 285 F23 Practice Questions in WordDocument6 pagesBUS 285 F23 Practice Questions in WordLê AnhNo ratings yet

- Simulated Exam Procedural ApplicationDocument3 pagesSimulated Exam Procedural ApplicationRosevie ZantuaNo ratings yet

- Lat. Soal Completing Accounting Cycle 1Document1 pageLat. Soal Completing Accounting Cycle 1Cindy Cornelia Wahyu WardaniNo ratings yet

- Chapter 1 Acctg Equation JournalizingDocument4 pagesChapter 1 Acctg Equation JournalizingNicole Marie Pontay BajadeNo ratings yet

- Review 2 Set K Problem 1Document3 pagesReview 2 Set K Problem 1Marinel AbrilNo ratings yet

- Chapter 5Document27 pagesChapter 5nadima behzadNo ratings yet

- Task 2. Ban Gay and Ban Trai's Partnership: Statements of Changes in Partners' CapitalDocument11 pagesTask 2. Ban Gay and Ban Trai's Partnership: Statements of Changes in Partners' CapitalHuyen VuNo ratings yet

- Baaccen Final OutputDocument3 pagesBaaccen Final OutputtenderjuicyiyyyNo ratings yet

- Answer: PH P 1,240: SolutionDocument18 pagesAnswer: PH P 1,240: SolutionadssdasdsadNo ratings yet

- Suggested Answer CAP II June 2017rDocument104 pagesSuggested Answer CAP II June 2017rBAZINGANo ratings yet

- Peter Pan Accounting Firm General JournalDocument7 pagesPeter Pan Accounting Firm General JournalMarites AmorsoloNo ratings yet

- 01.correction of Errors - 245038322 PDFDocument4 pages01.correction of Errors - 245038322 PDFMaan CabolesNo ratings yet

- Chapter 2 Problems and Solutions EnglishDocument8 pagesChapter 2 Problems and Solutions EnglishyandaveNo ratings yet

- Case 4-1. PC Depot (Homework) Account Name DRDocument11 pagesCase 4-1. PC Depot (Homework) Account Name DRariela oktafiraNo ratings yet

- Acc 1 QuizDocument7 pagesAcc 1 QuizAyat MukahalNo ratings yet

- Basic Accounting Mock PrelimsDocument4 pagesBasic Accounting Mock Prelimshadassah VillarNo ratings yet

- Exercise 2BDocument2 pagesExercise 2Bmytu261105No ratings yet

- Accounting Cycle: Journal EntriesDocument5 pagesAccounting Cycle: Journal EntriesNeha PandeyNo ratings yet

- Excel Merchandising CompanyDocument1 pageExcel Merchandising Companygolemwitch01No ratings yet

- Corrected TB CH 2Document1 pageCorrected TB CH 2Birhanu DesalegnNo ratings yet

- J. Mañas WorksheetDocument30 pagesJ. Mañas WorksheetAngela MacailaoNo ratings yet

- Dnda Putri Nurhaliza - Tugas Chapter 3Document2 pagesDnda Putri Nurhaliza - Tugas Chapter 3dindawatanabe54No ratings yet

- Name: Rowma Danielle Lactao Date Submitted: 1-28-22 Grade & Section: 10-Peace Teacher: Ms. Lizz DelosoDocument2 pagesName: Rowma Danielle Lactao Date Submitted: 1-28-22 Grade & Section: 10-Peace Teacher: Ms. Lizz DelosoRowma Danielle LactaoNo ratings yet

- Worksheet ProblemsDocument3 pagesWorksheet ProblemsClaren Sidnne MadridNo ratings yet

- FLJ BK3Document2 pagesFLJ BK3Whotfis MaysieNo ratings yet

- Tapia MiceDocument1 pageTapia MiceWhotfis MaysieNo ratings yet

- BK1Document1 pageBK1Whotfis MaysieNo ratings yet

- Desti ScriptDocument4 pagesDesti ScriptWhotfis MaysieNo ratings yet

- Research QuestionsDocument1 pageResearch QuestionsWhotfis MaysieNo ratings yet

- BK3 PEP TalksDocument1 pageBK3 PEP TalksWhotfis MaysieNo ratings yet

- Formative Assessment 5Document5 pagesFormative Assessment 5Whotfis MaysieNo ratings yet

- DMM ReflectionDocument1 pageDMM ReflectionWhotfis MaysieNo ratings yet

- Hosting ScriptDocument2 pagesHosting ScriptWhotfis MaysieNo ratings yet

- DMM. Destination Planning and PolicyDocument2 pagesDMM. Destination Planning and PolicyWhotfis MaysieNo ratings yet

- DMM DigitalizationDocument6 pagesDMM DigitalizationWhotfis MaysieNo ratings yet

- Try FBDocument16 pagesTry FBWhotfis MaysieNo ratings yet

- Heritage FA2Document2 pagesHeritage FA2Whotfis MaysieNo ratings yet

- BswotDocument2 pagesBswotWhotfis MaysieNo ratings yet

- ImpleDocument3 pagesImpleWhotfis MaysieNo ratings yet

- FFF Strama g5Document14 pagesFFF Strama g5Whotfis MaysieNo ratings yet

- Name Section: Finals - Formative Assessment 5Document3 pagesName Section: Finals - Formative Assessment 5Whotfis MaysieNo ratings yet

- NSTP Fa3Document2 pagesNSTP Fa3Whotfis MaysieNo ratings yet

- Name Year Level Section/ Time: Formative Assessment 7: Food and BeveragesDocument3 pagesName Year Level Section/ Time: Formative Assessment 7: Food and BeveragesWhotfis MaysieNo ratings yet

- Analysis: Weight Rating Weighted Score Rating Weighted Score Rating Weighted ScoreDocument8 pagesAnalysis: Weight Rating Weighted Score Rating Weighted Score Rating Weighted ScoreWhotfis MaysieNo ratings yet

- On Why We Are ShallowDocument6 pagesOn Why We Are ShallowWhotfis MaysieNo ratings yet

- REFERENCEDocument1 pageREFERENCEWhotfis MaysieNo ratings yet

- Learning Objectives For The Study of World War II Chapter 25 & Chapter 26Document2 pagesLearning Objectives For The Study of World War II Chapter 25 & Chapter 26Whotfis MaysieNo ratings yet

- .Sec2. TapiaM - Activity 1Document1 page.Sec2. TapiaM - Activity 1Whotfis MaysieNo ratings yet

- Learning Objectives For World War IIDocument2 pagesLearning Objectives For World War IIWhotfis MaysieNo ratings yet

- A. Identify Different Firms in The Philippines That Provides Services To Travelers. Explain What Services They Provide To Travelers. 1. AirlineDocument3 pagesA. Identify Different Firms in The Philippines That Provides Services To Travelers. Explain What Services They Provide To Travelers. 1. AirlineWhotfis MaysieNo ratings yet

- Viii. Operations: A. Management StructureDocument3 pagesViii. Operations: A. Management StructureWhotfis MaysieNo ratings yet

- Characteristics Map - TemplateDocument2 pagesCharacteristics Map - TemplateWhotfis MaysieNo ratings yet

- Christmas Vacation Outline (Written Work 2) Title: - IDocument1 pageChristmas Vacation Outline (Written Work 2) Title: - IWhotfis MaysieNo ratings yet