Professional Documents

Culture Documents

When You Dismiss Your Tax Representative, Please Submit "Notification of Dismissal of Tax Representative For Income Tax/consumption Tax". 70

Uploaded by

renatoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

When You Dismiss Your Tax Representative, Please Submit "Notification of Dismissal of Tax Representative For Income Tax/consumption Tax". 70

Uploaded by

renatoCopyright:

Available Formats

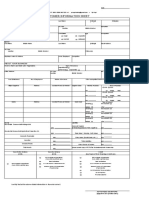

‶⁗⁕⁞⁓⁓⁛‒⁀⁓ ⁛⁙‒⁓‒⁂⁗‒‒″⁖ ⁛⁛⁗‒⁚⁗‒⁆⁓⁓⁗’‒⁆⁓‒″⁘⁘⁓⁛‒⁘‒⁛⁕ ⁗‡⁕ ⁛‒⁓‒

If you appoint a tax representative to file tax returns and administer other tax affairs because you do not or will not have an address in Japan,

please prepare “Declaration Naming a Person to Administer the Taxpayer’s Tax Affairs for Income Tax and Consumption Tax” and submit it

to the local Tax Office in charge of the location of your address, etc. at the time you appoint a tax representative or prior to the date of

departure from Japan.

payment place.

locations, etc. than tax

other address and office

Please write if there are any

Please write the place of tax payment and telephone number.

to the tax you will report.

the title and in the text, according your seal.

and” or “and consumption tax” in name and affix

Cross out either “income tax

birth.

your date of

Please write

Please write your

Individual Number.

Please write your

representative.

residence of the tax

address or place of

Please write the

name.

the trade

Please write

affix a seal.

representative and

name of the tax

Please write the

occupation.

your

Please write

tax representative.

occupation of the

Please write the

and the taxpayer.

the tax representative

relationship between

Please write the

residence outside Japan.

please write the address or place of

If you plan to move out of Japan,

representative.

of the tax

telephone number

Please write the

representative.

designated a tax

reason why you

Please state the

from/to Japan.

departure or arrival

(planned) date of

Please write the

For the type of income sourced in Japan, please circle the Please write if you have any income other than the

applicable type of income or describe the content. above or the income type is unknown.

*When you dismiss your tax representative, please submit “Notification of dismissal of tax representative

for income tax/consumption tax”.

70

You might also like

- Ena KaDocument12 pagesEna KaBobot MazzeNo ratings yet

- Estate AccountDocument15 pagesEstate AccountVasishtha Teeluckdharry100% (1)

- Paye Coding Notice PDFDocument2 pagesPaye Coding Notice PDFNebu MathewsNo ratings yet

- CRA01 Confirmation of Residential or Business Address For Online Completion External FormDocument2 pagesCRA01 Confirmation of Residential or Business Address For Online Completion External FormBrandon BothaNo ratings yet

- IT77C - Application For Registration As A Company or Change of Particulars Company - External FormDocument6 pagesIT77C - Application For Registration As A Company or Change of Particulars Company - External FormAndile NtuliNo ratings yet

- 納稅義務人 Taxpayer: 2020 Individual Income Tax Return Of The Republic Of ChinaDocument2 pages納稅義務人 Taxpayer: 2020 Individual Income Tax Return Of The Republic Of China妮妮No ratings yet

- CP22 Pin1 2011 PDFDocument1 pageCP22 Pin1 2011 PDFYin ChuangNo ratings yet

- Appointment of DirectorDocument2 pagesAppointment of DirectorStephen Oluwafemi AyilaraNo ratings yet

- Occupational Tax and Registration Return For Wagering: Type or PrintDocument6 pagesOccupational Tax and Registration Return For Wagering: Type or Printeugenio02No ratings yet

- Important Information To Include On Your Tax Return Before Sending It To UsDocument10 pagesImportant Information To Include On Your Tax Return Before Sending It To UsHagiNo ratings yet

- Santa Clara Business LicenseDocument2 pagesSanta Clara Business LicenseTom Reynolds100% (1)

- Instruction For Trust Account: Aristocapital New Account ContactDocument11 pagesInstruction For Trust Account: Aristocapital New Account ContactАлександр ЛебедевNo ratings yet

- Instruction For New AccountDocument7 pagesInstruction For New AccountVasishtha TeeluckdharryNo ratings yet

- Instruction For Trust Account: Aristocapital New Account ContactDocument10 pagesInstruction For Trust Account: Aristocapital New Account ContactАлександр ЛебедевNo ratings yet

- Sa100 - 2013-2014 - Copy2Document10 pagesSa100 - 2013-2014 - Copy2lucy baikNo ratings yet

- Instruction For Trust Account: Sogotrade New Account ContactDocument10 pagesInstruction For Trust Account: Sogotrade New Account ContactVasishtha TeeluckdharryNo ratings yet

- 15CADocument2 pages15CAShant NagChaudhuriNo ratings yet

- Module - 3 TAXATIONDocument77 pagesModule - 3 TAXATIONTabish RehmanNo ratings yet

- Main - Form Sa100 Tax Return United KingdomDocument10 pagesMain - Form Sa100 Tax Return United KingdomadminNo ratings yet

- File Tax ReturnDocument10 pagesFile Tax ReturnJonNo ratings yet

- SA100 Tax Return English 2020Document10 pagesSA100 Tax Return English 2020Mal WilliamsonNo ratings yet

- Re-KYC and Dormant Activation Form For Resident Individuals: PersonalDocument2 pagesRe-KYC and Dormant Activation Form For Resident Individuals: PersonalNitin RamnaniNo ratings yet

- III II : Employer'S Data Form (Edf)Document1 pageIII II : Employer'S Data Form (Edf)Raiza Mei AndresNo ratings yet

- How To Complete Form W-8BENDocument2 pagesHow To Complete Form W-8BENRagil Wahyu KurniawanNo ratings yet

- BSP 2ndsem2021Document2 pagesBSP 2ndsem2021Agatha EnriNo ratings yet

- Cover Letter TemplateDocument2 pagesCover Letter TemplateCole HarrisNo ratings yet

- Extended KYC Annexure - Individuals (Including Sole-Proprietors) (Applicable For Resident and Non-Resident Customers) (Mandatory)Document2 pagesExtended KYC Annexure - Individuals (Including Sole-Proprietors) (Applicable For Resident and Non-Resident Customers) (Mandatory)Leo SaimNo ratings yet

- IT77TR Application For Registration Trust External FormDocument7 pagesIT77TR Application For Registration Trust External FormBrandon BothaNo ratings yet

- 34 - Change in Owners Details Notice - WEBDocument2 pages34 - Change in Owners Details Notice - WEBaDAMNo ratings yet

- Haider Al Marshadi TR 2021Document12 pagesHaider Al Marshadi TR 2021iraqnoorNo ratings yet

- Undertaking To File An Income Tax Return by A Non-ResidentDocument2 pagesUndertaking To File An Income Tax Return by A Non-ResidentjessiechowemailNo ratings yet

- ZIP Code Country: Nature of Work/Business/Economic ActivityDocument1 pageZIP Code Country: Nature of Work/Business/Economic ActivityDiana HudieresNo ratings yet

- Irc 3111 ADocument2 pagesIrc 3111 AVintonius Raffaele PRIMUSNo ratings yet

- 2022 Kansas Fiduciary VoucherDocument2 pages2022 Kansas Fiduciary VoucherArchibald BareassoleNo ratings yet

- Ministry of Revenue Retail Sales TaxDocument2 pagesMinistry of Revenue Retail Sales Taxdeep431No ratings yet

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax ReturnKusunoki MasashigeNo ratings yet

- CV ApplicationFormDocument4 pagesCV ApplicationFormVijay V RaoNo ratings yet

- 2017 TaxReturnDocument7 pages2017 TaxReturntripsrealplugNo ratings yet

- POCB-F-SVD-002 Application For Registration V7Document2 pagesPOCB-F-SVD-002 Application For Registration V7Melanie TamayoNo ratings yet

- Form 42 Client Where Owner Not Client Gives Owners Details Private CertifierDocument2 pagesForm 42 Client Where Owner Not Client Gives Owners Details Private CertifieraDAMNo ratings yet

- Amara Enyia's 2016 Tax ReturnDocument4 pagesAmara Enyia's 2016 Tax ReturnMark KonkolNo ratings yet

- US Internal Revenue Service: F940ez - 1995Document4 pagesUS Internal Revenue Service: F940ez - 1995IRSNo ratings yet

- Stuff ExerciseDocument2 pagesStuff ExercisearschNo ratings yet

- Kia Lopez Form 1040Document2 pagesKia Lopez Form 1040Stephanie RobinsonNo ratings yet

- Tax Invoice PrintingDocument2 pagesTax Invoice PrintingMadhan Kumar BobbalaNo ratings yet

- Trust Tax Return 2019 PDFDocument16 pagesTrust Tax Return 2019 PDFIsabelle Che KimNo ratings yet

- 2016 Tax ReturnDocument19 pages2016 Tax ReturnPatrick Svitek100% (1)

- Income Tax Fundamentals 2015 Whittenburg 33rd Edition Solutions ManualDocument6 pagesIncome Tax Fundamentals 2015 Whittenburg 33rd Edition Solutions ManualCharles Davis100% (29)

- International Business or Company Tax Reg FormDocument4 pagesInternational Business or Company Tax Reg FormNithinNo ratings yet

- V1-14400ITRP01 : Form 400 ItrDocument14 pagesV1-14400ITRP01 : Form 400 ItrAnthony BasantaNo ratings yet

- MI-330 (Update of Billing Information)Document1 pageMI-330 (Update of Billing Information)aravindan ranganNo ratings yet

- Application Form: InstructionsDocument6 pagesApplication Form: Instructionsابراهيم بن يعقوبNo ratings yet

- Germany 2022Document10 pagesGermany 2022Olichka LyubackayaNo ratings yet

- Wsib 012386Document5 pagesWsib 012386rajNo ratings yet

- Important Information To Include On Your Tax Return Before Sending It To UsDocument10 pagesImportant Information To Include On Your Tax Return Before Sending It To UsGeorge SardisNo ratings yet

- Edited CIS - SPLDocument1 pageEdited CIS - SPLEjay HiwatigNo ratings yet

- Vermont: Notice To Withdraw Vermont Homestead DeclarationDocument2 pagesVermont: Notice To Withdraw Vermont Homestead DeclarationsuckballsNo ratings yet

- Power of Attorney: WWW - Ftb.ca - GovDocument5 pagesPower of Attorney: WWW - Ftb.ca - Govphamel2648No ratings yet

- Mindset Development Organisation Annual Report 2012Document29 pagesMindset Development Organisation Annual Report 2012chenyi55253779No ratings yet

- Calibration Form: This Form Should Be Filled Out and Sent With Your ShipmentDocument1 pageCalibration Form: This Form Should Be Filled Out and Sent With Your ShipmentLanco SANo ratings yet

- Line Follower Robot Using ArduinoDocument5 pagesLine Follower Robot Using Arduinochockalingam athilingam100% (1)

- The List of the Korean Companies in the UAE: Company Name 이름 Off. Tel Off. Fax P.O.BoxDocument34 pagesThe List of the Korean Companies in the UAE: Company Name 이름 Off. Tel Off. Fax P.O.Boxnguyen phuong anh100% (1)

- Inventory Management (Pertemuan V)Document85 pagesInventory Management (Pertemuan V)Asep RahmatullahNo ratings yet

- scs502 Module Three Observational Study WorksheetDocument2 pagesscs502 Module Three Observational Study Worksheetharshit.prajapati74No ratings yet

- Periyava Times Apr 2017 2 PDFDocument4 pagesPeriyava Times Apr 2017 2 PDFAnand SNo ratings yet

- Novena To ST JudeDocument2 pagesNovena To ST JudeBeatrice Mae ChuaNo ratings yet

- The Global Workforce Crisis BCG PDFDocument28 pagesThe Global Workforce Crisis BCG PDFdakintaurNo ratings yet

- 6 - Cash Flow StatementDocument42 pages6 - Cash Flow StatementBhagaban DasNo ratings yet

- Sample Annotated BibliographyDocument1 pageSample Annotated Bibliographyfcrocco100% (1)

- Gender Inequality in Bangladesh PDFDocument20 pagesGender Inequality in Bangladesh PDFshakilnaimaNo ratings yet

- Practical Auditing by Empleo 2022 Chapter 4 Receivables Related RevenuesDocument55 pagesPractical Auditing by Empleo 2022 Chapter 4 Receivables Related RevenuesDarence IndayaNo ratings yet

- Syllabus Mathematics (Honours and Regular) : Submitted ToDocument19 pagesSyllabus Mathematics (Honours and Regular) : Submitted ToDebasish SharmaNo ratings yet

- Appellate BriefDocument3 pagesAppellate Briefelan de noir100% (1)

- How To Change The Default Displayed Category in Point of Sale - OdooDocument4 pagesHow To Change The Default Displayed Category in Point of Sale - OdooDenaNo ratings yet

- Lesson 7. Linear Momentum and ImpulseDocument6 pagesLesson 7. Linear Momentum and ImpulselopomNo ratings yet

- Rules & Regulations BDC NTUDocument5 pagesRules & Regulations BDC NTUMohammad YasinNo ratings yet

- Madeleine Leininger Transcultural NursingDocument5 pagesMadeleine Leininger Transcultural Nursingteabagman100% (1)

- Intermediate Macroeconomics Sec 222Document163 pagesIntermediate Macroeconomics Sec 222Katunga MwiyaNo ratings yet

- Walt Disney OutlineDocument9 pagesWalt Disney Outlineapi-234693246No ratings yet

- JournalDocument6 pagesJournalAlyssa AlejandroNo ratings yet

- Battery Charging Technologies For Advanced Submarine RequirementsDocument4 pagesBattery Charging Technologies For Advanced Submarine Requirementsjwpaprk1100% (1)

- Outcomes of Democracy: How Do We Assess Democracy?Document7 pagesOutcomes of Democracy: How Do We Assess Democracy?Ankita MondalNo ratings yet

- FPSC - Inspector - Custom - Intelligence - Officer - PDF Filename - UTF-8''FPSC Inspector Custom Intelligence OfficerDocument405 pagesFPSC - Inspector - Custom - Intelligence - Officer - PDF Filename - UTF-8''FPSC Inspector Custom Intelligence Officerasimafzal100% (1)

- 1 Assignment-2Document8 pages1 Assignment-2abhiNo ratings yet

- Germany: Country NoteDocument68 pagesGermany: Country NoteeltcanNo ratings yet

- Grade 12 Mathematical Literacy: Question Paper 1 MARKS: 150 TIME: 3 HoursDocument53 pagesGrade 12 Mathematical Literacy: Question Paper 1 MARKS: 150 TIME: 3 HoursOfentse MothapoNo ratings yet

- Camping Checklist: Essentials / Survival Sleep GearDocument2 pagesCamping Checklist: Essentials / Survival Sleep GearRomi Roberto100% (1)

- ASVAB Core ReviewDocument208 pagesASVAB Core Reviewstanley100% (1)