Professional Documents

Culture Documents

Calculate sales tax and discounts

Uploaded by

MICHAEL WYZARD0 ratings0% found this document useful (0 votes)

16 views1 pageSales Tax and Sales worksheet

Original Title

Sales Tax and Sales

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSales Tax and Sales worksheet

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views1 pageCalculate sales tax and discounts

Uploaded by

MICHAEL WYZARDSales Tax and Sales worksheet

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Sales Tax and Sales Dr.

Wyzard, Spring 2019

Sales tax review: Sales review:

find tax (multiply) and total price (add) find discount (multiply) and total price (subtract)

1) $60 shirt 2) $90 jeans 3) $147 phone 4) $17.99 DVD

4% tax 7% tax 20% off 25% off

Both: find sale price first. Then apply the sales tax.

Example: $49.95, 15% off with 6% tax

100% − 15% = 85% 49.95 x 0.85 = $42.46 sale price

100% + 6% = 106% 42.46 x 1.06 = $45

5) $130 shoes 6) $370 bike 7) $900 chair 8) $1600 bed

$20 discount $50 coupon 10% off 30% off

5% tax 6% tax 7% tax 5% tax

9) $180 10) $540 11) $1200 12) $24.99

$40 coupon $75 off 20% off 15% off

7% tax 6% tax 7% tax 5% tax

13) $49.99 14) $96 15) $245 16) $39.95

20% off $9 off $25 rebate 50% off

6% tax 6.5% tax 8.5% tax 5.5% tax

You might also like

- Percentage Week ThreeDocument2 pagesPercentage Week ThreempetionNo ratings yet

- Math WorkDocument2 pagesMath WorkdannishaNo ratings yet

- Math WorkDocument2 pagesMath WorkZeromasters20xxNo ratings yet

- Book 1Document2 pagesBook 1yulianisfundoraNo ratings yet

- Percent Off: 10% 20% 25% Regular PriceDocument2 pagesPercent Off: 10% 20% 25% Regular Priceshay1119No ratings yet

- Book 1Document2 pagesBook 1Live4Him007No ratings yet

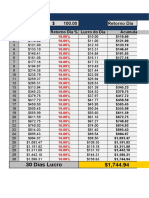

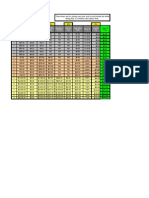

- 10 Pips A Day SpreadsheetDocument1 page10 Pips A Day Spreadsheet4zhhmwqb75No ratings yet

- % Off: Price $4.99 $9.99 $14.99 $19.99Document2 pages% Off: Price $4.99 $9.99 $14.99 $19.99maldini_p46978No ratings yet

- 10 Pips Per DayDocument1 page10 Pips Per DayLestijono Last100% (1)

- Percentage of Regular Price $4.99 $9.99 $14.99Document2 pagesPercentage of Regular Price $4.99 $9.99 $14.99willleon18No ratings yet

- Tran Duc Thai - 11203514Document8 pagesTran Duc Thai - 11203514Thái TranNo ratings yet

- Dicount TableDocument1 pageDicount TableisadovnicNo ratings yet

- $4.99 $9.99 $14.99 $19.99 $24.99 $39.99 $49.99Document2 pages$4.99 $9.99 $14.99 $19.99 $24.99 $39.99 $49.99IzzyggNo ratings yet

- Plan & Journal TradingDocument10 pagesPlan & Journal TradingRafli Rezza0% (1)

- Mathematics For Business 10th Edition Salzman Test BankDocument16 pagesMathematics For Business 10th Edition Salzman Test Bankbrandoncook07011996ogy100% (34)

- Bicycle Shop Financial Model - CapEx ForecastDocument9 pagesBicycle Shop Financial Model - CapEx ForecastNatalieNo ratings yet

- Mathematics For Business 10Th Edition Salzman Test Bank Full Chapter PDFDocument37 pagesMathematics For Business 10Th Edition Salzman Test Bank Full Chapter PDFretailnyas.rjah100% (12)

- CLW Analysis 6-1-21Document5 pagesCLW Analysis 6-1-21HunterNo ratings yet

- Valuation of AppleDocument25 pagesValuation of AppleQuofi SeliNo ratings yet

- Minha Banca de 100Document8 pagesMinha Banca de 100Jeozadaque MarcondesNo ratings yet

- FRX Compound PlanDocument35 pagesFRX Compound Planpaperchas100% (1)

- Analisis Suturas 2020Document6 pagesAnalisis Suturas 2020David SantoandreNo ratings yet

- Outreach Networks Case DardenDocument3 pagesOutreach Networks Case DardenPaco Colín100% (1)

- Calculating bond duration and yieldDocument48 pagesCalculating bond duration and yieldOUSSAMA NASRNo ratings yet

- Profit and Loss Income StatementDocument3 pagesProfit and Loss Income StatementJamaluddin SaidNo ratings yet

- G.R Mtob 2.0Document12 pagesG.R Mtob 2.0LucasAugustoNo ratings yet

- Gerenciamento de CapitalDocument3 pagesGerenciamento de CapitalwemmerosonNo ratings yet

- Gerenciamento de Capital-1Document3 pagesGerenciamento de Capital-1adilsonNo ratings yet

- Historical ProjectionsDocument2 pagesHistorical ProjectionshekmatNo ratings yet

- Calculating DiscountsDocument2 pagesCalculating Discountsapi-520685801No ratings yet

- Gerenciamento de RiscoDocument21 pagesGerenciamento de RiscoIgor PriscoNo ratings yet

- 01 - Four CornersDocument50 pages01 - Four CornersElias CamposNo ratings yet

- Glittering Rhinestone Evening Bag for $7.40Document1 pageGlittering Rhinestone Evening Bag for $7.40Huma AhmedNo ratings yet

- Revenues % Growth Operating Income Oper. Margin % Shares Outstanding Shares RepurchasedDocument7 pagesRevenues % Growth Operating Income Oper. Margin % Shares Outstanding Shares RepurchasedAaron FosterNo ratings yet

- Pricing table optimizationDocument210 pagesPricing table optimizationJesús Adrián González CadenaNo ratings yet

- Simulador de Rentabilidade em DólaresDocument12 pagesSimulador de Rentabilidade em DólaresbrujohncambuyNo ratings yet

- Funciones FinancierasDocument23 pagesFunciones Financierasjosué alexander guzmán camposNo ratings yet

- Calculate Bond Prices and Yields Using Spot and Forward RatesDocument6 pagesCalculate Bond Prices and Yields Using Spot and Forward RatesAlly AbdullahNo ratings yet

- Meta SemanalDocument21 pagesMeta SemanalJunior FreitasNo ratings yet

- TG Brand ABC PPC and Sales Performance ReportDocument5 pagesTG Brand ABC PPC and Sales Performance ReportMorgan MarkulNo ratings yet

- FcffvsfcfeDocument2 pagesFcffvsfcfePro ResourcesNo ratings yet

- Percentage ChartDocument2 pagesPercentage ChartMatthew GómezNo ratings yet

- Gerenciamento Completo Blaze Alunos Do MasterDocument12 pagesGerenciamento Completo Blaze Alunos Do MasterMauzi 777No ratings yet

- Group08 FedEx SecADocument17 pagesGroup08 FedEx SecAMrudul Vasant NaikNo ratings yet

- Sneaker 2013 ExcelDocument8 pagesSneaker 2013 ExcelMehwish Pervaiz67% (6)

- Gerenciamento de Juros CompostoDocument9 pagesGerenciamento de Juros CompostoGeneral KamikaziNo ratings yet

- Solucion Caso Lady MDocument13 pagesSolucion Caso Lady Mjohana irma ore pizarroNo ratings yet

- MM 20 - Per Day ProjectDocument21 pagesMM 20 - Per Day Projectferdy molNo ratings yet

- Calculadora de Interés Compuesto Mensual 2023 ? 5Document2 pagesCalculadora de Interés Compuesto Mensual 2023 ? 5JULIO CESAR FERNANDEZNo ratings yet

- Calculadora de Interés Compuesto Mensual 2023 ?Document2 pagesCalculadora de Interés Compuesto Mensual 2023 ?JULIO CESAR FERNANDEZNo ratings yet

- 00 Empreendedorismo DigitalDocument1 page00 Empreendedorismo DigitalJoannis HalvantzisNo ratings yet

- Seller FeesDocument2 pagesSeller FeesSteve GibsonNo ratings yet

- Gerenciamento Grupo VipDocument36 pagesGerenciamento Grupo VipGabriel MoraisNo ratings yet

- Investimento de R$44 gera lucro de R$58 milhões em 150 diasDocument15 pagesInvestimento de R$44 gera lucro de R$58 milhões em 150 diasPedro PrachedesNo ratings yet

- The Cost of ChristmasDocument18 pagesThe Cost of ChristmasEko MaruliNo ratings yet

- Investimento de $100 rende mais de $133 milhões em 150 diasDocument30 pagesInvestimento de $100 rende mais de $133 milhões em 150 diasJadson FernandoNo ratings yet

- Gerenciamento Blaze RetornosDocument15 pagesGerenciamento Blaze RetornosDroop ShopNo ratings yet

- IC Daily Sales Dashboard Report 11436Document5 pagesIC Daily Sales Dashboard Report 11436ascwarehouse mgrNo ratings yet

- 20pip 10$ Accont ChallangeDocument2 pages20pip 10$ Accont ChallangeDeepak GautamNo ratings yet