Professional Documents

Culture Documents

Income Statements: (Amounts Expressed in Sri Lankan Rs. '000) For The Year Ended 31st March

Income Statements: (Amounts Expressed in Sri Lankan Rs. '000) For The Year Ended 31st March

Uploaded by

Sab KeelsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Statements: (Amounts Expressed in Sri Lankan Rs. '000) For The Year Ended 31st March

Income Statements: (Amounts Expressed in Sri Lankan Rs. '000) For The Year Ended 31st March

Uploaded by

Sab KeelsCopyright:

Available Formats

Income Statements

(Amounts expressed in Sri Lankan Rs. ’000)

Group Company

For the year ended 31st March 2008 2007 Change 2008 2007 Change

Note % %

Revenue 11 15,583,756 9,620,950 62 41,828 122,142 (66)

Direct

operating

expenses

(6,765,383) (4,848,143) 40 (11,100) (81,062) (86)

8,818,373 4,772,807 85 30,728 41,080 (25)

Changes in fair value of

biological assets 25 779,113 346,191 125 – – –

Changes in fair value of

investment properties 23 – 197,529 (100) – – –

Gain/(loss) on mark to market valuation

of short-term investments 30 (45,025) 154,241 (129) (13,079) 31,662 (141)

Other income 12 27,089 76,512 (65) – – –

Distribution expenses (1,521,808) (741,011) 105 – – –

Administrative expenses (1,786,185) (1,322,721) 35 (6,181) (5,083) 22

Other operating

expenses

(118,715) (117,374) 1 – – –

Profit

from operations

13 6,152,842 3,366,174 83 11,468 67,659 (83)

Finance expenses 14 (832,961) (539,058) 55 – – –

Foreign

exchange

gain/(loss)

15 (39,149) (58,112) (33) – 5,576 (100)

Profit before net results of associate 5,280,732 2,769,004 91 11,468 73,235 (84)

Share of net results of associate

16 35,620 22,797 56 – – –

Profit before taxation 11 5,316,352 2,791,801 90 11,468 73,235 (84)

Income tax expenses

Taxation - Current taxation (1,170,630) (367,765) 218 (2,632) (250) 953

-

Deferred

taxation (272,241) (324,092) (16) – – –

17 (1,442,871) (691,857) 109 (2,632) (250) 953

Profit for the year

11 3,873,481 2,099,944 84 8,836 72,985 (88)

Profit Attributable to

Equity holders of the parent 11 1,490,660 811,641 84 8,836 72,985 (88)

Minority

shareholders

11 2,382,821 1,288,303 85 – – –

3,873,481 2,099,944 84 8,836 72,985 (88)

Earnings per ordinary share (Rs.) 19 148.34 80.37 85 0.16 6.51 (100)

Dividend per ordinary share* (Rs.) 18 5.00 5.50 (9) 5.00 5.50 (9)

Notes from pages 26 to 110 form an integral part of these Financial Statements.

* Based on proposed dividend.

Figures in brackets indicate deductions.

22 Annual Report 2007/08 Bukit Darah PLC

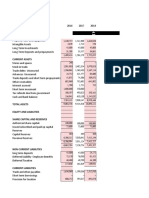

Balance Sheets

(Amounts expressed in Sri Lankan Rs. ’000)

Group Company

As at 31st March Note 2008 2007 2008 2007

Assets

Non-Current Assets

Property, plant & equipment 20 13,794,454 11,825,786 – –

Capital work in progress 21 907,243 1,867,803 – –

Prepaid lease payment 22 309,416 317,910 – –

Investment properties 23 1,370,947 1,370,779 – –

Intangible assets 24 299,196 291,275 – –

Biological assets 25 9,142,432 7,308,318 – –

Investment in subsidiaries 26 – – 1,326,739 1,326,739

Investment in associates 26 394,185 350,117 36 36

Long-term investments 26 2,854,017 2,278,884 – –

Advances pending capitalisation 29 – – 1,189,965 1,189,965

Deferred

tax asset

17 243,180 107,674 – –

Total

non-current

assets

29,315,070 25,718,546 2,516,740 2,516,740

Current Assets

Inventories 27 2,242,139 1,530,237 – –

Trade and other receivables 28 2,097,622 1,287,247 405 45

Short-term investments 30 345,387 623,257 78,902 102,452

Short-term deposits 31 387,102 531,363 25,141 48,434

Cash in hand and at bank

31 1,678,451 639,422 53,230 6,695

Total

current assets

6,750,701 4,611,526 157,678 157,626

Total assets

36,065,771 30,330,072 2,674,418 2,674,366

Equity

Stated capital 32 101,804 101,804 101,804 101,804

Capital reserves 33 1,136,051 1,048,370 40,000 40,000

Revenue

reserves

34 7,609,533 6,164,628 2,507,916 2,510,577

Total equity attributable to

equity holders of the parent 8,847,388 7,314,802 2,649,720 2,652,381

Minority

shareholders’

equity interest 12,412,246 10,256,725 – –

Total

equity

21,259,634 17,571,527 2,649,720 2,652,381

Non-Current Liabilities

Long-term borrowings 35 4,154,213 4,135,831 – –

Trade and other payables 36 658,918 1,673,847 – –

Retirement benefit obligations 37 103,599 76,548 – –

Deferred

tax liability

17 2,069,085 1,679,402 –

–

Total

non-current

liabilities

6,985,815 7,565,628 –

–

Current Liabilities

Trade and other payables 36 2,355,432 1,951,023 21,989 21,032

Current tax liabilities 1,247,436 153,976 2,709 953

Long-term borrowings falling due

within one year 35 1,249,581 831,888 – –

Short-term borrowings 35 1,002,999 1,652,015 – –

Bank

overdraft

35 1,964,874 604,015 – –

Total

current

liabilities

7,820,322 5,192,917 24,698 21,985

Total

liabilities

14,806,137 12,758,545 24,698 21,985

Total equity and liabilities

36,065,771 30,330,072 2,674,418 2,674,366

Net assets per ordinary share 884.56 731.30 264.79 265.06

I certify that these Financial Statements are in compliance with the requirements of Companies Act No. 7 of 2007.

(Sgd.)

A.P. Weeratunge

Chief Financial Officer

The Board of Directors is responsible for the preparation and presentation of these Financial Statements.

These Financial Statements were approved by the Board on 26th May 2008.

Approved and signed on behalf of the Managers Approved and signed on behalf of the Board

(Sgd.) (Sgd.) (Sgd.)

D.C.R. Gunawardena M. Selvanathan P.C.P. Tissera

Director Director Director

Carsons Management Services (Private) Limited

Notes from pages 26 to 110 form an integral part of these Financial Statements.

Bukit Darah PLC Annual Report 2007/08 23

Statements of Changes in Equity

(Amounts expressed in Sri Lankan Rs. ’000)

Attributable to Equity holders of the Parent

Share Capital Capital Reserves Revenue Reserves

Ordinary Share Preference Capital Revaluation Other General Retained Total Minority Total

Capital Share Redemption Reserve Capital Reserve Earnings Shareholders’

Capital Reserve Reserve Interest

Group

Balance as at 1st April 2006 100,000 1,804 40,000 34,851 705,947 200,881 4,816,956 5,900,439 8,830,784 14,731,223

Impairment of property,

plant & equipment – – – (10,571) – – – (10,571) (17,480) (28,051)

Effect of adopting

revised SLAS 25 – – – – – – 326,682 326,682 – 326,682

Changes in equity – – – – 105,475 (118,010) (194,966) (207,501) 336,814 129,313

Exchange translation

differences

– – – – 172,668 378,621 – 551,289 34,978 586,267

Gain/(loss) recognised

directly in equity 100,000 1,804 40,000 24,280 984,090 461,492 4,948,672 6,560,338 9,185,096 15,745,434

Profit for

the period

– – – – – – 811,641 811,641 1,288,303 2,099,944

Total recognised Income 100,000 1,804 40,000 24,280 984,090 461,492 5,760,313 7,371,979 10,473,399 17,845,378

Transfer – – – – – 433,525 (433,525) – – –

Dividend

paid – – – – – – (57,177) (57,177) (216,674) (273,851)

Balance as 31st March 2007 100,000 1,804 40,000 24,280 984,090 895,017 5,269,611 7,314,802 10,256,725 17,571,527

Surplus on revaluation of

property, plant & equipment – – – 33,459 – – 9,723 43,182 61,532 104,714

Changes in equity – – – – (36,407) 18,078 (153,230) (171,559) (339,194) (510,753)

Exchange translation

differences

– – – 90,629 – 91,171 – 181,800 284,136 465,936

Gain/(loss) recognised

directly in equity 100,000 1,804 40,000 148,368 947,683 1,004,266 5,126,104 7,368,225 10,263,199 17,631,424

Profit for the period – – – – – – 1,490,660 1,490,660 2,382,821 3,873,481

Transfer

– – – – – (26,697) 26,697 – – –

Total recognised Income 100,000 1,804 40,000 148,368 947,683 977,569 6,643,461 8,858,885 12,646,020 21,504,905

Dividend

paid – – – – – – (11,497) (11,497) (233,774) (245,271)

Balance as at

31st March, 2008 100,000 1,804 40,000 148,368 947,683 977,569 6,631,964 8,847,388 12,412,246 21,259,634

Company

Balance as at

1st April, 2006 100,000 1,804 40,000 – – 9,283 2,485,486 2,636,573 – 2,636,573

Profit for the period – – – – – – 72,985 72,985 – 72,985

Transfer – – – – – 31,662 (31,662) – – –

Dividend

paid – – – – – – (57,177) (57,177) – (57,177)

Balance as at

31st March, 2007 100,000 1,804 40,000 40,945 2,469,632 2,652,381 – 2,652,381

Profit for the period – – – – – – 8,836 8,836 – 8,836

Transfer – – – – – (13,079) 13,079 – – –

Dividend

paid – – – – – – (11,497) (11,497) – (11,497)

Balance as at

31st March, 2008 100,000 1,804 40,000 – – 27,866 2,480,050 2,649,720 – 2,649,720

In Accordance with Section 58 of Companies Act No. 7 of 2007, share capital has been re-classified as stated capital. The presentation of comparative information has been

reclassified accordingly.

Notes from pages 26 to 110 form an integral part of these Financial Statements.

Figures in brackets indicate deductions.

24 Annual Report 2007/08 Bukit Darah PLC

Cash Flow Statements

(Amounts expressed in Sri Lankan Rs. ’000)

Group Company

For the year ended 31st March 2008 2007 2008 2007

Cash Flows From Operating Activities

Profit/(loss) before taxation 5,316,352 2,791,801 11,468 73,235

Adjustments for:

Foreign exchange loss 39,149 58,112 – –

Gain from changes in fair value of biological assets (779,113) (346,191) – –

Fair value adjustment - in investment properties – (197,529) – –

Mark to market value adjustment for short-term investment 45,025 (154,241) 13,079 (31,662)

Share of net results of associates (35,620) (22,797) – –

Depreciation 664,952 482,295 – –

Amortisation of intangible assets/prepaid lease payment 26,677 18,082 – –

Provision for retiring gratuity 34,362 20,266 – –

Finance costs 832,961 539,058 – –

Profit on disposal of property, plant & equipment (40,142) (23,599) – –

Adjustment on capital work-in-progress 48,131 – – –

Dividend

from Associate

Companies 6,468 4,356 – –

Operating cash flows before working capital changes 6,159,202 3,169,613 24,547 41,573

(Increase)/decrease in inventories (572,155) (938,904) – –

(Increase)/decrease in trade and other receivables (810,375) (34,990) (360) 19,752

Increase/(decrease)

in

trade and other payables 403,963 145,920 511 8

5,180,635 2,341,639 24,698 61,333

Net

cash

flow from investments

(394,063) (708,434) 10,470 5,713

Net

cash

generated

from/(used in) operating activities 4,786,572 1,633,205 35,168 67,046

Finance costs paid (1,175,133) (575,429) – –

Tax paid (78,304) (224,817) (880) (445)

Retiring

gratuity

paid

(6,695) (5,671) – –

Net

cash

inflow/(outflow)

from operating activities 3,526,440 827,288 34,288 66,601

Cash Flows from Investing Activities

Purchase of property, plant & equipment & biological assets (2,539,892) (4,413,259) – –

Investment in Associate Companies – (2,261) – –

Purchase of intangible assets/prepaid lease payment (30,325) (96,658) – –

Purchase of investments – (205,871) – (638,851)

(Increase)/decrease in amounts due from related companies – – – 661,432

Proceeds from disposal of investment property – 224,000 – –

Proceeds from disposal of property, plant & equipment 69,366 28,492 – –

Deposits received 24,484 58,194 – –

Deposits

refunded

(4,269) (9,930) – –

Net

cash

generated

from/(used in) investing activities (2,480,636) (4,417,293) – 22,581

Cash Flow from Financing Activities

Proceeds from long-term loans 1,273,573 4,027,010 – –

Repayment of loans (675,473) (1,683,455) – –

Increase in long-term creditors (1,035,144) 162,762 – –

Repayment of finance lease creditors (181,015) (158,324) – –

Net decrease in minority shareholders’ interest (233,774) (216,674) – –

Dividends

paid (including

preference dividends) (11,046) (55,636) (11,046) (55,636)

Net

cash

generated

from/(used in) financing activities (862,879) 2,075,683 (11,046) (55,636)

Increase/(Decrease) in cash and cash equivalents 182,925 (1,514,322) 23,242 33,546

Cash and cash

equivalents

at the beginning of the year (1,085,245) 429,077 55,129 21,583

Cash and cash equivalents at the end of the year [Note 31(b)] (902,320) (1,085,245) 78,371 55,129

Notes from pages 26 to 110 form an integral part of these Financial Statements.

Figures in brackets indicate deductions.

Bukit Darah PLC Annual Report 2007/08 25

You might also like

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Assessment Formal AssessmentDocument8 pagesAssessment Formal Assessmentashish100% (1)

- Sri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 31 December 2019Document14 pagesSri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 31 December 2019Nilupul BasnayakeNo ratings yet

- Sri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 30 June 2019Document13 pagesSri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 30 June 2019Nilupul BasnayakeNo ratings yet

- Sri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 30 September 2019Document14 pagesSri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 30 September 2019Nilupul BasnayakeNo ratings yet

- SGXNET FY2016 - 21feb17Document12 pagesSGXNET FY2016 - 21feb17phuawlNo ratings yet

- Airasia Quarter ReportDocument34 pagesAirasia Quarter ReportChee Meng TeowNo ratings yet

- 3rd Quarter 2021Document19 pages3rd Quarter 2021sakib9949No ratings yet

- Abans QuarterlyDocument14 pagesAbans QuarterlyGFMNo ratings yet

- Adventa Sofp & Sopl 2021Document3 pagesAdventa Sofp & Sopl 2021ariash mohdNo ratings yet

- Sofp, Sopl Adventa&uem 20-21Document14 pagesSofp, Sopl Adventa&uem 20-21ariash mohdNo ratings yet

- UCrest Bhd-Q4 Financial Result Ended 31.5.2022Document8 pagesUCrest Bhd-Q4 Financial Result Ended 31.5.2022Jeff WongNo ratings yet

- Historical Data Dec19Document9 pagesHistorical Data Dec19WilsonNo ratings yet

- Name: Ticker: Industry: Jurisdiction of Incorporation: Number of Shares of Common Stock OutstandingDocument6 pagesName: Ticker: Industry: Jurisdiction of Incorporation: Number of Shares of Common Stock OutstandingTahreem BalochNo ratings yet

- Colgate Cash FlowsDocument2 pagesColgate Cash FlowsChetan DhuriNo ratings yet

- Audited Financial Results For The Quarter and Financial Year Ended 31st March 2021Document12 pagesAudited Financial Results For The Quarter and Financial Year Ended 31st March 2021Abhilash ABNo ratings yet

- Quarterly - Report - 2q2021-Segment ReportDocument2 pagesQuarterly - Report - 2q2021-Segment ReporthannacuteNo ratings yet

- 2011 MAS Annual 2Document9 pages2011 MAS Annual 2Thaw ZinNo ratings yet

- Interim Financial Statement - 2nd Quarter: Aitken Spence Hotel Holdings PLCDocument16 pagesInterim Financial Statement - 2nd Quarter: Aitken Spence Hotel Holdings PLCkasun witharanaNo ratings yet

- Afr Q4fy20Document8 pagesAfr Q4fy20Abhilash ABNo ratings yet

- Time Watch Investments Limited Unaudited 2nd QTR 1HF2009 Financial Statement 090210Document13 pagesTime Watch Investments Limited Unaudited 2nd QTR 1HF2009 Financial Statement 090210WeR1 Consultants Pte LtdNo ratings yet

- Eeff Ilustrativos Niif PymesDocument16 pagesEeff Ilustrativos Niif PymesjgilzamoraNo ratings yet

- FIN 422-Midterm AssDocument43 pagesFIN 422-Midterm AssTakibul HasanNo ratings yet

- Multi Finance PLC: Interim Financial StatementsDocument7 pagesMulti Finance PLC: Interim Financial StatementsCr CryptoNo ratings yet

- P-H-O-E-N-I-X Petroleum Philippines, Inc. (PSE:PNX) Financials Income StatementDocument12 pagesP-H-O-E-N-I-X Petroleum Philippines, Inc. (PSE:PNX) Financials Income StatementDave Emmanuel SadunanNo ratings yet

- Directors Report 2014 PDFDocument14 pagesDirectors Report 2014 PDFgalacticwormNo ratings yet

- 03 Steppe Cement - Simple Spread - 2018Document1 page03 Steppe Cement - Simple Spread - 2018Phạm Thanh HuyềnNo ratings yet

- Income Statements: Brown & Company PLCDocument5 pagesIncome Statements: Brown & Company PLCprabathdeeNo ratings yet

- Airasia Financial StatementDocument35 pagesAirasia Financial StatementDyna AzmirNo ratings yet

- RBGH Financials 30 June 2021 Colour 15.07.2021 2 Full Pages EdtDocument2 pagesRBGH Financials 30 June 2021 Colour 15.07.2021 2 Full Pages EdtFuaad DodooNo ratings yet

- Financial Statement 2017 - 2019Document14 pagesFinancial Statement 2017 - 2019Audi Imam LazuardiNo ratings yet

- Financial Statements: For The Year Ended 31 December 2019Document11 pagesFinancial Statements: For The Year Ended 31 December 2019RajithWNNo ratings yet

- Blackstone 1 Q 20 Earnings Press ReleaseDocument40 pagesBlackstone 1 Q 20 Earnings Press ReleaseZerohedgeNo ratings yet

- Unaudited Consolidated Financial Results For The Quarter Ended 31 March 2010Document4 pagesUnaudited Consolidated Financial Results For The Quarter Ended 31 March 2010poloNo ratings yet

- Sri Lanka Telecom 2010 /09Document11 pagesSri Lanka Telecom 2010 /09Inde Pendent LkNo ratings yet

- Cash Flow StatementDocument2 pagesCash Flow Statementsasanka1987No ratings yet

- National Stock Exchange of India LimitedDocument2 pagesNational Stock Exchange of India LimitedAnonymous DfSizzc4lNo ratings yet

- HBL FSAnnouncement 3Q2016Document9 pagesHBL FSAnnouncement 3Q2016Ryan Hock Keong TanNo ratings yet

- SBI Annual Report 2022-244-245Document2 pagesSBI Annual Report 2022-244-245Radhika GoelNo ratings yet

- Sedania Innovator Berhad - 2Q2022Document19 pagesSedania Innovator Berhad - 2Q2022zul hakifNo ratings yet

- Cfin Sep2022Document14 pagesCfin Sep2022jdNo ratings yet

- Jamna Auto Industries Limited: Registered Office: Jai Spring Road, Industrial Area, Yamunanagar-135001, HaryanaDocument4 pagesJamna Auto Industries Limited: Registered Office: Jai Spring Road, Industrial Area, Yamunanagar-135001, HaryanapoloNo ratings yet

- Published Results 31 March 2010Document2 pagesPublished Results 31 March 2010Ravi ChaturvediNo ratings yet

- Profit and Loss AccountDocument1 pageProfit and Loss AccountmuazzampkNo ratings yet

- Nestlé Pakistan LTD.: Financial Results For The Quarter Ended March 31, 2020Document1 pageNestlé Pakistan LTD.: Financial Results For The Quarter Ended March 31, 2020Umer AftabNo ratings yet

- Consolidated 11-Year Summary: Financial / Data SectionDocument60 pagesConsolidated 11-Year Summary: Financial / Data SectionMUHAMMAD ISMAILNo ratings yet

- Consolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsDocument2 pagesConsolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsFuaad DodooNo ratings yet

- JFC - PH Jollibee Foods Corp. Annual Income Statement - WSJDocument1 pageJFC - PH Jollibee Foods Corp. Annual Income Statement - WSJフ卂尺乇ᗪNo ratings yet

- Second Quarter Results Financial Statement and Related AnnouncementDocument14 pagesSecond Quarter Results Financial Statement and Related AnnouncementAzhar Zainal0% (1)

- Q4 2022 Bursa Announcement - 2Document13 pagesQ4 2022 Bursa Announcement - 2Quint WongNo ratings yet

- VIL Reg 33 Results Q4FY24Document10 pagesVIL Reg 33 Results Q4FY24Samim Al RashidNo ratings yet

- Assignment FSADocument15 pagesAssignment FSAJaveria KhanNo ratings yet

- 3rd Quarter Report 2018Document1 page3rd Quarter Report 2018Tanzir HasanNo ratings yet

- Mar 12Document1 pageMar 12akshay kausaleNo ratings yet

- Fy2023 Analysis of Revenue and ExpenditureDocument24 pagesFy2023 Analysis of Revenue and ExpenditurePutri AgustinNo ratings yet

- AAGB Quarter1 Ended 31.03.2021Document26 pagesAAGB Quarter1 Ended 31.03.2021NUR RAHIMIE FAHMI B.NOOR ADZMAN NUR RAHIMIE FAHMI B.NOOR ADZMANNo ratings yet

- Renuka Foods PLC: Interim Financial Statements - For The Period Ended 31 December 2021Document11 pagesRenuka Foods PLC: Interim Financial Statements - For The Period Ended 31 December 2021hvalolaNo ratings yet

- DV QuestionsDocument24 pagesDV QuestionsevitaveigasNo ratings yet

- Public Disclosure For LI ADocument84 pagesPublic Disclosure For LI AShashankNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- 3.4 - Comptes Consolidés 31 Décembre 2020 - (VA) - VDEFDocument64 pages3.4 - Comptes Consolidés 31 Décembre 2020 - (VA) - VDEFsamullemNo ratings yet

- A Big Tuck Shop Project Feasibility Report: Prepared By: Ansa Nazir AhmedDocument10 pagesA Big Tuck Shop Project Feasibility Report: Prepared By: Ansa Nazir AhmedAnsa AhmedNo ratings yet

- Property - 493 Balite Vs LimDocument5 pagesProperty - 493 Balite Vs LimXing Keet LuNo ratings yet

- D49195GC10 sg1 PDFDocument438 pagesD49195GC10 sg1 PDFNisha SharmaNo ratings yet

- Chapter Five Mix and Yield VariancesDocument9 pagesChapter Five Mix and Yield Variancesshimelis100% (1)

- Smart SchoolDocument2 pagesSmart SchoolAlade AdegboyegaNo ratings yet

- KPMG Audit of Memorial Gardens' ProjectDocument20 pagesKPMG Audit of Memorial Gardens' ProjectNorthbaynuggetNo ratings yet

- WORKSHEET GE ELEC 14 - LESSON 8 - Marc Loui A. RiveroDocument1 pageWORKSHEET GE ELEC 14 - LESSON 8 - Marc Loui A. RiveroMarc Loui RiveroNo ratings yet

- Torrecampo vs. AlindoganDocument2 pagesTorrecampo vs. AlindoganMarianne AndresNo ratings yet

- Contract Pentru Comenzi ExterneDocument3 pagesContract Pentru Comenzi ExterneDaniela BuicaNo ratings yet

- The Sarbanes-Oxley Act of 2002: Recommendations For Higher EducationDocument11 pagesThe Sarbanes-Oxley Act of 2002: Recommendations For Higher EducationHeeyNo ratings yet

- Entrepreneurship Development BBA Notes, EbookDocument80 pagesEntrepreneurship Development BBA Notes, EbookSatish Kumar RanjanNo ratings yet

- Stock ValuationDocument33 pagesStock Valuationpoona ramwaniNo ratings yet

- Pinto pm5 Inppt 03Document31 pagesPinto pm5 Inppt 03Gabriel Korletey0% (1)

- Account ListDocument96 pagesAccount ListNikit ShahNo ratings yet

- Ikea Fraud AnalysisDocument2 pagesIkea Fraud AnalysisPrecious SanchezNo ratings yet

- PR Release StrategyDocument21 pagesPR Release StrategyabdulNo ratings yet

- LIC Forms Claim DischargeDocument6 pagesLIC Forms Claim DischargeSriramNo ratings yet

- The Polish Cosmetic IndustryDocument20 pagesThe Polish Cosmetic IndustryBasil Fletcher100% (1)

- Question BankDocument5 pagesQuestion Bankkalpitgupta786No ratings yet

- Implication of Clauses in EPCDocument9 pagesImplication of Clauses in EPCSrinivas AmaraNo ratings yet

- Full Download Human Resource Management A Contemporary Approach 8th Edition Beardwell Solutions ManualDocument36 pagesFull Download Human Resource Management A Contemporary Approach 8th Edition Beardwell Solutions Manuallixivialkeen9r0fu100% (34)

- Bank Teller Application - Glenroy WoodDocument2 pagesBank Teller Application - Glenroy Woodapi-3701112No ratings yet

- Workmen of Dimakuchi Tea Estate Vs The ManagementDocument10 pagesWorkmen of Dimakuchi Tea Estate Vs The Managementboohoo19150% (2)

- 5.IT4RIs 18 Paper 4Document9 pages5.IT4RIs 18 Paper 4Filip Ion DorinelNo ratings yet

- App 1 ModuleDocument15 pagesApp 1 ModuleJaemine GuecoNo ratings yet

- Micro Finance PolicyDocument85 pagesMicro Finance PolicyBelkis RiahiNo ratings yet

- 128824795680597571Document7 pages128824795680597571vishnusankarNo ratings yet

- Brand Positioning of PepsiCoDocument9 pagesBrand Positioning of PepsiCoAbhishek DhawanNo ratings yet

- Magazine: Hamilton: The Next Waterloo?Document24 pagesMagazine: Hamilton: The Next Waterloo?sctaguiamNo ratings yet