Professional Documents

Culture Documents

1904 January 2018 ENCS Final - PDF

Uploaded by

Eisley SarzadillaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1904 January 2018 ENCS Final - PDF

Uploaded by

Eisley SarzadillaCopyright:

Available Formats

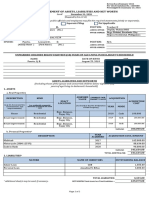

(To be filled out by BIR) DLN: _______________________

Republic of the Philippines

Department of Finance

APPLICATION FOR REGISTRATION BIR Form No.

Bureau of Internal Revenue

For One-Time Taxpayer and Person Registering under E.O. 98

Enter all required information in CAPITAL LETTERS using BLACK ink. Mark all applicable

boxes with an “X”. One copy must be filed with the BIR and one held by the taxpayer. 1904

January 2018 (ENCS)

(Securing a TIN to be able to transact with any government office)

1 PhilSys Number (PSN) 2 Taxpayer Identification Number (TIN) 3 Date of Registration 4 RDO Code

(If Applicable) (MM/DD/YYYY)

- - -

Part I – Taxpayer Information

5 Taxpayer Type

E.O. 98 (Filipino Citizen) One-Time Transaction – Foreign National Passive Income Earner Only

E.O. 98 (Foreign National) Non-Resident Foreign Corporation

One-Time Transaction – Filipino Citizen Non-Resident Foreign Partnership

6 Foreign TIN (if any) 7 Country of Residence

8 Taxpayer’s Name (If Individual) Last Name First Name Middle Name Suffix Nickname

9 Taxpayer’s Name (If Non-Individual, Registered Name)

10 Taxpayer’s Name [If ESTATE , ESTATE of (First Name, Middle Name, Last Name, Suffix)] [If TRUST, FAO: (First Name, Middle Name, Last Name, Suffix)]

11 Local/Registered Address

Unit/Room/Floor/Building No. Building Name/Tower

Lot/Block/Phase/House No. Street Name

Subdivision/Village/Zone Barangay

Town/District Municipality/City

Province ZIP Code

12 Principal Foreign Address (indicate complete foreign address)

13 Date of Birth/Organization 14 Contact Number 15 Date of Arrival in the Philippines 16 Municipality Code

(MM/DD/YYYY) (Phone/Mobile No.) (MM/DD/YYYY) (To be filled-up by BIR)

/ / / /

17 Mother’s Maiden Name 18 Father’s Name

19 Gender 20 Email Address

Male Female

Part II – Transaction Details

21 Purpose of TIN Application

A Dealings with Banks B Dealings with Government Agencies C Tax Treaty Relief

Part III – Withholding Agent/Accredited Tax Agent Information

22 Taxpayer Identification Number (TIN) - - - 23 RDO Code

24 Withholding Agent/Accredited Tax Agent’s Name (Last Name, First Name, Middle Name for Individual)/(Registered Name for Non-Individual) (if different from taxpayer)

25 Registered Address (Sub-street, Building/Street, Barangay, City/Municipality, Province)

25A ZIP Code

26 Contact Number (Phone/Mobile No.) 27 Email Address

28 Declaration Stamp of BIR Receiving Office

I declare, under the penalties of perjury, that this application has been made in good faith, verified by me and to the best of my knowledge and belief, is true and and Date of Receipt

correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, I give my consent to

the processing of my information as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes.

_____________________________________________ ________________________

TAXPAYER/AUTHORIZED REPRESENTATIVE Title/Position of Signatory

(Signature over Printed Name)

*Note: The BIR Data Privacy Policy is in the BIR website (www.bir.gov.ph)

Required Attachments/Documents:

A. For Individual – Any identification issued by an authorized government body (e.g. Birth Certificate, Passport, Driver’s License) that shows the name, address and birthdate of the applicant

– Passport (in case of Non-Resident Alien not engaged in trade or business)

B. For Non-Individual – Any official document issued by an authorized government body (e.g. government agency (tax authority) thereof, or a municipality) that includes the name of the non-individual and the

address of its principal office in the jurisdiction in which the non-individual was incorporated or organized (e.g. Articles of Incorporation, Certificate of Residency)

You might also like

- DEEDofContribution IndividualDocument3 pagesDEEDofContribution Individualjckgonzales97No ratings yet

- Rubric For Rating Groupmates 1Document1 pageRubric For Rating Groupmates 1Gladys Glo MarceloNo ratings yet

- Department of Health: PhilippinesDocument2 pagesDepartment of Health: PhilippinesJerome JoseNo ratings yet

- Affidavit of Witness: IN WITNESS WHEREOF, I Have Hereunto Affixed My Signature This 7thDocument1 pageAffidavit of Witness: IN WITNESS WHEREOF, I Have Hereunto Affixed My Signature This 7thron dominic dagumNo ratings yet

- Certification: Tanggapan NG Punong BarangayDocument2 pagesCertification: Tanggapan NG Punong BarangayBryan AvilaNo ratings yet

- 2019 Unified Request FormDocument1 page2019 Unified Request FormMarilou G. EsparagozaNo ratings yet

- Giner. Factors Affecting StudentsDocument37 pagesGiner. Factors Affecting StudentsJOSEPH C. INGGANNo ratings yet

- 2020 Form 1 Freshmen Revised 1 Application For Admission ADocument4 pages2020 Form 1 Freshmen Revised 1 Application For Admission AJasyon Matindi100% (1)

- DTR SampleDocument1 pageDTR SampleHadji HrothgarNo ratings yet

- Salary Loan Record Form Rev2 (8.5 X 13)Document3 pagesSalary Loan Record Form Rev2 (8.5 X 13)KRYSTEL JUMANOYNo ratings yet

- Certificateof EmploymentDocument1 pageCertificateof EmploymentNelvin NemenzoNo ratings yet

- Colegio de San Francisco Javier: Social CaseworkDocument3 pagesColegio de San Francisco Javier: Social CaseworkSORIA Shinehah EvaNo ratings yet

- Letter To The DeanDocument2 pagesLetter To The DeanJessie L. Labiste Jr.No ratings yet

- E. TerminationDocument6 pagesE. TerminationDraque Torres100% (2)

- PDF CSC Personal Data Sheet PDS 2017 Page4 PDFDocument1 pagePDF CSC Personal Data Sheet PDS 2017 Page4 PDFHaimin HadilNo ratings yet

- Sample Acknowledgement Letter For In-Kind DonationsDocument1 pageSample Acknowledgement Letter For In-Kind DonationsRowena Furog Baduya EmpanadoNo ratings yet

- Authorization LetterDocument1 pageAuthorization LetterRegineDagumanFuellas100% (1)

- Survey For ThesisDocument4 pagesSurvey For ThesisJerwin DaveNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net WorthSixteen Liquido100% (1)

- Eca Form LatestDocument2 pagesEca Form LatestVeron Caladiao100% (1)

- DOLE TUPAD FormDocument2 pagesDOLE TUPAD FormShienna Mariz Caldito Elep100% (2)

- Paluwagan Agreemen1Document1 pagePaluwagan Agreemen1John Beldad100% (1)

- Indigency CertificateDocument7 pagesIndigency CertificateJey GonzalesNo ratings yet

- Sworn Statement of Assets, Liabilities and Net Worth: Joint Filing Separate Filing Not ApplicableDocument4 pagesSworn Statement of Assets, Liabilities and Net Worth: Joint Filing Separate Filing Not ApplicableGerah Arcayos BiñasNo ratings yet

- Parental or Guardian Permission Form For Research Involving A MinorDocument3 pagesParental or Guardian Permission Form For Research Involving A MinorCamz MedinaNo ratings yet

- Description of The LessonDocument6 pagesDescription of The LessonJerald CañeteNo ratings yet

- COR Request LetterDocument1 pageCOR Request LetterDoriel Jake RubioNo ratings yet

- Baliuag UniversityDocument9 pagesBaliuag UniversityLoraineBaezNo ratings yet

- Authorization Letter With Id of The Business Owner and RepresentativeDocument2 pagesAuthorization Letter With Id of The Business Owner and RepresentativeMarco Regunayan100% (1)

- Concept Paper Dog SchoolDocument4 pagesConcept Paper Dog SchoolClea Marie Mission100% (2)

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net Worthrhenz villafuerteNo ratings yet

- EdefwDocument1 pageEdefwOddly SatisfyingNo ratings yet

- Fsic - Bus - Taguig - Ben 2 - FsicDocument1 pageFsic - Bus - Taguig - Ben 2 - FsicAngelito RegulacionNo ratings yet

- 3Document1 page3Ghe Midz100% (1)

- Authorization LetterDocument1 pageAuthorization LetterReuben MarcelNo ratings yet

- Authorization Letter PhilhealthDocument1 pageAuthorization Letter PhilhealthDariel Baculbas Alvarez50% (4)

- Attendance Sheet: (If Applicable (If Applicable) (If Applicable)Document3 pagesAttendance Sheet: (If Applicable (If Applicable) (If Applicable)Joseph Nobleza86% (7)

- Barangay Manggahan Community-Wide Clean-Up Drive #Battle For Esteros & RiversDocument57 pagesBarangay Manggahan Community-Wide Clean-Up Drive #Battle For Esteros & RiversBarangay ManggahanNo ratings yet

- JID Catering Services BALANCE SHEETDocument1 pageJID Catering Services BALANCE SHEETmarivicNo ratings yet

- Ojt Daily Time RecordDocument1 pageOjt Daily Time Recordcytnhia bulikdayNo ratings yet

- Sample-Authorization-Letter-DSWD-Clearance 3Document1 pageSample-Authorization-Letter-DSWD-Clearance 3Ian Carl Ambrosio100% (1)

- Pag-Ibig MPL Loan App Fillable Feb 2021Document2 pagesPag-Ibig MPL Loan App Fillable Feb 2021Mercelita Tabor San GabrielNo ratings yet

- PhilHealth Auth LetterDocument1 pagePhilHealth Auth Lettergem_mata0% (1)

- Feasibility StudyDocument3 pagesFeasibility Studyapi-264484515No ratings yet

- Certificate of Completion: Ralgo Industries IncorporatedDocument6 pagesCertificate of Completion: Ralgo Industries IncorporatedElton EvangelistaNo ratings yet

- Spes Accomplishment Report 2021Document1 pageSpes Accomplishment Report 2021Jhozelle TandaguenNo ratings yet

- Form D Informed Consent Assessment Form: University of Mindanao Ethics Review CommitteeDocument2 pagesForm D Informed Consent Assessment Form: University of Mindanao Ethics Review CommitteePeHmyang Pineda Diel100% (2)

- Application Form: Department of HealthDocument1 pageApplication Form: Department of Healthmswd0% (1)

- FDC-GA-SP-009 F-03 Ver01 Motor Vehicle Turn-Over FormDocument1 pageFDC-GA-SP-009 F-03 Ver01 Motor Vehicle Turn-Over FormJG Mesp100% (1)

- Appendices - Consent Form For InterviewDocument3 pagesAppendices - Consent Form For InterviewP MarieNo ratings yet

- Explanation Letter For Absence Without A Medical Certificate 2Document1 pageExplanation Letter For Absence Without A Medical Certificate 2Bunga QieshNo ratings yet

- IMRD With ExamplesDocument3 pagesIMRD With ExamplesLalleska AraujoNo ratings yet

- Narrative ReportDocument13 pagesNarrative ReportJunald SolanoNo ratings yet

- BIR Form NoDocument1 pageBIR Form NoAlden Christopher LumotNo ratings yet

- Application For Registration: BIR Form NoDocument1 pageApplication For Registration: BIR Form NoNy Li NamNo ratings yet

- Bir 1904Document2 pagesBir 1904Ann C PalomoNo ratings yet

- Bir Form 1904Document2 pagesBir Form 1904Kate Brzezinska50% (4)

- 1901 Jul 2021 ENCS FinalDocument4 pages1901 Jul 2021 ENCS FinalJed Baylosis (JBL)No ratings yet

- Application For Registration: Taxpayer Identification Number (TIN)Document4 pagesApplication For Registration: Taxpayer Identification Number (TIN)Levi Tomol0% (2)

- Datascope System 98Document16 pagesDatascope System 98Guillermo ZalazarNo ratings yet

- Cross-Compilers: / / Running ARM Grub On U-Boot On QemuDocument5 pagesCross-Compilers: / / Running ARM Grub On U-Boot On QemuSoukous LoverNo ratings yet

- 00 Saip 76Document10 pages00 Saip 76John BuntalesNo ratings yet

- Arab Open University B326: Advanced Financial Accounting TMA - Spring 2022-2023 V2Document7 pagesArab Open University B326: Advanced Financial Accounting TMA - Spring 2022-2023 V2samiaNo ratings yet

- Salary Data 18092018Document5,124 pagesSalary Data 18092018pjrkrishna100% (1)

- University of MauritiusDocument4 pagesUniversity of MauritiusAtish KissoonNo ratings yet

- Resume 202309040934Document5 pagesResume 202309040934dubai eyeNo ratings yet

- Level of Life Skills Dev 5Document59 pagesLevel of Life Skills Dev 5MJ BotorNo ratings yet

- PX4211 2Document3 pagesPX4211 2kalpanaNo ratings yet

- Social Media Engagement and Feedback CycleDocument10 pagesSocial Media Engagement and Feedback Cyclerichard martinNo ratings yet

- Republic vs. CA (G.R. No. 139592, October 5, 2000)Document11 pagesRepublic vs. CA (G.R. No. 139592, October 5, 2000)Alexandra Mae GenorgaNo ratings yet

- Resume ObjectiveDocument2 pagesResume Objectiveapi-12705072No ratings yet

- Public Instructions For Death CorrectionsDocument4 pagesPublic Instructions For Death CorrectionsMukuru TechnologiesNo ratings yet

- Forty Years Ago, December 1, 1980 - PM On Prices - The Indian ExpressDocument8 pagesForty Years Ago, December 1, 1980 - PM On Prices - The Indian ExpresshabeebNo ratings yet

- Microstrip Antennas: How Do They Work?Document2 pagesMicrostrip Antennas: How Do They Work?Tebogo SekgwamaNo ratings yet

- 40 MTCNA QuestionsDocument10 pages40 MTCNA QuestionsM Aris Firjatullah FirdausNo ratings yet

- Latest Eassy Writing Topics For PracticeDocument18 pagesLatest Eassy Writing Topics For PracticeAnjani Kumar RaiNo ratings yet

- BCK Test Ans (Neha)Document3 pagesBCK Test Ans (Neha)Neha GargNo ratings yet

- DS TEGO Polish Additiv WE 50 e 1112Document3 pagesDS TEGO Polish Additiv WE 50 e 1112Noelia Gutiérrez CastroNo ratings yet

- ADocument2 pagesAẄâQâŗÂlïNo ratings yet

- 10.isca RJCS 2015 106Document5 pages10.isca RJCS 2015 106Touhid IslamNo ratings yet

- Bangalore University: Regulations, Scheme and SyllabusDocument40 pagesBangalore University: Regulations, Scheme and SyllabusYashaswiniPrashanthNo ratings yet

- Analyzing Sri Lankan Ceramic IndustryDocument18 pagesAnalyzing Sri Lankan Ceramic Industryrasithapradeep50% (4)

- Válvula DireccionalDocument30 pagesVálvula DireccionalDiego DuranNo ratings yet

- HOVAL Dati Tecnici Caldaie IngleseDocument57 pagesHOVAL Dati Tecnici Caldaie Ingleseosama alabsiNo ratings yet

- Goal of The Firm PDFDocument4 pagesGoal of The Firm PDFSandyNo ratings yet

- Vigi Module Selection PDFDocument1 pageVigi Module Selection PDFrt1973No ratings yet

- Python BarchartDocument34 pagesPython BarchartSeow Khaiwen KhaiwenNo ratings yet

- U HalliburtonDocument3 pagesU Halliburtonanas soufNo ratings yet

- MBA-CM - ME - Lecture 16 Market Structure AnalysisDocument11 pagesMBA-CM - ME - Lecture 16 Market Structure Analysisrohan_solomonNo ratings yet