Professional Documents

Culture Documents

Capital Budgeting: Even Cash Flow Uneven Cash Flow

Uploaded by

Keno OcampoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Budgeting: Even Cash Flow Uneven Cash Flow

Uploaded by

Keno OcampoCopyright:

Available Formats

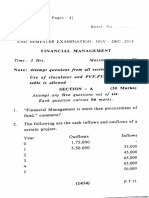

CAPITAL BUDGETING

To arrive at a long term decision, a firm needs to identify the following:

1. 2.

a. 3.

b.

c.

METHODS

Those that do not consider time value of money

1. Payback Period 2. Accounting Rate of Return

Those that consider time value of money

1. Discounted payback period 4. Modified internal rate of return

2. Net present value 5. Profitability Index

3. Internal rate of return

Payback Period

Even Cash Flow Uneven Cash Flow

Aquino plans to purchase a piece of Aquino plans to purchase a piece of

equipment which amounts to P210,000 in equipment which amounts to P210,000 in

accordance with an investment proposal from a accordance with an investment proposal from a

member of his staff. If the equipment is bought, it member of his staff. If the equipment is bought, it

is expected to generate an annual cash inflow of is expected to generate cash inflow as shown

P40,000. A five year payback period is acceptable below. A five year payback period is acceptable to

to Aquino. Aquino.

Year Cash Inflow Year Cash Inflow

1 40,000 1 P20,000

2 40,000 2 30,000

3 40,000 3 40,000

4 40,000 4 50,000

5 40,000 5 50,000

6 40,000 6 40,000

Accounting Rate of Return

Tina’s initial investment on Project A is P100,000. Its estimated useful life is 20 years. Cash inflow per

year is P17,500. What is the ARR?

Discounted Payback Period

Mr. Hopia plans to put up a small stall in front of his house. The overall cost of the construction is

P180,000. The stall is expected to generate cash inflow for 7 years as shown below. A four-year discounted

payback period is acceptable to Mr. Hopia. (WACC is 12%)

Year Annual Cash Returns PVf Discounted amount

1 50,000

2 50,000

3 50,000

4 50,000

5 50,000

6 50,000

7 50,000

Year Annual Cash Returns PVf Discounted amount

1 40,000

2 40,000

3 50,000

4 50,000

5 60,000

6 60,000

7 50,000

Net Present Value

Kim Corp invested P25,000 in a 4-year project. Kim’s cost of capital is 8%. Additional bits of

information on the project are as follows:

After tax Cash Inflow of

Year P1 PVf Present Value

1 10,000

2 15,000

3 18,000

4 16,000

Internal Rate of Return

Assume the following information from Kam’s Korner:

Initial Investment P100,000

Estimated life 10 years

Annual cash inflows P20,000

Cost of capital 12.0%

Modified Internal Rate of Return

A 5-year project with an initial outlay of P18,000 an d a cost of capital of 14% will produce an annual

cash return of P5,600. The IRR of the project is 16.80%.

Profitability Index

Compute for the PI in the problems in NPV and DPP

Mutually exclusive projects

Assume the following cash returns for Projects A and B with the cost of capital of 10%

Year Project A Project B

0 (P2,000) (P2,000)

1 200 900

2 400 700

3 600 600

4 700 400

5 900 200

Compute for the projects’ NPV and IRR (between 14% and 16%)

Capital Rationing (combination of acceptable projects)

Projects Initial Present NPV Profitability Ranking

Outlay Value Index

A 90,000 112,500 22,500 1.250

B 80,000 90,000 10,000 1.125

C 120,000 180,000 60,000 1.500

D 80,000 80,000 - 1.000

E 40,000 30,000 (10,000) 0.750

F 50,000 90,000 40,000 1.800

/RCR

You might also like

- Accounting For LawyersDocument51 pagesAccounting For Lawyersnamratha minupuri100% (2)

- AFAR Notes by Dr. Ferrer PDFDocument21 pagesAFAR Notes by Dr. Ferrer PDFjexNo ratings yet

- Final Project - FA Assignment Financial Analysis of VoltasDocument26 pagesFinal Project - FA Assignment Financial Analysis of VoltasHarvey100% (2)

- Law On SalesDocument9 pagesLaw On SalesSue Cleo Flores Cornejo100% (3)

- Solution Manual Chapter 1Document52 pagesSolution Manual Chapter 1octorp77% (13)

- CparDocument6 pagesCparmxviolet100% (4)

- 10 FS Analysis Sample Exam Discussion KEYDocument10 pages10 FS Analysis Sample Exam Discussion KEYrav danoNo ratings yet

- Proposal A Proposal B Proposal CDocument6 pagesProposal A Proposal B Proposal CMaha HamdyNo ratings yet

- Essay QuestionsDocument16 pagesEssay QuestionssheldonNo ratings yet

- LA 2 Construction Contracts PDFDocument3 pagesLA 2 Construction Contracts PDFliliNo ratings yet

- Financial Statement Analysis UnileverDocument19 pagesFinancial Statement Analysis UnileverGelay MagatNo ratings yet

- CH 9 Factory Overhead - 2Document43 pagesCH 9 Factory Overhead - 2Rana Umair67% (3)

- ACTIVITY 1 Capital BudgetingDocument12 pagesACTIVITY 1 Capital BudgetingkmarisseeNo ratings yet

- Value Added TaxDocument26 pagesValue Added TaxAimee100% (1)

- Capital Budgeting NotesDocument3 pagesCapital Budgeting NotesSahil RupaniNo ratings yet

- UNIT-II-Problems On Capital BudgetingDocument2 pagesUNIT-II-Problems On Capital BudgetingGlyding FlyerNo ratings yet

- Capital Budgeting ExercisesDocument5 pagesCapital Budgeting ExercisesSophia ManglicmotNo ratings yet

- Capital Budgeting For MSC Finance Basic Revision SumsDocument5 pagesCapital Budgeting For MSC Finance Basic Revision SumskimjethaNo ratings yet

- Assignment in Capital InvestmentDocument1 pageAssignment in Capital InvestmentLiberty VeluntaNo ratings yet

- A-3 Capital BudgetingDocument4 pagesA-3 Capital BudgetingUTkarsh DOgraNo ratings yet

- Financial Management Session 10Document11 pagesFinancial Management Session 10Shivangi MohpalNo ratings yet

- MAS Part II Illustrative Examples (Capital Budgeting)Document2 pagesMAS Part II Illustrative Examples (Capital Budgeting)Princess SalvadorNo ratings yet

- Capital Budgeting Sheet 2Document2 pagesCapital Budgeting Sheet 2Gursheen KaurNo ratings yet

- Chapter - 10 - Capital Budgeting DecisionsDocument17 pagesChapter - 10 - Capital Budgeting DecisionsVishwa ShahNo ratings yet

- CapbudexercisesDocument5 pagesCapbudexercisesJhaister Ashley LayugNo ratings yet

- Group and Individual Exercises COTEM 6022Document12 pagesGroup and Individual Exercises COTEM 6022China AlemayehouNo ratings yet

- VND Openxmlformats-Officedocument Wordprocessingml Document&rendition 1Document4 pagesVND Openxmlformats-Officedocument Wordprocessingml Document&rendition 1Rohit Singh RajputNo ratings yet

- Numericals On Capital BudgetingDocument3 pagesNumericals On Capital BudgetingRevati ShindeNo ratings yet

- Fernandez Acctg 14N Finals ExamDocument5 pagesFernandez Acctg 14N Finals ExamJULLIE CARMELLE H. CHATTONo ratings yet

- Gaurav Solanki Section E 447 Assingment 3Document10 pagesGaurav Solanki Section E 447 Assingment 3Praveen Singh ChauhanNo ratings yet

- AP TA BU TIN Apprai A D: I L DGE G S L Metho SDocument11 pagesAP TA BU TIN Apprai A D: I L DGE G S L Metho SKanha SharmaNo ratings yet

- Assignment - 1 (Capital Budgeting)Document3 pagesAssignment - 1 (Capital Budgeting)AnusreeNo ratings yet

- Girum Tsega PerfectDocument13 pagesGirum Tsega PerfectMesi YE GINo ratings yet

- Answers To Warm-Up Exercises: AnswerDocument21 pagesAnswers To Warm-Up Exercises: AnswerMeyzla Ativa HuslikNo ratings yet

- Capital Budgeting MathDocument3 pagesCapital Budgeting MathMD.TARIQUL ISLAM CHOWDHURYNo ratings yet

- Investment Appraisal/capital Investment: Page 1 of 20Document20 pagesInvestment Appraisal/capital Investment: Page 1 of 20parwez_0505No ratings yet

- Capital BudgetingDocument25 pagesCapital BudgetingAnkit JindalNo ratings yet

- Assignment OF Corporate Tax Planning ON: School of Management Studies Punjabi University PatialaDocument6 pagesAssignment OF Corporate Tax Planning ON: School of Management Studies Punjabi University PatialaKaran KalraNo ratings yet

- San Pedro College: Accounting & Financial ManagementDocument4 pagesSan Pedro College: Accounting & Financial ManagementJuan FrivaldoNo ratings yet

- Solutions On Capital BudgetingDocument25 pagesSolutions On Capital BudgetingASH GAMING GamesNo ratings yet

- Cap Evaluation Methods QuestionsDocument4 pagesCap Evaluation Methods QuestionsSrijan AcharyaNo ratings yet

- FINMAN MIDTERMS FinalDocument5 pagesFINMAN MIDTERMS FinalJennifer RasonabeNo ratings yet

- Evaluating TechniquesDocument13 pagesEvaluating TechniquesMario YyyyNo ratings yet

- Capital BudgetingDocument9 pagesCapital BudgetingAnoop SinghNo ratings yet

- Problems 7Document4 pagesProblems 7jojNo ratings yet

- Capital Budgeting MathDocument4 pagesCapital Budgeting MathMuhammad Akmal HossainNo ratings yet

- Rahul Shah 21bsp3195Document24 pagesRahul Shah 21bsp3195Charvi GosaiNo ratings yet

- Rahul Shah 21bsp3195Document24 pagesRahul Shah 21bsp3195Charvi GosaiNo ratings yet

- Capital Budgeting LectureDocument3 pagesCapital Budgeting Lectureamormi2702No ratings yet

- ReportDocument4 pagesReportAlly M. EulalioNo ratings yet

- FM Capital Budgeting SumsDocument4 pagesFM Capital Budgeting SumsRahul GuptaNo ratings yet

- Fina6000 Module 4 - Capital Budgeting BDocument20 pagesFina6000 Module 4 - Capital Budgeting BMar SGNo ratings yet

- Investment Appraisal TutorialDocument6 pagesInvestment Appraisal TutorialQin Yi NgNo ratings yet

- Docslide - Us Assignment 2 55844503ab61cDocument4 pagesDocslide - Us Assignment 2 55844503ab61cAhmedNo ratings yet

- Adobe Scan May 24, 2022Document4 pagesAdobe Scan May 24, 2022Aamod JainNo ratings yet

- Financial Management Session 10Document20 pagesFinancial Management Session 10vaidehirajput03No ratings yet

- Capital Budgeting: Prepared By:-Priyanka GohilDocument44 pagesCapital Budgeting: Prepared By:-Priyanka GohilSunil PillaiNo ratings yet

- Chapter 5. An Introduction Investment Appraisal TechniquesDocument10 pagesChapter 5. An Introduction Investment Appraisal TechniquesHastings KapalaNo ratings yet

- Chapter 4 Capital Budgeting Techniques 2021 - Practice ProblemsDocument20 pagesChapter 4 Capital Budgeting Techniques 2021 - Practice ProblemsAkshat SinghNo ratings yet

- Index: 10.1 Introduction 10.2 Meaning of Capital Rationing 10.3 Steps Involved in Capital Rationing 10.4 SummaryDocument14 pagesIndex: 10.1 Introduction 10.2 Meaning of Capital Rationing 10.3 Steps Involved in Capital Rationing 10.4 SummaryNithin MoozhikkalNo ratings yet

- (A) Payback Period: InvestmentDocument6 pages(A) Payback Period: InvestmentJuliet BhandariNo ratings yet

- FM - Assignment 2 (Capital Budgeting) - 2019-2021Document3 pagesFM - Assignment 2 (Capital Budgeting) - 2019-2021dangerous saif100% (1)

- Bus Com Handout 1 Bus CombinationDocument9 pagesBus Com Handout 1 Bus CombinationChristine RepuldaNo ratings yet

- AtcpDocument2 pagesAtcpnavie VNo ratings yet

- Me 5.4 RMDocument12 pagesMe 5.4 RMPawan NayakNo ratings yet

- Financial EvaluationDocument5 pagesFinancial EvaluationAbebe GetanehNo ratings yet

- FAR2Document8 pagesFAR2Kenneth DiabordoNo ratings yet

- Chapter 6 - Capital BudgetingDocument12 pagesChapter 6 - Capital BudgetingParth GargNo ratings yet

- I. Law On ObligationDocument21 pagesI. Law On ObligationJayvee M FelipeNo ratings yet

- Summary of PSADocument66 pagesSummary of PSAKeno OcampoNo ratings yet

- Department of Trade and Industry (DTI)Document1 pageDepartment of Trade and Industry (DTI)Keno OcampoNo ratings yet

- Polytechnic University of The Philippines-Manila Based On A Five-Level TaxonomyDocument1 pagePolytechnic University of The Philippines-Manila Based On A Five-Level TaxonomyKeno OcampoNo ratings yet

- Chapter 6 Multiple Choice T F Test QuestionsDocument6 pagesChapter 6 Multiple Choice T F Test QuestionsAnh LýNo ratings yet

- Sas - Day #5 - Quiz #1 PDFDocument4 pagesSas - Day #5 - Quiz #1 PDFRochelle Joyce CosmeNo ratings yet

- Dows ExcelDocument18 pagesDows ExcelJaydeep SheteNo ratings yet

- Test Bank For Government and Not For Profit Accounting Concepts and Practices 7th EditionDocument25 pagesTest Bank For Government and Not For Profit Accounting Concepts and Practices 7th EditionMelvin Wakeman100% (39)

- Accounting 1 Assignment 4Document17 pagesAccounting 1 Assignment 4Adinda TiaraNo ratings yet

- Arus Kas DKKDocument5 pagesArus Kas DKKsri nur aulyaNo ratings yet

- Chapter 8 QuizDocument3 pagesChapter 8 QuizTriet Nguyen0% (1)

- Week 12 Cost Volume Profit Analysis RevDocument47 pagesWeek 12 Cost Volume Profit Analysis RevMefilzahalwa AlyayouwanNo ratings yet

- Acc306 Individual Assignment-QDocument3 pagesAcc306 Individual Assignment-QShoaib AhmedNo ratings yet

- Accounting Multilang VocabDocument114 pagesAccounting Multilang Vocabzsuzsaprivate7365No ratings yet

- Week 1 - ACCY111 NotesDocument7 pagesWeek 1 - ACCY111 NotesDarcieNo ratings yet

- Eicher Motors: PrintDocument3 pagesEicher Motors: PrintAryan BagdekarNo ratings yet

- Answers: Operating Income Changes in Net Operating AssetsDocument6 pagesAnswers: Operating Income Changes in Net Operating AssetsNawarathna KumariNo ratings yet

- Assignment 1 - FINACR2Document5 pagesAssignment 1 - FINACR2Deryl GalveNo ratings yet

- United Breweries Limited MisDocument24 pagesUnited Breweries Limited MisManishNo ratings yet

- Rizzah Rahmaniah Ipacc I 20160420023Document3 pagesRizzah Rahmaniah Ipacc I 20160420023Rizzah NianiahNo ratings yet

- Consolidated Key Financial Ratios of Hindalco IndustriesDocument3 pagesConsolidated Key Financial Ratios of Hindalco IndustriesManav JhaveriNo ratings yet

- ShareholdersDocument7 pagesShareholderszhutilNo ratings yet

- Accounting (IAS) Level 3/series 2 2008 (Code 3901)Document20 pagesAccounting (IAS) Level 3/series 2 2008 (Code 3901)Hein Linn Kyaw100% (3)

- Mindtree 08 09Document3 pagesMindtree 08 09muthusubaNo ratings yet

- Notes - Investment Property BookDocument2 pagesNotes - Investment Property BookJake AustriaNo ratings yet

- The RE Formula Is As Follows:: ProfitsDocument4 pagesThe RE Formula Is As Follows:: Profitserica lamsenNo ratings yet

- Contributed CapitalDocument2 pagesContributed CapitalNiño Rey LopezNo ratings yet

- Take Home Quiz - UASDocument2 pagesTake Home Quiz - UASMonalusiNo ratings yet

- Auditing Investments 1Document2 pagesAuditing Investments 1Sabel FordNo ratings yet