Professional Documents

Culture Documents

2019 07 22 21 53 18 209 - 1563812598209 - XXXPR7908X - Itrv PDF

Uploaded by

pramodOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2019 07 22 21 53 18 209 - 1563812598209 - XXXPR7908X - Itrv PDF

Uploaded by

pramodCopyright:

Available Formats

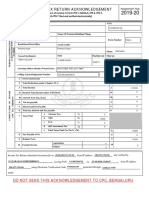

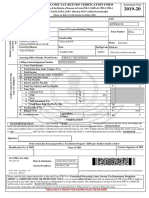

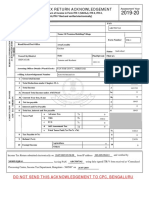

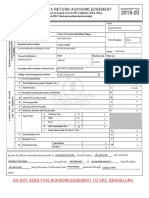

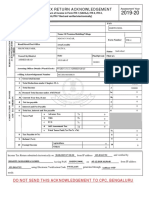

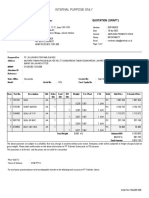

INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year

FORM 2019-20

ITR-V [Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3,

ITR-4(SUGAM), ITR-5, ITR-7 filed but NOT verified electronically]

(Please see Rule 12 of the Income-tax Rules, 1962)

Name PAN

PRAMOD RAGAM

PERSONAL INFORMATION AND THE

CATPR7908H

Flat/Door/Block No Name Of Premises/Building/Village

ACKNOWLEDGEMENT

Form Number ITR-1

2-125

NUMBER

Road/Street/Post Office Area/Locality

POCHAMMA VEEDHI HUZURABAD

Status Individual

PEDDHAPAPAYA PALLI

Town/City/District State Pin/ZipCode Filed u/s

KARIMNAGAR

TELANGANA 505498 139(1)-On or before due date

Assessing Officer Details (Ward/Circle) WARD 1,KARIMNAGAR

e-Filing Acknowledgement Number 679272270220719

1 Gross Total Income 1 1236379

2 Total Deductions under Chapter-VI-A 2 211878

3 Total Income 3 1024500

COMPUTATION OF INCOME

3a Deemed Total Income under AMT/MAT 3a 0

3b Current Year loss, if any 3b

AND TAX THEREON

0

4 Net Tax Payable 4 124644

5 Interest and Fee Payable 5 0

6 Total Tax, Interest and Fee Payable 6 124644

7 Taxes Paid

a Advance Tax 7a 0

b TDS 7b 139570

c TCS 7c 0

d Self Assessment Tax 7d 0

e Total Taxes Paid (7a+7b+7c +7d) 7e 139570

8 Tax Payable (6-7e) 8 0

9 Refund (7e-6) 9 14930

Agriculture 0

10 Exempt Income 10 0

Others 0

VERIFICATION

I, PRAMOD RAGAM son/ daughter of MONDAIAH RAGAM , solemnly declare that to the best of my knowledge and

belief, the information given in the return which has been submitted by me vide acknowledgement number 679272270220719 is

correct and complete and is in accordance with the provisions of the Income-tax Act, 1961. I further declare that I am making this return in my capacity

as Self and I am also competent to make this return and verify it. I am holding permanent account number CATPR7908H .

Sign here

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below

Identification No. of TRP Name of TRP Counter Signature of TRP

For Office Use Only

Receipt No Date of submission 22-07-2019 21:53:18

Source IP address 157.44.116.55

Seal and signature of CATPR7908H01679272270220719F1A8DBDA23D7ABF4317BC65C36861674F81E0C29

receiving official

Please send the duly signed (preferably in blue ink) Form ITR-V to “Centralized Processing Centre, Income Tax Department, Bengaluru

560500”, by ORDINARY POST OR SPEED POST ONLY, so as to reach within 120 days from date of submission of ITR. Form ITR-V shall not

be received in any other office of the Income-tax Department or in any other manner. The confirmation of receipt of this Form ITR-V at ITD-CPC

will be sent to the e-mail Id PRAMOD.RAGAM1@GMAIL.COM .

On successful verification, the acknowledgement can be downloaded from e-Filing portal as a proof of filing the return.

THIS IS NOT A PROOF FOR HAVING FILED THE RETURN

You might also like

- Itr 19-20 PDFDocument1 pageItr 19-20 PDFAnonymous fM5CtB8Qm7No ratings yet

- 2019 06 26 21 51 09 259 - 1561566069259 - XXXPS5856X - Acknowledgement PDFDocument1 page2019 06 26 21 51 09 259 - 1561566069259 - XXXPS5856X - Acknowledgement PDFKamal SharmaNo ratings yet

- 2019 07 17 16 27 54 965 - 1563361074965 - XXXPD0630X - ItrvDocument1 page2019 07 17 16 27 54 965 - 1563361074965 - XXXPD0630X - ItrvAbhiraj dodNo ratings yet

- 2020 11 30 19 02 08 649 - 1606743128649 - XXXPM4571X - ItrvDocument1 page2020 11 30 19 02 08 649 - 1606743128649 - XXXPM4571X - ItrvSahana SkNo ratings yet

- 2019 07 17 13 29 12 415 - 1563350352415 - XXXPM7581X - Itrv PDFDocument1 page2019 07 17 13 29 12 415 - 1563350352415 - XXXPM7581X - Itrv PDFAnil AnnajiNo ratings yet

- 2019 08 21 12 13 35 858 - 1566369815858 - XXXPC1439X - Itrv PDFDocument1 page2019 08 21 12 13 35 858 - 1566369815858 - XXXPC1439X - Itrv PDFSrishti Abhishek JainNo ratings yet

- A9R4h5iip 14alzlm 5ngDocument1 pageA9R4h5iip 14alzlm 5ngEvergreen Digital BannersNo ratings yet

- RSM Itrv 2019-20Document1 pageRSM Itrv 2019-20Rajesh KumarNo ratings yet

- 2019 08 20 21 00 05 439 - 1566315005439 - XXXPB0009X - Acknowledgement PDFDocument1 page2019 08 20 21 00 05 439 - 1566315005439 - XXXPB0009X - Acknowledgement PDFMurali KrishnaNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Pravin MasalgeNo ratings yet

- 2020 12 30 14 40 29 638 - 1609319429638 - XXXPS2759X - Itrv PDFDocument1 page2020 12 30 14 40 29 638 - 1609319429638 - XXXPS2759X - Itrv PDFansarNo ratings yet

- XXXPD9714X - Itr VDocument1 pageXXXPD9714X - Itr VSohil DiwanNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruKushal MalhotraNo ratings yet

- Balwinder Singh ITR 2Document1 pageBalwinder Singh ITR 2Pawan KumarNo ratings yet

- 2020 07 28 17 40 29 427 - 1595938229427 - XXXPG8558X - ItrvDocument1 page2020 07 28 17 40 29 427 - 1595938229427 - XXXPG8558X - ItrvPANKAJ KUMAR GIRINo ratings yet

- 2019 07 22 18 47 23 855 - 1563801443855 - XXXPS3282X - Itrv PDFDocument1 page2019 07 22 18 47 23 855 - 1563801443855 - XXXPS3282X - Itrv PDFsselvhakumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalururambabu peddapalliNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruHarshwardhan SharmaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAnil vaddiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAnsar ValiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurukrishna kasanNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurugamini bhargavNo ratings yet

- A.Y. 2019-20 ItrvunlDocument1 pageA.Y. 2019-20 Itrvunlkishan bhalodiyaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAnonymous k9nrtxANo ratings yet

- Itr 19-20Document1 pageItr 19-20Ashwani KumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruGanesh DasaraNo ratings yet

- 2019 08 29 00 39 44 009 - 1567019384009 - XXXPK4733X - ItrvDocument1 page2019 08 29 00 39 44 009 - 1567019384009 - XXXPK4733X - Itrvramesh jothyNo ratings yet

- Itr Ack Fin Yr 2018-19 (2019-20) PDFDocument1 pageItr Ack Fin Yr 2018-19 (2019-20) PDFgunda satishkumarNo ratings yet

- 2019 08 24 15 36 22 554 - 1566641182554 - XXXPR5688X - Itrv PDFDocument1 page2019 08 24 15 36 22 554 - 1566641182554 - XXXPR5688X - Itrv PDFShankar Rao AsipiNo ratings yet

- 2019 06 24 15 21 22 990 - 1561369882990 - XXXPA6889X - Acknowledgement PDFDocument1 page2019 06 24 15 21 22 990 - 1561369882990 - XXXPA6889X - Acknowledgement PDFSiva KumariNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurusmit myangarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSandip BakundiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruVikas MahorNo ratings yet

- 2019 08 21 13 18 30 806 - 1566373710806 - XXXPY2179X - AcknowledgementDocument1 page2019 08 21 13 18 30 806 - 1566373710806 - XXXPY2179X - Acknowledgementkasturi YogenderNo ratings yet

- ACKDocument1 pageACKSAITEJA SOLVENT PURCHASENo ratings yet

- Itr 2018-19 PDFDocument1 pageItr 2018-19 PDFMalik MuzafferNo ratings yet

- 2019 05 07 12 56 41 653 - 1557214001653 - XXXPK2148X - AcknowledgementDocument1 page2019 05 07 12 56 41 653 - 1557214001653 - XXXPK2148X - AcknowledgementDeepak KumarNo ratings yet

- A.Y. 2019-20 PDF - 759201740040819Document1 pageA.Y. 2019-20 PDF - 759201740040819mukesh singhNo ratings yet

- Itr-V GMCPS4166R 2019-20 480205390220519Document1 pageItr-V GMCPS4166R 2019-20 480205390220519kumarhealthcare2000No ratings yet

- 2019 08 28 20 01 51 446 - 1567002711446 - XXXPP5379X - AcknowledgementDocument1 page2019 08 28 20 01 51 446 - 1567002711446 - XXXPP5379X - AcknowledgementParvatareddy TriveniNo ratings yet

- 2019 08 29 08 03 51 002 - 1567046031002 - XXXPS7042X - Acknowledgement PDFDocument1 page2019 08 29 08 03 51 002 - 1567046031002 - XXXPS7042X - Acknowledgement PDFsonal aNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Karan VetNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruNadeemNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMohit JainNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruNeethinathanNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBINAYAK CHAKRABORTYNo ratings yet

- 2020 01 02 15 41 29 892 - 1577959889892 - XXXPT8767X - AcknowledgementDocument1 page2020 01 02 15 41 29 892 - 1577959889892 - XXXPT8767X - AcknowledgementKanahiya TandonNo ratings yet

- Itr 19-20Document1 pageItr 19-20Ruloans VaishaliNo ratings yet

- Gita Singh IndividualDocument1 pageGita Singh IndividualjccchhhNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSmr OrganizationsNo ratings yet

- PDF 531439100260619Document1 pagePDF 531439100260619Animesh JainNo ratings yet

- Acknowledgement ItrDocument1 pageAcknowledgement ItrSourav KumarNo ratings yet

- 2019 06 14 15 52 41 008 - 1560507761008 - XXXPR2319X - Acknowledgement PDFDocument1 page2019 06 14 15 52 41 008 - 1560507761008 - XXXPR2319X - Acknowledgement PDFrama jagadeshNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurujasvir singhNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruZa HidNo ratings yet

- BHARTI GOYAL - AcknowledgementDocument1 pageBHARTI GOYAL - AcknowledgementSuman jhaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSagar Kumar GuptaNo ratings yet

- 2019 12 20 11 04 21 881 - 1576820061881 - XXXPJ2291X - Acknowledgement PDFDocument1 page2019 12 20 11 04 21 881 - 1576820061881 - XXXPJ2291X - Acknowledgement PDFArjunJaiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSubhendu NathNo ratings yet

- Bangalore FruitsDocument6 pagesBangalore FruitsMahesh GNo ratings yet

- Vro 2014 Question PaperDocument21 pagesVro 2014 Question PaperpramodNo ratings yet

- Economy Now A DaysDocument1 pageEconomy Now A DayspramodNo ratings yet

- Corona Effecet UsaDocument1 pageCorona Effecet UsapramodNo ratings yet

- 11 Distance ProtectionDocument22 pages11 Distance ProtectionSristick100% (1)

- Corna Effect in UsaDocument1 pageCorna Effect in UsapramodNo ratings yet

- Piano Chord ChartDocument2 pagesPiano Chord Chartjosephdahiroc838467% (6)

- Learn Circle of 4ths by CountingDocument6 pagesLearn Circle of 4ths by CountingJonathan Israel Peña RomeroNo ratings yet

- P 55Document1 pageP 55pramodNo ratings yet

- P 44Document1 pageP 44pramodNo ratings yet

- P 66Document2 pagesP 66pramodNo ratings yet

- P 33Document1 pageP 33pramodNo ratings yet

- Ee Ee Ee Ee GGG BBB BeeDocument1 pageEe Ee Ee Ee GGG BBB BeepramodNo ratings yet

- Paper 4Document1 pagePaper 4pramodNo ratings yet

- Piano LessonsDocument1 pagePiano LessonspramodNo ratings yet

- Music For BeginnersDocument1 pageMusic For BeginnerspramodNo ratings yet

- Its Paper 3 by Me I Am Uploading HereDocument1 pageIts Paper 3 by Me I Am Uploading HerepramodNo ratings yet

- Music Is Devine Music Music Is Devine Music Is Devine Music Is DevineDocument1 pageMusic Is Devine Music Music Is Devine Music Is Devine Music Is DevinepramodNo ratings yet

- Music Is Devine Music Music Is Devine Music Is Devine Music Is DevineDocument1 pageMusic Is Devine Music Music Is Devine Music Is Devine Music Is DevinepramodNo ratings yet

- Namra Finance LimitedDocument5 pagesNamra Finance LimitedPramila TyagiNo ratings yet

- International Trade and Finance (Derivatives)Document52 pagesInternational Trade and Finance (Derivatives)NikhilChainani100% (1)

- Credit Risk Modelling Literature ReviewDocument5 pagesCredit Risk Modelling Literature Reviewea3h1c1p100% (1)

- Finance & Banking - NU SyllabusDocument8 pagesFinance & Banking - NU SyllabusadctgNo ratings yet

- Chapter 9, 11: Assignment Questions (Ch9) P9-16 (Document2 pagesChapter 9, 11: Assignment Questions (Ch9) P9-16 (Cheung HarveyNo ratings yet

- Daily Report MonitoringDocument9 pagesDaily Report MonitoringMaasin BranchNo ratings yet

- Nepal Bank Limited: Summer Training Project Report ON "Deposit Schemes of Nepal Bank"Document61 pagesNepal Bank Limited: Summer Training Project Report ON "Deposit Schemes of Nepal Bank"Aditya VermaNo ratings yet

- Meet Your TeamDocument2 pagesMeet Your TeamAyushman MathurNo ratings yet

- The Paddington Place - Studio 23.67sqmDocument14 pagesThe Paddington Place - Studio 23.67sqmGenki DayouNo ratings yet

- Lesson 1 - Overview of Valuation Concepts and MethodsDocument5 pagesLesson 1 - Overview of Valuation Concepts and MethodsF l o w e rNo ratings yet

- Profits and Gains of Business or Profession: After Studying This Chapter, You Would Be Able ToDocument214 pagesProfits and Gains of Business or Profession: After Studying This Chapter, You Would Be Able ToPragasNo ratings yet

- Problem 1Document4 pagesProblem 1Live LoveNo ratings yet

- Allux Indo 8301385679Document2 pagesAllux Indo 8301385679Ardi dutaNo ratings yet

- Company Name: Starting Date Cash Balance Alert MinimumDocument3 pagesCompany Name: Starting Date Cash Balance Alert MinimumdantevariasNo ratings yet

- Ja TinderDocument6 pagesJa TinderHitlisted VasuNo ratings yet

- Investment Wisdom From The Super AnalystsDocument6 pagesInvestment Wisdom From The Super Analystsautostrada.scmhrdNo ratings yet

- Accounting PrinciplesDocument4 pagesAccounting PrinciplesManjulaNo ratings yet

- Capstone (M&a IN BANKS IN INDIA)Document13 pagesCapstone (M&a IN BANKS IN INDIA)Mandeep SinghNo ratings yet

- Member Statement: Questions?Document8 pagesMember Statement: Questions?Michael CarsonNo ratings yet

- Satyam ScamDocument17 pagesSatyam ScamRakib HasanNo ratings yet

- 10 Musharka FinancingDocument24 pages10 Musharka FinancingFaheemullah HaddadNo ratings yet

- BSE SME Exchange - BusinessDocument53 pagesBSE SME Exchange - BusinessDeepak GajareNo ratings yet

- Strategy 10: Long StraddleDocument9 pagesStrategy 10: Long StraddlenemchandNo ratings yet

- SRM Sem1 Exam Fee ReceiptDocument2 pagesSRM Sem1 Exam Fee Receiptdeeksha6548gkNo ratings yet

- A. Under Statement of Financial Position: Typical Account Titles UsedDocument6 pagesA. Under Statement of Financial Position: Typical Account Titles UsedAshlyn MaeNo ratings yet

- Issues and Challenges of Insurance Industry in IndiaDocument3 pagesIssues and Challenges of Insurance Industry in Indianishant b100% (1)

- CA51024 - Quiz 2 (Solutions)Document6 pagesCA51024 - Quiz 2 (Solutions)The Brain Dump PHNo ratings yet

- Delayed: Intermediaries, They CollecDocument16 pagesDelayed: Intermediaries, They CollecNadeesha UdayanganiNo ratings yet

- Schedule of New Fees - RetooledDocument2 pagesSchedule of New Fees - RetooledRaymund Fernandez CamachoNo ratings yet

- Generally Accepted Accounting PrinciplesDocument12 pagesGenerally Accepted Accounting PrinciplesMARIA ANGELICA100% (1)