Professional Documents

Culture Documents

2019 07 22 18 47 23 855 - 1563801443855 - XXXPS3282X - Itrv PDF

Uploaded by

sselvhakumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2019 07 22 18 47 23 855 - 1563801443855 - XXXPS3282X - Itrv PDF

Uploaded by

sselvhakumarCopyright:

Available Formats

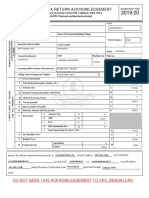

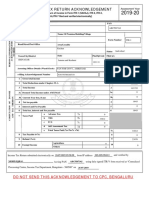

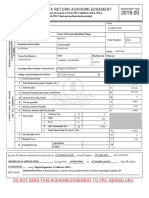

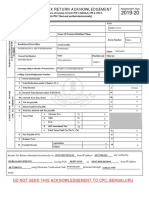

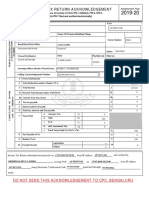

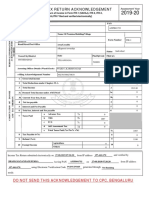

INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year

FORM 2019-20

ITR-V [Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3,

ITR-4(SUGAM), ITR-5, ITR-7 filed but NOT verified electronically]

(Please see Rule 12 of the Income-tax Rules, 1962)

Name PAN

SANTHANAM SELVHAKUMAR

PERSONAL INFORMATION AND THE

AYHPS3282M

Flat/Door/Block No Name Of Premises/Building/Village

ACKNOWLEDGEMENT

Form Number ITR-1

Q 54/ 2EB QUARTERS

NUMBER

Road/Street/Post Office Area/Locality

NEAR CHINNA PARK Mettur

Status Individual

Town/City/District State Pin/ZipCode Filed u/s

SALEM

TAMILNADU 636401 139(1)-On or before due date

Assessing Officer Details (Ward/Circle) WARD 2(5) SALEM

e-Filing Acknowledgement Number 676853340220719

1 Gross Total Income 1 1026308

2 Total Deductions under Chapter-VI-A 2 0

3 Total Income 3 1026310

COMPUTATION OF INCOME

3a Deemed Total Income under AMT/MAT 3a 0

3b Current Year loss, if any 3b

AND TAX THEREON

0

4 Net Tax Payable 4 125209

5 Interest and Fee Payable 5 0

6 Total Tax, Interest and Fee Payable 6 125209

7 Taxes Paid

a Advance Tax 7a 0

b TDS 7b 125207

c TCS 7c 0

d Self Assessment Tax 7d 0

e Total Taxes Paid (7a+7b+7c +7d) 7e 125207

8 Tax Payable (6-7e) 8 0

9 Refund (7e-6) 9 0

Agriculture 0

10 Exempt Income 10 0

Others 0

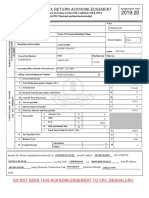

VERIFICATION

I, SANTHANAM SELVHAKUMAR son/ daughter of SANTHANAM , solemnly declare that to the best of my knowledge and

belief, the information given in the return which has been submitted by me vide acknowledgement number 676853340220719 is

correct and complete and is in accordance with the provisions of the Income-tax Act, 1961. I further declare that I am making this return in my capacity

as Self and I am also competent to make this return and verify it. I am holding permanent account number AYHPS3282M .

Sign here

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below

Identification No. of TRP Name of TRP Counter Signature of TRP

For Office Use Only

Receipt No Date of submission 22-07-2019 18:47:23

Source IP address 117.201.16.20

Seal and signature of AYHPS3282M0167685334022071909AE7FCD2048F52C9BBEE003C34EFB03805CAA41

receiving official

Please send the duly signed (preferably in blue ink) Form ITR-V to “Centralized Processing Centre, Income Tax Department, Bengaluru

560500”, by ORDINARY POST OR SPEED POST ONLY, so as to reach within 120 days from date of submission of ITR. Form ITR-V shall not

be received in any other office of the Income-tax Department or in any other manner. The confirmation of receipt of this Form ITR-V at ITD-CPC

will be sent to the e-mail Id sselvhakumartpas@gmail.com .

On successful verification, the acknowledgement can be downloaded from e-Filing portal as a proof of filing the return.

THIS IS NOT A PROOF FOR HAVING FILED THE RETURN

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Pravin MasalgeNo ratings yet

- 2019 07 17 16 27 54 965 - 1563361074965 - XXXPD0630X - ItrvDocument1 page2019 07 17 16 27 54 965 - 1563361074965 - XXXPD0630X - ItrvAbhiraj dodNo ratings yet

- 2019 07 22 21 53 18 209 - 1563812598209 - XXXPR7908X - Itrv PDFDocument1 page2019 07 22 21 53 18 209 - 1563812598209 - XXXPR7908X - Itrv PDFpramodNo ratings yet

- Itr 19-20 PDFDocument1 pageItr 19-20 PDFAnonymous fM5CtB8Qm7No ratings yet

- 2020 11 30 19 02 08 649 - 1606743128649 - XXXPM4571X - ItrvDocument1 page2020 11 30 19 02 08 649 - 1606743128649 - XXXPM4571X - ItrvSahana SkNo ratings yet

- 2019 08 21 12 13 35 858 - 1566369815858 - XXXPC1439X - Itrv PDFDocument1 page2019 08 21 12 13 35 858 - 1566369815858 - XXXPC1439X - Itrv PDFSrishti Abhishek JainNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruVikas MahorNo ratings yet

- RSM Itrv 2019-20Document1 pageRSM Itrv 2019-20Rajesh KumarNo ratings yet

- 2020 12 30 14 40 29 638 - 1609319429638 - XXXPS2759X - Itrv PDFDocument1 page2020 12 30 14 40 29 638 - 1609319429638 - XXXPS2759X - Itrv PDFansarNo ratings yet

- 2019 07 17 13 29 12 415 - 1563350352415 - XXXPM7581X - Itrv PDFDocument1 page2019 07 17 13 29 12 415 - 1563350352415 - XXXPM7581X - Itrv PDFAnil AnnajiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurugamini bhargavNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAnsar ValiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurusayesha chandNo ratings yet

- 2019 08 29 00 39 44 009 - 1567019384009 - XXXPK4733X - ItrvDocument1 page2019 08 29 00 39 44 009 - 1567019384009 - XXXPK4733X - Itrvramesh jothyNo ratings yet

- A9R4h5iip 14alzlm 5ngDocument1 pageA9R4h5iip 14alzlm 5ngEvergreen Digital BannersNo ratings yet

- Itr-V Atipc3056f 2012-13 661170550180713Document1 pageItr-V Atipc3056f 2012-13 661170550180713Gst IndiaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengaluruvishnu ksNo ratings yet

- 2020 07 28 17 40 29 427 - 1595938229427 - XXXPG8558X - ItrvDocument1 page2020 07 28 17 40 29 427 - 1595938229427 - XXXPG8558X - ItrvPANKAJ KUMAR GIRINo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruZa HidNo ratings yet

- 2019 12 20 11 04 21 881 - 1576820061881 - XXXPJ2291X - Acknowledgement PDFDocument1 page2019 12 20 11 04 21 881 - 1576820061881 - XXXPJ2291X - Acknowledgement PDFArjunJaiNo ratings yet

- 2019 08 20 21 00 05 439 - 1566315005439 - XXXPB0009X - Acknowledgement PDFDocument1 page2019 08 20 21 00 05 439 - 1566315005439 - XXXPB0009X - Acknowledgement PDFMurali KrishnaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAnil vaddiNo ratings yet

- 2019 06 26 21 51 09 259 - 1561566069259 - XXXPS5856X - Acknowledgement PDFDocument1 page2019 06 26 21 51 09 259 - 1561566069259 - XXXPS5856X - Acknowledgement PDFKamal SharmaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruGanesh DasaraNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBINAYAK CHAKRABORTYNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruNadeemNo ratings yet

- Balwinder Singh ITR 2Document1 pageBalwinder Singh ITR 2Pawan KumarNo ratings yet

- A.Y. 2019-20 ItrvunlDocument1 pageA.Y. 2019-20 Itrvunlkishan bhalodiyaNo ratings yet

- 2019 07 03 19 45 07 276 - 1562163307276 - XXXPM2399X - ItrvDocument1 page2019 07 03 19 45 07 276 - 1562163307276 - XXXPM2399X - ItrvDedaram FulwariyaNo ratings yet

- Aman Jain Itr (A.y.2017-18)Document1 pageAman Jain Itr (A.y.2017-18)ramanNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMohit JainNo ratings yet

- XXXPD9714X - Itr VDocument1 pageXXXPD9714X - Itr VSohil DiwanNo ratings yet

- Gita Singh IndividualDocument1 pageGita Singh IndividualjccchhhNo ratings yet

- Ack VDocument1 pageAck VShantanu MetayNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalururengarajan82No ratings yet

- 2020 01 02 15 41 29 892 - 1577959889892 - XXXPT8767X - AcknowledgementDocument1 page2020 01 02 15 41 29 892 - 1577959889892 - XXXPT8767X - AcknowledgementKanahiya TandonNo ratings yet

- 2019 11 01 21 37 31 963 - 1572624451963 - XXXPP7803X - Acknowledgement PDFDocument1 page2019 11 01 21 37 31 963 - 1572624451963 - XXXPP7803X - Acknowledgement PDFKunal PaulNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)ANSHU KAPOORNo ratings yet

- 2019 08 18 21 20 24 392 - 1566143424392 - XXXPS7518X - AcknowledgementDocument1 page2019 08 18 21 20 24 392 - 1566143424392 - XXXPS7518X - Acknowledgementajayavisagar1No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAnonymous k9nrtxANo ratings yet

- 2019 08 29 08 03 51 002 - 1567046031002 - XXXPS7042X - Acknowledgement PDFDocument1 page2019 08 29 08 03 51 002 - 1567046031002 - XXXPS7042X - Acknowledgement PDFsonal aNo ratings yet

- 2019 08 25 22 36 30 211 - 1566752790211 - XXXPN9296X - AcknowledgementDocument1 page2019 08 25 22 36 30 211 - 1566752790211 - XXXPN9296X - AcknowledgementBibhudatta TripathyNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruHarjot SinghNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruJayabrata sahooNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSmr OrganizationsNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)deepakNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruPavitra Nityanand DasNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruNeethinathanNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Anmol KhannaNo ratings yet

- Itr 2018-19 PDFDocument1 pageItr 2018-19 PDFMalik MuzafferNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSagar Kumar GuptaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSandip BakundiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruPradeep NegiNo ratings yet

- Itr Ack Fin Yr 2018-19 (2019-20) PDFDocument1 pageItr Ack Fin Yr 2018-19 (2019-20) PDFgunda satishkumarNo ratings yet

- 2019 08 08 14 49 18 168 - 1565255958168 - XXXPD2712X - Acknowledgement PDFDocument1 page2019 08 08 14 49 18 168 - 1565255958168 - XXXPD2712X - Acknowledgement PDFMaheshNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMaheshNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalururambabu peddapalliNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurukrishna kasanNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSubhendu NathNo ratings yet

- 0-Sales - Invoice-Waghade Kirana ShopDocument1 page0-Sales - Invoice-Waghade Kirana ShopPankaj NimjeNo ratings yet

- TAX Taxation of Employment IncomeDocument37 pagesTAX Taxation of Employment Incomedarcpamaterials90% (10)

- Salary Slip Format For 25000Document2 pagesSalary Slip Format For 25000Saravanan KNo ratings yet

- Solved Comet Operates Solely Within The United States It Owns Two PDFDocument1 pageSolved Comet Operates Solely Within The United States It Owns Two PDFAnbu jaromiaNo ratings yet

- A DP Payroll With CheckDocument1 pageA DP Payroll With CheckFuvv FreeNo ratings yet

- Problems I: P4-5 Eamirrgr)Document1 pageProblems I: P4-5 Eamirrgr)Amel LiaNo ratings yet

- House Rent Receipt - FormatDocument2 pagesHouse Rent Receipt - Formatshruthi shruNo ratings yet

- Application For Property Tax Relief For Military PersonnelDocument1 pageApplication For Property Tax Relief For Military PersonnelSyed Mohammed AizazNo ratings yet

- Wa0000.Document2 pagesWa0000.Atul ThakreNo ratings yet

- Gross To Nett - Yarra VlogDocument2 pagesGross To Nett - Yarra VlogRichardo Putra SiahaanNo ratings yet

- Goods Transport Agency (GTA) in GSTDocument6 pagesGoods Transport Agency (GTA) in GSTbhanupriya beheraNo ratings yet

- Prefill 2019Document2 pagesPrefill 2019Usama AshfaqNo ratings yet

- Sample Honorarium LetterDocument1 pageSample Honorarium LetterChristy Ledesma-NavarroNo ratings yet

- Mileage-Parking Reimbursement FormDocument2 pagesMileage-Parking Reimbursement Formrich chastNo ratings yet

- FTF 2022-03-23 1648079099327Document14 pagesFTF 2022-03-23 1648079099327Charles Goodwin100% (1)

- InvoiceDocument1 pageInvoiceprashantNo ratings yet

- Chapter 8: Tax Management: Planning, Avoidance and EvasionDocument16 pagesChapter 8: Tax Management: Planning, Avoidance and EvasionCharlesNo ratings yet

- Chapter 13 Income Taxes of PartnershipsDocument2 pagesChapter 13 Income Taxes of PartnershipsMike Rajas33% (6)

- AutoPay Output Documents PDFDocument2 pagesAutoPay Output Documents PDFAnonymous QZuBG2IzsNo ratings yet

- RMC No. 94-2021Document2 pagesRMC No. 94-2021JelaineNo ratings yet

- Tax Movie Research Paper - AADocument6 pagesTax Movie Research Paper - AAAndrea Galeazzi RosilloNo ratings yet

- FORM MO-1040A: Missouri Individual Income Tax Return Single/Married (Income From One Spouse) - Short FormDocument2 pagesFORM MO-1040A: Missouri Individual Income Tax Return Single/Married (Income From One Spouse) - Short Formpixel986No ratings yet

- RMO No. 23-2018 DigestDocument4 pagesRMO No. 23-2018 DigestMary Joy NavajaNo ratings yet

- NPCF 0723Document1 pageNPCF 0723anirudh shahNo ratings yet

- G.R. No. 251065, 30 June 2021 Makati City and The City Treasurer of Makati City, Petitioner Vs Metro Pacific RESOURCES INC. (MPRI), RespondentDocument2 pagesG.R. No. 251065, 30 June 2021 Makati City and The City Treasurer of Makati City, Petitioner Vs Metro Pacific RESOURCES INC. (MPRI), RespondentKateDeseoNo ratings yet

- Uma Salary Slip JulyDocument1 pageUma Salary Slip Julyjyothi sNo ratings yet

- Cash Receipts Journal Template ExcelDocument1 pageCash Receipts Journal Template ExcelPaul Gabriel100% (1)

- Questions and Suggested AnswersDocument1 pageQuestions and Suggested AnswersjustinebetteNo ratings yet

- CGST & Central Excise - Range OfficeDocument2 pagesCGST & Central Excise - Range OfficeAYUSH PRADHANNo ratings yet

- 1601EQ 2nd Qtr. 2019 PDFDocument2 pages1601EQ 2nd Qtr. 2019 PDFmarifel barinqueNo ratings yet