Professional Documents

Culture Documents

Format of TDS Return Cancellation Request

Format of TDS Return Cancellation Request

Uploaded by

NITESH JAISINGHANI0 ratings0% found this document useful (0 votes)

8 views1 pageOriginal Title

Format of TDS return Cancellation request.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageFormat of TDS Return Cancellation Request

Format of TDS Return Cancellation Request

Uploaded by

NITESH JAISINGHANICopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

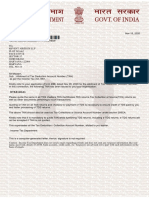

25.05.

2017

To,

The Facilitation centre of NSDL

Sub: Request for cancellation of Paper TDS Returns filed earlier so as to facilitate filing of e TDS

Return.

Dear sir ,

Following are the details for which cancellation is requested:

TAN –

Token No

Financial Year –

Form - 26Q

Quarter - Q4

Contact Detail -

Email ID –

Reason for cancellation - Outstanding Demand of challan mismatch and correction is not possible

online, therefore filling e-tds return in lieu of Cancellation of Paper return

Name & Designation of Authorized person –

PAN of Authorized Person:

We request you to kindly cancel the same

Thanking you,

Yours faithfully,

You might also like

- Payment AuthorizationDocument1 pagePayment Authorizationiqbalgaul01+24No ratings yet

- PF LettersDocument29 pagesPF Lettersfaizanaalam50% (2)

- Clearance FormDocument2 pagesClearance FormselvamuthukumarNo ratings yet

- Please Read (Ofbs)Document36 pagesPlease Read (Ofbs)MTO LGU-GOANo ratings yet

- Refund Request FormatDocument1 pageRefund Request FormatRam Narasimha100% (1)

- For Billing Enquiry Visit Https://selfcare - Tikona.inDocument2 pagesFor Billing Enquiry Visit Https://selfcare - Tikona.inAdd K0% (1)

- TAN - Khidmat Tours & Travels PVT LTDDocument1 pageTAN - Khidmat Tours & Travels PVT LTDSahab Uddin Ahmed ChoudhuryNo ratings yet

- RTKR20027ADocument1 pageRTKR20027Ajijaboy366No ratings yet

- NCPL TanDocument1 pageNCPL TanCA Alpesh TatedNo ratings yet

- Gmail - Sub - Beneficiary Registration-Status Warning - Rejection-Documents Required For Re-Initiation of Beneficiary Registration-RegDocument2 pagesGmail - Sub - Beneficiary Registration-Status Warning - Rejection-Documents Required For Re-Initiation of Beneficiary Registration-Regvenkatesh07121999No ratings yet

- TAN - Sanjayrekha Aggregator - PNES82580BDocument1 pageTAN - Sanjayrekha Aggregator - PNES82580BHarshad JathotNo ratings yet

- Annex 055840100375124Document2 pagesAnnex 055840100375124Siddhi PatilNo ratings yet

- VRF FormDocument1 pageVRF FormSny Kumar DeepakNo ratings yet

- Guidelines On F&F Settlement For Staff Who Have Resigned From RollsDocument5 pagesGuidelines On F&F Settlement For Staff Who Have Resigned From RollsSantosh Prasad0% (1)

- Team Ralys TANDocument1 pageTeam Ralys TANrameshNo ratings yet

- Stamp Paper FormDocument1 pageStamp Paper FormnavinkapilNo ratings yet

- Post Bag No.2, Electronic City Post Office, Bangalore-560100Document1 pagePost Bag No.2, Electronic City Post Office, Bangalore-560100Pavas SaxenaNo ratings yet

- Annex 882039274666970Document1 pageAnnex 882039274666970sandeep.soniNo ratings yet

- Offline Payment ConfirmationDocument2 pagesOffline Payment ConfirmationSharad GuptaNo ratings yet

- Sub: Allotment of Tax Deduction Account Number (TAN) As Per Income Tax Act, 1961Document1 pageSub: Allotment of Tax Deduction Account Number (TAN) As Per Income Tax Act, 1961Abu TaherNo ratings yet

- Non Receipt of Exit PAn OptionsDocument2 pagesNon Receipt of Exit PAn OptionsMKNo ratings yet

- Mail - RE - Claim Status - YFAE950884YF PDFDocument3 pagesMail - RE - Claim Status - YFAE950884YF PDFSankalp Suman ChandelNo ratings yet

- Form 26QB Property Tax Payment Form13Document3 pagesForm 26QB Property Tax Payment Form13JayCharleysNo ratings yet

- Application IndDocument1 pageApplication IndVinay KulkarniNo ratings yet

- Non Recei Pot of Bond Cert HDocument5 pagesNon Recei Pot of Bond Cert HMKNo ratings yet

- Application For Fees RefundDocument2 pagesApplication For Fees Refundmd saadan anjumNo ratings yet

- Session III: Subscriber MaintenanceDocument16 pagesSession III: Subscriber MaintenanceslowspeedyNo ratings yet

- Acknowledgment For Request For New PAN Card or - and Changes or Correction in PAN Data (881030205408706)Document1 pageAcknowledgment For Request For New PAN Card or - and Changes or Correction in PAN Data (881030205408706)kapilchandanNo ratings yet

- TAN CertificateDocument1 pageTAN Certificatesabir hussainNo ratings yet

- MR Rajnan Kumar: Other Bill Payment OptionsDocument2 pagesMR Rajnan Kumar: Other Bill Payment OptionsMukesh BohraNo ratings yet

- TAN UnlockedDocument1 pageTAN UnlockedthimothiNo ratings yet

- MR - V. Venkata Ramudu HQ / 87 BN, CRPF Salbagan, Agartala Tripura - 799012Document1 pageMR - V. Venkata Ramudu HQ / 87 BN, CRPF Salbagan, Agartala Tripura - 799012Supan DbarmaNo ratings yet

- Auto Debit Application Form: Detail of Application (As in Nric/Passport)Document1 pageAuto Debit Application Form: Detail of Application (As in Nric/Passport)retrii27No ratings yet

- Application EstampDocument1 pageApplication Estampvijay_vbvNo ratings yet

- E-Challan Template: PART - I (Details of Applicant/ Remitter/ Originator) Date 30-11-2021Document2 pagesE-Challan Template: PART - I (Details of Applicant/ Remitter/ Originator) Date 30-11-2021Kartikey singhNo ratings yet

- Hema Daga 154 ReminderDocument1 pageHema Daga 154 ReminderRajat NayakNo ratings yet

- Annex 881130211969615Document1 pageAnnex 881130211969615saleem shaikhNo ratings yet

- E-Toll Confirmation / Change of Direct Debit DetailsDocument1 pageE-Toll Confirmation / Change of Direct Debit DetailsBobdNo ratings yet

- WWW - Igrs.ap - Gov.in: EnclosuresDocument1 pageWWW - Igrs.ap - Gov.in: EnclosuresPavan Kumar Reddy ChillaNo ratings yet

- Ecircular: Non-Financial Service (NFS) Requests Introduction of Standard Customer Request Form (CRF)Document7 pagesEcircular: Non-Financial Service (NFS) Requests Introduction of Standard Customer Request Form (CRF)Simar100% (1)

- Associated Sites Bill Payment (Single Account) Bill Payment (Multiple Account) View Bill Lodge A Complaint Payment HistoryDocument1 pageAssociated Sites Bill Payment (Single Account) Bill Payment (Multiple Account) View Bill Lodge A Complaint Payment HistoryPulastaMahapatraNo ratings yet

- Our RefDocument68 pagesOur RefAmmer Yaser MehetanNo ratings yet

- Elec BillDocument1 pageElec BillPriya N AshuNo ratings yet

- Elec BillDocument1 pageElec BillReiki Channel Anuj BhargavaNo ratings yet

- TR Document 4Document2 pagesTR Document 4Bhairab Pd. PandeyNo ratings yet

- DPID Stamp: DPID Stamp:: NSDL Account Opening FormDocument20 pagesDPID Stamp: DPID Stamp:: NSDL Account Opening FormKalyan ChakravarthyNo ratings yet

- Updation Form: SMC Global Securities Limited SMC Comtrade LTDDocument2 pagesUpdation Form: SMC Global Securities Limited SMC Comtrade LTDসোমনাথ মহাপাত্রNo ratings yet

- LT Bill 46001160003 201512Document2 pagesLT Bill 46001160003 201512Santanu DasNo ratings yet

- BANK NOC-Cancelled LetterDocument1 pageBANK NOC-Cancelled Letterrumelrashid_seuNo ratings yet

- Please Confirm Your Information Before Proceeding: Form 26QB Confirmation PageDocument5 pagesPlease Confirm Your Information Before Proceeding: Form 26QB Confirmation PageRevecons LLPNo ratings yet

- Rttax Usa EngDocument8 pagesRttax Usa EngRodion ChesovNo ratings yet

- Bank LetterDocument1 pageBank LetterSubbarao NatakamNo ratings yet

- WordPad Pan Card LetterDocument1 pageWordPad Pan Card Lettermozammila295No ratings yet

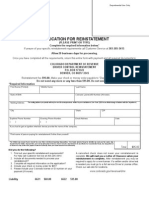

- DR2870 Reinstatment FormDocument1 pageDR2870 Reinstatment FormJack HoffmanNo ratings yet

- Application Form For UPDocument1 pageApplication Form For UPankitNo ratings yet

- Bristol Online Services Pvt. LTD.: Membership Application FormDocument3 pagesBristol Online Services Pvt. LTD.: Membership Application FormTiffany HodgesNo ratings yet

- Starter FormDocument4 pagesStarter FormHelly GleiceNo ratings yet

- MR Sankaran Narayanan - A H: Other Bill Payment OptionsDocument4 pagesMR Sankaran Narayanan - A H: Other Bill Payment OptionsHari SreyasNo ratings yet

- ManishDocument1 pageManishmanishrajak238961No ratings yet

- OVD DeclarationDocument1 pageOVD DeclarationArun MotorsNo ratings yet