Professional Documents

Culture Documents

True or False Mqe Reviewer

Uploaded by

arnel barawedCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

True or False Mqe Reviewer

Uploaded by

arnel barawedCopyright:

Available Formats

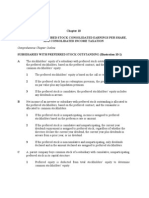

TRUE OR FALSE

1. Partners’ capital accounts are credited for the amount invested and or permanently withdrawn.

2. Partner’s regular withdrawal of cash is credited to a separate drawing account.

3. Partner’s regular withdrawal of cash is debited to a separate drawing account.

4. If a partner’s investment in a partnership consists of equipment that has accumulated depreciation of

P 8, 000, it should be recorded at net of accumulated depreciation in the partnership books.

5. When the partnership’s market value is greater than the book value of equity, the new partner is

usually required to pay a bonus to the current partners.

6. If a partnership incurs a loss for the period, the Income Summary account is required to be credited in

a closing entry to allocate the loss to the partners.

7. When a 10% bonus to a managing partner is stipulated in the partnership agreement, this should be

given even if the business operation resulted to a loss.

8. It indicates that a bonus was paid to the original partners if a new partner invests in a partnership at

book value and acquires a ¼ interest in total partnership capital.

9. When a retiring partner receives partnership assets that are less than his or her capital balance on the

date of withdrawal, a bonus to the remaining partners results.

10. In admission by investment, if total contributions exceed the total agreed capital, it may be implied

that assets are overstated and should be decreased through an adjustment.

11. The amounts that the partners withdraw from the partnership are taxed.

12. The salary allowances or interest cannot be used as a method of determining profit share if the

partnership incurs a loss.

13. The salary allowances or interest cannot be used as a method of determining profit share if the

partnership’s net income is not sufficient to cover them.

14. Ordinary shareholders always share equally with preference shareholders in all dividends.

15. Par value is the price at which a share of stock is bought or sold.

16. The ease of transferability of shares of stock and the shareholders’ limited liability in a corporation

makes the shares of stock attractive to investors.

17. The legal capital requirements protect creditors by requiring a minimum level of net assets.

You might also like

- Partnership and Corporation AccountingDocument13 pagesPartnership and Corporation AccountingOrestes Mendoza91% (66)

- COMPREHENSIVE PARTNERSHIP EXAMDocument25 pagesCOMPREHENSIVE PARTNERSHIP EXAMJoemar Santos Torres100% (3)

- PARTNERSHIP ACCOUNTING EXAM REVIEWDocument26 pagesPARTNERSHIP ACCOUNTING EXAM REVIEWIts meh Sushi50% (2)

- Partnership - TheoriesDocument1 pagePartnership - TheoriesBrian Christian VillaluzNo ratings yet

- AdFAR.701 - Partnership Accounting - OnlineDocument6 pagesAdFAR.701 - Partnership Accounting - OnlineMikaela Lapuz Salvador100% (2)

- PartnershipDocument3 pagesPartnershipjaneNo ratings yet

- Partnership Reviewer: True/False and Multiple Choice QuestionsDocument14 pagesPartnership Reviewer: True/False and Multiple Choice Questionsjano_art21No ratings yet

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- BAC 112 Midterm Examination With QuestionsDocument11 pagesBAC 112 Midterm Examination With Questionsjanus lopezNo ratings yet

- Muhammad Ihtisamuddin C1I018026 Quiz 10Document2 pagesMuhammad Ihtisamuddin C1I018026 Quiz 10Haikal Nur FahreziNo ratings yet

- Finals - Financial AccountingDocument6 pagesFinals - Financial AccountingAlyssa QuiambaoNo ratings yet

- True or FalseDocument7 pagesTrue or FalseColline ZoletaNo ratings yet

- Comprehensive Exam For Partnership AcctgDocument30 pagesComprehensive Exam For Partnership AcctgchingNo ratings yet

- Partnerships Organization and OperationDocument6 pagesPartnerships Organization and OperationAshraf Uz ZamanNo ratings yet

- CH09MANDocument42 pagesCH09MANBudi KurniajiNo ratings yet

- Chap009 131230191204 Phpapp01Document41 pagesChap009 131230191204 Phpapp01AndrianMelmamBesyNo ratings yet

- Accounting For Special Transactions PartneshipDocument43 pagesAccounting For Special Transactions Partneshipvee viajeroNo ratings yet

- 429266Document45 pages429266Shofiana Ifada100% (1)

- PARTNERSHIP FORMATIONDocument43 pagesPARTNERSHIP FORMATIONnash67% (3)

- Acc 9 TestbankDocument143 pagesAcc 9 TestbankPaula de Torres100% (2)

- 01a Partnership Formation & Admission of A PartnerxxDocument73 pages01a Partnership Formation & Admission of A PartnerxxAnaliza OndoyNo ratings yet

- Practical Accounting 2: Theory & Practice Advance Accounting Partnership - Formation & AdmissionDocument46 pagesPractical Accounting 2: Theory & Practice Advance Accounting Partnership - Formation & AdmissionKeith Anthony AmorNo ratings yet

- Partnership Accounting ModuleDocument15 pagesPartnership Accounting ModuleMon RamNo ratings yet

- Module 1 - Advacc 1Document10 pagesModule 1 - Advacc 1Andrea Lyn Salonga CacayNo ratings yet

- Accounting 2 PrelimsDocument3 pagesAccounting 2 PrelimsJohn Alfred Castino100% (1)

- W1 Partnership AccountingDocument11 pagesW1 Partnership AccountingChristine Joy MondaNo ratings yet

- Advanced Financial Accounting Christensen 10th Edition Solutions ManualDocument42 pagesAdvanced Financial Accounting Christensen 10th Edition Solutions ManualMariaDaviesqrbg100% (40)

- Nvestment in AssociatesDocument4 pagesNvestment in AssociatesJeric Lagyaban AstrologioNo ratings yet

- Partnership FormationDocument1 pagePartnership FormationIskaNo ratings yet

- Accounting Theories ReviewDocument5 pagesAccounting Theories Reviewsamitsu wpNo ratings yet

- LLP Organization and Partnership AgreementsDocument6 pagesLLP Organization and Partnership AgreementsAhmad Al-Tarifi Abu JozephNo ratings yet

- TOA Book Value, Basic and Diluted Per ShareDocument1 pageTOA Book Value, Basic and Diluted Per SharePatrick BacongalloNo ratings yet

- PDF 1pdfsam01 Partnership Formation Amp Admission of A Partnerxx 1pdfDocument57 pagesPDF 1pdfsam01 Partnership Formation Amp Admission of A Partnerxx 1pdflinkin soyNo ratings yet

- Partnership Operations Chapter Explains Profit SharingDocument3 pagesPartnership Operations Chapter Explains Profit SharingCleofe Mae Piñero AseñasNo ratings yet

- Advanced Financial Accounting and ReportingDocument15 pagesAdvanced Financial Accounting and ReportingAcain RolienNo ratings yet

- SM Chap 9Document41 pagesSM Chap 9Debora BongNo ratings yet

- AFAR Partnership FormationDocument4 pagesAFAR Partnership FormationCleofe Mae Piñero AseñasNo ratings yet

- Polytechnic University of The Philippines College of Accountancy and FinanceDocument1 pagePolytechnic University of The Philippines College of Accountancy and FinanceChin Chin FrancoNo ratings yet

- Advanced Financial Accounting 11th Edition Christensen Solutions ManualDocument43 pagesAdvanced Financial Accounting 11th Edition Christensen Solutions Manualtiffanywilliamsenyqjfskcx100% (18)

- Advanced Financial Accounting 11th Edition Christensen Solutions Manual Full Chapter PDFDocument64 pagesAdvanced Financial Accounting 11th Edition Christensen Solutions Manual Full Chapter PDFSandraMurraykean100% (12)

- Partnerships Lecture Notes Partnership Formation and OperationDocument3 pagesPartnerships Lecture Notes Partnership Formation and OperationJessalyn CilotNo ratings yet

- #15 Investment in AssociatesDocument3 pages#15 Investment in AssociatesZaaavnn VannnnnNo ratings yet

- W1 Partnership AccountingDocument8 pagesW1 Partnership AccountingChristine Joy MondaNo ratings yet

- Chapter 15Document56 pagesChapter 15idm284100% (1)

- Theory - Part 2 PDFDocument21 pagesTheory - Part 2 PDFBettina OsterfasticsNo ratings yet

- 1st AssessmentDocument6 pages1st AssessmentRae Jeniña E.MerelosNo ratings yet

- Subsidiary Preferred Stock Consolidated Earnings Per Share, and Consolidated Income TaxationDocument16 pagesSubsidiary Preferred Stock Consolidated Earnings Per Share, and Consolidated Income TaxationAnzas Rustamaji PratamaNo ratings yet

- Practical Accounting 2: Theory & Practice Advance Accounting Partnership - Formation & AdmissionDocument56 pagesPractical Accounting 2: Theory & Practice Advance Accounting Partnership - Formation & AdmissionGwen Cabarse Pansoy100% (1)

- Significant Influence EvidenceDocument5 pagesSignificant Influence Evidenceelle friasNo ratings yet

- Chap 002Document45 pagesChap 002poop gravy100% (1)

- Partnership FormationDocument32 pagesPartnership FormationLean Campo100% (1)

- 1 Partnership FormationDocument5 pages1 Partnership FormationArmhel FangonNo ratings yet

- Lesson 1. Introduction To PartnershipDocument4 pagesLesson 1. Introduction To Partnershipangelinelucastoquero548No ratings yet

- Chap 002Document52 pagesChap 002Kiky Agustyan TanoewidjajaNo ratings yet

- Chapter 14 Advanced SolutionsDocument32 pagesChapter 14 Advanced SolutionsIntal XDNo ratings yet

- ACC 311 - Chapter 1 PartnershipDocument6 pagesACC 311 - Chapter 1 PartnershipMark Laurence SanchezNo ratings yet

- Summary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingFrom EverandSummary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingNo ratings yet

- Causes and effects of vomitingDocument2 pagesCauses and effects of vomitingarnel barawedNo ratings yet

- FSDocument1 pageFSarnel barawedNo ratings yet

- AccountingsDocument1 pageAccountingsarnel barawedNo ratings yet

- Financial QnalysisDocument1 pageFinancial Qnalysisarnel barawedNo ratings yet

- Financial StatementDocument1 pageFinancial StatementThariqNo ratings yet

- WitchcraftDocument2 pagesWitchcraftarnel barawedNo ratings yet

- BICYCLEDocument1 pageBICYCLEarnel barawedNo ratings yet

- Ear Human Right Ear (Cropped) .JPG The Outer Portion of The Human EarDocument1 pageEar Human Right Ear (Cropped) .JPG The Outer Portion of The Human Eararnel barawedNo ratings yet

- Working CapitalDocument3 pagesWorking CapitalDeepthi RadhakrishnanNo ratings yet

- EARDocument1 pageEARarnel barawedNo ratings yet

- Causes and effects of vomitingDocument2 pagesCauses and effects of vomitingarnel barawedNo ratings yet

- Causes and effects of vomitingDocument2 pagesCauses and effects of vomitingarnel barawedNo ratings yet

- Ear Human Right Ear (Cropped) .JPG The Outer Portion of The Human EarDocument1 pageEar Human Right Ear (Cropped) .JPG The Outer Portion of The Human Eararnel barawedNo ratings yet

- EARDocument1 pageEARarnel barawedNo ratings yet

- BICYCLEDocument1 pageBICYCLEarnel barawedNo ratings yet

- The Solar Syste-WPS OfficeDocument1 pageThe Solar Syste-WPS Officearnel barawedNo ratings yet

- COOP Love NotesDocument23 pagesCOOP Love NotesKoreangelica ChipeNo ratings yet

- Causes and effects of vomitingDocument2 pagesCauses and effects of vomitingarnel barawedNo ratings yet

- Types of Animal-WPS OfficeDocument3 pagesTypes of Animal-WPS Officearnel barawedNo ratings yet

- Blaw Parcor ReviewerDocument4 pagesBlaw Parcor Reviewerarnel barawedNo ratings yet

- Study Skills, a-WPS OfficeDocument1 pageStudy Skills, a-WPS Officearnel barawedNo ratings yet

- AIS ReviewerDocument3 pagesAIS Reviewerarnel barawedNo ratings yet

- QUESTIONNAIREDocument4 pagesQUESTIONNAIREarnel barawedNo ratings yet

- QUESTIONNAIREDocument3 pagesQUESTIONNAIREarnel barawedNo ratings yet

- INTAX ScandalDocument12 pagesINTAX Scandalarnel barawedNo ratings yet

- QUESTIONNAIRE about FOOD COMPETENCIESDocument10 pagesQUESTIONNAIRE about FOOD COMPETENCIESNavNo ratings yet

- SASA RevisedDocument3 pagesSASA Revisedarnel barawedNo ratings yet

- ACCOUNT PAYABLE-WPS OfficeDocument2 pagesACCOUNT PAYABLE-WPS Officearnel barawedNo ratings yet

- TaxDocument5 pagesTaxarnel barawedNo ratings yet

- ACCOUNT PAYABLE-WPS OfficeDocument1 pageACCOUNT PAYABLE-WPS Officearnel barawedNo ratings yet