Professional Documents

Culture Documents

All Goals Within Easy Reach: Family Fi Nance

Uploaded by

sudOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

All Goals Within Easy Reach: Family Fi Nance

Uploaded by

sudCopyright:

Available Formats

family finance

16 The Economic Times Wealth September 23-29, 2019

All goals within

easy reach

By utilising his existing resources and securing risks

adequately, Shravan can ensure a smooth journey. SHRAVAN I. & RADHIKA, 32 & 29 YEARS, SALARIED, TAMIL NADU

by Riju Mehta

How to invest for goals

Portfolio

S

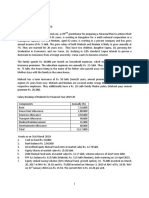

hravan I. is a 32-year-old soft- INVESTMENT

FUTURE COST (`) / RESOURCES

ware engineer from Tamil Nadu GOAL NEEDED

CURRENT VALUE TIME TO ACHIEVE USED

and gets a monthly salary of ASSET (`/MONTH)

(`)

`89,500. He stays with his home-

maker wife in a rented house.

Emergency fund 7.1 lakh Cash, FD, P2P loan -

Real estate 60 lakh

After considering his household expens-

Buying a car 8.5 lakh / 3 yrs - 30,000

es, rent and insurance premium, he is left Cash 2.8 lakh

with a surplus of `32,308. His portfolio, Vacation 3.5 lakh / 5 yrs Cash -

Debt

worth `1.8 crore, comprises real estate in

the form of three plots of land worth `60 PPF 17.5 lakh Buying a house 70 lakh / 5 yrs Real estate -

lakh, debt worth `40.6 lakh and equity

worth `83 lakh. His goals include building

EPF 16.9 lakh Future child’s

1.7 crore / 18 yrs Mutual funds -

a contingency corpus, buying a car and education

Fixed deposits 3 lakh

a house, taking a vacation, saving for his Future child’s

future child’s education and wedding, and Others (P2P loan) 3.2 lakh 2.7 crore / 25 yrs Mutual funds -

wedding

his retirement. Equity Mutual funds,

Financial Planner Pankaaj Maalde sug- Retirement 8.3 crore / 23 yrs -

Direct equity 44.4 lakh PMS, EPF, PPF

gests he build an emergency corpus of `3.6

lakh for the couple and a medical buffer of Investible surplus

PMS 38.6 lakh 30,000

`3.5 lakh for his parents. This can be done needed

by allocating a portion of his cash, fixed Total 1.86 crore Annual return assumed to be 12% for equity and 8% for debt funds. Inflation assumed to be 7%.

deposit and P2P loan, which should be

invested in an ultra short duration fund.

Shravan wants to buy a car worth `8.5

LIABILITIES CURRENT VALUE (`)

Insurance portfolio

lakh after three years and can amass the

Home loan -

EXISTING SUGGESTED

EXISTING

amount by starting an SIP of `30,000 in an Total liability - MONTHLY MONTHLY

INSURANCE COVER SUGGESTIONS

equity savings fund. For his goal of tak- PREMIUM PREMIUM

(`)

ing a `3.5 lakh vacation in five years, he (`) (`)

can invest his cash holding of `2 lakh in a Net worth `1.86 crore

Life insurance

short duration fund. No existing resource

has been allocated to both these goals. Term plan - - Buy `1 crore plan 833

Shravan also wants to buy a house worth

`70 lakh in five years, for which he can sell Traditional

- - - -

plan

his plots to get the desired amount.

For the education of his future child in

Cash flow Ulips - - -

18 years, Shravan has estimated a need EXISTING SUGGESTED

of `1.7 crore. For this, he can assign a por- (`) (`) TOTAL - - `1 crore 833

tion of his mutual fund corpus, which will

help amass the required amount in the Income 89,500 89,500 Health insurance

specified time. For the child’s wedding

in 25 years, he wants `2.7 crore, and can Employer’s 7.5 lakh 2,025 - -

Outflow

allocate the remaining mutual fund cor-

pus for this goal. For retirement, he will 1,000

Household Buy `10 lakh family

need `8.3 crore in 23 years as he wants to 55,167 55,167 Own - - + 2,025

expenses floater plan

retire at 55 years. For this, he can assign (existing)

his PPF, EPF, PMS and remaining mu- Insurance 2,025 4,191 TOTAL 7.5 lakh 2,025 `17.5 lakh 3,025

tual fund corpus. No fresh investment is premium

needed for this goal. Critical illness Buy `25 lakh

Shravan has no life insurance, and a Investment - 30,000 & accident - - accident 333

`7.5 lakh family floater plan for health disability disability plan

insurance, which has been provided by Total outflow 57,192 89,500 TOTAL - - - 333

his employer. Maalde suggests he buy a

`1 crore term plan, which will cost him Insurance cost - 2,025 - 4,191

`833 a month in premium. For health in-

Surplus 32,308 142

Premiums are indicative and could vary for different insurers.

surance, he should buy a `10 lakh family

floater plan, which will cost him `1,000 a

month in premium. He should also pur-

FINANCIAL PLAN BY

Write to us Looking for a professional to analyse your investment

portfolio? Write to us at etwealth@timesgroup.com with

chase a `25 lakh accident disability plan

at a monthly premium of `333. This should

PANKAAJ MAALDE for expert ‘Family Finances’ as the subject. Our experts will study

your portfolio and offer objective advice on where and

take care of his insurance needs.

CERTIFIED FINANCIAL PLANNER

advice how much you need to invest to reach your goals.

You might also like

- Commercial Law Aspects of Residential Mortgage Securitisation in AustraliaFrom EverandCommercial Law Aspects of Residential Mortgage Securitisation in AustraliaNo ratings yet

- Priti CaseDocument3 pagesPriti Casecarry minatteeNo ratings yet

- Assignment of Personal Financial Planning: TopicDocument9 pagesAssignment of Personal Financial Planning: Topicvikas anandNo ratings yet

- Fund Fact Sheets - Prosperity Balanced FundDocument1 pageFund Fact Sheets - Prosperity Balanced FundJohh-RevNo ratings yet

- Gurpreet 2020Document3 pagesGurpreet 2020Aditya BohraNo ratings yet

- Intenal Assesment-3Document6 pagesIntenal Assesment-3chandumicrocosm1986No ratings yet

- Case Study: PointDocument1 pageCase Study: PointprasadzinjurdeNo ratings yet

- M5Pankaj Sen 5Document5 pagesM5Pankaj Sen 5api-3814557No ratings yet

- Fund Fact Sheets - Prosperity Equity FundDocument1 pageFund Fact Sheets - Prosperity Equity FundJohh-RevNo ratings yet

- MSPP LeafletDocument4 pagesMSPP LeafletChayan MukherjeeNo ratings yet

- Fatkhul Arief - PERSONAL FINANCEDocument11 pagesFatkhul Arief - PERSONAL FINANCEVania WahyuningtyasNo ratings yet

- Case Study - RamDocument5 pagesCase Study - RamswathyNo ratings yet

- Manappuram Finance - Corporate Presentation - Nov 2019Document29 pagesManappuram Finance - Corporate Presentation - Nov 2019rupesh kumarNo ratings yet

- Financial Plan Goals, Assets, and Life Parameters for Roger G D'MelloDocument12 pagesFinancial Plan Goals, Assets, and Life Parameters for Roger G D'MellotarangtgNo ratings yet

- Ppfas MF Factsheet October 2019Document8 pagesPpfas MF Factsheet October 2019Shyam GuptaNo ratings yet

- Retirement planning & financial goals for coupleDocument4 pagesRetirement planning & financial goals for coupleARYA SHETHNo ratings yet

- Total: Life Insurance 2 LakhsDocument2 pagesTotal: Life Insurance 2 LakhsBMPNo ratings yet

- Family finances case study and recommendationsDocument1 pageFamily finances case study and recommendationsthangave2000No ratings yet

- Test-2: New Scheme Final Course - Group I Paper 2: Strategic Financial ManagementDocument6 pagesTest-2: New Scheme Final Course - Group I Paper 2: Strategic Financial Managementshiva kumarNo ratings yet

- Case Study For CFPDocument1 pageCase Study For CFPsinghanshu21100% (2)

- 9 CFP Exam5-Afp-2008 Case Studies PDFDocument130 pages9 CFP Exam5-Afp-2008 Case Studies PDFankur892No ratings yet

- SREFP Brochure BookletDocument20 pagesSREFP Brochure BookletKaran GuptaNo ratings yet

- Protect your family's future with i-GR8 HARAPANDocument28 pagesProtect your family's future with i-GR8 HARAPANMohamedSuffianNo ratings yet

- Wealth Management CompetitionDocument14 pagesWealth Management Competitionapi-663792863No ratings yet

- Case CDocument3 pagesCase Cnaveen0037No ratings yet

- Q2 W1 General MathematicsDocument39 pagesQ2 W1 General MathematicsSamantha ManibogNo ratings yet

- Case Study 7Document2 pagesCase Study 7.No ratings yet

- (Investor) Sbi MF - Children's Benefit Fund - Compliance Approved PPT - 21.08.2020Document31 pages(Investor) Sbi MF - Children's Benefit Fund - Compliance Approved PPT - 21.08.2020Abhishek JainNo ratings yet

- Case: Roger: (Reference Date: 1st April, 2019)Document6 pagesCase: Roger: (Reference Date: 1st April, 2019)Krish BhutaNo ratings yet

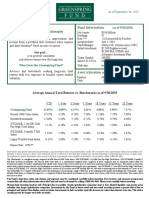

- Greenspring Fund Philosophy Fund Information: (As of 9/30/2019)Document2 pagesGreenspring Fund Philosophy Fund Information: (As of 9/30/2019)Anonymous TtkcZvPNo ratings yet

- Imagine Today Is Your 25th BirthdayDocument23 pagesImagine Today Is Your 25th BirthdayChintan DesaiNo ratings yet

- Sample Case StudYDocument11 pagesSample Case StudYArun SahooNo ratings yet

- Webinar With Zerodha - Kalpen Parekh: February 22, 2019Document7 pagesWebinar With Zerodha - Kalpen Parekh: February 22, 2019SPNo ratings yet

- AL Debt Fund - One Pager - v3Document2 pagesAL Debt Fund - One Pager - v3kanikaNo ratings yet

- CFP RaipDocument3 pagesCFP RaipsinhapushpanjaliNo ratings yet

- 9M 2018 GT Capital Investor Presentation v5 - OnlineDocument80 pages9M 2018 GT Capital Investor Presentation v5 - OnlineJan SanielNo ratings yet

- Financial plan for Ashwin and familyDocument3 pagesFinancial plan for Ashwin and familyAditya BohraNo ratings yet

- CFP TAXDocument15 pagesCFP TAXAmeyaNo ratings yet

- Mahehs 2019Document3 pagesMahehs 2019Aditya BohraNo ratings yet

- About Parag Parikh Flexi Cap Fund: (Please Visit Page 2)Document14 pagesAbout Parag Parikh Flexi Cap Fund: (Please Visit Page 2)Dr. Mukesh JindalNo ratings yet

- Goals Within Reach With Higher Equity Exposure: FinancesDocument1 pageGoals Within Reach With Higher Equity Exposure: FinanceskrjuluNo ratings yet

- Fund Fact Sheets - Prosperity Bond FundDocument1 pageFund Fact Sheets - Prosperity Bond FundJohh-RevNo ratings yet

- Govt SchemesDocument5 pagesGovt SchemesNavneet KumarNo ratings yet

- RTPBDocument87 pagesRTPBKr PrajapatNo ratings yet

- IRT, Panchkula: Allahabad Bank E-Learning ProjectDocument5 pagesIRT, Panchkula: Allahabad Bank E-Learning Projectसंदीप सिंह परिहारNo ratings yet

- Hand Book On Retail Loan Products PDFDocument78 pagesHand Book On Retail Loan Products PDFparadise_27No ratings yet

- Chintan CaseDocument3 pagesChintan Caseaadi sharmaNo ratings yet

- Investment OptionsDocument4 pagesInvestment OptionssomnathpalsNo ratings yet

- MLTT Sales Idea For Takaful Life Planner - V4Document16 pagesMLTT Sales Idea For Takaful Life Planner - V4Nazarul FazreenNo ratings yet

- Maf253 Quiz Jan 2023 QDocument2 pagesMaf253 Quiz Jan 2023 QSyamimi NabilaNo ratings yet

- St. Kabir Institute of Professional Studies End Term Examination marketing financial productsDocument4 pagesSt. Kabir Institute of Professional Studies End Term Examination marketing financial productsKetan BhoiNo ratings yet

- Impact of Financial Cost Due To Increase in KIBOR June 15, 2022Document3 pagesImpact of Financial Cost Due To Increase in KIBOR June 15, 2022usmanthesaviorNo ratings yet

- About Parag Parikh Flexi Cap Fund: (Please Visit Page 2)Document14 pagesAbout Parag Parikh Flexi Cap Fund: (Please Visit Page 2)TunirNo ratings yet

- 6 Reasons to choose Max LifeDocument2 pages6 Reasons to choose Max LifeVaibhav GargNo ratings yet

- Marwen-Ayari-Pay-Package (1)Document1 pageMarwen-Ayari-Pay-Package (1)Novalabs StudiosNo ratings yet

- Sanjay: Negotiated by Monthly Granted FloatingDocument8 pagesSanjay: Negotiated by Monthly Granted FloatingPrashanth JogimuttNo ratings yet

- Ppfas MF Factsheet For December 2023Document20 pagesPpfas MF Factsheet For December 2023Ashu KumarNo ratings yet

- Case BDocument2 pagesCase BKajolNo ratings yet

- Personalised Proposal For Securing Your Guaranteed Income NeedsDocument6 pagesPersonalised Proposal For Securing Your Guaranteed Income NeedsSirshajit SanfuiNo ratings yet

- Scan Doc with CamScanner AppDocument1 pageScan Doc with CamScanner AppsudNo ratings yet

- New Doc 2019-07-16 15.52.28Document1 pageNew Doc 2019-07-16 15.52.28sudNo ratings yet

- CamScanner Scans PDF DocsDocument6 pagesCamScanner Scans PDF DocssudNo ratings yet

- New Doc 2019-06-01 10.33.21 - 1Document1 pageNew Doc 2019-06-01 10.33.21 - 1sudNo ratings yet

- New Doc 2019-06-01 10.58.18 - 1Document1 pageNew Doc 2019-06-01 10.58.18 - 1sudNo ratings yet

- Now, Pay Health Premium Monthly: Preview PreviewDocument1 pageNow, Pay Health Premium Monthly: Preview PreviewsudNo ratings yet

- ETM 2019 09 23 Page 38Document1 pageETM 2019 09 23 Page 38sudNo ratings yet

- Stocks Stocks: Fairchem Specialty HDFC BankDocument1 pageStocks Stocks: Fairchem Specialty HDFC BanksudNo ratings yet

- The Stocks To Consider For This Year's Mahurat TradingDocument1 pageThe Stocks To Consider For This Year's Mahurat TradingsudNo ratings yet

- Why we all must save a little for an uncertain futureDocument1 pageWhy we all must save a little for an uncertain futuresudNo ratings yet

- Stocks: Larsen & Toubro Bharat Electronics Finolex CablesDocument1 pageStocks: Larsen & Toubro Bharat Electronics Finolex CablessudNo ratings yet

- ETM 2019 09 23 Page 36Document1 pageETM 2019 09 23 Page 36sudNo ratings yet

- Best True Wireless Earbuds On A Budget: Check CheckDocument1 pageBest True Wireless Earbuds On A Budget: Check ChecksudNo ratings yet

- These Capital Goods Stocks Could Create WealthDocument1 pageThese Capital Goods Stocks Could Create WealthsudNo ratings yet

- ETM 2019 09 23 Page 28Document1 pageETM 2019 09 23 Page 28sudNo ratings yet

- Precoro Capture (Autosaved)Document264 pagesPrecoro Capture (Autosaved)Steffany NoyaNo ratings yet

- ProCapture-T User Manual V1.1 - 20210903 PDFDocument65 pagesProCapture-T User Manual V1.1 - 20210903 PDFahmad khanNo ratings yet

- Gold Jewelry Manufacturing and Retail ShopDocument37 pagesGold Jewelry Manufacturing and Retail ShopMubeen Qureshi100% (1)

- 2 2005Document13 pages2 2005VinothKumarDhananjayan100% (1)

- Arnold Hidalgo - CaseDocument13 pagesArnold Hidalgo - CaseAllana NacinoNo ratings yet

- Danh Sach Khach Hang San Giao Dich Vang VGB TPHCMDocument27 pagesDanh Sach Khach Hang San Giao Dich Vang VGB TPHCMMr. DATANo ratings yet

- ICICI Prudential StudyDocument43 pagesICICI Prudential StudyMaytanNo ratings yet

- Shooting An ElephantDocument2 pagesShooting An ElephantShilpaDasNo ratings yet

- 2022-2023 UA Room & Board RatesDocument1 page2022-2023 UA Room & Board RatesKiranvarma KakarlapudiNo ratings yet

- RizalDocument14 pagesRizalJohn Christopher BadiolaNo ratings yet

- Chapter 3: An Introduction To Consolidated Financial StatementsDocument44 pagesChapter 3: An Introduction To Consolidated Financial StatementsMUHAMMAD ARIFNo ratings yet

- Introducing Bill Evans: Nat HentoffDocument2 pagesIntroducing Bill Evans: Nat HentoffSeda BalcıNo ratings yet

- Sin Missing The MarkDocument2 pagesSin Missing The MarkCeray67No ratings yet

- The Core Beliefs and Practices of SikhismDocument26 pagesThe Core Beliefs and Practices of SikhismGVNo ratings yet

- Nutri Jingle 2016Document2 pagesNutri Jingle 2016Soc SaballaNo ratings yet

- Malaysia Sewerage Industry Guideline Volume 1Document281 pagesMalaysia Sewerage Industry Guideline Volume 1Asiff Razif100% (1)

- Key Performance Indicators - Signposts To Loss PreventionDocument2 pagesKey Performance Indicators - Signposts To Loss PreventionSteve ForsterNo ratings yet

- H14.72.HR.090702.PE Data SheetDocument5 pagesH14.72.HR.090702.PE Data SheeteekamaleshNo ratings yet

- Q&A Accounting Sales and Purchase JournalsDocument16 pagesQ&A Accounting Sales and Purchase JournalsQand A BookkeepingNo ratings yet

- WJ 2016 07Document158 pagesWJ 2016 07JastenJesusNo ratings yet

- Ipsas 35 SummaryDocument6 pagesIpsas 35 SummaryWilson Mugenyi KasendwaNo ratings yet

- EPI Program Member ManualDocument56 pagesEPI Program Member Manualcharina.nemenzo23No ratings yet

- Six Basic Food Groups of the Caribbean DietDocument2 pagesSix Basic Food Groups of the Caribbean DietEn GeorgeNo ratings yet

- In The Court of Hon'Ble District Judge Pune, at Pune CAVEAT APPLICATION NO. - OF 2012Document2 pagesIn The Court of Hon'Ble District Judge Pune, at Pune CAVEAT APPLICATION NO. - OF 2012AniketNo ratings yet

- Research CaseDocument3 pagesResearch Casenotes.mcpu100% (1)

- Retailing, Wholesaling and LogisticsDocument31 pagesRetailing, Wholesaling and LogisticsBilal Raja100% (2)

- In - C2 - Comprensión - Textos - EscritosDocument9 pagesIn - C2 - Comprensión - Textos - EscritosEledhwen90No ratings yet

- Cisco Enterprise Reporting: Data SheetDocument9 pagesCisco Enterprise Reporting: Data SheetsridivakarNo ratings yet

- Spree Watch Marketing Plan Summary: Situation AnalysisDocument8 pagesSpree Watch Marketing Plan Summary: Situation AnalysisSreejib DebNo ratings yet

- Hexaware DelistingDocument48 pagesHexaware DelistingNihal YnNo ratings yet