Professional Documents

Culture Documents

CBSE Class 12 Accountancy 2014 Delhi Paper Solution

Uploaded by

Ashish GangwalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CBSE Class 12 Accountancy 2014 Delhi Paper Solution

Uploaded by

Ashish GangwalCopyright:

Available Formats

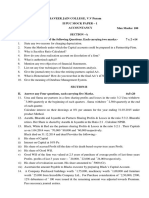

Question

Paper 2014 Delhi set 2

CBSE Class 12 ACCOUNTANCY

General Instruction:

(i) This question paper contains three parts A, B and C.

(ii) Part A is compulsory for all candidates.

(iii) Candidates can attempt only one part of the remaining part B and C.

(iv) All parts of the questions should be attempted at one place.

Part A

(Accounting for Partnership Firms and Companies)

1. Give any one purpose for which the amount received as ‘Securities Premium’ may be

utilized. (1)

2. Why heirs of a retiring/deceased partner are entitled a share of goodwill of the firm? (1)

3. What is the maximum amount of discount at which forfeited shares can be re-issued? (1)

4. Give the meaning of Debenture’. (1)

5. Distinguish between ‘Dissolution of Partnership’ and ‘Dissolution of Partnership Firm’ on

the basis of closure of books. (1)

6. X, Y and Z are partner sharing profits in the ratio of and . Find the new ratio of

remaining partners if Z retires. (1)

7. What is meant by ‘Reconstitution of a Partnership Firm? (1)

8. BG. Ltd issued 2,000, 12% debenture of Rs. 100 each on 1st April 2012. The issue was fully

subscribed. According to the terms of issue on the debentures is payable half-yearly on 30th

Material downloaded from myCBSEguide.com. 1 / 11

September and 31st March and the tax deducted at source is 10%.

Pass necessary journal entries related to debenture interest for the half-yearly ending 31st

March 2013 and transfer of interest on debentures of the year to the statement of Profit &

Loss. (3)

9. Saloni and Shrishti was partners in a firm sharing profits in the ratio of 7 : 3. Their capitals

were Rs. 2,00,000 and Rs. 1,50,000 respectively. The admitted Aditi on 1st April 2013 as a new

partner for share in future profits. Aditi brought Rs. 1,00,000 as her capital. Calculate

the value transaction on Aditi’s admission. (3)

10. Pass necessary journal entries in the following cases: (3)

(i) Pharma Ltd. redeemed 2500, 12% debentures of Rs. 100 each issued at a discount of 6% by

converting them into equity of Rs. 100 each issued at a premium of 25%.

(ii) Jain Ltd. converted 2000, 12% debentures of Rs. 100 each issued at par into equity shares

of Rs. 100 each issued at a premium of 25%.

11. Pass necessary journal entries of the following transactions in the books of Rajan Ltd: (4)

(a) Rajan Ltd. purchased machinery of Rs. 7,20,000 form Kundan Ltd. The payment was made

to Kundan Ltd. by issue of equity shares of Rs. 100 each at 10% discount.

(b) Rajan Ltd. Purchased a running business from Vikas Ltd. for a sum for a sum of Rs.

2,50,000 payables as Rs. 2,20,00 in fully paid equity shares of Rs. 10 each and balance by a

bank draft. The assets and liabilities consisted of the following:

Plant & machinery Rs. 90,000; Building Rs. 90,000; Sundry Debtors Rs. 30,000; stock Rs.

50,000; Cash Rs. 20,000; Sundry creditors Rs. 20,000.

12. Satnam and Qureshi after doing their MBA decided to start a partnership firm to

manufacture ISI marked electronic goods for economically weaker section of the society.

Satnam also expressed his willingness to admit Juliee as a partner without capital who is

especially abled but a very creative and intelligent friend of him. Qureshi agreed to this.

They formed a partnership on 1st April 2012 on the following terms: (4)

Material downloaded from myCBSEguide.com. 2 / 11

(i) Satnam will contribute Rs. 4,00,000 and Qureshi will share profits in the ratio of 2 : 2 : 1.

(ii) Interest on capital will be allowed @6% p.a.

Due to shortage of capital Satnam contributed Rs. 50,000 on 30th September 2012 and

Qureshi contributed Rs. 20,000 on 1st January 2013 as additional capital. The profit of the

firm for the year ended 31st March 2013 was Rs. 3,37,800.

(a) Identify any two values which the firm wants to communicate to the society.

(b) Prepare Profit & Loss Appropriation Account for the year ending 31st March 2013.

13. Virad, Vished and Roma were partners in a firm sharing profits in the ratio of 5 : 3 : 2

respectively. On March 31, 2013, their Balance Sheet was as under: (4)

Balance Sheet of Virad. Vished and Roma as on March 31, 2013

Liabilities Amount Rs. Assets Amount Rs.

2,00,000

Capitals Building

3,00,000

Virad 3,00,000 Machinery

1,10,000

Vished 2,50,000 Patents

7,00,000 1,00,000

Roma 1,50,000 Stock

60,000 80,000

Reserve Fund Debtors

1,10,000 80,000

Creditors Cash

8,70,000 8,70,000

Virad died on October 1, 2013. It was agreed between his executors and the remaining

partner’s that:

(a) Goodwill of the firm be valued at years purchase of average profits for the last three

years. The average profits were Rs. 1,50,000.

(b) Interest on capital be provided at 10% p.a.

(c) Profit for the year 2013 – 14 be taken as having accrued at the same rate as that of the

previous year which was Rs. 1,15,000.

Material downloaded from myCBSEguide.com. 3 / 11

Prepare Virad’s Capital Account to be presented to his Executors as on October 1, 2013.

14. On 1st April 2012 Janta ltd. was formed with an authorized capital of Rs. 50,00,000 divided

into 1,00,000 equity shares of Rs. 50 each. The company issued prospectus inviting

applications for 90,000 shares. The issue price was payable as under: (4)

On Application : Rs. 15

On Allotment : Rs. 20

On Call : Balance amount

The issue was fully subscribed and the company allotted shares of the applicants. The

company did not make the call during the year.

Show the following:

(a) Share capital in the Balance Sheet of the company as per revised schedule – VI – Part – I of

the Companies Act, 1956.

(b) Also prepare ‘Notes to accounts’ for the same.

15. Abdul, Kadir and Kasim were partners in a firm manufacturing blankets. They are

sharing profits in the ratio of 5 : 3 : 2. Their capitals on 1st April 2012 were Rs. 2,00,000; Rs.

1,00,000 and Rs. 3,00,000 respectively. After the floods in Uttaranchal, all partners decided to

help the flood victims personally.

For this Naveen withdrew Rs. 20,000 from the firm on 1st September 2012. Seerat instead of

withdrawing cash from the firm took blankets amounting to Rs. 12,000 from the firm and

distributed to the flood victims. On the other hand, Hina withdrew Rs. 1,00,000 from her

capital on 1st January 2013 and set up a centre to provide medical facilities in the flood

affected area.

The partnership deed provided for charging interest on drawing @ 6% p.a. After the Final

Account were prepared, it was discovered that interest on drawings had not been charged.

Give the necessary adjusting journal entry and show the working notes clearly. Also state

Material downloaded from myCBSEguide.com. 4 / 11

any two values that the partners wanted to communicate to the society. (6)

16. Jayant and Ramakant were partners in a firm. On 31st March 2013, their Balance Sheet

was a follow: (6)

Balance Sheet of Jayant and Ramakant as on 31st March 2013

Liabilities Amount Rs. Assets Amount Rs.

75,000 70,000

Creditors

Bank 2,00,000

Workmen Compensation

45,000 Debtors 20,000

Fund

Stock 20,000

Jayant’s Current Account

Furniture 3,12,000

Capital’s:

3,00,000 Machinery 13,000

Jayant

2,00,000 Ramakant’s Current Account

Ramakant

6,35,000 6,35,000

On above date the firm was dissolved:

(a) Jayant took over 40% of the stock at 10% less than its book value and the remaining stock

was sold for Rs. 15,000. Furniture realized Rs. 20,000

(b) An unrecorded investment was sold for Rs. 3,000. Machinery was sold at a loss of Rs.

75,000.

(c) Debtors realized Rs. 10,000.

(d) There was an outstanding bill for repair for which Rs. 38,000 were paid.

Prepare Realisation Account.

17. XYZ Ltd. invited application for 40,000 equity shares of Rs. 100 each at a discount of 6%.

The amount was payable as follow: (8)

On Application and allotment – Rs. 90 per share.

On First and Final Call – the balance amount.

Material downloaded from myCBSEguide.com. 5 / 11

Application for 60,000 shares were received. Applications for 10,000 shares were rejected

and shares were allotted on pro-rata basis to remaining applicants. Excess application

money received on application and allotment was adjust towards sums due on first and final

call. The calls were made. A shareholder, who applied for 50 shares, failed to pay the first

and final call money. His shares were forfeited. All the forfeited shares were re-issued at Rs.

97 per share fully paid up.

Pass necessary journal entreis for the above transactions in the books of XYZ Ltd.

OR

AB ltd. invited applications for issuing 75,000 equity shares of Rs. 100 each at a premium of

Rs. 30 per share. The amount was payable as follows:

On Application and Allotment – Rs. 85 per share (including premium)

On First and final call – the balance Amount

Applications for 1,27,000 shares were received. Applications for 27,500 shares were rejected

and share were allotted on pro – rata basis to the remaining applicants. Excess money

received on application and allotment was adjusted towards sums due to first and final call.

The calls were made. A Shareholder, who applied for 1,000 shares, failed to pay the first and

final call money. His Shares were forfeited. All the forfeited shares were reissued at Rs. 150

per share fully paid up.

Pass necessary Journal entries for the above transactions in the books of AB Ltd.

18. Mohan and Mahesh were partners in a firm sharing profits in the ratio of 3 : 2. On 1st

April 2012 they admitted Nusrat as a partner in the firm. The Balance Sheet of Mohan and

Mahesh on that date was as under: (8)

Balance Sheet of Mohan and Mahesh as on 1st April 2012

Liabilities Amount Rs. Assets Amount Rs.

Creditors 2,10,000 1,40,000

Workmen’s Compensation Cash in Hand 1,60,000

2,50,000 1,20,000

Material downloaded from myCBSEguide.com. 6 / 11

Fund 1,60,000 Debtors 1,00,000

General Reserve Stock 2,80,000

Capitals: Machinery

Mohan 1,00,000 1,80,000 Building

Mahesh 80,000 8,00,000 8,00,000

It was great that:

(i) The Value of Building and stock be appreciated to Rs. 3,80,000 and Rs. 1,60,000

respectively.

(ii) The liabilities of workmen’s compensation fund was determined at Rs. 2,30,000.

(iii) Nusrat brought in her share of goodwill Rs. 1,00,000 in cash.

(iv) Nusrat was to bring further cash as would make her capital equal to 20% of the

combined capital of Mohan and Mahesh after above revaluation and adjustments are carried

out.

(v) The future profit sharing ratio will be Mohan , Mahesh , Nusrat .

Prepare Revaluation Account, Partner’s Capital Accounts and Balance Sheet of the new firm.

Also show clearly calculation of Capital brought by Nusrat.

OR

Kushal, Kumar and Kavita were partners in a firm sharing profits in the ratio of 3 : 1 : 1. On

2st April 2012 their Balance sheet was as follows:

Balance Sheet of Kushal, Kumar and Kavita as on 1st April 2012

Liabilities Amounts Rs. Assets Amount Rs.

Creditors 1,20,000 70,000

Cash

Bills payable 1,80,000

Debtors 2,00,000

Material downloaded from myCBSEguide.com. 7 / 11

General Reserve 1,20,000 Less: Provision 10,000 1,90,000

Capitals: Stock 2,20,000

Kushal 3,00, 000 Furniture 1,20,000

Kumar 2,80,000 Building 3,00,000

Kavita 3,00,000 8,80,000 Land 4,00,000

13,00,000 13,00,000

On the above date Kavita and the following was agreed:

(i) Goodwill of the firm was valued at Rs. 40,000.

(ii) Land was to be appreciated by 30% and building was to be depreciated by Rs. 1,00,000.

(iii) Value of furniture was to be reduced by Rs. 20,000.

(iv) Bad debts reserve is to be increased to Rs. 15,000.

(v) 10% of the amount payable to Kavita was paid in cash and the balance was transferred to

her loan Account.

(vi) Capitals of Kushal and Kumar will be in proportion to their new profit sharing ratio. The

surplus/deficit, if any in their Capital Accounts will be adjusted through Current Accounts.

Prepare Revaluation Account, Partner’s Capital and Balance Sheet of Kushal and Kumar

After Kavita’s Retirement.

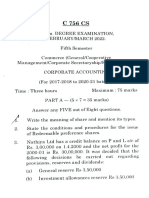

Part B

(Financial Statement Analysis)

19. State any one limitation of ‘Analysis of Financial Statements’. (1)

20. What is meant by ‘Cash Equivalents’ While preparing Cash Flow Statement? (1)

21. State the objective of preparing ‘Cash Flow Statement’. (1)

22. Under Which major sub-heading the following items will be placed in the Balance sheet

of a company as per revised schedule – VI, Part I of the companies Act, 1956: (3)

Material downloaded from myCBSEguide.com. 8 / 11

(i) Accured Incomes

(ii) Loose Tools

(iii) Provisional for employee’s benefits

(iv) Unpaid dividend

(v) Short term loans

(vi) Long term loans.

23. From the following ‘Statement of Profit & Loss’ for the year ended 31st March 2013,

prepare a ‘Comparative Statement of Profit & Loss’ of Vidya Ltd. (4)

Particulars Note no. 2012-13 Rs. 2011-12 Rs.

Revenue from operation 14,00,000 11,00,000

Other income 4,00,000 3,00,000

Expenses 11,00,000 12,00,000

Rate of income tax was 50%.

24. (a) From the following, compute Debt-Equity Ratio: (4)

Rs.

Long term Borrowings 4,00,000

Long term Provisions 2,00,000

Current Liabilities 1,00,000

Non-Current-Assets 7,20,000

Current-Assets 1,80,000

(b) The current ratio of Y Ltd. is 2 : 1. State with reason which of the following transactions

would (i) increase; (ii) Decrease or (iii) not change the ratio.

(1) Trade receivable included debtors of Rs. 40,000 which were received.

(2) Company purchased furniture of Rs. 45,000. The vendor was paid by issue of equity

Material downloaded from myCBSEguide.com. 9 / 11

shares of Rs. 10 each at par.

25. Prepare a Cash Flow Statement on the basis of the information given in the Balance

Sheets of Liva Ltd. As at 31.3.2013 and 31.3.2012: (6)

Note

Particular 31.3.2013 Rs. 31.3.2012

No.

I. Equity and Liabilities

1. Shareholders’ funds

(a) Share Capital 2,10,000 1,80,000

(b) Reserve & Surplus 1,32,000 24,000

1

2. Non-current Liabilities

(a) Long term-borrowings 1,50,000 1,50,000

3. Current Liabilities

(a) Trade Payables 75,000 27,000

Total 5,67,000 3,81,000

II. Assets

1. Non-current Assets

(a) Fixed Assets

(i) Tangible Assets 2,94,000 2,52,000

(b) non-current Investments 48,000 18,000

2. Current Assets

(a) Current-Investment 54,000 60,000

(marketable)

(b) Inventories 1,07,000 24,000

(c) Trade Receivables 40,000 17,500

(d) Cash and Cash-equivalents 24,000 9,500

Total 5,67,000 3,81,000

Notes of Accounts:

Particulars 2013 Rs. 2012 Rs.

Reserves and Surplus

Material downloaded from myCBSEguide.com. 10 / 11

Surplus (balance in statement

of profit and loss) 1,32,000 24,000

Part C

(Computerized Accounting)

19. What is meant by ‘Table’? (1)

20. What is meant by ‘procedure’ as a component of Computerized Accounting System? (1)

21. What is SQL? (1)

22. Give one advantage and two limitations of computerized Accounting System. (3)

23. Explain any four advantage of data Base Management System. (4)

24. Explain ‘Sequential’ and ‘Mnemonic’ codes. (4)

25. Calculate the formulae from the following information of Excel for computing the

amounts for: (6)

(a) Dearness Allowance, Basis pay upto Rs. 25,000 at 20% and above it at 25%.

(b) Tax payable, Basis pay upto Rs. 25,000 at 15% and 20% above that.

(c) Net salary, adding Dearness allowance and deducting Tax Payable from Basis pay.

Material downloaded from myCBSEguide.com. 11 / 11

You might also like

- Accountancy Assignment Grade 12Document4 pagesAccountancy Assignment Grade 12sharu SKNo ratings yet

- CBSE Class 12 Accountancy Sample Papers 2014 - 15Document7 pagesCBSE Class 12 Accountancy Sample Papers 2014 - 15Karthick KarthickNo ratings yet

- XII Test (Death, Ret - Diss)Document4 pagesXII Test (Death, Ret - Diss)MLastTryNo ratings yet

- Syjc - B. K. - Prelim Exam No. 7Document4 pagesSyjc - B. K. - Prelim Exam No. 7karkeraadiyaNo ratings yet

- Cbse Question Bank Admission of PartnersDocument6 pagesCbse Question Bank Admission of Partnersvsy9926No ratings yet

- Karnataka II PUC Accountancy Model Question Paper 17Document6 pagesKarnataka II PUC Accountancy Model Question Paper 17Kishu KishoreNo ratings yet

- Accounting for Partnership Admission & DissolutionDocument5 pagesAccounting for Partnership Admission & DissolutionPranit PanditNo ratings yet

- 12th HSC Accounts Sample PaperDocument5 pages12th HSC Accounts Sample Papervaibhavnakashe44No ratings yet

- Accountancy - XII - QPDocument5 pagesAccountancy - XII - QPKulvirkuljitharmeet singhNo ratings yet

- Accounts DPP Retirement of A PartnerDocument15 pagesAccounts DPP Retirement of A PartnerPreeti SharmaNo ratings yet

- BK Prelims ComDocument6 pagesBK Prelims ComAafreen QureshiNo ratings yet

- 12 2006 Accountancy 4Document5 pages12 2006 Accountancy 4Akash TamuliNo ratings yet

- Admission Test No. 2Document5 pagesAdmission Test No. 2Mitesh Sethi0% (1)

- Alpha Arts College Corporate Accounting ExamDocument3 pagesAlpha Arts College Corporate Accounting Exammahabalu123456789No ratings yet

- Retirement and Dissolution of Firm Class TestDocument2 pagesRetirement and Dissolution of Firm Class TestHarish RajputNo ratings yet

- Worksheet 2Document4 pagesWorksheet 2singhharshu3222No ratings yet

- CBSE Class 12 Accountancy Sample Paper-01 (For 2013)Document7 pagesCBSE Class 12 Accountancy Sample Paper-01 (For 2013)cbsestudymaterialsNo ratings yet

- CBSE Sample Paper Accountancy Class 12 SolvedDocument16 pagesCBSE Sample Paper Accountancy Class 12 SolvedShreya PalejkarNo ratings yet

- Isc-Xii Debk Model Test PapersDocument160 pagesIsc-Xii Debk Model Test PapersRahul PareekNo ratings yet

- TtryuiopDocument6 pagesTtryuiopNAVEENNo ratings yet

- Sample Paper (Cbse) - 2009 Accountancy - XiiDocument5 pagesSample Paper (Cbse) - 2009 Accountancy - XiiJanine AnzanoNo ratings yet

- Paper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Document56 pagesPaper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Basant OjhaNo ratings yet

- 12th Marking AccountancyDocument52 pages12th Marking AccountancyManoj GiriNo ratings yet

- Sample Question Paper-Ii Accountancy Class Xii Maximum Marks: 80 Time Allowed: 3 Hrs. General InstructionsDocument38 pagesSample Question Paper-Ii Accountancy Class Xii Maximum Marks: 80 Time Allowed: 3 Hrs. General Instructionsmohit pandeyNo ratings yet

- 3 AdmissionDocument14 pages3 AdmissionAman KakkarNo ratings yet

- CALCULATING PURCHASE CONSIDERATIONDocument11 pagesCALCULATING PURCHASE CONSIDERATIONJoel VargheseNo ratings yet

- II Puc Accountancy Mock Paper IIDocument5 pagesII Puc Accountancy Mock Paper IISAI KISHORENo ratings yet

- Dissolution Practice Questions. PDFDocument8 pagesDissolution Practice Questions. PDFUmesh JaiswalNo ratings yet

- Test Retirement Death Dissolution-1Document4 pagesTest Retirement Death Dissolution-1Vibhu VashishthNo ratings yet

- Corrporate ModelDocument10 pagesCorrporate Modelnithinjoseph562005No ratings yet

- Test Paper 11Document8 pagesTest Paper 11Sukhjinder SinghNo ratings yet

- Adv Acc MTPO1 PDFDocument18 pagesAdv Acc MTPO1 PDFuma shankarNo ratings yet

- Dissolution of Partnership FirmDocument5 pagesDissolution of Partnership FirmDark SoulNo ratings yet

- Shares & Debentures TestDocument10 pagesShares & Debentures TestAthul Krishna KNo ratings yet

- Corporate Accounting ProblemDocument6 pagesCorporate Accounting ProblemparameshwaraNo ratings yet

- 1Document5 pages1firoozdasmanNo ratings yet

- 12th BK Prelim Quesiton Paper March 2021Document8 pages12th BK Prelim Quesiton Paper March 2021Harendra PrajapatiNo ratings yet

- Test Paper 12Document6 pagesTest Paper 12Sukhjinder SinghNo ratings yet

- SYJC - 16: Book - Keeping & AccountancyDocument8 pagesSYJC - 16: Book - Keeping & AccountancyhareshNo ratings yet

- 12th Accounts Partnership Test 15 Sept.Document6 pages12th Accounts Partnership Test 15 Sept.SGEVirtualNo ratings yet

- Admission of PartnerDocument3 pagesAdmission of PartnerPraWin KharateNo ratings yet

- Retirement Collage SPCC Term 2..Document5 pagesRetirement Collage SPCC Term 2..Taaran ReddyNo ratings yet

- Screenshot 2023-01-07 at 7.33.02 AMDocument5 pagesScreenshot 2023-01-07 at 7.33.02 AMhchandiramani3No ratings yet

- Class 12 Cbse Accountancy Sample Paper 2012 Model 2Document20 pagesClass 12 Cbse Accountancy Sample Paper 2012 Model 2Sunaina RawatNo ratings yet

- ABPM Weekly Test 06.02.2020Document3 pagesABPM Weekly Test 06.02.2020Veera SwamyNo ratings yet

- 2020-21 - HYE - QP - Accountancy - SET A - XII - PDFDocument3 pages2020-21 - HYE - QP - Accountancy - SET A - XII - PDFLakshay SethNo ratings yet

- Test Series: March, 2019 Mock Test Paper - 1 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March, 2019 Mock Test Paper - 1 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced AccountingPiyush AmbastaNo ratings yet

- 12 2006 Accountancy 1Document5 pages12 2006 Accountancy 1Akash TamuliNo ratings yet

- Retire Death Dissolution SheetDocument6 pagesRetire Death Dissolution SheetTanvi SisodiaNo ratings yet

- Partner Ship Accounts - I: Balance Sheet Dr. Cr. Particulars Amount Rs. Particulars Amount RsDocument17 pagesPartner Ship Accounts - I: Balance Sheet Dr. Cr. Particulars Amount Rs. Particulars Amount RsM JEEVARATHNAM NAIDUNo ratings yet

- Guru Gobind Singh Pubilc School: Sector - V Term - Ii, Pre-Board Examination 2021-22 Class - XII GDocument6 pagesGuru Gobind Singh Pubilc School: Sector - V Term - Ii, Pre-Board Examination 2021-22 Class - XII GSAURABH JAINNo ratings yet

- AccountancyDocument32 pagesAccountancysunil kumarNo ratings yet

- Corporate Accounting Exam Questions PaperDocument7 pagesCorporate Accounting Exam Questions PaperAmmar Bin NasirNo ratings yet

- 04 Sample PaperDocument45 pages04 Sample Papergaming loverNo ratings yet

- Admitting New PartnersDocument8 pagesAdmitting New PartnersVineet KumarNo ratings yet

- MAY 15 ADV ACC Merged - Document - 2mtps PDFDocument43 pagesMAY 15 ADV ACC Merged - Document - 2mtps PDFMohit KaundalNo ratings yet

- Cbse Sample Papers For Class 12 Accountancy With Solution PDFDocument24 pagesCbse Sample Papers For Class 12 Accountancy With Solution PDFVicky PawarNo ratings yet

- 12 2006 Accountancy 2Document5 pages12 2006 Accountancy 2Akash TamuliNo ratings yet

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportFrom EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Class 6 P.A.1 Syllabus and DatesheetDocument2 pagesClass 6 P.A.1 Syllabus and DatesheetAshish GangwalNo ratings yet

- Language Development English: Affiliated To The CISCE, New DelhiDocument4 pagesLanguage Development English: Affiliated To The CISCE, New DelhiAshish GangwalNo ratings yet

- Vardhman International School: Holiday Homework (AY: 2022-23) Research WorkDocument2 pagesVardhman International School: Holiday Homework (AY: 2022-23) Research WorkAshish GangwalNo ratings yet

- Business Studies Class XII I Pre-Board Paper (2021-22)Document4 pagesBusiness Studies Class XII I Pre-Board Paper (2021-22)Ashish GangwalNo ratings yet

- S Subject: ARTS Class: U. K. G Subject Teacher: Swati GangwalDocument3 pagesS Subject: ARTS Class: U. K. G Subject Teacher: Swati GangwalAshish GangwalNo ratings yet

- BST Test 20 DecDocument4 pagesBST Test 20 DecAshish GangwalNo ratings yet

- Class XI Entrepreneurship Ii Term Examination Answer KeyDocument3 pagesClass XI Entrepreneurship Ii Term Examination Answer KeyAshish GangwalNo ratings yet

- S Subject: ARTS: Affiliated To The CISCE, New DelhiDocument3 pagesS Subject: ARTS: Affiliated To The CISCE, New DelhiAshish GangwalNo ratings yet

- 25th Wedding Anniversary: Mr. Murli Manohar Mathur Mrs. Suman MathurDocument3 pages25th Wedding Anniversary: Mr. Murli Manohar Mathur Mrs. Suman MathurAshish GangwalNo ratings yet

- Math Readiness: Affiliated To The CISCE, New DelhiDocument4 pagesMath Readiness: Affiliated To The CISCE, New DelhiAshish GangwalNo ratings yet

- Academic Remarks For MarksheetDocument2 pagesAcademic Remarks For MarksheetAshish GangwalNo ratings yet

- KP Horary Table 1 249 PDFDocument5 pagesKP Horary Table 1 249 PDFSunil ThombareNo ratings yet

- Mock Test 2 Datesheet FinalDocument1 pageMock Test 2 Datesheet FinalAshish GangwalNo ratings yet

- Language Development English: Affiliated To The CISCE, New DelhiDocument4 pagesLanguage Development English: Affiliated To The CISCE, New DelhiAshish GangwalNo ratings yet

- Ashish CertificateDocument1 pageAshish CertificateAshish GangwalNo ratings yet

- 1 Entrepreneurship - What, Why and HowDocument17 pages1 Entrepreneurship - What, Why and HowAshish Gangwal100% (1)

- Pa 2 Datesheet Class I - Ix & XiDocument1 pagePa 2 Datesheet Class I - Ix & XiAshish GangwalNo ratings yet

- Seedling Group of Schools: Warm RegardsDocument1 pageSeedling Group of Schools: Warm RegardsAshish GangwalNo ratings yet

- Office Order - Class 1 To 12 Teachers For ERP Marks EntryDocument2 pagesOffice Order - Class 1 To 12 Teachers For ERP Marks EntryAshish GangwalNo ratings yet

- Unit Ii-An Entrepreneur Multiple Choice QuestionsDocument16 pagesUnit Ii-An Entrepreneur Multiple Choice QuestionsAshish Gangwal100% (1)

- Touch and See Your Solution: Finding Solutions For Your Problems in Bhagvad GitaDocument1 pageTouch and See Your Solution: Finding Solutions For Your Problems in Bhagvad Gitaanu50% (2)

- 12 HouseDocument20 pages12 HouseRomani Bora100% (1)

- Academic Remarks For MarksheetDocument2 pagesAcademic Remarks For MarksheetAshish Gangwal100% (1)

- 3 Entrepreneurial JourneyDocument20 pages3 Entrepreneurial JourneyAshish GangwalNo ratings yet

- Aissce Practical Examination (2020-21) Shree Narayana Central School Ahmedabad Sample Paper For Revision by Simmi PrakashDocument1 pageAissce Practical Examination (2020-21) Shree Narayana Central School Ahmedabad Sample Paper For Revision by Simmi PrakashAshish GangwalNo ratings yet

- KizaksaknaDocument2 pagesKizaksaknaT Suan Lian TonsingNo ratings yet

- Notification: CBSE/Training Unit/2020 18.09.2020Document2 pagesNotification: CBSE/Training Unit/2020 18.09.2020Ashish GangwalNo ratings yet

- PA2 Blueprint Ep Class 11Document1 pagePA2 Blueprint Ep Class 11Ashish GangwalNo ratings yet

- SEEDLING Modern High School Class IX Protor Details: S No. School Code Role User Name Login IDDocument3 pagesSEEDLING Modern High School Class IX Protor Details: S No. School Code Role User Name Login IDAshish GangwalNo ratings yet

- 31 Circular 2021Document3 pages31 Circular 2021Ashish GangwalNo ratings yet

- Basic Board of Directors FunctionsDocument2 pagesBasic Board of Directors FunctionsGSK SECURITY AND INVESTIGATION AGENCYNo ratings yet

- I.U. Faculty of Political Science Take Home Midterm Exam Cost and Managerial Accounting 2020-2021 Spring Assoc - Prof.Dr - İpek TürkerDocument3 pagesI.U. Faculty of Political Science Take Home Midterm Exam Cost and Managerial Accounting 2020-2021 Spring Assoc - Prof.Dr - İpek Türkerİsmail KorkmazNo ratings yet

- Life Cycle Q&aDocument48 pagesLife Cycle Q&aanjNo ratings yet

- Lot at First Site: South Philippines Adventist College Camanchilles, Matamao, Davao Del SurDocument5 pagesLot at First Site: South Philippines Adventist College Camanchilles, Matamao, Davao Del SurArly Kurt TorresNo ratings yet

- PhonePe Statement Feb2024 Mar2024Document7 pagesPhonePe Statement Feb2024 Mar2024jtularam15No ratings yet

- Marketing Audit TemplateDocument7 pagesMarketing Audit Templatesandeep yadavNo ratings yet

- Types of Loan: Secured Loan Unsecured LoanDocument17 pagesTypes of Loan: Secured Loan Unsecured Loanadi809hereNo ratings yet

- YOMA Bank (Branch Visit Report)Document8 pagesYOMA Bank (Branch Visit Report)kyawthNo ratings yet

- Torrens University Business Mbampm Course FlyerDocument2 pagesTorrens University Business Mbampm Course FlyerRagul RaNo ratings yet

- 2020advisory Ronnie-Barrientos Crowd1Document3 pages2020advisory Ronnie-Barrientos Crowd1Rolly OcampoNo ratings yet

- NL-0000325 DocDocument14 pagesNL-0000325 DocAjeya SaxenaNo ratings yet

- Labor Relations Termination GuideDocument15 pagesLabor Relations Termination GuideOlenFuerteNo ratings yet

- Registration of e Mail Ids and Other KYC DetailsDocument2 pagesRegistration of e Mail Ids and Other KYC DetailsYash KaleNo ratings yet

- Master Thesis Topics Corporate FinanceDocument7 pagesMaster Thesis Topics Corporate Financemarialackarlington100% (2)

- Post Mortem ReportDocument5 pagesPost Mortem ReportMichael del RosarioNo ratings yet

- The Humane Solution: Trap-Ease Mouse TrapsDocument14 pagesThe Humane Solution: Trap-Ease Mouse TrapsSamiul21No ratings yet

- v3n2p31 39Document9 pagesv3n2p31 39novan kostkaNo ratings yet

- Power, Function and Duties of Directors andDocument20 pagesPower, Function and Duties of Directors andHimanshu JainNo ratings yet

- Globallogic Reference LetterDocument1 pageGloballogic Reference LetterSiddharthNo ratings yet

- RWJ 08Document38 pagesRWJ 08Kunal PuriNo ratings yet

- Integrated Marketing Communications: by Mark Anthony Camilleri, PHD (Edinburgh)Document22 pagesIntegrated Marketing Communications: by Mark Anthony Camilleri, PHD (Edinburgh)Ksheerod ToshniwalNo ratings yet

- EDI Basics GXS EbookDocument43 pagesEDI Basics GXS EbookSriram RaghuNo ratings yet

- Stock Trading Mastery - Explainer PDFDocument19 pagesStock Trading Mastery - Explainer PDFAG ShayariNo ratings yet

- BSBRSK501 Manage Risk Assessment 2Document5 pagesBSBRSK501 Manage Risk Assessment 2prasannareddy9989No ratings yet

- A87ffmercedes Benz - Competitive Forces and Competitive StrategyDocument2 pagesA87ffmercedes Benz - Competitive Forces and Competitive Strategythuyanhvirgo0809100% (1)

- L'OREAL Cosmetics: Marketing PlanDocument12 pagesL'OREAL Cosmetics: Marketing Plansly westNo ratings yet

- survey questionnaireDocument2 pagessurvey questionnairePinky Dela Cruz AballeNo ratings yet

- The Kerala State Co-Operative Bank LTD Customer Rights PolicyDocument14 pagesThe Kerala State Co-Operative Bank LTD Customer Rights PolicyAkhilAkhilNo ratings yet

- Financial Analysis: Unit 9Document20 pagesFinancial Analysis: Unit 9Đinh AnhNo ratings yet

- 02 CartelsDocument45 pages02 CartelsThirunarayanan SampathNo ratings yet