Professional Documents

Culture Documents

Battery Technologies 022018

Uploaded by

maheshmbelgaviCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Battery Technologies 022018

Uploaded by

maheshmbelgaviCopyright:

Available Formats

2018

New Year’s Briefing

6-7 February 2018 | Frankfurt, Germany

Christian Müller, Principal Analyst & Manager

0049 (69) 20973 328, Christian.mueller@ihsmarkit.com

© 2018 IHS Markit. All Rights Reserved.

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

Factors Affecting Our Perception of EV and Battery Technology

Performance

Price

Durability Cost

Production

Safety

Capacity

Recharging

Driving Range

Infrastructure

Raw

Energy

Material

Density

Availability

Confidential. © 2018 IHS MarkitTM. All Rights Reserved. 2

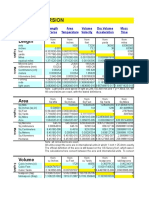

Setting the scene - battery pack breakdown

Prismatic Cylindrical Pouch

Battery cell

Battery module Battery pack

Source: CATL– photo taken by IHS Markit at IAA

2017, Frankfurt, Germany, September 2017

Confidential. © 2018 IHS MarkitTM. All Rights Reserved. 3

Lithium based battery technology continues to offer the highest potential

First commercialization

in electrification Name Voltage (V) Energy (Wh/kg) Cycle life

Li-solid state

1891 Lead acid 2.0 50 500

1982 Ni-MH 1.2 100 1,000

1998

Expectation

Li-ion 3.6 200 2,000

2022? Li-solid state 4.8 400 +10,000

All figures are simplified to easily compare technologies

Ni-MH Lead acid

Li-sulfur

Li-air

Li-ion

Mg-ion

Na-air

Source: IHS Markit

Time

Confidential. © 2018 IHS MarkitTM. All Rights Reserved. 4

Li-ion Battery System Technology Roadmap

More energy and power, and safer

2017 2020 2025

Rich Nickel

Cathode LFP, LMO, NMC, NCA

(High voltage spinell)

Sulfur, Air

Anode Carbon, Graphite Silicon Lithium-metal, CNT

Electrolyte Liquid, Polymer Solid state

Separator Polymer mebranes None

Confidential. © 2018 IHS MarkitTM. All Rights Reserved. 5

Electrode Material

NMC seems to offer the most accepted compromise between all requirements

Cell Leading Characteristics of electrode materials

Acronym Material

voltage supplier

NCA Lithium Nickel Cobalt Aluminum 3.65 V Tesla Low cost

oxide Panasonic

NMC Lithium Nickel Manganese 3.7 V LG

Cobalt oxide Samsung

LFP Lithium Iron Phosphate 3.2-3.3 V CATL Specific energy

Life

BYD (kWh/kg)

Lishen

LTO Lithium Titanate Oxide 2.4 V Toshiba

LMO Lithium Manganese Oxide 4V AESC

(original li-ion technology)

Charge /

• Except LTO, these are cathode materials. The anode is usually discharge rate

Safety

graphite.

• NCA is used only by Tesla, on license from Panasonic

• LTO and LMO are loosing significance in the automotive market NCA NMC LFP LMO LTO

• LCO is the original Lithium Ion technology but no longer used

Confidential. © 2018 IHS MarkitTM. All Rights Reserved. 6

Major Raw Material use for selected models

Tons of Material used per year

Tesla Model S

Cathode Type: NCA

Nickel Lithium Cobalt Manganese Aluminium

17,5 Kg 3,2 Kg 4,3 Kg 0,5 Kg 0,5 Kg

Chevrolet Bolt

Cathode Type: NMC

Nickel Lithium Cobalt Manganese Aluminium

7,5 Kg 2,5 Kg 7,5 Kg 6,5 Kg 0 Kg

Confidential. © 2018 IHS MarkitTM. All Rights Reserved. 7

Major Raw Material Deposits for Batteries

Which countries are OEMs exposing themselves to?

Lithium

Cobalt

Nickel

Manganese

Confidential. © 2018 IHS MarkitTM. All Rights Reserved. 8

Securing raw material supplies

Will Material Hedging Solve this Problem?

“Manufacturers such as electric vehicle “The procurement project is one of the

makers should be concerned that the supply largest in the history of the automotive

of one of the key mineral components, or the industry, with a total order volume of over 50

processing and refining infrastructure, could billion euros,” it said in a statement. “That will

become too centralised in a single country. meet the Group’s needs for the first wave of

Without diverse source options, the e-mobility.”

possibility of supply restriction becomes Volkswagen Statement

more likely.”

Ben McLellan, senior research fellow at Kyoto University

“A secure and sustainable

supply of raw materials for the “They want a fixed price, which won’t work for

Li-ion [lithium ion] battery will people who need security and they want to

Tesla Motors and BMW is also said be the key factor to become e- reserve the right to not take metal they don’t

to be looking for supplies of cobalt, mobility market leader,” need,” another cobalt source said. “They want

according to people in the market, Volkswagen Statement producers to take all the risks ... they want an

though no formal tenders have been

option at low prices, for long maturities at zero

issued.

cost.”

Cobalt Trader

Confidential. © 2018 IHS MarkitTM. All Rights Reserved. 9

Cell Technology options

Pouch cells gaining ground thanks to Korean manufacturers

Cylindrical Prismatic Pouch

Electrodes rolled/winded flat winded stacked

Packaging stainless steel can aluminium (for automotive) casing, flexible aluminium+plastic foil (may swell

welded shut. during charge/discharge).

Pros & Cons + self-supporting mechanical structure + energy density, specific energy + high specific energy (kWh/kg)

- lower energy density (kWh/cm³) - thermal management + cost

- cost - needs a rigid support from the module.

Leading auto Tesla & Panasonic BYD, Samsung SDI, LG

suppliers SK Innovation

CATL

Often used for NCA (since Panasonic is the main manufacturer) high voltage LFP and low voltage Lithium polymer with solid electrolyte

all chemistries

Form factor standardized (somehwat) no standard, but usually fixed to a few sizes for a given no standard, usually custom size

• 18650: Ø18x65 mm, most widespread: laptops, ebikes, supplier

previously used Tesla

• 26650: often used for LFP

• 2170(0): Ø21x70 mm, new Tesla format

Confidential. © 2018 IHS MarkitTM. All Rights Reserved. 10

Battery Demand by Cell Type

Capacity demand by cell type Vehicle production volume

Million units (pack)

GWh

300 30

250 25

200 20

150 15

100 10

50 5

0 0

2017 2018 2019 2020 2021 2022 2023 2017 2018 2019 2020 2021 2022 2023

Unknown Cylinder Pouch Prismatic Unknown Cylinder Pouch Prismatic

Source: IHS Markit © 2018 IHS Markit Source: IHS Markit © 2018 IHS Markit

Confidential. © 2018 IHS MarkitTM. All Rights Reserved. 11

Profiles of major battery manufacturers

A diverse supply base

60

GWh 50

2016 2020

40

30

20

10

0

Manufacturer Tesla Panasonic LG Chem Samsung SDI CATL Lishen Guoxan BYD OptimumNano

High Tech

Cells NCA LMO NCM NCM LFP and NCM LFP LFP & NMC LFP LFP

cylindrical cylindrical pouch prismatic prismatic cylindrical & prismatic & cylindrical

prismatic pouch

Core EV consumer and diversified diversified batteries batteries electrical EV batteries

business pro appliances equipment

Confidential. © 2018 IHS MarkitTM. All Rights Reserved. 12

Mapping the Announced Major Battery Cell Manufacturing Locations

GWh China

400

334 Others

300

Tianjin Lishen

200

Guoxuan

100 68

0 Optimum

Nano

2016 2020

GWh North America GWh Europe GWh Japan, Korea

60 60 60 54

Others

38 Others

40 40 Samsung SDI 40

Others Samsung SDI

30

LG Chemical 23 LG Chemical

LG Chemical

20 Panasonic

20 SK Innovation 20

AESC

1 Terra E

0 Panasonic

0 0 Northvolt 0

2016 2020 2016 2020 2016 2020

Confidential. © 2018 IHS MarkitTM. All Rights Reserved. 13

Battery supply chain in automotive industry

Cell Cell Module Pack Electric Vehicle OEM

supplier

Fiat Chrysler Automobiles,

Geely, Guangzhou

Volkswagen, Renault, BMW, Tesla,

General Motors, Daimler, Hyundai (Browns battery, Accumotive, Mobis)

Lifan, (Nissan)

PEVE, AESC, LEJ, BEJ, Pride Power,

HLGP, BESK, Shanghai Jiexin, Wuhu Qida

Samsung SDI, SK Innovation, LG Chemical, Tianjin Lishen, Optimumnano,

Farasis, Guoxuan, Sinopoly, Electrovaya, Chuangyuan

Do-Fluoride, Wanxiang A123/Fisker, BYD

Source: IHS Markit Industry Disruptors: Dyson, Hyperdrive

Innovation, Webasto

Confidential. © 2018 IHS MarkitTM. All Rights Reserved. 14

Key Take Aways For Suppliers

• Carmakers are still very much in experimental

mode (large scale but experimental) about batteries

and EVs. Evolution of automotive battery landscape

• Battery pack assembly done more in house NimH Li+ LiS?

• Raw material availability concentrated around few now

difficult locations

Japan S. Korea

• Battery cell production capacity increase needed to

sustain projected growth rates China

Confidential. © 2018 IHS MarkitTM. All Rights Reserved. 15

Presentation Name / Month 2017

IHS Markit Customer Care

CustomerCare@ihsmarkit.com

Americas: +1 800 IHS CARE (+1 800 447 2273)

Europe, Middle East, and Africa: +44 (0) 1344 328 300

Asia and the Pacific Rim: +604 291 3600

Disclaimer

The information contained in this presentation is confidential. Any unauthorized use, disclosure, reproduction, or dissemination, in full or in part, in any media or by any means, without the prior written permission of IHS Markit Ltd. or any of its affiliates ("IHS Markit") is

strictly prohibited. IHS Markit owns all IHS Markit logos and trade names contained in this presentation that are subject to license. Opinions, statements, estimates, and projections in this presentation (including other media) are solely those of the individual author(s) at the

time of writing and do not necessarily reflect the opinions of IHS Markit. Neither IHS Markit nor the author(s) has any obligation to update this presentation in the event that any content, opinion, statement, estimate, or projection (collectively, "information") changes or

subsequently becomes inaccurate. IHS Markit makes no warranty, expressed or implied, as to the accuracy, completeness, or timeliness of any information in this presentation, and shall not in any way be liable to any recipient for any inaccuracies or omissions. Without

limiting the foregoing, IHS Markit shall have no liability whatsoever to any recipient, whether in contract, in tort (including negligence), under warranty, under statute or otherwise, in respect of any loss or damage suffered by any recipient as a result of or in connection with

any information provided, or any course of action determined, by it or any third party, whether or not based on any information provided. The inclusion of a link to an external website by IHS Markit should not be understood to be an endorsement of that website or the site's

owners (or their products/services). IHS Markit is not responsible for either the content or output of external websites. Copyright © 2017, IHS MarkitTM. All rights reserved and all intellectual property rights are retained by IHS Markit.

You might also like

- Driving the Future: Combating Climate Change with Cleaner, Smarter CarsFrom EverandDriving the Future: Combating Climate Change with Cleaner, Smarter CarsNo ratings yet

- Renewable energy finance: Sovereign guaranteesFrom EverandRenewable energy finance: Sovereign guaranteesNo ratings yet

- Battery State of The Union 2021Document72 pagesBattery State of The Union 2021Jon DiGiacomandreaNo ratings yet

- IHS Markit International Outlook Josefin BergDocument37 pagesIHS Markit International Outlook Josefin BergspionkindNo ratings yet

- Exploring Cost Reduction Strategies For Electric Vehicle EV BatteriesDocument71 pagesExploring Cost Reduction Strategies For Electric Vehicle EV BatteriesShubham SrivastavaNo ratings yet

- Vehicle ElectrificationDocument30 pagesVehicle ElectrificationSteve B. SalongaNo ratings yet

- BMO Capital Markets - Lithium-Ion Battery EV MKTDocument132 pagesBMO Capital Markets - Lithium-Ion Battery EV MKTdgavrile100% (1)

- Battery Manufacturing PlantDocument13 pagesBattery Manufacturing PlantShubham100% (1)

- History of Electric Motorcycles and ScootersDocument5 pagesHistory of Electric Motorcycles and Scooterspaurak100% (1)

- EV Presentation - NK - 20062020Document17 pagesEV Presentation - NK - 20062020Anshumaan SinghNo ratings yet

- GE Corporate Venture EffortsDocument8 pagesGE Corporate Venture EffortsApolline MorelleNo ratings yet

- Lithium-Ion Battery Costs and Market - BNEFDocument14 pagesLithium-Ion Battery Costs and Market - BNEFHarsh ModyNo ratings yet

- Exploring Cost Reduction Strategies For Electric Vehicle EV BatteriesDocument72 pagesExploring Cost Reduction Strategies For Electric Vehicle EV BatteriesVishwa KNo ratings yet

- Batteries For Electric Cars FocusDocument18 pagesBatteries For Electric Cars Focusjose carlos braguinhaNo ratings yet

- White Paper Lithium Ion MaterialsDocument10 pagesWhite Paper Lithium Ion MaterialsNanoMarketsNo ratings yet

- The Supply Chain For Electric Vehicle BatteriesDocument21 pagesThe Supply Chain For Electric Vehicle BatteriesProbonogoya Erawan Sastroredjo100% (2)

- Effect of Lithium Battery On EnvironmentDocument4 pagesEffect of Lithium Battery On EnvironmentInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 2019 06 Batteries On Wheels TE Briefing PDFDocument6 pages2019 06 Batteries On Wheels TE Briefing PDFRaúlNo ratings yet

- Lithium X Energy - Investor PresentationDocument20 pagesLithium X Energy - Investor PresentationkaiselkNo ratings yet

- Lithium-Ion Battery Value Chain ReportDocument56 pagesLithium-Ion Battery Value Chain ReportSuhail100% (1)

- Electric Vehicle Battery Supply Chain AnalysisDocument157 pagesElectric Vehicle Battery Supply Chain AnalysisTitus PackiarajNo ratings yet

- Rightsizing and Management of Prototype Vehicle Testing at Ford Motor CompanyDocument15 pagesRightsizing and Management of Prototype Vehicle Testing at Ford Motor CompanyVinay KonikantiNo ratings yet

- -Batteries and Fuel Cells. Chemical Reviews v.104, N.10, -Химия (2004)Document647 pages-Batteries and Fuel Cells. Chemical Reviews v.104, N.10, -Химия (2004)javimartinezcaNo ratings yet

- (Volta - Foundation) The Battery Report 2021Document133 pages(Volta - Foundation) The Battery Report 2021Huynh Nghiep ThanhNo ratings yet

- Tesla MAxwell Dry Electrode Coating TechnologyDocument4 pagesTesla MAxwell Dry Electrode Coating TechnologyFred Lamert100% (5)

- EV Report - FullDocument55 pagesEV Report - FullKarthik ChandrasekarNo ratings yet

- Manufacture of Lithium-Ion Battery Electrode (Pre Report)Document5 pagesManufacture of Lithium-Ion Battery Electrode (Pre Report)Tony XRahmanxNo ratings yet

- All Charged Up: Indonesia Electric VehiclesDocument96 pagesAll Charged Up: Indonesia Electric VehiclesYohannie Linggasari100% (1)

- Kelleher Final EV Battery Reuse and Recycling Report To API 18sept2019 Edits 18dec2019Document206 pagesKelleher Final EV Battery Reuse and Recycling Report To API 18sept2019 Edits 18dec2019bisfotNo ratings yet

- Electric Vehicle Policy in Thailand Limitations of Product ChampionsDocument26 pagesElectric Vehicle Policy in Thailand Limitations of Product Championsthumula.ramesh100% (1)

- Batteries Europe Strategic Research Agenda December 2020 1Document75 pagesBatteries Europe Strategic Research Agenda December 2020 1Mansour Al-wardNo ratings yet

- Electric Vehicle MarketDocument17 pagesElectric Vehicle Marketramaswamykama786No ratings yet

- Battery Recycle Process Yash+Emanuel FinalDocument16 pagesBattery Recycle Process Yash+Emanuel FinalEmanuel wilsonNo ratings yet

- Tesla MW Charging StandardDocument10 pagesTesla MW Charging StandardFred Lamert100% (5)

- Adl Future of Batteries-MinDocument24 pagesAdl Future of Batteries-MinsrinathNo ratings yet

- 2021 02 Battery Raw Materials Report FinalDocument75 pages2021 02 Battery Raw Materials Report FinalFred Lamert100% (5)

- Li Ion Battery Consultation ReportDocument21 pagesLi Ion Battery Consultation ReportPolymer KingsNo ratings yet

- Electric Car Future Prediction - tcm27-67440Document10 pagesElectric Car Future Prediction - tcm27-67440quantumflightNo ratings yet

- Chemistry, Cost and Practicality, Impact On Society and Environmental Impact of A CellDocument4 pagesChemistry, Cost and Practicality, Impact On Society and Environmental Impact of A Celltshahriyar100% (4)

- Review of Li - Ion Battery Thermal Management Methods and Mitigating Techniques: 2/3 W Electric Vehicle For Tropical Climatic ConditionDocument12 pagesReview of Li - Ion Battery Thermal Management Methods and Mitigating Techniques: 2/3 W Electric Vehicle For Tropical Climatic ConditionIJRASETPublicationsNo ratings yet

- Tesla Economic Footprint Report FinalDocument28 pagesTesla Economic Footprint Report FinalFred Lamert100% (1)

- Water Scarcity & Climate - InvestorsDocument60 pagesWater Scarcity & Climate - InvestorsDickNo ratings yet

- IVCA Guide To Venture Capital PDFDocument64 pagesIVCA Guide To Venture Capital PDFNuwan Tharanga LiyanageNo ratings yet

- Rule: Hazardous Materials Transportation: Lithium BatteriesDocument22 pagesRule: Hazardous Materials Transportation: Lithium BatteriesJustia.comNo ratings yet

- Consumption of Electric Vehicle (2) FinalDocument5 pagesConsumption of Electric Vehicle (2) FinalVaibhav AroraNo ratings yet

- Understanding Batteries For EV - PPT PDFDocument20 pagesUnderstanding Batteries For EV - PPT PDFsrujanodayNo ratings yet

- Electric Vehicle Report EN - AS FINALDocument60 pagesElectric Vehicle Report EN - AS FINALCREAFUTURNo ratings yet

- Revolt UM RV400 91219 PDFDocument48 pagesRevolt UM RV400 91219 PDFjohnloganmac100% (1)

- Global Hybrid & Electric Cars: Marketline Industry ProfileDocument41 pagesGlobal Hybrid & Electric Cars: Marketline Industry ProfileRACHNA SALUJANo ratings yet

- Tesla Powerpack Project With ConEdDocument34 pagesTesla Powerpack Project With ConEdFred Lamert100% (2)

- Electric Vehicle Research Battery TechnologyDocument2 pagesElectric Vehicle Research Battery Technologyishtiaq ahmedNo ratings yet

- Global EV Outlook 2020Document276 pagesGlobal EV Outlook 2020Tri Ho100% (1)

- CE Delft - Impact of Electric VehiclesDocument87 pagesCE Delft - Impact of Electric VehiclesbhushanrautNo ratings yet

- Silicon Metal (ZhongYa Silicon)Document3 pagesSilicon Metal (ZhongYa Silicon)Benge WengNo ratings yet

- Battery Manufacturing For Hybrid and Electric Vehicles CRSDocument34 pagesBattery Manufacturing For Hybrid and Electric Vehicles CRSsgsg100% (1)

- Simple Economics of Electric Vehicle AdoptionDocument10 pagesSimple Economics of Electric Vehicle AdoptionHamed KhazaeeNo ratings yet

- Battery Swaping Brief Sun MobilityDocument3 pagesBattery Swaping Brief Sun MobilityRohit KumarNo ratings yet

- Global Supply Chains of Ev BatteriesDocument68 pagesGlobal Supply Chains of Ev Batteriessdfgh100% (1)

- New Trends and Recent Developments in Automotive Engineering PDFDocument13 pagesNew Trends and Recent Developments in Automotive Engineering PDFRohinton PaulNo ratings yet

- Battery Manufacturing For Hybrid and Electric Vehicles - Policy IssuesDocument31 pagesBattery Manufacturing For Hybrid and Electric Vehicles - Policy IssuesChuck Achberger100% (1)

- 03 - Killmann - Toyota - Hybrid TechnologyDocument28 pages03 - Killmann - Toyota - Hybrid TechnologymaheshmbelgaviNo ratings yet

- Systematic Synthesis of Dedicated Hybrid Transmission: Lin Li Haijun Chen Ferit KüçükayDocument9 pagesSystematic Synthesis of Dedicated Hybrid Transmission: Lin Li Haijun Chen Ferit KüçükaymaheshmbelgaviNo ratings yet

- S-N DiagramDocument7 pagesS-N DiagrammaheshmbelgaviNo ratings yet

- Shell Oil TF 0870 Material Data SheetDocument1 pageShell Oil TF 0870 Material Data Sheetmaheshmbelgavi50% (2)

- Gears Standards-1Document10 pagesGears Standards-1maheshmbelgavi100% (1)

- Tractorsmart PDFDocument2 pagesTractorsmart PDFmaheshmbelgaviNo ratings yet

- NRB Tractor VehiclesDocument13 pagesNRB Tractor VehiclesmaheshmbelgaviNo ratings yet

- Unit Conversion: LengthDocument35 pagesUnit Conversion: LengthAnonymous 8aj9gk7GCLNo ratings yet

- ISO4156 Spline Design CalcsDocument10 pagesISO4156 Spline Design CalcsmaheshmbelgaviNo ratings yet

- (182253875) Consumer Buying Behavior While Purchasing Apple LaptopDocument6 pages(182253875) Consumer Buying Behavior While Purchasing Apple Laptop400bNo ratings yet

- 5384 EVAir CompressorDocument88 pages5384 EVAir CompressorNanda Wicaksono100% (3)

- Lesson 1 Computer Fundamentals: Rogelio C. Agustin JRDocument40 pagesLesson 1 Computer Fundamentals: Rogelio C. Agustin JRRamzen Raphael DomingoNo ratings yet

- Acoustic Audio 802 Mixer Manual 1Document4 pagesAcoustic Audio 802 Mixer Manual 1Bush Pilot DudeNo ratings yet

- Analog Devices Datasheet CN0511Document9 pagesAnalog Devices Datasheet CN0511Ravindra MogheNo ratings yet

- Yokogawa System SpecificationDocument6 pagesYokogawa System Specificationusamakhan205No ratings yet

- GTP 33 KV CTCTS, PTs Upto 33KV, SMC Boxes, Deep Drawn Boxes, AB Switch, DO Fuse Set, Isolators, Hardware Fittings, Chemical Earthing, C&R Panels Upto 33KVDocument4 pagesGTP 33 KV CTCTS, PTs Upto 33KV, SMC Boxes, Deep Drawn Boxes, AB Switch, DO Fuse Set, Isolators, Hardware Fittings, Chemical Earthing, C&R Panels Upto 33KVSharafatNo ratings yet

- CNC Angle Punching Marking and Cutting Line Model Blz2020 Bl2020 Bl1412Document3 pagesCNC Angle Punching Marking and Cutting Line Model Blz2020 Bl2020 Bl1412ayad100% (1)

- Pe 1999-12Document92 pagesPe 1999-12franciscocampoverde8224No ratings yet

- Interruptor RecloserDocument4 pagesInterruptor RecloserbleerNo ratings yet

- Lecture3 - Three Phase Power Converter Control Strategies For Three Machine TypesDocument26 pagesLecture3 - Three Phase Power Converter Control Strategies For Three Machine Typesthulasi_krishnaNo ratings yet

- Determination of Wavelength of Light Using A Diffraction GratingDocument2 pagesDetermination of Wavelength of Light Using A Diffraction GratingsubhradipNo ratings yet

- Doordarshan SandeepDocument41 pagesDoordarshan Sandeepkavi_mishra92No ratings yet

- AD IFC300 Profibus PA V0200 en PDFDocument24 pagesAD IFC300 Profibus PA V0200 en PDFCesar GuidoNo ratings yet

- 08 Qi No Fault Found Intermittent FailureDocument12 pages08 Qi No Fault Found Intermittent FailureJack Xuan100% (1)

- Computer Fundamentals Assignment-1Document3 pagesComputer Fundamentals Assignment-1Anchu NainaNo ratings yet

- Ultra - Power Vacuum CleanerDocument16 pagesUltra - Power Vacuum Cleanerdavid vazNo ratings yet

- Parker Parvex RTS Servo Drive ManualDocument65 pagesParker Parvex RTS Servo Drive ManualJose LopezNo ratings yet

- Xaga SpojniceDocument2 pagesXaga SpojnicedugoprstiNo ratings yet

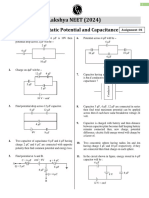

- Electrostatic Potential and Capacitance - Assignment 01 - Lakshya NEET 2024Document4 pagesElectrostatic Potential and Capacitance - Assignment 01 - Lakshya NEET 2024Yash Kumar DasNo ratings yet

- OS CN DS DBMS SE Interview QuestionsDocument38 pagesOS CN DS DBMS SE Interview QuestionsSeshu Gagan60% (5)

- Accu StopDocument4 pagesAccu StopTarekAlgamdiNo ratings yet

- Ee Module 4 April 2012Document3 pagesEe Module 4 April 2012Znevba QuintanoNo ratings yet

- Relaying Applications of Traveling Waves: Dr.M.Manjula ProfessorDocument61 pagesRelaying Applications of Traveling Waves: Dr.M.Manjula ProfessornemarjeltnNo ratings yet

- HW 05 PDFDocument2 pagesHW 05 PDFFatima Afzal100% (1)

- Free Vibration of Sdof SystemsDocument90 pagesFree Vibration of Sdof SystemsJedidiah Joel AguirreNo ratings yet

- Plecs Demo Model: Three-Phase Grid-Connected PV InverterDocument5 pagesPlecs Demo Model: Three-Phase Grid-Connected PV Inverter544D GamingNo ratings yet

- EVERLIGHT - DATA SHEET - 2016-03-01 - Led SMD 0,2 Watt - 67-21S-KK5C-HXXXXXXXX2833Z6-2T - EMM - V2 PDFDocument19 pagesEVERLIGHT - DATA SHEET - 2016-03-01 - Led SMD 0,2 Watt - 67-21S-KK5C-HXXXXXXXX2833Z6-2T - EMM - V2 PDFbetodias30No ratings yet

- Air Samsung Option ProcedureDocument33 pagesAir Samsung Option ProcedureAnamaria AlexandraNo ratings yet

- Question Bank: Ee 1403 - Design of Electrical ApparatusDocument11 pagesQuestion Bank: Ee 1403 - Design of Electrical ApparatussuriyasureshNo ratings yet