Professional Documents

Culture Documents

12 Accountancy ch01 Test Paper 10 Capitalisation Method PDF

Uploaded by

Richa SharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

12 Accountancy ch01 Test Paper 10 Capitalisation Method PDF

Uploaded by

Richa SharmaCopyright:

Available Formats

Test Papers Designed By : Dr. Vinod Kumar (e-mail : authorcbse@gmail.

com)

Dr. Vinod Kumar is a great name in the field of Accountancy.

He is author of very popular book “Ultimate Book of Accountancy” class 12th and 11th.

Contact Detail : Vishvas Publications 09216629576 and 09256657505

Website : http://bestaccountancybook.in/ and http://vishvasbooks.com/

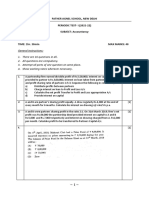

CBSE TEST PAPER-10

Class - XII Accountancy (Goodwill)

Topic : Capitalisation Method

1. Give the formula of Goodwill by ‘Capitalisation of Average Profits’ Method. [1]

2. Give the formula for calculation of Goodwill by ‘Capitalisation of Super Profit’ Method. [1]

3. Why is Goodwill considered as an intangible asset but not a Fictitious Asset? [1]

4. A partnership firm earned net profits during the last three years as follows: [4]

Years Profit

2007-08 38,000

2008-09 44,000

2009-10 50,000

The Capital Employed in the firm throughout the above mentioned period has been Rs.80,000.

Having regard to the risk involved, 15% is considered to be a fair return on the capital. The

remuneration of all the partners during this period is estimated to be Rs.20,000 per annum.

Calculate the value of goodwill on the basis of (i) Two years purchase of super profits earned on

average basis during the above mentioned three years and (ii) Capitalization method.

5. A Business earned average profits of Rs.5,00,000 during the last few years and the normal rate of [4]

return in similar business is 10%. Find out the value of Goodwill by

(i) Capitalization of Super Profit method and

(ii) Super Profit method, if the goodwill is valued at 3 years purchase of super profit.

The assets of the business were Rs.50,00,000 and its external liabilities Rs.9,00,000.

6. Vinod and Kumar are partners in a firm. Their capitals were: Vinod Rs.6,00,000 and [4]

Kumar Rs.4,00,000. During the year 2014 the firm earned a profit of Rs.3,00,000.

Calculate the value of goodwill of the firm assuming that the normal rate of return is 20%.

7. A Business has earned average profits of Rs.2,00,000 during the last few years and the [4]

normal rate of return in a similar type of business is 10%. Ascertain the value of Goodwill

by Capitalisation method. Given that the value of Net Assets of the firm is Rs.16,40,000.

Material downloaded from http://myCBSEguide.com and http://onlineteachers.co.in

Portal for CBSE Notes, Test Papers, Sample Papers, Tips and Tricks

8. Larson, William and Harry are partners in a firm with the capitals of Rs.1,87,500 , [4]

Rs.1,50,000 , Rs.1,12,500. Average profit of the business for last few years is

Rs.72,000. Normal rate of return in a similar business is 10%. Calculate the value

of goodwill by capitalization of super profit.

Accountancy Challenge

Challenge : 1

From the following information, Calculate value of goodwill by capitalizing the super profit :

i) Average net capital employed in the business Rs.7,00,000.

ii) Net Trading profit of the firm for the last three years : Rs.1,47,600 ; Rs.1,48,100 ; and

Rs.1,52,500.

iii) Rate of return expected from the capital having regard to the risk involved 18%.

iv) Fair remuneration to the partners for their services Rs.12,000 per annum.

v) Sundry Assets (excluding goodwill) of the firm Rs.7,54,762 ; Sundry Liabilities

Rs.31,329.

Find goodwill on the basis of :

a) 3 years purchase of average profits

b) 3 years purchase of super profits

c) Capitalization of average profits

d) Capitalization of super profits

Challenge : 2

(a) The goodwill of a firm is estimated at three years purchase of the average Profits of the last five

years which are as follows:

Years 2010 2011 2012 2013 2014

Profits (Loss) 20,000 30,000 8,000 (10,000 Loss) 12,000

(b) If in the firm total capital employed is Rs.2,00,000 and normal rate of return is 8%, the average

profit for last 5 years is Rs.24,000 and Goodwill is estimated at 3 years purchase of super

profits, remuneration to partners Rs.6,000.

(c) Vinod Brothers earn a net profit of Rs.60,000 with a capital of Rs.4,00,000. The normal rate of

return in the business is 10%. Use Capitalisation of super profits method to value the goodwill

of the firm.

Material downloaded from http://myCBSEguide.com and http://onlineteachers.co.in

Portal for CBSE Notes, Test Papers, Sample Papers, Tips and Tricks

You might also like

- Goodwill 1Document3 pagesGoodwill 1D. Naarayan NandanNo ratings yet

- 4 RJDocument1 page4 RJms1522060No ratings yet

- Worksheet 2 AccountsDocument3 pagesWorksheet 2 Accountshanu kesharwaniNo ratings yet

- General Instructions:: Class: XII Max. Marks: 30 Date: 13-08-2021 Time: 1 HourDocument3 pagesGeneral Instructions:: Class: XII Max. Marks: 30 Date: 13-08-2021 Time: 1 HourDANESH RICHARDNo ratings yet

- Accounts FinalDocument104 pagesAccounts FinalAMIN BUHARI ABDUL KHADERNo ratings yet

- Good Will Tuition QuestionsDocument3 pagesGood Will Tuition QuestionsKunika DubeyNo ratings yet

- 5 Good Will AccountsDocument13 pages5 Good Will AccountsNisarga T DaryaNo ratings yet

- REVISION 2022 Part A - CH. 3Document2 pagesREVISION 2022 Part A - CH. 3ADAM ABDUL RAZACKNo ratings yet

- Xii Acc WS 3Document4 pagesXii Acc WS 3Gaytri ThaparNo ratings yet

- RKG Imp Q (CH 1 & 2) DoneDocument3 pagesRKG Imp Q (CH 1 & 2) Donepriyanshi.bansal25No ratings yet

- Chapter 2 - Goodwill Nature and Valuation - Volume IDocument11 pagesChapter 2 - Goodwill Nature and Valuation - Volume Iakshaya sangeethaNo ratings yet

- Top 100 Questions of AccountsDocument75 pagesTop 100 Questions of Accountschauhanthakur554No ratings yet

- 4 RsDocument1 page4 Rsms1522060No ratings yet

- Father Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40Document4 pagesFather Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40fffffNo ratings yet

- Methods of Valuing Goodwill of A Company (7 Methods)Document16 pagesMethods of Valuing Goodwill of A Company (7 Methods)Muhammad AsadNo ratings yet

- ACC Assignment Questions Extra PractiseDocument20 pagesACC Assignment Questions Extra Practisesikeee.exeNo ratings yet

- Introduction Part of Envoy TextileDocument4 pagesIntroduction Part of Envoy Textileshaiqua TashbihNo ratings yet

- 5 Module 5-1Document56 pages5 Module 5-1Isha kaleNo ratings yet

- Goodwill 01Document4 pagesGoodwill 01Chanderprakash GuptaNo ratings yet

- CH 2 Goodwill Nature and ValuationDocument3 pagesCH 2 Goodwill Nature and Valuationaryannchauhaan30No ratings yet

- Valuation of GoodwillDocument5 pagesValuation of GoodwillChaaru VarshiniNo ratings yet

- Work 2 Joshi ClassDocument6 pagesWork 2 Joshi ClassSatyajeet RananavareNo ratings yet

- Valuation of Goodwill XII ScannerDocument5 pagesValuation of Goodwill XII ScannerRajesh NangaliaNo ratings yet

- Business Finance Assignment EnaaDocument4 pagesBusiness Finance Assignment EnaaEna Bandyopadhyay100% (1)

- FM - Assignment Batch 19 - 21 IMS IndoreDocument3 pagesFM - Assignment Batch 19 - 21 IMS IndoreaskjdfaNo ratings yet

- Goodwill ValuationDocument15 pagesGoodwill ValuationREHANRAJ100% (1)

- FM Revision 3rd YearDocument39 pagesFM Revision 3rd YearBharat Satyajit100% (1)

- Assignments +2 2022 2023 A1 CHAPTR 3Document3 pagesAssignments +2 2022 2023 A1 CHAPTR 3Lester WilliamsNo ratings yet

- Financial Management 201Document4 pagesFinancial Management 201Avijit DindaNo ratings yet

- Importanat Questions - Doc (FM)Document5 pagesImportanat Questions - Doc (FM)Ishika Singh ChNo ratings yet

- Dayalbagh Educational Institute Faculty of Commerce Abm 801: Financial Management & Analysis Question BankDocument9 pagesDayalbagh Educational Institute Faculty of Commerce Abm 801: Financial Management & Analysis Question BankneetamoniNo ratings yet

- 19 Valuation of Goodwill PDFDocument5 pages19 Valuation of Goodwill PDF801chiru801100% (1)

- Class 12th Accounts Unsolved Sample Paper 1Document9 pagesClass 12th Accounts Unsolved Sample Paper 1Vikrant NainNo ratings yet

- Valuationofgoodwillandsharesl 171209084328Document48 pagesValuationofgoodwillandsharesl 171209084328Shweta ShrivastavaNo ratings yet

- Bismillah 2011-12 Accounts NotesDocument94 pagesBismillah 2011-12 Accounts NotesAMIN BUHARI ABDUL KHADER0% (1)

- 100 Pages ACDocument98 pages100 Pages ACAMIN BUHARI ABDUL KHADERNo ratings yet

- Rajdhani College FM Assignment FinalDocument6 pagesRajdhani College FM Assignment Finalayushkorea52629No ratings yet

- Economics Pa 1 Class IXDocument2 pagesEconomics Pa 1 Class IXidealNo ratings yet

- Accounting Procedure For Valuation of GoodwillDocument12 pagesAccounting Procedure For Valuation of GoodwillMuhammad AsadNo ratings yet

- Jairam Higher Secondary School, Salem-8 Quarterly Examination-2020-2021 Class: Xii Accountancy MARKS: 90 DATE: 16.10.2020 TIME: 2 Hrs I. Choose The Correct Answer: (20 X 1 20)Document6 pagesJairam Higher Secondary School, Salem-8 Quarterly Examination-2020-2021 Class: Xii Accountancy MARKS: 90 DATE: 16.10.2020 TIME: 2 Hrs I. Choose The Correct Answer: (20 X 1 20)ShruthikaNo ratings yet

- Accounts Notes For 2010 11 HSC Maharashtra BoardDocument106 pagesAccounts Notes For 2010 11 HSC Maharashtra BoardSumeet KumbhaniNo ratings yet

- 820003Document3 pages820003Minaz VhoraNo ratings yet

- Acct TestDocument16 pagesAcct TestNavya KhemkaNo ratings yet

- Accountancy 12th Class PaperDocument5 pagesAccountancy 12th Class PaperSanjana SinghNo ratings yet

- CHAPTER-3 - Valuation of GoodwillDocument9 pagesCHAPTER-3 - Valuation of GoodwillTrupthi S ReddyNo ratings yet

- Financial ManagementDocument6 pagesFinancial ManagementAshish PrajapatiNo ratings yet

- Valuation of Goodwill: NRR Ofit AverageDocument5 pagesValuation of Goodwill: NRR Ofit AverageKrishna Teddy100% (1)

- Chapter 3-Valuation of GoodwillDocument12 pagesChapter 3-Valuation of GoodwillnabhayNo ratings yet

- T1 GoodwillDocument1 pageT1 GoodwillSanchita KhattarNo ratings yet

- Pyq CH 2-GoodwillDocument13 pagesPyq CH 2-Goodwillhk6206131516No ratings yet

- 05 s601 SFM - 3 PDFDocument4 pages05 s601 SFM - 3 PDFMuhammad Zahid FaridNo ratings yet

- Lesson-18 Capital BudgetingDocument23 pagesLesson-18 Capital BudgetingMurali Krishna VelavetiNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityAmul PatelNo ratings yet

- Fa Iv Unit 3Document13 pagesFa Iv Unit 3misba shaikhNo ratings yet

- Business FinanceDocument8 pagesBusiness FinanceLesley DenisNo ratings yet

- MCQ - Goodwill (Class XII)Document5 pagesMCQ - Goodwill (Class XII)WHY NOT YOU ??50% (2)

- 68 Ujala BookDocument104 pages68 Ujala BookRicha SharmaNo ratings yet

- Revised Final Result Punjab Haryana High Court PCS JB 2019Document30 pagesRevised Final Result Punjab Haryana High Court PCS JB 2019Richa SharmaNo ratings yet

- Introduction: The Term "Execution" Has Not Been Defined in The Code. in Its WidestDocument25 pagesIntroduction: The Term "Execution" Has Not Been Defined in The Code. in Its WidestRicha SharmaNo ratings yet

- Q.P. Suitability Test - 2017 First Q.PDocument34 pagesQ.P. Suitability Test - 2017 First Q.PRicha SharmaNo ratings yet

- Criminal Law LLM 2nd SemDocument2 pagesCriminal Law LLM 2nd SemRicha SharmaNo ratings yet

- Hindi All Competitive Exams: (31 JANUARY 2018)Document1 pageHindi All Competitive Exams: (31 JANUARY 2018)Richa SharmaNo ratings yet

- 2.bail For Children in Conflict With The LawDocument7 pages2.bail For Children in Conflict With The LawRicha SharmaNo ratings yet

- P-947 Interns Report Conference Sentencing Brief by Vaibhav Kumar 15-10-15Document16 pagesP-947 Interns Report Conference Sentencing Brief by Vaibhav Kumar 15-10-15Richa SharmaNo ratings yet

- List of The Chairman/Member & Staff of Haryana Public Service Commission, PanchkulaDocument3 pagesList of The Chairman/Member & Staff of Haryana Public Service Commission, PanchkulaRicha SharmaNo ratings yet

- PGGC-11 Subject Change List Sr. No Form No. Name Roll No. Old Comb New Comb Left Sub Taken SubDocument3 pagesPGGC-11 Subject Change List Sr. No Form No. Name Roll No. Old Comb New Comb Left Sub Taken SubRicha SharmaNo ratings yet

- WelcomeLetterSeptember2020 693448463Document2 pagesWelcomeLetterSeptember2020 693448463Richa SharmaNo ratings yet

- Order") That Is The Subject of This Analysis. The Final Order Found That The Respondent Had ViolatedDocument2 pagesOrder") That Is The Subject of This Analysis. The Final Order Found That The Respondent Had ViolatedRicha SharmaNo ratings yet

- The Legal Profession Is Governed by A Moral Code That Is The Key To Maintaining Independence and Accountability and Instilling Trust Among Clients by Ritu GuptaDocument4 pagesThe Legal Profession Is Governed by A Moral Code That Is The Key To Maintaining Independence and Accountability and Instilling Trust Among Clients by Ritu GuptaRicha SharmaNo ratings yet

- Note For Teachers and Students: AnswersDocument1 pageNote For Teachers and Students: AnswersRicha SharmaNo ratings yet

- Laurence Connors - Bollinger Bands Trading Strategies That WorkDocument39 pagesLaurence Connors - Bollinger Bands Trading Strategies That Worksamgans91% (11)

- Estimating Long-Run PD, Asset Correlation, and Portfolio Level PD by Vasicek ModelsDocument13 pagesEstimating Long-Run PD, Asset Correlation, and Portfolio Level PD by Vasicek Modelsh_y02No ratings yet

- CPA Board Examination Operation - Advance Accounting: Page 1 of 11Document11 pagesCPA Board Examination Operation - Advance Accounting: Page 1 of 11Janella Patrizia0% (1)

- Introduction To Book Keeping and Accounting: Videos Exercises QuizDocument14 pagesIntroduction To Book Keeping and Accounting: Videos Exercises QuizBhasker KharelNo ratings yet

- AmalgamationDocument48 pagesAmalgamationJaTinGupTa100% (2)

- A2 IndictmentDocument16 pagesA2 IndictmentArmandoInfoNo ratings yet

- Aro Granite ReportDocument7 pagesAro Granite ReportsiddharthgrgNo ratings yet

- Study On Forex MarketDocument16 pagesStudy On Forex MarketPiyush PalandeNo ratings yet

- 09 Chapter4 PDFDocument45 pages09 Chapter4 PDFBasuNo ratings yet

- Chapter - I, Ii, Iii, IvDocument92 pagesChapter - I, Ii, Iii, IvHarichandran KarthikeyanNo ratings yet

- Cost of Capital and Project ValuationDocument24 pagesCost of Capital and Project ValuationJordanNo ratings yet

- MY UNIVERSE Terms - ConditionDocument17 pagesMY UNIVERSE Terms - ConditionparveencareNo ratings yet

- Working With Dairy Businesses in Challenging TimesDocument49 pagesWorking With Dairy Businesses in Challenging TimesaamritaaNo ratings yet

- Bbap2103 Akaun PengurusanDocument10 pagesBbap2103 Akaun PengurusanEima AbdullahNo ratings yet

- A Study On Capital Budgeting at Bharathi Cement LTDDocument4 pagesA Study On Capital Budgeting at Bharathi Cement LTDEditor IJTSRDNo ratings yet

- Monthly MIS FormatDocument19 pagesMonthly MIS FormatRajit SuriNo ratings yet

- Balakrishna TemplateDocument4 pagesBalakrishna TemplatebagyaNo ratings yet

- Breakfast With Dave 111610Document5 pagesBreakfast With Dave 111610adam2938No ratings yet

- Micro Finance in BrazilDocument7 pagesMicro Finance in BrazilguptarohanNo ratings yet

- Tute 7 PDFDocument5 pagesTute 7 PDFRony RahmanNo ratings yet

- 1830 AH RulesDocument16 pages1830 AH RulestobymaoNo ratings yet

- Understanding Real Estate Investment Trusts (Reits) & Reit Valuation ModellingDocument4 pagesUnderstanding Real Estate Investment Trusts (Reits) & Reit Valuation ModellingidkwhiiNo ratings yet

- Balance Sheet: LiabilitiesDocument19 pagesBalance Sheet: LiabilitiesSpurgeon SathyaSuganthNo ratings yet

- Bachelor of Science (Honours) : Accounting Accounting and FinanceDocument12 pagesBachelor of Science (Honours) : Accounting Accounting and FinanceBryan SingNo ratings yet

- Handout For EntrepreneurshipDocument2 pagesHandout For EntrepreneurshipMerben AlmioNo ratings yet

- Combined Address Change FormDocument2 pagesCombined Address Change FormsushikumNo ratings yet

- Financial Management - Midterm Exam - 1st DraftDocument5 pagesFinancial Management - Midterm Exam - 1st DraftRenalyn Paras100% (2)

- "Parker Pen Company": Case Study AnalysisDocument12 pages"Parker Pen Company": Case Study AnalysisSherren Marie NalaNo ratings yet

- Davies Opening Appeal Brief - California Bankruptcy Court - Ninth - June 2011Document42 pagesDavies Opening Appeal Brief - California Bankruptcy Court - Ninth - June 201183jjmackNo ratings yet

- CMT Level3 ReadingDocument7 pagesCMT Level3 Readingsankarjv0% (1)