Professional Documents

Culture Documents

4 RJ

Uploaded by

ms1522060Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4 RJ

Uploaded by

ms1522060Copyright:

Available Formats

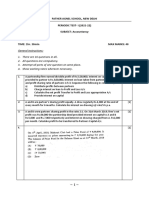

5.

The capital of the firm of Anuj and Benu is ₹10,00,000 and the

1

market rate of interest is (15%) Annual salary to the partners is

₹60,000 each. The profit for the last three years were 3,00,000,

₹3,60,000 and ₹4,20,000. Goodwill of the firm is to be valued on the

basis of two years purchase of last three years average super profit.

Calculate the goodwill of the firm. (CBSE 2019)[

Ans.: Goodwill-1,80,000.]

16. Atul and Bipul had a firm in which they had invested ₹50,000.

On an average, the profits were ₹16,000. The normal rate of return

in the industry is 15%. Goodwill is to be valued at four years'

purchase of profits in excess of profits @15% on the money

invested. Calculate the value of goodwill.

SUPER PROFITS[ Ans.: Goodwill-34,000.]

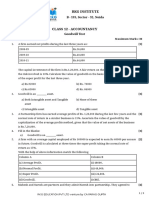

24. Average profit earned by a firm is ₹7,50,000 which includes

overvaluation of stock of ₹30000 on an average basis. The capital

invested in the business is ₹42,00,000 and the normal rate of return

is 15%.

Calculate goodwill of the firm on the basis of 3 times the super

profit.

18. A business earned an average profit of ₹8,00,000 during the last

few years. The normal rate of profit in the similar type of business

is 10%. The total value of assets and liabilities of the business were

₹22,00,000 and ₹5,60,000 respectively. Calculate the value of

goodwill of the firm by super profit method if it is valued at 2½

years' purchase of super profit.

21.On 1st April, 2022, an existing firm had assets of ₹ ₹75,000

including cash of ₹ 5,000. Its creditors amounted to ₹5,000 on that

date. The firm had a Reserve of ₹10,000 while Partners' Capital

Accounts showed a balance of ₹ 60,000. If Normal Rate of Return is

20% and goodwill of the firm is valued at ₹24,000 at four years

purchase of super profit, find average profit per year of the existing

firm.

You might also like

- 4 RsDocument1 page4 Rsms1522060No ratings yet

- Good Will Tuition QuestionsDocument3 pagesGood Will Tuition QuestionsKunika DubeyNo ratings yet

- CH 2 Goodwill Nature and ValuationDocument3 pagesCH 2 Goodwill Nature and Valuationaryannchauhaan30No ratings yet

- 12 Accountancy ch01 Test Paper 10 Capitalisation Method PDFDocument2 pages12 Accountancy ch01 Test Paper 10 Capitalisation Method PDFRicha SharmaNo ratings yet

- Chapter 2 - Goodwill Nature and Valuation - Volume IDocument11 pagesChapter 2 - Goodwill Nature and Valuation - Volume Iakshaya sangeethaNo ratings yet

- GoodwillDocument19 pagesGoodwillmenekyakiaNo ratings yet

- Valuation of GoodwillDocument5 pagesValuation of GoodwillChaaru VarshiniNo ratings yet

- Xii Acc WS 3Document4 pagesXii Acc WS 3Gaytri ThaparNo ratings yet

- GoodwillDocument4 pagesGoodwilldivyarwt0No ratings yet

- Top 100 Questions of AccountsDocument75 pagesTop 100 Questions of Accountschauhanthakur554No ratings yet

- Accounts FinalDocument104 pagesAccounts FinalAMIN BUHARI ABDUL KHADERNo ratings yet

- Worksheet 2 AccountsDocument3 pagesWorksheet 2 Accountshanu kesharwaniNo ratings yet

- Assignments +2 2022 2023 A1 CHAPTR 3Document3 pagesAssignments +2 2022 2023 A1 CHAPTR 3Lester WilliamsNo ratings yet

- Valuation of Goodwill XII ScannerDocument5 pagesValuation of Goodwill XII ScannerRajesh NangaliaNo ratings yet

- 100 QUESTIONS AccountsDocument84 pages100 QUESTIONS AccountsShraddha Bansal100% (1)

- Valuation of Goodwill Class NotesDocument4 pagesValuation of Goodwill Class NotesRajesh NangaliaNo ratings yet

- 5 Module 5-1Document56 pages5 Module 5-1Isha kaleNo ratings yet

- 5 Good Will AccountsDocument13 pages5 Good Will AccountsNisarga T DaryaNo ratings yet

- Accountancy 12th Class PaperDocument5 pagesAccountancy 12th Class PaperSanjana SinghNo ratings yet

- Accountancy GoodwillDocument5 pagesAccountancy GoodwillPrachi SanklechaNo ratings yet

- Methods of Valuing Goodwill of A Company (7 Methods)Document16 pagesMethods of Valuing Goodwill of A Company (7 Methods)Muhammad AsadNo ratings yet

- 08 Partnership Admission Type of Goodwill 1 95Document12 pages08 Partnership Admission Type of Goodwill 1 95Rashi GuptaNo ratings yet

- Goodwill 01Document4 pagesGoodwill 01Chanderprakash GuptaNo ratings yet

- Additional Questions 3Document4 pagesAdditional Questions 3Shyam SoniNo ratings yet

- Types of GoodwillDocument4 pagesTypes of GoodwillNitesh KotianNo ratings yet

- Presented By: Prajal, Prateekshya, Pravin, Priya, Rikesh and RubinaDocument27 pagesPresented By: Prajal, Prateekshya, Pravin, Priya, Rikesh and RubinaRightchoice BooksNo ratings yet

- ACC501 Special 2006 Final Term Pape4Document3 pagesACC501 Special 2006 Final Term Pape4Ateeb ElahiNo ratings yet

- Question Sheet: (Net Profit Before Depreciation and After Tax)Document11 pagesQuestion Sheet: (Net Profit Before Depreciation and After Tax)Vinay SemwalNo ratings yet

- Assignment 1 CF Section BDocument2 pagesAssignment 1 CF Section BPoornima SharmaNo ratings yet

- All Math pdf2Document6 pagesAll Math pdf2MD Hafizul Islam HafizNo ratings yet

- Latihan Soal Mk1 2014Document5 pagesLatihan Soal Mk1 2014Joni SuhartoNo ratings yet

- XII ACC Holiday HomeworkDocument3 pagesXII ACC Holiday HomeworkGaurav SainNo ratings yet

- GoodwillDocument14 pagesGoodwillsandeep44% (9)

- FM-Imp QuestionsDocument2 pagesFM-Imp QuestionsPau GajjarNo ratings yet

- Pyq CH 2-GoodwillDocument13 pagesPyq CH 2-Goodwillhk6206131516No ratings yet

- STR 581 Capstone Final Examination, Part Two - Transweb E TutorsDocument10 pagesSTR 581 Capstone Final Examination, Part Two - Transweb E Tutorstranswebetutors3No ratings yet

- Amaysim Australia LimitedDocument9 pagesAmaysim Australia LimitedMahnoor NooriNo ratings yet

- Practice Test MidtermDocument6 pagesPractice Test Midtermrjhuff41No ratings yet

- Importanat Questions - Doc (FM)Document5 pagesImportanat Questions - Doc (FM)Ishika Singh ChNo ratings yet

- Special Issues in Corporate FinanceDocument6 pagesSpecial Issues in Corporate FinanceMD Hafizul Islam HafizNo ratings yet

- Nestle India Submitted By: GARIMA BHATTDocument2 pagesNestle India Submitted By: GARIMA BHATTakshayNo ratings yet

- Father Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40Document4 pagesFather Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40fffffNo ratings yet

- Acc501 Final Special2006Document5 pagesAcc501 Final Special2006Ab DulNo ratings yet

- Dayalbagh Educational Institute Faculty of Commerce Abm 801: Financial Management & Analysis Question BankDocument9 pagesDayalbagh Educational Institute Faculty of Commerce Abm 801: Financial Management & Analysis Question BankneetamoniNo ratings yet

- ACC202 PCOQ 2 RealDocument8 pagesACC202 PCOQ 2 RealGish KK.GNo ratings yet

- Financial ManagementDocument24 pagesFinancial ManagementVindicate LeeNo ratings yet

- 100 Pages ACDocument98 pages100 Pages ACAMIN BUHARI ABDUL KHADERNo ratings yet

- Tutorial 3 For FM-IDocument5 pagesTutorial 3 For FM-IarishthegreatNo ratings yet

- Valuatio of Goodwill WS-1Document2 pagesValuatio of Goodwill WS-1Srishti SinghNo ratings yet

- Valuation of Goodwill by Arjun SinghDocument15 pagesValuation of Goodwill by Arjun SingharjunNo ratings yet

- Valuation of Goodwill by Arjun SinghDocument15 pagesValuation of Goodwill by Arjun SingharjunNo ratings yet

- Method 3 of GoodwillDocument3 pagesMethod 3 of GoodwillkalyanikamineniNo ratings yet

- Dividend Decision Question-3Document10 pagesDividend Decision Question-3Savya Sachi50% (2)

- Goodwill PDFDocument14 pagesGoodwill PDFShaileshNo ratings yet

- Financial Accounting and Reporting: Subject Code - MFT4CCEF02Document9 pagesFinancial Accounting and Reporting: Subject Code - MFT4CCEF02Varun RathoreNo ratings yet

- Goodwill 1Document3 pagesGoodwill 1D. Naarayan NandanNo ratings yet