Professional Documents

Culture Documents

Goodwill

Uploaded by

menekyakia0 ratings0% found this document useful (0 votes)

2 views19 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views19 pagesGoodwill

Uploaded by

menekyakiaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 19

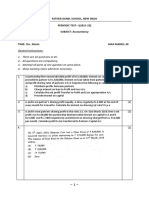

• Doremon, Sinchan and Nobita are partners sharing profits

and losses in the ratio of 3:2:1. With effect from 1st April, 2022

they agree to share profits equally. For this purpose, goodwill

is to be valued at two year’s purchase of the average profit of

last four years which were as follows:

• 31st March, 2019 Rs. 50,000

• 31st March, 2020 Rs. 1,20,000

• 31st March, 2021 Rs. 1,80,000

• 31st March, 2022 Rs. 70,000(Loss)

• On 1st April, 2021 a Motor Bike costing Rs. 50,000 was

purchased and debited to travelling expenses account, on

which depreciation is to be charged @ 20 % p.a. by Staright

Line Method. The firm also paid an annual insurance

premium of Rs. 20,000 which had already been charged to

Profit & Loss account for all the years.

• You are required to calculate the value of goodwill.

• Luv and Kush are partners sharing profits equally. They admit

Shubh into partnership for equal share. Goodwill was agreed to

be valued at two year’s purchase of average profit of last four

years. Profits for last four years were:

Year Ended Normal Profit/Loss

31st March, 2019 70,000

31st March, 2020 1,00,000

31st March, 2021 55,000(loss)

31st March, 2022 1,44,000

The books of accounts of the firm revealed as follows:

• Firm had abnormal gain of Rs. 10,000 during the year ended 31st

March, 2019.

• Firm incurred abnormal loss of Rs. 20,000 during the year ended

31st March, 2020.

• Repairs to car of Rs. 50,000 was wrongly debited to Vehicles

Account on 1st June, 2020. Depreciation was charged on Vehicles

@ 12% p.a. on Straight Line Method

• Dinesh and Mahesh are partners sharing profits and losses

in the ratio of 3:2. They admit Ramesh into partnership for

1/4th share in profits. Ramesh brings in his share of

goodwill in cash. Goodwill for this purpose shall be

calculated at two years' purchase of the weighted average

normal profit of past three years. Weights being assigned to

each year

(a) 2017−1; (b) 2018−2 (c) 2019−3.

• Profits of the last three years were:

• (a) 2017 − Profit ₹ 50,000 (including profits on sale of assets ₹

5,000).

• (b) 2018 − Loss ₹ 20,000 (including loss by fire ₹ 35,000).

• (c) 2019 − Profit ₹ 70,000 (including insurance claim received

₹ 18,000 and interest on investments and dividend received ₹

8,000).

• Calculate the value of goodwill. Also, calculate the goodwill

brought in by Ramesh.

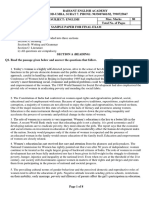

• Mahesh and Suresh are partners and they admit Naresh into

partnership. They agreed to value goodwill at three years' purchase on

Weighted Average Profit Method taking profits for the last five years.

They assigned weights from 1 to 5 beginning from the earliest year and

onwards. The profits for the last five years were as follows:

Year Ended Profits (Rs.)

31st Mar 2015 1,25,000

31st Mar 2016 1,40,000

31st Mar 2017 1,20,000

31st Mar 2018 55,000

31st Mar 2019 2,57,000

Scrutiny of books of account revealed the following:

(a) A second-hand machine was purchased for ₹ 5,00,000 on 1st July, 2017 and ₹

1,00,000 were spent to make it operational.

(b) ₹ 1,00,000 were wrongly debited to Repairs Account.

(c) Machinery is depreciated @ 20% p.a. on Written Down Value Method.

(d) Closing Stock as on 31st March, 2018 was undervalued by ₹ 50,000.

(e) Remuneration to partners was to be considered as charge against profit and

remuneration of ₹ 20,000 p.a. for each partner was considered appropriate.

Calculate the value of goodwill.

• Ayub and Amit are partners in a firm and they admit

Jaspal into partnership w.e.f. 1st April, 2023. They

agreed to value goodwill at 3 year’s purchase of Super

Profit Method for which they decided to average profit

of last 5 years. The profits of the last 5 years were:

Year Ended Profit (Rs.)

31st March, 2019 1,50,000

31st March, 2020 1,80,000

31st March, 2021 1,00,000 (Including abnormal

loss of Rs. 1,00,000)

31st March, 2022 2,60,000 ( Including abnormal

gain of Rs. 40,000)

31st March, 2023 2,40,000

The firm has total assets of Rs. 20,00,000 and Outside

Liabilities of Rs. 5,00,000 as on that date. Normal Rate

of Return in similar business is 10%. Calculate value of

Goodwill.

• The average profit earned by a firm is Rs. 75,000 which

includes undervaluation of stock of Rs. 5,000 on an average

basis. The capital invested in the business is Rs. 7,00,000

and the normal rate of return is 7%. Calculate goodwill of

the firm on the basis of 5 times the super profit.

• M/s. Supertech India has assets of Rs. 5,00,000, whereas

Liabilities are: Partner’s Capitals- Rs. 3,50,000, General

Reserve – Rs. 60,000 and Sundry creditors – Rs. 90,000. If

Normal Rate of Return is 10% and Goodwill of the firm is

valued at Rs. 90,000 at 2 years purchase of Super profit, the

Average Profit of the firm will be?

• On 1st April, 2014 a firm had assets of Rs. 1,00,000 excluding

stock of Rs. 20,000. Partner’s Capital Accounts showed a

balance of Rs. 60,000. The current liabilities were Rs. 10,000

and the balance constituted the reserve. If the normal rate

of return is 8%, the Goodwill of the firm is valued at Rs.

60,000 at four year’s purchase of super profit, find average

profit of the firm.

• Yash and Karan were partners in an interior designer firm. Their fixed

capital were Rs. 6,00,000 and Rs. 4,00,000 respectively. There were credit

balances in their current accounts of Rs. 4,00,000 and Rs. 5,00,000

respectively. The firm had a balance of Rs. 1,00,000 in General Reserve.

The firm did not have any liability. They admitted Radhika into

partnership for 1/4th share in the profits of the firm. The average profits

of the firm for the last five years were Rs. 5,00,000. Calculate the value of

goodwill of the firm by capitalisation of average profits method. The

normal rate of return in the business is 10%.

• Puneet and Tarun are in restaurant business having credit balance in

their fixed Capital Accounts as Rs. 2,50,000 each. They have credit

balances in their Current Accounts of Rs. 30,000 and Rs. 20,000

respectively. The firm does not have any liability. They are regularly

earning profits and their average profit of last 5 years is Rs. 1,00,000. If

the normal rate of return is 10%, find the value of goodwill by

Capitalisation of Super Profit Method.

You might also like

- Ohio Rules of Civil ProcedureDocument356 pagesOhio Rules of Civil ProcedureBrotherBrunoNo ratings yet

- B.D. Bharucha v. C.I.T. Ruling on Bad Debt DeductionDocument3 pagesB.D. Bharucha v. C.I.T. Ruling on Bad Debt DeductionFaraz AliNo ratings yet

- Taxation Law Q&A (Final)Document17 pagesTaxation Law Q&A (Final)Daphne Dianne Mendoza100% (1)

- Class 12 Accounts CA Parag GuptaDocument368 pagesClass 12 Accounts CA Parag GuptaJoel Varghese0% (1)

- Partnership Formation and Operation GuideDocument8 pagesPartnership Formation and Operation GuidePauline Idra100% (1)

- Xii Comm Holiday Homework 2020 23Document44 pagesXii Comm Holiday Homework 2020 23Mohit SuryavanshiNo ratings yet

- Rojas vs. Maglana, G.R. No. 30616, December 10, 1990 DIGESTEDDocument1 pageRojas vs. Maglana, G.R. No. 30616, December 10, 1990 DIGESTEDJacquelyn Alegria0% (1)

- Project On Consumer Perception About Life Insurance PolicyDocument65 pagesProject On Consumer Perception About Life Insurance PolicySukhbeer KaurNo ratings yet

- Good Will Tuition QuestionsDocument3 pagesGood Will Tuition QuestionsKunika DubeyNo ratings yet

- Long Answer Type QuestionDocument75 pagesLong Answer Type Questionincome taxNo ratings yet

- Assignments +2 2022 2023 A1 CHAPTR 3Document3 pagesAssignments +2 2022 2023 A1 CHAPTR 3Lester WilliamsNo ratings yet

- Accountancy GoodwillDocument5 pagesAccountancy GoodwillPrachi SanklechaNo ratings yet

- Goodwill PDFDocument5 pagesGoodwill PDFBHUMIKA JAINNo ratings yet

- T1 GoodwillDocument1 pageT1 GoodwillSanchita KhattarNo ratings yet

- Accounts and Business Studies Question BankDocument5 pagesAccounts and Business Studies Question BankAkshat TiwariNo ratings yet

- Xii Acc WS 3Document4 pagesXii Acc WS 3Gaytri ThaparNo ratings yet

- Change in Psr-12th Commerce-AccountancyDocument5 pagesChange in Psr-12th Commerce-Accountancysinghharshu3222No ratings yet

- RKG Imp Q (CH 1 & 2) DoneDocument3 pagesRKG Imp Q (CH 1 & 2) Donepriyanshi.bansal25No ratings yet

- Summer Vacation Assignment - AccountancyDocument2 pagesSummer Vacation Assignment - Accountancykrishgupta723No ratings yet

- GoodwillDocument4 pagesGoodwilldivyarwt0No ratings yet

- Valuation of Goodwill Class NotesDocument4 pagesValuation of Goodwill Class NotesRajesh NangaliaNo ratings yet

- Without AnswerDocument4 pagesWithout AnswerRakesh AryaNo ratings yet

- Valuation of GoodwillDocument5 pagesValuation of GoodwillChaaru VarshiniNo ratings yet

- Delhi Public School: ACCOUNTANCY - (Subject Code: 055)Document4 pagesDelhi Public School: ACCOUNTANCY - (Subject Code: 055)AbhishekNo ratings yet

- Fundamentals of Partnership: Dhiman ClaimsDocument7 pagesFundamentals of Partnership: Dhiman ClaimsAyareena GiriNo ratings yet

- 12 Accountancy ch01 Test Paper 04 Past Adjestments PDFDocument3 pages12 Accountancy ch01 Test Paper 04 Past Adjestments PDFRicha SharmaNo ratings yet

- GKJ Accounts Xii - Rs 68.00Document67 pagesGKJ Accounts Xii - Rs 68.00sintisharma67No ratings yet

- Partnership FundamentalsDocument3 pagesPartnership FundamentalsDeepanshu kaushikNo ratings yet

- (2022-23) 15-5-2022 Xii May Unit Test For Convent - Fundamental, Goodwill & Change in PSRDocument4 pages(2022-23) 15-5-2022 Xii May Unit Test For Convent - Fundamental, Goodwill & Change in PSRnitya mahajanNo ratings yet

- Basics of Partnership Unit 1Document1 pageBasics of Partnership Unit 1Kalpesh ShahNo ratings yet

- AHLCON PUBLIC SCHOOL Accountancy Class XII AssignmentDocument59 pagesAHLCON PUBLIC SCHOOL Accountancy Class XII Assignmentrajat0% (1)

- Father Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40Document4 pagesFather Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40fffffNo ratings yet

- Fundamental of Partnership - Test-17-11-2023Document2 pagesFundamental of Partnership - Test-17-11-2023umangchh2306No ratings yet

- Assessement Test 5 - Partnership Accounts & Goodwill - Docx - 1660529707799Document2 pagesAssessement Test 5 - Partnership Accounts & Goodwill - Docx - 1660529707799Shreya PushkarnaNo ratings yet

- 12 Cbse Accountancy Set 1 QPDocument12 pages12 Cbse Accountancy Set 1 QPAymenNo ratings yet

- XII ACC Holiday HomeworkDocument3 pagesXII ACC Holiday HomeworkGaurav SainNo ratings yet

- Change in Profit Sharing Ratio Among The Existing PartnersDocument15 pagesChange in Profit Sharing Ratio Among The Existing Partnersvajoj90546No ratings yet

- WS 2 FUNDAMENTALS OF PARTNERSHIP - DocxDocument5 pagesWS 2 FUNDAMENTALS OF PARTNERSHIP - DocxGeorge Chalissery RajuNo ratings yet

- General Instructions:: Class: XII Max. Marks: 30 Date: 13-08-2021 Time: 1 HourDocument3 pagesGeneral Instructions:: Class: XII Max. Marks: 30 Date: 13-08-2021 Time: 1 HourDANESH RICHARDNo ratings yet

- REVISION 2022 Part A - CH. 2Document5 pagesREVISION 2022 Part A - CH. 2ADAM ABDUL RAZACKNo ratings yet

- APS Class 12th Accountancy ExamDocument5 pagesAPS Class 12th Accountancy Exammmt05No ratings yet

- Introduction To Partnership Class WorkDocument1 pageIntroduction To Partnership Class WorkChaaru VarshiniNo ratings yet

- Fundamental Test PDFDocument2 pagesFundamental Test PDFHarshit AgarwalNo ratings yet

- Class Test Fundamentals and Goodwill Set A 01.05.2023 1Document2 pagesClass Test Fundamentals and Goodwill Set A 01.05.2023 1ANTECNo ratings yet

- Basic Concept (Test)Document4 pagesBasic Concept (Test)Midhun PerozhiNo ratings yet

- 4 RJDocument1 page4 RJms1522060No ratings yet

- Worksheet 1-Fundamentals of PartnershipDocument6 pagesWorksheet 1-Fundamentals of Partnershipshakir surtiNo ratings yet

- Accounting For Partnership Firms - Fundamentals (Revision)Document4 pagesAccounting For Partnership Firms - Fundamentals (Revision)pratham bhagatNo ratings yet

- Class XII Assignment - 2 Accounting For Partnership Firms-Fundamentals 1Document3 pagesClass XII Assignment - 2 Accounting For Partnership Firms-Fundamentals 1Lester Williams100% (1)

- Chhaya Public School: Class 12 Subject - AccountancyDocument3 pagesChhaya Public School: Class 12 Subject - AccountancyAlankar SharmaNo ratings yet

- ACC Assignment Questions Extra PractiseDocument20 pagesACC Assignment Questions Extra Practisesikeee.exeNo ratings yet

- Valuatio of Goodwill WS-1Document2 pagesValuatio of Goodwill WS-1Srishti SinghNo ratings yet

- Indus Universal School Accountancy worksheet on partnershipDocument7 pagesIndus Universal School Accountancy worksheet on partnershipLexNo ratings yet

- 28 07 2023 - 344571Document4 pages28 07 2023 - 344571Boda TanviNo ratings yet

- Partnership AccountingDocument21 pagesPartnership AccountingTharun P.Mu.No ratings yet

- Partnership Fundamentals - WorksheetDocument7 pagesPartnership Fundamentals - WorksheetMihika GunturNo ratings yet

- Accountancy 12th Class PaperDocument5 pagesAccountancy 12th Class PaperSanjana SinghNo ratings yet

- Accounting For PartnershipDocument7 pagesAccounting For PartnershipShajila AnvarNo ratings yet

- New profit sharing ratiosDocument9 pagesNew profit sharing ratiosAman KakkarNo ratings yet

- Valuation of GoodwillDocument4 pagesValuation of GoodwillPANKAJ's ACCOUNTANCY PATHSHALANo ratings yet

- 12 Account SP 01 PDFDocument24 pages12 Account SP 01 PDFJanvi KushwahaNo ratings yet

- Question No. 1 To 20 1marksDocument3 pagesQuestion No. 1 To 20 1markssameeksha kosariaNo ratings yet

- 1712765004473_Ch_2_Goodwill_Nature_and_ValuationDocument3 pages1712765004473_Ch_2_Goodwill_Nature_and_Valuationaryannchauhaan30No ratings yet

- 12 Accountancy Ch01 Test Paper 01 Profit and Loss AppropriationDocument3 pages12 Accountancy Ch01 Test Paper 01 Profit and Loss AppropriationHari SharmaNo ratings yet

- Past adjustmentsDocument6 pagesPast adjustmentsgaurav.jahnavimishraNo ratings yet

- 14 March 24Document1 page14 March 24menekyakiaNo ratings yet

- Practice Paper 11 23-24Document5 pagesPractice Paper 11 23-24menekyakiaNo ratings yet

- Class 11th Final TestDocument7 pagesClass 11th Final TestmenekyakiaNo ratings yet

- Sample Paper EnglishDocument8 pagesSample Paper EnglishmenekyakiaNo ratings yet

- Sample Paper AccountsDocument7 pagesSample Paper AccountsmenekyakiaNo ratings yet

- NBPDocument25 pagesNBPShaikh JunaidNo ratings yet

- Partnership and Corporation by Estoppel in Fishing Business Debt CaseDocument3 pagesPartnership and Corporation by Estoppel in Fishing Business Debt CaseKhalid Sharrif 0 SumaNo ratings yet

- GR 11 Accounting 3 in 1 ExtractDocument17 pagesGR 11 Accounting 3 in 1 Extractsmpk2q7d8mNo ratings yet

- Advantages of A Partnership Include ThatDocument11 pagesAdvantages of A Partnership Include ThatLen-Len CobsilenNo ratings yet

- LLP Law - Taxmann-Amit Sachdeva PDFDocument14 pagesLLP Law - Taxmann-Amit Sachdeva PDFnalluriimpNo ratings yet

- Quiz - Pengantar Bisnis 101Document14 pagesQuiz - Pengantar Bisnis 101Depi JNo ratings yet

- ACC CourseDocument22 pagesACC Courseshah md musleminNo ratings yet

- Assignment # 1 (Sheryaar)Document3 pagesAssignment # 1 (Sheryaar)Nofel AmeenNo ratings yet

- Sppulaw Question BankDocument82 pagesSppulaw Question Banksony dakshuNo ratings yet

- Differentiating The Forms of Business Organization and Giving Examples of Forms of Business OrganizationsDocument8 pagesDifferentiating The Forms of Business Organization and Giving Examples of Forms of Business OrganizationsJohn Fort Edwin AmoraNo ratings yet

- Laws1100 TortsDocument29 pagesLaws1100 TortsAndy KellieNo ratings yet

- Documents Needed for Home Loan ApplicationDocument3 pagesDocuments Needed for Home Loan ApplicationJitendra KatiyarNo ratings yet

- HSM 543 Health Services Finance Week 7 Course Project AnswerDocument64 pagesHSM 543 Health Services Finance Week 7 Course Project AnswerMike RussellNo ratings yet

- Chapter 3 Business OrganizationsDocument10 pagesChapter 3 Business Organizationstotskie haraNo ratings yet

- CaseDocument22 pagesCaseMarli Rose MasibayNo ratings yet

- LLP Notes As Per DU SyllabusDocument39 pagesLLP Notes As Per DU SyllabusAryan GuptaNo ratings yet

- Acc QuizDocument3 pagesAcc QuizRey Joyce AbuelNo ratings yet

- Partnership FormationDocument8 pagesPartnership FormationAira Kaye MartosNo ratings yet

- CH 8 - Partnership PDFDocument112 pagesCH 8 - Partnership PDFtasleemfca100% (1)

- PARTNERSHIPS TO BOOST ASIAN SUPPLY CHAIN FINANCEDocument2 pagesPARTNERSHIPS TO BOOST ASIAN SUPPLY CHAIN FINANCEHieu NguyenNo ratings yet

- Junior Accountant Syllabus RajasthanDocument6 pagesJunior Accountant Syllabus RajasthanPriyanka JainNo ratings yet

- by Cs Himanshi Dhakad: Summary of Moa & Preparation StrategyDocument22 pagesby Cs Himanshi Dhakad: Summary of Moa & Preparation StrategyHimanshi dhakarNo ratings yet

- SAUCESea: A Feasibility Study for a New Organic-Vegan Fish Sauce BrandDocument137 pagesSAUCESea: A Feasibility Study for a New Organic-Vegan Fish Sauce BrandAbegail RamiroNo ratings yet

- O&M Module PDF File-1Document177 pagesO&M Module PDF File-1Strewbary BarquioNo ratings yet