Professional Documents

Culture Documents

Valuatio of Goodwill WS-1

Uploaded by

Srishti SinghOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Valuatio of Goodwill WS-1

Uploaded by

Srishti SinghCopyright:

Available Formats

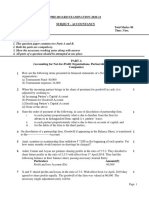

Class: XII Accountancy

Commerce

Worksheet No: 1 Topic: Valuation of Goodwill

1.Calculate the value of goodwill on the basis of four years purchase of average profit

of the lastfive years. The profits were:

2016-17 – ₹ 30,000

2017-18 – ₹ 70,000

2018-19 – ₹ 1,00,000

2019-20 – ₹1,40,000

2020-21 – ₹1,20,000 (Loss)

2. Sumit purchased Amit's business on 1st April, 2020. Goodwill was decided to be

valued at two years' purchase of average normal profit of last four years. The profits for

the past four years were:

Year Ended 31st March, 31st March, 31st March, 31st March,

2017 2018 2019 2020

Profit (₹) 80,000 1,45,000 1,60,000 2,00,000

Books of Account revealed that:

(i) Abnormal loss of ₹ 20,000 was debited to Profit and Loss Account for the year

ended 31stMarch, 2017.

(ii) A fixed asset was sold in the year ended 31st March, 2018 and gain (profit) of ₹

25,000 wascredited to Profit and Loss Account.

(iii) In the year ended 31st March, 2019 assets of the firm were not insured due to

oversight.Insurance premium not paid was ₹ 15,000.

Calculate the value of goodwill.

3.A purchased B’s business with effect from 1.4.2020. It was agreed that the fir’s

goodwill is to bevalued at two years’ purchase of normal average profit of the last three

years. The profits of B’s business for the last three years were:

2017-18: ₹ 80,000 (including an abnormal gain of ₹10,000)

2018-19: ₹1,00,000 )after charging an abnormal loss of

₹20,000)

2019-20: ₹90,000 (excluding ₹10,000 as insurance premium on firm’s

property)Calculate the of the firm’s goodwill.

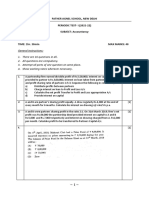

4. X and Y are partners in a firm. They admit Z into partnership for equal share. It was

agreed thatgoodwill will be valued at three years' purchase of average profit of last five

years. Profits for the last five years were:

31st 31st 31st 31st 31st

Year

March, March, March, March, March,

Ended

2016 2017 2018 2019 2020

Profit (₹) 90,000 (Loss) 1,60,000 1,50,000 65,000 1,77,000

Books of Account of the firm revealed that:

(i) The firm had gain (profit) of ₹ 50,000 from sale of machinery sold in the year ended

31st March,2017. The gain (profit) was credited in Profit and Loss Account.

(ii) There was an abnormal loss of ₹ 20,000 incurred in the year ended 31st March, 2018

because ofa machine becoming obsolete in accident.

(iii) Overhauling cost of second hand machinery purchased on 1st July, 2019

amounting to ₹1,00,000 was debited to Repairs Account.

Calculate the value of goodwill.

5. The total capital of the firm of Sakshi, Mehak and Megha is ₹ 1,00,000 and the market

rate of interest is 15%. The net profits for the last 3 years were ₹ 30,000; ₹ 36,000 and ₹

42,000. Goodwillis to be valued at 2 years' purchase of the last 3 years' super profits.

Calculate the goodwill of the firm.

6. The average profits of firm were ₹ 16,000. The normal rate of return in the industry is

15%. Goodwill is to be valued at four years' purchase of super profits. The total assets of

firm is 1,50,000and outside liabilities were 50,000. Calculate the value goodwill.

7. The capital of the firm of Anuj and Benu is ₹10,00,000 and the market rate of

interest is 15%.Annual salary to the partners is ₹60,000 each. The profit for the last

three years were ₹3,00,000,

₹3,60,000 and ₹4,20,000. Goodwill of the firm is to be valued on the basis of two years

purchase oflast three years average super profits. Calculate the goodwill of the firm.

8. Average net profit expected in future by XYZ firm is ₹ 36,000 per year. Average capital

employed in the business by the firm is ₹ 2,00,000. The normal rate of return from

capital investedin this class of business is 10%. Remuneration of the partners is

estimated to be ₹ 6,000

p.a. Calculate the value of goodwill on the basis of two years' purchase of super profit.

9. A business earned an average profit of ₹ 8,00,000 during the last few years. The

normal rate of profit in the similar type of business is 10%. The total value of assets and

liabilities of the businesswere ₹ 22,00,000 and ₹ 5,60,000 respectively. Calculate the

1

value of goodwill of the firm by superprofit method if it is valued at 2 /2 years' purchase

of super profits.

You might also like

- ECN 204 Final Exam ReviewDocument24 pagesECN 204 Final Exam ReviewLinette YangNo ratings yet

- Class 12 Accounts CA Parag GuptaDocument368 pagesClass 12 Accounts CA Parag GuptaJoel Varghese0% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Importance of Social Cost Benefit AnalysisDocument9 pagesImportance of Social Cost Benefit AnalysisMohan RaoNo ratings yet

- China Merchant BankDocument4 pagesChina Merchant BankKevin McleanNo ratings yet

- Goodwill PDFDocument5 pagesGoodwill PDFBHUMIKA JAINNo ratings yet

- Valuation of Goodwill Class NotesDocument4 pagesValuation of Goodwill Class NotesRajesh NangaliaNo ratings yet

- Good Will Tuition QuestionsDocument3 pagesGood Will Tuition QuestionsKunika DubeyNo ratings yet

- Accountancy GoodwillDocument5 pagesAccountancy GoodwillPrachi SanklechaNo ratings yet

- Xii Acc WS 3Document4 pagesXii Acc WS 3Gaytri ThaparNo ratings yet

- Valuation of GoodwillDocument5 pagesValuation of GoodwillChaaru VarshiniNo ratings yet

- Assignments +2 2022 2023 A1 CHAPTR 3Document3 pagesAssignments +2 2022 2023 A1 CHAPTR 3Lester WilliamsNo ratings yet

- Change in Profit Sharing Ratio Among The Existing PartnersDocument15 pagesChange in Profit Sharing Ratio Among The Existing Partnersvajoj90546No ratings yet

- Valuation of GoodwillDocument4 pagesValuation of GoodwillPANKAJ's ACCOUNTANCY PATHSHALANo ratings yet

- Goodwill QuestionsDocument7 pagesGoodwill QuestionsTanisha JainNo ratings yet

- Ch2 AssignmentDocument2 pagesCh2 AssignmentRachit JainNo ratings yet

- Valuation of GoodwillDocument16 pagesValuation of GoodwillRavi ganganiNo ratings yet

- T1 GoodwillDocument1 pageT1 GoodwillSanchita KhattarNo ratings yet

- REVISION 2022 Part A - CH. 3Document2 pagesREVISION 2022 Part A - CH. 3ADAM ABDUL RAZACKNo ratings yet

- Valuation of Goodwill 3Document2 pagesValuation of Goodwill 3Yash MaheswariNo ratings yet

- Goodwill 1Document3 pagesGoodwill 1D. Naarayan NandanNo ratings yet

- Goodwill: ICM 12 Standard Gautam BeryDocument9 pagesGoodwill: ICM 12 Standard Gautam BeryGautam KhanwaniNo ratings yet

- Additional Questions 3Document4 pagesAdditional Questions 3Shyam SoniNo ratings yet

- GoodwillDocument19 pagesGoodwillmenekyakiaNo ratings yet

- RKG Imp Q (CH 1 & 2) DoneDocument3 pagesRKG Imp Q (CH 1 & 2) Donepriyanshi.bansal25No ratings yet

- Change in Psr-12th Commerce-AccountancyDocument5 pagesChange in Psr-12th Commerce-Accountancysinghharshu3222No ratings yet

- Long Answer Type QuestionDocument75 pagesLong Answer Type Questionincome taxNo ratings yet

- Exemplar Questions: TH THDocument9 pagesExemplar Questions: TH THAman KakkarNo ratings yet

- Rapid Test Series 2021 (Accounting For Not For Profit Organizations, Partnership Firms)Document5 pagesRapid Test Series 2021 (Accounting For Not For Profit Organizations, Partnership Firms)Swami NarangNo ratings yet

- TS Grewal Solution Class 12 Chapter 2 Goodwill Nature and Valuation (2018 2019)Document20 pagesTS Grewal Solution Class 12 Chapter 2 Goodwill Nature and Valuation (2018 2019)Krishna singhNo ratings yet

- Practical Q - To PracticeDocument4 pagesPractical Q - To PracticeArjun JadhavNo ratings yet

- Topper 2 101 504 549 Accountancy Question Up201801231745 1516709744 8573Document15 pagesTopper 2 101 504 549 Accountancy Question Up201801231745 1516709744 8573gauravNo ratings yet

- QP Class Xii AccountancyDocument8 pagesQP Class Xii AccountancyRKS TECHNo ratings yet

- Marginal CostingDocument2 pagesMarginal CostingOmkar DhamapurkarNo ratings yet

- FundamentalDocument4 pagesFundamentalPainNo ratings yet

- Father Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40Document4 pagesFather Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40fffffNo ratings yet

- Accounting Ipcc May10 Paper1Document55 pagesAccounting Ipcc May10 Paper1Luvangel HeartNo ratings yet

- Class-Xii Accountancy (2020-2021) General InstructionsDocument10 pagesClass-Xii Accountancy (2020-2021) General InstructionsSaad AhmadNo ratings yet

- Test-1 TIME-1Hour Goodwill: Nature and Valuation M.M.-20Document1 pageTest-1 TIME-1Hour Goodwill: Nature and Valuation M.M.-20vkbabaschildNo ratings yet

- Class XII Accountancy Unit Test 1 15.05.2021Document3 pagesClass XII Accountancy Unit Test 1 15.05.2021Mohm. Armaan MalikNo ratings yet

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingDocument27 pagesQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarNo ratings yet

- As 20 Earning Per ShareDocument18 pagesAs 20 Earning Per ShareNishant Jha Mcom 2No ratings yet

- 1,60,000. C Is Admitted and New Profit Sharing Ratio Is Agreed at 6: 9Document6 pages1,60,000. C Is Admitted and New Profit Sharing Ratio Is Agreed at 6: 9Indra Kumar TiwariNo ratings yet

- 12 Acc 1 ModelDocument11 pages12 Acc 1 ModeljessNo ratings yet

- (2022-23) 15-5-2022 Xii May Unit Test For Convent - Fundamental, Goodwill & Change in PSRDocument4 pages(2022-23) 15-5-2022 Xii May Unit Test For Convent - Fundamental, Goodwill & Change in PSRnitya mahajanNo ratings yet

- Accountancy QP-Term II-Pre Board 1 - Class XIIDocument6 pagesAccountancy QP-Term II-Pre Board 1 - Class XIIRaunofficialNo ratings yet

- Accounts Mock 2Document6 pagesAccounts Mock 2Aryan AggarwalNo ratings yet

- Accountancy: Goodwill: Nature and Valuation 1:00 HOURS Maximum Marks: 20Document3 pagesAccountancy: Goodwill: Nature and Valuation 1:00 HOURS Maximum Marks: 20PRABHAT JOSHINo ratings yet

- Accts Xi Analytical Ques.Document2 pagesAccts Xi Analytical Ques.DEV NANKANINo ratings yet

- Accountancy 12th Class PaperDocument5 pagesAccountancy 12th Class PaperSanjana SinghNo ratings yet

- Goodwill ValuationDocument15 pagesGoodwill ValuationREHANRAJ100% (1)

- Partnership QuestionsDocument11 pagesPartnership QuestionsTRIPTI GUPTANo ratings yet

- Suggested Answers 2017Document33 pagesSuggested Answers 2017Ram UpendraNo ratings yet

- Revision Test Paper: Cap-Ii: Advanced Accounting: Questions Accounting For DepartmentsDocument153 pagesRevision Test Paper: Cap-Ii: Advanced Accounting: Questions Accounting For Departmentsshankar k.c.No ratings yet

- Class Test Fundamentals and Goodwill Set A 01.05.2023 1Document2 pagesClass Test Fundamentals and Goodwill Set A 01.05.2023 1ANTECNo ratings yet

- Girl's High School and College, Prayagraj 2020-2021Document2 pagesGirl's High School and College, Prayagraj 2020-2021Shinchan ShuklaNo ratings yet

- 12 Accounts CBSE Sample Papers 2019Document10 pages12 Accounts CBSE Sample Papers 2019Salokya KhandelwalNo ratings yet

- Revision - Test - Paper - CAP - II - June - 2017 9Document181 pagesRevision - Test - Paper - CAP - II - June - 2017 9Dipen AdhikariNo ratings yet

- Revision Test Paper: Cap Ii (June 2017)Document12 pagesRevision Test Paper: Cap Ii (June 2017)binuNo ratings yet

- Accountancy Previous QuestionsDocument4 pagesAccountancy Previous QuestionsmurthyNo ratings yet

- 12 Accounts 2020 21 Practice Paper 3Document9 pages12 Accounts 2020 21 Practice Paper 3Vijey RamalingamNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- 2009 Business Partners Annual ReportDocument96 pages2009 Business Partners Annual ReportLCNo ratings yet

- HardikDocument28 pagesHardikKeyur PatelNo ratings yet

- Metamorphs Journal: Patience Deteriorating!Document4 pagesMetamorphs Journal: Patience Deteriorating!Conrad HarrisonNo ratings yet

- 1.1 Background of The StudyDocument5 pages1.1 Background of The StudySocialist GopalNo ratings yet

- Level Up-CMPC 131 ReviewerDocument6 pagesLevel Up-CMPC 131 ReviewerazithethirdNo ratings yet

- SPYKAR JEANS (1) ................ WordDocument21 pagesSPYKAR JEANS (1) ................ WordNishant Bhimraj Ramteke75% (4)

- NMIMS Marketing of Financial Services - Assignment Answers (Sem-III)Document6 pagesNMIMS Marketing of Financial Services - Assignment Answers (Sem-III)Udit JoshiNo ratings yet

- Comparative Analysis of Various Alternative of Wealth ManagementDocument58 pagesComparative Analysis of Various Alternative of Wealth ManagementViral ZoneNo ratings yet

- Time Value of MoneyDocument13 pagesTime Value of MoneyAulia EndiniNo ratings yet

- Vivriti Capital 30sep2019Document12 pagesVivriti Capital 30sep2019Gajendra AudichyaNo ratings yet

- JKT Profle ProjectDocument3 pagesJKT Profle ProjectGeorge MyungNo ratings yet

- Assignment For IBSDocument14 pagesAssignment For IBSahmedsmateNo ratings yet

- Saudi Arabia Investment Guide EngDocument98 pagesSaudi Arabia Investment Guide EngZafr O'Connell100% (1)

- Problem Set 2Document3 pagesProblem Set 2Anonymous U3fw3IANo ratings yet

- Futures & Options SegmentDocument36 pagesFutures & Options SegmentVijay MadhvanNo ratings yet

- Performance Training Sales Management in Denver CO Resume Geoff LeopoldDocument1 pagePerformance Training Sales Management in Denver CO Resume Geoff LeopoldGeoffLeopoldNo ratings yet

- ACCA SBR PapersDocument9 pagesACCA SBR PapersKaran KumarNo ratings yet

- Advanced Ratios in Mutual Fund Part1Document19 pagesAdvanced Ratios in Mutual Fund Part1Invest EasyNo ratings yet

- FinMar FINALSDocument9 pagesFinMar FINALSJoy CastillonNo ratings yet

- Libyan Oil ReservesDocument12 pagesLibyan Oil Reservesmohammad_abubakerNo ratings yet

- Graham - Heritage As Knowledge, Capital or CultureDocument15 pagesGraham - Heritage As Knowledge, Capital or CultureHéctor Cardona Machado0% (1)

- Tutorial - Demand & SupplyDocument3 pagesTutorial - Demand & SupplyYee Sin MeiNo ratings yet

- Operating ExposureDocument31 pagesOperating ExposureMai LiênNo ratings yet

- Article Review On TQMDocument21 pagesArticle Review On TQMKaemon BistaNo ratings yet

- Portfolio Diversification Using Correlation MatrixDocument1 pagePortfolio Diversification Using Correlation MatrixBratNo ratings yet

- Corporate Governance by Ibrahim YahayaDocument38 pagesCorporate Governance by Ibrahim Yahayaib ibrahimNo ratings yet

- ACC 107 Practice ExamDocument29 pagesACC 107 Practice ExamAJ Jahara GapateNo ratings yet