Professional Documents

Culture Documents

TS Grewal Solution Class 12 Chapter 2 Goodwill Nature and Valuation (2018 2019)

Uploaded by

Krishna singhCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TS Grewal Solution Class 12 Chapter 2 Goodwill Nature and Valuation (2018 2019)

Uploaded by

Krishna singhCopyright:

Available Formats

Downloaded from https:// www.studiestoday.

com

CONTINUED FROM

HTTPS://WWW.STUDIESTODAY.COM

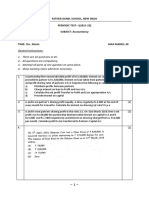

Question 7:

A and B are partners in a firm sharing profits and losses in the ratio of 2 : 1. They decide to take C into

partnership for 1/4th share on 1st April, 2018. For this purpose, goodwill is to be valued at four times the

average annual profit of the previous four or five years whichever is higher. The agreed profits for goodwill

purpose of the past five years are:

Year 2013–14 2014–15 2015–16 2016–17 2017–18

Profit (Rs) 14,000 15,500 10,000 16,000 15,000

Answer 7:

Option 1 :

Goodwill under Average Profit Method = Average profit per year × Years Purchase

= × Years Purchase

= 56,400

Or

Option 2 :

Goodwill under Average Profit Method = Average profit per year × Years Purchase

= × Years Purchase

= 56,500

Goodwill of the firm will be the higher value of the above two options i.e, 56,400 or 56,500. So the

goodwill of the firm will be 56,500

PAGE NO 2.21:

Question 8:

Sumit purchased Amit's business on 1st April, 2018. Goodwill was decided to be valued at two years'

purchase of average normal profit of last four years. The profits for the past four years were:

Year Ended 31st March, 2015 31st March, 2016 31st March, 2017 31st March, 2018

Profit (Rs) 80,000 1,45,,000 1,60,000 2,00,000

Books of Account revealed that:

(i) Abnormal loss of Rs 20,000 was debited to Profit and Loss Account for the year ended 31st March,

2015.

(ii) A fixed asset was sold in the year ended 31st March, 2016 and gain (profit) of Rs 25,000 was credited

to Profit and Loss Account.

(iii) In the year ended 31st March, 2017 assets of the firm were not insured due to oversight. Insurance

5

premium not paid was Rs 15,000.

Page

Calculate the value of goodwill.

Copyright © https://www.studiestoday.com All rights reserved. No part of this publication may be

reproduced, distributed, or transmitted in any form or by any means, including photocopying,

recording, or other electronic or mechanical methods, without the prior written permission.

Downloaded from https:// www.studiestoday.com

Downloaded from https:// www.studiestoday.com

Answer 8:

Goodwill under Average Profit Method = Average Normal Profit per year × Years Purchase

= × Years Purchase

= ×2

= × 2 Years = 2,82,500

POINT OF KNOWLEDGE:-

Normal Profit for year 2015

Actual profit + Abnormal loss - Abnormal profit

80,000 + 20,000 - -

Normal Profit = 1,00,000

Normal Profit for year 2016

Actual loss + Abnormal loss - Abnormal profit

1,45,000 + - - 25,000

Normal Profit = 1,20,000

Normal Profit for year 2017

Actual profit + Abnormal loss - Abnormal profit

1,60,000 + - - 15,000

Normal Profit = 1,45,000

Normal Profit for year 2017

Actual profit + Abnormal loss - Abnormal profit

2,00,000 + - - -

Normal Profit = 2,00,000

PAGE NO 2.22:

Question 9:

X and Y are partners in a firm. They admit Z into partnership for equal share. It was agreed that goodwill

6

will be valued at three years' purchase of average profit of last five years. Profits for the last five years

Page

were:

Year Ended 31st March, 2014 31st March, 2015 31st March, 2016 31st March, 31st March, 2018

Copyright © https://www.studiestoday.com All rights reserved. No part of this publication may be

reproduced, distributed, or transmitted in any form or by any means, including photocopying,

recording, or other electronic or mechanical methods, without the prior written permission.

Downloaded from https:// www.studiestoday.com

Downloaded from https:// www.studiestoday.com

2017

Profit (Rs) 90,000 (Loss) 1,60,000 1,50,000 65,000 1,77,000

Books of Account of the firm revealed that:

(i) The firm had gain (profit) of Rs 50,000 from sale of machinery sold in the year ended 31st March, 2015.

The gain (profit) was credited in Profit and Loss Account.

(ii) There was an abnormal loss of Rs 20,000 incurred in the year ended 31st March, 2016 because of a

machine becoming obsolete in accident.

(iii) Overhauling cost of second hand machinery purchased on 1st July, 2016 amounting to Rs 1,00,000

was debited to Repairs Account. Depreciation is charged @ 20% p.a. on Written Down Value Method.

Calculate the value of goodwill.

Answer 9:

Goodwill under Average Profit Method = Average Normal Profit per year × Years Purchase

= × Years Purchase

= × 3 Years

={ } × 3 Years

= 3,00,000

PAGE NO 2.22:

Question 10:

Profits of a firm for the year ended 31st March for the last five years were:

31st March,

Year ended 31st March, 2014 31st March, 2015 31st March, 2016 31st March, 2018

2017

Profit (Rs) 20,000 24,000 30,000 25,000 18,000

Calculate value of goodwill on the basis of three years' purchase of Weighted Average Profit after assigning

weights 1, 2, 3, 4 and 5 respectively to the profits for years ended 31st March, 2014, 2015, 2016, 2017 and

2018.

Answer 10:

Goodwill under Weighted Average Profit Method

= Weighted Average Profit per Year × Years Purchase

= × Years Purchase

={ } × 3 Years Purchase

={ }×3

= 69,600

7

Page

PAGE NO 2.22:

Copyright © https://www.studiestoday.com All rights reserved. No part of this publication may be

reproduced, distributed, or transmitted in any form or by any means, including photocopying,

recording, or other electronic or mechanical methods, without the prior written permission.

Downloaded from https:// www.studiestoday.com

Downloaded from https:// www.studiestoday.com

Question 11:

A and B are partners sharing profits and losses in the ratio of 5 : 3. On 1st April, 2018, C is admitted to the

partnership for 1/4th share of profits. For this purpose, goodwill is to be valued at two years' purchase of

last three years' profits (after allowing partners' remuneration). Profits to be weighted 1 : 2 : 3, the greatest

weight being given to last year. Net profit before partners' remuneration were: 2015–16: Rs 2,00,000;

2016–17: Rs 2,30,000; 2017 015018: Rs 2,50,000. The remuneration of the partners is estimated to be Rs

90,000 p.a. Calculate amount of goodwill.

Answer 11:

Goodwill under weighted Average Profit Method

= Weighted Average profit per year × Years Purchase

= × Years Purchase

={ } × 2 Years

= 2,90,000

PAGE NO 2.22:

Question 12:

Manbir and Nimrat are partners and they admit Anahat into partnership. It was agreed to value goodwill at

three tears' purchase on Weighted Average Profit Method taking profits of last five years. Weights assigned

to each year as 1, 2, 3, 4 and 5 respectively to profit for the year ended 31st March, 2014 to 2108. The

profit for these years were: Rs 70,000, Rs 1,40,000, Rs 1,00,000, Rs 1,60,000 and Rs 1,65,000

respectively.

Scrutiny of books of account revealed following information:

(i) There was an abnormal loss of Rs 20,000 in the year ended 31st March, 2014.

(ii) There was an abnormal gain (profit) of Rs 30,000 in the year ended 31st March, 2015.

(iii) Closing Stock as on 31st March, 2017 was overvalued by Rs 10,000.

Calculate the value of goodwill.

Answer 12:

Goodwill under weighted Average profit method

= Weighted Average profit per year × Years Purchase

= × Years Purchase

= } × 3 Years

={ } × 3 Years

={ } × 3 Years

=( ) × 3 Years

= 4,17,000

8

Page

PAGE NO 2.22:

Copyright © https://www.studiestoday.com All rights reserved. No part of this publication may be

reproduced, distributed, or transmitted in any form or by any means, including photocopying,

recording, or other electronic or mechanical methods, without the prior written permission.

Downloaded from https:// www.studiestoday.com

Downloaded from https:// www.studiestoday.com

Question 13:

Calculate the goodwill of a firm on the basis of three years' purchase of the weighted average profit of the

last four years. The appropriate weights to be used and profits are:

Year 2014-15 2015-16 2016-17 2017-18

Profit (Rs) 1,01,000 1,24,000 1,00,000 1,40,000

Weight 1 2 3 4

On a scrutiny of the accounts, the following matters are revealed:

(i) On 1st December, 2016, a major repair was made in respect of the plant incurring Rs 30,000 which was

charged to revenue. The said sum is agreed to be capitalised for goodwill calculation subject to adjustment

of depreciation of 10% p.a. on reducing balance method.

(ii) The closing stock for the year 2015-16 was overvalued by Rs 12,000.

(iii) To cover management cost, an annual charge of Rs 24,000 should be made for the purpose of goodwill

valuation.

(iv) In 2015-16, a machine having a book value of Rs 10,000 was sold for Rs 11,000 but the proceeds were

wrongly credited to Profit and Loss Account. No effect has been given to rectify the same. Depreciation is

charged on machine @ 10% p.a. on reducing balance method.

Answer 13:

Goodwill under weighted Average Profit Method

= weighted Average profit per year × Years Purchase

= × Years Purchase

={ × 3 Years Purchase

={ } × 3 Years Purchase

={ } × 3 Years

= 3,12,702

Points of Knowledge :

Statements showing adjustment :

Note 1: Book value of machine includes 1,000 depreciation . So profit on sale of machine 1,000 which was

wrongly credited as 11,000, should be rectified by debiting 10,000 to the profits of the second year.

Years Profit Repairs Dep. Stock Expenses Wrong Cr. Dep. Adj. Profit

First Year 1,01,000 -24,000 77,000

Second Year 1,24,000 -12,000 -24,000 -10,000 78,000

Third Year 1,00,000 +30,000 -1,000 +12,000 -24,000 +900 1,17,900

Fourth Year 1,40,000 -2,900 -24,000 +810 1,13,910

PAGE NO 2.23:

9 Page

Question 14:

Copyright © https://www.studiestoday.com All rights reserved. No part of this publication may be

reproduced, distributed, or transmitted in any form or by any means, including photocopying,

recording, or other electronic or mechanical methods, without the prior written permission.

Downloaded from https:// www.studiestoday.com

Downloaded from https:// www.studiestoday.com

Gupta and Bose had a firm in which they had invested Rs 50,000. On an average, the profits were Rs

16,000. The normal rate of return in the industry is 15%. Goodwill is to be valued at four years' purchase of

profits in excess of profits @ 15% on the money invested. Value th goodwill.

Answer 14:

Goodwill under Super Profit Method = Super Profit × Years Purchase

=(Actual or Average Profit – Normal Profit) × Years Purchase

=(16,000 – 50,000 × 15%) × 4 Years

=(16,000 – 7,500) × 4 Years

=8,500 × 4 Years

=42,000

PAGE NO 2.23:

Question 15:

The total capital of the firm of Sakshi, Mehak and Megha is Rs 1,00,000 and the market rate of interest is

15%. The net profits for the last 3 years were Rs 30,000; Rs 36,000 and Rs 42,000. Goodwill is to be

valued at 2 years' purchase of the last 3 years' super profits. Calculate the goodwill of the firm.

Answer 15:

Goodwill under Super Profit Method = Super Profit × Years Purchase

=(Average Profit – Normal Profit) × Years Purchase

=(36,000 – 1,00,000 × 15%) × 2 Years

=(36,000 – 15,000) × 2 Years

=21,000 × 2 Years

=42,000

Points of Knowledge :

Average Profit per Year =

={

= 36,000

PAGE NO 2.23:

Question 16:

10

The average net profit expected in future by XYZ firm is Rs 36,000 per year. Average capital employed in

the business by the firm is Rs 2,00,000. The normal rate of return from capital invested in this class of

Page

business in 10%. Remuneration of the partners is estimated to be Rs 6,000 p.a. Find out the value of

goodwill on the basis of two years' purchase of super profit.

Copyright © https://www.studiestoday.com All rights reserved. No part of this publication may be

reproduced, distributed, or transmitted in any form or by any means, including photocopying,

recording, or other electronic or mechanical methods, without the prior written permission.

Downloaded from https:// www.studiestoday.com

Downloaded from https:// www.studiestoday.com

Answer 16:

Goodwill under Super Profit Method = Super Profit × Years Purchase

=(Actual Profit – Remuneration of Partners – Normal Profit) × Years Purchase

=(36,000 – 6,000 – 2,00,000 ×10%) × 2 Years Purchase

=(36,000 – 6,000 – 20,000) × 2 Years Purchase

=10,000 × 2 Years

=20,000

PAGE NO 2.23:

Question 17:

A partnership firm earned net profits during the last three years ended 31st March, as follows: 2016–Rs

17,000; 2017–Rs 20,000; 2018–Rs 23,000.

The capital investment in the firm throughout the above-mentioned period has been Rs 80,000. Having

regard to the risk involved, 15% is considered to be a fair return on the capital. Calculate value of goodwill

on the basis of two years' purchase of average super profit earned during the above-mentioned three

years.

Answer 17:

Goodwill under Super Profit Method = Super Profit × Years Purchase

=(Average Profit – Normal Profit) × Years Purchase

=(20,000 – 80,000 × 15%) × 2 Years

=(20,000 – 12,000) × 2 Years

=8,000 × 2 Years

=16,000

Points of Knowledge :

Average Profit per Year =

={

= 20,000

PAGE NO 2.23:

Question 18:

A partnership firm earned net profits during the past three years as follows:

11

Year ended 31st March, 2018 31st March, 2017 31st March, 2016

Net Profit (Rs) 2,30,000 2,00,000 1,70,000

Page

Capital investment in the firm throughout the above-mentioned period has been Rs 4,00,000. Having

regard to the risk involved,15% in considered to be a fair return on the capital. The remuneration of the

Copyright © https://www.studiestoday.com All rights reserved. No part of this publication may be

reproduced, distributed, or transmitted in any form or by any means, including photocopying,

recording, or other electronic or mechanical methods, without the prior written permission.

Downloaded from https:// www.studiestoday.com

Downloaded from https:// www.studiestoday.com

partners during this period is estimated to be Rs 1,00,000 p.a.

Calculate value of goodwill on the basis of two years' purchase of average super profit earned during the

above-mentioned three years.

Answer 18:

Goodwill under Super Profit Method = Super Profit × Years Purchase

=(Average Profit – Partner’s Commission – Normal Profit) × Years Purchase

=(2,00,000 – 1,00,000 – 4,00,000 × 15%) × 2 Years

=(2,00,000 – 1,00,000 – 60,000) × 2 Years

=40,000 × 2 Years

= 80,000

Points of Knowledge :

Average Profit per Year =

={ }

= 2,00,000

PAGE NO 2.23:

Question 19:

A business earned an average profit of Rs 8,00,000 during the last few years. The normal rate of profit in

the similar type of business is 10%. The total value of assets and liabilities of the business were Rs

22,00,000 and Rs 5,60,000 respectively. Calculate the value of goodwill of the firm by super profit method if

it is valued at 212/212 years' purchase of super profits.

Answer 19:

Goodwill under Super Profit Method = Super Profit × Year’s Purchase

=(Average Profit – Normal Profits) × Year’s Purchase

=(Average Profit – (Assets – Liabilities) ×10%) × Years Purchase

=(8,00,000 – (22,00,000 – 5,60,000) × 10%) × 2.5 Years Purchase

=(8,00,000 – 16,40,000 × 10%) × 2.5 Years Purchase

=(8,00,000 – 1,64,000) × 2.5 Years Purchase=6,36,000 × 2.5 Years

=15,90,000

PAGE NO 2.23:

12

Question 20:

Page

Capital of the firm of Sharma and Verma is Rs 2,00,000 and the market rate of interest is 15%. Annual

salary to partners is Rs 12,000 each. The profits for the last three years were Rs 60,000; Rs 72,000 and Rs

Copyright © https://www.studiestoday.com All rights reserved. No part of this publication may be

reproduced, distributed, or transmitted in any form or by any means, including photocopying,

recording, or other electronic or mechanical methods, without the prior written permission.

Downloaded from https:// www.studiestoday.com

Downloaded from https:// www.studiestoday.com

84,000. Goodwill is to be valued at 2 years' purchase of last 3 years' average super profit.

Calculate goodwill of the firm.

Answer 20:

Goodwill under Super Profit Method = Super Profit × Year’s Purchase

= (Average Profit – Normal Profit) × Year’s Purchase

= (Average Profit – Capital Employed) × % of Normal Rate of Return)×Years Purchase

= (48,000 – 2,00,000 × 15%)×2 years Purchase

= (48,000 – 30,000) × 2 Years

= 18,000 × 2 Years

= 36,000

Points of Knowledge :

Average Profit per year =

={ }

= 48,000

PAGE NO 2.24:

Question 21:

A and B are equal partners. They decide to admit C for 1/3rd share. For the purpose of admission of C,

goodwill of the firm is to be valued at four years' purchase of super profit. Average capital employed in the

firm is Rs 1,50,000. Normal rate of return may be taken as 15% p.a. Average profit of the firm is Rs 40,000.

Calculate value of goodwill.

Answer 21:

Goodwill under Super Profit Method = Super Profit × Years Purchase

=(Average Maintainable Profit – Normal Profit) × Years Purchase

=(40,000 – 1,50,000 × 15%) × 4 years Purchase

=(40,000 – 22,500) × 4 years

= 17,500 × 4 years

= 70,000

13

PAGE NO 2.24:

Page

Copyright © https://www.studiestoday.com All rights reserved. No part of this publication may be

reproduced, distributed, or transmitted in any form or by any means, including photocopying,

recording, or other electronic or mechanical methods, without the prior written permission.

Downloaded from https:// www.studiestoday.com

Downloaded from https:// www.studiestoday.com

Question 22:

On 1st April, 2018, an existing firm had assets of Rs 75,000 including cash of Rs 5,000. Its creditors

amounted to Rs 5,000 on that date. The firm had a Reserve of Rs 10,000 while Partners' Capital Accounts

showed a balance of Rs 60,000. If Normal Rate of Return is 20% and goodwill of the firm is valued at Rs

24,000 at four years' purchase of super profit, find average profit per year of the existing firm.

Answer 22:

Goodwill Under Super Profit Method

or Goodwill = Super Profit × Year’s Purchase

or Goodwill = (Average Profit – Normal Profit)×Years Purchase

or 24,000 = (Average Profit – 14,000) × 4 Years Purchase

or ( ) = Average Profit – 14,000

or 6,000 = Average Profit – 14,000

or Average Profit = 14,000 + 6,000

or Average Profit = 20,000

Points of Knowledge :

Capital Employed = Assets – Creditors = 75,000 – 5,000 = 70,000

= Capital + Reserve Fund = 60,000 + 10,000 = 70,000

Normal Rate of Return = 20%

Normal Profit = 70,000 × 20% = 14,000

PAGE NO 2.24:

Question 23

The average profit earned by a firm is Rs 1,00,000 which includes undervaluation of stock of Rs 40,000 on

an average basis. The capital invested in the business is Rs 6,30,000 and the normal tare of return is 5%.

Calculate goodwill of the firm on the basis of 5 time the super profit.

Answer 23:

Goodwill under Super Profit Method = Super Profit × Years Purchase

= Super Profit × Times Purchase

14

= (Average Profit + Under Valuation of Stock – Normal Profit)×Times Purchase

Page

Copyright © https://www.studiestoday.com All rights reserved. No part of this publication may be

reproduced, distributed, or transmitted in any form or by any means, including photocopying,

recording, or other electronic or mechanical methods, without the prior written permission.

Downloaded from https:// www.studiestoday.com

Downloaded from https:// www.studiestoday.com

=(1,00,000 + 40,000 – 6,30,000 × 5%) × 5 Times Purchase

=(1,00,000 + 40,000 – 31,500 ) × 5 Times Purchase

=1,08,500 × 5 Times Purchase

=5,42,500

PAGE NO 2.24:

Question 24:

The average profit earned by a firm is Rs 7,50,000 which includes overvaluation of stock of Rs 30,000 on

an average basis. The capital invested in the business is Rs 4,20,000 and the normal tare of return is 15%.

Calculate goodwill of the firm on the basis of 3 time the super profit.

Answer 24:

Goodwill under Super Profit Method = Super Profit × Years Purchase

= Super Profit × Times Purchase

= (Average Profit – Over Valuation of Stock – Normal Profit)×Times Purchase

=(7,50,000 – 30,000 – 42,00,000 × 15%) × 5 Times Purchase

=(7,50,000 – 30,000 – 6,30,000) × 5 Times Purchase

=90,000 × 3 Times Purchase

=2,70,000

PAGE NO 2.24:

Question 25:

Ayub and Amit are partners in a firm and they admit Jaspal into partnership w. e. f. 1st April, 2018. They

agreed to value goodwill at 3 years' purchase of Super Profit Method for which they decided to average

profit of last 5 years. The profit for the last 5 years were:

Year Ended Net Profit (Rs)

31st March, 2014 1,50,000

31st March, 2015 1,80,000

31st March, 2016 1,00,000 ( Including abnormal loss of Rs 1,00,000)

31st March, 2017 2,60,000 (Including abnormal gain (profit) of Rs 40,000)

31st March, 2018 2,40,000

The firm has total assets of Rs 20,00,000 and Outside Liabilities of Rs 5,00,000 as on that date. Normal

Rate of Return in similar business is 10%.

Calculate value of goodwill.

Answer 25:

15

Page

Copyright © https://www.studiestoday.com All rights reserved. No part of this publication may be

reproduced, distributed, or transmitted in any form or by any means, including photocopying,

recording, or other electronic or mechanical methods, without the prior written permission.

Downloaded from https:// www.studiestoday.com

Downloaded from https:// www.studiestoday.com

Value of Goodwill under super Profit Method

= Super Profit × Years Purchase

= 48,000 × 3 Years

= 1,44,000

Points of Knowledge :

Actual or Average Profit

={ }

= 1,98,000

Actual Capital = Assets – Liabilities

= 20,000,00 – 5,00,000

= 15,00,000

Normal Profit = Actual Capital × Rate of Return

= 15,00,000 × 10/100

= 1,50,000

Super Profit = Average Profit – Normal Profit

= (1,98,000 – 1,50,000)

= 48,000

PAGE NO 2.24:

Question 26:

From the following information, calculate value of goodwill of the firm by applying Capitalisation Method:

Total Capital of the firm Rs 16,00,000.

Normal rate of return 10%. Profit for the year Rs 2,00,000.

Answer 26:

16

Page

Copyright © https://www.studiestoday.com All rights reserved. No part of this publication may be

reproduced, distributed, or transmitted in any form or by any means, including photocopying,

recording, or other electronic or mechanical methods, without the prior written permission.

Downloaded from https:// www.studiestoday.com

Downloaded from https:// www.studiestoday.com

Goodwill under Capitalisation Method

= Expected Capital – Actual Capital

= Profit for the year × Reverse of Reasonable Rate of Return – Actual Capital

= 2,00,000 × 100/10 – 16,00,000

= 20,00,000 – 16,00,000

= 4,00,000

PAGE NO 2.24:

Question 27:

A business has earned average profit of Rs 1,00,000 during the last few years. Find out the value of

goodwill by capitalisation method, given that the assets of the business are Rs 10,00,000 and its external

liabilities are Rs 1,80,000. The normal rate of return is 10%.

Answer 27:

Actual or Average Profit Rs. 1,00,000

Capitalised value of Average Profit

= 1,00,000 × 100/10

0r Expected Capital = 10,00,000

Actual Capital = Assets – Liabilities

= 10,00,000 – 1,80,000

= 8,20,000

Value of Goodwill under Capitalisation of Average Profit Method

= Capitalised Value of Average Profit – Actual Capital

= 10,00,000 – 8,20,000

= 1,80,000

PAGE NO 2.24:

Question 28:

17

Form the following particulars, calculate value of goodwill of a firm by applying Capitalisation of Average

Profit Method:

Page

(i) Profits of last five consecutive years ending 31st March are: 2018–Rs 54,000; 2017–Rs42,000; 2016–Rs

Copyright © https://www.studiestoday.com All rights reserved. No part of this publication may be

reproduced, distributed, or transmitted in any form or by any means, including photocopying,

recording, or other electronic or mechanical methods, without the prior written permission.

Downloaded from https:// www.studiestoday.com

Downloaded from https:// www.studiestoday.com

39,000; 2015–Rs 67,000 and 2014–Rs 59,000

(ii) Capitalisation rate 20%.

(iii) Net assets of the firm Rs 2,00,000.

Answer 28:

Value of Goodwill by applying Capitalisation of average profit Method

= Capitalisation of Average Profit or Expected Capital – Actual Capital

= 2,61,000 – 2,00,000

= 61,000

Points of Knowledge :

Average profit per year =

={ }

= 52,200

= Capitalisation of Average Profit or Expected Capital

= 52,200 × 100/20

= 2,61,000

Net Assets = Actual Capital = 2,00,000

PAGE NO 2.25:

Question 29:

A business has earned average profit of Rs 4,00,000 during the last few years and the normal rate of return

in similar business is 10%. Find value of goodwill by:

(i) Capitalisation of Super Profit Method, and

(ii) Super Profit Method if the goodwill is valued at 3 years' purchase of super profits.

Assets of the business were Rs 40,00,000 and its external liabilities Rs 7,20,000.

Answer 29:

18

Page

Copyright © https://www.studiestoday.com All rights reserved. No part of this publication may be

reproduced, distributed, or transmitted in any form or by any means, including photocopying,

recording, or other electronic or mechanical methods, without the prior written permission.

Downloaded from https:// www.studiestoday.com

Downloaded from https:// www.studiestoday.com

Actual or Average Profit Rs. 4,00,000

Capitalised Value of Average Profit = 4,00,000 ×

Or Expected capital = 40,00,000

Actual Capital = Assets – Liabilities

= 40,00,000 – 7,20,000

= 32,80,000

Value of Goodwill under Capitalisation of Average Profit

Method

= Capitalised value of Average Profit – Actual Capital

= 40,00,000 – 32,80,000 × 10/100

= 7,20,000

Super Profit = Average Profit – Normal Profit

= 4,00,000 – 32,80,000 × 10/100

= 4,00,000 – 3,28,000

= 72,000

(1) Value of Goodwill under Capitalisation of Super Profit Method

= Super Profit × Reverse Rate of Return

= 72,000 × 100/10

= 7,20,000

(2) Value of Goodwill Under Super Profit Method

= Super Profit × Years Purchase

= 72,000 × 3 Years Purchase

= 2,16,00

PAGE NO 2.25:

Question 30:

A firm earns profit of Rs 5,00,000. Normal Rate of Return in a similar type of business is 10%. The value of

total assets (excluding goodwill) and total outsiders' liabilities as on the date of goodwill are Rs 55,00,000

and Rs 14,00,000 respectively. Calculate value of goodwill according to Capitalisation of Super Profit

Method as well as Capitalisation of Average Profit Method.

19

Answer 30:

Page

Copyright © https://www.studiestoday.com All rights reserved. No part of this publication may be

reproduced, distributed, or transmitted in any form or by any means, including photocopying,

recording, or other electronic or mechanical methods, without the prior written permission.

Downloaded from https:// www.studiestoday.com

Downloaded from https:// www.studiestoday.com

Total Assets = Assets Excluding Stock + Stock

1,00,000 + 20,000 = 1,20,000

Capital = Assets – Current Liabilities

1,20,000 – 10,000

1,10,000

Goodwill Under Super Profit Method = Super Profit × Year’s Purchase

Goodwill Under Super Profit Method = (Average Profit – Normal Profit)

60,000 = (Average Profit – 1,10,000 × 8/100) × 4 Years

60,000 = (Average Profit – 8,800) × 4 Years

60,000 + 4 + 8,800 = Average Profit

Average or Actual Profit = 23,800

PAGE NO 2.25:

Question 31:

Average profit of the firm is Rs 2,00,000. Total assets of the firm are Rs 15,00,000 whereas Partners'

Capital is Rs 12,00,000. If normal rate of return in a similar business is 10% of the capital employed, what

is the value of goodwill by Capitalisation of Super Profit?

Answer 31:

Goodwill by Capitalisation of Super Profit Method = Super Profit × Reverse Rate of Return

( Average Profit – Normal Profit ) × Reverse of Rate of Return

( Average Profit – Capital Employed × Normal Rate of Return) × Reverse of Rate of Return

( 2,00,000 – 12,00,000 × )×

( 2,00,000 – 1,20,000 ) ×

80,000 ×

8,00,000

20

PAGE NO 2.25:

Page

Question 32:

Copyright © https://www.studiestoday.com All rights reserved. No part of this publication may be

reproduced, distributed, or transmitted in any form or by any means, including photocopying,

recording, or other electronic or mechanical methods, without the prior written permission.

Downloaded from https:// www.studiestoday.com

Downloaded from https:// www.studiestoday.com

Rajan and Rajani are partners in a firm. Their capitals were Rajan Rs 3,00,000; Rajani Rs 2,00,000. During

the year 2017-18, the firm earned a profit of Rs 1,50,000. Calculate the value of goodwill of the firm by

capitalisation of super profit assuming that the normal rate of return is 20%.

Answer 32:

Goodwill by Capitalisation of Super Profit Method = Super Profit × Reverse Rate of Return

( Actual Profit – Normal Profit ) × Reverse of Rate of Return

( Actual Profit – Capital Employed × Normal Rate of Return) × Reverse of Rate of Return

( 1,50,000 – 5,00,000 × ) × Reverse of Rate of Return

( 1,50,000 – 1,00,000 ) ×

50,000 ×

2,50,000

PAGE NO 2.25:

Question 33:

Average profit of GS & Co. is Rs 50,000 per year. Average capital employed in the business is Rs

3,00,000. If the normal rate of return of capital employed is 10%, calculate goodwill of the firm by:

(i) Super Profit Method at three years' purchase; and

(ii) Capitalisation of Super Profit Method.

Answer 33:

(1) Goodwill by Super Profit Method at three year’s Purchase

( Average Profit – Normal Profit ) × Years Purchase

( Average Profit – Capital Employed × Normal Rate of Return) × Year’s Purchase

( 50,000 – 3,00,000 × ) × Year’s Purchase

( 50,000 – 30,000 ) × 3 years Purchase

20,000 × 3 Years

60,000

(2) Goodwill by capitalisation of Super Profit Method

21

Page

Copyright © https://www.studiestoday.com All rights reserved. No part of this publication may be

reproduced, distributed, or transmitted in any form or by any means, including photocopying,

recording, or other electronic or mechanical methods, without the prior written permission.

Downloaded from https:// www.studiestoday.com

Downloaded from https:// www.studiestoday.com

( Average Profit – Normal Profit ) × Reverse of Rate of Return

( Average Profit – Capital Employed × Normal Rate of Return) × Reverse of Rate of Return

( 50,000 – 3,00,000 × ) × Reverse of Rate of Return

( 50,000 – 30,000 ) ×

2,00,000

PAGE NO 2.25:

Question 34:

From the following information, calculate value of goodwill of the firm:

(i) At three years' purchase of Average Profit.

(ii) At three years' purchase of Super Profit.

(iii) On the basis of Capitalisation of Super Profit.

(iv) On the basis of Capitalisation of Average profit.

Information:

(a) Average Capital Employed is Rs 6,00,000.

(b) Net Profit/(Loss) of the firm for the last three years ended are:

31st March, 2108–Rs 2,00,000, 31st March, 2107–Rs 1,80,000, and 31st March, 2106–Rs 1,60,000.

(c) Normal Rate of Return in similar business is 10%.

(d) Remuneration of Rs 1,00,000 to partners is to be taken as charge against profit.

(e) Assets of the firm (excluding goodwill, fictitious assets and not-trade investments) is Rs 7,00,000

whereas Partners' Capital is Rs 6,00,000 and Outside Liabilities Rs 1,00,000.

Answer 34:

(1) Goodwill at three years purchase of Average profits = Average profit pe × Years Purchase

= × Years Purchase

= ×3 years

= 80,000 × 3years

= 2,40,000

(2) Goodwill by super profit method at three years purchase = Super Profit × Years Purchase

22

Page

Copyright © https://www.studiestoday.com All rights reserved. No part of this publication may be

reproduced, distributed, or transmitted in any form or by any means, including photocopying,

recording, or other electronic or mechanical methods, without the prior written permission.

Downloaded from https:// www.studiestoday.com

Downloaded from https:// www.studiestoday.com

(Average Profit – Normal Profit) × Years Purchase

(Average Profit – Capital Employed × Normal Rate of return) × Years Purchase

- 6,00,000 ×

= (80,000 – 60,000) × 3years purchase

= 20,000 × 3Years

= 60,000

(3) Goodwill by capitalisation super profit method = Super Profit × reverse rate of return

(Average Profit – Normal Profit) × Reverse rate of return

(Average Profit – Capital Employed × Normal Rate of return) × reverse of rate of return

- 6,00,000 ×

= (80,000 – 60,000) ×

= 20,000 ×

= 2,00,000

(4) Goodwill by capitalisation of average profit method = Average Profit × reverse rate of return

= 80,000 ×

= 8,00,000

Points to Remember in this chapter:-

There are three methods are followed for valuing goodwill:-

1.) Average Profit Method

2.) Super Profit Method

3.) Capitalisation Method

23

Methods of Valuation of Goodwill:-

I.) Average Profit Method:-

Page

1.) Simple Average Profit Method:- Average Profit × Number of Year’s Purchase

Copyright © https://www.studiestoday.com All rights reserved. No part of this publication may be

reproduced, distributed, or transmitted in any form or by any means, including photocopying,

recording, or other electronic or mechanical methods, without the prior written permission.

Downloaded from https:// www.studiestoday.com

Downloaded from https:// www.studiestoday.com

2.) Weighted Average Profit Method:- Weighted Average Profit × Number of Year’s Purchase

II.) Super Profit Method:- Super Profit × Number of year’s Purchase

III.) Capitalisation Method:-

1.) Capitalisation of Average Normal Profit:- Capitalised Value – Net Assets

2.) Capitalisation of Super Profit:- Super Profit × 100

24

Page

Copyright © https://www.studiestoday.com All rights reserved. No part of this publication may be

reproduced, distributed, or transmitted in any form or by any means, including photocopying,

recording, or other electronic or mechanical methods, without the prior written permission.

Downloaded from https:// www.studiestoday.com

You might also like

- New Holland India Team Case Study - Vinod Gandhi - International Management InstituteDocument11 pagesNew Holland India Team Case Study - Vinod Gandhi - International Management InstituteVinod Gandhi89% (9)

- Direct Tax Law and Practice BookDocument694 pagesDirect Tax Law and Practice BookPrem MahalaNo ratings yet

- Test Bank For Government and Not For Profit Accounting Concepts and Practices 5th Edition GranofDocument15 pagesTest Bank For Government and Not For Profit Accounting Concepts and Practices 5th Edition Granofsamuel debebe100% (1)

- Anandam Manufacturing CompanyDocument9 pagesAnandam Manufacturing CompanyAijaz AslamNo ratings yet

- HR and Talent Management Toolkit - Overview and ApproachDocument44 pagesHR and Talent Management Toolkit - Overview and ApproachMaria AngelNo ratings yet

- Analysis of Porter Five ForceDocument6 pagesAnalysis of Porter Five ForceAbul Kashem Mohammad Mohiuddin100% (1)

- AP 300Q Quizzer On Audit of Liabilities ResaDocument13 pagesAP 300Q Quizzer On Audit of Liabilities Resaryan rosalesNo ratings yet

- Valuation of GoodwillDocument16 pagesValuation of GoodwillRavi ganganiNo ratings yet

- Goodwill PDFDocument5 pagesGoodwill PDFBHUMIKA JAINNo ratings yet

- Valuation of GoodwillDocument4 pagesValuation of GoodwillPANKAJ's ACCOUNTANCY PATHSHALANo ratings yet

- Accountancy GoodwillDocument5 pagesAccountancy GoodwillPrachi SanklechaNo ratings yet

- Change in Profit Sharing Ratio Among The Existing PartnersDocument15 pagesChange in Profit Sharing Ratio Among The Existing Partnersvajoj90546No ratings yet

- Assignments +2 2022 2023 A1 CHAPTR 3Document3 pagesAssignments +2 2022 2023 A1 CHAPTR 3Lester WilliamsNo ratings yet

- Valuatio of Goodwill WS-1Document2 pagesValuatio of Goodwill WS-1Srishti SinghNo ratings yet

- Good Will Tuition QuestionsDocument3 pagesGood Will Tuition QuestionsKunika DubeyNo ratings yet

- Exemplar Questions: TH THDocument9 pagesExemplar Questions: TH THAman KakkarNo ratings yet

- Goodwill: ICM 12 Standard Gautam BeryDocument9 pagesGoodwill: ICM 12 Standard Gautam BeryGautam KhanwaniNo ratings yet

- Valuation of GoodwillDocument5 pagesValuation of GoodwillChaaru VarshiniNo ratings yet

- Bcom 3 Sem Corporate Accounting 1 19102078 Oct 2019Document5 pagesBcom 3 Sem Corporate Accounting 1 19102078 Oct 2019xyxx1221No ratings yet

- Valuation of Goodwill Class NotesDocument4 pagesValuation of Goodwill Class NotesRajesh NangaliaNo ratings yet

- Xii Acc WS 3Document4 pagesXii Acc WS 3Gaytri ThaparNo ratings yet

- Goodwill QuestionsDocument7 pagesGoodwill QuestionsTanisha JainNo ratings yet

- Valuation of GoodwillDocument6 pagesValuation of GoodwillPrasad NaikNo ratings yet

- Intermediate Accounting 3-Activity 2: Perdizo, Miljane P. Bsa IiiDocument3 pagesIntermediate Accounting 3-Activity 2: Perdizo, Miljane P. Bsa Iiimiljane perdizoNo ratings yet

- Ts Grewal Solutions Class 12 Accountancy Vol 1 Chapter 3 GoodwillDocument28 pagesTs Grewal Solutions Class 12 Accountancy Vol 1 Chapter 3 GoodwillAbi AbiNo ratings yet

- Ts Grewal Solutions Class 12 Accountancy Vol 1 Chapter 3 GoodwillDocument28 pagesTs Grewal Solutions Class 12 Accountancy Vol 1 Chapter 3 GoodwillblessycaNo ratings yet

- Additional Questions 3Document4 pagesAdditional Questions 3Shyam SoniNo ratings yet

- Ch2 AssignmentDocument2 pagesCh2 AssignmentRachit JainNo ratings yet

- bcom-CORPORATE ACCOUNTING I - JAN 23Document5 pagesbcom-CORPORATE ACCOUNTING I - JAN 23xyxx1221No ratings yet

- 01 Sample PaperDocument24 pages01 Sample Papergaming loverNo ratings yet

- Goodwill 1Document3 pagesGoodwill 1D. Naarayan NandanNo ratings yet

- Receivables ExercisesDocument5 pagesReceivables ExercisesChrystelle Gail LiNo ratings yet

- Partnership (Basic Concepts)Document33 pagesPartnership (Basic Concepts)MERRY DONNo ratings yet

- Change in Psr-12th Commerce-AccountancyDocument5 pagesChange in Psr-12th Commerce-Accountancysinghharshu3222No ratings yet

- Goodwill 01Document4 pagesGoodwill 01Chanderprakash GuptaNo ratings yet

- Aud Quiz 2Document6 pagesAud Quiz 2MC allivNo ratings yet

- GoodwillDocument19 pagesGoodwillmenekyakiaNo ratings yet

- Class Test Fundamentals and Goodwill Set A 01.05.2023 1Document2 pagesClass Test Fundamentals and Goodwill Set A 01.05.2023 1ANTECNo ratings yet

- T1 GoodwillDocument1 pageT1 GoodwillSanchita KhattarNo ratings yet

- Father Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40Document4 pagesFather Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40fffffNo ratings yet

- REVISION 2022 Part A - CH. 3Document2 pagesREVISION 2022 Part A - CH. 3ADAM ABDUL RAZACKNo ratings yet

- Chapter 8Document7 pagesChapter 8jeanNo ratings yet

- 06 Correction of Errors PDFDocument5 pages06 Correction of Errors PDFRoxanneNo ratings yet

- Girl's High School and College, Prayagraj 2020-2021Document2 pagesGirl's High School and College, Prayagraj 2020-2021Shinchan ShuklaNo ratings yet

- Class XII Accountancy Unit Test 1 15.05.2021Document3 pagesClass XII Accountancy Unit Test 1 15.05.2021Mohm. Armaan MalikNo ratings yet

- 12 Account SP 01 PDFDocument24 pages12 Account SP 01 PDFJanvi KushwahaNo ratings yet

- RKG Imp Q (CH 1 & 2) DoneDocument3 pagesRKG Imp Q (CH 1 & 2) Donepriyanshi.bansal25No ratings yet

- APS Class 12th Accountancy ExamDocument5 pagesAPS Class 12th Accountancy Exammmt05No ratings yet

- Intermediate - Accounting - 2 - Quiz - 1.pdf Filename - UTF-8''InterDocument3 pagesIntermediate - Accounting - 2 - Quiz - 1.pdf Filename - UTF-8''InterClaire Magbunag AntidoNo ratings yet

- Topper 2 101 504 549 Accountancy Question Up201801231745 1516709744 8573Document15 pagesTopper 2 101 504 549 Accountancy Question Up201801231745 1516709744 8573gauravNo ratings yet

- Midlands State University Faculty of CommerceDocument9 pagesMidlands State University Faculty of CommerceOscar MakonoNo ratings yet

- Intermediate Accounting 2 Prelim Exam Part II PDF FreeDocument5 pagesIntermediate Accounting 2 Prelim Exam Part II PDF FreeShairine AquinoNo ratings yet

- ACCOUNTANCY Test 2Document2 pagesACCOUNTANCY Test 2krishnansivanNo ratings yet

- Accounts XiiDocument12 pagesAccounts XiiTanya JainNo ratings yet

- Accountancysp PDFDocument10 pagesAccountancysp PDFRupesh ChouhanNo ratings yet

- Practice-Exercises-Chapters-17-19 2Document5 pagesPractice-Exercises-Chapters-17-19 2Queenie Mae ArsuloNo ratings yet

- 1) AccountsDocument21 pages1) AccountsKrushna MateNo ratings yet

- Chapter 2 - Goodwill Nature and Valuation - Volume IDocument11 pagesChapter 2 - Goodwill Nature and Valuation - Volume Iakshaya sangeethaNo ratings yet

- Accounts g1 MTPDocument191 pagesAccounts g1 MTPJattu TatiNo ratings yet

- Sri Vijay Vidyalaya Mat. Hr. Sec. School, Dpi: Second Mid Term Test Aug-2021, Xii-Comm Accountancy (DT)Document4 pagesSri Vijay Vidyalaya Mat. Hr. Sec. School, Dpi: Second Mid Term Test Aug-2021, Xii-Comm Accountancy (DT)BS2.SVVD BS2.SVVDNo ratings yet

- University of Luzon College of Accountnacy Acc 412 - NCL Part 2 NAME: - Problem 1Document3 pagesUniversity of Luzon College of Accountnacy Acc 412 - NCL Part 2 NAME: - Problem 1fghhnnnjmlNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument20 pagesCambridge International Advanced Subsidiary and Advanced LevelPhiri Arah RachelNo ratings yet

- Retest For ToppersDocument3 pagesRetest For Toppersbhumika aggarwalNo ratings yet

- GOODWILLDocument35 pagesGOODWILLsafafasfasfasfsafNo ratings yet

- Calculation of Average Profits For The Last Three Years: Year ProfitDocument25 pagesCalculation of Average Profits For The Last Three Years: Year ProfitRiddhima DasNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- MGT 2Document4 pagesMGT 2Dharren Rojan Garvida AgullanaNo ratings yet

- BSBMGT608 2 ChangeDocument37 pagesBSBMGT608 2 ChangenehaNo ratings yet

- Im Final PPT Slides CompiledDocument26 pagesIm Final PPT Slides CompiledAbdullah MuhammadNo ratings yet

- List of TrainingDocument16 pagesList of TrainingMalik Khuram ShazadNo ratings yet

- Price List 28-09-23Document7 pagesPrice List 28-09-23sanyam100% (1)

- US Deal Drivers H1Document72 pagesUS Deal Drivers H1Frank Akinwande WilliamsNo ratings yet

- Spa-Mark Allan AtienzaDocument4 pagesSpa-Mark Allan AtienzaArsène HeisenbergNo ratings yet

- Dr. Solomon U. Molina CollegeDocument3 pagesDr. Solomon U. Molina CollegeAllyn Talaboc CalisoNo ratings yet

- Adjusting For Bad DebtsDocument16 pagesAdjusting For Bad DebtssamahaseNo ratings yet

- Actividad de Proyecto 16 Evidencia 7Document6 pagesActividad de Proyecto 16 Evidencia 7Carlos Alberto DuranNo ratings yet

- The Discipline of Market Leaders: Take-AwaysDocument6 pagesThe Discipline of Market Leaders: Take-AwaysDiego Andres Diaz CuervoNo ratings yet

- MIS 201304 Ashish AgarwalDocument6 pagesMIS 201304 Ashish AgarwalRavi Kant SinghNo ratings yet

- Review Lecture Notes Chapter 15Document7 pagesReview Lecture Notes Chapter 15- OriNo ratings yet

- Effect of Tax, Tunneling Incentive, Good Corporate Governance, Profitability, and Bonus Mechanism On Transfer PricingDocument10 pagesEffect of Tax, Tunneling Incentive, Good Corporate Governance, Profitability, and Bonus Mechanism On Transfer PricingAJHSSR JournalNo ratings yet

- Topic 10 CSRDocument66 pagesTopic 10 CSRDiana Vergara MacalindongNo ratings yet

- Disruptive Innovations and Competitive Advantage Merian TeteDocument6 pagesDisruptive Innovations and Competitive Advantage Merian TeteGarima GargNo ratings yet

- CV Randi Prandika A (2022)Document1 pageCV Randi Prandika A (2022)RPANo ratings yet

- Course Outline SCM 2022Document4 pagesCourse Outline SCM 2022Alexander HernachNo ratings yet

- Summer Internship Project FinalDocument73 pagesSummer Internship Project FinalReemaChavan1234100% (1)

- BMM3003 - Assignment 1 - Business Operation and Management - 02.12.2022Document14 pagesBMM3003 - Assignment 1 - Business Operation and Management - 02.12.2022victoria.gutu91No ratings yet

- Risk of Material Misstatement Worksheet - Overview General InstructionsDocument35 pagesRisk of Material Misstatement Worksheet - Overview General InstructionswellawalalasithNo ratings yet

- Statement of PurposeDocument1 pageStatement of PurposeJehan NatarajanNo ratings yet

- House Hearing, 110TH Congress - Other Transaction Authority: Flexibility at The Expense of Accountability?Document49 pagesHouse Hearing, 110TH Congress - Other Transaction Authority: Flexibility at The Expense of Accountability?Scribd Government DocsNo ratings yet

- Midterm - Chapter 4Document78 pagesMidterm - Chapter 4JoshrylNo ratings yet