Professional Documents

Culture Documents

Validly Be Placed Thereon: Insurable Interest Property Insurance Life Insurance

Uploaded by

Anny YanongOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Validly Be Placed Thereon: Insurable Interest Property Insurance Life Insurance

Uploaded by

Anny YanongCopyright:

Available Formats

INSURABLE INTEREST

PROPERTY INSURANCE LIFE INSURANCE

The EXPECTATION OF BENEFIT must have The EXPECTATION OF BENEFIT to be

a legal basis derived from the continued existence of a

life need not have any legal basis

The actual value of the interest therein There is no limit to the amount of

is the limit of the insurance that can insurance that may be taken upon life

validly be placed thereon

An interest insured MUST EXIST when the It is enough that insurable interest exists

insurance takes effect and when the loss AT THE TIME WHEN THE CONTRACT IS

occurs but need not exist in the MADE but it need not exist at the time of

meantime loss.

CO-INSURANCE REINSURANCE

is the percentage in the value of the is where the insurer procures a third

insured property which the insured party, called the reinsurer, to insure him

himself assumes or undertakes to act as against liability by reason of such original

insurer to the extent of the deficiency in insurance.

the insurance of the insured property.

Basically a reinsurance is an insurance

against liability which the original insurer

may incur in favor of the original insured

EXCEPTIONS TO CASH AND CARRY BASIS

1. Life/industrial life when the grace period applies

2. Whenever under the broker and agency agreements with duly licensed

intermediaries, a ninety (90)-day credit extension is given. No credit extension to

a duly licensed intermediary should exceed ninety (90) days from date of issuance

of the policy.

3. An acknowledgment in a policy or contract of insurance or the receipt of premium

is conclusive evidence of its payment, so far as to make the policy binding,

notwithstanding any stipulation therein that it shall not be binding until the premium

is actually paid.

4. When the parties have agreed on installment payment (Makati Tuscany case)

5. When the insurer has renewed the insurance over the years under a clear credit

term arrangement (UCPB case)

6. In Suretyship where the obligee accepts the bond even if premium has not been

paid (Sec. 177)

WHEN IS INSURED ENTITLED TO RETURN OF PREMIUM?

1. If the contract is voidable and subsequently annulled under the provisions of the

Civil Code

2. On account of fraud / misrepresentation of insure/agent, facts insured was ignorant

of, default of insured other than fraud.

PROVISIONS

1. SECTION 84- Proximate cause of the loss must be the covered peril

2. SECTION 86- PROXIMATE CAUSE

3. SECTION 87- LOSS IN THE COURSE OF RESCUE- insurer liable

4. SECTION 89- WILLFUL ACT/ CONNIVANCE OF INSURED- insurer not liable

5. SECTION 13- INSURABLE INTEREST

6. SECTION 14- CONSISTING OF INSURABLE INTEREST

7. SECTION 18- Beneficiary should have insurable interest in the property

8. SECTION 8- Insurable interest on mortgaged property

9. SECTION 17- Extent of measure of insurable interest

10. SECTION 20- suspension of insurance in the event of change of ownership

11. SECTION 58- Transfer of property does not transfer the policy

a. EXCEPT by:

i. Will; or

ii. Sucession

12. SECTION 59- Kinds of policy (SECTION 60-62)

You might also like

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- Suretyship Property InsuranceDocument4 pagesSuretyship Property InsuranceJustin IsidoroNo ratings yet

- Suretyship Property InsuranceDocument5 pagesSuretyship Property InsuranceEd Karell GamboaNo ratings yet

- Topic Insurance LawDocument28 pagesTopic Insurance LawAtty Rester John NonatoNo ratings yet

- Commercial Law Finals ReviewerDocument8 pagesCommercial Law Finals ReviewerTOLENTINO, DENSSEL L.No ratings yet

- Law 315 Reviewer by FJDocument41 pagesLaw 315 Reviewer by FJjerico lopezNo ratings yet

- Reviewer in InsuranceDocument17 pagesReviewer in InsuranceAnonymous BBs1xxk96VNo ratings yet

- MercRev - InsuranceDocument18 pagesMercRev - InsuranceA GrafiloNo ratings yet

- Insurance Reviewer1555555Document29 pagesInsurance Reviewer1555555Rudy G. Alvarez Jr.No ratings yet

- Insurance NotesDocument31 pagesInsurance NotesKevin SalazarNo ratings yet

- Principle of InsuranceDocument3 pagesPrinciple of InsuranceShweta AgrawalNo ratings yet

- Insurance Notes (Rkuw/Rondez) : What Laws Govern Insurance?Document46 pagesInsurance Notes (Rkuw/Rondez) : What Laws Govern Insurance?anne valbuenaNo ratings yet

- Insurance Reviewer Midterm ExamsDocument9 pagesInsurance Reviewer Midterm ExamsSantoy CartallaNo ratings yet

- Commercial Law Review: Maria Zarah Villanueva - CastroDocument31 pagesCommercial Law Review: Maria Zarah Villanueva - CastroEarl Andre PerezNo ratings yet

- Comm Law For EditingDocument16 pagesComm Law For EditingJerick Bambi SadernasNo ratings yet

- 1st Part Outline InsuranceDocument12 pages1st Part Outline InsuranceCharmila SiplonNo ratings yet

- Life InsuranceDocument6 pagesLife InsurancePeasant MarieNo ratings yet

- Zarah NotesDocument31 pagesZarah NotesYieMaghirangNo ratings yet

- Insurance Reviewer Based On Syllabus Part 2Document4 pagesInsurance Reviewer Based On Syllabus Part 2juna luz latigayNo ratings yet

- Commercial Law - InsuranceDocument14 pagesCommercial Law - InsuranceRoji Belizar HernandezNo ratings yet

- Insurance Midterm ReviewerDocument13 pagesInsurance Midterm ReviewerDaphnie CuasayNo ratings yet

- Commercial Law Reviewer 2021Document79 pagesCommercial Law Reviewer 2021Apple LanuganNo ratings yet

- Essentials of Valid Insurance ContractDocument8 pagesEssentials of Valid Insurance ContractHarsh SharmaNo ratings yet

- Law On InsuranceDocument31 pagesLaw On InsuranceThea DagunaNo ratings yet

- Fundamentals of Insurance - B. Com V - AS-2637Document10 pagesFundamentals of Insurance - B. Com V - AS-2637Sneha SNo ratings yet

- Notes On Insurance - Rene Callanta Insurance Code: (P.D. 1460, As Amended)Document22 pagesNotes On Insurance - Rene Callanta Insurance Code: (P.D. 1460, As Amended)Cervus Augustiniana LexNo ratings yet

- Insurance - Callanta NotesDocument22 pagesInsurance - Callanta NotesCervus Augustiniana LexNo ratings yet

- 9252 - Insurance Law - R.A. No. 2427Document4 pages9252 - Insurance Law - R.A. No. 2427dahpne saquianNo ratings yet

- Esut Business School: Assignment On The Application of The Basic Principles of Insurance in Insurance Practice in NigeriaDocument9 pagesEsut Business School: Assignment On The Application of The Basic Principles of Insurance in Insurance Practice in NigeriaRichie OdodoNo ratings yet

- Ndemnity NtroductionDocument6 pagesNdemnity NtroductionAnand YadavNo ratings yet

- Amended Insurance CodeDocument97 pagesAmended Insurance CodeAnne Laraga LuansingNo ratings yet

- Commercial Law Review: Maria Zarah Villanueva - CastroDocument31 pagesCommercial Law Review: Maria Zarah Villanueva - Castrokamilskie100% (2)

- Insurance Code PDFDocument32 pagesInsurance Code PDFaivi santosNo ratings yet

- Zara Notes Transpo InsuranceDocument193 pagesZara Notes Transpo InsuranceYuri NishimiyaNo ratings yet

- Insurance Code: P.D. 612 R.A. 10607 Atty. Jobert O. Rillera, CPA, REB, READocument85 pagesInsurance Code: P.D. 612 R.A. 10607 Atty. Jobert O. Rillera, CPA, REB, REAChing ApostolNo ratings yet

- Finals - Insurance NotesDocument22 pagesFinals - Insurance NotesBlaise VENo ratings yet

- Insurance-Law CompressDocument4 pagesInsurance-Law Compressrieann leonNo ratings yet

- 2018 Insurance Law Notes (Rondez)Document48 pages2018 Insurance Law Notes (Rondez)Troy GonzalesNo ratings yet

- Insurance As ContractDocument3 pagesInsurance As ContractAparajita SharmaNo ratings yet

- Principle of InsuranceDocument11 pagesPrinciple of InsuranceUdayJahanNo ratings yet

- Part Three - InsuranceDocument4 pagesPart Three - InsuranceIreneLeahC.RomeroNo ratings yet

- Insurance ReviewerDocument37 pagesInsurance ReviewerDiane88% (8)

- Subrogation: The Insurance Involved Is Property Insurance 1Document3 pagesSubrogation: The Insurance Involved Is Property Insurance 1Esto, Cassandra Jill SumalbagNo ratings yet

- Essentials of An Insurance ContractDocument7 pagesEssentials of An Insurance ContractSameer JoshiNo ratings yet

- Insurance Finals PDFDocument42 pagesInsurance Finals PDFDessa ReyesNo ratings yet

- Insurance PrinciplesDocument11 pagesInsurance PrinciplesDivaxNo ratings yet

- Chapter 5 - Insurance LawDocument11 pagesChapter 5 - Insurance LawMarrick MbuiNo ratings yet

- Insurance Law in IndiaDocument44 pagesInsurance Law in IndiaVaibhav AhujaNo ratings yet

- Principles of InsuranceDocument2 pagesPrinciples of Insurancepsawant77No ratings yet

- Flash CardsDocument29 pagesFlash Cardsrclemente01No ratings yet

- History and Sources of Law of InsuranceDocument4 pagesHistory and Sources of Law of InsuranceMary-Lou Anne MohrNo ratings yet

- LSP Insurance PDFDocument28 pagesLSP Insurance PDFGERARDO DAYAO III MARTINEZNo ratings yet

- Assignment No. 4 - JAReyes - COMMREVDocument7 pagesAssignment No. 4 - JAReyes - COMMREVReyes JericksonNo ratings yet

- Commercial Law 2021Document385 pagesCommercial Law 2021Roberto Galano Jr.0% (1)

- VIII&X - Law of Insurance (Opt.)Document14 pagesVIII&X - Law of Insurance (Opt.)Chandrashekhar SharmaNo ratings yet

- Nature of The Contract of InsuranceDocument3 pagesNature of The Contract of InsuranceJuly BacarNo ratings yet

- Insurance 1Document42 pagesInsurance 1markbulloNo ratings yet

- Insurance Code of The Philippines: Compensate The Other For Loss On A Specified Subject by Specified PerilsDocument12 pagesInsurance Code of The Philippines: Compensate The Other For Loss On A Specified Subject by Specified PerilskrstnkyslNo ratings yet

- Principles of Insurance Law with Case StudiesFrom EverandPrinciples of Insurance Law with Case StudiesRating: 5 out of 5 stars5/5 (1)

- Past Exam Definition of TermsDocument2 pagesPast Exam Definition of TermsAnny YanongNo ratings yet

- Republic Act No. 10607Document85 pagesRepublic Act No. 10607Anny YanongNo ratings yet

- Banking AmlaDocument23 pagesBanking AmlaAnny YanongNo ratings yet

- Insurance Law Review Rizal Memorial Colleges Law School Insurance Code of 2013 Session 1Document37 pagesInsurance Law Review Rizal Memorial Colleges Law School Insurance Code of 2013 Session 1Anny YanongNo ratings yet

- Syllabus For The 2022 Bar Examinations CIVIL LAW (And Practical Exercises)Document31 pagesSyllabus For The 2022 Bar Examinations CIVIL LAW (And Practical Exercises)Anny YanongNo ratings yet

- Competition Law-Case DigestDocument23 pagesCompetition Law-Case DigestAnny YanongNo ratings yet

- NSFD 2021 Application Form and Contract of UndertakingDocument2 pagesNSFD 2021 Application Form and Contract of UndertakingAnny YanongNo ratings yet

- ANT I-Laundering Act: MoneyDocument27 pagesANT I-Laundering Act: MoneyAnny YanongNo ratings yet

- St. Paul College Quezon City vs. Ancheta (Sept. 7, 2011)Document3 pagesSt. Paul College Quezon City vs. Ancheta (Sept. 7, 2011)Anny YanongNo ratings yet

- People vs. PanisDocument1 pagePeople vs. PanisAnny YanongNo ratings yet

- People V VelardeDocument2 pagesPeople V VelardeShariefaAichaseAsali0% (2)

- Philsa vs. Sec. of LaborDocument2 pagesPhilsa vs. Sec. of LaborAnny YanongNo ratings yet

- 103 People V IlardeDocument3 pages103 People V IlardeChingNo ratings yet

- Demand Letter: Ms. Rhea SomidoDocument1 pageDemand Letter: Ms. Rhea SomidoAnny YanongNo ratings yet

- Anti-Money Laundering Act of 2001, As Amended (Republic Act 9160, 9194, 10167, 10365, 10927)Document17 pagesAnti-Money Laundering Act of 2001, As Amended (Republic Act 9160, 9194, 10167, 10365, 10927)Anny YanongNo ratings yet

- Associated Labor Unions (Alu) vs. Ferrer - CallejaDocument2 pagesAssociated Labor Unions (Alu) vs. Ferrer - CallejaAnny YanongNo ratings yet

- Lecture Notes ObliconDocument189 pagesLecture Notes ObliconAnny Yanong100% (1)

- Lecture Notes ObliconDocument189 pagesLecture Notes ObliconAnny Yanong100% (1)

- Municipal Trial Court in CitiesDocument8 pagesMunicipal Trial Court in CitiesAnny YanongNo ratings yet

- For Monday - Full Text - EthicsDocument37 pagesFor Monday - Full Text - EthicsAnny YanongNo ratings yet

- Motion To Release Exhibit SampleDocument3 pagesMotion To Release Exhibit SampleAnny Yanong100% (2)

- Amla ReviewerDocument8 pagesAmla ReviewerFatMan8750% (2)

- Answer: Municipal Trial Court in CitiesDocument5 pagesAnswer: Municipal Trial Court in CitiesAnny YanongNo ratings yet

- Anti-Money Laundering Act of 2001, As Amended (Republic Act 9160, 9194, 10167, 10365, 10927)Document17 pagesAnti-Money Laundering Act of 2001, As Amended (Republic Act 9160, 9194, 10167, 10365, 10927)Anny YanongNo ratings yet

- Group 3Document91 pagesGroup 3Anny YanongNo ratings yet

- Conflicts Atty. Suarez TSN 1 PDFDocument170 pagesConflicts Atty. Suarez TSN 1 PDFAnny YanongNo ratings yet

- Partnership PDFDocument31 pagesPartnership PDFAnny YanongNo ratings yet

- Cedaw Op Karen Vertido CaseDocument19 pagesCedaw Op Karen Vertido CaseRoldan Arca Pagapos100% (1)

- Gender, Law and Jurisprudence: July 2017Document10 pagesGender, Law and Jurisprudence: July 2017Anny YanongNo ratings yet

- Insurance Code: Bar Exams Questions and Answers in Mercantile Law Review IIDocument163 pagesInsurance Code: Bar Exams Questions and Answers in Mercantile Law Review IIMarivic EscuetaNo ratings yet

- Financial ModellingDocument16 pagesFinancial ModellingthobeyceleNo ratings yet

- Asset Purchase AgreementDocument51 pagesAsset Purchase AgreementNurul Huda LimNo ratings yet

- Summer Internship ProgrammeDocument61 pagesSummer Internship Programmebirbal singhNo ratings yet

- Dr. A.K. Sengupta: Former Dean, Indian Institute of Foreign TradeDocument12 pagesDr. A.K. Sengupta: Former Dean, Indian Institute of Foreign TradeimadNo ratings yet

- Emergency Loan (Active Member) Application FormDocument2 pagesEmergency Loan (Active Member) Application FormenzoNo ratings yet

- ACFrOgB Hig3c9hwk GPxYSL YwErusr8K4lDkrDJMgt1 0KcEICnet0X6CdMZA2cLdsLJzKWkH9uE3NdtHtcecT2T2ZWZki8F4lcc3bNsCfdZPQ1rPCzFurUP7Sbhmx13gTU22S Nagg UmhOGxDocument8 pagesACFrOgB Hig3c9hwk GPxYSL YwErusr8K4lDkrDJMgt1 0KcEICnet0X6CdMZA2cLdsLJzKWkH9uE3NdtHtcecT2T2ZWZki8F4lcc3bNsCfdZPQ1rPCzFurUP7Sbhmx13gTU22S Nagg UmhOGxas2207530No ratings yet

- UNIT 3 InsuranceDocument10 pagesUNIT 3 InsuranceAroop PalNo ratings yet

- Three Payment Plan Plus-1Document4 pagesThree Payment Plan Plus-1tapas1361No ratings yet

- Traders Royal Bank v. Court of AppealsDocument13 pagesTraders Royal Bank v. Court of Appealslovekimsohyun89No ratings yet

- BSP Circular 801-13Document9 pagesBSP Circular 801-13Nash Ortiz LuisNo ratings yet

- Template (General & Preliminaries)Document4 pagesTemplate (General & Preliminaries)Carlo Mangalindan100% (1)

- Project FinanceDocument10 pagesProject FinanceElj LabNo ratings yet

- Financial Planning QuestionnaireDocument7 pagesFinancial Planning QuestionnairerosanajonesNo ratings yet

- 2016 990 Nonprofit Tax Return Engagement LetterDocument11 pages2016 990 Nonprofit Tax Return Engagement LettersarahvillalonNo ratings yet

- Hospital Indemnity Claim Form: Policy NumberDocument2 pagesHospital Indemnity Claim Form: Policy NumberMoyo Mitchell0% (1)

- Hiring A Drone Pilot The Ultimate Guide - The Drone LifeDocument5 pagesHiring A Drone Pilot The Ultimate Guide - The Drone LifeblinkeskuNo ratings yet

- Actaury Ref BooksDocument8 pagesActaury Ref BooksvamshidsNo ratings yet

- Fin-Ch 8Document22 pagesFin-Ch 8Fazal Ur Rehman Wali MuhammadNo ratings yet

- Overall Report OutlineDocument8 pagesOverall Report OutlineDominique LimoconNo ratings yet

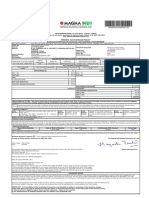

- Private Car Package Policy Endorsed Certificate of Insurance Cum Schedule /TAX INVOICEDocument2 pagesPrivate Car Package Policy Endorsed Certificate of Insurance Cum Schedule /TAX INVOICEhiteshmohakar15No ratings yet

- 165 1 COST EST COMPLI Proposal1Document17 pages165 1 COST EST COMPLI Proposal1Sofiane SetifienNo ratings yet

- 29AAFCA3559A1ZV: Transportation of Used Household Goods For Personal Use (Gta) Sac-996511Document3 pages29AAFCA3559A1ZV: Transportation of Used Household Goods For Personal Use (Gta) Sac-996511javedNo ratings yet

- Department of MathematicsDocument31 pagesDepartment of MathematicsmcdabenNo ratings yet

- Methods of Using Artificial Intelligence in Insurance Companies and Its Promising DirectionsDocument7 pagesMethods of Using Artificial Intelligence in Insurance Companies and Its Promising DirectionsResearch ParkNo ratings yet

- QBE at A Glance FactsheetDocument2 pagesQBE at A Glance FactsheetQBE European Operations Risk ManagementNo ratings yet

- QUIRICO D. ANIÑON v. GOVERNMENT SERVICE INSURANCE SYSTEMDocument23 pagesQUIRICO D. ANIÑON v. GOVERNMENT SERVICE INSURANCE SYSTEMFaustina del RosarioNo ratings yet

- Disbursements Transactions PDFDocument6 pagesDisbursements Transactions PDFMarlyn Joy YaconNo ratings yet

- Philippine American General Insurance Company V Pks Shipping CompanyDocument1 pagePhilippine American General Insurance Company V Pks Shipping CompanyJames Evan I. ObnamiaNo ratings yet

- Dissertation TopicsDocument24 pagesDissertation Topicsdineshlutya50% (2)