Professional Documents

Culture Documents

Assignment 1

Assignment 1

Uploaded by

Anushka Gupta0 ratings0% found this document useful (0 votes)

10 views6 pagesOriginal Title

Assignment 1.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views6 pagesAssignment 1

Assignment 1

Uploaded by

Anushka GuptaCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 6

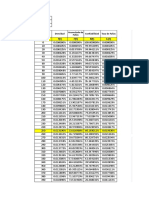

DATA Airtel HDFC Life Axis Bank Nippon R1 R2 R3 R4

3-Sep-19 336.85 536.75 645.7 283 0 0 0 0

4-Sep-19 345.7 535.65 647.3 276.55 0.0259336 -0.002051 0.0024749 -0.023055

5-Sep-19 347.7 528.5 649.6 277.85 0.0057687 -0.013438 0.0035469 0.0046898

6-Sep-19 349.25 529.9 671.1 282.85 0.004448 0.0026455 0.0325614 0.0178353

9-Sep-19 356.45 530.9 671.55 286.1 0.020406 0.0018854 0.0006703 0.0114247

11-Sep-19 355.1 537.9 681.7 277.3 -0.003795 0.013099 0.0150012 -0.031241

12-Sep-19 347.55 537.85 662.9 261.9 -0.021491 -9.296E-05 -0.027966 -0.057137

13-Sep-19 343.05 540.4 674.25 262.25 -0.013032 0.0047299 0.0169768 0.0013355

16-Sep-19 344 537.65 670.9 248.85 0.0027654 -0.005102 -0.004981 -0.052448

17-Sep-19 339.85 530.7 640.45 228.5 -0.012137 -0.013011 -0.046449 -0.085314

18-Sep-19 335.6 539.1 648.4 233.5 -0.012584 0.0157042 0.0123367 0.0216459

19-Sep-19 337.6 532.45 638.2 230.65 0.0059418 -0.012412 -0.015856 -0.012281

20-Sep-19 356.4 563.85 680.35 253.7 0.0541919 0.0572993 0.0639557 0.0952511

23-Sep-19 348 540.75 725.5 251.35 -0.023851 -0.041831 0.0642537 -0.009306

24-Sep-19 348.65 551.05 704.4 261.25 0.0018661 0.0188685 -0.029515 0.0386314

25-Sep-19 341.65 557.85 694.95 263.15 -0.020282 0.0122646 -0.013506 0.0072464

26-Sep-19 344.05 569.3 699.9 266.25 0.0070002 0.0203174 0.0070976 0.0117115

27-Sep-19 349.1 582.3 700.6 265.8 0.0145714 0.0225782 0.0009996 -0.001692

30-Sep-19 367.05 601.15 685 260.35 0.0501397 0.0318587 -0.022518 -0.020717

1-Oct-19 350.95 598.2 679.15 265.7 -0.044854 -0.004919 -0.008577 0.020341

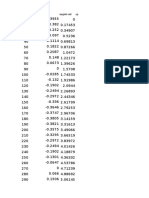

Risk Free

Share Mean Variance Rate

Bharti Airtel 0.22% 0.000598 0.01%

HDFC Life 0.61% 0.000459

Axis Bank 0.26% 0.000921

Reliance Nippon 0.93% 0.001764

Variance Covariance Matrix

Airtel HDFC Life Axis Bank Nippon

Airtel 55.49562 81.0721 73.97376 47.83858

HDFC Life 81.0721 481.5092 249.5451 3.19845

Axis Bank 73.97376 249.5451 547.8287 62.87321

Nippon 47.83858 3.19845 62.87321 273.8241

Weights 25% 25% 25% 25% 1

Expected Return 0.005041

Portfolio SD 12.23637

Weights 0% 27% 0% 73% 1

Expected Return 0.008413

Portfolio SD 13.50348

Sharpe's Ratio 0.000612

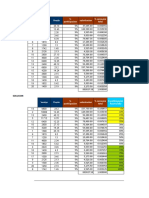

HDFC Life Nippon R1 R2 1 2

536.75 283 0 0 Mean 0.005705 -0.00332

535.65 276.55 -0.00205 -0.02306 SD 0.020907 0.038995

528.5 277.85 -0.01344 0.00469

529.9 282.85 0.002646 0.017835 Weight 1 Weight 2 P Risk P Return

530.9 286.1 0.001885 0.011425 0% 100% 0.038995 -0.00332

537.9 277.3 0.013099 -0.03124 10% 90% 0.035158 -0.00242

537.85 261.9 -9.3E-05 -0.05714 20% 80% 0.031475 -0.00151 0.1

540.4 262.25 0.00473 0.001335 30% 70% 0.028008 -0.00061

537.65 248.85 -0.0051 -0.05245 40% 60% 0.024847 0.00029 0.08

530.7 228.5 -0.01301 -0.08531 50% 50% 0.022123 0.001192

539.1 233.5 0.015704 0.021646 60% 40% 0.020017 0.002095 0.06

532.45 230.65 -0.01241 -0.01228 70% 30% 0.018736 0.002997

563.85 253.7 0.057299 0.095251 80% 20% 0.018455 0.0039 0.04

540.75 251.35 -0.04183 -0.00931 90% 10% 0.019217 0.004802

0.02

551.05 261.25 0.018868 0.038631 100% 0% 0.020907 0.005705

557.85 263.15 0.012265 0.007246 110% -10% 0.023326 0.006607

0

569.3 266.25 0.020317 0.011712 120% -20% 0.026273 0.00751 0 0.05 0.1

582.3 265.8 0.022578 -0.00169 130% -30% 0.02959 0.008412 -0.02

601.15 260.35 0.031859 -0.02072 140% -40% 0.033167 0.009315

598.2 265.7 -0.00492 0.020341 150% -50% 0.036928 0.010217

160% -60% 0.040822 0.01112

170% -70% 0.044815 0.012022

180% -80% 0.048882 0.012925

190% -90% 0.053007 0.013827

200% -100% 0.057176 0.01473

210% -110% 0.061381 0.015632

220% -120% 0.065615 0.016535

230% -130% 0.069873 0.017437

240% -140% 0.07415 0.01834

250% -150% 0.078444 0.019242

260% -160% 0.082751 0.020145

270% -170% 0.08707 0.021047

280% -180% 0.091399 0.02195

290% -190% 0.095737 0.022852

300% -200% 0.100083 0.023755

310% -210% 0.104435 0.024657

320% -220% 0.108793 0.02556

330% -230% 0.113156 0.026462

340% -240% 0.117524 0.027364

350% -250% 0.121896 0.028267

360% -260% 0.126271 0.029169

370% -270% 0.13065 0.030072

380% -280% 0.135032 0.030974

390% -290% 0.139417 0.031877

400% -300% 0.143804 0.032779

410% -310% 0.148193 0.033682

420% -320% 0.152584 0.034584

430% -330% 0.156977 0.035487

440% -340% 0.161372 0.036389

450% -350% 0.165769 0.037292

460% -360% 0.170167 0.038194

470% -370% 0.174566 0.039097

480% -380% 0.178966 0.039999

490% -390% 0.183368 0.040902

500% -400% 0.187771 0.041804

510% -410% 0.192175 0.042707

520% -420% 0.196579 0.043609

530% -430% 0.200985 0.044512

540% -440% 0.205391 0.045414

550% -450% 0.209798 0.046317

560% -460% 0.214206 0.047219

570% -470% 0.218615 0.048122

580% -480% 0.223024 0.049024

590% -490% 0.227434 0.049927

600% -500% 0.231844 0.050829

610% -510% 0.236255 0.051732

620% -520% 0.240667 0.052634

630% -530% 0.245078 0.053536

640% -540% 0.249491 0.054439

650% -550% 0.253904 0.055341

660% -560% 0.258317 0.056244

670% -570% 0.26273 0.057146

680% -580% 0.267144 0.058049

690% -590% 0.271558 0.058951

700% -600% 0.275973 0.059854

710% -610% 0.280388 0.060756

720% -620% 0.284803 0.061659

730% -630% 0.289219 0.062561

740% -640% 0.293634 0.063464

750% -650% 0.298051 0.064366

760% -660% 0.302467 0.065269

770% -670% 0.306883 0.066171

780% -680% 0.3113 0.067074

790% -690% 0.315717 0.067976

800% -700% 0.320134 0.068879

810% -710% 0.324552 0.069781

820% -720% 0.328969 0.070684

830% -730% 0.333387 0.071586

840% -740% 0.337805 0.072489

850% -750% 0.342223 0.073391

860% -760% 0.346641 0.074294

870% -770% 0.35106 0.075196

880% -780% 0.355479 0.076099

890% -790% 0.359897 0.077001

900% -800% 0.364316 0.077904

910% -810% 0.368735 0.078806

920% -820% 0.373154 0.079708

930% -830% 0.377574 0.080611

940% -840% 0.381993 0.081513

950% -850% 0.386413 0.082416

960% -860% 0.390832 0.083318

970% -870% 0.395252 0.084221

980% -880% 0.399672 0.085123

990% -890% 0.404092 0.086026

1000% -900% 0.408512 0.086928

P Return

0.1

0.08

0.06

0.04

0.02

0

0 0.05 0.1 0.15 0.2 0.25 0.3 0.35 0.4 0.45

-0.02

You might also like

- Multiple Regression PDFDocument19 pagesMultiple Regression PDFSachen KulandaivelNo ratings yet

- Paired Sample T-TestDocument5 pagesPaired Sample T-TestAre MeerNo ratings yet

- Statprob q3 Mod25 ComputingAppropriateSampleSizeUsingtheLengthoftheInterval v2Document27 pagesStatprob q3 Mod25 ComputingAppropriateSampleSizeUsingtheLengthoftheInterval v2Moreal QazNo ratings yet

- Classification Algorithms Used in Data Mining. This Is A Lecture Given To MSC Students.Document63 pagesClassification Algorithms Used in Data Mining. This Is A Lecture Given To MSC Students.Sushil Kulkarni100% (5)

- Data Mining, KlasifikasiDocument88 pagesData Mining, KlasifikasiNaufal DaaniNo ratings yet

- Thermodynamic Properties of Water (Perry's HB)Document3 pagesThermodynamic Properties of Water (Perry's HB)Aileen MaeNo ratings yet

- EF 2023 - Class Room TemplateDocument12 pagesEF 2023 - Class Room TemplatedeoverNo ratings yet

- OrderHistoryInfo 4Document9 pagesOrderHistoryInfo 4Fuc Nguyen XuanNo ratings yet

- Trabajo 30 06Document3 pagesTrabajo 30 06Irene Monja Camizan100% (1)

- Mttf η β: Tiempo vs. DensidadDocument10 pagesMttf η β: Tiempo vs. DensidadLuis AsenciosNo ratings yet

- Calculo de Peraltes AashtoDocument6 pagesCalculo de Peraltes AashtoManuel Bernuy CoralNo ratings yet

- Tugas 2Document9 pagesTugas 2Adi PrasetyoNo ratings yet

- UC Davis Cenrifuge Data KKR 03Document5 pagesUC Davis Cenrifuge Data KKR 03Ravi SalimathNo ratings yet

- 4 Case Analysis Alibaba y AmazonDocument58 pages4 Case Analysis Alibaba y AmazonJAVIER HUMBERTO COLCA CRUZNo ratings yet

- Fecha S&P 500 LN S&P 500 ABT LN Abt Valor NasvDocument12 pagesFecha S&P 500 LN S&P 500 ABT LN Abt Valor NasvKaren Xiomara Galeano ContrerasNo ratings yet

- Inch Mill Smallnumbers 2017Document1 pageInch Mill Smallnumbers 2017Muhammad FayyazNo ratings yet

- Inch Mill Smallnumbers 2017 PDFDocument1 pageInch Mill Smallnumbers 2017 PDFMuhammad FayyazNo ratings yet

- Closing Rates and Returns of CompanysDocument1 pageClosing Rates and Returns of CompanysAhmad hassanNo ratings yet

- Datos SiO2 TiO2 TACDocument15 pagesDatos SiO2 TiO2 TACFelipeBohorquezNo ratings yet

- Longitud (CM) 120 ALTURA (CM) 13.5Document9 pagesLongitud (CM) 120 ALTURA (CM) 13.5Jimena RubioNo ratings yet

- Date Tata Power Polycab Greenpanel Tata Elxsi Kotak Mahindra BankDocument15 pagesDate Tata Power Polycab Greenpanel Tata Elxsi Kotak Mahindra BankAayushi ChandwaniNo ratings yet

- Micron Technology, Inc. (MU) - Data-AnnualDocument13 pagesMicron Technology, Inc. (MU) - Data-AnnualwillyNo ratings yet

- Tabla VC TP2Document15 pagesTabla VC TP2Julio TorresNo ratings yet

- Angulo Cpcos Angulo Rad CPDocument2 pagesAngulo Cpcos Angulo Rad CPAngel VargasNo ratings yet

- Isolamento-Planilha de CálculoDocument60 pagesIsolamento-Planilha de CálculoTiago RossiNo ratings yet

- WeibullDocument22 pagesWeibullJose ParraNo ratings yet

- WarrantsDocument2 pagesWarrantstok janggutNo ratings yet

- Tramo θ θ S: Diagrama de desplazamientoDocument5 pagesTramo θ θ S: Diagrama de desplazamientonixon contrerasNo ratings yet

- Tramo θ θ S: Diagrama de desplazamientoDocument5 pagesTramo θ θ S: Diagrama de desplazamientoJessyOrtizNo ratings yet

- Thermodynamic Properties of R-134a Saturated R-134aDocument6 pagesThermodynamic Properties of R-134a Saturated R-134aGvbo rA9No ratings yet

- Appendix A TablesDocument35 pagesAppendix A TableseshbliNo ratings yet

- Copia de Data-Espectro - MextcitDocument4 pagesCopia de Data-Espectro - MextcitJuan Jose GutierrezNo ratings yet

- Performance Ayam CobbDocument2 pagesPerformance Ayam CobbBagus Aji SutrisnoNo ratings yet

- Date S&P 500 Amazon %rend S&P - Mdo Pij %rend AmazonDocument4 pagesDate S&P 500 Amazon %rend S&P - Mdo Pij %rend AmazonDMORI EjercitoNo ratings yet

- Triaxial Calculos Fio y MadeDocument12 pagesTriaxial Calculos Fio y MadeMadeleinePumaPacoriNo ratings yet

- Simulaciones Hidraulica 20211110Document402 pagesSimulaciones Hidraulica 20211110Tomás Ignacio Herrera MuñozNo ratings yet

- Ventas Precio Valorizacion % Participacion % Consumo Total: Ejemplo 2Document2 pagesVentas Precio Valorizacion % Participacion % Consumo Total: Ejemplo 2Patty GonzalezNo ratings yet

- CAPMDocument4 pagesCAPMjoseph AlbaNo ratings yet

- Question 1 (I) For 0% Damping: Displacement (MM)Document63 pagesQuestion 1 (I) For 0% Damping: Displacement (MM)Kshitiz ShresthaNo ratings yet

- Lon 1Document12 pagesLon 1Pine ThrowsNo ratings yet

- Thermo of WaterDocument4 pagesThermo of WaterFaye StylesNo ratings yet

- Date Adj Close CCR CCR Adj Close CCR CCR CCRDocument17 pagesDate Adj Close CCR CCR Adj Close CCR CCR CCRRanjith KumarNo ratings yet

- P Vs T PentanolDocument6 pagesP Vs T PentanolLaura Valentina Villalobos CastroNo ratings yet

- Annuities p1Document4 pagesAnnuities p1Juan Felipe OrtizNo ratings yet

- Advanced Corporate Finance (ACF) : Bharti Airtel Ltd. NTPC Ltd. Sun Pharmaceutical LTDDocument4 pagesAdvanced Corporate Finance (ACF) : Bharti Airtel Ltd. NTPC Ltd. Sun Pharmaceutical LTDJayesh PurohitNo ratings yet

- Volatilidad Histórica ManualDocument12 pagesVolatilidad Histórica ManualbuscopersonalsmaNo ratings yet

- Carta PsicrometricaDocument14 pagesCarta PsicrometricaNemesi De L'amourNo ratings yet

- Bajaj AutoDocument8 pagesBajaj AutoAllwyn FlowNo ratings yet

- TABLE 2-351 Saturated Water Substance-Temperature (Fps Units)Document6 pagesTABLE 2-351 Saturated Water Substance-Temperature (Fps Units)Ricardo VelozNo ratings yet

- Curva Fe FabianDocument11 pagesCurva Fe FabianFabian RodriguezNo ratings yet

- STUDY ABOUT 641-212 AIRFOIL PROPERTIES - Fillipe OliveiraDocument15 pagesSTUDY ABOUT 641-212 AIRFOIL PROPERTIES - Fillipe OliveiraFillipe OliveiraNo ratings yet

- RaportDocument90 pagesRaportOficialfb LozanoNo ratings yet

- Datos Del MotorDocument46 pagesDatos Del MotorArmando TelloNo ratings yet

- Grafico de Funcion SenoDocument7 pagesGrafico de Funcion SenoJulioNo ratings yet

- Saidi y Saifi 2021 CuscoDocument92 pagesSaidi y Saifi 2021 CuscoSEBASTIAN100% (1)

- Practical Electronics - SWG - Wikibooks, Open Books For An Open WorldDocument4 pagesPractical Electronics - SWG - Wikibooks, Open Books For An Open WorldZia ur rehmanNo ratings yet

- Posición-Velocidad: X V (CM/S) ADocument2 pagesPosición-Velocidad: X V (CM/S) AalexNo ratings yet

- Resumen de Registro de Perforación de Diamante - Bob1 ZoneDocument8 pagesResumen de Registro de Perforación de Diamante - Bob1 ZoneJhonny Carrasco TaipeNo ratings yet

- Curvas ROC (Receiver Operating Characteristic, o Característica Operativa Del Receptor)Document7 pagesCurvas ROC (Receiver Operating Characteristic, o Característica Operativa Del Receptor)datalifeNo ratings yet

- Empresa: Ferrari Ferrari S&P RF RM Probabilidad P (RF) P (RM)Document4 pagesEmpresa: Ferrari Ferrari S&P RF RM Probabilidad P (RF) P (RM)Ribaul DiazNo ratings yet

- Assignment 3 - 1180100739Document1 pageAssignment 3 - 1180100739mayuriNo ratings yet

- Copia de EjercicioDocument6 pagesCopia de EjercicioWilson Jose Soto De LeonNo ratings yet

- Tabel Nilai-Nilai R Product Moment: N Taraf Signif N Taraf Signif N Taraf Signif 5% 1% 5% 1% 5% 1%Document1 pageTabel Nilai-Nilai R Product Moment: N Taraf Signif N Taraf Signif N Taraf Signif 5% 1% 5% 1% 5% 1%Mahyoe DinNo ratings yet

- Final Excel Sheet - HulDocument34 pagesFinal Excel Sheet - HulSakshi Jain Jaipuria JaipurNo ratings yet

- HLM in StataDocument26 pagesHLM in Stataajp11No ratings yet

- Chapter3-Goodness of Fit TestsDocument24 pagesChapter3-Goodness of Fit Testsjoseph kamwendoNo ratings yet

- The Influence of Guidance and Counseling Services On The Career Choices of Secondary School Students in Surulere Local Government Area, LagosDocument74 pagesThe Influence of Guidance and Counseling Services On The Career Choices of Secondary School Students in Surulere Local Government Area, Lagosjamessabraham2No ratings yet

- Fraction Percent Decimal Cheat SheetDocument1 pageFraction Percent Decimal Cheat SheetmswalshNo ratings yet

- The Work-Family Con Ict Scale (WAFCS) : Development and Initial Validation of A Self-Report Measure of Work-Family Con Ict For Use With ParentsDocument13 pagesThe Work-Family Con Ict Scale (WAFCS) : Development and Initial Validation of A Self-Report Measure of Work-Family Con Ict For Use With ParentsRima TrianiNo ratings yet

- MCQ of Statistics & Probability: Measures of Central Tendencies and DispersionDocument60 pagesMCQ of Statistics & Probability: Measures of Central Tendencies and DispersionvedantNo ratings yet

- Textbook Regression Analysis Microsoft Excel 1St Edition Conrad Carlberg Ebook All Chapter PDFDocument53 pagesTextbook Regression Analysis Microsoft Excel 1St Edition Conrad Carlberg Ebook All Chapter PDFjeffrey.westerheide846No ratings yet

- Research Hypothesis Type I and Type II Errors de La CruzDocument31 pagesResearch Hypothesis Type I and Type II Errors de La CruzLettynia Mellisze Famoso SorongonNo ratings yet

- Module 2 - Lect 5 - Forecasting PDFDocument36 pagesModule 2 - Lect 5 - Forecasting PDFMhmd KaramNo ratings yet

- Inferential Statistical Decision Making TreesDocument2 pagesInferential Statistical Decision Making TreesLeana Polston-MurdochNo ratings yet

- Yaari 2013Document11 pagesYaari 2013Susana PaçoNo ratings yet

- Chapter - 8.pdf Filename UTF-8''Chapter 8Document36 pagesChapter - 8.pdf Filename UTF-8''Chapter 8Jinky P. RefurzadoNo ratings yet

- Markov-Switching GARCH Models in R: The MSGARCH Package: Journal of Statistical Software May 2018Document40 pagesMarkov-Switching GARCH Models in R: The MSGARCH Package: Journal of Statistical Software May 2018Max ChenNo ratings yet

- 21CS63 - Unit1 Practice QuestionsDocument3 pages21CS63 - Unit1 Practice Questionschaithanyasgowda10No ratings yet

- Multiple Linear Regression: BIOST 515 January 15, 2004Document32 pagesMultiple Linear Regression: BIOST 515 January 15, 2004HazemIbrahimNo ratings yet

- FIN441 Homework 2 FL16 SolutionDocument10 pagesFIN441 Homework 2 FL16 SolutionMatthewLiuNo ratings yet

- PR2 Summative TestDocument4 pagesPR2 Summative TestRey Julius RanocoNo ratings yet

- (Answer Ch3) Chapter 3 Answers 8-11Document4 pages(Answer Ch3) Chapter 3 Answers 8-11a11914212No ratings yet

- GROUP 3 Research PPT ReportDocument49 pagesGROUP 3 Research PPT ReportRaiana AlfaroNo ratings yet

- EDA Lesson 3Document3 pagesEDA Lesson 3Cathrina ClaveNo ratings yet

- Components of Market Risk and Return, Maheu, McCurdyDocument35 pagesComponents of Market Risk and Return, Maheu, McCurdyamerdNo ratings yet

- M3L12Document13 pagesM3L12abimana100% (1)

- Is The Dependent Variable Related To The Independent Variable?Document10 pagesIs The Dependent Variable Related To The Independent Variable?tinkitNo ratings yet

- Chapter 8 Interval EstimationDocument25 pagesChapter 8 Interval EstimationTitis SiswoyoNo ratings yet

- 2021-A Complete Guide To Stepwise Regression in RDocument4 pages2021-A Complete Guide To Stepwise Regression in RLuis GarretaNo ratings yet