Professional Documents

Culture Documents

Assignment FM

Assignment FM

Uploaded by

Kartik AhirOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment FM

Assignment FM

Uploaded by

Kartik AhirCopyright:

Available Formats

1.

Assignment Details:-

a) Identify the listed company (TITAN COMPANY LIMITED) (NSE listed only) that

has raised funds using long term sources of finance methods. From the published

information, list the reasons for using the various long term finances by the

company and evaluate whether the financing option opted by the company is

appropriate. Also, explore the other long term sources of finance which was not

opted by the company so far and suggest which option shall be preferred which

proves to be worthful with appropriate justification. The student shall rely upon the

latest annual reports of the company (for the last 5 years).

b) The students is expected to conduct the performance analysis of the company using

the ratios as available from the reading resources with appropriate justification for

the trend. For the purpose of the analysis, the student shall use the annual results of

the company and can also use the descriptive statistics followed by OLS regression

(with ROE as dependent variable). To conduct the performance analysis of the

company, the student shall use the data for the last 5 years.

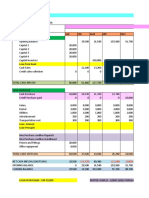

c) The student is also expected to determine the weighted average cost of capital (book

value and market value weights) using the resources available. In case, if the

necessary data is not available, the student can make the relevant assumptions. The

assumptions shall be valid and justifiable with appropriate references. The

determination of cost of each specific source of finance should be presented.

d) The student shall also analyse the capital structure of the company and its

relationship to the profitability of the company. Refer the research papers published

for the treatment of the independent variables and dependent variable (ROE). The

student shall also use OLS Regression to determine the impact of capital structure

on the profitability of the company. Also the analysis shall highlight, in detail,

which of the theories of capital structure is relevant.

e) Company = TITAN COMPANY LIMITED.

Course Outcome Mapped: CO1: To evaluate the company’s performance in line with the

objectives of the firm. CO2:To assess the relationship between long term investment decisions,

cost of capital and value of firm. CO3:To estimate the relationship between the optimal capital

structure, dividend decisions and value of firm.

Evaluation Parameters: a) Identification of long term sources from the annual reports, explain

the reasons for opting the existing sources and not opting the other sources. (10 Marks) Suggest

the appropriate sources with justification (5 marks)

b) Analyse the performance of the company using the ratios using descriptive statistics (10

marks) Analyzing the effect of leverage, liquidity, turnover, profitability and capital structure

ratios on return on equity using OLS Regression (10 Marks) c) Determining the cost of each

specific source of finance (10 marks) Determining the weighted average cost of capital (book

value and market value weights) (5 marks) d) Identify the capital structure determinants (5

marks) OLS Regression results to determine the impact of capital structure determinants on

profitability of the firm (10 marks) Link the relevant theories of capital structure and the results

(5 marks)

You might also like

- First Summative Examination in EntrepreneurshipDocument6 pagesFirst Summative Examination in EntrepreneurshipHart Franada80% (25)

- Chap - 3 (Dividends) AnswersDocument22 pagesChap - 3 (Dividends) AnswersStelvin Jaison100% (1)

- Guidelines D-MBA-404 Industrial ProjectsDocument7 pagesGuidelines D-MBA-404 Industrial ProjectsSayanti DeyNo ratings yet

- C-O-S-T: Cost Optimization System and TechniqueDocument37 pagesC-O-S-T: Cost Optimization System and TechniqueCharlene KronstedtNo ratings yet

- EasyJet Assignment 1Document4 pagesEasyJet Assignment 1Debraj ChatterjeeNo ratings yet

- Unsolved Problems 1-8Document26 pagesUnsolved Problems 1-8AsħîŞĥLøÝå60% (5)

- Project Guidelines For Investment AnalysisDocument2 pagesProject Guidelines For Investment AnalysisanasouNo ratings yet

- DL Corporate Finance AssessmentDocument2 pagesDL Corporate Finance Assessmentsarge1986No ratings yet

- 12 - MWS96KEE127BAS - 1research Project - WalmartDocument7 pages12 - MWS96KEE127BAS - 1research Project - WalmartashibhallauNo ratings yet

- Financial Research Project T Mobile Valuation and AnalysisDocument24 pagesFinancial Research Project T Mobile Valuation and Analysisalka murarka100% (1)

- (B) Objectives of The StudyDocument3 pages(B) Objectives of The StudyVicky RajuriyaNo ratings yet

- Capital Structure and Financial Performance of Selected Cement Companies in India: An AnalysisDocument8 pagesCapital Structure and Financial Performance of Selected Cement Companies in India: An AnalysisArbazNo ratings yet

- Capital Structure and Financial Performance of Selected Cement Companies in India: An AnalysisDocument4 pagesCapital Structure and Financial Performance of Selected Cement Companies in India: An Analysisziyan sk100% (1)

- Assessment Brief: The University of NorthamptonDocument11 pagesAssessment Brief: The University of NorthamptonThara DasanayakaNo ratings yet

- 202003261537533100jk Sharma FINANCIAL DECISIONDocument1 page202003261537533100jk Sharma FINANCIAL DECISIONAyush BishtNo ratings yet

- Project Guidelines FS 2022Document3 pagesProject Guidelines FS 2022Rahul UoNo ratings yet

- Research Proposal Impact of Capital Structure On Firm's Performance FinalDocument28 pagesResearch Proposal Impact of Capital Structure On Firm's Performance FinalLidia SamuelNo ratings yet

- AFM-Module 4-Part 1Document16 pagesAFM-Module 4-Part 1kanikaNo ratings yet

- Business FinanceDocument2 pagesBusiness FinanceDavinder BhawaniNo ratings yet

- Ratio Analysis - NATRAJ OILDocument8 pagesRatio Analysis - NATRAJ OILRaja MadhanNo ratings yet

- Synopsis NewDocument5 pagesSynopsis NewPataley PrashanthNo ratings yet

- Applying TOPSIS Method To Evaluate The Business Operation Performance of Vietnam Listing Securities CompaniesDocument5 pagesApplying TOPSIS Method To Evaluate The Business Operation Performance of Vietnam Listing Securities CompaniesSaid AhmadNo ratings yet

- Acc 599 Week 10 Assignment 3 Capstone Research ProjectDocument2 pagesAcc 599 Week 10 Assignment 3 Capstone Research ProjectKevin0% (1)

- Cash Flow-Latest ViewsDocument44 pagesCash Flow-Latest ViewsSyed Sheraz AliNo ratings yet

- Valuation Stocks Using DCF TechniqueDocument9 pagesValuation Stocks Using DCF TechniqueDaris Purnomo JatiNo ratings yet

- Introduction To The Topic: The Financial Analysis of Ashok Leyland, LTDDocument25 pagesIntroduction To The Topic: The Financial Analysis of Ashok Leyland, LTDRavi JoshiNo ratings yet

- Select A Company Listed On An InternationallyDocument4 pagesSelect A Company Listed On An InternationallyTalha chNo ratings yet

- Assignment 1 - Financial ManagementDocument2 pagesAssignment 1 - Financial ManagementTien Dong HaNo ratings yet

- Ratio AnalysisDocument39 pagesRatio AnalysisRajesh GuptaNo ratings yet

- FINE610 - Group ProjectDocument5 pagesFINE610 - Group Projecttantoon-2008No ratings yet

- What Is Required:: MPF753/953: Assignment 2, T2 2011 Due Date: Monday 5 September 2011Document2 pagesWhat Is Required:: MPF753/953: Assignment 2, T2 2011 Due Date: Monday 5 September 2011Sanchit AroraNo ratings yet

- Fin 611course Project Part 2Document3 pagesFin 611course Project Part 2peter muliNo ratings yet

- Effect of Financial Performance On Stock PriceDocument14 pagesEffect of Financial Performance On Stock PriceMuhammad Yasir YaqoobNo ratings yet

- Executive SummaryDocument30 pagesExecutive SummarysubhoNo ratings yet

- Research ProposalDocument8 pagesResearch ProposalRajesh twaynaNo ratings yet

- End of Term Assignment For The Course: Corporate FinanceDocument2 pagesEnd of Term Assignment For The Course: Corporate FinanceLê Thị Minh HươngNo ratings yet

- TMA 1 Advanced Financial ManagementDocument4 pagesTMA 1 Advanced Financial ManagementfisehaNo ratings yet

- Acca - BSC Hons Degree - Rap Topics - Top Grade PapersDocument4 pagesAcca - BSC Hons Degree - Rap Topics - Top Grade PapersTop Grade Papers100% (1)

- Analysis of Financial Statements of Reliance Industries LimitedDocument2 pagesAnalysis of Financial Statements of Reliance Industries LimitedAnkit VermaNo ratings yet

- Annual Report Project W2011 - ACCO310 CCDocument5 pagesAnnual Report Project W2011 - ACCO310 CCAbu HayyanNo ratings yet

- Capital ExpendituresDocument9 pagesCapital Expenditurestaoyuan521No ratings yet

- Project 2Document4 pagesProject 2kipkemei ezekielNo ratings yet

- Ratio Analysis KESORAgMDocument85 pagesRatio Analysis KESORAgMbhagathnagarNo ratings yet

- Guidelines For Corporate Strategic Audit ProjectDocument7 pagesGuidelines For Corporate Strategic Audit ProjectMay Cris BondocNo ratings yet

- FM-Fin. Statements Analysis - Session-2 (12.1.2015 & 13.1.2015)Document18 pagesFM-Fin. Statements Analysis - Session-2 (12.1.2015 & 13.1.2015)PratikNo ratings yet

- Group - Assignment Best To UsedDocument3 pagesGroup - Assignment Best To UsedNour FaizahNo ratings yet

- Ratio-Based Financial Performance Analysis of Pepsi: Mengqi DongDocument8 pagesRatio-Based Financial Performance Analysis of Pepsi: Mengqi DongvermaashleneNo ratings yet

- Objective'S of StudyDocument4 pagesObjective'S of StudydeegaurNo ratings yet

- Financial Ratios at B.D.K. Ltd. Hubli PROJECT REPORTDocument69 pagesFinancial Ratios at B.D.K. Ltd. Hubli PROJECT REPORTBabasab Patil (Karrisatte)100% (1)

- Research Methodology of KSFCDocument4 pagesResearch Methodology of KSFCTinku KumarNo ratings yet

- Ratio Analysis Heritage Foods Ltd-2Document64 pagesRatio Analysis Heritage Foods Ltd-2Varun ThatiNo ratings yet

- Chapter 1 - Introduction: 1.1 - Objective of The StudyDocument28 pagesChapter 1 - Introduction: 1.1 - Objective of The StudySpandan GhoshNo ratings yet

- 4 The Effect of Corporate Strategy and PDFDocument13 pages4 The Effect of Corporate Strategy and PDFPrince McGershonNo ratings yet

- Chapter ThreeDocument5 pagesChapter ThreeHenry BitrusNo ratings yet

- BT11003 Group AssignmentDocument6 pagesBT11003 Group AssignmentShumi Wijaya WirajudaNo ratings yet

- Financial Radio Analysis-AmbujaDocument94 pagesFinancial Radio Analysis-Ambujak eswariNo ratings yet

- Literature Review PointsDocument2 pagesLiterature Review Pointsangadshadmani56No ratings yet

- ACCT2111 Case 2017Document3 pagesACCT2111 Case 2017ArtyomNo ratings yet

- Companies and Identifying Their Current Strengths and WeaknessesDocument2 pagesCompanies and Identifying Their Current Strengths and WeaknessesShahed SharifNo ratings yet

- Final Empirical AnalysisDocument14 pagesFinal Empirical AnalysisOnyango StephenNo ratings yet

- Financial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesFrom EverandFinancial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesNo ratings yet

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationFrom EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationNo ratings yet

- Financial Statement Analysis: Business Strategy & Competitive AdvantageFrom EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Logistics Management Assignment: Team Members NameDocument10 pagesLogistics Management Assignment: Team Members NameKartik AhirNo ratings yet

- Logistics Management Assignment: Team Members NameDocument10 pagesLogistics Management Assignment: Team Members NameKartik AhirNo ratings yet

- 35 & 36, Rajiv Gandhi Infotech Park, Phase - L, MIDC, Hinjawadi, Pune - 411057, India Phone: +91 - 20 - 6652 5000 - Fax: +91 - 20 - 6652 5001Document188 pages35 & 36, Rajiv Gandhi Infotech Park, Phase - L, MIDC, Hinjawadi, Pune - 411057, India Phone: +91 - 20 - 6652 5000 - Fax: +91 - 20 - 6652 5001Kartik AhirNo ratings yet

- Annual Report 2016 17 PDFDocument284 pagesAnnual Report 2016 17 PDFKartik AhirNo ratings yet

- Human Resource Management UNIT 3Document66 pagesHuman Resource Management UNIT 3Kartik AhirNo ratings yet

- Human Resource Management UNIT 1Document50 pagesHuman Resource Management UNIT 1Kartik AhirNo ratings yet

- Human Resource Management UNIT 7Document42 pagesHuman Resource Management UNIT 7Kartik AhirNo ratings yet

- RM VariablesDocument12 pagesRM VariablesKartik AhirNo ratings yet

- Initiatives To Improve The Conditions of Government BanksDocument2 pagesInitiatives To Improve The Conditions of Government BanksKartik AhirNo ratings yet

- Publication 1 Seid MDocument9 pagesPublication 1 Seid Mseid100% (1)

- AI and The Future of FinanceDocument5 pagesAI and The Future of Financesweet rabia brohiNo ratings yet

- Britam Unit Trusts Individual Application FormDocument6 pagesBritam Unit Trusts Individual Application Formmumobenard57No ratings yet

- IB Business & Management HLDocument13 pagesIB Business & Management HLjustin bieberNo ratings yet

- F2 Past Paper - Question06-2002Document8 pagesF2 Past Paper - Question06-2002ArsalanACCANo ratings yet

- Unit 9 Key PremiumDocument4 pagesUnit 9 Key Premiummashanguyen4411No ratings yet

- Pintu SekhDocument1 pagePintu SekhSampa ShilNo ratings yet

- Sap MM Interview Question and AnswersDocument21 pagesSap MM Interview Question and Answerskrishna akulaNo ratings yet

- Multi A SDN BHDDocument15 pagesMulti A SDN BHDMUHAMMAD AZIB ZAKHWAN BIN ZAKARIA (BG)No ratings yet

- Eajournalbg, Journal Manager, FRANCHISING AS A BUSINESS CONCEPT - CHANCE FOR MANY IN SERBIADocument20 pagesEajournalbg, Journal Manager, FRANCHISING AS A BUSINESS CONCEPT - CHANCE FOR MANY IN SERBIAtasyaserbiaNo ratings yet

- CW 2 SolutionDocument4 pagesCW 2 SolutionMtl AndyNo ratings yet

- Session17 - Gender GapDocument3 pagesSession17 - Gender GapRaj DixitNo ratings yet

- House and Land Rent Tax Act 2023 1966Document9 pagesHouse and Land Rent Tax Act 2023 1966Samish DhakalNo ratings yet

- Talent ManagementDocument19 pagesTalent ManagementNiNo ratings yet

- AIESEC Case Study - Pranay SwarupDocument1 pageAIESEC Case Study - Pranay SwarupPranay SwarupNo ratings yet

- How Honda Localizes Its Global Strategy (Fernando)Document3 pagesHow Honda Localizes Its Global Strategy (Fernando)Tu Anh NguyenNo ratings yet

- B Micro HA 3 Problem SetDocument13 pagesB Micro HA 3 Problem SetAzar0% (1)

- Geography Assignment222Document15 pagesGeography Assignment222Elias Berhanu86% (7)

- GE 11 2nd Examination ManalangDocument3 pagesGE 11 2nd Examination ManalangBelinda ViernesNo ratings yet

- CBM 121 Lesson 2Document21 pagesCBM 121 Lesson 2RIJJIE Y�IGO DEVERANo ratings yet

- 2.2 Waste Mitigation StrategiesDocument8 pages2.2 Waste Mitigation StrategiesAishwarya SangalNo ratings yet

- Globank & ConsultantsDocument15 pagesGlobank & ConsultantsSnehashis SenNo ratings yet

- Deutsche Bank (M) BHD V MBF Holdings BHD & Anor (2015) 6 MLJ 310Document50 pagesDeutsche Bank (M) BHD V MBF Holdings BHD & Anor (2015) 6 MLJ 310Qila ZahinNo ratings yet

- Puzzle Ppt-PlayfulDocument14 pagesPuzzle Ppt-PlayfulArvind MishraNo ratings yet

- Rahamans ResumeDocument2 pagesRahamans ResumeAndrew ReedNo ratings yet

- Definition of Human Resource ManagementDocument29 pagesDefinition of Human Resource ManagementQamar AbbasNo ratings yet