Professional Documents

Culture Documents

Practice Makes Perfect

Uploaded by

Michael AninoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Practice Makes Perfect

Uploaded by

Michael AninoCopyright:

Available Formats

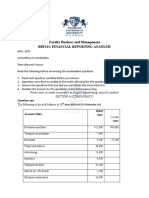

Practice Set

EJ Manufacturing Corp is a retailer of Softdrinks with a sales price of P30 and uses perpetual system of

inventory. It started its operations on January 1, 2O19. The company's unadjusted trial balance as of

December 31,2O19 is as follows:

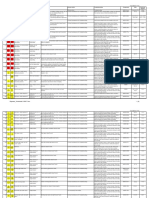

Unadjusted Trial Balance

ACCOUNT TITLES Debit Credit

Cash and Cash Equivalents 4,950,000.00

Trade and Other Receivables 2,575,000.00

Merchandise Inventory 2,745,000.00

Premiums - glass 450,000.00

Prepayments 565,300.00

Property and Equipment 6,236,834.00 12 years

Accumulated Depreciation 344,000.00 3 years

Right of Use Asset 1,352,000.00 3.0373

Accumulated Depreciation 135,200.00

Trade and Other Payables 1,205,000.00

Notes Payable 4,000,000.00 2500000

Discount on Note Payable 811,136.00 0.7118 12%

Lease Liability 1,067,200.00

Bonds Payable 2,000,000.00 5 years 10% 200,000

Premium on Bonds Payable 86,596.00

Share Capital, 10o par 6,000,000.00

Share Premium 500,000.00

Retained Earnings 1,800,000.00

Sales 12,000,000.00

Cost of Sales 5,200,000.00

Salaries and Wages 1,552,000.00

Depreciation Expense 350,000.00

Light and Water 228,500.00

Insurance Expense 200,000.00

Repairs and Mainenance 340,550.00

Taxes and Licenses 144,500.00

Representation Expense 344,400.00

Office Supplies Expense 234,700.00

SSS, PHIC, HDMF Premiums Expense 403,000.00

Advertising Expense 230,000.00

Premium Expense 120,000.00

Interest Expense 105,076.00 ###

TOTAL 29,137,996.00 29,137,996.00

EJ Co. started a promotional program in the current year. For every 20 empty cans

returned, customers receive a glass with a cost of P15 The entity estimated that only

80% of the cans reaching the market will be redeemed and the entity already

distributed 50% of the expected number of premiums to be distributed.

On April 1, 2019, EJ Co. issued 3-year 12% bonds with face amount of P2,000,000.

Interest is payable semiannually April 1 and October 1 and it is said to have an

effective interest rate of 10%.. The bonds were issued for 2,101,520.

On January 1, 2018, EJ Co. acquired a tract of land for P5,250,000. The entity paid

P1,250,000 down and signed a noninterest bearing note for the balance which is due

on January 1, 2021. The prevailing interest rate for this type of nore was 12%. Use

PVF with 4 decimal places.

On January 1, 2018, EJ Co. leased machinery from My Co. for a 10-year period. The

useful life of the asser is 20 years. Equal annual payments under the lease are

P200,000 and are due on January 1 of each year started January 1, 2018. The present

value on January 1, 2016 of the lease payments over the lease term discounted at

implicit interest rate of 10% was P1,352,000. The lease provides for a transfer of

title to the lessee upon expiration of the lease term.

The following equity transactions were incurred during the current year but not

reflected in the books of EJ Co.:

a. On January 26, the entity reacquired for cash 5,000 shares for P110 per

share.

b. On April 4, the entity sold for cash 3,000 shares of treasury for P140 per

share.

c. On June 1, the entity declared a cash dividend of P20 per share,

payable July 5, to shareholders of record on July 1.

d. On November 1, the entity declared a 2 for 1 split and changed the par

value from P100 to P50. On November 20, shares were issued for the

share split.

e. On December 5, 4000 shares were issued in exchange for a second

hand equipment. The equipment originally cost P400,000 was carried by

the preevious owner at a carrying amount of P200,000 and was fairly

valued at P260,000

You might also like

- Johnson and Vanderhoef PMHNP Certification Review ManualDocument451 pagesJohnson and Vanderhoef PMHNP Certification Review ManualSoojung Nam93% (14)

- Instant Download Biology Today and Tomorrow Without Physiology 5th Edition Starr Test Bank PDF Full ChapterDocument19 pagesInstant Download Biology Today and Tomorrow Without Physiology 5th Edition Starr Test Bank PDF Full Chapterjesselact0vvk100% (10)

- Stone Cold (Puffin Teenage Fict - Robert SwindellsDocument148 pagesStone Cold (Puffin Teenage Fict - Robert SwindellsDaniel PardoNo ratings yet

- Quizzer - Financial Accounting ProcessDocument8 pagesQuizzer - Financial Accounting ProcessLuisitoNo ratings yet

- Nptel Big Data Full Assignment Solution 2021Document36 pagesNptel Big Data Full Assignment Solution 2021Sayantan Roy100% (6)

- 10 FS Analysis Sample Exam Discussion KEYDocument10 pages10 FS Analysis Sample Exam Discussion KEYrav danoNo ratings yet

- Act1111 Final ExamDocument7 pagesAct1111 Final ExamHaidee Flavier SabidoNo ratings yet

- Code Fig 1. Fig 2. Description Condition Limits Vehicle Drivers Action Troubleshooting Component Pins Electrical DiagramDocument8 pagesCode Fig 1. Fig 2. Description Condition Limits Vehicle Drivers Action Troubleshooting Component Pins Electrical DiagramIvan ErmolaevNo ratings yet

- Practice ProblemDocument9 pagesPractice ProblemMichael AninoNo ratings yet

- Worksheet 5 NMIMSDocument4 pagesWorksheet 5 NMIMSvipulNo ratings yet

- Basic Accounting Mock PrelimsDocument4 pagesBasic Accounting Mock Prelimshadassah VillarNo ratings yet

- Financial Analysis ProblemDocument16 pagesFinancial Analysis ProblemShreyashi DasNo ratings yet

- Review 2 Set K Problem 1Document3 pagesReview 2 Set K Problem 1Marinel AbrilNo ratings yet

- Chapter-1 Homework Basic Concepts Part 1Document4 pagesChapter-1 Homework Basic Concepts Part 1Kenneth Christian WilburNo ratings yet

- FM Model - Coffee ParlorDocument11 pagesFM Model - Coffee ParlorPRITESH PATILNo ratings yet

- ScheduleDocument10 pagesScheduleKusuma MNo ratings yet

- Accounts Project 2Document17 pagesAccounts Project 2navya almalNo ratings yet

- Assignment No 1 POFDocument4 pagesAssignment No 1 POFFARAH -No ratings yet

- 3rd Year Diagnostic TestDocument11 pages3rd Year Diagnostic TestRaizell Jane Masiglat CarlosNo ratings yet

- P1 Quali 2017Document13 pagesP1 Quali 2017Red Christian PalustreNo ratings yet

- 027 Practice Test 09 Accounting Test Solution Subjective Udesh RegularDocument6 pages027 Practice Test 09 Accounting Test Solution Subjective Udesh Regulardeathp006No ratings yet

- ACCT1200 (20) Additional P&L Account and Balance Sheet QuestionDocument2 pagesACCT1200 (20) Additional P&L Account and Balance Sheet QuestionTaleh HasanzadaNo ratings yet

- Q2: (8+8 16marks) Debit BalancesDocument2 pagesQ2: (8+8 16marks) Debit BalancesMaryam EhsanNo ratings yet

- Competency Exam Practice-211Document5 pagesCompetency Exam Practice-211marites yuNo ratings yet

- Profits Tax Computation QuestionDocument2 pagesProfits Tax Computation Question何健珩No ratings yet

- Pakistan Institute of Public Finance Accountants: Financial AccountingDocument27 pagesPakistan Institute of Public Finance Accountants: Financial AccountingMuhammad QamarNo ratings yet

- Memory Enhancement ProgramDocument8 pagesMemory Enhancement ProgramLhowellaAquinoNo ratings yet

- Chapter 1 11 IA3Document10 pagesChapter 1 11 IA3ZicoNo ratings yet

- SPREADSHEET APPLICATIONS - PEA 2021-2022 SESSION - Case StudiesDocument8 pagesSPREADSHEET APPLICATIONS - PEA 2021-2022 SESSION - Case StudiesOladapo Oluwakayode AbiodunNo ratings yet

- Financial Accounting Cat 1 JonathanDocument14 pagesFinancial Accounting Cat 1 JonathanjonathanNo ratings yet

- 2ND Year QualiDocument4 pages2ND Year QualiMark Domingo MendozaNo ratings yet

- Quiz 2 Cashflows Final PDFDocument4 pagesQuiz 2 Cashflows Final PDFChito MirandaNo ratings yet

- LatihanDocument7 pagesLatihanDeny WilyartaNo ratings yet

- Cash Flow Statement Cash AnalysisDocument21 pagesCash Flow Statement Cash Analysisshrestha.aryxnNo ratings yet

- Buscom SeatworkDocument3 pagesBuscom SeatworkTintin AquinoNo ratings yet

- ACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationDocument2 pagesACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationRyan PedroNo ratings yet

- ACCTBA1 - Quiz 3Document2 pagesACCTBA1 - Quiz 3Marie Beth BondestoNo ratings yet

- Auditing Problem Assignment Lyeca JoieDocument12 pagesAuditing Problem Assignment Lyeca JoieEsse ValdezNo ratings yet

- FINANCIALREPORTINGand Analysis ExamDocument7 pagesFINANCIALREPORTINGand Analysis ExamKizito KizitoNo ratings yet

- PROBLEM 1. INTERMEDIATE ACCTNG (JFP)Document6 pagesPROBLEM 1. INTERMEDIATE ACCTNG (JFP)Justine FloresNo ratings yet

- 286practice Questions - AnswerDocument17 pages286practice Questions - Answerma sthaNo ratings yet

- Additional Tutorial Question-Company AccountDocument3 pagesAdditional Tutorial Question-Company AccountmaiNo ratings yet

- Assignment For Accountancy Taxation, BBS 1st Yr, NOU, 2080-2-24Document1 pageAssignment For Accountancy Taxation, BBS 1st Yr, NOU, 2080-2-24Rojila luitelNo ratings yet

- Cash Flow Tutorial QnsDocument13 pagesCash Flow Tutorial QnsCristian Renatus100% (1)

- Accounting Class Test 1.: DATE:10 APRIL, 2020 TIME: 1:hours MARKS: 30 Total No. of Questions: 3 Total No. of Pages: 03Document3 pagesAccounting Class Test 1.: DATE:10 APRIL, 2020 TIME: 1:hours MARKS: 30 Total No. of Questions: 3 Total No. of Pages: 03Mandeep KaurNo ratings yet

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision Questionskelvinmunashenyamutumba100% (1)

- Acctg34 Franchise Pret. Remaining Items AkeyDocument6 pagesAcctg34 Franchise Pret. Remaining Items AkeyDonna Mae SingsonNo ratings yet

- Class Activity 1 Cash Flow StatementDocument2 pagesClass Activity 1 Cash Flow StatementHacker SKNo ratings yet

- Faculty Business and Management Bbf211: Financial Reporting AnanlsisDocument7 pagesFaculty Business and Management Bbf211: Financial Reporting AnanlsisMichael AronNo ratings yet

- Ias 1 - Questions..Document8 pagesIas 1 - Questions..Timothy KawumaNo ratings yet

- Coffee Shop Business Plan - Financial PL PDFDocument18 pagesCoffee Shop Business Plan - Financial PL PDFSamenNo ratings yet

- 2021 Unit 7 Tutorial QuestionsDocument6 pages2021 Unit 7 Tutorial Questions日日日No ratings yet

- 2021 Business AccountingDocument5 pages2021 Business AccountingVISHESH 0009No ratings yet

- Problems - Cash FlowDocument5 pagesProblems - Cash FlowKevin JoyNo ratings yet

- Question BankDocument31 pagesQuestion BankmahendrabpatelNo ratings yet

- Assignemnt Analysis of FS 03.22.2021Document3 pagesAssignemnt Analysis of FS 03.22.2021Eva Ruth MedilloNo ratings yet

- FINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)Document2 pagesFINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)ISABELA QUITCONo ratings yet

- BSA 314 Module 4 Output, Atillo Lyle CDocument10 pagesBSA 314 Module 4 Output, Atillo Lyle CJeth MahusayNo ratings yet

- ReviewerDocument4 pagesReviewerDrie LimNo ratings yet

- Review - SFP To Interim ReportingDocument3 pagesReview - SFP To Interim ReportingAna Marie IllutNo ratings yet

- Gujarat Technological UniversityDocument6 pagesGujarat Technological UniversitymansiNo ratings yet

- Cash Flow QuestionsDocument6 pagesCash Flow QuestionsBhakti GhodkeNo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- CDocument3 pagesCPraveen KumarNo ratings yet

- Manual Monitor Qbex 2216SwDocument16 pagesManual Monitor Qbex 2216SwJose AlfonsoNo ratings yet

- 01-ASME B16 Series - READ ME - Table of ContentsDocument1 page01-ASME B16 Series - READ ME - Table of ContentstahirkhaliqueNo ratings yet

- Absolute Sale - Dumapit To ZernaDocument3 pagesAbsolute Sale - Dumapit To ZernaMegan HerreraNo ratings yet

- Topic: Restaurants: Listening Gap FillDocument2 pagesTopic: Restaurants: Listening Gap FillKim DungNo ratings yet

- Kelken US Metric Chart ASTM F1554 Grade 36Document1 pageKelken US Metric Chart ASTM F1554 Grade 36muathNo ratings yet

- Practice Questions On Parajumble: Verbal Test Questions and AnswersDocument4 pagesPractice Questions On Parajumble: Verbal Test Questions and AnswersRICHARDSIBANDANo ratings yet

- MUN Position Paper - EgyptDocument2 pagesMUN Position Paper - EgyptpatNo ratings yet

- X6 RM-551 RM-552 RM-559 SM L3&4 PDFDocument230 pagesX6 RM-551 RM-552 RM-559 SM L3&4 PDFElmer Leodan Rojas CachayNo ratings yet

- SSR 2022-23Document619 pagesSSR 2022-23BASADNo ratings yet

- PSS1 0109Document4 pagesPSS1 0109Joanna BaileyNo ratings yet

- Updated On 27 September 2018: Government of The People'S Republic of BangladeshDocument73 pagesUpdated On 27 September 2018: Government of The People'S Republic of BangladeshSAE/SO Damudya MahbubNo ratings yet

- The Effect of Study Preparation On Test Anxiety AnDocument7 pagesThe Effect of Study Preparation On Test Anxiety AnjuneldelmundoNo ratings yet

- Rhino Level 1 Training ManualDocument278 pagesRhino Level 1 Training Manualpopious_j_pitoNo ratings yet

- Exam ManualDocument48 pagesExam ManualNilakshi Barik MandalNo ratings yet

- Sales Case Digest Part 2Document6 pagesSales Case Digest Part 2lchieSNo ratings yet

- What Is PLC? History of PLC Major Components of PLC Ladder Logic Example of Starting and Stopping of A Motor Disadvantages ApplicationDocument7 pagesWhat Is PLC? History of PLC Major Components of PLC Ladder Logic Example of Starting and Stopping of A Motor Disadvantages ApplicationyashNo ratings yet

- Construction Logbook Rev. 0Document3 pagesConstruction Logbook Rev. 0Christian - Ian FarnacioNo ratings yet

- Play Passport USADocument3 pagesPlay Passport USAKaprice Dal CerroNo ratings yet

- Quiz FinalsDocument2 pagesQuiz Finalshoonie.parkz27No ratings yet

- How To Prevent Glass Mildew and MoldDocument3 pagesHow To Prevent Glass Mildew and MoldHAN HANNo ratings yet

- Risk & Return NCFMDocument41 pagesRisk & Return NCFMworld4meNo ratings yet

- Types of RoutingDocument34 pagesTypes of RoutingmulukenNo ratings yet

- Manuscript Centrifugal Pumps FinalDocument9 pagesManuscript Centrifugal Pumps FinalRaymond BaldelovarNo ratings yet

- Greycon Customer PDFDocument4 pagesGreycon Customer PDFSankar MNo ratings yet