Professional Documents

Culture Documents

Chapter 8 Solutions: Solutions To Questions For Review and Discussion

Uploaded by

Albert CruzOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 8 Solutions: Solutions To Questions For Review and Discussion

Uploaded by

Albert CruzCopyright:

Available Formats

Chapter 8 Solutions

Solutions to Questions for Review and Discussion

1. Profit is an overall measure of how well an organization is doing. A variance between actual

profit and planned profit is an indicator that something changed during the period. The causes

of such a variance, the things that changed, are related to the various elements that make up

net income: revenues, cost of goods sold, and operating expenses. The significance of the

analysis comes in identifying the causes, investigating ways to correct those causes, and

making the necessary changes.

2. A standard cost system works best when an organization has standard products, services, or

repetitive operations and when management controls the factors comprising a standard cost.

3. A standard cost for a product consists of a price standard and a quantity standard. The price

standard is the price for materials, the rate for labor, and the rate for factory overhead. The

quantity standard is the amount for materials, time for labor, and activity or volume for factory

overhead.

4. The five major categories of advantages for a standard cost system are cost control, cost

management, decision making, recordkeeping costs, and inventory valuation. These

advantages are important for any organization.

Cost control is comparing the actual performance with the standard performance, analyzing

variances to identify controllable causes, and taking action to correct or adjust future planning

and control. Standards become the benchmark for measurement.

Cost management emphasizes establishing the level of costs that becomes the benchmark for

measuring performance. As standards are set and periodically reviewed, operations can be

analyzed to identify waste and inefficiency and to eliminate their sources. A standard cost

system creates an environment in which people become cost conscious, always looking for

improvements in the process.

If standards are set at currently attainable levels, the standard costs are useful in making many

types of decisions. Because an analysis is the basis for setting the standard costs, managers

need not perform new analyses for each decision.

A standard cost system saves recordkeeping costs. The main elements here are that all

inventories are stated at a standard cost and that no concern is given to inventory cost

methods such as specific identification, FIFO, LIFO, moving average, or weighted average.

A standard cost system records the same costs for physically identical units of materials and

products. Therefore, standards provide for a more rational cost in valuing inventories.

5. Management by exception emphasizes those weak areas that require management's attention.

The main advantage is that management need not investigate insignificant variances. The

disadvantage is related to the people managed. if a worker, for example, is ignored when

operating according to the standard and is noticed only when something is wrong, the worker

may become resentful and perform less satisfactorily. Without recognition for good work, the

worker becomes discontented; and this discontent may spread throughout the organization

with a loss in both morale and productivity.

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-1

6. In setting standards, care must be taken to ensure that the level of standard selected will tend

to motivate the employees. In some situations, a very challenging standard may motivate

employees to achieve better performance. In other situations, a very challenging standard

may discourage employees. Hence, the abilities and attitudes of employees must be

evaluated carefully to set standards that can be attained with reasonable effort; a standard

should not be too difficult or too easy. Hence, the quality of the standard relates to how

employees are motivated to succeed.

7. A tight standard will give the lowest unit standard cost because tight means waste and

inefficiency have been eliminated or reduced to a point where the employee is really

challenged to meet that standard.

8. A key to knowing when to review standards is to identify changes taking place that outdate the

existing standards. Examples of such changes include:

Increase or decrease in the price levels of specific materials and supplies.

Change in payment plan or wage schedule.

Modification of material type or specification.

Acquisition of new equipment or disposition of old equipment.

Modification of operations or procedures.

Addition or deletion of product lines.

Expansion or contraction of facilities.

Change in management policies that affect the amount of costs and the way costs are

accumulated and identified with activities, operations, and products.

Increased experience of employees.

9. A standard cost sheet is a summary of standards set for materials, labor, and overhead. Such

a sheet reflects the cost of each category of direct materials used, of each direct labor

operation employed, and of all overhead tasks, operations, processes, and support functions

applied to a unit of final product.

A standard cost sheet is important because it greatly facilitates the accounting for costs as

products flow from work in process inventory to finished goods inventory and later to cost of

goods sold.

10. A materials price variance is the difference between the prices at which materials are acquired

and the prices established in the standards. Its calculation is the actual quantities purchased

multiplied by the difference between actual and standard prices. A favorable materials price

variance exists when the actual price is less than the standard price; an unfavorable variance

occurs when the actual price exceeds the standard price.

11. Accounts Payable is credited with the actual price times the actual quantities purchased.

Materials Inventory is charged with the standard price times the actual quantities purchased.

The difference goes into a materials price variance account.

12. Although many causes for a materials price variance pertain to any given situation, the

common sources are:

Random fluctuations in market prices.

Materials substitutions.

Market shortages or excesses.

Purchasing from vendors other than those offering the terms used in the standard.

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-2

Purchasing higher or lower quality materials.

Purchasing in nonstandard or uneconomical quantities.

Changes in the mode of transportation.

Changes in the production schedule that result in rush orders or additional materials.

Unexpected price increases.

Fortunate buys.

Failure to take cash discounts.

13. A materials usage variance is the difference between the materials removed from materials

inventory for production and the quantity of materials allowed for production. Its calculation is

the standard price times the difference between the actual quantities used and the standard

quantities allowed.

14. As materials are removed from the storeroom, Materials Inventory is credited with the standard

price times the actual quantities removed; and Work in Process is charged with the standard

price times the standard quantities allowed. The difference goes into a materials usage

variance account.

15. To explain a materials usage variance, investigate the elements that make up the quantity

standard and the specific situation. Examples of common causes are:

Changes in product specifications.

Materials substitutions.

Handling of materials during movement and processing.

Use of workers different from what the standards required for processing materials.

Machine settings operating at nonstandard levels.

Waste.

Pilferage.

16. The purchasing department is usually charged with the responsibility for price variances.

Ordinarily, materials usage variances are chargeable to the various production departments

using materials.

17. Inferior materials may be purchased at so-called bargain prices that are well below standard

prices. The inferior grade of materials may be unsuitable for production with the result being

that more materials are used to accomplish good production.

18. The labor rate variance can be computed by multiplying the actual number of direct labor hours

by the difference between the actual labor rate per hour and the standard labor rate per hour.

The labor efficiency variance can be computed by multiplying the standard labor rate per hour

by the difference between the actual direct labor hours used and the standard direct labor

hours allowed for good production.

19. The labor rate variance:

70 hours x ($10 - $9) = $70 unfavorable per person

$70 x 3 persons = $210 total unfavorable labor rate variance

The assignment of 3 people for 70 hours each at an unfavorable labor rate variance of $1 per

hour results in overspending of $210.

20. Labor rate variances occur for a number of reasons. The common ones are:

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-3

Changes in the worker mix.

Substituting a worker with higher pay for a worker with lower pay or vice versa.

Changes in shift differentials.

Increases or decreases in the amount of overtime worked.

Changes in payroll taxes.

Changes in fringe benefits.

21. The common causes for a labor efficiency variance include:

Use of lower-skilled or higher-skilled workers.

Effects of the learning curve.

Lower-quality or higher-quality materials.

Changes in production methods.

Changes in production scheduling.

Installation of new equipment.

Poorly maintained equipment or machine malfunction.

Delays in routing work, materials, tools, or instructions.

Insufficient training, incorrect instructions, or worker dissatisfaction.

22. The interrelationship is based on the assumption that workers are paid a rate per hour and

must produce so much good product per hour. A change of workers can affect both the rate

and the production per hour. For example, a worker is having difficulties working on a

particular machine and is taking more time than standard to complete the product. The

supervisor shifts a more skilled, higher-paid worker to the machine. The higher paid worker

causes the rate variance to go unfavorable. However, the worker's efficiency can reduce an

already unfavorable efficiency variance and can even create a favorable one.

23. Workers use materials in production. Any event that causes a worker to increase materials

usage will cause a shortage in the storeroom. More materials must be ordered immediately if

production is to remain on schedule. Under these circumstances, special purchases usually

mean uneconomical buys-prices are higher.

For example, a worker starts the shift fatigued and stressed. His lack of concentration results

in higher waste and more time, causing unfavorable materials usage and labor efficiency

variances. Because more materials are needed, the manager requisitions additional materials

from the storeroom. The storekeeper now does not have enough of the required materials.

Consequently, purchasing is asked to place a rush order so that production can proceed with

minimum delay. The rush order will increase the purchasing costs and cause an unfavorable

materials price variance.

24. The five major considerations in developing factory overhead rates are:

(1) Cost elements.

(2) Measure of activity.

(3) Capacity level.

(4) Cost behavior.

(5) Plant-wide rates versus rates for smaller cost groupings.

Cost elements refer to the costs that are included in factory overhead. A measure of activity

represents the factor that best expresses how costs change as volume increases or

decreases. Capacity level is the anticipated level of activity for purposes of charging factory

overhead costs to products and services. The four basic capacity levels are theoretical,

practical, normal, and expected actual.

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-4

Cost behavior refers to the way costs change as the measure of activity increases or

decreases. The behavior of each cost category as variable, semivariable, or fixed is important

because management plans for and controls variable costs differently than it plans for and

controls fixed costs. The consideration for smaller cost groupings versus plant-wide rates

becomes important for accurately tracing costs to products and services; this minimizes

distortions that often result when large cost pools are used.

25. Underapplied or overapplied factory overhead can be analyzed into budget and capacity

variances in two steps. First, prepare a flexible budget for the actual units produced. The

budget variance is the difference between the actual factory overhead costs and the flexible

budget costs. The capacity variance is the difference between the flexible budget costs and

the applied costs.

26. A budget variance is the difference between actual overhead costs and the flexible budget for

actual units produced. The major categories of causes of a budget variance are:

Price changes in the individual cost components making up overhead costs.

Quantity changes in individual items within overhead cost components, probably in the

variable overhead costs

Estimation errors in segregating variable and fixed costs.

Any overhead costs that are incurred or saved because of inefficient or efficient use of the

underlying activity measure.

27. A capacity variance is the difference between the flexible budget for the actual units produced

and the amounts applied to work in process inventory. Because the variable costs are the

same for the flexible budget and the amounts applied to actual units, the capacity variance is

the difference between the budgeted fixed overhead costs and the applied fixed overhead

costs. Therefore, the capacity variance is the amount of budgeted fixed overhead not applied

(unfavorable) or the amount applied in excess of the budgeted fixed costs (favorable). A

capacity variance occurs, then, if actual production differs from the capacity level used to

calculate the standard fixed overhead rate.'

28. Ordinarily, a capacity variance is considered to be uncontrollable. The company, through no

fault of its own due to conditions in the market, may not be able to produce and sell at normal

capacity. However, a portion of the capacity variance may be controllable. If the sales division

did not make its sales quota, or if the production division did not schedule properly to meet

sales commitments, managers should be held accountable for the resulting capacity variance.

29. A process cost system requires the computation of equivalent units for each element of cost

against which standard costs are applied. Although equivalent units may be needed in a job

cost system, they are more commonly used in a process cost system. The standard costs for

a process cost system are accumulated by department instead of by job.

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-5

Solutions to Exercises

8-1. Standard cost sheet for a “black box:”

Direct materials:

Iron (6 sheets at $7 per sheet) $42.00

Copper (4 spools at $3.50 per spool) 14.00 $56.00

Direct labor (4 hours at $6 per hour) 24.00

Factory overhead:

Variable (4 hours at $3 per hour) $12.00

Fixed (4 hours at $2 per hour) 8.00 20.00

Standard cost per unit $100.00

8-2.

(1) Materials price variance:

Actual price x actual units purchased:

$2.91 x 150,000 $436,500

$3.15 x 30,000 94,500 $531,000

Standard price x actual units purchased:

$3 x 180,000 540,000

Favorable materials price variance ($9,000)

(2) Materials usage variance:

Standard price x actual units used:

$3.00 x 180,000 $540,000

Standard price x standard units allowed:

$3 x 178,500 535,500

Unfavorable materials price variance $4,500

(3) T-account flow of cost:

Materials Inventory Accounts Payable

(a) 540,000 | (b) 540,000 | (a) 531,000

Materials Price Variance Completed Jobs

| (a) 9,000 (b) 535,500 |

Materials Usage Variance

(b) 4,500 |

(a) Purchase of materials

(b) Usage of materials

8-3. Labor Rate Variance:

1,447 x ($18.60 – $19.00) = $579 Favorable

Labor Efficiency Variance:

$19 x [1,447 – 550 (2.5)] = $19 x (1,447 – 1,375) = $1,368 Unfavorable

8-4.

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-6

(1) Materials price variance:

Actual cost of materials Y600,000

Standard cost (50,000 materials x Y11) 550,000

Unfavorable materials price variance Y50,000

(2) Units of product manufactured:

Y33,000 materials usage variance ÷ Y11 per part = 3,000 parts materials usage variance

46,000 parts used – 3,000 parts materials usage variance = 43,000 actual product units

Standard product units (46,000 ÷ 5) 9,200

Unfavorable product unit variance (3,000 ÷ 5) 600

Actual units of product made (43,000 ÷ 5) 8,600

(3) Total materials allowed for production = 8,600 x 5 = 43,000 materials units

(4) Charges to Work in Process:

The actual units produced times the standard allowed per unit, times the standard price

equals the amount charged to Work in Process:

43,000 x Y11 = Y473,000

8-5. Materials price variance = 23,000 x ($1.21 – $1.26) = $1,150 Favorable

Materials usage variance = $1.26 x [23,000 - (20)(1,000)] = $1.26 x 3,000

= $3,780 Unfavorable

8-6.

(1) Standard quantity allowed:

Materials usage variance = Standard price x (Actual quantity used – Standard quantity allowed)

$384 unfavorable = $3.20 x (1,320 – Standard quantity allowed

= $4,224 – ($3.20 x Standard quantity allowed)

Standard quantity allowed = ($4,224 - $384) $3.20

= $3,840 $3.20

= 1,200 kilograms

(2) Materials price variance:

Actual price x actual quantity purchased $8,580

Standard price x actual quantity purchased:

$3.20 x 2,600 kilograms 8,320

Unfavorable materials price variance $(260)

(3) T-account flow of cost:

Materials Inventory Accounts Payable

(a) 8,320 | (b) 4,224 | (a) 8,580

Materials Price Variance Work in Process Inventory

(a) 260 | (b) 3,840 |

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-7

Materials Usage Variance

(b) 384 |

(a) Purchase of materials

(b) Usage of materials

8-7.

(1) Standard labor cost per assembly (old standard):

4 employees x 38 hours per week = 152 labor hours per week

2,280 assemblies 152 labor hours = 15 assemblies per hour

$12 labor hour rate 15 assemblies per hour = $0.80 standard labor cost per assembly

(2) Standard labor cost per assembly (new standard):

$12 labor hour rate 20 assemblies per hour = $0.60 standard labor cost per assembly

(3) Actual labor cost per assembly this past week:

152 hours x $12 per hour 2,000 (2,000 – 500 rejected assemblies)

= $1,824 2000

= $0.912 actual cost per assembly

(4) While it may be possible to make 20 units per labor hour, it may not be possible to operate at

that level on a sustained basis. The workers may have been pressed, resulting in more

wasted materials and rejected units.

8-8.

Standard wage rate = $24/2 = $12 per hour

Standard hours = 675 x 2 = 1,350 hours

Actual labor cost = 1,400 x $13 = $18,200

Standard labor cost = $12 x 1,350 = $16,200

Labor rate variance = 1,400 x ($13 - $12) = $1,400 unfavorable

Labor efficiency variance = $12 x (1,400 – 1,350) = $600 unfavorable

T-accounts cost flow:

Wages Payable Work in Process Inventory

| 18,200 16,200 |

Labor Rate Variance Labor Efficiency Variance

1,400 | 600 |

8-9.

(1) Labor efficiency variance:

Actual labor hours 2,150

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-8

Standard labor hours (263,000 100) 2,630

Difference in hours 480

Standard labor rate per hour x $10

Favorable labor efficiency variance $ 4,800

(2) The manager might fear that standards would be revised by top management reflecting a

larger required output per hour.

8-10.

(1) Labor rate variance:

Actual rate x Actual hours:

$5.00 x 60,000 $300,000

$7.50 x 10,000 75,000 $375,000

Standard rate x Actual hours:

$5.00 x 70,000 350,000

Unfavorable labor rate variance ($25,000)

(2) Labor efficiency variance:

Standard rate x Actual hours: $5.00 x 70,000 $350,000

Standard rate x Standard hours allowed $5.00 x (550,000 8) 343,750

Unfavorable labor efficiency variance: ($6,250)

(3) T-accounts cost flow:

Wages Payable Income Taxes Withheld

| 365,000 | 105,000

FICA Taxes Payable Employee Voluntary Withholdings

| 42,000 | 4,000

Work in Process Inventory

343,750 |

Factory Overhead Labor Rate Variance

141,000 | 25,000 |

Labor Efficiency Variance

6,250 |

8-11.

Labor rate variance + $7,000 favorable = $13,000 unfavorable

Labor rate variance = $20,000 unfavorable

$20,000 = Actual hours x ($120 – $110)

Actual hours = $20,000 $10

Actual hours = 2,000

8-12.

(1) Standard cost of making a delivery:

Variance cost per delivery (rate of one delivery per hour) $12

Fixed cost per delivery ($240,000 60,000 deliveries) 4

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-9

Standard cost per delivery (also per hour) $16

(2) Costs applied or charged to deliveries:

$16 per delivery x 63,000 deliveries $1,008,000

(3) Budget variance:

Actual overhead costs:

Variable costs $748,000

Fixed costs 240,000 $988,000

Flexible budget at 63,000 deliveries:

Variable costs ($12 x 63,000 hours) $756,000

Fixed costs 240,000 996,000

Favorable budget variance $8,000

(4) Capacity variance:

Flexible budget at 63,000 deliveries:

Variable costs ($12 x 63,000 hours) $756,000

Fixed costs 240,000 $996,000

Applied costs:

Variable costs ($12 x 63,000 hours) $756,000

Fixed costs ($4 x 63,000 hours) 252,000 1,008,000

Favorable capacity variance $12,000

8-13.

(1) Amount of under/over applied overhead:

Overhead rates:

Variable ($320,000 80,000 machine hours) $4 per hour

Fixed ($480,000 80,000 machine hours) 6 per hour

$10 per hour

Actual overhead costs:

Variable costs $287,000

Fixed costs 475,000 $762,000

Applied overhead:

Variable costs ($4 x 70,000) $280,000

Fixed costs ($6 x 70,000) 420,000 700,000

Under applied overhead ($62,000)

(2) Budget variance:

Actual overhead costs:

Variable costs $287,000

Fixed costs 475,000 $762,000

Flexible budget:

Variable costs [$4 x (420,000 6)] $280,000

Fixed costs 480,000 760,000

Unfavorable budget variance ($2,000)

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-10

(3) The major causes of a budget variance are:

Price changes in the individual cost components comprising overhead costs.

Quantity changes in individual items within overhead cost components, probably in the

variable overhead costs.

Estimation errors in segregating variable and fixed costs.

Any overhead costs that are incurred or saved because of inefficient or efficient use of the

underlying activity measure.

(4) Capacity variance:

Flexible budget:

Variable costs [$4 x (420,000 6)] $280,000

Fixed costs 480,000 $760,000

Applied overhead:

Variable costs ($4 x 70,000) $280,000

Fixed costs ($6 x 70,000) 420,000 700,000

Unfavorable capacity variance ($60,000)

(5) Reasons for a capacity variance:

A capacity variance occurs anytime the production level used to calculate the fixed overhead

rate differs from the actual production level. Therefore, the causes of a capacity variance are

things that slow down production or increase productivity so that the plan can be exceeded.

Common examples are:

Sales demand does not absorb production.

Excessive machine downtime.

Inefficient production scheduling.

Greater than planned efficiency or productivity.

Excessive use of unskilled workers for skilled tasks.

Natural disasters, such as floods or tornadoes.

8-14.

(1) $3,762 = SP x (330) (5)

SP = $2.28

(2) 800 = $2.28 (AQU – 1,650)

AQU = 2,001

(3) MPV = 2,001 ($6,600 3,000 – $2.28) = $160 favorable

8-15.

(1) Fixed overhead budget last year:

Fixed overhead charged (applied) to patients $630,000

Unfavorable capacity variance 350,000

Budgeted fixed overhead $980,000

(2) Fixed overhead rate per patient:

$630,000 fixed overhead applied 9,000 patients = $70 fixed overhead rate per patient

$70 x 5 patients per hour = $350 per hour

(3) Normal volume for patients:

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-11

$980,000 budgeted fixed overhead $70 per patient = 14,000 patients

(4) If 12,000 patients were processed, the capacity variance would equal $140,000 unfavorable

[$70 x (14,000 – 12,000)]. Therefore, the capacity variance would be smaller at 12,000

patients.

8-16.

(1) Cumulative average hours per unit:

Cumulative Cumulative

Units Per Number of Hours Per Cumulative Average

Batch Units Batch Hours Hours Per Unit

500 500 10,000 10,000 20

500 1,000 4,000 14,000 14

1,000 2,000 5,600 19,600 9.8

(2) The learning process is completed with cumulative average hours per unit of 9.8. The last

batch of 1,000 units was completed in 5,600 hours. Hence, subsequent batches should be

completed at an average of 5.6 hours per unit (5,600 1,000). The expected labor cost per

unit will be $112 (5.6 x $20).

8-17. Gain or loss on proposal:

Cost of materials: $30 per completed unit x 97% x 7 units = $203.70

Cost of labor:

Cumulative Cumulative

Number of Hours Per Cumulative Average

Units Units Unit Hours Hours Per Unit

1 1 50 50 50

1 2 30 80 40

2 4 24 128 32

4 8 19.2 204.8 25.6

Cumulative hours for 8 units 204.8

Total hours for 1 unit 50.0

Cumulative hours for 7 units 154.8

Hourly rate x $10

Labor cost $1,548

Gain or loss on proposal:

Materials $203.70

Labor 1,548.00

Variable overhead ($2 x 154.8 hours) 309.60

$2,061.30

Proposal price 2,000.00

Loss on proposal ($61.30)

Fixed overhead was not included because these costs have already been incurred and this

order would not change the level of fixed costs.

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-12

8-18.

(1) and (2)

Calculation of underapplied/overapplied overhead:

Overhead rates per unit:

Variable costs J$10

Fixed costs (J$100,000 25,000 units) 4

Total overhead rate J$14

Overhead rates per machine hour:

Variable costs (J$10 2 hours) J$5

Fixed costs (J$4 2 hours) 2

Total overhead rate J$7

Variable Fixed Total

Actual overhead J$230,000 J$120,000 J$350,000

Applied overhead:

J$10 x 20,000 units 200,000 200,000

J$4 x 20,000 units 80,000 80,000

Underapplied overhead (J$30,000 ) (J$40,000 ) (J$70,000)

(3) Spending and efficiency variables:

Spending variance: Variable Fixed Total

Actual overhead J$230,000 J$120,000 J$350,000

Flexible budget at 42,000 hours:

J$5 x 42,000 210,000 210,000

Budgeted fixed 100,000 100,000

Unfavorable variance (J$20,000 ) (J$20,000 ) (J$40,000)

Efficiency variance: Variable Fixed Total

Flexible budget at 42,000 hours:

J$ 5 x 42,000 J$210,000 J$210,000

Budgeted fixed J$100,000 100,000

Flexible budget at 20,000 units:

J$10 x 20,000 200,000

Budgeted fixed 100,000 300,000

Unfavorable variance (J$10,000 ) J$0 (J$10,000)

Note: Since the efficiency variance is a comparison of two budgets, fixed costs will always be

the same. Therefore, the overhead efficiency variance is the difference in variable

costs. Omit any reference to fixed costs.

(4) Capacity variance: Variable Fixed Total

Flexible budget at 20,000 units:

J$10 x 20,000 J$200,000 J$200,000

Budgeted fixed J$100,000 300,000

Applied overhead:

J$10 x 20,000 units 200,000

J$4 x 20,000 units 80,000 280,000

Unfavorable variance J$0 (J$20,000 ) (J$20,000)

Note: The capacity variance is only the difference between budgeted fixed costs and applied

fixed costs. Variable costs can always be ignored. Therefore, the capacity variance

could be simplified to $100,00 – ($4 x 20,000 units).

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-13

(5) Proof of equality:

Unfavorable spending variance J$40,000

Unfavorable efficiency variance 10,000

Unfavorable capacity variance 20,000

Underapplied overhead (J$70,000)

8-19.

(1) Labor rate and efficiency variance:

Labor rate variance

Actual labor costs $234,000

Standard rate x Actual hours ($5 x 52,000) 260,000

Favorable labor rate variance $26,000

Labor efficiency variance:

Standard rate x Actual hours ($5 x 52,000) $260,000

Standard rate x Standard hours allowed

[$5 x (5,000 units x 10 hours)] 250,000

Unfavorable labor efficiency variance ($10,000)

(2) Calculation of underapplied /overapplied overhead:

Actual overhead incurred

Variable costs $103,000

Fixed costs 147,000 $250,000

Applied overhead:

Variable costs ($2 x 10 x 5,000) $100,000

Fixed costs ($3 x 10 x 5,000) 150,000 250,000

No underapplied/overapplied overhead $0

(3) Spending, efficiency, and capacity variances:

Spending variance:

Actual overhead incurred

Variable costs $103,000

Fixed costs 147,000 $250,000

Budget for 52,000 hours:

Variable costs ($2 x 52,000) $104,000

Fixed costs 150,000 254,000

Favorable spending variance $4,000

Efficiency variance:

Budget for 52,000 hours:

Variable costs ($2 x 52,000) $104,000

Fixed costs 150,000 $254,000

Budget for 5,000 units:

Variable costs ($2 x 10 x 5,000) $100,000

Fixed costs 150,000 250,000

Unfavorable efficiency variance ($4,000)

Capacity variance:

Budget for 5,000 units:

Variable costs ($2 x 10 x 5,000) $100,000

Fixed costs 150,000 $250,000

Applied overhead:

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-14

Variable costs ($2 x 10 x 5,000) $100,000

Fixed costs ($3 x 10 x 5,000) 150,000 250,000

No capacity variance $0

(4) The labor efficiency and overhead efficiency variances are related because they are based on

the same measure of activity. Since they are unfavorable variances, this indicates that the

workers were inefficient in the use of labor time. The overhead efficiency variance measures

the amount of overhead costs incurred to support those inefficient hour. To find the causes of

the overhead efficiency variance, look at the causes of the labor efficiency variance.

(5) Variable and fixed components of spending variance:

Variable Fixed Total

Actual overhead $103,000 $147,000 $250,000

Budget for 52,000 hours 104,000 150,000 254,000

Favorable spending variance $1,000 $3,000 $4,000

Solutions to Problems

8-20. Standard cost sheet for standard material and labor cost for a 25-liter drum:

Direct materials:

Destino (1,500 liters x B200) 48 drums B6,250.00

Promesa (1,500 liters x B150) 48 drums 4,687.50

Bono (2 kg x B600) 48 drums 25.00 B10,962.50

Direct labor 500.00

Total standard material and labor cost per drum B11,462.50

Supporting calculations:

Drums per batch = 1,500 liters of Velocidad 25 liter drums = 60

Good drums per batch = 60 drums – 12 drums inspection loss

= 48 good drums per batch

Labor cost per good drum

B1,200 per hour 3 drums per hour = B400 per drum before inspection

B400 (100% – 20% inspection loss) = B500 per drum after inspection

8-21. Standard cost sheet for completed workstation:

Direct materials:

Lumber (64 feet at $1.60) $102.40

Drawer handles and fixtures 16.80

Stain (0.8 gallons at $16.70) 13.36 $132.56

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-15

Direct labor:

Cutting (0.5 hour at $9.50) $4.75

Assembly (2 hours at $11.60) 23.20

Finishing (1/3 hour at $7.80) 2.60 30.55

Factory overhead:

Cutting (0.5 hour at $10.00) $5.00

Assembly (2 hours at $9.50) 19.00

Staining (1/4 hours at $18.00) 4.50

Finishing (1/3 hour at $9.00) 3.00 31.50

Total standard cost per workstation $194.61

8-22.

(1) a. Materials price variance by ingredient for each plant for June:

Favorable

Gurvey Plant: Actual Prices x Standard Prices x (Unfavorable)

Actual Quantities Actual Quantities Variance

Oil $1,414,400 $1,248,000 ($166,400)

Metal 374,900 407,500 32,600

Sealer 96,000 80,000 (16,000)

Totals $1,885,300 $1,735,500 ($149,800)

Oliker Plant: Actual Prices x Standard Prices x

Actual Quantities Actual Quantities Variance

Oil $856,800 $756,000 ($100,800)

Metal 234,600 255,000 20,400

Sealer 60,240 50,200 (10,040)

Totals $1,151,640 $1,061,200 ($90,440)

(1) b. Material price variance by ingredient for each plant for July:

Gurvey Plant: Actual Prices x Standard Prices x

Actual Quantities Actual Quantities Variance

Oil $1,473,150 $1,281,000 ($192,150)

Metal 408,000 425,000 17,000

Sealer 111,150 85,500 (25,650)

Totals $1,992,300 $1,791,500 ($200,800)

Oliker Plant: Actual Prices x Standard Prices x

Actual Quantities Actual Quantities Variance

Oil $1,104,000 $960,000 ($144,000)

Metal 302,400 315,000 12,600

Sealer 78,520 60,400 (18,120)

Totals $1,484,920 $1,335,400 ($149,520)

(2) a. Materials usage variance by ingredient for each plant for June:

Gurvey Plant: Standard Prices x Standard Prices x

Actual Quantities Standard Quantities Variance

Oil $1,248,000 $1,200,000 ($48,000)

Metal 407,500 400,000 (7,500)

Sealer 80,000 80,000 0

Totals $1,735,500 $1,680,000 ($55,500)

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-16

Oliker Plant: Standard Prices x Standard Prices x

Actual Quantities Standard Quantities Variance

Oil $756,000 $750,000 ($6,000)

Metal 255,000 250,000 (5,000)

Sealer 50,200 50,000 (200)

Totals $1,061,200 $1,050,000 ($11,200)

(2) b. Materials usage variance by ingredient for each plant for July:

Gurvey Plant: Standard Prices x Standard Prices x

Actual Quantities Standard Quantities Variance

Oil $1,281,000 $1,275,000 ($60,000)

Metal 425,000 425,000 0

Sealer 85,500 85,000 (500)

Totals $1,791,500 $1,785,000 ($6,500)

Oliker Plant: Standard Prices x Standard Prices x

Actual Quantities Standard Quantities Variance

Oil $960,000 $900,000 ($60,000)

Metal 315,000 300,000 (15,000)

Sealer 60,400 60,000 (400)

Totals $1,335,400 $1,260,000 ($75,400)

(3) The Gurvey Plant had the larger materials usage variance in June. The Oliker Plant had the

larger materials usage variance in July.

8-23.

(1) Labor rate variance [Actual cost – (Standard rate x Actual hours)]:

Crushing: $159,358 – ($20 x 8,400) = $8,642 Favorable

Baking: $52,752 – ($12 x 3,820) = $6,912 Unfavorable

Mixing: $29,172 – ($16 x 1,410) = $6,612 Unfavorable

Packaging: $29,368 – ($12 x 2,653) = $2,468 Favorable

(2) Labor efficiency variance [Standard costs x (Actual hours – Standard hours allowed)]:

Crushing: $20 x [8,400 – (100 x 83)] = $2,000 Unfavorable

Baking: $12 x [3,820 – (40 x 83)] = $6,000 Unfavorable

Mixing: $16 x [1,410 – (20 x 83)] = $4,000 Favorable

Packaging: $12 x [2,653 – (40 x 83)] = $8,004 Favorable

(3) T-accounts cost flow:

Wages Payable Work in Process Inventory

| (a) 159,358 (a) 166,000 |

| (b) 52,752 (b) 39,840 |

| (c) 29,172 (c) 26,560 |

| (d) 29,368 (d) 39,840 |

Labor Rate Variance – Crushing Labor Efficiency Variance – Crushing

| (a) 8,642 (a) 2,000 |

Labor Rate Variance – Baking Labor Efficiency Variance – Baking

(b) 6,912 | (b) 6,000 |

Labor Rate Variance – Mixing Labor Efficiency Variance – Mixing

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-17

(c) 6,612 | | (c) 4,000

Labor Rate Variance – Packaging Labor Efficiency Variance – Packaging

| (d) 2,468 | (d) 8,004

(a) Record labor for Crushing Department

(b) Record labor for Baking Department

(c) Record labor for Mixing Department

(d) Record labor for Packaging Department

8-24.

(1) Standard costs using cheaper yarn:

Materials (200,000 x $0.12) $24,000

Labor (20,000 x $8.50) 170,000

Total standard cost $194,000

Standard cost per unit ($194,000 20,000 units) $9.70

(2) Standard costs using more expensive yarn:

Materials (160,000 x $0.25) $40,000

Labor (16,000 x $8.50) 136,000

Total standard cost $176,000

Standard cost per unit ($176,000 20,000 units) $8.80

(3) A net cost savings exists in the amount of $18,000 ($194,000 - $176,000)

(4) With a better grade of material, the machines will work better and may have a longer useful

life. Furthermore, with better grade materials, the quality of the product may be improved.

8-25.

(1) Actual materials price per kilogram:

AP = Actual price

AQP = Actual quantities purchased

SP = Standard price

(AP x AQP) – (SP x AQP) = Materials price variance

(AP x 300,000) – (M$8.5 x 300,000) = (7,500)

300,000 AP – 2,550,000 = (7,500)

300,000 AP = 2,542,500

AP = 2,542,500 300,000

AP = M$8.475

(2) Actual materials used:

AQU = Actual quantity used

SQ = Standard quantity allowed

(SP x AQU) – (SP x SQ) = Materials usage variance

M$8.5 AQU – [M$8.5 x (120,000 x 2)] = 8,500

M$8.5 AQU – (M$8.5 x 240,000) = 8,500

M$8.5 AQU – 2,040,000 = 8,500

M$8.5 AQU = 2,048,500

AQU = 2,048,500 8.5

AQU = 241,000 kilograms

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-18

(3) Actual number of labor hours worked:

SR = Standard rate

AH = Actual hours worked

SH = Standard hours allowed

(SR x AH) – (SR x SH) = Labor efficiency variance

M$12AH – [M$12 x (120,000 x 0.5 hours)] = (12,000)

M$12 AH – (M$12 x 60,000) = (12,000)

M$12 AH – 720,000 = (12,000)

M$12 AH = 708,000

AH = 708,000 12

AH = 59,000 hours

8-26.

(1) Materials price and usage variances:

Actual price = $15,000 50,000 units = $0.30

Standard price = $22,500 50,000 units = $0.45

Actual price x actual quantities: $0.30 x 50,000 units $15,000

Standard price x actual quantities: $0.45 x 50,000 units 22,500

Favorable materials price variance $7,500

Standard price x actual quantities used: $0.45 x 42,000 units $18,900

Standard price x standard quantities allowed: $0.45 x (6,000 x 5) 13,500

Unfavorable materials usage variance ($5,400)

(2) Labor rate and efficiency variances:

Actual rate x actual hours worked $31,750

Standard rate x actual hours worked: $8 x 3,300 hours 26,400

Unfavorable labor rate variance ($5,350)

Standard rate x actual hours worked: $8 x 3,300 hours $26,400

Standard rate x standard hours allowed: $8 x (6,000 x 1/2 hour) 24,000

Unfavorable labor efficiency variance ($2,400)

(3) Net effect of variances:

Favorable materials price variance $7,500

Unfavorable materials usage variance (5,400)

Unfavorable labor rate variance (5,350)

Unfavorable labor efficiency variance (2,400)

Net unfavorable variance ($5,650)

Because of the net unfavorable variance, the company did not benefit from this lower-cost

purchase of substandard materials.

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-19

(4) Under normal circumstances, the materials price variance would be assigned to the purchasing

agent. That variance is favorable. The remaining variances are assigned to the operating

manager. The sum of those variances is unfavorable. In this case, however, it appears that the

actions of the purchasing manager (i.e., buying substandard nails) led to the three unfavorable

variances.

8-27. Materials price variance:

Actual quantity = 165,000 miles 24 miles per gallon = 6,900 gallons

MPV = 6,900 x ($1.16 - $1.20) = $276 favorable

Materials usage variance:

SQ = (1 8,480 deliveries) x (153,000 miles 17,000 deliveries) x (1 gal 22 miles)

= 7,560 gallons

MUV = $1.20 x (6,900 – 7,560) = $792 Favorable

8-28.

(a) Actual quantities of materials used at standard price:

Standard costs of units purchased ($3.10 x 350,000) $1,085,000

Raw materials beginning inventory 52,700 $1,137,700

Raw materials ending inventory 108,500

Materials used at standard price $1,029,200

Units used ($1,029,200 3.10) 332,000

(b) Actual cost of materials purchased:

Standard costs of units purchased ($3.10 x 350,000) $1,085,000

Unfavorable materials price variance 175,000

Actual cost of units purchased $1,260,000

Actual price ($1,260,000 350,000) $3.60

(c) Units of material needed for each dog-day:

Units of material used 332,000

Units in unfavorable materials usage variance ($21,700 $3.10) 7,000

Total materials allowed 325,000

325,000 materials allowed 65,000 dog-days = 5 pounds per dog-day

(d) Standard direct materials cost of production:

65,000 dog-days x 5 pounds x $3.10 = $1,007,500

(e) Standard direct labor cost:

Actual labor cost $320,000

Unfavorable labor rate variance 10,000

Actual hours at standard rate $310,000

Favorable labor efficiency variance 15,000

Standard direct labor cost $325,000

(f) Standard labor rate per hour:

$310,000 actual hours at standard rate 32,000 actual hours = $9.6875 per hour

(g) Standard labor hours per dog-day:

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-20

($325,000 standard direct labor cost $9.6875 per hour) = 33,548 standard hours

65,000 dog-days 65,000 dog-days

= 0.52 hours per dog-days

8-29.

(1) Standard variable and fixed overhead cost per unit:

$4 variable overhead per hour 100 standard pieces per hour = $0.04 per unit

$6,000,000 fixed overhead budget 60,000,000 units at normal capacity = $0.10 per unit

Total overhead cost per unit = $0.14 per unit

(2) Application of overhead to current production:

Applied overhead:

Variable ($0.04 x 58,000,000 units) $2,320,000

Fixed ($0.10 x 58,000,000) 5,800,000 $8,120,000

(3) a. Overhead budget variance:

Actual overhead:

Variable $1,935,000

Fixed 6,030,000 $7,965,000

Flexible budget for 58,000,000 units:

Variable ($0.04 x 58,000,000) $2,320,000

Budgeted fixed costs 6,000,000 8,320,000

Favorable-budget variance $355,000

(3) b. Overhead capacity variance:

Flexible budget for 58,000,000 units:

Variable ($0.04 x 58,000,000) $2,320,000

Budgeted fixed costs 6,000,000 $8,320,000

Applied overhead:

Variable ($0.04 x 58,000,000 units) $2,320,000

Fixed ($0.10 x 58,000,000) 5,800,000 8,120,000

Unfavorable-capacity variance ($200,000)

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-21

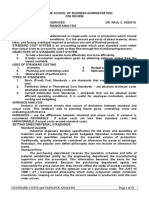

(4) Graph that shows existence of capacity variance:

Fixed overhead budget

$6 Mill

5.8

$5 Mill Applied Fixed Costs (58,000,000 actual units produced)

Fixed

Overhead

Dollars Budgeted Fixed Costs

$4 Mill ($6,000,000)

Capacity Variance

($6,000,000 – $5,800,000 = $200,000)

$3 Mill

Normal Production

(60,000,000 units)

$2 Mill Actual Production

(58,000,000 units)

$1 Mill Applied Fixed Costs

($0.10 x 58,000,000 = $5,800,000)

$0

10 20 30 40 50 58 60 70

Units of Product (in Millions)

8-30.

(1) (a) Materials price variance:

Actual price x Actual quantity purchased $7,540,000

Standard price x Actual quantity purchased ($4 x 2,000,000 units) 8,000,000

Favorable materials price variance $460,000

(b) Materials usage variance:

Standard price x Actual quantity used ($4 x 1,812,000 units) $7,248,000

Standard price x Standard quantity allowed:

$4 x (300,000 product units x 6) 7,200,000

Unfavorable materials usage variance ($48,000)

(c) Labor rate variance:

Actual rate x Actual hours $1,610,000

Standard rate x Actual hours ($8 x 200,000 hours) 1,600,000

Unfavorable labor rate variance ($10,000)

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-22

(d) Labor efficiency variance:

Standard rate x Actual hours ($8 x 200,000 hours) $1,600,000

Standard rate x Standard hours allowed [$8 x (300,000 x 0.7 hour)] 1,680,000

Favorable labor efficiency variance ($80,000)

(e) Overhead budget variance:

Actual overhead:

Variable $880,000

Fixed 6,321,000 $7,201,000

Flexible budget for 300,000 units:

Variable ($3 x 300,000) $900,000

Fixed 6,400,000 7,300,000

Favorable overhead budget variance $99,000

(f) Overhead capacity variance:

Flexible budget for 300,000 units:

Variable ($3 x 300,000) $900,000

Fixed 6,400,000 $7,300,000

Applied overhead:

Variable ($3 x 300,000) $900,000

Fixed ($15 x 300,000) 4,500,000 5,400,000

Unfavorable overhead capacity variance ($1,900,000)

(2) Largest unfavorable variance:

The largest unfavorable variance that is potentially controllable, in part at least, is the

$1,900,000 capacity variance.

(3) With a large capacity variance, management may search for ways to increase sales volume.

Also, is production responsible for the loss of any orders by not meeting scheduled delivery

dates? If volume cannot be increased, then it may be necessary to make large reductions in

fixed cost.

(4) T-account flow of costs:

Accounts Payable Materials Inventory

| (a) 7,540,000 (a) 8,000,000 | (b) 7,248,000

| (e) 7,201,000 Bal 752,000

Materials Price Variance Materials Usage Variance

(h) 460,000 | (a) 460,000 (b) 48,000 | (h) 48,000

Work in Process Inventory Wages Payable

(b) 7,200,000 | (f) 14,280,000 | (c) 1,610,000

(c) 1,680,000 |

(d) 5,400,000 |

Bal 0 |

Labor Rate Variance Labor Efficiency Variance

(c) 10,000 | (h) 10,000 (h) 80,000 | (c) 80,000

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-23

Factory Overhead Applied Factory Overhead

(e) 7,201,000 | (h) 7,201,000 (h) 5,400,000 | (d) 5,400,000

Finished Goods Inventory Cost of Goods Sold

(f) 14,280,000 | (g) 11,900,000 (g) 11,900,000 |

Bal 2,380,000 | (h) 1,319,000 |

Bal 13,219,000 |

(a) Purchase of materials

(b) Record issuance of materials to production

(c) Record distribution of direct labor payroll

(d) Record application of overhead to Work in Process Inventory: ($3 + $15) x 300,000 =

$5,400,000

(e) Record actual overhead: $880,000 + $6,321,000 = $7,201,000

(f) Transfer of completed units to finished goods: 300,000 units x $47.60 = $14,280,000

(g) Transfer of cost of units sold from finished goods inventory: 250,000 x $47.60 = $11,900,000

(h) Closing of variances to Cost of Goods Sold

8-31.

(1) Overhead rates per hour and per loan:

Overhead rates per hour:

Variable $2.40

Fixed ($33,000 12,000) 2.75

Total $5.15

Overhead rates per loan:

Variable ($2.40 x 2 hours) $4.80

Fixed ($2.75 x 2 hours) 5.50

Total $10.30

(2) Calculation of underapplied/overapplied overhead:

Actual overhead:

Variable $28,460

Fixed 31,950 $60,410

Applied overhead:

Variable ($4.80 x 5,800) $27,840

Fixed ($5.50 x 5,800) 31,900 59,740

Underapplied overhead ($670)

(3) a. Overhead budget variance:

Actual overhead:

Variable $28,460

Fixed 31,950 $60,410

Flexible budget for 5,800 loans:

Variable ($4.80 x 5,800) $27,840

Fixed 33,000 60,840

Favorable overhead budget variance $430

(3) b. Overhead capacity variance:

Flexible budget for 5,800 loans:

Variable ($4.80 x 5,800) $27,840

Fixed 33,000 $60,840

Applied overhead,

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-24

Variable ($4.80 x 5,800) $27,840

Fixed ($5.50 x 5,800) 31,900 59,740

Unfavorable overhead capacity variance ($1,100)

(4) Variable and fixed costs in budget variance:

Variable Fixed Total

Actual overhead costs $28,460 $31,950 $60,410

Flexible budget costs 27,840 33,000 60,840

Overhead budget variance ($620) $1,050 $430

8-32.

(1) Materials price variance:

Actual cost of materials purchased $104,500

Standard price x Actual quantity of materials:

$2.50 x 38,000 95,000

Unfavorable materials price variance ($9,500)

(2) Standard costs:

Standard price x Standard quantity allowed [$2.50 x (18,000 x 2 lbs. per feeding)] = $90,000

(3) Materials usage variance:

Actual lbs. of materials used at standard prices $95,000

Standard cost of materials allowed 90,000

Unfavorable-materials usage variance ($5,000)

(4) Actual direct labor hours – See (5) below.

(5) Labor efficiency variance:

Actual direct labor cost $63,000

Minus unfavorable labor rate variance 6,000

Actual hours at standard rate $57,000

$57,000 $10 standard labor rate = 5,700 actual labor hours

18,000 feedings 3 feedings per hour (20 minutes each) = 6,000 standard hours allowed

Actual hours 5,700

Standard hours allowed 6,000

Hours below standard 300

Standard labor rate per hour x $10

Favorable labor efficiency variance $3,000

(6) Standard cost of direct labor:

Standard hours allowed 6,000

Standard labor rate per hour x $10

Standard cost of direct labor $60,000

8-33.

(a) When demand exceeds expectation, primarily look to two variances: overhead capacity

variance and overhead budget variance.

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-25

The capacity variance will be favorable because the high demand means that more than

budgeted fixed costs are charged to the product. The budget variance is important because

higher than expected demand frequently means overtime work. The costs of the overtime

premium are included in overhead. Since the overtime was not expected, it will show up in the

actual costs and result in an unfavorable budget variance.

Many students will argue that the budget variance will be unfavorable because of the inefficient

use of labor and the impact inefficiency has on variable overhead costs. Efficiency relates

inputs to outputs. The company can have demand over or under expectations and still

produce according to standard times. Therefore, overhead efficiency is not an issue merely

because demand exceeds expectations.

One also might argue that other variances are potentially influenced. For example, higher than

expected demand may mean sufficient materials are not on hand and rush orders must be

placed. That will result in an unfavorable price variance. Perhaps the workers can’t cope with

overtime without fatigue, resulting in an unfavorable labor efficiency variance. Also, the

company may hire temporaries to hold down overtime premiums. Temporary help is usually at

a rate different from the standard rate, and their efficiency is different. Whether the labor rate

variance is favorable or unfavorable depends on the rate for temporaries and the skill level

they fill. The same considerations are present for labor efficiency variance.

(b) The primary variances affected here are materials price and materials usage variances. The

materials price variance will be unfavorable because the price will be higher than normal

ordering quantity prices and the delivery charges are higher. The materials usage variance is

reflected in the excessive usage of materials and would be unfavorable.

One can also argue that labor efficiency is influenced because time is related to excess waste.

In that case, the labor efficiency variance is unfavorable.

(c) Three primary variances are created with this situation: materials price, materials usage, and

labor efficiency. The materials price variance is favorable because it is less than standard

price. The materials usage variance is unfavorable because of the higher usage. Any time the

extra employee spends beyond the standard time results in an unfavorable labor efficiency

variance.

A labor rate variance may result from the hiring of the extra employee. It depends on the wage

rate of the employee and the wage rate associated with the work the employee is doing.

One could also argue that overhead was incurred to support the extra work and that support cost

is somewhere in the overhead budget variance. If so, the budget variance would be unfavorable.

(d) Because the orders were produced in the standard time allowed, no labor efficiency variance

exists. Although overtime exists now, the capacity for the period may not be greater than

expectations. It could even be less than expectations. One would not expect a capacity

variance as a result of meeting delivery schedules. No indication of an impact on materials is

given.

The primary variance is an unfavorable overhead budget variance because the overtime

premium is in actual overhead costs.

(e) No variance is affected. The actual labor rate for the contract is what is paid the employees,

and the standard is set at the contract rate.

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-26

(f) The two primary variances are labor rate and labor efficiency variances. The labor rate

variance is favorable because the actual rate is less than standard. The labor efficiency

variance is unfavorable because they could not produce output in the standard times.

Because some overhead support exists for labor, these costs are in the overhead budget

variance. However, similar costs are probably associated with the regular work. Therefore,

one cannot tell whether a variance exists or which direction it goes.

(g) The major variance impacted by this situation is the overhead budget variance. Two reasons

are possible. First, the extra repair and maintenance supplies represent an unfavorable

variance. Second, the workers operating the machines are sitting around twiddling their

thumbs – idle time. Generally, idle time is not treated as the inefficiency related to production

but is charged to overhead. Therefore, the cost of idle time becomes an unfavorable element

of the overhead budget variance.

(h) The workers are able to continue their efforts but at a slower pace. On the surface, that

suggests a labor efficiency variance that is unfavorable. The lower electricity cost and the

additional overhead costs to support the workers will be included in the overhead budget

variance. The impact of these items on the overhead budget variance is difficult to assess. In

all probability, the unfavorable labor efficiency variance will dominate the situation.

(i) The issue here is idle time, not inefficient operations. The workers’ time for cleaning up the

mess and getting the machine running should be charged as the cost of idle time to overhead.

That will be an unfavorable element in an overhead budget variance. There may be a small

influence on a labor efficiency variance and on a capacity variance, but that influence is

difficult to assess.

(j) The immediate impact on production is that workers are not spending the time they should to

produce good units. The online workers and inspectors are able to process more units per

hour. Therefore, one expects a favorable labor efficiency variance. If direct labor is the

measure of activity for overhead, the costs to support direct labor will be less, a favorable

element in the overhead budget variance. There is also the possibility that the extra time is

used to produce more units than originally planned, which creates a favorable capacity

variance. If the demand is not present, then the workers have extra time that may fall into idle

time and be charged to the overhead which affects the overhead budget variance.

8-34.

Labor rate variance:

$90,000 – (9,700 x $10.25) = $90,000 – $99,425 = $9,425 favorable

Labor efficiency variance:

$10.25 x [9,700 – 3,175 (9,300 3,100)] = $10.25 x (9,700 – 9,525) = $1,794 unfavorable

8-35.

(1) Budget for 5,000 machine hours:

Variable costs:

Lubrication ($0.75 x 5,000) $3,750

Supplies ($0.30 x 5,000) 1,500

Power ($0.25 x 5,000) 1,250

Repairs ($0.50 x 5,000) 2,500

Maintenance ($0.80 x 5,000) 4,000

Total variable costs $13,000

Fixed costs:

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-27

Supervision $4,500

Indirect labor 11,500

Heat and light 3,200

Taxes and insurance 1,600

Depreciation 1,800

Total fixed costs $22,600

Total overhead costs $35,600

(2) Performance report of actual and budget: Under

Actual Budgeted (Over)

Costs Costs Budget

Variable costs:

Lubrication $3,900 $3,750 ($150)

Supplies 1,700 1,500 (200)

Power 1,500 1,250 (250)

Repairs 2,800 2,500 (300)

Maintenance 4,300 4,000 (300)

Total variable costs $14,200 $13,000 ($1,200)

Fixed costs:

Supervision $4,000 $4,500 $500

Indirect labor 12,000 11,500 (500)

Heat and light 3,200 3,200 0

Taxes and insurance 1,400 1,600 200

Depreciation 1,600 1,800 200

Total fixed costs $22,200 $22,600 $400

Total overhead costs $36,400 $35,600 ($800)

(3) The major causes of a budget variance are:

Price changes in the individual cost components comprising overhead costs.

Quantity changes in individual items within overhead cost components, probably in the

variable overhead costs.

Estimation errors in segregating variable and fixed costs.

Any overhead costs that are incurred or saved because of inefficient or efficient use of the

underlying activity measure.

8-36.

(1) Break-even point with 80% learning curve:

Note: Assume no learning curve and calculate a break-even point. This gives a starting point

for the analysis.

Materials cost per patient $100

Direct labor (100 hours x $10) 1,000

Variable overhead (100 hours x $4) 400

Variable costs $1,500

Revenue 1,700

Contribution margin $200

Break-even point = $5,000 $200 = 25 patients

Since a learning curve is in effect, we know the hours will be less than 100 per patient, which

increases the contribution margin and lowers the break-even point.

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-28

80% learning curve: Cumulative

Average

Cumulative Hours Per Cumulative Hours

Patients Patients Patient Hours Per Patient*

1 1 100 100 100

1 2 60 160 80

2 4 48 256 64

4 8 38.4 409.6 51.2

8 16 30.72 655.36 40.96

16 32 24.576 1,048.576 32.768

* Cumulative average is 80% of previous cumulative average.

Calculation of a break-even point:

Cumulative Materials Labor and Contribution

Patients Cost Overhead Revenues Margin

1 $100 $1,400 $1,700 $200

2 200 2,240 3,400 960

4 400 3,584 6,800 2,816

8 800 5,734.40 13,600 7,065.60

The contribution margin of $7,065.60 is higher than the fixed costs. Therefore, the break-even

point is somewhere between 4 and 8 patients. A rough approximation is to interpolate between

the 4 and 8 patients as follows:

5,000 – 2,816 = 2,184 = 0.51393

7,065.6 – 2,816 4,249.6

0.551393 x (8 - 4) = 2.06 patients above 4 patients

The break-even point is approximately 6 patients.

(2) Number of patients with constrained labor time:

Looking at the table of learning curve hours, we find that 300 hours are between 4 and 8

patients. The time suggests the company could handle at least 5 patients. This is one patient

short of breaking even.

(3) 75% learning curve: Cumulative

Average

Cumulative Hours Per Cumulative Hours

Patients Patients Patient Hours Per Patients*

1 1 100 100 100

1 2 50 150 75

2 4 37.5 225 56.25

4 8 28.125 337.5 42.1875

8 16 21.09 506.25 31.640625

16 32 15.82 759.37 23.730469

* Cumulative average is 75% of previous cumulative average.

The break-even point is approximately 535 hours. We have 16 patients at 506 hours, and the

per patient hours on the next group show 15.82 each or an additional 2 patients. Therefore,

the company can handle approximately 18 patients in the time it would handle 6 patients under

the 80% learning curve.

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-29

8-37.

(1) Cumulative average work hours per unit:

80% learning curve: Cumulative

Average

Cumulative Hours Per Cumulative Hours

Units Units Unit Hours Per Unit*

1 1 500 500 500

(a) 1 2 300 800 400

(b) 2 4 240 1,280 320

(c) 4 8 192 2,048 256

(d) 8 16 153.6 3,276.8 204.8

* Cumulative average is 80% of previous cumulative average.

90% learning curve: Cumulative

Average

Cumulative Hours Per Cumulative Hours

Units Units Unit Hours Per Unit*

1 1 500 500 500

(a) 1 2 400 900 450

(b) 2 4 360 1,620 405

(c) 4 8 324 2,916 364.5

(d) 8 16 291.6 5,248.8 328.05

* Cumulative average is 90% of previous cumulative average.

(2) Estimated direct labor cost for 15 units:

(a) 80% learning curve:

Cumulative hours at 16 units 3,276.8

Hours for first unit 500.0

Hours for 15 additional units 2,776.8

Rate per hour ($8,000 500) x $16

Direct labor cost per order $44,428 .80

(b)90% learning curve:

Cumulative hours at 16 units 5,248.8

Hours for first unit 500.0

Hours for 15 additional units 4,748.8

Rate per hour ($8,000 500) x $16

Direct labor cost per order $75,980 .80

(3) Cost difference with 85% learning curve:

Cumulative

Average

Cumulative Hours Per Cumulative Hours

Units Units Unit Hours Per Unit*

1 1 500 500 500

1 2 350 850 425

2 4 297.5 1,445 361.25

4 8 252.875 2,456.5 307.0625

8 16 214.94375 4,176.05 261.003125

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-30

* Cumulative average is 85% of previous cumulative average.

Cumulative hours at 16 units 4,176.05

Hours for first unit 500.00

Hours for 15 additional units 3,676.05

Rate per hour ($8,000 500) x $16

Direct labor cost per order $58,816 .80

Direct labor costs for 90% learning curve $75,980.80

Direct labor costs for 85% learning curve 58,816.80

Cost savings $17,164 .00

Direct labor costs for 80% learning curve $44,428.80

Direct labor costs for 85% learning curve 58,816.80

Cost increase $14,388 .00

8-38.

(1) Overhead efficiency and capacity variances:

1,200,000 units of product 300,000 machine hours = 4 units per hour at standard

M$4,800,000 fixed costs 1,200,000 units of product = M$4 fixed overhead per unit

Standard overhead cost per unit:

Variable overhead per unit, Category 1 M$3.00

Variable overhead per unit, Category 2

(M$8 per hour 4 units per hour) 2.00

Fixed overhead per unit 4.00

Total M$9.00

Standard hours allowed for actual production:

800,000 units of product 4 units per hour = 200,000 standard hours allowed

Overhead efficiency variance:

Budget for 800,000 units and 250,000 actual hours:

Variable: M$3 x 800,000 units M$2,400,000

M$8 x 250,000 hours 2,000,000 M$4,400,000

Fixed 4,800,000

M$9,200,000

Budget for 800,000 units and 200,000 hours allowed:

Variable: M$3 x 800,000 units M$2,400,000

M$8 x 200,000 hours 1,600,000 M$4,000,000

Fixed 4,800,000

M$8,800,000

Budget for actual units and actual hours M$9,200,000

Budget for actual units and standard hours 8,800,000

Unfavorable overhead efficiency variance (M$400,000)

Capacity variance:

Budget for actual units and standard hours M$8,800,000

Applied overhead: M$9 x 800,000 7,200,000

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-31

Unfavorable capacity variance (M$1,600,000)

(2) The overhead efficiency variance measures the amount of overhead costs incurred or saved

with the inefficient or efficient use of the measure of activity. The capacity variance measures

the amount of fixed overhead costs that is not applied to products or applied in excess of the

budgeted amount. In general, the overhead efficiency and capacity variances are not related.

(3) Julio Diaz is correct in saying that a capacity variance cannot be eliminated by merely working

more hours. The hours must be used effectively. Only the standard hours allowed for the

output can be considered in measuring the capacity variance. Ernesto Valdez, however, is

correct in stating that the efficiency variance involves only the variable overhead. Valdez is

incorrect in wanting to use actual hours for a measurement of the capacity variance.

8-39.

(1) Standard hours allowed: Standard Standard

Units Hours Per Hours

Product Produced Unit Allowed

SD 3,800 3.0 11,400

CMD 2,700 4.0 10,800

CCD 2,200 5.0 11,000

Total standard hours allowed 33,200

(2) Calculation of under/overapplied overhead:

Variable Fixed Total

Actual overhead $326,540 $271,000 $597,540

Applied overhead:

$10 x 33,200 332,000 332,000

$7.50 x 33,200 249,000 249,000

(Underapplied)/Overapplied $5,460 ($22,000) ($16,540)

(3) Calculation of four-way overhead variances:

Variable spending variance:

Actual variable overhead $326,540

Budgeted variable overhead at 32,800 hours: $10 x 32,800 hours 328,000

Favorable variable spending variance $1,460

Variable efficiency variance:

Budgeted variable overhead at 32,800 $328,000

Budgeted variable overhead at 33,200: $10 x 33,200 332,000

Favorable variable efficiency variance $4,000

Fixed spending variance:

Actual fixed overhead $271,000

Budgeted fixed overhead: $7.50 x 36,000 270,000

Unfavorable fixed spending variance ($1,000)

Fixed capacity variance:

Budgeted fixed overhead $270,000

Applied fixed overhead 249,000

Unfavorable fixed capacity variance ($21,000)

(4) When direct labor hours are the measure of activity, the labor efficiency and variable overhead

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-32

efficiency variances are caused by the same underlying factor and move in the same direction.

If labor hours are inefficiently used, the labor efficiency variance measures the labor costs

incurred for that inefficiency. The variable overhead efficiency variance is the additional

overhead cost incurred to support the inefficient labor. A favorable labor efficiency variance

means the variable overhead efficiency variance is also favorable and represents the savings

in overhead costs due to efficient labor.

(5) In general, no relationship exists between the variable efficiency variance and the fixed

capacity variance. Efficiency relates inputs to outputs, and capacity relates to the level of

capacity utilized. They measure two different things. However, a specific set of circumstances

can cause a chain reaction that affects several variances.

8-40.

(1) Reports of divisional overhead variances:

August (in thousands): Divisions

1 2 3 4 Total

Actual overhead £ 92 £155 £240 £487 £974

Budgeted overhead for actual hours 88 150 245 484 967

Spending variance: favorable (unfavorable) (£4) (£5) £5 (£3) (£7)

Budgeted overhead for actual hours £88 £150 £245 £484 £967

Budgeted overhead for standard hours 90 138 250 460 938

Efficiency variance: favorable (unfavorable) £2 (£12) £5 (£24) (£29)

Budgeted overhead for standard hours £90 £138 £250 £460 £938

Applied overhead 75 120 250 450 895

Capacity variance: favorable (unfavorable) (£15) (£18) £0 (£10) (£43)

Total variances (£17) (£35) £10 (£37) (£79)

September (in thousands): Divisions

1 2 3 4 Total

Actual overhead £83 £188 £226 £498 £995

Budgeted overhead for actual hours 84 180 230 500 994

Spending variance: favorable (unfavorable) £1 (£8) £4 £2 (£1)

Budgeted overhead for actual hours £84 £180 £230 £500 £994

Budgeted overhead for standard hours 88 162 210 500 960

Efficiency variance: favorable (unfavorable) £4 (£18) (£20) £0 (£34)

Budgeted overhead for standard hours £88 £162 £210 £500 £960

Applied overhead 70 180 150 500 900

Capacity variance: favorable (unfavorable) (£18) £18 (£60) £0 (£60)

Total variances (£13) (£8) £76 £2 (£95)

October (in thousands): Divisions

1 2 3 4 Total

Actual overhead £76 £197 £233 £475 £981

Budgeted overhead for actual hours 78 186 240 476 980

Spending variance: favorable (unfavorable) £2 (£11) £7 £1 (£1)

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-33

Budgeted overhead for actual hours £78 £186 £240 £476 £980

Budgeted overhead for standard hours 80 180 230 500 990

Efficiency variance: favorable (unfavorable) £2 (£6) (£10) £24 £10

Budgeted overhead for standard hours £80 £180 £230 £500 £990

Applied overhead 50 225 200 500 975

Capacity variance: favorable (unfavorable) (£30) £45 (£30) £0 (£15)

Total variances (£26) £28 (£33) £25 (£6)

(2) Division 4 had the worst efficiency variance for August. Division 3 had the worst efficiency

variance for September and October. Division 3 also had the worst capacity variance for

September and October. Division 2 had the worst spending variance all three months and the

worst capacity variance for August. Division 1 tied for the worst capacity variance during

October.

(3) The idea of which division will run into problems first is related to subjects we have discussed

in previous chapters: namely, margin of safety and break-even points. In general, we can say

that the division with the most unfavorable capacity variance is the one operating closest to the

break-even point and having the lowest margin of safety.

The division with the most instability in its capacity variance is Division 3. This division has a

capacity variance of zero in August, of £60,000 unfavorable in September, and of £30,000

unfavorable in October. That is an unfavorable capacity variance of £90,000 for the three

months. The next closest division is Division 1 with an unfavorable capacity variance of

£63,000 for the three months.

Solutions to Cases

CASE 8A – Stroll’s Bicycles, Inc.

(1) a. Material variances:

Materials price variance (no material usage variance exists):

Actual price x actual quantity purchased $617,500

Standard price x actual quantity purchased:

$60 x 9,500 product units* 570,000

Unfavorable materials price variance ($47,500)

* Since no materials usage variance exists, the actual quantity used equals the standard

quantity allowed. Therefore, we can arrive at the standard cost of units purchased by using

the standard materials cost per unit of product and the number of products manufactured.

(1) b. Labor variances:

Labor rate variance:

Actual rate x actual hours worked $249,375

Standard rate x actual hours worked ($10 x 23,750 hours) 237,500

Unfavorable labor rate variance ($11,875)

Labor efficiency variance:

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-34

Standard rate x actual hours worked $237,500

Standard rate x standard hours allowed [$10 x (4 x 9,500)] 380,000

Favorable labor efficiency variance $142,500

(1) c. Overhead variances:

Overhead spending variance:

Actual overhead costs:

Variable $163,000

Fixed 80,000 $243,000

Budget for 23,750 hours:

Variable ($5 x 23,750 units) $118,750

Fixed ($8 x 10,000 units) 80,000 198,750

Unfavorable overhead spending variance ($44,250)

Overhead efficiency variance:

Budget for 23,750 hours

Variable ($5 x 23,750 hours) $118,750

Fixed ($8 x 10,000 units) 80,000 $198,750

Budget for 9,500 units:

Variable ($20 x 9,500 units) $190,000

Fixed 80,000 270,000

Favorable overhead efficiency variance $71,250

Overhead budget variance:

Overhead spending variance $44,250

Overhead efficiency variance (71,250)

Favorable overhead budget variance $27,000

Actual overhead costs:

Variable $163,000

Fixed 80,000 $243,000

Budget for 9,500 units:

Variable ($20 x 9,500 units) $190,000

Fixed 80,000 270,000

Favorable overhead budget variance $27,000

Overhead capacity variance:

Budget for 9,500 units:

Variable ($20 x 9,500) $190,000

Fixed 80,000 $270,000

Applied overhead:

Variable ($20 x 9,500) $190,000

Fixed ($8 x 9,500) 76,000 266,000

Unfavorable overhead capacity variance ($4,000)

(2) The only variances that will relate, without further information, are the labor efficiency variance

and the overhead efficiency variance (if the three-variance method is used). The labor

efficiency variance measures the cost of labor saved because of efficient use of labor time.

The overhead efficiency variance measures the overhead costs saved because the labor

saved did not need overhead support.

(3) The only variance typically treated as not controllable is the overhead capacity variance. All of

the other variances are controllable at the level the variances are calculated. Materials price

variance is controllable by the purchasing agent. The labor variances are controllable by the

Managerial Accounting Solutions, Schneider/Sollenberger, 4th Edition, Chapter 8, Page 8-35

operating departments. The overhead variances, except the capacity variance, are

controllable by the operating departments.

(4) New standard cost per unit.

Materials ($617,500 9,500) $65.00

Labor ($10.50* x 2.5 hours +) 26.25

Variable overhead ($163,000 9,500) 17.16

Fixed overhead 8.00

Standard cost per unit $116.41

* Labor rate: $249,375 23,750 = $10.50

+