Professional Documents

Culture Documents

GST Entries For Every Month Sales

Uploaded by

Giri SukumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GST Entries For Every Month Sales

Uploaded by

Giri SukumarCopyright:

Available Formats

GST ENTRIES FOR EVERY MONTH

SALES

Debtors A/c ..Dr

To Sales A/c Cr.

To CGST Output A/c Cr.

To SGST Output A/c Cr.

To IGST Output A/c Cr.

PURCHASES

Purchases A/c ..Dr

CGST Input A/c ..Dr

SGST Input A/c ..Dr

IGST Input A/c ..Dr

To Creditors A/c Cr.

EXPENSES (Other Than RCM)

Expenses A/c ..Dr

CGST Input A/c ..Dr

SGST Input A/c ..Dr

IGST Input A/c ..Dr

To Bank A/c Cr.

RCM

Expenses A/c ..Dr

RCM CGST Input A/c ..Dr

RCM SGST Input A/c ..Dr

RCM IGST Input A/c ..Dr

To Bank A/c Cr.

To RCM CGST Payable A/c Cr.

To RCM SGST Payable A/c Cr.

To RCM IGST Payable A/c Cr.

CLOSURE ENTRY TO BE PASSED ON THE LAST DAT OF MONTH

i)

CGST Output A/c ..Dr

SGST Output A/c ..Dr

IGST Output A/c ..Dr

To CGST Payable A/c Cr.

To SGST Payable A/c Cr.

To IGST Payable A/c Cr.

(Being Output collected during the month transferred to Respective payable A/c)

Note: After this entry, All GST output A/c Balance will become NIL

ii)

CGST Payable A/c ..Dr

SGST Payable A/c ..Dr

IGST Payable A/c ..Dr

To CGST Input A/c Cr.

To SGST Input A/c Cr.

To IGST Input A/c Cr.

(Being input created out of purchases and expenses during the month transferred

to Respective payable A/c)

Note: After this entry, All GST input A/c Balance will become NIL

iii)

CGST Payable A/c ..Dr

SGST Payable A/c ..Dr

IGST Payable A/c ..Dr

To RCM CGST Input A/c Cr.

To RCM SGST Input A/c Cr.

To RCM IGST Input A/c Cr.

(Being balance lying in RCM Input A/c for the month transferred to Respective

payable A/c)

Note: After this entry, All RCM input A/c Balance will become NIL

iv)

RCM CGST Payable A/c ..Dr

RCM SGST Payable A/c ..Dr

RCM IGST Payable A/c ..Dr

To Bank Cr.

(Being GST payable on RCM Basis paid in Cash)

v)

CGST Payable A/c

SGST Payable A/c

IGST Payable A/c

To Bank Cr.

(Being GST payable after netting off of Outputs and Inputs paid)

Prepared By: Ashwani Dhanuka

7873350239

You might also like

- Accounting Entries Under GST For Different SituationsDocument42 pagesAccounting Entries Under GST For Different Situationsamit chavariaNo ratings yet

- How To Pass Accounting Entries Under GSTDocument6 pagesHow To Pass Accounting Entries Under GSTSunando Narayan BiswasNo ratings yet

- Journal Entries For TDSDocument2 pagesJournal Entries For TDSManish DebNo ratings yet

- List of Ledgers and It's Under Group in TallyDocument5 pagesList of Ledgers and It's Under Group in Tallyrachel KujurNo ratings yet

- Ledger accounts for business transactionsDocument16 pagesLedger accounts for business transactionsmark njeru ngigiNo ratings yet

- GST Practical Record 40-50 Key PointsDocument48 pagesGST Practical Record 40-50 Key PointsAditya raj ojhaNo ratings yet

- Tally E Book 2Document154 pagesTally E Book 2anjali44499No ratings yet

- Tally Sample Paper With GST Feb 2023Document3 pagesTally Sample Paper With GST Feb 2023Bhumi NavtiaNo ratings yet

- 10 Illustration of Ledger 24.10.08Document7 pages10 Illustration of Ledger 24.10.08denish gandhiNo ratings yet

- Questions On Trial Balance To StudentsDocument6 pagesQuestions On Trial Balance To Studentsveraji3735No ratings yet

- Six Day in Tally Class (What Is Ledger and How To Create Ledger in Tally)Document9 pagesSix Day in Tally Class (What Is Ledger and How To Create Ledger in Tally)Kamlesh KumarNo ratings yet

- Set 1 & 3 PDFDocument6 pagesSet 1 & 3 PDFCorona VirusNo ratings yet

- Villamor FinalDocument25 pagesVillamor FinalRinconada Benori ReynalynNo ratings yet

- TS Grewal Solution For Class 11 Accountancy Chapter 5 - JournalDocument47 pagesTS Grewal Solution For Class 11 Accountancy Chapter 5 - JournalRUSHIL GUPTANo ratings yet

- Tally Erp 9 Practise Set 1Document28 pagesTally Erp 9 Practise Set 1Anusha ShettyNo ratings yet

- Tally InterviewDocument6 pagesTally InterviewGST Point Taxation & Accounting ServicesNo ratings yet

- Tally - ERP9 Book With GSTDocument1,843 pagesTally - ERP9 Book With GSThatimNo ratings yet

- 59journal Solved Assignment 13-14Document12 pages59journal Solved Assignment 13-14anon_350417051No ratings yet

- Tally Practical (B) - 1Document3 pagesTally Practical (B) - 1Bhaavya GuptaNo ratings yet

- Journal EntriesDocument61 pagesJournal EntriesTavnish Singh100% (1)

- Tally Prime NotesDocument54 pagesTally Prime Notesroshandhamankar0100% (1)

- Basic Accounting Terms.1Document5 pagesBasic Accounting Terms.1k srinivasNo ratings yet

- Prep Trading - Profit-And-Loss-Ac Balance SheetDocument25 pagesPrep Trading - Profit-And-Loss-Ac Balance Sheetfaltumail379100% (1)

- Tally Prime Course PayrollDocument7 pagesTally Prime Course PayrollElakiyaaNo ratings yet

- Tally - Business Accounts Question BankDocument9 pagesTally - Business Accounts Question BankBhaskar bhaskarNo ratings yet

- List of Ledgers: S.No Ledger Name Under: GroupDocument5 pagesList of Ledgers: S.No Ledger Name Under: GroupSuraj KumarNo ratings yet

- Accounting and Finance Numericals Problems and AnsDocument11 pagesAccounting and Finance Numericals Problems and AnsPramodh Kanulla0% (1)

- Test 3Document7 pagesTest 3info view0% (1)

- Tally reports for Crockery Store transactionsDocument2 pagesTally reports for Crockery Store transactionsabhishek georgeNo ratings yet

- Accountancy Higher Secondary - Second Year Volume IDocument132 pagesAccountancy Higher Secondary - Second Year Volume Iakvssakthivel100% (1)

- TallyGURU Syllabus Covers GST, TDS, TCS, PayrollDocument2 pagesTallyGURU Syllabus Covers GST, TDS, TCS, PayrollWedsa Kumari50% (2)

- Trading and Profit and Loss Account Further ConsiderationsDocument5 pagesTrading and Profit and Loss Account Further ConsiderationsbillNo ratings yet

- 59journal Solved Assignment 13 14Document7 pages59journal Solved Assignment 13 14Monica SainiNo ratings yet

- Chapter 7 LedgerDocument18 pagesChapter 7 LedgerJumayma MaryamNo ratings yet

- Tally Module 1 Assignment SolutionDocument6 pagesTally Module 1 Assignment Solutioncharu bishtNo ratings yet

- Purchase and Sales Entry in Journal ModeDocument9 pagesPurchase and Sales Entry in Journal ModeBiplab SwainNo ratings yet

- Volume 3Document178 pagesVolume 3VFX zoneNo ratings yet

- Assignment 1 ACCOUNTANCYDocument3 pagesAssignment 1 ACCOUNTANCYCHINMAY AGRAWALNo ratings yet

- Tally 036Document191 pagesTally 036anjalishah7No ratings yet

- Sample Reports in Tally - Erp 9 - Tally Shopper - Access To Tally - Tally Web InterfaceDocument287 pagesSample Reports in Tally - Erp 9 - Tally Shopper - Access To Tally - Tally Web InterfacejohnabrahamstanNo ratings yet

- Tally Question For InterviewDocument7 pagesTally Question For InterviewSANTOSH KUMARNo ratings yet

- Accounting Fundamentals ExplainedDocument20 pagesAccounting Fundamentals Explained1986anuNo ratings yet

- YCI Tally NotesDocument85 pagesYCI Tally NoteshxjdyufjNo ratings yet

- KVS STUDY MATERIAL FOR CLASS 11 ACCOUNTANCYDocument144 pagesKVS STUDY MATERIAL FOR CLASS 11 ACCOUNTANCYmalathi SNo ratings yet

- Vouchering and Posting Basic Accounting Problems in TallyDocument9 pagesVouchering and Posting Basic Accounting Problems in TallyM ZNo ratings yet

- Tally Test: Kishan Lal SharmaDocument4 pagesTally Test: Kishan Lal Sharmakhan patelNo ratings yet

- Solutions To Text Book Exercises: Consignment AccountsDocument23 pagesSolutions To Text Book Exercises: Consignment AccountsM JEEVARATHNAM NAIDUNo ratings yet

- Depreciation Question and Answers 4Document4 pagesDepreciation Question and Answers 4AMIN BUHARI ABDUL KHADERNo ratings yet

- Extra Journal QuestionsDocument3 pagesExtra Journal QuestionsMba BNo ratings yet

- Accounting BasicsDocument21 pagesAccounting BasicsasifparwezNo ratings yet

- CA Foundation Accounting Notes by Bharadwaj InstituteDocument127 pagesCA Foundation Accounting Notes by Bharadwaj Institutenasiransar26No ratings yet

- Problem 1Document3 pagesProblem 1karthikeyan01No ratings yet

- B - Com - Tally I Sem Exam Set 3Document2 pagesB - Com - Tally I Sem Exam Set 3Vikas100% (1)

- Questions Journal, Ledger & TBDocument9 pagesQuestions Journal, Ledger & TBHarsh GhaiNo ratings yet

- Chapter 13Document12 pagesChapter 13palash khannaNo ratings yet

- GST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyFrom EverandGST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyRating: 5 out of 5 stars5/5 (1)

- GST Basics and AccountingDocument30 pagesGST Basics and AccountingHarnitNo ratings yet

- CH 12 Goods and Service TaxDocument15 pagesCH 12 Goods and Service TaxHarshul MittalNo ratings yet

- How To Pass Accounting Entries Under GST - GST Impact On FinancialsDocument9 pagesHow To Pass Accounting Entries Under GST - GST Impact On FinancialsHimanshu ChaudharyNo ratings yet

- Accounting Entries Under GSTDocument7 pagesAccounting Entries Under GSTPiousPatialaNo ratings yet

- Paper 11 NEW GST PDFDocument399 pagesPaper 11 NEW GST PDFsomaanvithaNo ratings yet

- GST Flyer 51 PDFDocument468 pagesGST Flyer 51 PDFGiri SukumarNo ratings yet

- GST Icai Volumeii 01012018 PDFDocument499 pagesGST Icai Volumeii 01012018 PDFGiri SukumarNo ratings yet

- Financial Modeling Best Practices for Building Financial ModelsDocument84 pagesFinancial Modeling Best Practices for Building Financial Modelshvsboua67% (6)

- GST Icai Volumeii 01012018 PDFDocument499 pagesGST Icai Volumeii 01012018 PDFGiri SukumarNo ratings yet

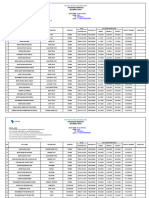

- New Microsoft Office Excel WorksheetDocument1 pageNew Microsoft Office Excel WorksheetGiri SukumarNo ratings yet

- Refresher Course On GSTDocument144 pagesRefresher Course On GSTGiri SukumarNo ratings yet

- IT & GST Ready ReckonerDocument43 pagesIT & GST Ready ReckonerNishant Sipani100% (1)

- GST Icai Volumeii 01012018 PDFDocument499 pagesGST Icai Volumeii 01012018 PDFGiri SukumarNo ratings yet

- Projected Profit and Loss, BISDocument13 pagesProjected Profit and Loss, BISGiri SukumarNo ratings yet

- IT & GST Ready ReckonerDocument43 pagesIT & GST Ready ReckonerNishant Sipani100% (1)

- IT & GST Ready ReckonerDocument43 pagesIT & GST Ready ReckonerNishant Sipani100% (1)

- Cbic 3rd Edition Faq December 15 2018 PDFDocument561 pagesCbic 3rd Edition Faq December 15 2018 PDFGiri SukumarNo ratings yet

- Charge OF GST: After Studying This Chapter, You Will Be Able ToDocument49 pagesCharge OF GST: After Studying This Chapter, You Will Be Able ToGiri SukumarNo ratings yet

- Cbic 3rd Edition Faq December 15 2018 PDFDocument561 pagesCbic 3rd Edition Faq December 15 2018 PDFGiri SukumarNo ratings yet

- Provisions of GST Effective From 1St April 2019Document3 pagesProvisions of GST Effective From 1St April 2019Giri SukumarNo ratings yet

- Accounting Entries Under GSTDocument43 pagesAccounting Entries Under GSTladmohanNo ratings yet

- View GST Lecture on Composition Scheme Benefits and DrawbacksDocument18 pagesView GST Lecture on Composition Scheme Benefits and DrawbacksGiri SukumarNo ratings yet

- Scope of IncomeDocument46 pagesScope of IncomeSHRIKANT SAHUNo ratings yet

- Provisions Before 1st Feb 2019Document3 pagesProvisions Before 1st Feb 2019Giri SukumarNo ratings yet

- Charge OF GST: After Studying This Chapter, You Will Be Able ToDocument49 pagesCharge OF GST: After Studying This Chapter, You Will Be Able ToGiri SukumarNo ratings yet

- Note On GST Input Tax Credit CA Yashwant KasarDocument32 pagesNote On GST Input Tax Credit CA Yashwant KasarGiri SukumarNo ratings yet

- FAQs and MCQs On GST Sep18 PDFDocument523 pagesFAQs and MCQs On GST Sep18 PDFGiri SukumarNo ratings yet

- 40 Tax Audit in Tally Erp 9Document15 pages40 Tax Audit in Tally Erp 9Giri SukumarNo ratings yet

- Model Agreement of Sale of Immovable PropertyDocument3 pagesModel Agreement of Sale of Immovable PropertyGiri SukumarNo ratings yet

- CA Final GST QB Part IDocument72 pagesCA Final GST QB Part IAejaz MohamedNo ratings yet

- Bond For Export of Goods or Services Without Payment of Integrated TaxDocument1 pageBond For Export of Goods or Services Without Payment of Integrated TaxGiri SukumarNo ratings yet

- Paper 11 NEW GST PDFDocument399 pagesPaper 11 NEW GST PDFsomaanvithaNo ratings yet

- 40 Tax Audit in Tally Erp 9Document15 pages40 Tax Audit in Tally Erp 9Giri SukumarNo ratings yet

- Lyotard Jean Francois Political WritingsDocument178 pagesLyotard Jean Francois Political WritingsgurdasaabNo ratings yet

- ITS Troupe Constitution Template - 2015-2016 - FINAL-2Document5 pagesITS Troupe Constitution Template - 2015-2016 - FINAL-2Rob GalloNo ratings yet

- Affidavit in Support of Foia RequestDocument10 pagesAffidavit in Support of Foia RequestJack RyanNo ratings yet

- NSP SummaryDocument4 pagesNSP SummaryUsman ZafarNo ratings yet

- Social Justice in The Context of The Church - S MissionDocument23 pagesSocial Justice in The Context of The Church - S MissionJazper ComiaNo ratings yet

- 3 Complaint-With-Application-For-ReceivershipDocument4 pages3 Complaint-With-Application-For-ReceivershipIanLightPajaroNo ratings yet

- 00758-060407 DcsDocument107 pages00758-060407 DcslegalmattersNo ratings yet

- PIL Legislative CommentDocument4 pagesPIL Legislative Commentaditi ranaNo ratings yet

- Propaganda - The Formation of Men's Attitudes - Wikipedia, The Free EncyclopediaDocument12 pagesPropaganda - The Formation of Men's Attitudes - Wikipedia, The Free EncyclopediaCarl Cord100% (1)

- Nancy Vogeley - The Bookrunner - A History of Inter-American Relations - Print, Politics, and Commerce in The US and Mexico 1800-1830 PDFDocument342 pagesNancy Vogeley - The Bookrunner - A History of Inter-American Relations - Print, Politics, and Commerce in The US and Mexico 1800-1830 PDFManticora PretiosaNo ratings yet

- Selection and Sampling Procedures in Qualitative ResearchDocument7 pagesSelection and Sampling Procedures in Qualitative ResearchEric Mauricio Cotrina LeónNo ratings yet

- United States v. Sixty Acres in Etowah County, Evelyn Charlene Ellis, 930 F.2d 857, 11th Cir. (1991)Document7 pagesUnited States v. Sixty Acres in Etowah County, Evelyn Charlene Ellis, 930 F.2d 857, 11th Cir. (1991)Scribd Government DocsNo ratings yet

- Diminished Expectations Redistributive Preferences in Truncated Welfare StatesDocument40 pagesDiminished Expectations Redistributive Preferences in Truncated Welfare StatesandreaNo ratings yet

- Islamic Economics: Still in Search of An Identity: Abdulkader Cassim MahomedyDocument14 pagesIslamic Economics: Still in Search of An Identity: Abdulkader Cassim MahomedySon Go HanNo ratings yet

- ONCURATING Issue9Document94 pagesONCURATING Issue9William ChanNo ratings yet

- UCSP Final Exam 2023Document7 pagesUCSP Final Exam 2023edward100% (2)

- Stages of DevelopmentDocument7 pagesStages of DevelopmentDwight Jenna de MesaNo ratings yet

- Civil Disobedience Aff CaseDocument4 pagesCivil Disobedience Aff CaseMatthew WylieNo ratings yet

- 2022 Gad Accomplishment Report Fy 1Document15 pages2022 Gad Accomplishment Report Fy 1Bpv BarangayNo ratings yet

- Negotiation SkillsDocument24 pagesNegotiation Skillssamy zaherNo ratings yet

- Upper Guinea and Origins of African Slave Trade Enslaved in The New World - by Waltner Rodney (1969)Document20 pagesUpper Guinea and Origins of African Slave Trade Enslaved in The New World - by Waltner Rodney (1969)AbuAbdur-RazzaqAl-MisriNo ratings yet

- Isl 232 - Islamic Economic SystemDocument86 pagesIsl 232 - Islamic Economic SystemJawad UllahNo ratings yet

- Framework Answers - Berkeley 2017Document151 pagesFramework Answers - Berkeley 2017Andrew GrazianoNo ratings yet

- Boat Booking PDJT-BRT 17.5.2023 Via Blue Petra 2 IncomingDocument3 pagesBoat Booking PDJT-BRT 17.5.2023 Via Blue Petra 2 IncomingMohd NasrullahNo ratings yet

- Chapter 24 (Flores)Document14 pagesChapter 24 (Flores)Julius de la CruzNo ratings yet

- Aquinas Treatise on Law Explores Divine, Natural, and Human LawsDocument5 pagesAquinas Treatise on Law Explores Divine, Natural, and Human LawsEmerson Cajayon MaalaNo ratings yet

- PCS Union Midlands Regional Newsline Autumn 2012Document8 pagesPCS Union Midlands Regional Newsline Autumn 2012PcsMidlandsNo ratings yet

- LESSON 1what Is A Hero Rizal Law (R. A. 1425)Document4 pagesLESSON 1what Is A Hero Rizal Law (R. A. 1425)Maria Charise TongolNo ratings yet

- Vance Joy - Riptide Case StudyDocument18 pagesVance Joy - Riptide Case StudySkye DrewNo ratings yet