Professional Documents

Culture Documents

Bird Worldwide Flight Services India Pay Slip Details

Uploaded by

SUNIL KUMAR0 ratings0% found this document useful (0 votes)

179 views1 pageIata codes

Original Title

Sunil Kumar(DELS0210)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIata codes

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

179 views1 pageBird Worldwide Flight Services India Pay Slip Details

Uploaded by

SUNIL KUMARIata codes

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

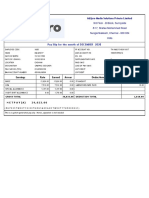

BIRD WORLDWIDE FLIGHT SERVICES INDIA PVT. LTD.

E-9,Connaught House,Connaught Place, New Delhi

Pay Slip for the month of September 2019

Employee Name Sunil Kumar Branch DELHI AIRPORT

Emp ID DELS0210 Month September

Designation TEAM LEADER Year 2019

Department RAMP Pay Mode Bank

Date of Joining 21-Aug-2010 Bank Name VIJAYA BANK

Date of Birth 10-Mar-1989 A/C No 600401141001143

Father/Husband Name Brahampal ESI No. 1113556394

IT/PAN No. DONPK2567A Aadhar Card No. 829176907003

PF A/c No. DLCPM00395480000001548 UAN 100385644185

OT Hours 0 Paid Days 30

Earnings Gross Amount Arrear Paid Amount Deductions Ded. Amount

BASIC 8868.00 8868.00 PF 1270.00

HRA 4430.00 4430.00 ESI 150.00

CONVEYANCE 800.00 800.00

UNIFORM AL 728.00 728.00

MEDICAL 728.00 728.00

LTA 728.00 728.00

SPL. ALLOW 728.00 728.00

PROD. ALL 727.00 727.00

ATTEND ALL 0.00 500.00

VDA 1716.00 1716.00

Total 19453.00 0.00 19953.00 Total 1420.00

In Words (Rupees Eighteen Thousand Five Hundred Thirty Three Only) Net Pay 18533.00

INCOME TAX CALCULATION INVESTMENT DETAILS

Cummulative Less:

Particulars

Total

Add: Projected

Exempted

Annual Statutory Provident Fund 15240.00

BASIC 53208.00 53208.00 106416.00

HRA 26580.00 26580.00 0.00 53160.00

CONVEYANCE 4800.00 4800.00 0.00 9600.00

UNIFORM AL 4368.00 4368.00 0.00 8736.00

MEDICAL 4368.00 4368.00 0.00 8736.00

LTA 4368.00 4368.00 0.00 8736.00

SPL. ALLOW 4368.00 4368.00 0.00 8736.00

PROD. ALL 4362.00 4362.00 0.00 8724.00

ATTEND ALL 3000.00 0.00 0.00 3000.00

VDA 10296.00 10296.00 0.00 20592.00

Other Earnings 15088.00 0.00 15088.00

Total Income 134806.00 116718.00 0.00 251524.00

Add: Income Received from previous employer 0.00

GROSS TAXABLE INCOME 251524.00 Total 15240.00

Less: Standard Deduction 50000.00 HRA Rent Paid Details

Less: Income from House Property 0.00 April No 0.00

Less: Professional tax deducted by previous employer 0.00 May No 0.00

Less: Professional tax deducted by current employer 0.00 June No 0.00

Add: Other taxable Income reported by the employee 0.00 July No 0.00

NETT TAXABLE INCOME 201524.00 August No 0.00

Less: 80C 15240.00 September No 0.00

October No 0.00

November No 0.00

December No 0.00

January No 0.00

INCOME CHARGEABLE TO TAX (ROUNDED OFF) 186280.00 February No 0.00

INCOME TAX DEDUCTION March No 0.00

Rebate Amount 0.00 Income Tax Payable 0.00 Total 0.00

Add: Surcharge 0.00 Medical Bills Submitted

Add: E. Cess 0.00 April October

Total Income Tax/Surcharge/E. Cess 0.00 May November

Less: Income Tax/Surcharge/E. Cess Deducted by previous employer 0.00 June December

Income Tax/Surcharge/E. Cess to be recovered 0.00 July January

Income Tax/Surcharge/E. Cess recovered till September 0.00 August February

September March

2019

Balance Income Tax/Surcharge/E. Cess to be recovered 0.00

Avg. Monthly Income Tax/Surcharge/E. Cess to be recovered 0.00 Total 0.00

"THIS IS COMPUTER GENERATED STATEMENT SO SIGNATURE IS NOT REQUIRED"

You might also like

- Dec07 PDFDocument1 pageDec07 PDFomkassNo ratings yet

- OE0036Document1 pageOE0036kumud kalaNo ratings yet

- Earnings Deductions: Eicher Motors LimitedDocument1 pageEarnings Deductions: Eicher Motors LimitedR SEETHARAMANNo ratings yet

- You Have Opted For Old Tax RegimeDocument2 pagesYou Have Opted For Old Tax RegimeRamsheed Ashraf100% (1)

- Mar18 PDFDocument1 pageMar18 PDFomkassNo ratings yet

- Uni-Com India PVT - LTDDocument1 pageUni-Com India PVT - LTDcredit cardNo ratings yet

- Payslip 03Document1 pagePayslip 03kroopeshreddy2298No ratings yet

- PAY May 2022Document1 pagePAY May 2022Rohit raagNo ratings yet

- Salary Slip July 2023 - UnlockedDocument1 pageSalary Slip July 2023 - UnlockedPardeep AttriNo ratings yet

- Payslip Sep-2022 NareshDocument3 pagesPayslip Sep-2022 NareshDharshan RajNo ratings yet

- Fortis Hospital February 2019 PayslipDocument1 pageFortis Hospital February 2019 PayslipmkumarsejNo ratings yet

- Amount in Words Is Rupees Eleven Thousand Six OnlyDocument1 pageAmount in Words Is Rupees Eleven Thousand Six OnlyGunaganti MaheshNo ratings yet

- Bharti AXA Life Insurance Employee PayslipDocument1 pageBharti AXA Life Insurance Employee PayslipJoginderNo ratings yet

- Teleperformance Global Services Private Limited: Full and Final Settlement - December 2023Document3 pagesTeleperformance Global Services Private Limited: Full and Final Settlement - December 2023vishal.upadhyay9279No ratings yet

- 2nd FLOOR, Gold Field, Sion Dharavi Link Road, Sion (W), Mumbai-400017Document1 page2nd FLOOR, Gold Field, Sion Dharavi Link Road, Sion (W), Mumbai-400017Faisal NumanNo ratings yet

- Salary Slip - February 2023 - Gurjeet Singh SainiDocument1 pageSalary Slip - February 2023 - Gurjeet Singh SainiGurjeet SainiNo ratings yet

- Earnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Document1 pageEarnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Nanha-Munna swaggerNo ratings yet

- Amit JiDocument1 pageAmit JiRohit RajNo ratings yet

- DDICGDIAP72DINOV22Document1 pageDDICGDIAP72DINOV22raghav bharadwajNo ratings yet

- Global Edge Software Limited: Payslip For The Month of December - 2018Document1 pageGlobal Edge Software Limited: Payslip For The Month of December - 2018Manoj SahooNo ratings yet

- Chola Business Services Pay SlipDocument3 pagesChola Business Services Pay SlipsathyaNo ratings yet

- Vistaar Financial Services Private Limited: Payslip For The Month of February 2018Document1 pageVistaar Financial Services Private Limited: Payslip For The Month of February 2018AlleoungddghNo ratings yet

- 1033553563Document1 page1033553563Virendra Nalawde100% (1)

- Durga Malleswara RaoDocument1 pageDurga Malleswara RaoRajesh pvkNo ratings yet

- Payslip - May - 2020 PDFDocument1 pagePayslip - May - 2020 PDFchanduNo ratings yet

- MIOT Hospitals pay slip Oct 2022Document1 pageMIOT Hospitals pay slip Oct 2022jesten jadeNo ratings yet

- Sep2022 STFC PayslipDocument1 pageSep2022 STFC PayslipAjith NandhaNo ratings yet

- DownloadDocument1 pageDownloadJitaram SamalNo ratings yet

- Salma Saifi May SlipDocument2 pagesSalma Saifi May Slipsalma saifiNo ratings yet

- QUA05891 SepSalarySlipwithTaxDetailsDocument1 pageQUA05891 SepSalarySlipwithTaxDetailssrajput66No ratings yet

- Pay Slip For The Month of December 2021: Plot No 5, 49, Parwana Road, Brij Puri, New Brij Puri,, East Delhi-110051Document1 pagePay Slip For The Month of December 2021: Plot No 5, 49, Parwana Road, Brij Puri, New Brij Puri,, East Delhi-110051pawan kaushikNo ratings yet

- March Salary PDFDocument1 pageMarch Salary PDFomkassNo ratings yet

- Payslip For The Month of November 2016Document1 pagePayslip For The Month of November 2016chittaNo ratings yet

- India Local Monthly130122210312905Document1 pageIndia Local Monthly130122210312905NAGARJUNANo ratings yet

- This Is My Money. I Earned It by Doing My Best For Our CustomersDocument3 pagesThis Is My Money. I Earned It by Doing My Best For Our CustomersAbzi SyedNo ratings yet

- SlipDocument5 pagesSlipHiten kaneshriyaNo ratings yet

- Salary Slip EDIT-JULYDocument4 pagesSalary Slip EDIT-JULYpathyashisNo ratings yet

- EazeWorkPaySlip86723 Salslip 1017Document1 pageEazeWorkPaySlip86723 Salslip 1017Dhiraj LokhandeNo ratings yet

- FAMS BETTER LIFE LLP PAY SLIP FOR OCT 2021Document1 pageFAMS BETTER LIFE LLP PAY SLIP FOR OCT 2021shreyas kotiNo ratings yet

- Employee Details Payment & Working Days Details Location Details Nilu KumariDocument1 pageEmployee Details Payment & Working Days Details Location Details Nilu KumariRohit raagNo ratings yet

- Spice Mobile LimitedDocument1 pageSpice Mobile LimitedChristopher GarciaNo ratings yet

- Payslip 8 2022Document1 pagePayslip 8 2022Md SharidNo ratings yet

- PaySlip 221253181486P PDFDocument1 pagePaySlip 221253181486P PDFpraveenNo ratings yet

- Payslip Oct-2022 NareshDocument3 pagesPayslip Oct-2022 NareshDharshan Raj0% (1)

- AUGUST PayslipDocument1 pageAUGUST PayslipRakesh MandalNo ratings yet

- Pay Slip For January 2018: Cybage Software Private LimitedDocument1 pagePay Slip For January 2018: Cybage Software Private LimitedSudheer0% (1)

- STEAG Energy Services Pay Slip for August 2020Document1 pageSTEAG Energy Services Pay Slip for August 2020Tuhin ChakrabortyNo ratings yet

- Nov 2022Document1 pageNov 2022nirmal sridharNo ratings yet

- Pay Slip Title Under 40 CharactersDocument1 pagePay Slip Title Under 40 CharactersMickey CreationNo ratings yet

- Payslip 2023 2024 10 05607 VASTUGROUPDocument1 pagePayslip 2023 2024 10 05607 VASTUGROUPNavamani VigneshNo ratings yet

- Salary Slip (30385759 May, 2018)Document1 pageSalary Slip (30385759 May, 2018)munafNo ratings yet

- Payslip 2023 2024 6 200000000029454 IGSLDocument1 pagePayslip 2023 2024 6 200000000029454 IGSLMohit SagarNo ratings yet

- Sampangi Sowbhagya (POL11622)Document1 pageSampangi Sowbhagya (POL11622)Sowbhagya VaderaNo ratings yet

- Servlet ControllerDocument1 pageServlet ControllerYashasvi GuptaNo ratings yet

- Payslip 172820180712150142Document1 pagePayslip 172820180712150142LakshmananNo ratings yet

- Venus Precision Tools and Components PVT - LTD: Salary Slip For The Month of October, 2020Document1 pageVenus Precision Tools and Components PVT - LTD: Salary Slip For The Month of October, 2020pyNo ratings yet

- PAYSLIP Nov-2022 - NareshDocument3 pagesPAYSLIP Nov-2022 - NareshDharshan RajNo ratings yet

- Altruist Customer Management India PVT LTD: Personal DetailsDocument1 pageAltruist Customer Management India PVT LTD: Personal DetailsSampathKPNo ratings yet

- SALARY SLIP JAN 2024Document1 pageSALARY SLIP JAN 2024ajinkyadiwakar717No ratings yet

- Kirandeep August SalaryDocument1 pageKirandeep August Salaryprince.gill07No ratings yet

- Dividend Policy and Firm Value Assignment 2Document2 pagesDividend Policy and Firm Value Assignment 2riddhisanghviNo ratings yet

- Tax1 1 Basic Principles of Taxation 01.30.11-Long - For Printing - Without AnswersDocument10 pagesTax1 1 Basic Principles of Taxation 01.30.11-Long - For Printing - Without AnswersCracker Oats83% (6)

- Mentoring AkDocument11 pagesMentoring Akkhoirul nasNo ratings yet

- PESTEL ANALYSIS AND FIVE FORCES MODEL OF LIJJAT PAPADDocument14 pagesPESTEL ANALYSIS AND FIVE FORCES MODEL OF LIJJAT PAPADKeyur Popat100% (1)

- Chapter 15 Investment, Time, and Capital Markets: Teaching NotesDocument65 pagesChapter 15 Investment, Time, and Capital Markets: Teaching NotesMohit ChetwaniNo ratings yet

- Corporate Liquidation DisDocument4 pagesCorporate Liquidation DisRenelyn DavidNo ratings yet

- Doing Business in Latvia 2010Document53 pagesDoing Business in Latvia 2010BDO TaxNo ratings yet

- Covivio Hotels Bond Investor PresentationDocument57 pagesCovivio Hotels Bond Investor PresentationTung NgoNo ratings yet

- Capital Gains Tax PDFDocument3 pagesCapital Gains Tax PDFvalsupmNo ratings yet

- A Study A Study On Financial Performance Analysis With Reference To Kesoram Cementon Financial Performance Analysis With Reference To Kesoram CementDocument81 pagesA Study A Study On Financial Performance Analysis With Reference To Kesoram Cementon Financial Performance Analysis With Reference To Kesoram CementjeganrajrajNo ratings yet

- Financial Ratio Analysis Aldar UpdatedDocument36 pagesFinancial Ratio Analysis Aldar UpdatedHasanNo ratings yet

- Answers To Essay QuestionsDocument17 pagesAnswers To Essay QuestionsDarren LimNo ratings yet

- Lesson On Financial AnalysisDocument3 pagesLesson On Financial AnalysiscassieNo ratings yet

- Choose Business Structure GuideDocument32 pagesChoose Business Structure Guideczds6594No ratings yet

- Assignment of Management of Working Capital: Topic: Cash BudgetDocument10 pagesAssignment of Management of Working Capital: Topic: Cash BudgetDavinder Singh BanssNo ratings yet

- PLC AND MARKETING STRATEGIES OF LUX SOAPDocument7 pagesPLC AND MARKETING STRATEGIES OF LUX SOAPPuneet Singh Chhabra100% (1)

- Msmed Act, 2006Document21 pagesMsmed Act, 2006manisha100% (2)

- Unique Aspects of The Hospitality IndustryDocument25 pagesUnique Aspects of The Hospitality Industry李曉泉100% (1)

- Preparing An Income Statement, Statement of Retained Earnings, and Balance SheetDocument5 pagesPreparing An Income Statement, Statement of Retained Earnings, and Balance SheetJames MorrisonNo ratings yet

- Cost TB C02 CarterDocument23 pagesCost TB C02 CarterArya Stark100% (1)

- Investing in Stocks and Bonds: Understanding Risks and ReturnsDocument49 pagesInvesting in Stocks and Bonds: Understanding Risks and Returnsbonifacio gianga jrNo ratings yet

- Memorandum of Association of TRADE ORGANIZATIONDocument8 pagesMemorandum of Association of TRADE ORGANIZATIONSyed Zahid ImtiazNo ratings yet

- Principles of AccountingDocument13 pagesPrinciples of AccountingRoe BelleNo ratings yet

- Insurance Commission Ruling on Life Insurance ClaimsDocument8 pagesInsurance Commission Ruling on Life Insurance ClaimsMarioneMaeThiamNo ratings yet

- Io73moh25 - ACTIVITY - CHAPTER 4 - TYPES OF MAJOR ACCOUNTS.Document4 pagesIo73moh25 - ACTIVITY - CHAPTER 4 - TYPES OF MAJOR ACCOUNTS.James CastañedaNo ratings yet

- Finsas: Financial Statement Analysis SpreadsheetDocument25 pagesFinsas: Financial Statement Analysis SpreadsheetDharm Veer RathoreNo ratings yet

- Financial Data Questionnaire Student Visa Application American Consulate GeneralDocument5 pagesFinancial Data Questionnaire Student Visa Application American Consulate Generalmuhyminul100% (3)

- Financial Analysis of Hòa Phát Group Joint Stock CompanyDocument36 pagesFinancial Analysis of Hòa Phát Group Joint Stock CompanySang NguyễnNo ratings yet

- SLIP GAJI DANDI Des Jan FebDocument3 pagesSLIP GAJI DANDI Des Jan Febharun chandraNo ratings yet

- The Impacts of Unemployment in Zimbabwe From The 2009-2019Document12 pagesThe Impacts of Unemployment in Zimbabwe From The 2009-2019Tracy AlpsNo ratings yet