Professional Documents

Culture Documents

M S Ajanta Private Limited Vs Deputy Commissioner of Income ... On 7 March, 2018 PDF

M S Ajanta Private Limited Vs Deputy Commissioner of Income ... On 7 March, 2018 PDF

Uploaded by

Deepak PanwarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

M S Ajanta Private Limited Vs Deputy Commissioner of Income ... On 7 March, 2018 PDF

M S Ajanta Private Limited Vs Deputy Commissioner of Income ... On 7 March, 2018 PDF

Uploaded by

Deepak PanwarCopyright:

Available Formats

M/S Ajanta Private Limited vs Deputy Commissioner Of Income ...

on 7 March, 2018

Gujarat High Court

M/S Ajanta Private Limited vs Deputy Commissioner Of Income ... on 7 March, 2018

Bench: Akil Kureshi, B.N. Karia

C/TAXAP/683/2017 ORDER

IN THE HIGH COURT OF GUJARAT AT AHMEDABAD

TAX APPEAL NO. 683 of 2017

==========================================================

M/S AJANTA PRIVATE LIMITED

Versus

DEPUTY COMMISSIONER OF INCOME TAX,

==========================================================

Appearance:

DARSHAN R PATEL for the PETITIONER(s) No. 1

MRS MAUNA M BHATT for the RESPONDENT(s) No. 1

NOTICE NOT RECD BACK for the RESPONDENT(s) No. 1

==========================================================

CORAM: HONOURABLE MR.JUSTICE AKIL KURESHI

and

HONOURABLE MR.JUSTICE B.N. KARIA

Date : 07/03/2018

ORAL ORDER

( P E R : H O N O U R A B L E M R . J U S T I C E A K I L K U R E S H I )

This appeal is filed by the appellant challenging judgment of the Income Tax Appellate

Tribunal. We frame the following substantial question of law :

"Whether on the facts and circumstances of the case, the

Tribunal has substantially erred in law in concluding that

an amount of Rs.1,24,51,176/− earned on sale of carbon

credits is a revenue receipt exigible to tax?

Issue pertains to taxability of the income earned by the

assessee through trading in surplus carbon credits. The Tribunal by the impugned judgment

h e l d t h a t s u c h i n c o m e i s i n t h e

nature of revenue receipt and therefore, liable to be taxed. The

grievance of the assessee is that the Tribunal in case of this very

same assessee in earlier years, had taken a different view, upon

which, the department had filed appeal before the High Court.

Indian Kanoon - http://indiankanoon.org/doc/7563231/ 1

M/S Ajanta Private Limited vs Deputy Commissioner Of Income ... on 7 March, 2018

C/TAXAP/683/2017 ORDER Ignoring such a binding precedent, the Tribunal in the present case

had taken a contrary view. Apart from the principle of

judicial comity and law of precedence, we notice that this Court

has in the past, following the judgments of of Karnataka High Court in case of CIT v. Subhash

Kabini Power Corporation reported in (2016) 385 ITR 592(Karn) and Andhra Pradesh High

Court in case of Commissioner of Income−tax v. My Home

Power Limited reported in (2014) 365 ITR 82(AP) held the issue against the Revenue. In case of

PR Commissioner of Income Tax Vadodara−1 v. Alembic Limited (Tax Appeal No. 553/2017 and

connected matter, Order dated 28.8.2017), following observations were made :

"6. The last surviving question pertains to the treatment

that the assessee's income from trading of carbon credits

should be given. The Tribunal held that receipts should be

in the nature of capital receipts and therefore, would not invite tax. This issue

has been examined by two High Courts. The Karnataka High Court in

case of CIT v. Subhash Kabini Power Corporation Ltd. reported in

(2016) 385 ITR 592 (Karn) and Andhra Pradesh High Court in case of

Commissioner of Income−tax v. My Home Power Limited reported in

( 2 0 1 4 ) 3 6 5 I T R 8 2 ( A P ) h a v e

held that receipts of carbon credit are in nature of revenue receipts.

Following the decision of said two High Courts,

this question is also not considered."

In the result, Tax Appeal is allowed. The question is

answered in favour of the assessee. Judgment of the Tribunal to

the above extent is reversed. Tax Appeal is disposed of.

(AKIL KURESHI, J.) (B.N. KARIA, J.) raghu

Indian Kanoon - http://indiankanoon.org/doc/7563231/ 2

You might also like

- Drug-Free Workplace Sample PolicyDocument12 pagesDrug-Free Workplace Sample PolicySanjay Sahoo0% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- JHC 491832Document11 pagesJHC 491832Kunal NawaleNo ratings yet

- Per Rajpal Yadav, Judicial MemberDocument5 pagesPer Rajpal Yadav, Judicial MemberSrijan MishraNo ratings yet

- TS-61-HC-2023CAL-Jankalyan Vinimay Private Limited It 1Document25 pagesTS-61-HC-2023CAL-Jankalyan Vinimay Private Limited It 1bharath289No ratings yet

- No Appeals Against Orders of CESTAT, High Court, Supreme Court - CBEC - SIMPLE TAX INDIADocument38 pagesNo Appeals Against Orders of CESTAT, High Court, Supreme Court - CBEC - SIMPLE TAX INDIAphani raja kumarNo ratings yet

- Group1 Law ProjectDocument16 pagesGroup1 Law ProjectSumeru HosihiNo ratings yet

- Sandeep Mehta and Vijay Bishnoi, JJ.: Equiv Alent Citation: 2020 (37) G.S.T.L. 289Document15 pagesSandeep Mehta and Vijay Bishnoi, JJ.: Equiv Alent Citation: 2020 (37) G.S.T.L. 289nidhidaveNo ratings yet

- Kar HC TP SoftbrandsDocument80 pagesKar HC TP SoftbrandsGVKNo ratings yet

- JudgementbyjdateDocument27 pagesJudgementbyjdateBasanta Kumar SahooNo ratings yet

- Navneet Dutta Vs ITO Revision of ClaimDocument4 pagesNavneet Dutta Vs ITO Revision of ClaimAnkur ShahNo ratings yet

- 139 Lascona Land Co. - vs. CIRDocument12 pages139 Lascona Land Co. - vs. CIRKriszan ManiponNo ratings yet

- SC Judgement That There Is No Bar On MACT To Award Compensation More Than The Claimed Amount 2018Document5 pagesSC Judgement That There Is No Bar On MACT To Award Compensation More Than The Claimed Amount 2018Latest Laws TeamNo ratings yet

- ITC Cannot Be Denied Solely Due To GSTR 2A & 3B Discrepancies - Kerala HC - Taxguru - inDocument2 pagesITC Cannot Be Denied Solely Due To GSTR 2A & 3B Discrepancies - Kerala HC - Taxguru - inRiya Shankar SharmaNo ratings yet

- Pyaridevi Chabiraj Steels Pvt. Ltd. Vs National Insurance Co. Ltd. NCDRCDocument5 pagesPyaridevi Chabiraj Steels Pvt. Ltd. Vs National Insurance Co. Ltd. NCDRCakash singhNo ratings yet

- 1775 2021 36 1502 27668 Judgement 20-Apr-2021Document61 pages1775 2021 36 1502 27668 Judgement 20-Apr-2021Richa KesarwaniNo ratings yet

- SC ECom Gill Sec 70 KVATDocument20 pagesSC ECom Gill Sec 70 KVATGVKNo ratings yet

- Sahara Order Winding UpDocument48 pagesSahara Order Winding UpAhmadShazebAzharNo ratings yet

- Office of The Assistant Commissioner Central GST Division: Rajkot - IDocument2 pagesOffice of The Assistant Commissioner Central GST Division: Rajkot - INitish MittalNo ratings yet

- CESTAT Order Interest On Delayed PaymentDocument14 pagesCESTAT Order Interest On Delayed PaymentReview UdaipurNo ratings yet

- M/S.Ashok Leyland LTD Vs The Assistant Commissioner of On 10 February, 2016Document2 pagesM/S.Ashok Leyland LTD Vs The Assistant Commissioner of On 10 February, 2016shantXNo ratings yet

- Cit Vs Ambika CottonDocument12 pagesCit Vs Ambika CottonGovind GuptaNo ratings yet

- In The District Court Gurgaon: U/S 138 Negotiable Instrument. (CASE NO.23230 /2018)Document2 pagesIn The District Court Gurgaon: U/S 138 Negotiable Instrument. (CASE NO.23230 /2018)Harsh SethiNo ratings yet

- DCIT v. Punjab Retail - ITAT IndoreDocument17 pagesDCIT v. Punjab Retail - ITAT IndorekalravNo ratings yet

- STATE TAX OFFICER CaseDocument31 pagesSTATE TAX OFFICER Casedevanshi jainNo ratings yet

- Lacsona V CIR (2012)Document11 pagesLacsona V CIR (2012)Ayra CadigalNo ratings yet

- 4 Whether This Case Involves A ... Vs Simplex Infrastructure Limited On 9 June, 2017Document34 pages4 Whether This Case Involves A ... Vs Simplex Infrastructure Limited On 9 June, 2017SarinNo ratings yet

- Kurvan Ansari Alias Kurvan Ali VS Shyam Kishore Murmu PDFDocument3 pagesKurvan Ansari Alias Kurvan Ali VS Shyam Kishore Murmu PDFM. NAGA SHYAM KIRANNo ratings yet

- Lascona Land, Inc. vs. CIRDocument12 pagesLascona Land, Inc. vs. CIRraiza_andresNo ratings yet

- Commissioner of Internal Revenue v. GS GrainsDocument12 pagesCommissioner of Internal Revenue v. GS GrainsimianmoralesNo ratings yet

- MR - JayagDocument3 pagesMR - JayagDence Cris RondonNo ratings yet

- ITAT Upheld Addition of 100% of Bogus Purchases - Taxguru - inDocument12 pagesITAT Upheld Addition of 100% of Bogus Purchases - Taxguru - invijay40.laxmiNo ratings yet

- TS 333 ITAT 2013DEL TS 333 ITAT 2013DEL SPX India PVT LTDDocument5 pagesTS 333 ITAT 2013DEL TS 333 ITAT 2013DEL SPX India PVT LTDbharath289No ratings yet

- Bpi Savings v. Cta, 330 Scra 507 (2000)Document6 pagesBpi Savings v. Cta, 330 Scra 507 (2000)Raymund CallejaNo ratings yet

- (2010) 328 ITR 169 (Punjab & Haryana) (19-08-2009) Commissioner of Income-Tax vs. Mandeep SinghDocument2 pages(2010) 328 ITR 169 (Punjab & Haryana) (19-08-2009) Commissioner of Income-Tax vs. Mandeep SinghkalravNo ratings yet

- Facts:: G.R. No. 175723, February 4, 2014 The City of Manila vs. Hon. Caridad H. Grecia-CuerdoDocument5 pagesFacts:: G.R. No. 175723, February 4, 2014 The City of Manila vs. Hon. Caridad H. Grecia-CuerdoShielden B. MoradaNo ratings yet

- Lascona Land Vs CirDocument15 pagesLascona Land Vs Circode4saleNo ratings yet

- Carpet Mahal NK Proteins Bogus PurchasesDocument15 pagesCarpet Mahal NK Proteins Bogus PurchasesExcelNo ratings yet

- Tax EvasionDocument17 pagesTax EvasionDandvade SumitNo ratings yet

- Litigation of The Income Tax CasesDocument5 pagesLitigation of The Income Tax CasesAnonymous CwJeBCAXpNo ratings yet

- Moot Proposition 12th KR Ramamani Memorial National Taxation Moot Court Competition 2022Document2 pagesMoot Proposition 12th KR Ramamani Memorial National Taxation Moot Court Competition 2022Sivasurya Home GardensNo ratings yet

- Bharat Petroleum Corporation ... Vs Addl Cit RG 2 (1), Mumbai On 14 June, 2017Document14 pagesBharat Petroleum Corporation ... Vs Addl Cit RG 2 (1), Mumbai On 14 June, 2017NIMESH BHATTNo ratings yet

- Compedium Respondent AnonymousDocument153 pagesCompedium Respondent Anonymouspratham mohantyNo ratings yet

- High Court of Jammu and Kashmir at JammuDocument13 pagesHigh Court of Jammu and Kashmir at JammuanilmahalaNo ratings yet

- Dated This The 2 Day of November 2016 Present The Hon'Ble MR - Justice Jayant Patel AND The Hon'Ble MR - Justice Aravind KumarDocument32 pagesDated This The 2 Day of November 2016 Present The Hon'Ble MR - Justice Jayant Patel AND The Hon'Ble MR - Justice Aravind KumarKinjal KeyaNo ratings yet

- 7 - Edison Bataan Cogeneration Corporation vs. CIRDocument17 pages7 - Edison Bataan Cogeneration Corporation vs. CIRMae Angieline Tibon SalvaNo ratings yet

- J 2019 SCC OnLine PH 6256 2019 ACD 940 2020 3 RCR CR Rohit07820 Mpdnluacin 20220720 210147 1 7Document7 pagesJ 2019 SCC OnLine PH 6256 2019 ACD 940 2020 3 RCR CR Rohit07820 Mpdnluacin 20220720 210147 1 7rohit mewaraNo ratings yet

- J 2022 SCC OnLine SC 1162 Akankshapurohit26 Gmailcom 20230111 113519 1 16Document16 pagesJ 2022 SCC OnLine SC 1162 Akankshapurohit26 Gmailcom 20230111 113519 1 16Akanksha PurohitNo ratings yet

- 187 State of Karnataka V Ecom Gill Coffee Trading PVT LTD 13 Mar 2023 463904Document7 pages187 State of Karnataka V Ecom Gill Coffee Trading PVT LTD 13 Mar 2023 463904Nithyananda N LNo ratings yet

- CIT v. Institute of Plasma Research Bhat, 2018 SCC OnLine ITAT 23518Document2 pagesCIT v. Institute of Plasma Research Bhat, 2018 SCC OnLine ITAT 23518sarusharmaNo ratings yet

- Reema Salkan Vs Sumer Singh Salkan On 25 September 2018Document9 pagesReema Salkan Vs Sumer Singh Salkan On 25 September 2018Prateek RaiNo ratings yet

- 10 - CIR v. Yusen Logistics Center, Inc.Document3 pages10 - CIR v. Yusen Logistics Center, Inc.Carlota VillaromanNo ratings yet

- The Hon'Ble Mr. Justice K.Ravichandrabaabu: W.P.No.26187 of 2019Document10 pagesThe Hon'Ble Mr. Justice K.Ravichandrabaabu: W.P.No.26187 of 2019ACCTLVO 35No ratings yet

- J D Aneja Edible Oil Ganganagar 7th Jun 2019 in The Matter of Sushant Aneja PDFDocument23 pagesJ D Aneja Edible Oil Ganganagar 7th Jun 2019 in The Matter of Sushant Aneja PDFCA Himanshu GuptaNo ratings yet

- DCIT Vs Bhilwara Energy Ltd. 14ADocument2 pagesDCIT Vs Bhilwara Energy Ltd. 14AAnkur ShahNo ratings yet

- DCIT Vs Bhilwara Energy Ltd. 14ADocument2 pagesDCIT Vs Bhilwara Energy Ltd. 14AAnkur ShahNo ratings yet

- Court: Republic of The Philippines of Tax Appeals Quezon City First DivisionDocument20 pagesCourt: Republic of The Philippines of Tax Appeals Quezon City First DivisionJason MergalNo ratings yet

- CIT v. Tata Iron & Steel Co. Ltd.Document3 pagesCIT v. Tata Iron & Steel Co. Ltd.Saksham ShrivastavNo ratings yet

- Mcdowell & CoDocument17 pagesMcdowell & Cosudhy009No ratings yet

- 1656658970-6153 Narayan IndustriesDocument20 pages1656658970-6153 Narayan IndustriesAshish GoelNo ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- Difference Between Venue and Seat of Arbitration: International Commercial ArbitrationsDocument8 pagesDifference Between Venue and Seat of Arbitration: International Commercial ArbitrationsDeepak PanwarNo ratings yet

- Section 156 CRPC Post CognizanceDocument66 pagesSection 156 CRPC Post CognizanceDeepak PanwarNo ratings yet

- WWW - Livelaw.In: Hereinafter Referred To AsDocument10 pagesWWW - Livelaw.In: Hereinafter Referred To AsDeepak PanwarNo ratings yet

- Nta Net Law Paper 2 Jan 2017Document32 pagesNta Net Law Paper 2 Jan 2017Deepak PanwarNo ratings yet

- Representation Delhi JudiciaryDocument2 pagesRepresentation Delhi JudiciaryDeepak PanwarNo ratings yet

- Lease: Section 105Document14 pagesLease: Section 105Deepak PanwarNo ratings yet

- 4352 002 The-Roots-Of-Restraint WEBDocument78 pages4352 002 The-Roots-Of-Restraint WEBputranto100% (1)

- Attendance Sheet For EvacuationDocument10 pagesAttendance Sheet For EvacuationSALGIE SERNALNo ratings yet

- Vector Integration: Vector Analysis Dr. Mohammed Yousuf KamilDocument3 pagesVector Integration: Vector Analysis Dr. Mohammed Yousuf KamilSonu YadavNo ratings yet

- Books On Islam Jarir Bookstore KSADocument1 pageBooks On Islam Jarir Bookstore KSAygd4qy468cNo ratings yet

- Creation of ContractDocument17 pagesCreation of Contractwanangwa nyasuluNo ratings yet

- Consti2 MidtermsDocument21 pagesConsti2 MidtermsAnob EhijNo ratings yet

- MUSIC10 - Q3 - ASwith BOLDocument7 pagesMUSIC10 - Q3 - ASwith BOLBenjamin Codilla Gerez, Jr.No ratings yet

- MT ReviewerDocument30 pagesMT Reviewerfrancis dungcaNo ratings yet

- Affidavit WifeDocument3 pagesAffidavit WifeBen Dover McDuffinsNo ratings yet

- A Cpas & Controllers Checklist For Closing Your Books at Year-End Part One: Closing The Books at Year-EndDocument3 pagesA Cpas & Controllers Checklist For Closing Your Books at Year-End Part One: Closing The Books at Year-EndDurbanskiNo ratings yet

- Paper - Vii TaxationDocument350 pagesPaper - Vii TaxationvengaidjNo ratings yet

- Secretary's Cert - Mission Valley Pre-SchoolDocument2 pagesSecretary's Cert - Mission Valley Pre-SchoolHector Jamandre DiazNo ratings yet

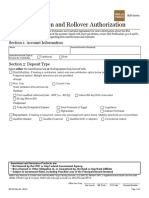

- IRA Contribution and RolloverDocument4 pagesIRA Contribution and Rolloverja leeNo ratings yet

- Santierra T2B12L10 Nuvali Lot For SaleDocument5 pagesSantierra T2B12L10 Nuvali Lot For SaleJP ReyesNo ratings yet

- Acst252 - Week 3 - Ross - 7e - PPT - ch03 - V3Document41 pagesAcst252 - Week 3 - Ross - 7e - PPT - ch03 - V3nathanNo ratings yet

- Aatma Nirbhar Bharat Abhiyaan (2020) - Key Highlights RBI GR B 2020 - NABARD GR A 2020 - SEBI GR A 2020Document9 pagesAatma Nirbhar Bharat Abhiyaan (2020) - Key Highlights RBI GR B 2020 - NABARD GR A 2020 - SEBI GR A 2020avyay sudhakarNo ratings yet

- Dangwa Transportation v. CADocument2 pagesDangwa Transportation v. CANomi ImbangNo ratings yet

- Case DigestsDocument59 pagesCase Digestsaysus_yayahoocom100% (4)

- 3HAC024480-005 - Rev02 (Cabinet Schematic)Document137 pages3HAC024480-005 - Rev02 (Cabinet Schematic)SpamNo ratings yet

- Borromeo vs. CA 47 SCRA 65Document5 pagesBorromeo vs. CA 47 SCRA 65Rhei BarbaNo ratings yet

- Albafix RDocument4 pagesAlbafix RF.M. ShafiqNo ratings yet

- Chowking: Chowking at The SM City BaliwagDocument2 pagesChowking: Chowking at The SM City Baliwagmad pcNo ratings yet

- Ermita Malate Hotel and Motel Operators Vs City of ManilaDocument2 pagesErmita Malate Hotel and Motel Operators Vs City of ManilaWilliam Azucena100% (1)

- Magazine ContentDocument5 pagesMagazine ContentGail PerezNo ratings yet

- Wa0004.Document3 pagesWa0004.Chandra sekhar VallepuNo ratings yet

- CIA Backs A New Ottoman Caliphate in EurasiaDocument16 pagesCIA Backs A New Ottoman Caliphate in EurasiaFernando NogueiraNo ratings yet

- Maintenance of 132 & 220 KV SubstationsDocument137 pagesMaintenance of 132 & 220 KV SubstationsanuragpugaliaNo ratings yet

- Quiz 2 BPDocument4 pagesQuiz 2 BPspur iousNo ratings yet

- Register With Seller Portal PDFDocument7 pagesRegister With Seller Portal PDFMoncif MohamedNo ratings yet