Professional Documents

Culture Documents

Barra Farras Athaya 1906323022 Investasi Proyek

Uploaded by

BarraFarrasCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Barra Farras Athaya 1906323022 Investasi Proyek

Uploaded by

BarraFarrasCopyright:

Available Formats

Kelas Investasi Proyek 2019

Kriteria Credit Rating Project Finance Nama: Barra Farras Athaya

NPM : 1906323022

Tugas: Identifikasi dan Pembahasan Credit Rating Methodology & Criteria

No Topic/Aspect Standard & Poors 2014 Fitchratings 2011

1 Definition of 'Project Finance' Project activity that have two distinct periods Construction and Operations The “Rating Criteria for Infrastructure and Project Finance” (Master Criteria) is used

which is In order for a debt issue or debt-like obligation to be assigned an when rating debt instruments where repayment is dependent upon cash flows from

issue credit rating under these criteria : the construction and operation of a stand-alone project or infrastructure facility,

including those that may encompass several project assets in different locations

covering :

1. A project finance transaction structure 1. Instrument Ratings

2. Limited recourse or nonrecourse to the sponsors or shareholders of a 2. Evaluate Cash Flow Stability

project, but full recourse to the project's cash flows and assets 3. Evaluate Financial Structure

4. Evaluate Stress Scenarios

5. Typical Investment-Grade Attributes

3. Both revenue and operating risk

4. A limited asset life with restricted activities

2 Definition of Main Rating Criteria Main rating criteria of standart & Poors project finance ratings methodology is to Fitch Ratings publishes opinions on a variety of scales. The most common of these

ensure our criteria are comparable globally and keep pace with market changes. The are credit ratings, but the agency also publishes ratings, scores and other relative

remaining key components of our Project Finance criteria and the overarching opinions relating to financial or operational strength. For example, Fitch also

framework covering the entire methodology covering 4 components :

provides specialized ratings of servicers of residential and commercial mortgages,

asset managers and funds. In each case, users should refer to the definitions of

each individual scale for guidance on the dimensions of risk covered in each

assessment covering :

1. Counterparty Risk Criteria 1. Structure and Information

2. Construction Phase Criteria 2. Completion Risk

3. Operations Phase Criteria 3. Operation Risk

4. Transaction Structure Criteria 4. Macro Risks

5. Debt Structure

6. Debt Service and Counterparty Risk

3 Grouping of Sub Rating Criteria 1. Counterparty Risk Criteria 1. Structure and Information

1a. Assigning A Counterparty Dependency Assessment (CDA) 1a. Ownership and Sponsors

The quality of owners or sponsors is an important consideration when

assessing the potential success of a project. Fitch considers this attribute to be

asymmetric. Weak sponsors may cause the rating to be lower, all other things

being equal. In contrast, while the presence of strong sponsors will be considered

when evaluating the impact of stress scenarios and the ability of an SPP to

manage through them, strong sponsors cannot substantially elevate the

1b. Materiality 1b. Project Vehicle Status and Project Structure

This part of the analysis is undertaken to establish the degree to which factors

other than the economic success of the project might affect the project cash flows.

Fitch’s infrastructure and project finance criteria assume the existence of a project

vehicle or equivalent means of segregation, the SPP, to ring-fence the assets and

operation of the project and the cash flows, which are the repayment source of the

rated debt instruments. Similar ratings may be achieved through specific legal

frameworks without the existence of a project vehicle (as would be the case for

airport and other transportation revenue bonds in the U.S. for instance) or by

contractual structural features. Below is a diagram for a typical project financing.

1c. Replaceability 1c. Legal and Regulatory

Forming an opinion of the quality of the legal framework upon which many

project assumptions rest is a prerequisite to the credit analysis. For instance, this

may be purely contractual or rely on statute or codified law, or a particular statutory

instrument, or the powers of a constitutional or statutory authority. The project

contract suite (and if appropriate, any legislation it may depend on) or detailed

summary documents (such as a prospectus) are reviewed for key commercial

elements and conformity to general market standards. Fitch analysts will look for

contract clarity, especially regarding allocation or transfer of risk within the project

structure.

1d. Credit Enhancement For Counterparty Replacement 1d. Use of Expert Reports

The information provided to Fitch may contain reports, forecasts, or opinions

provided to the issuer or their agents by various experts. These include legal

advisors, third-party engineers, traffic, market, fuel/resource or environmental

consultants, insurance advisors, and others. Sector criteria will describe the

reports, forecasts, or opinions that are most relevant to risk analysis in the related

sector. Where these reports contain matters of fact, Fitch will question the source

and reliability. Where the information is a forecast or opinion, Fitch expects these to

be based on well-reasoned analysis supported by the facts.

1e. Information Quality

The quality of information received by Fitch, both quantitative and qualitative,

can be a constraining factor for ratings. Information quality may constrain the rating

category to some maximum level or in extreme cases preclude the assignment of a

rating opinion. Information quality for the initial rating and for surveillance purposes

is considered when a project finance rating is first assigned. Fitch must be

confident that adequate ongoing data will be available to monitor and maintain a

rating once assigned. Information quality encompasses such factors as timeliness

and frequency, reliability, level of detail, and scope.

1f. Data Sources

Fitch’s analysis and rating decisions are based on relevant information available

to its analysts. The sources of this information are the issuer, the arranger, third-

party engineers or consultants, and the public domain. This includes relevant

publicly available information on the issuer, such as audited and unaudited (e.g.

interim) financial statements and regulatory filings. The rating process also can

incorporate information provided by other third-party sources. If this information is

material to the rating, the specific rating action will disclose the relevant source.

2. Construction Phase Criteria 2. Completion Risk

2a. Construction Phase Business Assessment 2a. Contractors

2b. Financial Risk Adjustment 2b. Cost Structure

2c. Construction Phase Stand-Alone Credit Profile 2c. Delay Risk

2d. Other Factors 2d. Contract Terms

2e. Contractual Risk Allocations

2f. Disputes

2g. Insurance and Force Majeure

2h. Construction Quality Assessment

2i. Related Infrastructure

2j. Technology Risk

3. Operations Phase Criteria 3. Operation Risk

3a. Operations Phase Business Assessment 3a. Operator

3b. Determining The Operations Phase SACP 3b. Costs

3c. Supply Risk

3d. Technology Risk

3e. Tail Risk

3f. Revenue Risk

3g. Other Considerations

3h. Infrastructure Development and Renewal/Obsolescence and Economic Life/

3i. Early Termination Risk

4. Transaction Structure Criteria 4. Macro Risks

4a. Parent Linkage Analysis 4a. Country Ceiling and Dependability of Legal Regime

4b. Structural Protection Analysis 4b. Industry Risks

4c. Additional Structural Elements 4c. Event Risks

5. Debt Structure

5a. Debt Characteristics and Terms

5b. Structural Features

5c. Derivatives and Contingent Obligations

5d. Security Package and Creditor Rights

5e. Refinance Risk

6. Debt Service and Counterparty Risk

6a. Models

6b. Base Case

6c. Project Stresses

6d. Financial Stresses

6e. Rating Cases, Combined Downside, and Break-Even Stresses

6f. Metrics

6g. Counterparty Risks

6h. Peer Analysis

6i. Surveillance

4 Clarity of Methodology for Assessment

1. Project and Infrastructure Debt Ratings

2. Instrument Ratings

3. Evaluate Cash Flow Stability

4. Evaluate Financial Structure

5. Evaluate Stress Scenarios

6. Typical Investment-Grade Attributes

Give Rating According Sub Criteria

You might also like

- Certificate in Commercial Credit IndiaDocument4 pagesCertificate in Commercial Credit Indiaskumarites100% (1)

- Fitch CLOs and Corporate CDOsRating Criteria PDFDocument57 pagesFitch CLOs and Corporate CDOsRating Criteria PDFantonyNo ratings yet

- Accenture Risk Analytics Network Credit Risk AnalyticsDocument16 pagesAccenture Risk Analytics Network Credit Risk AnalyticssuryanshNo ratings yet

- Cfas Chapter 2Document55 pagesCfas Chapter 2Lance Lenard Divinagracia Calimpos100% (1)

- Analyzing Banking Risk (Fourth Edition): A Framework for Assessing Corporate Governance and Risk ManagementFrom EverandAnalyzing Banking Risk (Fourth Edition): A Framework for Assessing Corporate Governance and Risk ManagementRating: 5 out of 5 stars5/5 (5)

- IAS36 impairment quiz answersDocument4 pagesIAS36 impairment quiz answersTram Nguyen100% (1)

- Comparative Study of Home Loan and Personal Loan of Icici Bank With Sbi & Other BanksDocument136 pagesComparative Study of Home Loan and Personal Loan of Icici Bank With Sbi & Other Banksrahulsogani12350% (2)

- Polar SportsDocument15 pagesPolar SportsjordanstackNo ratings yet

- CCRA Final Brochure PDFDocument4 pagesCCRA Final Brochure PDFYogesh LassiNo ratings yet

- The Global Benchmark in Credit Education Program OverviewDocument4 pagesThe Global Benchmark in Credit Education Program OverviewHarveyNo ratings yet

- Credit Risk ManagementDocument4 pagesCredit Risk ManagementMitchell NathanielNo ratings yet

- Global Infrastructure and Project FinancDocument44 pagesGlobal Infrastructure and Project FinancZulmy Ikhsan WNo ratings yet

- Credit Appraisal Process PDFDocument8 pagesCredit Appraisal Process PDFmithil0% (1)

- Moody's Certificate in Commercail CreditDocument8 pagesMoody's Certificate in Commercail CreditExplore with TejuNo ratings yet

- Credit Risk Management ProcessDocument5 pagesCredit Risk Management ProcessMitchell NathanielNo ratings yet

- Objectives of The Project:: International Business School, KolkataDocument119 pagesObjectives of The Project:: International Business School, Kolkataavani singhNo ratings yet

- Certified Credit Research Analyst (CCRA)Document4 pagesCertified Credit Research Analyst (CCRA)Suksham SoodNo ratings yet

- An Overview of Credit Appraisal System With Special Reference To Micro Small and Medium Enterprises (MSME)Document11 pagesAn Overview of Credit Appraisal System With Special Reference To Micro Small and Medium Enterprises (MSME)Abhi DNo ratings yet

- Section3 2Document80 pagesSection3 2aNo ratings yet

- A Study On Credit Appraisal System in India With Special Reference To South Indian BanksDocument5 pagesA Study On Credit Appraisal System in India With Special Reference To South Indian BanksEditor IJTSRDNo ratings yet

- DT MT Srep Pub Icaap IlaapDocument16 pagesDT MT Srep Pub Icaap IlaapzenemexNo ratings yet

- Credit Skills For Bankers Certificate Sme IndiaDocument4 pagesCredit Skills For Bankers Certificate Sme IndiaitsurarunNo ratings yet

- Commercial Lending Course Teaches Risk AssessmentDocument2 pagesCommercial Lending Course Teaches Risk AssessmentExplore with TejuNo ratings yet

- OCC S New Fair Lending Guide May Portend Broader Changes 1675948989Document3 pagesOCC S New Fair Lending Guide May Portend Broader Changes 1675948989Stanford A. Stanford Sr.No ratings yet

- Riskcalc Irb ApproachDocument8 pagesRiskcalc Irb Approachzync100No ratings yet

- Credit Risk Analysis in Construction, Hospitality & BeveragesDocument90 pagesCredit Risk Analysis in Construction, Hospitality & BeveragesShashi Kant Shrivastava100% (1)

- Indonesia Certificate in Banking Risk and Regulation Training Instructor Course - Level 3Document73 pagesIndonesia Certificate in Banking Risk and Regulation Training Instructor Course - Level 3endro suendroNo ratings yet

- Bond Funds Methodology 14oct20Document13 pagesBond Funds Methodology 14oct20Wajeeha IftikharNo ratings yet

- SBI CREDIT APPRAISALDocument19 pagesSBI CREDIT APPRAISALSahil BeighNo ratings yet

- Capital Adequacy: Sem 3 TMDocument45 pagesCapital Adequacy: Sem 3 TMahsan habibNo ratings yet

- Fitch Ratings - Sukuk Rating CriteriaDocument10 pagesFitch Ratings - Sukuk Rating CriteriaTareq NewazNo ratings yet

- CBPTM - Course OutlineDocument3 pagesCBPTM - Course OutlineAru RanjanNo ratings yet

- Auditing and Assurance Services 6th Edition Louwers Solutions ManualDocument25 pagesAuditing and Assurance Services 6th Edition Louwers Solutions ManualCynthiaRussellxapo100% (53)

- CRISILs Rating Criteria For Real Estate DevelopersDocument11 pagesCRISILs Rating Criteria For Real Estate DevelopersTay MonNo ratings yet

- Full Download Auditing and Assurance Services 6th Edition Louwers Solutions ManualDocument35 pagesFull Download Auditing and Assurance Services 6th Edition Louwers Solutions Manualzickshannenukus100% (22)

- Dwnload Full Auditing and Assurance Services 6th Edition Louwers Solutions Manual PDFDocument35 pagesDwnload Full Auditing and Assurance Services 6th Edition Louwers Solutions Manual PDFmutevssarahm100% (12)

- Building A Holistic Capital Management FrameworkDocument16 pagesBuilding A Holistic Capital Management FrameworkCognizantNo ratings yet

- RETIRED Corporates Project Finance Project Finance Framework Methodology 09162014 12212022 enDocument47 pagesRETIRED Corporates Project Finance Project Finance Framework Methodology 09162014 12212022 enAbhijeetNo ratings yet

- Summer Internship Report: Table of ContentDocument83 pagesSummer Internship Report: Table of ContentNitin PatelNo ratings yet

- Credit Appraisal in BankingDocument31 pagesCredit Appraisal in Bankingchintan05ecNo ratings yet

- AUDITING Concepts & ApplicationsDocument2 pagesAUDITING Concepts & ApplicationsClarish S. TanNo ratings yet

- CARE's Issuer Rating: 1. ScopeDocument7 pagesCARE's Issuer Rating: 1. ScopeSuryaNo ratings yet

- Solution Manual For Auditing and Assurance Services 6th Edition Louwers 0077862341 9780077862343Document36 pagesSolution Manual For Auditing and Assurance Services 6th Edition Louwers 0077862341 9780077862343charlesblackdmpscxyrfi100% (25)

- Solution Manual For Auditing and Assurance Services 6Th Edition Louwers 0077862341 9780077862343 Full Chapter PDFDocument36 pagesSolution Manual For Auditing and Assurance Services 6Th Edition Louwers 0077862341 9780077862343 Full Chapter PDFlarry.mccoy970100% (14)

- Fps B Practice GuidelinesDocument10 pagesFps B Practice Guidelinesjpsmu09No ratings yet

- Conceptual Framework OverviewDocument56 pagesConceptual Framework OverviewShevina Maghari shsnohsNo ratings yet

- Basel Committee On Banking Supervision: CRE Calculation of RWA For Credit RiskDocument51 pagesBasel Committee On Banking Supervision: CRE Calculation of RWA For Credit RiskAnghel StefanNo ratings yet

- Conceptual Framework of Financial ReportingDocument14 pagesConceptual Framework of Financial ReportinghudaNo ratings yet

- Banking Credit and Risk Management Program: Executive EducationDocument12 pagesBanking Credit and Risk Management Program: Executive EducationMaria TaniusNo ratings yet

- Pacra ArticleDocument6 pagesPacra ArticleMercy KnightNo ratings yet

- ICAI MaterialDocument15 pagesICAI MaterialJignaNo ratings yet

- 1682320015credit Operations and Management (COM)Document185 pages1682320015credit Operations and Management (COM)Sumon AhmedNo ratings yet

- Accounting 1Document146 pagesAccounting 1Touhidul IslamNo ratings yet

- Financial Risk Management For Banks Responding To Challenges Presented by Covid 19 PDFDocument6 pagesFinancial Risk Management For Banks Responding To Challenges Presented by Covid 19 PDFshama shoukatNo ratings yet

- ISCO 22301 Lead ImplementerDocument15 pagesISCO 22301 Lead ImplementerepraseuthNo ratings yet

- User Requirement SpecificationDocument10 pagesUser Requirement SpecificationEcolor SRL100% (1)

- Indonesia Certificate in Banking Risk and Regulation Training Instructor Course - Level 3Document46 pagesIndonesia Certificate in Banking Risk and Regulation Training Instructor Course - Level 3endro suendroNo ratings yet

- Credit Risk S1Document33 pagesCredit Risk S1tanmaymehta24No ratings yet

- NYIF Williams Credit Risk Analysis I Aug-2016Document117 pagesNYIF Williams Credit Risk Analysis I Aug-2016victor andrésNo ratings yet

- Auditing and Assurance Services 7th Edition Louwers Solutions ManualDocument25 pagesAuditing and Assurance Services 7th Edition Louwers Solutions ManualDebraPricemkw100% (48)

- Bank of Boroda RajibDocument131 pagesBank of Boroda Rajibutpalbagchi100% (5)

- Bulletin 01 Code of Conduct and EthicsDocument15 pagesBulletin 01 Code of Conduct and EthicsFernando Enrique Montejo DiazNo ratings yet

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiFrom EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiNo ratings yet

- Barra Farras Athaya 1906323022 Investasi ProyekDocument2 pagesBarra Farras Athaya 1906323022 Investasi ProyekBarraFarrasNo ratings yet

- Pemahaman PPP For S2 UI PDFDocument29 pagesPemahaman PPP For S2 UI PDFBarraFarrasNo ratings yet

- PBTS AirDocument26 pagesPBTS AirBarraFarrasNo ratings yet

- Pu PDFDocument1 pagePu PDFBarraFarrasNo ratings yet

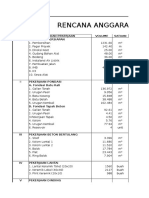

- Rencana Anggaran Biaya: Uraian Pekerjaan Satuan Pekerjaan PersiapanDocument4 pagesRencana Anggaran Biaya: Uraian Pekerjaan Satuan Pekerjaan PersiapanBarraFarrasNo ratings yet

- عتماد مستنديDocument1 pageعتماد مستنديNassar Al-shabiNo ratings yet

- AFA1-3C - Assignment 2Document10 pagesAFA1-3C - Assignment 2Segarambal MasilamoneyNo ratings yet

- Federal Deposit Insurance Corporation, A United States Corporation, Plaintiff v. Bank of Boulder, A Colorado Corporation, 865 F.2d 1134, 10th Cir. (1988)Document24 pagesFederal Deposit Insurance Corporation, A United States Corporation, Plaintiff v. Bank of Boulder, A Colorado Corporation, 865 F.2d 1134, 10th Cir. (1988)Scribd Government DocsNo ratings yet

- Policy Value Calculation and Recursive FormulasDocument44 pagesPolicy Value Calculation and Recursive FormulasĐặng Thị TrâmNo ratings yet

- RBC QuestionsDocument3 pagesRBC QuestionsShikha GuptaNo ratings yet

- Solution Manual For Entrepreneurship Starting and Operating A Small Business 5th Edition Caroline Glackin Steve MariottiDocument18 pagesSolution Manual For Entrepreneurship Starting and Operating A Small Business 5th Edition Caroline Glackin Steve MariottiDeanBucktdjx100% (35)

- Role of Sebi - As A Regulatory AuthorityDocument4 pagesRole of Sebi - As A Regulatory Authoritysneha sumanNo ratings yet

- BCom 3rd and 4th Sem SyllabusDocument26 pagesBCom 3rd and 4th Sem Syllabusshurikenjutsu123No ratings yet

- MF History: First Phase - 1964-1987Document3 pagesMF History: First Phase - 1964-1987vmktptNo ratings yet

- Capital BudgetingDocument7 pagesCapital Budgetingmiss independentNo ratings yet

- University of Mauritius: Reduit VacanciesDocument3 pagesUniversity of Mauritius: Reduit Vacanciespankaj_pandey_21No ratings yet

- Lesson 17 PDFDocument36 pagesLesson 17 PDFNelwan NatanaelNo ratings yet

- Bill Gates Profile and Milestone AchievementsDocument72 pagesBill Gates Profile and Milestone AchievementsvaibhavNo ratings yet

- 04-Lic Credit CardDocument25 pages04-Lic Credit Cardinammurad12No ratings yet

- Ali Cloud Investment ProfileDocument23 pagesAli Cloud Investment ProfileFarhan SheikhNo ratings yet

- Fin 254 SNT Project Ratio AnalysisDocument29 pagesFin 254 SNT Project Ratio Analysissoul1971No ratings yet

- Partnership Acctg Course Outline (CUP)Document1 pagePartnership Acctg Course Outline (CUP)Baron AJNo ratings yet

- Question and Answer - 47Document31 pagesQuestion and Answer - 47acc-expert0% (1)

- Redemption of Preference Shares IllustrationsDocument6 pagesRedemption of Preference Shares IllustrationsManya GargNo ratings yet

- Homework on Share-Based PaymentsDocument4 pagesHomework on Share-Based PaymentsCharles TuazonNo ratings yet

- Diskusi 1. D1-Anissa Asyahra-20.05.051.0253-Manajemen Keuangan 2Document9 pagesDiskusi 1. D1-Anissa Asyahra-20.05.051.0253-Manajemen Keuangan 2Anissa AsyahraNo ratings yet

- NAME: Jimenez, Ross John C. Year-Course-Section: 3-BSMA-A: InstrumentsDocument2 pagesNAME: Jimenez, Ross John C. Year-Course-Section: 3-BSMA-A: InstrumentsRoss John JimenezNo ratings yet

- 1988, Paraguay Country Memorandum PDFDocument129 pages1988, Paraguay Country Memorandum PDFFmartinezpyNo ratings yet

- Igcse Accounting Cash Book & Petty Cash Book: Prepared by D. El-HossDocument205 pagesIgcse Accounting Cash Book & Petty Cash Book: Prepared by D. El-HossThiri Myit Mo 9DNo ratings yet

- Revenue Requirements and RAB WebinarDocument26 pagesRevenue Requirements and RAB WebinarDallas Dragon100% (1)

- Project Report On "Cash Flow Statement at Thinknext Technologies Pvt. LTD"Document54 pagesProject Report On "Cash Flow Statement at Thinknext Technologies Pvt. LTD"Sat NamNo ratings yet

- MPCA Calculator by LoganDocument3 pagesMPCA Calculator by LoganGodwin AriwodoNo ratings yet