Professional Documents

Culture Documents

Lab 5 Report

Lab 5 Report

Uploaded by

api-2969151050 ratings0% found this document useful (0 votes)

39 views6 pagesOriginal Title

lab 5 report

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

39 views6 pagesLab 5 Report

Lab 5 Report

Uploaded by

api-296915105Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 6

EFFECTIVE

CUSTOMER

ACQUISITION

EDEN HANSING

FALL 2019

Goal: Method:

To spend money targeting people that Use a look-alike model on an existing

will likely be our customers and waste customer database to determine what

less money advertising to people who kind of people our customers are

won't become our customers

In our business of selling fixer-upper homes online, we want to improve our efficiency in custorner

acquisition. We've analyzed secondary data with our existing customer base to find out what

differentiated a customer frorn a non-customer and the pattern that we've discovered has proven to

be effective at determining a good, potential customer.

We want to reach more of the right people.

With a univariate approach, we found that there were relevant distinctions between customers and

non-custorners; however, through a multivariate approach, we could figure out which variables are

the best predictors in finding a custorner, how each variable effects an individual’s likelihood of

being a custorner and by how much

We have confidence in these results because we create the pattern from one half of the dataset and

test the pattern on the other half of the dataset. Then, we compare the model to check if it's similar

on oth halves on the set.

Utilizing the detailed information that we've gained, we can create a profile of our customer like the

one below and tailor our marketing efforts to capture people that fit the profile. We can evaluate

customers on an individual level and spend money on the people that will positively contribute to

our bottorn-line.

We want to target people that invest in real estate,

are male, and donate by contributions.

Variables that show the largest difference between customers and non-customers are real estate investment,

fernaleness, and home ownership. In the indexed graphs below, we see how much customers differ from the average

response. For example, customers are close to 80% more likely to invest in real estate than non-customers.

Customers are 23% more likely than average to be male, Non-customers are 47% more likely to not own their home,

Now we can begin to think that males, who invest in real estate, and own a home could be a good demographic to

target

Real Estate

Investment 10

‘Customers that we want to “avoid” have the

characteristics of groups #7 and #8. We have

high confidence that these customers don't like

us and we don't need any more information to

steer clear of investing rnoney into these

people.

Customers that fit into the “dubious” segment

are ones that dont like us but we have low

confidence in that finding. We could test ther

further to determine for sure, but it would most

likely be a waste of money.

‘Segment Matrix

Dubious * O27 Test uett ow

Femaleness

Home Ownership

Customer segments that yield high indexes and

make up a lerge portion of the population give

us high confidence that these characteristics

make up our “core” customer. We should invest

marketing efforts into people that fit these

qualifications,

Customers that fit into our “test” segment are

ones that like us but we don't have high

confidence in that. Further testing would be

needed to decide if we should invest marketing

efforts into people that have characteristics of

groups #3 and #4.

Route rartat oe of $1 306993

nro

ara Fouerarat lu of 1959-29599

12 Dountave realestate estmet

orate arte of 19599-29599 8

Paes ere

Has ose matt elu of es thn S124 2098

4 __tengtofretinceol 5 yours

4S Has a house market value of $124,999-149,999 &

Has a house market value of $499,999 or more &

6 Female & Age of 25+

Has a house market value of $289,990-308/422 &

#7 Doesn'town home

Has a house market value ef $299,999-208 422 &

#8 Does own home & Income of $249 999-749,999

To get an even better idea of what our customer looks like, we can use a multivariate approach. With a behavior-

based segmentation tool, we test all of the variables at once and then narrow down which variables are the most

relevant to our goa.

We found a pattern that shows how people's

character'stics make them look more like @ customer

or not. A variable that has a (#) in front of it means that

the more of that variable you have, the higher your

overall score will be, Negative scores mean that

activity looks less like our customer. In the pie chart,

the number associated with each variable tells us now

much that variable will affect your score relative to the

others, We want to investin people that produce high

scores on their scorecard.

The most significant variables:

* Real estate investment (value of 0.164)

# Femaleness (value of 0.149)

* Donates by contributions (value of 0.137)

sResterteinvecmere = Famaleness

+ Onrshore 1 Donatesty core butions

= Typsot aweng

ss Markervate

1 Feoxoress 2008 Reger ret

«Donec conservative grains

We score a set of known customers and non-customers with the scorecard above and then rank ther from the

hignest (most similar to our customers) to lowest scores. Then, we group these people into ten equal-sized deciles,

The group in the top decile that have the highest scores {people we think look most like our customers), contains

the highest concentration of customers, We see that what we observed has verified our explanation. The group in

the lowest decile, contains the highest concentration of non-customers. The pattern we found has successfully

explained the difference between customers and non-customers,

‘raining Set

Declaaeto oes

Thins.

Test Set

{ini

RECOMMENDATIONS

Place

Advertising adjacent to real estate listing

Collaborate with real estate agencies

Home improvernent publications

Partner with charitable organizations

Product & Price:

# Masculine branding

© Ourcustomers yield higher incomes and

market value homes which allows our price

tobe more inelastic

* Ourcustomers consider it an investrnent

Promotion:

© Messaging centered around investment ee

opportunities

© Utilize the masculine “working man’ theme

alongside images of home improvement

Univariate: Testing each variable individually to see the effect of it on the dependent

variable

Multivariate: Involving 2+ variables to find a solution

Chi Square Automatic Interaction Detector (CHAID): a program in SPSS that allows us

to find the single best differentiator for a dependent variable; the segments are

predictive of a specific behavior

Demographic, attitudinal or behavioral similarity: we assume that similarity generalizes,

to consumer products & services

Training set and testing set: In a dataset, a training set is implemented to build up a

model, while a test set is to validate the model built. Data points in the training set are

excluded from the test set

Dependent variable: Our dependent variable in this analysis is CUSTOMER to find what

variables are the most relevant to people that look like customers

Regression: Shows the correspondence between variables to make a score for how

much a combination of responses would look compared to the behaviors of exiting

customers

Confidence: A large enough portion of the population shows that the occurrence is not

just by chance

Type | Error (false positive): Calling a bad opportunity "good"

Type Il Error (false negative): Calling a good opportunity "bad"

Inelastic price: The demand doesn't change much as price increases

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Official Eden Hansing ResumeDocument1 pageOfficial Eden Hansing Resumeapi-296915105No ratings yet

- Use Case Stories WordDocument2 pagesUse Case Stories Wordapi-296915105No ratings yet

- Directors Guide ArtifactDocument2 pagesDirectors Guide Artifactapi-296915105No ratings yet

- Exaxmple of Student ScriptDocument1 pageExaxmple of Student Scriptapi-296915105No ratings yet

- Photographs of ProcessDocument2 pagesPhotographs of Processapi-296915105No ratings yet

- Rosie InterviewDocument3 pagesRosie Interviewapi-296915105No ratings yet

- Research 1Document2 pagesResearch 1api-296915105No ratings yet

- Relana InterviewDocument2 pagesRelana Interviewapi-296915105No ratings yet

- Stoney InterviewDocument3 pagesStoney Interviewapi-296915105No ratings yet

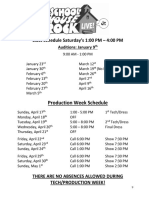

- Schoolhouse Rock ManualDocument15 pagesSchoolhouse Rock Manualapi-296915105No ratings yet

- ScheduleDocument1 pageScheduleapi-296915105No ratings yet

- Pic Artifacts 1Document1 pagePic Artifacts 1api-296915105No ratings yet

- Research 3Document1 pageResearch 3api-296915105No ratings yet

- Schoolhouse PricingDocument9 pagesSchoolhouse Pricingapi-296915105No ratings yet

- Ism-Interview Assignment Questions: Student Name: Period: 1stDocument2 pagesIsm-Interview Assignment Questions: Student Name: Period: 1stapi-296915105No ratings yet

- BrochureDocument3 pagesBrochureapi-296915105No ratings yet

- Budget BreakdownDocument1 pageBudget Breakdownapi-296915105No ratings yet