Professional Documents

Culture Documents

Intermediate Accounting I Inventories PDF

Intermediate Accounting I Inventories PDF

Uploaded by

Jesther VocalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Intermediate Accounting I Inventories PDF

Intermediate Accounting I Inventories PDF

Uploaded by

Jesther VocalCopyright:

Available Formats

Intermediate Accounting I

Inventories

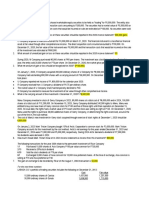

1. Bell Inc. took a physical inventory at the end of the year and determined that P780,000 of goods were on hand. In

addition, Bell, Inc. determined that P60,000 of goods that were in transit that were shipped f.o.b. shipping point

were actually received two days after the inventory count and that the company had P90,000 of goods out on

consignment. What amount should Bell report as inventory at the end of the year?

a. P780,000.

b. P840,000.

c. P870,000.

d. P930,000.

2. Gold Inc. took a physical inventory at the end of the year and determined that P760,000 of goods were on hand.

In addition, the following items were not included in the physical count. Gold, Inc. determined that P96,000 of

goods were in transit that were shipped f.o.b. destination (goods were actually received by the company three

days after the inventory count).The company sold P40,000 worth of inventory f.o.b. destination. What amount

should Gold report as inventory at the end of the year?

a. P760,000.

b. P856,000.

c. P800,000.

d. P896,000.

3. The following information is available for Gloxinia Company for 2012:

Freight-in P 30,000

Purchase returns 75,000

Selling expenses 200,000

Ending inventory 260,000

The cost of goods sold is equal to 400% of selling expenses. What is the cost of goods available for sale?

a. P800,000.

b. P1,090,000.

c. P1,015,000.

d. P1,060,000.

Use the following information for questions 98 and 99.

The following information was available from the inventory records of Rich Company for January:

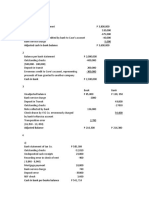

Units Unit Cost Total Cost

Balance at January 1 3,000 P9.77 P29,310

Purchases:

January 6 2,000 10.30 20,600

January 26 2,700 10.71 28,917

Sales:

January 7 (2,500)

January 31 (4,300)

Balance at January 31 900

4. Assuming that Rich does not maintain perpetual inventory records, what should be the inventory at January 31,

using the weighted-average inventory method, rounded to the nearest dollar?

a. P9,454.

b. P9,213.

c. P9,234.

d. P9,324.

5. Assuming that Rich maintains perpetual inventory records, what should be the inventory at January 31, using the

moving-average inventory method, rounded to the nearest dollar?

a. P9,454.

b. P9,213.

c. P9,234.

d. P9,324

Niles Co. has the following data related to an item of inventory:

Inventory, March 1 100 units @ P2.10

Purchase, March 7 350 units @ P2.20

Purchase, March 16 70 units @ P2.25

Inventory, March 31 130 units

6. The value assigned to cost of goods sold if Niles uses FIFO is

a. P290.

b. P276.

c. P862.

d. P848.

7. Chess Top uses the periodic inventory system. For the current month, the beginning inventory consisted of 300

units that cost P65 each. During the month, the company made two purchases: 450 units at P68 each and 225

units at P70 each. Chess Top also sold 750 units during the month. Using the average cost method, what is the

amount of ending inventory?

a. P15,750.

b. P50,655.

c. P50,100.

d. P15,197.

8. Checkers uses the periodic inventory system. For the current month, the beginning inventory consisted of 2,400

units that cost P12 each. During the month, the company made two purchases: 1,000 units at P13 each and

4,000 units at P13.50 each. Checkers also sold 4,300 units during the month. Using the FIFO method, what is the

ending inventory?

a. P40,146.

b. P37,200.

c. P41,850.

d. P37,900.

9. The following information applied to Howe, Inc. for 2012:

Merchandise purchased for resale P350,000

Freight-in 8,000

Freight-out 5,000

Purchase returns 2,000

Howe's 2012 inventoriable cost was

a. P350,000.

b. P353,000.

c. P356,000.

d. P361,000.

10. The following information was derived from the 2012 accounting records of Perez Co.:

Perez 's Goods

Perez 's Central Warehouse Held by Consignees

Beginning inventory P130,000 P 14,000

Purchases 475,000 70,000

Freight-in 10,000

Transportation to consignees 5,000

Freight-out 30,000 8,000

Ending inventory 145,000 20,000

Perez's 2012 cost of sales was

a. P470,000.

b. P500,000.

c. P534,000.

d. P539,000.

11. Walsh Retailers purchased merchandise with a list price of P75,000, subject to trade discounts of 20% and 10%,

with no cash discounts allowable. Walsh should record the cost of this merchandise as

a. P52,500.

b. P54,000.

c. P58,500.

d. P75,000.

You might also like

- Test Bank - Ifa Part 3 (2015 Edition)Document284 pagesTest Bank - Ifa Part 3 (2015 Edition)Fery Ann75% (8)

- Chapter 5-Accounting For Manufacturing OverheadDocument31 pagesChapter 5-Accounting For Manufacturing OverheadDecery BardenasNo ratings yet

- A. TheoryDocument10 pagesA. TheoryROMULO CUBID100% (1)

- Final Exams April 2, 2019Document4 pagesFinal Exams April 2, 2019Joovs JoovhoNo ratings yet

- SY1920 1st Sem ACCO4083 - 3rd EvaluationDocument9 pagesSY1920 1st Sem ACCO4083 - 3rd EvaluationPaul Adriel BalmesNo ratings yet

- Cs Cost MCQ Part 11Document48 pagesCs Cost MCQ Part 11dmaxprasangaNo ratings yet

- Inventory With SolutionDocument11 pagesInventory With Solutionjjabarquez100% (1)

- Financial Merchandise Management: Retail Management: A Strategic ApproachDocument31 pagesFinancial Merchandise Management: Retail Management: A Strategic ApproachJohnny LewisNo ratings yet

- Dysas - Fin Acc - 3rdDocument5 pagesDysas - Fin Acc - 3rdJao FloresNo ratings yet

- Finished Goods Inventory: Exercise 1-1 (True or False)Document16 pagesFinished Goods Inventory: Exercise 1-1 (True or False)Isaiah BatucanNo ratings yet

- PAS 36 Concept MapDocument1 pagePAS 36 Concept MapMicah RamaykaNo ratings yet

- Chapter 2Document8 pagesChapter 2cindyNo ratings yet

- Impairment of Loans and Receivable FinancingDocument17 pagesImpairment of Loans and Receivable FinancingGelyn CruzNo ratings yet

- Leslie Company Manufacturing Department Cost of Production Report For January Materials Conversion CostDocument8 pagesLeslie Company Manufacturing Department Cost of Production Report For January Materials Conversion Costmaica G.No ratings yet

- Chapter 4 Accounts ReceivableDocument12 pagesChapter 4 Accounts Receivableweddiemae villariza50% (2)

- Intermediate Accounting 1 Valix Chapter 17Document2 pagesIntermediate Accounting 1 Valix Chapter 17Captain Shield100% (1)

- Intacc 1a Reviewer Conceptual Framework and Accounting StandardsDocument32 pagesIntacc 1a Reviewer Conceptual Framework and Accounting StandardsKatherine Cabading InocandoNo ratings yet

- This Study Resource Was: Problem 1Document2 pagesThis Study Resource Was: Problem 1Michelle J UrbodaNo ratings yet

- Lecture Notes On Inventory Estimation - 000Document4 pagesLecture Notes On Inventory Estimation - 000judel ArielNo ratings yet

- 1 Inventories Pas 2 Reviewer Intermediate AccountingDocument5 pages1 Inventories Pas 2 Reviewer Intermediate AccountingDalia ElarabyNo ratings yet

- Finals Exam - IaDocument8 pagesFinals Exam - IaJennifer Rasonabe100% (1)

- Chapter 3 Answer Cost AccountingDocument17 pagesChapter 3 Answer Cost AccountingJuline Ashley A CarballoNo ratings yet

- Encantadia Practice SetDocument17 pagesEncantadia Practice SetIrahq Yarte Torrejos100% (2)

- CH 1 - Exercises & ProblemsDocument4 pagesCH 1 - Exercises & ProblemsMhico MateoNo ratings yet

- Chapter 13Document2 pagesChapter 13Jomer FernandezNo ratings yet

- AC - IntAcctg1 Quiz 03 With AnswersDocument3 pagesAC - IntAcctg1 Quiz 03 With AnswersSherri BonquinNo ratings yet

- 1-1-2017 Petty Cash FundDocument4 pages1-1-2017 Petty Cash FundMr. CopernicusNo ratings yet

- 7 Cost Formulas and LCNRVDocument6 pages7 Cost Formulas and LCNRVJorufel PapasinNo ratings yet

- ReceivablesDocument1 pageReceivablesLight MaidenNo ratings yet

- Financial Asset at Amortized CostDocument14 pagesFinancial Asset at Amortized CostLorenzo Diaz DipadNo ratings yet

- Interacc Word JPDocument28 pagesInteracc Word JPJOCELYN NUEVONo ratings yet

- Problem 23-7 and 23-8Document2 pagesProblem 23-7 and 23-8Maria LicuananNo ratings yet

- The Contribution Margin Ratio Will DecreaseDocument7 pagesThe Contribution Margin Ratio Will DecreaseSaeym SegoviaNo ratings yet

- ACt1104 Final Quiz No. 1wit AnsDocument7 pagesACt1104 Final Quiz No. 1wit AnsDyenNo ratings yet

- Article 1495 - 1506Document2 pagesArticle 1495 - 1506MarkNo ratings yet

- Variable Costing: A Decision-Making Perspective: True-False StatementsDocument8 pagesVariable Costing: A Decision-Making Perspective: True-False StatementsJanina Marie GarciaNo ratings yet

- Intermediate Accounting I Inventories 2 PDFDocument2 pagesIntermediate Accounting I Inventories 2 PDFJoovs JoovhoNo ratings yet

- Chapter 10 Assignment Answer 1Document3 pagesChapter 10 Assignment Answer 1Tawan VihokratanaNo ratings yet

- Semi Final Exam AE23Document6 pagesSemi Final Exam AE23HotcheeseramyeonNo ratings yet

- Notes ReceiDocument2 pagesNotes ReceiDIANE EDRANo ratings yet

- Assignment No. 2 (Solution)Document5 pagesAssignment No. 2 (Solution)Christine MalayoNo ratings yet

- Las 6Document4 pagesLas 6Venus Abarico Banque-AbenionNo ratings yet

- Investment in Bonds / Financial Assets at Amortized CostDocument1 pageInvestment in Bonds / Financial Assets at Amortized CostSteffanie Olivar0% (1)

- FARAP-4403 (Inventories)Document14 pagesFARAP-4403 (Inventories)Dizon Ropalito P.No ratings yet

- Effect of Loss of Objects of ObligationDocument3 pagesEffect of Loss of Objects of ObligationGabrielle MNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument8 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionGabrielle100% (1)

- Group Work - Inventory Cost Flow and LCNRV: AnswerDocument5 pagesGroup Work - Inventory Cost Flow and LCNRV: AnswerKawhileonard LeonardNo ratings yet

- 13 Acctg Ed 1 - Loan ReceivableDocument17 pages13 Acctg Ed 1 - Loan ReceivableNath BongalonNo ratings yet

- Cash and Cash EquivalentsDocument5 pagesCash and Cash EquivalentsFelsie Jane PenasoNo ratings yet

- This Study Resource Was Shared Via: Solution 23-2 Answer DDocument5 pagesThis Study Resource Was Shared Via: Solution 23-2 Answer DDummy GoogleNo ratings yet

- Voyager IncDocument1 pageVoyager IncLian Garl0% (1)

- A17NB - InventoryDocument4 pagesA17NB - Inventoryhellohello100% (1)

- Land Building Machinery ProblemsDocument13 pagesLand Building Machinery ProblemsJomerNo ratings yet

- Quiz - Recl FinancingDocument1 pageQuiz - Recl FinancingAna Mae HernandezNo ratings yet

- Chapter 2 - Asgmt-1Document2 pagesChapter 2 - Asgmt-1MarkJoven BergantinNo ratings yet

- AnswerQuiz - Module 8Document4 pagesAnswerQuiz - Module 8Alyanna AlcantaraNo ratings yet

- Process Costing ReviewerDocument46 pagesProcess Costing ReviewerAshNor Randy100% (1)

- Ae 212 Midterm Departmental Exam - Docx-1Document12 pagesAe 212 Midterm Departmental Exam - Docx-1Mariette Alex AgbanlogNo ratings yet

- Chapter 14 - Retail Inventory Method PDFDocument9 pagesChapter 14 - Retail Inventory Method PDFTurksNo ratings yet

- Singson DM A. Concept Map RevisionDocument2 pagesSingson DM A. Concept Map RevisionDonna Mae SingsonNo ratings yet

- Cash and CequizDocument5 pagesCash and CequizMaria Emarla Grace CanozaNo ratings yet

- INVENTORYDocument4 pagesINVENTORYNhemia ElevencionadoNo ratings yet

- Sample Problems For InventoryDocument3 pagesSample Problems For Inventorytough mamaNo ratings yet

- Intermediate 1A: Problem CompilationDocument24 pagesIntermediate 1A: Problem CompilationPatricia Nicole Barrios100% (4)

- Inventory Practice ProblemDocument7 pagesInventory Practice ProblemDonna Zandueta-TumalaNo ratings yet

- Applied - 3 MidtermDocument7 pagesApplied - 3 MidtermMarjorieNo ratings yet

- G.R. No. 154291Document13 pagesG.R. No. 154291Joovs JoovhoNo ratings yet

- G.R. No. 117847Document10 pagesG.R. No. 117847Joovs JoovhoNo ratings yet

- Filipinas Port V GoDocument2 pagesFilipinas Port V GoJoovs JoovhoNo ratings yet

- G.R. No. 188307Document14 pagesG.R. No. 188307Joovs JoovhoNo ratings yet

- G.R. No. L-15092Document3 pagesG.R. No. L-15092Joovs JoovhoNo ratings yet

- Ramirez Vs Orientalist Co.Document2 pagesRamirez Vs Orientalist Co.Joovs Joovho67% (3)

- Valle Verde Country Club Vs AfricaDocument2 pagesValle Verde Country Club Vs AfricaJoovs JoovhoNo ratings yet

- G.R. No. 199669Document17 pagesG.R. No. 199669Joovs JoovhoNo ratings yet

- People of The Philippines Vs BelloDocument1 pagePeople of The Philippines Vs BelloJoovs Joovho100% (2)

- G.R. No. 224825Document8 pagesG.R. No. 224825Joovs JoovhoNo ratings yet

- People Vs Marie Teresa Pangilinan GR 152662Document13 pagesPeople Vs Marie Teresa Pangilinan GR 152662Verbosee VVendettaNo ratings yet

- B3-B G.R. No. 167571 Panaguiton, Jr. vs. DOJ. G.R. No. 167571Document4 pagesB3-B G.R. No. 167571 Panaguiton, Jr. vs. DOJ. G.R. No. 167571Joovs JoovhoNo ratings yet

- B3-C G.R. No. 135808 SEC-vs-Interport-Resources-CorpDocument2 pagesB3-C G.R. No. 135808 SEC-vs-Interport-Resources-CorpJoovs Joovho100% (1)

- B1-B G.R. No. 183623 Leticia B. Agbayani vs. Court of AppealsDocument7 pagesB1-B G.R. No. 183623 Leticia B. Agbayani vs. Court of AppealsJoovs JoovhoNo ratings yet

- A16 G.R. No. 171175 People v. DucaDocument5 pagesA16 G.R. No. 171175 People v. DucaJoovs JoovhoNo ratings yet

- A12-2 G.R. No. 147097 Lazatin v. DesiertoDocument5 pagesA12-2 G.R. No. 147097 Lazatin v. DesiertoJoovs JoovhoNo ratings yet

- B3-A G.R. No. 168662 Sanrio Company Ltd. vs. Lim PDFDocument4 pagesB3-A G.R. No. 168662 Sanrio Company Ltd. vs. Lim PDFJoovs JoovhoNo ratings yet

- A11-5 G.R. No. 175457 & G.R. No. 175482 Ambil v. SandiganbayanDocument9 pagesA11-5 G.R. No. 175457 & G.R. No. 175482 Ambil v. SandiganbayanJoovs JoovhoNo ratings yet

- A17 G.R. No. 180010 Cariaga vs. PeopleDocument3 pagesA17 G.R. No. 180010 Cariaga vs. PeopleJoovs JoovhoNo ratings yet

- Ay2324 Fabm2 Handout 2.1Document11 pagesAy2324 Fabm2 Handout 2.1Shahinaz FatinNo ratings yet

- T7-Exer Sol - 1Document7 pagesT7-Exer Sol - 1Sharif Mohamad HalimNo ratings yet

- Need of The Study: Ratio Analysis and Comparative Study of Ratios of HPCL With Its CompetitorsDocument76 pagesNeed of The Study: Ratio Analysis and Comparative Study of Ratios of HPCL With Its Competitorssavita acharekarNo ratings yet

- Inventory FundamentalsDocument13 pagesInventory FundamentalsBodhiswattaNo ratings yet

- Cost AcctgDocument10 pagesCost AcctgCarl AngeloNo ratings yet

- SCM IiDocument482 pagesSCM IiassaNo ratings yet

- A Level Accounting NotesDocument16 pagesA Level Accounting NotesChaiwatTippuwananNo ratings yet

- MCQs On Costing 20210622130833Document5 pagesMCQs On Costing 20210622130833saritaNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument70 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeEnsy QuNo ratings yet

- TLE Calculate Cost of Production: CookeryDocument12 pagesTLE Calculate Cost of Production: CookeryPepito Rosario Baniqued, Jr100% (4)

- Assignment#2 - InventoryDocument3 pagesAssignment#2 - InventoryMarilor MamarilNo ratings yet

- Test I. True-False Direction: Write T If The Statement Is Correct and F If It Is Wrong BesideDocument8 pagesTest I. True-False Direction: Write T If The Statement Is Correct and F If It Is Wrong BesideXingYang KiSada0% (1)

- CH 25Document65 pagesCH 25Hasan AzmiNo ratings yet

- Solution - Eicher Motors LTDDocument28 pagesSolution - Eicher Motors LTDvasudevNo ratings yet

- Skema PSPM 17-18 Aa025Document4 pagesSkema PSPM 17-18 Aa025Dehey KNo ratings yet

- Managing Inventories in Supply ChainDocument26 pagesManaging Inventories in Supply Chaingeraldine bayno tumacasNo ratings yet

- CH 14Document4 pagesCH 14Hoàng HuyNo ratings yet

- BBMC 2023 DM - TutorialDocument12 pagesBBMC 2023 DM - TutorialChuan Sheng ChewNo ratings yet

- 62c39f2609022 Ferrell 12e PPT ch14Document51 pages62c39f2609022 Ferrell 12e PPT ch14fayyasin99No ratings yet

- Answer Key To Test #3 - ACCT-312 - Fall 2019Document8 pagesAnswer Key To Test #3 - ACCT-312 - Fall 2019Amir ContrerasNo ratings yet

- LEO Pharma Annual Report 2013Document27 pagesLEO Pharma Annual Report 2013karpeoNo ratings yet

- Overheads AbsorbtionDocument29 pagesOverheads AbsorbtionGaurav AgarwalNo ratings yet

- Test 2 Jan 2022Document3 pagesTest 2 Jan 20222021492824No ratings yet

- Pob SbaDocument14 pagesPob SbaJoshua DewarNo ratings yet

- Inventory 3-8-2021Document3 pagesInventory 3-8-2021bobNo ratings yet