Professional Documents

Culture Documents

TET03-B Income Tax On Discretionary Trusts - Part B PDF

Uploaded by

Alellie Khay JordanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TET03-B Income Tax On Discretionary Trusts - Part B PDF

Uploaded by

Alellie Khay JordanCopyright:

Available Formats

Tolley® Exam Training TRUSTS AND ESTATES CHAPTER 3

CHAPTER 3

INCOME TAX ON DISCRETIONARY TRUSTS

In this chapter you will cover the income tax rules for discretionary trusts including:

– the tax rates paid by discretionary Trustees

– the “basic rate” band for trusts

– how the Trustees get relief for expenses

– the tax position of the beneficiary

– the operation of the “tax pool”

– interest restrictions on property income

3.1 The Rates Applicable to Trusts

Because a discretionary trust is such a flexible vehicle, the rates of tax which apply

to income received by discretionary Trustees are higher than those which apply to

interest in possession Trustees. ITA 2007, s.479

Trustees of a discretionary trust pay income tax at “the rates applicable to trusts”

(RAT) on “accumulated or discretionary income”. There are two rates which are

applicable to discretionary trusts.

Non-savings income is charged to income tax at a flat rate of 45%. Interest is also

charged at 45%. Dividends are charged at 38.1%. ITA 2007, s.479(3)(4)

The Trustees are not entitled to the Personal Savings Allowance or the Dividend

Allowance so the full amount of any interest or dividends is chargeable to tax.

Accumulated or discretionary income” is income which: ITA 2007, s.480

a. Must be accumulated; or

b. Is payable at the discretion of the Trustees.

This means that the rates applicable to trusts – 45% or 38.1% – only apply to income

which the Trustees are able (if they wish) to keep within the trust. This tells us two

things:

1. If any income is subject to an interest in possession – i.e. if the beneficiary is

entitled to income from part of the trust fund – the rates applicable to trusts do

not apply to that income.

Any income which is subject to an interest in possession is charged at 20% or

7.5% depending on the source of income.

2. To arrive at income which is chargeable at the rate applicable to trusts, some

relief is available for trust management expenses. Remember that the rates

applicable to trusts only apply to income which is available for distribution. If

the Trustees have received some income and that income has been used to

meet expenses of the trust, such income is not available for distribution and is

therefore not chargeable at 45% or 38.1%.

© RELX (UK) Limited 2018 21 FA 2018

Tolley® Exam Training TRUSTS AND ESTATES CHAPTER 3

Therefore when putting together an income tax computation for a

discretionary trust, we can take a tax deduction for trust management

expenses.

3.2 The “Standard Rate” Band

The rates applicable to trusts (45% & 38.1%) do not apply to the first £1,000 of

income. Instead such income is taxed at the basic rate or the dividend ordinary

rate. ITA 2007, s.491

The “standard rate” band applies to non-savings income in priority to interest in

priority to dividends.

For example:

Non-savings income: First £1,000 @ 20%. If some of the standard rate band still

unused then…

Interest: Within the standard rate band, interest taxed @ 20%. If

some of the standard rate band still unused then…

Dividends: Within standard rate band, dividends taxed @ 7.5%

If the settlor has made more than one current settlement, the £1,000 band is

divided between them, subject to a minimum band of £200 for each trust. A

“current settlement” is one which is in existence at some time in the tax year. Trusts

which were wound up before the start of the tax year are therefore ignored.

ITA 2007, s.492

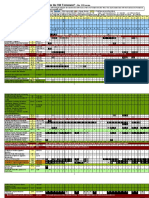

Illustration 1

A discretionary trust has the following income in 2018/19:

£

Rental profits 800

Bank interest 600

UK dividends 2,000

Calculate the tax payable for 2018/19.

Non-savings Interest Dividends

£ £ £

Rental profits 800

Bank interest 600

Dividends ___ ___ 2,000

Total trust income 800 600 2,000

Tax

“Standard rate”:

800 @ 20% 160

200 @ 20% 40

1,000

Rates applicable to trusts (RAT):

400 @ 45% 180

2,000 @ 38.1% 762

Tax payable by Trustees 1,142

© RELX (UK) Limited 2018 22 FA 2018

Tolley® Exam Training TRUSTS AND ESTATES CHAPTER 3

3.3 Trust Expenses

To arrive at the income that is chargeable at the rate applicable to trusts we

deduct trust management expenses from gross trust income. ITA 2007, s.484

Only expenses which are properly deductible against the income of the trust may

be relieved. This means that any expenses which should be charged against the

capital of the trust – for example legal fees associated with capital items or other

professional fees regarding trust investments etc – cannot be deducted for income

tax purposes.

As Trustees will have several sources of income, it is important to identify an order

of priority for the set-off of trust management expenses. As is the case for interest in

possession trusts, trust management expenses are set against dividend income in

priority to other income. ITA 2007, s.486

If there are insufficient dividends to meet the trust management expenses, the

expenses are next set against any interest and finally the expenses are set against

non-savings income.

When taking a deduction for trust expenses, we must gross up the expenses at the

appropriate rate. For example, if expenses are being deducted from dividend

income, the expenses must be grossed up at 100/92.5. The dividend income is still

subject to 7.5% tax. Consequently, if a trust expense of, say, £925 has been

incurred, the Trustees must have earned a dividend of £1,000 to meet that

expense.

Illustration 2

A discretionary trust has income and expenses in 2018/19 as below:

£

Rental profits 30,000

Bank interest 20,000

UK dividends 10,000

Trust expenses (1,850)

Calculate the income tax payable by the trustees for 2018/19.

The income tax computation is as below:

Non savings Interest Dividends

£ £ £

Rental profits 30,000

Bank interest 20,000

Dividends _____ _____ 10,000

Total trust income 30,000 20,000 10,000

Less: Expenses (1,850 x 100/92.5) _____ _____ (2,000)

Income after expenses 30,000 20,000 8,000

Expenses are met from dividend income, and accordingly must be grossed up at

100/92.5.

© RELX (UK) Limited 2018 23 FA 2018

Tolley® Exam Training TRUSTS AND ESTATES CHAPTER 3

The tax payable by the Trustees is as below:

Tax

“Standard rate”:

1,000 @ 20% 200

Rates applicable to trusts (RAT):

(30,000 – 1,000) @ 45% 13,050

20,000 @ 45% 9,000

8,000 @ 38.1% 3,048

2,000 @ 7.5% 150

Tax payable by Trustees 25,448

£2,000 of dividends were used by the Trustees to meet trust management

expenses. This £2,000 of income cannot be accumulated and is not available for

distribution to a beneficiary, so it is not charged at the rates applicable to trusts.

Income earned by the Trustees which has been used to pay expenses is

chargeable to tax but only at the ordinary or basic rates as appropriate. Therefore

the £2,000 of dividend income used to pay the expenses will be charged at the

dividend ordinary rate of 7.5%.

An income tax computation for a discretionary trust differs from an income tax

computation for an interest in possession trust in three main ways:

1. Discretionary trusts can receive some relief for trust management expenses.

These expenses are deducted from dividend income in priority to other

income.

2. Discretionary Trustees will pay tax at the basic rate or the dividend ordinary

rate on the first £1,000 of income then at 45% or 38.1%.

3. When putting together a tax computation for a discretionary trust, the income

which has been used to pay the trust expenses is taxable, but only at the basic

rate or the dividend ordinary rate.

3.4 Tax Position of Beneficiaries

Beneficiaries of a discretionary trust have no entitlement to income, and only

receive income at the discretion of the Trustees. ITA 2007, s.493

Any income distributed to a beneficiary is deemed to have been paid net of a 45%

tax credit. This 45% rate applies irrespective of the income actually received by the

Trustees.

For example, if the Trustees' only source of income is UK dividends on which tax is

paid at 38.1%, then if that income is subsequently distributed to a beneficiary, it will

always carry a 45% tax credit. ITA 2007, s.494

If a discretionary trust makes a distribution to a beneficiary, the distribution, and

the tax deducted therefrom, is certified on Form R185. ITA 2007, s.495

© RELX (UK) Limited 2018 24 FA 2018

Tolley® Exam Training TRUSTS AND ESTATES CHAPTER 3

Illustration 3

Assume that a discretionary trust distributes £5,500 to a beneficiary. The beneficiary

has received a net amount of £5,500. If we gross this up by 100/55, the beneficiary

is deemed to have received gross income from which 45% tax has been deducted

at source.

This will be certified as “trust income” on the form R185.

R185 Net Tax

£ £

Trust income 5,500 4,500

Unlike interest in possession trusts, there is no “transparency principle” for

discretionary trusts.

When a beneficiary receives a distribution of income from a discretionary trust, it is

certified as “trust income” on the Form R185 and is taxed as non-savings income in

the hands of the recipient. The beneficiary will enter a net sum of £5,500 on their

self-assessment return, and this is classed as non-savings income. The beneficiary

will not be able to use their Personal Savings Allowance or Dividend Allowance in

respect of discretionary income distributions.

If the beneficiary pays tax at the 45% rate, no extra tax will be due on the gross

trust income. If the taxpayer pays tax at the basic rate or at 40%, a tax repayment

will be due. The beneficiary may need to send the Form R185 to HMRC in support

of his repayment claim.

3.5 The “Tax Pool”

As beneficiaries in receipt of income distributions can always claim a tax credit of

45%, HMRC must have a method of making sure that any tax reclaimed by

beneficiaries does not exceed the tax originally paid by the Trustees. HMRC do this

by asking the Trustees to maintain a “tax pool”. ITA 2007, s.497

The “tax pool” is a running total of tax paid by the Trustees less any tax credits

which have been taken out of the pool by the beneficiaries. A record of the tax

pool is maintained and sent to HMRC along with the Trustees' tax return.

Every year tax will enter the pool. However when the Trustees pay income tax not

all tax paid by Trustees will be allowed as a “credit” to the tax pool. The credits to

the tax pool are as follows: ITA 2007, s.478

Standard rate band: Any tax paid at 20% and 7.5%

Non-savings income: Any tax paid at 45%

Interest: Any tax paid at 45%

Dividends: Dividends (after expenses) @ 38.1%

Tax on income used to pay expenses does not enter the pool (even if such income

is taxed at 20%).

Certain receipts of a capital nature are charged to income tax. These include

lease premiums, accrued income profits and chargeable event gains on certain

life assurance policies. The tax on these receipts which enters the tax pool is

restricted to 25% of the chargeable income (being the 45% trust rate less

disallowable basic rate tax). ITA 2007, s.498

© RELX (UK) Limited 2018 25 FA 2018

Tolley® Exam Training TRUSTS AND ESTATES CHAPTER 3

Whenever tax credits on distributions are claimed by beneficiaries, the balance in

the pool will go down. The tax claimed by beneficiaries is the total of the tax

columns on the form R185. For example, if a beneficiary receives a distribution of

£5,500, this is net of £4,500 of tax, and this credit of £4,500 will therefore leave the

pool.

Proforma Tax Pool

£

Balance b/fwd at 6 April X

Add: Tax paid by Trustees

Standard rate band @ 20%/7.5% X

Non-savings income @ 45% X

Interest income @ 45% X

Dividends after expenses @ 38.1% X

X

Less: Tax credits claimed by beneficiaries

Net distributions × 45/55 (X)

Balance c/fwd at 5 April X

If at the end of the year, the tax pool is in credit, this credit will be carried forward

as a positive balance at the start of the next tax year.

Illustration 4

A discretionary trust has the following income and expenses in 2018/19:

£

Rental profits 5,000

Bank interest 6,000

UK dividends 20,000

Trust management expenses (555)

The tax pool at 6 April 2018 is £1,000. In 2018/19, the Trustees made an income

distribution of £11,000 to a beneficiary.

Calculate the tax payable by the Trustees for 2018/19 and show the tax pool.

First calculate the tax payable by the Trustees:

Non-savings Interest Dividends

£ £ £

Rental profits 5,000

Bank interest 6,000

Dividends ____ ____ 20,000

Gross trust income 5,000 6,000 20,000

Less: Expenses (555 x 100/92.5) ____ ____ (600)

Income after expenses 5,000 6,000 19,400

Tax

“Standard rate”:

1,000 @ 20% 200

Rates applicable to trusts (RAT):

(5,000 – 1,000) @ 45% 1,800

6,000 @ 45% 2,700

19,400 @ 38.1% 7,391

600 @ 7.5% 45

Tax payable by Trustees 12,136

© RELX (UK) Limited 2018 26 FA 2018

Tolley® Exam Training TRUSTS AND ESTATES CHAPTER 3

Next we put together the tax pool:

Tax pool £

Balance b/fwd at 6 April 2018 1,000

Add: Tax paid by Trustees

1,000 @ 20% 200

4,000 @ 45% 1,800

6,000 @ 45% 2,700

Dividends after expenses @ 38.1%

19,400 @ 38.1% 7,391

13,091

Less: Tax credits claimed by beneficiaries

(11,000 × 45/55) (9,000)

Balance c/fwd at 5 April 2019 4,091

The beneficiary receives net income of £11,000 with a 45% tax credit. This will be

certified as “trust income” on the form R185.

R185 Net Tax

£ £

Trust income 11,000 9,000

3.6 Shortfalls in the Tax Pool

Problems arise when the tax pool goes into deficit. Essentially, if a pool goes into

deficit, this means that the tax paid by the Trustees is less than tax that has been

claimed by the beneficiaries.

Illustration 5

Assume in the above illustration, that the income distribution to the beneficiary in

2018/19 was £16,500 (instead of £11,000). All other information is as before.

The beneficiary receives net income of £16,500 with a 45% tax credit. This will be

certified as “trust income” on the form R185.

R185 Net Tax

£ £

Trust income 16,500 13,500

Show the changes to the tax pool and calculate the income tax payable by the

Trustees for 2018/19.

This changes the tax pool as follows:

Tax pool £

Balance b/fwd at 6 April 2018 1,000

Add: Tax paid by Trustees

1,000 @ 20% 200

4,000 @ 45% 1,800

6,000 @ 45% 2,700

19,400 @ 38.1% 7,391

13,091

Less: Tax credits claimed by beneficiaries

(16,500 × 45/55) (13,500)

Balance (409)

© RELX (UK) Limited 2018 27 FA 2018

Tolley® Exam Training TRUSTS AND ESTATES CHAPTER 3

Where a tax pool becomes negative, the Trustees must make up the difference,

and they will pay this tax under self-assessment. It will affect the payments on

account to be made for the following tax year. ITA 2007, s.496

The Trustees' tax payable for 2018/19 will now be:

£

Tax due as before 12,136

Add: s.496 liability 409

Revised tax payable 12,545

Therefore, as at 6 April 2019, the balance in the tax pool will be zero. Note that only

positive balances are carried forward. There is no negative balance to carry

forward as this tax will have been discharged by the Trustees.

A shortfall will typically happen when some of the trust income received is from

dividends. Dividends are taxed at the dividend trust rate of 38.1% and this tax

enters the pool. However income distributions always carry a 45% tax credit, so

Trustees with an asset base consisting mainly of shares need to be careful when

deciding how much income to pay out.

There is a “tax pool calculator” on the HMRC website which enables Trustees to

enter their estimated income and expenses for the year and the balance in the

tax pool. The tax pool calculator will then calculate the maximum amounts the

Trustees could distribute to beneficiaries in the tax year without creating a shortfall.

3.7 Tax Pools on Winding-Up the Trust

Trusts are wound up when the Trustees make a decision to distribute all remaining

funds to the beneficiaries. They will either do this:

1. Under the terms of the trust deed - for example if the deed gives beneficiaries

entitlement to capital at a specified age; or

2. At their discretion – for example if the Trustees decide that the beneficiaries

are sufficiently mature to accept the Trust assets or that the trust has fully

served its purpose.

The tax pool will therefore close when the trust is wound up. Any credits within the

pool at that point will not be repaid by HMRC and will then be lost. It is therefore

common planning for Trustees to make sufficient income distributions just before

the trust is finally wound up in order to enable the beneficiaries to take advantage

of the 45% tax credit (which often leads to tax repayments).

3.8 Property Income – Interest Restrictions

Trustees pay income tax on their annual net property income. Net property

income means income less allowable expenses.

The rules for deducting letting expenses against rental receipts are broadly the

same as those which apply for individuals. This means that Trustees who have

taken out a mortgage to acquire a residential property and who subsequently

pay interest on the loan will be affected by the interest restrictions brought in from

2017/18.

© RELX (UK) Limited 2018 28 FA 2018

Tolley® Exam Training TRUSTS AND ESTATES CHAPTER 3

Interest costs incurred by Trustees will be disallowed when computing the taxable

profits of the property business. ITTOIA 2005, s.272A

The restriction is being phased in as below:

% of finance costs % of finance costs given

allowable as an as an income tax

expense reduction

2017/18 75% 25%

2018/19 50% 50%

2019/20 25% 75%

2020/21 onwards Nil 100%

Discretionary trusts then receive tax relief for the disallowed interest as a tax

reducer in the income tax computation.

The tax reducer is the “relievable amount” multiplied by 20%.

The “relievable amount” is generally the lower of:

• The interest costs disallowed as an expense; and

• The taxable profits for the property business for the year (net of any allowable

losses brought forward).

ITTOIA 2005, s.274B

Illustration 6

A discretionary trust has income and expenses for 2018/19 as follows:

£

Income:

Rental income on a residential investment property 10,000

Bank interest 1,500

Dividends 9,000

Expenses:

Letting expenses 4,000

General management expenses 925

The letting expenses include £1,000 of interest on a loan taken out to partially fund

the acquisition of the investment property.

© RELX (UK) Limited 2018 29 FA 2018

Tolley® Exam Training TRUSTS AND ESTATES CHAPTER 3

The income tax payable by the Trustees in 2018/19 is as follows:

£ £

Rental income 10,000

Less: Letting expenses (4,000)

6,000

Add: Disallowed interest (£1,000 x 50%) 500

Net property income 6,500

Bank interest 1,500

Dividends 9,000

17,000

Less: Trust expenses met from dividends (1,000)

(925 x 100/92.5)

Liable at rates applicable to trust 16,000

Tax:

£1,000 @ 20% 200

£5,500 @ 45% 2,475

£1,500 @ 45% 675

£(9,000 – 1,000) @ 38.1% 3,048

£1,000 @ 7.5% 75

6,473

Less: Tax reduction for disallowed interest (100)

(£500 @ 20%)

Income tax payable 6,373

Note:

The relievable amount is £500 as this is lower than the net property income for the

year.

Credits to the tax pool are 45% of the amount of taxable property income (being

45% of the property business profits after the disallowance of interest). There is no

further adjustment to remove the 20% tax reducer from the tax pool.

In the above illustration, the tax pool for 2018/19 would be as follows:

£

Rental income on a residential investment property 500

Add:

Tax paid at basic rate 200

Tax paid at trust rate £(2,475 + 675) 3,150

Tax paid at dividend trust rate 3,048

Pool balance (available to frank income distributions to 6,898

beneficiaries)

Beneficiaries are unaffected and income distributions (even when made directly

from property business profits) will continue to be treated as “trust income” and will

carry a 45% tax credit.

3.9 Property Income Interest Restrictions – IIP Trusts

If an IIP trust has a UK property business, the property business profits for the tax

year are calculated as for a discretionary trust. Any interest costs are subject to the

phased-in restriction as outlined above. The resulting profit is then taxed in the

hands of the IIP Trustees at the basic rate (20%).

© RELX (UK) Limited 2018 30 FA 2018

Tolley® Exam Training TRUSTS AND ESTATES CHAPTER 3

The IIP Trustees are not entitled to a 20% tax reducer on the disallowed interest as

such relief only applies to “accumulated or discretionary income”.

Instead the tax reducer is given to the life tenant via his own income tax

computation.

As well as giving the life tenant a form R185 which certifies income which has been

taxed in their hands, the Trustees will also notify the life tenant of the amount of

interest which has been disallowed. The beneficiary will then claim a tax reduction

for this disallowed interest under the normal rules for individuals.

© RELX (UK) Limited 2018 31 FA 2018

Tolley® Exam Training TRUSTS AND ESTATES CHAPTER 3

EXAMPLES

Example 1

The Alpha discretionary trust has the following income and expenses in 2018/19:

£

Rental profits 24,000

Gilt interest 6,000

UK dividends 5,000

Trust expenses (185)

Calculate the tax due under self-assessment for 2018/19.

Example 2

The Beta discretionary trust has the following income and expenses in 2018/19:

£

UK dividends 80,000

Trust expenses (9,250)

The tax pool at 6 April 2018 was £2,000. The Trustees made an income distribution

of £35,200 to a beneficiary in 2018/19.

Show the tax pool for 2018/19.

© RELX (UK) Limited 2018 32 FA 2018

Tolley® Exam Training TRUSTS AND ESTATES CHAPTER 3

ANSWERS

Answer 1

Non savings Interest Dividends

£ £ £

Rental profits 24,000

Gilt interest 6,000

Dividends 5,000

Less: Expenses (185 x 100/92.5) _____ ____ (200)

Income after expenses 24,000 6,000 4,800

Tax

“Standard rate”:

1,000 @ 20% 200

Rates applicable to trusts (RAT):

(24,000 – 1,000) @ 45% 10,350

6,000 @ 45% 2,700

4,800 @ 38.1% 1,829

200 @ 7.5% 15

Tax payable by Trustees 15,094

Answer 2

£ £

Tax pool @ 6.4.18 2,000

Add:

Taxable dividends above standard rate band @ 38.1%

Dividends 80,000

Less: Expenses (9,250 @ 100/92.5) (10,000)

Taxable dividends 70,000

Charged at 7.5% (1,000)

Chargeable at dividend trust rate 69,000

@ 38.1% 26,289

Tax @ 7.5% (1,000 @ 7.5%) 75

28,364

Less: Credits claimed (35,200 × 45/55) (28,800)

Trustees liability (436)

Balance at 6.4.19 Nil

© RELX (UK) Limited 2018 33 FA 2018

Tolley® Exam Training TRUSTS AND ESTATES CHAPTER 3

INCOME TAX ON DISCRETIONARY TRUSTS

TRUST RATES

Discretionary trustees pay income tax at the following flat rates, known as the rates

applicable to trusts (RAT):

(ITA 2007, s.479)

Non-savings income 45%

Interest income 45%

Dividend income 38.1%

The first £1,000 of trust income in the tax year is charged at the basic or dividend ordinary

rates. The £1,000 “standard rate” band is allocated to non-savings income in priority to

interest then dividends.

(ITA 2007, s.491)

RELIEF FOR EXPENSES

Some relief is given in respect of trust expenses, in that any income used for expenses is

taxed at the IIP rates of 7.5%/20%, again deeming expenses to have come from dividend

income in priority to interest and non-savings income.

(ITA 2007, s.484)

DISTRIBUTIONS

A beneficiary who has received a distribution is deemed to have received income net of

a 45% tax credit. The grossed-up distribution is treated as non-savings income regardless of

the type of income actually received by the trust.

(ITA 2007, s.494)

To ensure that the Trustees have actually paid sufficient tax for the beneficiary to be

entitled to a 45% tax credit, a running total of tax paid and tax credits on distributions to

beneficiaries, known as the tax pool is maintained.

(ITA 2007, s.497)

All tax paid on non-savings income and interest at both “basic rate” and at 45% and tax

on dividends (after expenses) at both the dividend ordinary rate and at 38.1% can enter

the pool.

Having deducted tax credits claimed by beneficiaries, if the tax pool is in credit the

balance is carried forward to the following year. If there is a negative balance on the tax

pool, this represents a further liability for the Trustees and a nil balance is carried forward.

(ITA 2007, s.496)

Trusts are subject to interest restrictions on loans taken out to acquire residential rental

properties. Some of the interest (50% in 2018/19) will be disallowed in calculating the rental

profits.

(ITTOIA 2005, s.272A)

© RELX (UK) Limited 2018 34 FA 2018

Tolley® Exam Training TRUSTS AND ESTATES CHAPTER 3

Discretionary trusts will receive relief for the disallowed interest as a 20% tax reducer in the

income tax computation. IIP trusts cannot claim the 20% tax reducer (this will instead be

claimed by the life tenant).

(ITTOIA 2005, s.274B)

© RELX (UK) Limited 2018 35 FA 2018

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Aisc Quality ManualDocument404 pagesAisc Quality Manualvo thi kim xuyenNo ratings yet

- Auditing Problems With AnswersDocument12 pagesAuditing Problems With Answersaerwinde79% (34)

- Business Property Relief BPR - UKDocument8 pagesBusiness Property Relief BPR - UKAlellie Khay JordanNo ratings yet

- Chargeable Lifetime Transfers - Calculation of Tax: Basic PrinciplesDocument8 pagesChargeable Lifetime Transfers - Calculation of Tax: Basic PrinciplesAlellie Khay JordanNo ratings yet

- Chargeable Transfers - UKDocument8 pagesChargeable Transfers - UKAlellie Khay JordanNo ratings yet

- Chargeable Lifetime Transfers Calculation of Tax - UKDocument10 pagesChargeable Lifetime Transfers Calculation of Tax - UKAlellie Khay JordanNo ratings yet

- TET05-B Exit Charges On Relevant Property Trusts - Part B PDFDocument12 pagesTET05-B Exit Charges On Relevant Property Trusts - Part B PDFAlellie Khay JordanNo ratings yet

- Lifetime Transfers Grossing-Up - UKDocument8 pagesLifetime Transfers Grossing-Up - UKAlellie Khay JordanNo ratings yet

- A Business Property Relief Further Aspects - Part A - UKDocument10 pagesA Business Property Relief Further Aspects - Part A - UKAlellie Khay JordanNo ratings yet

- Additional Tax On Death - UKDocument8 pagesAdditional Tax On Death - UKAlellie Khay JordanNo ratings yet

- TET01-A Introduction To Trusts - Part A PDFDocument12 pagesTET01-A Introduction To Trusts - Part A PDFAlellie Khay JordanNo ratings yet

- TET05-B Exit Charges On Relevant Property Trusts - Part B PDFDocument12 pagesTET05-B Exit Charges On Relevant Property Trusts - Part B PDFAlellie Khay JordanNo ratings yet

- TET03-B Income Tax On Discretionary Trusts - Part B PDFDocument16 pagesTET03-B Income Tax On Discretionary Trusts - Part B PDFAlellie Khay JordanNo ratings yet

- Corporation Tax Self Assessment (CTSA) 1Document16 pagesCorporation Tax Self Assessment (CTSA) 1Alellie Khay JordanNo ratings yet

- Introduction To Inheritance Tax - UKDocument8 pagesIntroduction To Inheritance Tax - UKAlellie Khay JordanNo ratings yet

- Tax Tables 2018 19 - 4Document8 pagesTax Tables 2018 19 - 4Alellie Khay JordanNo ratings yet

- TET01-A Introduction To Trusts - Part A PDFDocument12 pagesTET01-A Introduction To Trusts - Part A PDFAlellie Khay JordanNo ratings yet

- Introduction To Corporation TaxDocument28 pagesIntroduction To Corporation TaxAlellie Khay JordanNo ratings yet

- CPAreviewDocument211 pagesCPAreviewCodeSeeker100% (1)

- CPAreviewDocument211 pagesCPAreviewCodeSeeker100% (1)

- Chapter 5 - Audit PlanningDocument13 pagesChapter 5 - Audit PlanningAlellie Khay JordanNo ratings yet

- Payment of Corporation Tax - Part ADocument16 pagesPayment of Corporation Tax - Part AAlellie Khay JordanNo ratings yet

- Long Periods of Account 1Document10 pagesLong Periods of Account 1Alellie Khay JordanNo ratings yet

- Accounting For VAT 1Document14 pagesAccounting For VAT 1Alellie Khay JordanNo ratings yet

- CPA REVIEW Questions - LAMBERSDocument51 pagesCPA REVIEW Questions - LAMBERSAlellie Khay JordanNo ratings yet

- Chapter 5 - Audit PlanningDocument13 pagesChapter 5 - Audit PlanningAlellie Khay JordanNo ratings yet

- Practical Accounting 2 With AnswersDocument11 pagesPractical Accounting 2 With Answerskidrauhl0767% (6)

- Practical Accounting 2 With AnswersDocument11 pagesPractical Accounting 2 With Answerskidrauhl0767% (6)

- CPAreviewDocument211 pagesCPAreviewCodeSeeker100% (1)

- CPA REVIEW Questions - LAMBERSDocument51 pagesCPA REVIEW Questions - LAMBERSAlellie Khay JordanNo ratings yet

- Kevin The Dino: Free Crochet PatternDocument3 pagesKevin The Dino: Free Crochet PatternMarina Assa100% (4)

- 2018 Management Accounting Ibm2 PrepDocument9 pages2018 Management Accounting Ibm2 PrepВероника КулякNo ratings yet

- Campus Tour (19 - 03)Document7 pagesCampus Tour (19 - 03)HoàngAnhNo ratings yet

- Azure Ea Us - Bif - Sow Template Fy15Document5 pagesAzure Ea Us - Bif - Sow Template Fy15SergeyNo ratings yet

- Design Proforma AmdDocument5 pagesDesign Proforma AmdsantkabirNo ratings yet

- Basics of Accounting Notes MBA 2nd SemDocument30 pagesBasics of Accounting Notes MBA 2nd SemVikash ChauhanNo ratings yet

- Architect's Letter To Village of La GrangeDocument13 pagesArchitect's Letter To Village of La GrangeDavid GiulianiNo ratings yet

- Intentional InjuriesDocument29 pagesIntentional InjuriesGilvert A. PanganibanNo ratings yet

- Army Institute of Law, MohaliDocument11 pagesArmy Institute of Law, Mohaliakash tiwariNo ratings yet

- Browerville Blade - 08/08/2013Document12 pagesBrowerville Blade - 08/08/2013bladepublishingNo ratings yet

- At The Butcher's, A Sample DialogueDocument1 pageAt The Butcher's, A Sample DialogueZine Edeb100% (1)

- Backup FTP and DeleteDocument9 pagesBackup FTP and DeleteChandra Bhushan ChoubeyNo ratings yet

- Unit 06 ContractingDocument44 pagesUnit 06 Contractingparneet chowdharyNo ratings yet

- 001) Each Sentence Given Below Is in The Active Voice. Change It Into Passive Voice. (10 Marks)Document14 pages001) Each Sentence Given Below Is in The Active Voice. Change It Into Passive Voice. (10 Marks)Raahim NajmiNo ratings yet

- The Blue & The Gray (1993) (Micro Miniatures Battle Manual)Document57 pagesThe Blue & The Gray (1993) (Micro Miniatures Battle Manual)mab58No ratings yet

- Assignment: Problem-Solving ProcessDocument3 pagesAssignment: Problem-Solving ProcessApril Joyce SamanteNo ratings yet

- BUSINESS ENGLISH WORKBOOK: Accounting and Commerce IIIDocument191 pagesBUSINESS ENGLISH WORKBOOK: Accounting and Commerce IIItimhort100% (1)

- NTSE 2011 Chandigarh STSE FormDocument4 pagesNTSE 2011 Chandigarh STSE FormacNo ratings yet

- Uttar Pradesh TourismDocument32 pagesUttar Pradesh TourismAnone AngelicNo ratings yet

- English Higher Tier Paoer 1 JuneDocument4 pagesEnglish Higher Tier Paoer 1 Junelsh_ss7No ratings yet

- How Much Did Early Christians Refer To The Old Testament?: - Mar. 2020 VersionDocument11 pagesHow Much Did Early Christians Refer To The Old Testament?: - Mar. 2020 VersionSteven MorrisonNo ratings yet

- BFS Property Listing For Posting As of 06.09.2017-Public-Final PDFDocument28 pagesBFS Property Listing For Posting As of 06.09.2017-Public-Final PDFkerwin100% (1)

- The Divine Bhrgu SamhitaDocument4 pagesThe Divine Bhrgu SamhitaJohn BregenzaNo ratings yet

- Internship Report Quetta Serena HotelDocument33 pagesInternship Report Quetta Serena HotelTalha Khan43% (7)

- Ethics A Very Short Introduction PDFDocument2 pagesEthics A Very Short Introduction PDFKimberly0% (1)

- Philipsek Part 5Document10 pagesPhilipsek Part 5HoldingfordNo ratings yet

- Chapter 1: Nature and Scope of Economics: Unit 1: IntroductionDocument2 pagesChapter 1: Nature and Scope of Economics: Unit 1: Introductionvasantha mulpuriNo ratings yet

- US History NotesDocument12 pagesUS History NotesLadli GirlNo ratings yet

- TM 9-816 AUTOCAR U 7144Document280 pagesTM 9-816 AUTOCAR U 7144Advocate100% (1)