Professional Documents

Culture Documents

Cost

Uploaded by

jeams vidalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost

Uploaded by

jeams vidalCopyright:

Available Formats

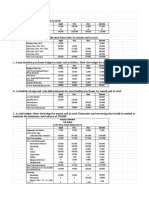

Job Order Costing Activity

Problem # 1

ABC Company manufactures custom-built conveyor systems for factory and commercial operations. Lisa French is the

cost accountant for ABC and she is in the process of educating a new employee, Julie English, about the job order costing

system that ABC uses. (The system is based on normal costs; overhead is applied based on direct labor cost and rounded

to the next whole dollar.) Lisa gathers the following job order cost records for May:

Direct Direct Total

Job No. Materials Labor Applied OH Cost

667 P 5,901 P1,730 P 1,990 P 9,621

669 18,312 1,810 2,082 22,204

670 406 500 575 1,481

671 51,405 9,500 10,925 71,830

672 9,615 550 633 10,798

To explain the missing job number, Lisa informed Julie that Job #668 had been completed in April. She also told her that

Job #667 was the only job in process at the beginning of May. At that time, the job had been assigned P4,300 for direct

material and P900 for direct labor. At the end of May, Job #671 had not been completed; all others had. Lisa asked Julie

several questions to determine whether she understood the job order system.

Required: Help Julie answer the following questions:

a. What is the predetermined overhead rate used by ABC Company?

b. What was the total cost of beginning Work in Process inventory?

c. What was total prime cost incurred for the month of May?

d. What was cost of goods manufactured for May?

Problem # 2

DEF Co. uses a job order costing system and has the following information for the first week of June 2019:

1. Direct labor and direct materials used:

Job No. Direct Material Direct Labor Hours

498 P1,500 116

506 960 16

507 415 18

508 345 42

509 652 24

511 308 10

512 835 30

Total P5,015 256

2. The direct labor wage rate is P4 per hour.

3. The overhead rate is P5 per direct labor hour.

4. Actual overhead costs for the week, P1,480.

5. Jobs completed: Nos. 498, 506, and 509.

6. The factory had no work in process at the beginning of the week.

Required:

a. Prepare a summary that will show the total cost assigned to each job.

b. Compute the amount of overhead over- or underapplied during the week.

c. Calculate the cost of the work in process at the end of the week.

Problem # 3

The Watson Tool Corporation, which commenced operations on August 1, employs a job order costing system. Overhead

is charged at a normal rate of P2.50 per direct labor hour. The actual operations for the month of August are summarized

as follows:

a. Purchases of raw material, 25,000 pieces @ P1.20/piece.

b. Material and labor costs charged to production:

Direct Direct

Job No. Units Material labor cost labor hours

101 10,000 P4,000 P6,000 3,000

102 8,800 3,600 5,400 2,700

103 16,000 7,000 9,000 4,500

104 8,000 3,200 4,800 2,400

105 20,000 8,000 3,600 1,800

c. Actual overhead costs incurred:

Variable P18,500

Fixed 15,000

d. Completed jobs: 101, 102, 103, and 104

e. Sales-P105,000. All units produced on Jobs 101, 102, and 103 were sold.

Required: Compute the following balances on August 31:

a. Material inventory

b. Work in process inventory

c. Finished goods inventory

d. Cost of goods sold

e. Under- or overapplied overhead

You might also like

- MasDocument4 pagesMasYaj CruzadaNo ratings yet

- Joint Operation Revenue and ExpensesDocument2 pagesJoint Operation Revenue and ExpensesMitch Tokong MinglanaNo ratings yet

- PROBLEM 1: How Should The 100,000 Be Distributed To The Following CreditorsDocument2 pagesPROBLEM 1: How Should The 100,000 Be Distributed To The Following CreditorsMitch Tokong MinglanaNo ratings yet

- Value Stream Design for Product FamilyDocument5 pagesValue Stream Design for Product FamilyMiljane PerdizoNo ratings yet

- Long Assignment - MinglanaDocument1 pageLong Assignment - MinglanaMitch Tokong MinglanaNo ratings yet

- Erika Co investment property reportingDocument4 pagesErika Co investment property reportingjeams vidalNo ratings yet

- Minglana, Mitch T. BSA 201: Activity 5: Rolls-Royce Case (Porter'S Five Forces Analysis)Document2 pagesMinglana, Mitch T. BSA 201: Activity 5: Rolls-Royce Case (Porter'S Five Forces Analysis)Mitch Tokong MinglanaNo ratings yet

- CONSOLIDATED - PROGRAMME-RECEIVABLES-PREPAYMENT-GROUP-5-v2-1Document6 pagesCONSOLIDATED - PROGRAMME-RECEIVABLES-PREPAYMENT-GROUP-5-v2-1Mitch Tokong Minglana0% (1)

- Value Stream Design for Product FamilyDocument5 pagesValue Stream Design for Product FamilyMiljane PerdizoNo ratings yet

- Calculate breakeven point, target sales, and safety margin for contribution margin analysisDocument5 pagesCalculate breakeven point, target sales, and safety margin for contribution margin analysisAbhijit AshNo ratings yet

- Gonzales Quiz Chapter 8 Notes Part 2 PDFDocument7 pagesGonzales Quiz Chapter 8 Notes Part 2 PDFJohn Michael SorianoNo ratings yet

- Ford Motor Company A Case Study Presentation With TransitionsDocument22 pagesFord Motor Company A Case Study Presentation With TransitionsMelissa FabillarNo ratings yet

- Intercompany Sale of Merchandise - AdditionalDocument4 pagesIntercompany Sale of Merchandise - AdditionalJaimell LimNo ratings yet

- Master in Managerial Advisory Services: Easy QuestionsDocument13 pagesMaster in Managerial Advisory Services: Easy QuestionsKervin Rey JacksonNo ratings yet

- MQ1 - Topics FAR.2901 To 2915.Document7 pagesMQ1 - Topics FAR.2901 To 2915.Waleed MustafaNo ratings yet

- Cost Management Questionnaire PCPDocument2 pagesCost Management Questionnaire PCPJoaquín Quiñones SoteloNo ratings yet

- Statutory Duties of AuditorsDocument1 pageStatutory Duties of AuditorsMitch Tokong MinglanaNo ratings yet

- Name: - Section: - Schedule: - Class Number: - DateDocument7 pagesName: - Section: - Schedule: - Class Number: - DateKylie sheena MendezNo ratings yet

- Final Exam Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Document7 pagesFinal Exam Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Marilou Arcillas PanisalesNo ratings yet

- Chapter 8 Entry Strategies in Global BusinessDocument3 pagesChapter 8 Entry Strategies in Global BusinessMariah Dion GalizaNo ratings yet

- Accounting Changes and ErrorsDocument3 pagesAccounting Changes and ErrorsJohn Emerson PatricioNo ratings yet

- ROMERO BSMA1E Standard Costing ExerciseDocument4 pagesROMERO BSMA1E Standard Costing ExerciseAliah Romero100% (1)

- Farparcor 2 Chapter 1 Exercises Problem AnswersDocument10 pagesFarparcor 2 Chapter 1 Exercises Problem AnswersWillnie Shane LabaroNo ratings yet

- 07 - Revenue - Consignment Sales PDFDocument17 pages07 - Revenue - Consignment Sales PDFCarla MarieNo ratings yet

- This Study Resource Was: Process Costing - AverageDocument7 pagesThis Study Resource Was: Process Costing - AverageIllion IllionNo ratings yet

- Gross Profit and Retail MethodDocument2 pagesGross Profit and Retail MethodMary Dale Joie BocalaNo ratings yet

- Unit II CFS Subsequent To Date of AcquisitionDocument10 pagesUnit II CFS Subsequent To Date of AcquisitionDaisy TañoteNo ratings yet

- Chapter 3 - Shareholders' Equity BreakdownDocument17 pagesChapter 3 - Shareholders' Equity BreakdownJohn Lloyd YastoNo ratings yet

- Accounting Lessons on Net Asset AcquisitionsDocument2 pagesAccounting Lessons on Net Asset AcquisitionsRafael BarbinNo ratings yet

- Multiple Choice Answers and Solutions: Realized Gross Profit, 2013 P 675,000Document26 pagesMultiple Choice Answers and Solutions: Realized Gross Profit, 2013 P 675,000ALEXANDRANICOLE OCTAVIANONo ratings yet

- Ex and P-BudgetingDocument10 pagesEx and P-BudgetingJessa Swing Dela CruzNo ratings yet

- Afar BuscombDocument22 pagesAfar BuscombMo Mindalano MandanganNo ratings yet

- Quiz 9 A6Document20 pagesQuiz 9 A6Lara FloresNo ratings yet

- Multiple Choices - Quiz - Chapter 1-To-3Document21 pagesMultiple Choices - Quiz - Chapter 1-To-3Ella SingcaNo ratings yet

- Case 8-31: April May June QuarterDocument2 pagesCase 8-31: April May June QuarterileviejoieNo ratings yet

- Accountants Embracing Changing Times in AcademeDocument12 pagesAccountants Embracing Changing Times in AcademeLorie Anne ValleNo ratings yet

- Installment Liquidation ExplainedDocument28 pagesInstallment Liquidation Explainedcynthia reyesNo ratings yet

- Strat Cost Drop or ContinueDocument1 pageStrat Cost Drop or ContinueStephannieArreolaNo ratings yet

- Assignment - Cost BehaviorsDocument11 pagesAssignment - Cost BehaviorsMary Antonette LastimosaNo ratings yet

- Quiz 2 Cost AccountingDocument1 pageQuiz 2 Cost AccountingRocel DomingoNo ratings yet

- PR Advance 1 Problem 10-7 Statement of AffairsDocument4 pagesPR Advance 1 Problem 10-7 Statement of AffairsReynaldi100% (1)

- Solman NRDocument13 pagesSolman NRMeeka CalimagNo ratings yet

- Multiple Choice - JOCDocument14 pagesMultiple Choice - JOCMuriel MahanludNo ratings yet

- Prob 5Document1 pageProb 5Mitch Tokong MinglanaNo ratings yet

- Sample Exam 2Document16 pagesSample Exam 2Zenni T XinNo ratings yet

- This Study Resource Was: Problem Set 7 Budgeting Problem 1 (Garrison Et Al. v15 8-1)Document8 pagesThis Study Resource Was: Problem Set 7 Budgeting Problem 1 (Garrison Et Al. v15 8-1)NCT100% (1)

- PDF Document 3Document13 pagesPDF Document 3Nina0% (1)

- Practice Problem SetDocument22 pagesPractice Problem SetJanielle NaveNo ratings yet

- Certs - Managerial EconomicsDocument42 pagesCerts - Managerial EconomicsCJ ManaloNo ratings yet

- Management Advisory Services Activity Cost and CVP Analysis MSQDocument9 pagesManagement Advisory Services Activity Cost and CVP Analysis MSQMa Teresa B. CerezoNo ratings yet

- Solutions To Review Exam Papers 1 To 3Document171 pagesSolutions To Review Exam Papers 1 To 3Roi NyanNo ratings yet

- Business Combination Drill PDFDocument2 pagesBusiness Combination Drill PDFMelvin MendozaNo ratings yet

- Answer: PH P 1,240: SolutionDocument18 pagesAnswer: PH P 1,240: SolutionadssdasdsadNo ratings yet

- Minglana, Mitch T. (Quiz 1)Document6 pagesMinglana, Mitch T. (Quiz 1)Mitch Tokong MinglanaNo ratings yet

- P2 BautistaDocument8 pagesP2 BautistaMedalla NikkoNo ratings yet

- MAS 2023 Module 5 Standard Costing and Variance AnalysisDocument20 pagesMAS 2023 Module 5 Standard Costing and Variance AnalysisDzulija Talipan100% (1)

- Chap 8 Responsibility AccountingDocument51 pagesChap 8 Responsibility AccountingXel Joe BahianNo ratings yet

- UNIT5 Cost Accounting AssignmentDocument29 pagesUNIT5 Cost Accounting AssignmentRuby RosiosNo ratings yet

- Chapter 7 Inventory ManagementDocument24 pagesChapter 7 Inventory ManagementAMNo ratings yet

- Auditing: Page 1 of 8Document8 pagesAuditing: Page 1 of 8jeams vidalNo ratings yet

- A Review in Managerial Economics: Prepared By: Jeams E. VidalDocument8 pagesA Review in Managerial Economics: Prepared By: Jeams E. Vidaljeams vidalNo ratings yet

- Richly Roboca IPPPE ME QuizDocument4 pagesRichly Roboca IPPPE ME Quizjeams vidalNo ratings yet

- Introduction To AisDocument41 pagesIntroduction To AisMarieJoiaNo ratings yet

- AP Ppe Quizzer QDocument28 pagesAP Ppe Quizzer Qkimberly bumanlagNo ratings yet

- QuestionnaireDocument4 pagesQuestionnaireTroisNo ratings yet

- Payroll Controls at SheridanDocument2 pagesPayroll Controls at Sheridanjeams vidalNo ratings yet

- Interim Visit 2Document2 pagesInterim Visit 2jeams vidalNo ratings yet

- An Analysis of Basic Accounting Practices of MicroenterprisesDocument10 pagesAn Analysis of Basic Accounting Practices of Microenterprisesjeams vidalNo ratings yet

- Materiality LevelDocument1 pageMateriality Leveljeams vidalNo ratings yet

- What Is A Cash Flow StatementDocument3 pagesWhat Is A Cash Flow Statementjeams vidalNo ratings yet

- Internal Audit Manual PhilippinesDocument295 pagesInternal Audit Manual PhilippinesAnonymous dtceNuyIFI100% (8)

- Erika Co investment property reportingDocument4 pagesErika Co investment property reportingjeams vidalNo ratings yet

- Final Visit Inventory AuditDocument7 pagesFinal Visit Inventory Auditjeams vidalNo ratings yet

- Imprest vs Fluctuating Fund AccountingDocument2 pagesImprest vs Fluctuating Fund Accountingjeams vidalNo ratings yet

- A Review in Managerial Economics: Prepared By: Jeams E. VidalDocument8 pagesA Review in Managerial Economics: Prepared By: Jeams E. Vidaljeams vidalNo ratings yet

- Internal Control - Accounts Receivable Credit SalesDocument4 pagesInternal Control - Accounts Receivable Credit Salesjeams vidalNo ratings yet

- A Review in Managerial Economics: Prepared By: Jeams E. VidalDocument8 pagesA Review in Managerial Economics: Prepared By: Jeams E. Vidaljeams vidalNo ratings yet

- Bank Reconciliation: Irene Mae C. Guerra, CPADocument25 pagesBank Reconciliation: Irene Mae C. Guerra, CPAjeams vidalNo ratings yet

- Imprest vs Fluctuating Fund AccountingDocument2 pagesImprest vs Fluctuating Fund Accountingjeams vidalNo ratings yet

- Determinants of Accounting Practices Among Street Food VendorsDocument15 pagesDeterminants of Accounting Practices Among Street Food VendorsShamae AfableNo ratings yet

- Chapter Three: Product Costing and Cost Accumulation in A Batch Production EnvironmentDocument71 pagesChapter Three: Product Costing and Cost Accumulation in A Batch Production Environmentjeams vidalNo ratings yet

- 4 - Accounting For OverheadDocument12 pages4 - Accounting For Overheadjeams vidalNo ratings yet

- Conceptual Framework: (Underlying Assumptions and Qualitative CharacteristicsDocument25 pagesConceptual Framework: (Underlying Assumptions and Qualitative Characteristicsjeams vidalNo ratings yet

- Cost Accounting & Control: (Introduction and OverviewDocument16 pagesCost Accounting & Control: (Introduction and Overviewjeams vidalNo ratings yet

- 2015 Senior Thesis TopicsDocument12 pages2015 Senior Thesis TopicspamelaNo ratings yet

- Proof of Cash: Irene Mae C. Guerra, CPADocument17 pagesProof of Cash: Irene Mae C. Guerra, CPAjeams vidalNo ratings yet

- Assignment: Multimedia Keyboards Comfort Type KeyboardsDocument1 pageAssignment: Multimedia Keyboards Comfort Type Keyboardsjeams vidal0% (2)

- Basic Accountin-WPS OfficeDocument4 pagesBasic Accountin-WPS Officejeams vidalNo ratings yet

- Eighteen: Allocation of Support Activity Costs and Joint CostsDocument67 pagesEighteen: Allocation of Support Activity Costs and Joint Costsjeams vidalNo ratings yet

- TatasteelfinalreportDocument53 pagesTatasteelfinalreportRishika Mondal100% (1)

- Tsega BiruDocument75 pagesTsega BiruAmhara AammhhaarraaNo ratings yet

- Workshop 4 Inventory Management at PhilipsDocument5 pagesWorkshop 4 Inventory Management at PhilipsAlexanderNo ratings yet

- Part DDocument67 pagesPart D2958863601No ratings yet

- Introduction To Master Data in SAPDocument4 pagesIntroduction To Master Data in SAPSai BodduNo ratings yet

- Personnel AdministrationDocument11 pagesPersonnel Administrationapi-3822959No ratings yet

- Cocof 10 0014 04 en Financial EngineeringDocument53 pagesCocof 10 0014 04 en Financial EngineeringdumitrutudoranNo ratings yet

- The Auditorx27s Responsibilitydocx PDF FreeDocument9 pagesThe Auditorx27s Responsibilitydocx PDF FreeGONZALES CamilleNo ratings yet

- Supply Chain Process RestructuringDocument23 pagesSupply Chain Process RestructuringJohn SujithNo ratings yet

- SegmentationDocument15 pagesSegmentationSj Satheesh KumarNo ratings yet

- Pearl Pet MahadDocument2 pagesPearl Pet MahadShree RangaNo ratings yet

- Completed Current MonthDocument17 pagesCompleted Current MonthCristel BautistaNo ratings yet

- Purchases Audit ProgramDocument3 pagesPurchases Audit Programvarghese200795% (22)

- Urgently Hiring Classified AdsDocument4 pagesUrgently Hiring Classified Adswilliam_malonzoNo ratings yet

- Software Engineering Question BankDocument3 pagesSoftware Engineering Question BankNALLAMILLIBALASAITEJAREDDY 2193118No ratings yet

- REi Main 2003 FormatDocument8 pagesREi Main 2003 FormatRawnak AdnanNo ratings yet

- Supply Chain Success of AMUL Dairy CooperativeDocument19 pagesSupply Chain Success of AMUL Dairy CooperativeBeingAbhishek RupawateNo ratings yet

- Mgt5013w3ar - 22072Document5 pagesMgt5013w3ar - 22072NarasimhaBadriNo ratings yet

- Gestion de PersonalDocument3 pagesGestion de PersonalNadia Moromenacho Solis0% (1)

- Case Study SolutionDocument4 pagesCase Study SolutionPranjal JaiswalNo ratings yet

- Determining Products, Selecting Activities, and Responding to Customer NeedsDocument2 pagesDetermining Products, Selecting Activities, and Responding to Customer NeedsJuan Miguel Salvador MaglalangNo ratings yet

- RAM BenchmarkDocument2 pagesRAM Benchmarkwiwiz2000No ratings yet

- Kotler Pom16e Inppt 01Document38 pagesKotler Pom16e Inppt 01ghali belamineNo ratings yet

- Key Marketing Issues of New Venture Prepared By:: Divyesh GandhiDocument24 pagesKey Marketing Issues of New Venture Prepared By:: Divyesh GandhimaazNo ratings yet

- Cash in Transit GuideDocument10 pagesCash in Transit GuideFrancisco Saraiva100% (1)

- CMQ Exam Preparation 3FOLD V1Document4 pagesCMQ Exam Preparation 3FOLD V1balu0% (2)

- CRM_CEQ_CS_CLDocument9 pagesCRM_CEQ_CS_CLranu groupNo ratings yet

- Applicability of Activity-Based Costing in Services: Case Study in A HotelDocument22 pagesApplicability of Activity-Based Costing in Services: Case Study in A HotelASIKIN AZIZ100% (9)

- Definition of Industrial MarketingDocument18 pagesDefinition of Industrial Marketingkartheek_aldi100% (1)

- Download More:- MCA Software Engineering PapersDocument49 pagesDownload More:- MCA Software Engineering PapersShubbyy ChanNo ratings yet