Professional Documents

Culture Documents

Joint Operation Revenue and Expenses

Uploaded by

Mitch Tokong Minglana0 ratings0% found this document useful (0 votes)

45 views2 pagesThis document contains the solutions to 8 accounting problems related to a joint operation between Company A and other parties in 2020. It shows:

1) Company A's 30% share of revenue was PHP 5.5 million and expenses was PHP 4.2 million.

2) Company A's net income from the joint operation was PHP 1.34 million.

3) Company A's ending capital investment was PHP 18.14 million after including the PHP 1.34 million net income.

4) The realized and unrealized gains on Company A's fiberglass contribution to the joint operation.

5) The depreciation expense and net book value of a yacht owned by the joint operation.

Original Description:

Original Title

QUIZ 5 ECAT

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains the solutions to 8 accounting problems related to a joint operation between Company A and other parties in 2020. It shows:

1) Company A's 30% share of revenue was PHP 5.5 million and expenses was PHP 4.2 million.

2) Company A's net income from the joint operation was PHP 1.34 million.

3) Company A's ending capital investment was PHP 18.14 million after including the PHP 1.34 million net income.

4) The realized and unrealized gains on Company A's fiberglass contribution to the joint operation.

5) The depreciation expense and net book value of a yacht owned by the joint operation.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

45 views2 pagesJoint Operation Revenue and Expenses

Uploaded by

Mitch Tokong MinglanaThis document contains the solutions to 8 accounting problems related to a joint operation between Company A and other parties in 2020. It shows:

1) Company A's 30% share of revenue was PHP 5.5 million and expenses was PHP 4.2 million.

2) Company A's net income from the joint operation was PHP 1.34 million.

3) Company A's ending capital investment was PHP 18.14 million after including the PHP 1.34 million net income.

4) The realized and unrealized gains on Company A's fiberglass contribution to the joint operation.

5) The depreciation expense and net book value of a yacht owned by the joint operation.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

IVY T.

ECAT

BSA 301

PROBLEM 1:

ANSWER AND SOLUTION:

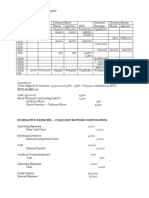

1. Compute the share of A in the revenue of the joint operation for 2020

(30%x18, 840, 000)= P 5, 544, 000

Cash 5,544,000

Revenue from pipeline 5,544,000

(30%x18, 840, 000)

2. Compute the share of A in the expenses of the joint operation for 2020

OPEX (30%x11,200,000) 3,360,000

Amortization Expense(16,800,000x100%/20 years) 840,000

Total 4,200,000

3. Compute the share of A in the gross profit/net income of the joint operation for

2020

Proportionate share (30%) Total (100% based)

Revenue P5, 544, 000 P18, 480, 000

Less: operating expenses 3, 360, 000 11, 200, 000

Amortization expense:

P16, 800, 000x`00% /20yrs. 840,000

P56, 000, 000x100%/20yrs. 2,800,000

Net income of the joint operation 4, 480, 000

Multiply by: 30% interest 30%

Net Income of A P1, 344, 000 1, 344, 000

4. Compute for the ending capital/investment of A

Investment P 16,800,000

Net Income of AA 1,344,000

Ending Capital P 18,144,000

5. Determine the realized gain upon the contribution of the fiberglass

FV of the fiberglass P 16,800,000.00

Less: Cost of the Fiberglass (P 12,320,000.00)

Realized gain P 4,480,000.00

6. Determine the unrealized gain upon the contribution of fiberglass at year end

FV of the fiberglass 16,800,000/20yrs = P 840,000

FV of the fiberglass 16,800,000

Depreciation expense P 840,000

CA P 15,960,000

Less: Cost of the Fiberglass (P 12,320,000.00)

unrealized gain P 3,640,000.00

7. Determine the amortization/depreciation expense for the year 2020

FV of yacht P 56,000,000.00

Divide: Useful life 20 years

Depreciation Expense P 2,800,000.00

8. Determine the yacht, net cost at the end of 2020

FV of yacht P 56,000,000.00

Less: Depreciation Expense P 2,800,000.00

Yacht, net cost at the end of 2020 P 53,200,000.00

You might also like

- Joint yacht operation revenue, expenses, and profit share calculationDocument3 pagesJoint yacht operation revenue, expenses, and profit share calculationMitch Tokong MinglanaNo ratings yet

- PROBLEM 1: How Should The 100,000 Be Distributed To The Following CreditorsDocument2 pagesPROBLEM 1: How Should The 100,000 Be Distributed To The Following CreditorsMitch Tokong MinglanaNo ratings yet

- Long Assignment - MinglanaDocument1 pageLong Assignment - MinglanaMitch Tokong MinglanaNo ratings yet

- CostDocument2 pagesCostjeams vidalNo ratings yet

- MasDocument4 pagesMasYaj CruzadaNo ratings yet

- Erika Co investment property reportingDocument4 pagesErika Co investment property reportingjeams vidalNo ratings yet

- Prob 5Document1 pageProb 5Mitch Tokong MinglanaNo ratings yet

- Intermediate Accounting 3-Activity 2: Perdizo, Miljane P. Bsa IiiDocument3 pagesIntermediate Accounting 3-Activity 2: Perdizo, Miljane P. Bsa Iiimiljane perdizoNo ratings yet

- GOVT ACCOUNTING OVERVIEWDocument15 pagesGOVT ACCOUNTING OVERVIEWTroisNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Sanchez, Mark Laurence S. BSA 2106 Cost Accounting Exercises: Multiple ChoiceDocument4 pagesSanchez, Mark Laurence S. BSA 2106 Cost Accounting Exercises: Multiple ChoiceMark Laurence SanchezNo ratings yet

- Cost Management Questionnaire PCPDocument2 pagesCost Management Questionnaire PCPJoaquín Quiñones SoteloNo ratings yet

- III - A Audit of The Expenditure and Disbursements CycleDocument10 pagesIII - A Audit of The Expenditure and Disbursements CycleVan MateoNo ratings yet

- 5.equity-EpsDocument54 pages5.equity-EpsArjun DonNo ratings yet

- Investments in Financial Instruments: Problem 1Document10 pagesInvestments in Financial Instruments: Problem 1Johanna Vidad100% (1)

- Long Quiz 1 Problems for Partnership Liquidation and Capital AccountsDocument5 pagesLong Quiz 1 Problems for Partnership Liquidation and Capital AccountsMitch Tokong MinglanaNo ratings yet

- PAL Company Seeks Liquidation After Restructuring FailsDocument1 pagePAL Company Seeks Liquidation After Restructuring Failskat kaleNo ratings yet

- Pamantasan ng Cabuyao Auditing and Assurance Services, Part 2 (ACCTG29&30) comprehensive incomeDocument2 pagesPamantasan ng Cabuyao Auditing and Assurance Services, Part 2 (ACCTG29&30) comprehensive incomeMimi YayaNo ratings yet

- Divide by Average Number of Shares OutstandingDocument11 pagesDivide by Average Number of Shares OutstandingJo FenNo ratings yet

- Governtment AccountingDocument2 pagesGoverntment Accountingjessica amorosoNo ratings yet

- Audit Practice ExamDocument17 pagesAudit Practice ExamNoel CaingletNo ratings yet

- 55026RR 14-2010 Accreditation PDFDocument5 pages55026RR 14-2010 Accreditation PDFlmin34No ratings yet

- Audit ProblemsDocument5 pagesAudit ProblemsRenalyn MadeloNo ratings yet

- IA3 Mod 4 REDocument12 pagesIA3 Mod 4 REjulia4razoNo ratings yet

- Multiple Choices - ComputationalDocument25 pagesMultiple Choices - ComputationalShenna Mae MateoNo ratings yet

- Far - Pre BoardDocument17 pagesFar - Pre BoardClene DoconteNo ratings yet

- HW On Operating Segments BDocument3 pagesHW On Operating Segments BJazehl Joy ValdezNo ratings yet

- FAR - Estimating Inventory - StudentDocument3 pagesFAR - Estimating Inventory - StudentPamelaNo ratings yet

- 3rd NCR Cup Junior Edition Quiz Bee KPMGDocument17 pages3rd NCR Cup Junior Edition Quiz Bee KPMGrcaa04100% (1)

- Chapter 4 ITISDocument40 pagesChapter 4 ITISmannybanwaitNo ratings yet

- I&M Corp formation from partnership assetsDocument1 pageI&M Corp formation from partnership assetsMitch Tokong MinglanaNo ratings yet

- Karma Company Sells Televisions at An Average Price of P7Document1 pageKarma Company Sells Televisions at An Average Price of P7Nicole AguinaldoNo ratings yet

- CORPORATE LIQUIDATION STATEMENTDocument73 pagesCORPORATE LIQUIDATION STATEMENTCasper John Nanas MuñozNo ratings yet

- Assignment Business CombinationDocument4 pagesAssignment Business CombinationLeisleiRagoNo ratings yet

- Saklob Corp Returns & Premium Liability"TITLE"Tisyu Co Warranty Estimates & Expenses" TITLE"Messa Corp Bond Issuance & AmortizationDocument4 pagesSaklob Corp Returns & Premium Liability"TITLE"Tisyu Co Warranty Estimates & Expenses" TITLE"Messa Corp Bond Issuance & AmortizationArn HicoNo ratings yet

- Tutorial 2: Exercise 12.2 Calculation of Current TaxDocument13 pagesTutorial 2: Exercise 12.2 Calculation of Current TaxKim FloresNo ratings yet

- Audcap1 Final OutputDocument7 pagesAudcap1 Final OutputIvan AnaboNo ratings yet

- Case 8-31: April May June QuarterDocument2 pagesCase 8-31: April May June QuarterileviejoieNo ratings yet

- ACC101 - Accounting for ReceivablesDocument15 pagesACC101 - Accounting for Receivablesinfinite_dreamsNo ratings yet

- UntitledDocument12 pagesUntitledMaykel BolañosNo ratings yet

- INACC Problem 2-3Document3 pagesINACC Problem 2-3Luigi Enderez BalucanNo ratings yet

- Temporary Differences and Deferred Tax Assets & Liabilities ExplainedDocument6 pagesTemporary Differences and Deferred Tax Assets & Liabilities ExplainedLeng ChhunNo ratings yet

- 2 Statement of Financial PositionDocument7 pages2 Statement of Financial Positionreagan blaireNo ratings yet

- Batch 18 1st Preboard (P1)Document14 pagesBatch 18 1st Preboard (P1)Jericho PedragosaNo ratings yet

- R3 - ARC - AP and ATDocument10 pagesR3 - ARC - AP and ATOliver SalamidaNo ratings yet

- Accounting Research DirectionsDocument5 pagesAccounting Research DirectionsIvan AnaboNo ratings yet

- Sample Auditing Problems Proof of Cash Sample Auditing Problems Proof of CashDocument17 pagesSample Auditing Problems Proof of Cash Sample Auditing Problems Proof of Cashmariyha PalangganaNo ratings yet

- Backflush Costing System and Activity Based Costing System With SolutionDocument15 pagesBackflush Costing System and Activity Based Costing System With SolutionJhazreene ArnozaNo ratings yet

- Bpo Quiz 1Document2 pagesBpo Quiz 1KaylaMae ZamoraNo ratings yet

- Chapter 15 - Consolidation: Controlled Entities: Review QuestionsDocument13 pagesChapter 15 - Consolidation: Controlled Entities: Review QuestionsShek Kwun Hei100% (1)

- Taxes 4 19 PDFDocument2 pagesTaxes 4 19 PDFlana del reyNo ratings yet

- Intercompany Sale of Merchandise - AdditionalDocument4 pagesIntercompany Sale of Merchandise - AdditionalJaimell LimNo ratings yet

- Case study chapter 9 engagement letterDocument4 pagesCase study chapter 9 engagement letterEricaNo ratings yet

- Installment Sales DayagDocument11 pagesInstallment Sales DayagJAP100% (1)

- NGA - JE ExercisesDocument3 pagesNGA - JE ExercisesShannise Dayne ChuaNo ratings yet

- The Unadjusted Trial Balance of Fashion Centre LTD Contained TheDocument2 pagesThe Unadjusted Trial Balance of Fashion Centre LTD Contained TheBube KachevskaNo ratings yet

- Conceptual Framework and Accounting StandardsDocument34 pagesConceptual Framework and Accounting StandardsJuaymah SabaNo ratings yet

- Nepomuceno, Henry James B. - Ast Quiz 5Document2 pagesNepomuceno, Henry James B. - Ast Quiz 5Mitch Tokong MinglanaNo ratings yet

- Jointly Operations Point of ViewDocument1 pageJointly Operations Point of ViewMarjorie100% (1)

- Module 5 Problem Solving: Partnership Liquidation and DistributionDocument11 pagesModule 5 Problem Solving: Partnership Liquidation and DistributionAldrin ZolinaNo ratings yet

- PROBLEM 6: Compute For The Net Income Did Irene Realize in August On TheDocument2 pagesPROBLEM 6: Compute For The Net Income Did Irene Realize in August On TheMitch Tokong MinglanaNo ratings yet

- Manlimos Lyka AssignmentDocument7 pagesManlimos Lyka AssignmentMitch Tokong MinglanaNo ratings yet

- 5 THDocument1 page5 THMitch Tokong MinglanaNo ratings yet

- Prob 3Document1 pageProb 3Mitch Tokong MinglanaNo ratings yet

- 2 NDDocument2 pages2 NDMitch Tokong MinglanaNo ratings yet

- Capital After The Adjustments P 614,476.00 P 683,052.00Document1 pageCapital After The Adjustments P 614,476.00 P 683,052.00Mitch Tokong MinglanaNo ratings yet

- Prob 5Document1 pageProb 5Mitch Tokong MinglanaNo ratings yet

- 4 THDocument1 page4 THMitch Tokong MinglanaNo ratings yet

- Resignation Letter Reanette T. MinglanaDocument1 pageResignation Letter Reanette T. MinglanaMitch Tokong MinglanaNo ratings yet

- Quiz 2 Problem 1Document4 pagesQuiz 2 Problem 1Mitch Tokong MinglanaNo ratings yet

- Long Quiz 1 Problems for Partnership Liquidation and Capital AccountsDocument5 pagesLong Quiz 1 Problems for Partnership Liquidation and Capital AccountsMitch Tokong MinglanaNo ratings yet

- I&M Corp formation from partnership assetsDocument1 pageI&M Corp formation from partnership assetsMitch Tokong MinglanaNo ratings yet

- Long QuizDocument1 pageLong QuizMitch Tokong MinglanaNo ratings yet

- Nepomuceno, Henry James B. - Ast Quiz 5Document2 pagesNepomuceno, Henry James B. - Ast Quiz 5Mitch Tokong MinglanaNo ratings yet

- Long Quiz 1 Problems for Partnership Liquidation and Capital AccountsDocument5 pagesLong Quiz 1 Problems for Partnership Liquidation and Capital AccountsMitch Tokong MinglanaNo ratings yet

- Millora, Beth Rachel Mae M. BSA 301 Accounting For Special Transaction - Quiz 1 Problem ADocument5 pagesMillora, Beth Rachel Mae M. BSA 301 Accounting For Special Transaction - Quiz 1 Problem AMitch Tokong MinglanaNo ratings yet

- Minglana-Quiz 3Document2 pagesMinglana-Quiz 3Mitch MinglanaNo ratings yet

- 5TH Requirement-Management Reports As of December 31, 2020 (Minglana - Surf - Resort - )Document1 page5TH Requirement-Management Reports As of December 31, 2020 (Minglana - Surf - Resort - )Mitch Tokong MinglanaNo ratings yet

- Long QuizDocument5 pagesLong QuizMitch Tokong MinglanaNo ratings yet

- Minglana, Mitch T. (Quiz 1)Document6 pagesMinglana, Mitch T. (Quiz 1)Mitch Tokong MinglanaNo ratings yet

- Problem 1:: Cash Avail For First Distribution: P65, 000 Less: Priority Creditors 50,000 Payment To Partners P15,000Document3 pagesProblem 1:: Cash Avail For First Distribution: P65, 000 Less: Priority Creditors 50,000 Payment To Partners P15,000Mitch Tokong MinglanaNo ratings yet

- 4TH Requirement-Profit and Loss As of December 31, 2020 (Minglana - Surf - Resort - )Document1 page4TH Requirement-Profit and Loss As of December 31, 2020 (Minglana - Surf - Resort - )Mitch Tokong MinglanaNo ratings yet

- Answers To Final ExamsDocument42 pagesAnswers To Final ExamsMitch Tokong MinglanaNo ratings yet

- Exit Feedback Form Rev 7.2020 HeheDocument2 pagesExit Feedback Form Rev 7.2020 HeheMitch Tokong MinglanaNo ratings yet

- 6TH Requirement-Inventory Summary As of December 31, 2020 (Minglana - Surf - Resort - )Document1 page6TH Requirement-Inventory Summary As of December 31, 2020 (Minglana - Surf - Resort - )Mitch Tokong MinglanaNo ratings yet

- Quiz 3: Attempt HistoryDocument21 pagesQuiz 3: Attempt HistoryCharmaine Mari OlmosNo ratings yet

- Chapter 16 - Teacher's Manual - Aa Part 2Document18 pagesChapter 16 - Teacher's Manual - Aa Part 2IsyongNo ratings yet

- Amalgamation TheoryDocument21 pagesAmalgamation TheorySubashVenkataram100% (1)

- CPA Review School Philippines ExamDocument17 pagesCPA Review School Philippines ExamChristine Mae MangahasNo ratings yet

- Business Finance: Financial Statement Preparation, Analysis, and InterpretationDocument7 pagesBusiness Finance: Financial Statement Preparation, Analysis, and InterpretationRosalyn Mauricio VelascoNo ratings yet

- Advance Financial Assignment #2Document10 pagesAdvance Financial Assignment #2peterNo ratings yet

- Fs ExerciseDocument6 pagesFs ExerciseDIVINE GRACE ROSALESNo ratings yet

- Adam SugarDocument11 pagesAdam SugarshirazhaqNo ratings yet

- PT Garuda Indonesia Persero TBK IDX GIAA FinancialsDocument48 pagesPT Garuda Indonesia Persero TBK IDX GIAA FinancialsTEDY TEDYNo ratings yet

- Adobe Scan 05 Sep 2021Document11 pagesAdobe Scan 05 Sep 2021GoBig KashmirNo ratings yet

- Exercice Chap 1 - Acc Equation - STDocument19 pagesExercice Chap 1 - Acc Equation - STNguyen Thi Ngoc Diep (FUG CT)No ratings yet

- Chapter 9 - Shareholders' Equity AnalysisDocument4 pagesChapter 9 - Shareholders' Equity AnalysisJudy Ann Acruz100% (1)

- Important Formulae for Financial ManagementDocument1 pageImportant Formulae for Financial ManagementakashNo ratings yet

- Polytechnic University Midterm Exam Adjusting EntriesDocument7 pagesPolytechnic University Midterm Exam Adjusting EntriesEdison San JuanNo ratings yet

- Firm Valuation (2) : Class 7 Financial Management, 15.414Document19 pagesFirm Valuation (2) : Class 7 Financial Management, 15.414Marino Brnic100% (4)

- Merchandising Quiz 2Document2 pagesMerchandising Quiz 2l mNo ratings yet

- MOCK EXAM FOR BA 118.1 – ADVANCED FINANCIAL ACCOUNTINGDocument16 pagesMOCK EXAM FOR BA 118.1 – ADVANCED FINANCIAL ACCOUNTINGAccounting 201No ratings yet

- Financial Ratios Analysis for AAV Mfg CorpDocument5 pagesFinancial Ratios Analysis for AAV Mfg CorpAngelita Dela cruzNo ratings yet

- Far Assignments Chapter 3Document15 pagesFar Assignments Chapter 3Vesenth May Magaro Rubinos0% (1)

- CPA exam syllabus covers financial accounting standardsDocument3 pagesCPA exam syllabus covers financial accounting standardsLala AlalNo ratings yet

- Uma Industry Assets and Liabilities MGTDocument80 pagesUma Industry Assets and Liabilities MGTKirthi KshatriyasNo ratings yet

- Nama Nama AkunDocument26 pagesNama Nama AkunTia YuliandiniNo ratings yet

- AP04 05 Audit of IntangiblesDocument8 pagesAP04 05 Audit of IntangibleseildeeNo ratings yet

- Adjusting ProbsDocument6 pagesAdjusting ProbsJheriko MallariNo ratings yet

- Accounting For Income Taxes Pt. 2: Temporary DifferencesDocument23 pagesAccounting For Income Taxes Pt. 2: Temporary Differenceskrisha milloNo ratings yet

- The Elements Directly Related To The Measurement of Financial Position AreDocument8 pagesThe Elements Directly Related To The Measurement of Financial Position AreKim Patrice NavarraNo ratings yet

- Making Capital Investment Decision: Topics CoveredDocument9 pagesMaking Capital Investment Decision: Topics Coveredsirkoywayo6628No ratings yet

- Assignment 14 Ok TDocument10 pagesAssignment 14 Ok TJu RaizahNo ratings yet

- Ans CH4Document15 pagesAns CH4Elsa MendozaNo ratings yet

- Merchandise Business Class Performance AnswersDocument14 pagesMerchandise Business Class Performance AnswersLerry RosellNo ratings yet