Professional Documents

Culture Documents

I&M Corp formation from partnership assets

Uploaded by

Mitch Tokong MinglanaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

I&M Corp formation from partnership assets

Uploaded by

Mitch Tokong MinglanaCopyright:

Available Formats

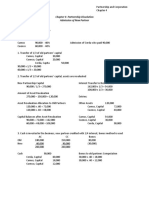

Problem 2

Irene and Mae are partners sharing profit and losses in the ration of 1:2 respectively. On July 1 2020

they decided to form the I and M Corporation by transferring the assets and liabilities from the

partnership to the corporation in exchange of its shares. The following is the post-closing trial balance of

the partnership:

Debit Credit

Cash 45,000

AR 60,000

Inventory 90,000

Fixed Assets 174,000

Liabilities 60,000

Irene, Capital 94,800

Mae, Capital 214,200

It was agreed that adjustments be made to the following assets to be transferred to the corporation:

AR 40,000

Inventory 68,000

Fixed Assets 180,600

The I and M Corporation was authorized to issue 100 par preference shares and 10 par ordinary share.

Irene and Mae agreed to receive for their equity in the partnership 720 ordinary share each, plus even

multiples of 10 shares for their remaining interest.

a. Compute for the total number of shares of preference and ordinary share issued by the

corporation in exchange of the assets and liabilities of the partnership.

Computation:

Assets

Cash P 45,000

Accounts Receivable 40,000

Inventory 68,000

Property and Equipment 180,600

Total Assets 333,600

Less: Liabilities (60,000)

Amount to be paid 273,600

Value of Equity shares to be issued to each partner = 720 x 10 = 7, 200

Total amount paid in form of equity shares = 7,200 x 2 = 14,400

Amount to be paid in form of preference shares = 273,600 – 14,400 = 259,200

Total No. of preference shares to be issued = 259,200 / 100 = 2592 shares

You might also like

- 4 - Lecture Notes - Partnership DissolutionDocument18 pages4 - Lecture Notes - Partnership DissolutionNikko Bowie PascualNo ratings yet

- Business Cup Level 1 Quiz BeeDocument28 pagesBusiness Cup Level 1 Quiz BeeRowellPaneloSalapareNo ratings yet

- Nepomuceno, Henry James B. - Ast Quiz 5Document2 pagesNepomuceno, Henry James B. - Ast Quiz 5Mitch Tokong MinglanaNo ratings yet

- Problem 1:: Cash Avail For First Distribution: P65, 000 Less: Priority Creditors 50,000 Payment To Partners P15,000Document3 pagesProblem 1:: Cash Avail For First Distribution: P65, 000 Less: Priority Creditors 50,000 Payment To Partners P15,000Mitch Tokong MinglanaNo ratings yet

- Prob 5Document1 pageProb 5Mitch Tokong MinglanaNo ratings yet

- SET A ACC 110 - CFE - SY 2023 2024 1st Sem - Answer KeyDocument19 pagesSET A ACC 110 - CFE - SY 2023 2024 1st Sem - Answer KeyJomar RabiaNo ratings yet

- Minglana, Mitch T. (Quiz 1)Document6 pagesMinglana, Mitch T. (Quiz 1)Mitch Tokong MinglanaNo ratings yet

- Intermediate Accounting 3-Activity 2: Perdizo, Miljane P. Bsa IiiDocument3 pagesIntermediate Accounting 3-Activity 2: Perdizo, Miljane P. Bsa Iiimiljane perdizoNo ratings yet

- Vergil Joseph I. Literal, DBA, CPA: Page 1 of 3Document3 pagesVergil Joseph I. Literal, DBA, CPA: Page 1 of 3hsjhsNo ratings yet

- Problem No. 1: Journal Entries PROBLEM NO. 5: JE and Statement of Financial Position Books of The Partnership Books of Fish R' UsDocument4 pagesProblem No. 1: Journal Entries PROBLEM NO. 5: JE and Statement of Financial Position Books of The Partnership Books of Fish R' UsJessa0% (1)

- Partnership Profit Division MethodsDocument18 pagesPartnership Profit Division MethodsSol LunaNo ratings yet

- Long Quiz 1 Problems for Partnership Liquidation and Capital AccountsDocument5 pagesLong Quiz 1 Problems for Partnership Liquidation and Capital AccountsMitch Tokong MinglanaNo ratings yet

- Division of ProfitsDocument55 pagesDivision of ProfitsMichole chin MallariNo ratings yet

- Accounting For Special TransactionsDocument43 pagesAccounting For Special TransactionsNezer VergaraNo ratings yet

- Partnership Operations ActivityDocument2 pagesPartnership Operations ActivityNedelyn PedrenaNo ratings yet

- There Is Revaluation of Assets Equal To P50,000Document2 pagesThere Is Revaluation of Assets Equal To P50,000Joana TrinidadNo ratings yet

- Partnership True or False QuizDocument3 pagesPartnership True or False QuizRoselyn Balik100% (1)

- Dissolution Problems DiscussionDocument8 pagesDissolution Problems DiscussionCalmaMoyjeNo ratings yet

- Chapter 1 Partnership Basic Considerations and FormationDocument20 pagesChapter 1 Partnership Basic Considerations and FormationMIKASANo ratings yet

- Accounting: Quantitative Information Primarily Financial inDocument19 pagesAccounting: Quantitative Information Primarily Financial inleeeydoNo ratings yet

- Partnership and Corporation Solman 2011 Chapter 1Document7 pagesPartnership and Corporation Solman 2011 Chapter 1Reymilyn Sanchez0% (1)

- Partnership Operation 004Document2 pagesPartnership Operation 004John GacumoNo ratings yet

- Partnership Formation QuizDocument5 pagesPartnership Formation QuizMJ NuarinNo ratings yet

- No safe paymentsDocument5 pagesNo safe paymentsMoon YoungheeNo ratings yet

- Partnership Operations and Financial ReportingDocument45 pagesPartnership Operations and Financial ReportingChristine Joyce EnriquezNo ratings yet

- Distribution of Partnership ProfitsDocument20 pagesDistribution of Partnership ProfitsJOANNA ROSE MANALONo ratings yet

- Q and A PartnershipDocument9 pagesQ and A PartnershipFaker MejiaNo ratings yet

- Module 3 - Partnership DissolutionDocument54 pagesModule 3 - Partnership DissolutionMaluDyNo ratings yet

- Partnership Liquidation Exam AnswersDocument7 pagesPartnership Liquidation Exam AnswersAlexandriteNo ratings yet

- Multiple Choice Answers and Solutions: PAR Boogie BirdieDocument19 pagesMultiple Choice Answers and Solutions: PAR Boogie BirdieNelia Mae S. VillenaNo ratings yet

- SATURDAYDocument20 pagesSATURDAYkristine bandaviaNo ratings yet

- Chap 3 and 4 - ParcorDocument4 pagesChap 3 and 4 - ParcorAnne Gwynneth RadaNo ratings yet

- Calculating Partnership Profits and Capital AccountsDocument19 pagesCalculating Partnership Profits and Capital AccountsMJ NuarinNo ratings yet

- Sol Man Chapter 11 She Part 2 2021 - CompressDocument27 pagesSol Man Chapter 11 She Part 2 2021 - CompressDump DumpNo ratings yet

- Chapter 3 ProblemshhhDocument15 pagesChapter 3 Problemshhhahmed arfanNo ratings yet

- CostDocument2 pagesCostjeams vidalNo ratings yet

- 03 - Partnership DissolutionDocument38 pages03 - Partnership DissolutionDonise Ronadel SantosNo ratings yet

- EXAM. MIDTERM. April 20, 2022Document15 pagesEXAM. MIDTERM. April 20, 2022Raziel Angelo AnsusNo ratings yet

- Name:: Score: ProfessorDocument6 pagesName:: Score: ProfessorkakaoNo ratings yet

- Partnership: Definition, Nature and FormationDocument19 pagesPartnership: Definition, Nature and FormationRuthchell CiriacoNo ratings yet

- Quiz 22-26 AkeyDocument6 pagesQuiz 22-26 AkeyRheman RosasNo ratings yet

- Wala LangDocument8 pagesWala LangMax Dela TorreNo ratings yet

- Solution Chapter 4Document11 pagesSolution Chapter 4accounts 3 lifeNo ratings yet

- Chapter 2 Problem 9 in Win Ballada ParcorDocument4 pagesChapter 2 Problem 9 in Win Ballada ParcorKatrina PetracheNo ratings yet

- Partners HIP - Pretest: - Introduction and FormationDocument38 pagesPartners HIP - Pretest: - Introduction and FormationKristia AnagapNo ratings yet

- ACFAR Partnership ExercisesDocument12 pagesACFAR Partnership ExercisesJhannamae PamugasNo ratings yet

- PreweekSol (Advacc)Document91 pagesPreweekSol (Advacc)Rommel Cruz100% (2)

- ParCor Chapter 4 - Hernandez - BSA 1-1 PDFDocument7 pagesParCor Chapter 4 - Hernandez - BSA 1-1 PDFBSA 1-1No ratings yet

- Long Assignment - MinglanaDocument1 pageLong Assignment - MinglanaMitch Tokong MinglanaNo ratings yet

- Finalchapter 20Document11 pagesFinalchapter 20Jud Rossette ArcebesNo ratings yet

- Partnership Organization GuideDocument42 pagesPartnership Organization Guidemubarek oumerNo ratings yet

- Accounting LiquidationDocument4 pagesAccounting LiquidationQuerecia IsidroNo ratings yet

- Qa PartnershipDocument9 pagesQa PartnershipFaker MejiaNo ratings yet

- Quiz 2 Partnership OperationsDocument4 pagesQuiz 2 Partnership OperationsChelit LadylieGirl FernandezNo ratings yet

- Partnership OperationDocument2 pagesPartnership OperationCjhay MarcosNo ratings yet

- Assets Liabilities and EquityDocument16 pagesAssets Liabilities and EquityYahlianah LeeNo ratings yet

- Buscom Midterm PDF FreeDocument29 pagesBuscom Midterm PDF FreeheyNo ratings yet

- Competency Appraisal UM Digos (PARTNERSHIP)Document10 pagesCompetency Appraisal UM Digos (PARTNERSHIP)Diana Faye CaduadaNo ratings yet

- May 2017 Advanced Financial Accounting & Reporting Final Pre-BoardDocument20 pagesMay 2017 Advanced Financial Accounting & Reporting Final Pre-BoardPatrick ArazoNo ratings yet

- PARTNERHIPDocument2 pagesPARTNERHIProsojanice08No ratings yet

- PROBLEM 6: Compute For The Net Income Did Irene Realize in August On TheDocument2 pagesPROBLEM 6: Compute For The Net Income Did Irene Realize in August On TheMitch Tokong MinglanaNo ratings yet

- Manlimos Lyka AssignmentDocument7 pagesManlimos Lyka AssignmentMitch Tokong MinglanaNo ratings yet

- 5 THDocument1 page5 THMitch Tokong MinglanaNo ratings yet

- Prob 3Document1 pageProb 3Mitch Tokong MinglanaNo ratings yet

- 2 NDDocument2 pages2 NDMitch Tokong MinglanaNo ratings yet

- Resignation Letter Reanette T. MinglanaDocument1 pageResignation Letter Reanette T. MinglanaMitch Tokong MinglanaNo ratings yet

- 4 THDocument1 page4 THMitch Tokong MinglanaNo ratings yet

- Quiz 2 Problem 1Document4 pagesQuiz 2 Problem 1Mitch Tokong MinglanaNo ratings yet

- Long Assignment - MinglanaDocument1 pageLong Assignment - MinglanaMitch Tokong MinglanaNo ratings yet

- Joint yacht operation revenue, expenses, and profit share calculationDocument3 pagesJoint yacht operation revenue, expenses, and profit share calculationMitch Tokong MinglanaNo ratings yet

- Long Quiz 1 Problems for Partnership Liquidation and Capital AccountsDocument5 pagesLong Quiz 1 Problems for Partnership Liquidation and Capital AccountsMitch Tokong MinglanaNo ratings yet

- Long Quiz 1 Problems for Partnership Liquidation and Capital AccountsDocument5 pagesLong Quiz 1 Problems for Partnership Liquidation and Capital AccountsMitch Tokong MinglanaNo ratings yet

- Long QuizDocument1 pageLong QuizMitch Tokong MinglanaNo ratings yet

- Capital After The Adjustments P 614,476.00 P 683,052.00Document1 pageCapital After The Adjustments P 614,476.00 P 683,052.00Mitch Tokong MinglanaNo ratings yet

- PROBLEM 1: How Should The 100,000 Be Distributed To The Following CreditorsDocument2 pagesPROBLEM 1: How Should The 100,000 Be Distributed To The Following CreditorsMitch Tokong MinglanaNo ratings yet

- Millora, Beth Rachel Mae M. BSA 301 Accounting For Special Transaction - Quiz 1 Problem ADocument5 pagesMillora, Beth Rachel Mae M. BSA 301 Accounting For Special Transaction - Quiz 1 Problem AMitch Tokong MinglanaNo ratings yet

- Minglana-Quiz 3Document2 pagesMinglana-Quiz 3Mitch MinglanaNo ratings yet

- 5TH Requirement-Management Reports As of December 31, 2020 (Minglana - Surf - Resort - )Document1 page5TH Requirement-Management Reports As of December 31, 2020 (Minglana - Surf - Resort - )Mitch Tokong MinglanaNo ratings yet

- Long QuizDocument5 pagesLong QuizMitch Tokong MinglanaNo ratings yet

- Joint Operation Revenue and ExpensesDocument2 pagesJoint Operation Revenue and ExpensesMitch Tokong MinglanaNo ratings yet

- PROBLEM 1: How Should The 100,000 Be Distributed To The Following CreditorsDocument2 pagesPROBLEM 1: How Should The 100,000 Be Distributed To The Following CreditorsMitch Tokong MinglanaNo ratings yet

- 4TH Requirement-Profit and Loss As of December 31, 2020 (Minglana - Surf - Resort - )Document1 page4TH Requirement-Profit and Loss As of December 31, 2020 (Minglana - Surf - Resort - )Mitch Tokong MinglanaNo ratings yet

- Answers To Final ExamsDocument42 pagesAnswers To Final ExamsMitch Tokong MinglanaNo ratings yet

- Exit Feedback Form Rev 7.2020 HeheDocument2 pagesExit Feedback Form Rev 7.2020 HeheMitch Tokong MinglanaNo ratings yet

- 6TH Requirement-Inventory Summary As of December 31, 2020 (Minglana - Surf - Resort - )Document1 page6TH Requirement-Inventory Summary As of December 31, 2020 (Minglana - Surf - Resort - )Mitch Tokong MinglanaNo ratings yet