Professional Documents

Culture Documents

Jointly Operations Point of View

Uploaded by

Marjorie100%(1)100% found this document useful (1 vote)

2K views1 pageOriginal Title

Jointly Operations Point of View.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

2K views1 pageJointly Operations Point of View

Uploaded by

MarjorieCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Jointly Operations Point of View- Unincorporated Joint Operation

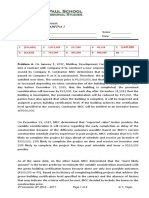

Use the following Information for question 1-4

AA, BB, and CC sign an agreement to collectively purchase a yacht and to hire a company to manage and operate the yacht on their behalf. The costs involved in

running and operating the yacht business and the revenue earned from the pipeline are shared by three parties based on their ownership percentage. All major

operating and financing decisions related to the yacht business must be agreed to by the three companies. The cost of purchasing the yacht was 56,000,000. The

yacht has an estimated 20-year useful life with no residual value. The management dee for operating the yacht business for 2017 was 11,200,000. Revenue

earned from the yacht business in 2017 was 18,480,000. AA invested 16,800,000 for a 30% interest.

1. Compute the share of AA in the revenue of the joint operation for 2017.

Cash 5,544,000

Revenue from pipeline 5.544,000

(30% x 18,840,000)

2. Compute the share of AA in the expenses of the joint operation for 2017:

X Proportionate share (30%) Total (100% based)

Revenue P 5,544,000 P 18,480,000

less: Operating expenses 3,360,000 11,200,000

Amortization expense: P 16,800,000 x 100% / 20 yrs. 840,000

P 56,000,000 x 100% / 20 yrs. 2,800,000

Net income of the Joint Operation 4,480,000

Multiply by: 30% interest 30%

Net income of AA 1,344,000 1,344,000

3. Compute the share of AA in the gross profit/net income in the joint op

You might also like

- Nepomuceno, Henry James B. - Ast Quiz 5Document2 pagesNepomuceno, Henry James B. - Ast Quiz 5Mitch Tokong MinglanaNo ratings yet

- YowDocument35 pagesYowJane Michelle Eman100% (1)

- 09 Additional NotesDocument4 pages09 Additional NotesMelody GumbaNo ratings yet

- 1 60Document23 pages1 60Joshua Gabrielle B. GalidoNo ratings yet

- Final Exam in Advanced Financial Accounting IDocument6 pagesFinal Exam in Advanced Financial Accounting IYander Marl BautistaNo ratings yet

- Answer To Practice Set IDocument1 pageAnswer To Practice Set IDin Rose Gonzales100% (1)

- Preweek Drill2Document7 pagesPreweek Drill2Grave KnightNo ratings yet

- CPAR PreweekDocument20 pagesCPAR Preweekrochielanciola100% (1)

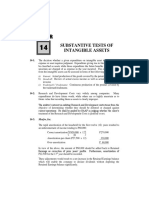

- Chapter 14Document25 pagesChapter 14Clarize R. Mabiog100% (1)

- Sample Problems For Joint Venture and ConsignmentDocument1 pageSample Problems For Joint Venture and ConsignmentChristine Jane RamosNo ratings yet

- Practice Problems 1Document1 pagePractice Problems 1Ma Angelica Balatucan0% (1)

- ProblemsDocument9 pagesProblemsMark Angelo AlvarezNo ratings yet

- Ulob Answer Key: Assets: Liabilities and EquityDocument4 pagesUlob Answer Key: Assets: Liabilities and Equityzee abadillaNo ratings yet

- EspressoDocument1 pageEspressoCarl Dhaniel Garcia SalenNo ratings yet

- Buscomsubsequent EventDocument4 pagesBuscomsubsequent EventJomar Villena67% (3)

- AFAR Final Preboard 2018 PDFDocument22 pagesAFAR Final Preboard 2018 PDFcardos cherryNo ratings yet

- Long Quiz 2Document8 pagesLong Quiz 2CattleyaNo ratings yet

- Problems Audit of InvestmentsDocument15 pagesProblems Audit of InvestmentsKm de Leon75% (4)

- Advacc Midterm ExamDocument13 pagesAdvacc Midterm ExamJosh TanNo ratings yet

- VELUNTA - Ass. in ASTDocument4 pagesVELUNTA - Ass. in ASTLiberty VeluntaNo ratings yet

- Q06A Audit of Non Cash AssetsDocument7 pagesQ06A Audit of Non Cash AssetsChristine Jane ParroNo ratings yet

- P2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Document12 pagesP2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Kate Alvarez100% (2)

- BagnpesDocument3 pagesBagnpesShiela Marie Sta AnaNo ratings yet

- Invent Invest PpeDocument10 pagesInvent Invest PpeLorie Jae DomalaonNo ratings yet

- Ho BRDocument3 pagesHo BRSummer Star33% (3)

- ConsignmentDocument2 pagesConsignmentJenica Joyce BautistaNo ratings yet

- C. The Results of Operations, Cash Flow, and The Balance Sheet As If The Parent and Subsidiary Were A Single EntityDocument13 pagesC. The Results of Operations, Cash Flow, and The Balance Sheet As If The Parent and Subsidiary Were A Single EntityAlijah MercadoNo ratings yet

- DocDocument5 pagesDocYour Materials33% (3)

- Audit Risk Model and MaterialityDocument14 pagesAudit Risk Model and Materialityedrick LouiseNo ratings yet

- Adjusted financials for HONESTY CORPORATIONDocument3 pagesAdjusted financials for HONESTY CORPORATIONAireyNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaNo ratings yet

- Finals SWDocument115 pagesFinals SWAira Jaimee GonzalesNo ratings yet

- CPA REVIEW: Calculating Depreciation and Estimated LiabilityDocument41 pagesCPA REVIEW: Calculating Depreciation and Estimated LiabilityalellieNo ratings yet

- Badvac1x - Mod 3 TemplatesDocument42 pagesBadvac1x - Mod 3 TemplatesKyla de SilvaNo ratings yet

- Audprob Answer 1Document1 pageAudprob Answer 1venice cambryNo ratings yet

- Consolidation Objectives: PAS 27 Objective of Setting The Standard To Be AppliedDocument11 pagesConsolidation Objectives: PAS 27 Objective of Setting The Standard To Be AppliedAdam SmithNo ratings yet

- Audit of PPE 2Document2 pagesAudit of PPE 2Raz MahariNo ratings yet

- Chapter 1 - DiscussionDocument15 pagesChapter 1 - DiscussionArah OpalecNo ratings yet

- Consolidated Financial Statements of Parent and SubsidiaryDocument1 pageConsolidated Financial Statements of Parent and SubsidiaryBonna Kerstine TiburcioNo ratings yet

- Brilliant Cosmetics 2017 financial statement adjustmentsDocument3 pagesBrilliant Cosmetics 2017 financial statement adjustmentsVilma Tayum100% (1)

- Quizzer Answers KeyDocument4 pagesQuizzer Answers KeyDaneen GastarNo ratings yet

- Chapter-5 Homework InventoriesDocument4 pagesChapter-5 Homework InventoriesKenneth Christian Wilbur0% (1)

- CH 8 LiabilitiesDocument10 pagesCH 8 LiabilitiesKrizia Oliva100% (1)

- F3Document2 pagesF3Kimberly PadlanNo ratings yet

- Auditing ProblemsDocument5 pagesAuditing ProblemsJayr BVNo ratings yet

- Acctg For Special Transaction - 3rd Lesson PDFDocument9 pagesAcctg For Special Transaction - 3rd Lesson PDFDebbie Grace Latiban LinazaNo ratings yet

- Responsibility Accounting & Transfer Pricing ConceptsDocument5 pagesResponsibility Accounting & Transfer Pricing ConceptsadorableperezNo ratings yet

- A Owns Majority of The Outstanding Ordinary SharesDocument2 pagesA Owns Majority of The Outstanding Ordinary Sharesasdfghjkl zxcvbnm100% (1)

- P2 1PB 2nd Sem 1314 With SolDocument15 pagesP2 1PB 2nd Sem 1314 With SolRhad EstoqueNo ratings yet

- Installment Sales Multiple QuestionsDocument36 pagesInstallment Sales Multiple QuestionsTrixie CapisosNo ratings yet

- Business Com Chapter 23Document5 pagesBusiness Com Chapter 23Nino Joycelee TuboNo ratings yet

- ProblemsDocument4 pagesProblemsUNKNOWNNNo ratings yet

- Advanced Accounting Drill ProblemsDocument6 pagesAdvanced Accounting Drill ProblemsiajycNo ratings yet

- Advance Accounting II Midterms ReviewDocument7 pagesAdvance Accounting II Midterms ReviewivankingbachoNo ratings yet

- QuizDocument2 pagesQuizAlyssa CamposNo ratings yet

- Joint yacht operation revenue, expenses, and profit share calculationDocument3 pagesJoint yacht operation revenue, expenses, and profit share calculationMitch Tokong MinglanaNo ratings yet

- Joint Operation Revenue and ExpensesDocument2 pagesJoint Operation Revenue and ExpensesMitch Tokong MinglanaNo ratings yet

- Calculate income tax for partnershipsDocument4 pagesCalculate income tax for partnershipsPrince Carl Lepiten SilvaNo ratings yet

- ACT115 - Topic 6Document6 pagesACT115 - Topic 6Le MinouNo ratings yet

- Taxation of Income of Partnership-1 - 034114Document6 pagesTaxation of Income of Partnership-1 - 034114temiladeadeyemi11No ratings yet

- United StatesDocument3 pagesUnited StatesMarjorieNo ratings yet

- Enterprise FundDocument1 pageEnterprise FundMarjorieNo ratings yet

- GV 2Document1 pageGV 2MarjorieNo ratings yet

- Gov ActDocument1 pageGov ActMarjorieNo ratings yet

- GvssDocument1 pageGvssMarjorieNo ratings yet

- Journal EntriesDocument1 pageJournal EntriesMarjorieNo ratings yet

- GvssDocument1 pageGvssMarjorieNo ratings yet

- IntroductionDocument1 pageIntroductionMarjorieNo ratings yet

- Jointly Operations Point of ViewDocument1 pageJointly Operations Point of ViewMarjorie100% (1)

- Journal EntriesDocument1 pageJournal EntriesMarjorieNo ratings yet

- GV 3Document1 pageGV 3MarjorieNo ratings yet

- Accounting Estimate: Appropriateness (Of Audit Evidence)Document3 pagesAccounting Estimate: Appropriateness (Of Audit Evidence)MarjorieNo ratings yet

- GV 3Document1 pageGV 3MarjorieNo ratings yet

- General FundDocument1 pageGeneral FundMarjorieNo ratings yet

- IntroductionDocument1 pageIntroductionMarjorieNo ratings yet

- General FundDocument1 pageGeneral FundMarjorieNo ratings yet

- Gov ActDocument1 pageGov ActMarjorieNo ratings yet

- Enterprise FundDocument1 pageEnterprise FundMarjorieNo ratings yet

- LOWDocument1 pageLOWMarjorieNo ratings yet

- United StatesDocument3 pagesUnited StatesMarjorieNo ratings yet

- Accounting Estimate: Appropriateness (Of Audit Evidence)Document3 pagesAccounting Estimate: Appropriateness (Of Audit Evidence)MarjorieNo ratings yet

- Appendix B: Sample Auditing and Attestation Testlet Released by AICPADocument50 pagesAppendix B: Sample Auditing and Attestation Testlet Released by AICPAMarjorie AmpongNo ratings yet

- GV 2Document1 pageGV 2MarjorieNo ratings yet

- Gov ActDocument1 pageGov ActMarjorieNo ratings yet

- Understanding The Entity and Its Environment: Phase I-CDocument1 pageUnderstanding The Entity and Its Environment: Phase I-CMarjorieNo ratings yet

- Audit Chapter 13 - Property, Plant and Equipment DepreciationDocument21 pagesAudit Chapter 13 - Property, Plant and Equipment DepreciationIntal XDNo ratings yet

- Alphabet Tracing Worksheets A-ZDocument26 pagesAlphabet Tracing Worksheets A-ZCrisjimay Zamora100% (5)

- Reviewer AdvacDocument4 pagesReviewer AdvacMarjorie AmpongNo ratings yet

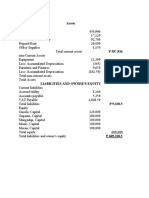

- Assets 1Document1 pageAssets 1Marjorie AmpongNo ratings yet