Professional Documents

Culture Documents

PFRS 5 Non-Current Assets Held For Sale

Uploaded by

jeanette lampitocOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PFRS 5 Non-Current Assets Held For Sale

Uploaded by

jeanette lampitocCopyright:

Available Formats

UNIVERSITY OF PERPETUAL HELP SYSTEM DALTA

CALAMBA CAMPUS, BRGY. PACIANO RIZAL,

CALAMBA CITY, LAGUNA, PHILIPPINES

Chapter 27: PFRS 5 Non-Current Assets Held For Sale EDMUND E. HILARIO, CPA, MBA

Financial Accounting 1stSEMESTER 2019 – 2020

===============================================================================================

Decommissioning liability instrument issued shall be recognized as gain or loss on

IFRIC 1 defines decommissioning liability as an obligation to extinguishment. The gain or loss on extinguishment shall

dismantle remove and restore an item of property plant and be reported as a separate line item in the income statement

equipment as required by law or contract. The

decommissioning liability is capitalized as cost of the Member’s shares in cooperative entities

property and initially recognized at present value Member’s shares in cooperative entities may be classified as

equity or liability depending on the terms and conditions of

Change in decommissioning liability the financial instrument. Member’s shares in cooperative

a. A decrease in decommissioning liability is deducted entities are classified as equity if the members did not have

from the cost of the asset a right to request for redemption under either of the

b. An increase in decommissioning liability is added to the following conditions

cost at the asset a. If the entity has an unconditional right to refuse

redemption of the member’s shares

Distribution of noncash asset to owners b. If redemption is unconditionally prohibited by law

The distribution of noncash asset to owners is actually regulation or the entity’s charter

payment of property dividend to shareholders. IFRIC 17

paragraph 11 provides that an entity shall measure a

liability to distribute noncash asset as a dividend to its

owners at the fair value of the asset to be distributed.

The dividend payable is initially recognized at the fair value

of the noncash asset on date of declaration and is increased

or decreased as a result of the change in fair value of the

asset at year end and date of settlement. The offsetting

debit or credit is through equity or directly retained

earnings.

Settlement of dividend payable

IFRIC 17 paragraph 14 provides that when an entity settles

the dividend payable the difference between the carrying

amount of the dividend payable and the carrying amount of

the asset distributed shall be recognized as gain or loss on

distribution of property dividend

Measurement of noncash asset distributed

Paragraph 15A of PFRS 5 provides that an entity shall

measure a noncurrent asset classified for distribution to

owners at the lower of carrying amount and fair value less

cost to distribute. Accordingly if the fair value less cost to

distribute is lower than the carrying amount of the asset at

the end of the reporting period the difference is

accounted for as impairment loss

Extinguishment of financial liability

How should an entity initially measure the equity instrument

issued to extinguish a financial liability? Actually this

transaction is simply known as equity swap. An equity

swap is the issuance of share capital by the debtor to the

creditor in full or partial payment of an obligation. IFRIC 19

provides that the equity instrument issued to extinguished a

financial liability shall be measured at the following amounts

in the order of priority

a. Fair value of equity instrument issued

b. Fair value of liability extinguished

c. Carrying amount of liability extinguished

The difference between the carrying amount of the financial

liability and the initial measurement of the equity

You might also like

- Retained EarningsDocument3 pagesRetained EarningsKyla RequironNo ratings yet

- Deegan5e SM Ch14Document10 pagesDeegan5e SM Ch14Rachel TannerNo ratings yet

- PFRS 5 Non-Current Assets Held For SaleDocument2 pagesPFRS 5 Non-Current Assets Held For SaleLovely AbadianoNo ratings yet

- Bonds Payable HandoutDocument3 pagesBonds Payable HandoutJeanieNo ratings yet

- Intermediate Accounting 3 - Statement of Financial PositionDocument6 pagesIntermediate Accounting 3 - Statement of Financial PositionLuisitoNo ratings yet

- Material Part IDocument64 pagesMaterial Part IKrishna AdhikariNo ratings yet

- Notes Payable and Debt RestructuringDocument14 pagesNotes Payable and Debt Restructuringglrosaaa cNo ratings yet

- Business Associations OutlineDocument62 pagesBusiness Associations OutlineClaudia GalanNo ratings yet

- 21 Financial Instruments s22 - FINALDocument95 pages21 Financial Instruments s22 - FINALAphelele GqadaNo ratings yet

- REO CPA Review: Separate and Consolidated FsDocument10 pagesREO CPA Review: Separate and Consolidated FsCriza MayNo ratings yet

- Liability Is Something A Person or Company Owes, Usually A Sum of Money. ... Recorded OnDocument5 pagesLiability Is Something A Person or Company Owes, Usually A Sum of Money. ... Recorded OnedrianclydeNo ratings yet

- OncaDocument6 pagesOncaVinylcoated ClipsNo ratings yet

- Yasir Riaz CFAP 1 Chap 6Document27 pagesYasir Riaz CFAP 1 Chap 6rameelamirNo ratings yet

- Financial Instrument SummaryDocument6 pagesFinancial Instrument SummaryJoshua ComerosNo ratings yet

- Baliuag University Integrated Accounting Course II Summer 2017 NotesDocument4 pagesBaliuag University Integrated Accounting Course II Summer 2017 NotesLuiNo ratings yet

- Theory - Part 2 PDFDocument21 pagesTheory - Part 2 PDFBettina OsterfasticsNo ratings yet

- Cfas Module 9Document5 pagesCfas Module 9April Noreen Riego PizarraNo ratings yet

- Rights To Interests Arising From Decommissioning, Restoration and Environmental Rehabilitation FundsDocument8 pagesRights To Interests Arising From Decommissioning, Restoration and Environmental Rehabilitation FundsJames BarzoNo ratings yet

- Afar ToaDocument22 pagesAfar ToaVanessa Anne Acuña DavisNo ratings yet

- IFRIC 5 - Rights of InterestsDocument8 pagesIFRIC 5 - Rights of InterestsJPNo ratings yet

- Ia LMCH7Document8 pagesIa LMCH7Al BertNo ratings yet

- Module Title: Partnership Liquidation: Bcacctg2 - Accounting For Partnership and CorporationDocument25 pagesModule Title: Partnership Liquidation: Bcacctg2 - Accounting For Partnership and CorporationNimfa SantiagoNo ratings yet

- Allocation of Partnership Liabilities (Full Version)Document3 pagesAllocation of Partnership Liabilities (Full Version)forbesadmin86% (37)

- CONSOLIDATION SummaryDocument5 pagesCONSOLIDATION Summaryjamaica deangNo ratings yet

- PFRS 14 15 16Document3 pagesPFRS 14 15 16kara mNo ratings yet

- Samplex FinalsDocument6 pagesSamplex FinalsZoe Jen RodriguezNo ratings yet

- Partnership Liquidation and Incorporation Joint Ventures: ©the Mcgraw Hill Companies, Inc. 2006 Mcgraw Hill/IrwinDocument29 pagesPartnership Liquidation and Incorporation Joint Ventures: ©the Mcgraw Hill Companies, Inc. 2006 Mcgraw Hill/Irwinmahmoud ragabNo ratings yet

- RewiewerDocument34 pagesRewiewerMickaella VergaraNo ratings yet

- Rights To Interests Arising From Decommissioning, Restoration and Environmental Rehabilitation FundsDocument8 pagesRights To Interests Arising From Decommissioning, Restoration and Environmental Rehabilitation FundsIssa BoyNo ratings yet

- IFRIC Interpretation 5Document8 pagesIFRIC Interpretation 5PlatonicNo ratings yet

- Ias - IfrsDocument7 pagesIas - IfrsFalguni PurohitNo ratings yet

- Joint ArrangementsDocument22 pagesJoint ArrangementsJhoanNo ratings yet

- SKSKKSKS SummaryDocument3 pagesSKSKKSKS SummaryMila Casandra CastañedaNo ratings yet

- PFRS 9 Financial Instruments GuideDocument11 pagesPFRS 9 Financial Instruments Guidejsus22100% (1)

- Joint Arrangements and Accounting for AssociatesDocument22 pagesJoint Arrangements and Accounting for AssociatesBianca AcoymoNo ratings yet

- Module 3 Joint ArrangementsDocument19 pagesModule 3 Joint ArrangementsNiki DimaanoNo ratings yet

- CFAS Review QuestionsDocument3 pagesCFAS Review QuestionsJay-B AngeloNo ratings yet

- Chapter 26Document8 pagesChapter 26Mae Ciarie YangcoNo ratings yet

- CFAS NotesDocument27 pagesCFAS NotesMikasa AckermanNo ratings yet

- NC Concept MapDocument3 pagesNC Concept MapMitch MindanaoNo ratings yet

- Pairamid Part 1Document75 pagesPairamid Part 1Peterpaul SilacanNo ratings yet

- FMGT 7121 Module 7 - 8th EditionDocument13 pagesFMGT 7121 Module 7 - 8th EditionhilaryNo ratings yet

- IND AS 32, 107, 109 (With Questions & Answers)Document69 pagesIND AS 32, 107, 109 (With Questions & Answers)Suraj Dwivedi100% (1)

- Consolidation Objectives: PAS 27 Objective of Setting The Standard To Be AppliedDocument11 pagesConsolidation Objectives: PAS 27 Objective of Setting The Standard To Be AppliedAdam SmithNo ratings yet

- Chapter 10 PAS 28 INVESTMENT IN ASSOCIATESDocument2 pagesChapter 10 PAS 28 INVESTMENT IN ASSOCIATESgabriel ramosNo ratings yet

- Chapter 18 Shareholders Equity - Docx-1Document14 pagesChapter 18 Shareholders Equity - Docx-1kanroji1923No ratings yet

- Financial Accounting 2Document17 pagesFinancial Accounting 2Devvrat TyagiNo ratings yet

- Ifric2 BKG enDocument12 pagesIfric2 BKG enTess De LeonNo ratings yet

- PFRS 9 - Financial Instruments (NEW)Document20 pagesPFRS 9 - Financial Instruments (NEW)eiraNo ratings yet

- ACCA When Does Debt Seem To Be EquityDocument3 pagesACCA When Does Debt Seem To Be Equityyung kenNo ratings yet

- Partnership LiquidationDocument73 pagesPartnership Liquidationlou-924No ratings yet

- Accounting for Business Combinations and Consolidated Financial StatementsDocument21 pagesAccounting for Business Combinations and Consolidated Financial StatementsJulliena BakersNo ratings yet

- Accountancy Liquidation ProceduresDocument3 pagesAccountancy Liquidation ProceduresJizelle BianaNo ratings yet

- Substantially Transferred The Risk and Rewards of Ownership or Has Not Retained Control of The Financial AssetsDocument3 pagesSubstantially Transferred The Risk and Rewards of Ownership or Has Not Retained Control of The Financial Assetsdianne caballeroNo ratings yet

- AFAR-01D Partnership LiquidationDocument8 pagesAFAR-01D Partnership LiquidationLouie RobitshekNo ratings yet

- Oblicon TheoriesDocument7 pagesOblicon TheoriesMaika NarcisoNo ratings yet

- Ia - 1 - Chapter 17 Investment in Associate Basic PrinciplesDocument19 pagesIa - 1 - Chapter 17 Investment in Associate Basic PrinciplesKhezia Mae U. GarlandoNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Chapter 4 - Accounting For Other LiabilitiesDocument21 pagesChapter 4 - Accounting For Other Liabilitiesjeanette lampitoc0% (1)

- AOMC Financial Report 2021Document1 pageAOMC Financial Report 2021jeanette lampitocNo ratings yet

- AOMC Financial Report 2020 For Christmas Party 2020 Collections Breakdown Expenses Breakdown Caroling SponsorsDocument2 pagesAOMC Financial Report 2020 For Christmas Party 2020 Collections Breakdown Expenses Breakdown Caroling Sponsorsjeanette lampitocNo ratings yet

- Business Finance Module 1Document22 pagesBusiness Finance Module 1Sebastian Montefalco93% (14)

- AOMC Contribution 2021Document5 pagesAOMC Contribution 2021jeanette lampitocNo ratings yet

- Audit of liabilities quiz problemsDocument4 pagesAudit of liabilities quiz problemsEarl Donne Cruz100% (4)

- Accounting For Liabilities: Characteristics of An Accounting Liability AreDocument35 pagesAccounting For Liabilities: Characteristics of An Accounting Liability Arejeanette lampitocNo ratings yet

- Chapter 34 PFRS 15 Revenue From Contracts With CustomersDocument3 pagesChapter 34 PFRS 15 Revenue From Contracts With Customersjeanette lampitocNo ratings yet

- Conceptual Framework For Financial Reporting: March 2018Document20 pagesConceptual Framework For Financial Reporting: March 2018Priss PrissNo ratings yet

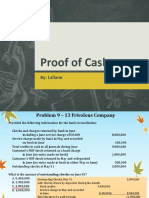

- Proof of Cash: By: LailaneDocument19 pagesProof of Cash: By: LailaneGianJoshuaDayrit100% (1)

- Audit of liabilities quiz problemsDocument4 pagesAudit of liabilities quiz problemsEarl Donne Cruz100% (4)

- My ReviewerDocument2 pagesMy Reviewerjeanette lampitocNo ratings yet

- Chap 5 Audit in ItDocument9 pagesChap 5 Audit in Itjeanette lampitocNo ratings yet

- Chap 5 Audit in ItDocument9 pagesChap 5 Audit in Itjeanette lampitocNo ratings yet

- Centralized Processing ModelDocument3 pagesCentralized Processing Modeljeanette lampitocNo ratings yet

- Audit in ItDocument6 pagesAudit in Itjeanette lampitocNo ratings yet

- Centralized Processing ModelDocument3 pagesCentralized Processing Modeljeanette lampitocNo ratings yet

- University of Perpetual Help System DaltaDocument1 pageUniversity of Perpetual Help System Daltajeanette lampitocNo ratings yet

- Chapter 4Document37 pagesChapter 4jeanette lampitocNo ratings yet

- Chapter 5Document38 pagesChapter 5xinfamousxNo ratings yet

- Auditing IT Governance ControlsDocument31 pagesAuditing IT Governance ControlsAira Belle100% (1)

- Information System AuditingDocument31 pagesInformation System Auditingannisa rNo ratings yet

- First, Think. Second, Believe. Third, Dream. and Finally, Dare.Document2 pagesFirst, Think. Second, Believe. Third, Dream. and Finally, Dare.jeanette lampitocNo ratings yet

- Security Part I: Auditing Operating Systems and Networks: IT Auditing, Hall, 4eDocument63 pagesSecurity Part I: Auditing Operating Systems and Networks: IT Auditing, Hall, 4ejeanette lampitoc100% (1)

- Letter of Consent From ParentDocument2 pagesLetter of Consent From Parentjeanette lampitocNo ratings yet

- JF 3 1Document43 pagesJF 3 1asroni asroniNo ratings yet

- Philippine Supreme Court Upholds Constitutionality of Truth CommissionDocument3 pagesPhilippine Supreme Court Upholds Constitutionality of Truth CommissionDeanne ClaireNo ratings yet

- The Maharashtra Prevention of Dangerous Activities of Slumlords, Bootleggers, Drug-Offenders, DanDocument10 pagesThe Maharashtra Prevention of Dangerous Activities of Slumlords, Bootleggers, Drug-Offenders, DanNk JainNo ratings yet

- Osprey, Men-at-Arms #444 Napoleon's Mounted Chasseurs of The Imperial Guard (2008) OCR 8.12 PDFDocument27 pagesOsprey, Men-at-Arms #444 Napoleon's Mounted Chasseurs of The Imperial Guard (2008) OCR 8.12 PDFJohn Santos100% (4)

- Tabernacle - 1112 PDFDocument16 pagesTabernacle - 1112 PDFelauwitNo ratings yet

- L/epublit Of: TBT BtlippintgDocument8 pagesL/epublit Of: TBT BtlippintgCesar ValeraNo ratings yet

- Tax.3105 - Capital Asset VS Ordinary Asset and CGTDocument10 pagesTax.3105 - Capital Asset VS Ordinary Asset and CGTZee QBNo ratings yet

- Solved Compare The Efficiency of Perfectly Competitive Markets Monopoly Markets andDocument1 pageSolved Compare The Efficiency of Perfectly Competitive Markets Monopoly Markets andM Bilal SaleemNo ratings yet

- Hugh Hendry Channels Irony and Paradox in His Latest Financial OutlookDocument5 pagesHugh Hendry Channels Irony and Paradox in His Latest Financial OutlookfourjeNo ratings yet

- SOP For Machine Maintenance - For UpdateDocument3 pagesSOP For Machine Maintenance - For UpdatePeracha Engineering60% (5)

- Types of Borrowers-Lending ProcessDocument39 pagesTypes of Borrowers-Lending ProcessEr YogendraNo ratings yet

- Indian Stock Market MechanismDocument2 pagesIndian Stock Market Mechanismneo0157No ratings yet

- Serban Nichifor: Forbidden Forest Interludes 1936-1939Document13 pagesSerban Nichifor: Forbidden Forest Interludes 1936-1939Serban NichiforNo ratings yet

- Case Digest - LTDDocument3 pagesCase Digest - LTDEmNo ratings yet

- Office Objects Vocabulary Matching Exercise Worksheets For KidsDocument4 pagesOffice Objects Vocabulary Matching Exercise Worksheets For KidsNoelia Peirats AymerichNo ratings yet

- Tangan Vs CADocument1 pageTangan Vs CAjoyNo ratings yet

- Chapter 6-The Companies Act, 2013 Incorporation of Company and Matters Incidental TheretoDocument101 pagesChapter 6-The Companies Act, 2013 Incorporation of Company and Matters Incidental TheretoJay senthilNo ratings yet

- Solution Manual For Options Futures and Other Derivatives 10th Edition John C HullDocument24 pagesSolution Manual For Options Futures and Other Derivatives 10th Edition John C HullFeliciaJohnsonjode100% (49)

- Shayan Zafar - Fourth Year (R) - Roll 58 - IPR Assignment - Concept of Design in IPRDocument16 pagesShayan Zafar - Fourth Year (R) - Roll 58 - IPR Assignment - Concept of Design in IPRShayan ZafarNo ratings yet

- 22 Sadhwani vs. Court of AppealsDocument2 pages22 Sadhwani vs. Court of AppealsJemNo ratings yet

- Do We Live in A MeritocracyDocument2 pagesDo We Live in A MeritocracymimirosellNo ratings yet

- ITP PaintingDocument1 pageITP PaintingYash Sharma100% (3)

- In Re Petition For Adoption of Michelle LimDocument4 pagesIn Re Petition For Adoption of Michelle LimtimothymaderazoNo ratings yet

- External Aids - IiiDocument84 pagesExternal Aids - IiiPrasun TiwariNo ratings yet

- 2012 Legal Ethics Bar Exam QDocument30 pages2012 Legal Ethics Bar Exam QClambeaux100% (1)

- Philips - 32pfl3403d 27 TP 1.2Document6 pagesPhilips - 32pfl3403d 27 TP 1.2JuanKaNo ratings yet

- Fusion TaskListDocument20 pagesFusion TaskListObulareddy BiyyamNo ratings yet

- The Sacrament of ReconciliationDocument6 pagesThe Sacrament of ReconciliationJohn Lester M. Dela CruzNo ratings yet

- Moa Junk Shop 2023Document3 pagesMoa Junk Shop 2023Calasag San Ildefonso71% (7)

- Canucks 2011-12 schedule and resultsDocument3 pagesCanucks 2011-12 schedule and resultsTBaby038392No ratings yet