Professional Documents

Culture Documents

Retained Earnings

Uploaded by

Kyla Requiron0 ratings0% found this document useful (0 votes)

27 views3 pages Retained earnings represent the cumulative balance of periodic net income or loss, dividend distributions, prior period errors, effects of change in accounting policy and other capital adjustments

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document Retained earnings represent the cumulative balance of periodic net income or loss, dividend distributions, prior period errors, effects of change in accounting policy and other capital adjustments

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

27 views3 pagesRetained Earnings

Uploaded by

Kyla Requiron Retained earnings represent the cumulative balance of periodic net income or loss, dividend distributions, prior period errors, effects of change in accounting policy and other capital adjustments

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

RETAINED EARNINGS

1. Define retained earnings

Retained earnings represent the cumulative balance of periodic net income or loss, dividend distributions,

prior period errors, effects of change in accounting policy and other capital adjustments

Under IAS, the term for retained earnings is accumulated profits

When the retained earnings account has a debit balance, it is called a “deficit”

A deficit is not an asset but a deduction from shareholders’ equity. The IAS term for deficit is “accumulated

losses”

Retained earnings can be classified into two namely:

a. Unappropriated retained earnings represent that portion which is free and can be declared as dividends

to stockholders

b. Appropriated retained earnings represent that portion which is restricted and therefore not available for

any dividend declaration

2. What are dividends?

Dividends are distribution of earnings or capital to shareholders in proportion to their shareholdings

Dividends out of earnings can be declared, only from retained earnings

If the entity has a deficit, it is illegal to pay dividends

The common forms of dividends out of earnings are cash dividend, property dividend and share dividend

Dividends out of capital are distributions of capital to shareholders in proportion to their shareholdings

Such dividends are popularly known as liquidating dividends

3. When are dividends recognized?

Under IFRIC 17 “Distribution of noncash assets to owners” paragraph 10, the liability to pay dividend shall be

recognized when the dividend is appropriately authorized and is no longer at the discretion of the entity,

which is the date:

a. When the dividends is declared by management or the board of directors if the local jurisdiction does

not require further approval

b. When the declaration of dividend by management or the board of directors is approved by relevant

authority, for example, the shareholders, if the local jurisdiction requires such approval

Simply stated, the liability for dividend must be recognized on the date of declaration

4. Explain property dividends

Property dividends or dividends in kind are distribution of earnings to the shareholders in the form of

noncash assets

IFRIC 17, paragraph 11 provides that an entity shall measure a liability to distribute noncash asset as a

dividend to owners at the fair value of the asset to be distributed

Paragraph 13 provides that the dividend payable is initially recognized at fair value of the noncash asset on

date of declaration and is increased or decreased as a result of the change in fair value of the asset at every

year-end and date of settlement

The offsetting debit or credit is through equity or directly retained earnings

Paragraph 14 provides that when an entity settles the dividend payable, the difference between the carrying

amount of the noncash asset distributed shall be recognized in profit or loss

PFRS 5, Paragraph 15A, provides that an entity shall measure a noncurrent asset classified for distribution to

owners at the lower of carrying amount and fair value les cost to distribute

Accordingly, if the fair value less cost to distribute is lower than the carrying amount of the asset at the end

of the reporting period, the difference is accounted for as impairment loss

5. What is a share dividend?

The IAS term for share dividend is “bonus issue”

Share dividend is distribution of the earnings of the entity in the form of the entity’s own shares

When share dividend is declared, the retained earnings of the entity are in effect capitalized or transferred

to share capital

The assets of the entity remain the same before and after the issuance of the share dividend

Share dividend payable is not a liability but an addition to the share capital in the shareholders’ equity

6. When share dividends are declared, what amount of retained earnings should be capitalized or what amount

should be debited to retained earnings?

The IFRS does not address share dividends

Thus the guidance is based on the Philippine GAAP in accounting for share dividends

a. If the share dividend is 20% or more, the par or stated value is capitalized or debited to retained

earnings. If the share dividend is 20% or more, the par or stated value is capitalized because this is

conceived to materially effect a reduction in the share market value. Share dividends of 20% or more is

considered as large share dividend

b. If the share dividend is less than 20% the fair value of the share on the date of declaration is capitalized.

However, if the fair value is lower than the par or stated value, the par or stated value is capitalized. If

the fair value is higher than par or stated value, the difference is credited to share premium from share

dividend. Share dividend of less than 20% is considered a small share dividend

7. What is quasi-reorganization?

A quasi-reorganization is the procedure of restating assets, liabilities and capital in conformity with fair value

for the purpose of eliminating a deficit

A quasi-reorganization may be accomplished through recapitalization and revaluation.

If done through recapitalization, the deficit is eliminated against the share premium from recapitalization

If done through revaluation, the deficit is eliminated against the revaluation surplus

Circumstances that may justify quasi-reorganization

a. When large deficit exists

b. When approved by the shareholders and creditors

c. When the cost basis of the accounting for property, plant and equipment becomes unrealistic

d. When a “fresh start’ appears to be desirable or advantageous to all parties concerned

An entity in financial difficulty may be permitted by the SEC to undergo a quasi-reorganization and in the

process may be allowed to revalue property, plant and equipment if current value is substantially more than

cost

Retained earnings subsequent to quasi-reorganization shall be restricted to the extent of the deficit wiped

out during the reorganization and cannot be declared as dividend

Losses subsequent to quasi-reorganization cannot be charged to the remaining revaluation surplus

The quasi-reorganization shall be disclosed for at least 3 years.

Direction: Read and encircle the letter which corresponds to the correct answer

1. Nonstock dividends shall be recognized as liability on the

a. Date of declaration

b. Date of record

c. Date of payment

d. Date of issuing check

2. Treasury shares may be reissued as dividends, in which case what amount should be charged to retained

earnings?

a. Cost of the treasury shares

b. Par value of the treasury shares

c. Fair value of the treasury shares on the date of declaration

d. Fair value of the treasury shares on the date of issuance

3. If the share dividend is less than 20%, what amount of the retained earnings should be capitalized?

a. Par value of the shares

b. Fair value of the shares on the date of declaration

c. Fair value of the shares on the date of record

d. Fair value of the shares on the date of issuance

4. In closely held entities, if share dividends are declared, retained earnings shall be capitalized at

a. Par or stated value

b. Book value

c. Fair value on date of declaration

d. Fair value on date of issue

5. An entity shall measure a liability to distribute noncash asset as dividend to the owners at

a. Carrying amount of the asset distributed

b. Fair value of the asset distributed

c. Either the carrying amount or fair value of the asset

d. Neither the carrying amount nor fair value

6. An entity shall measure a noncurrent asset classified as held for distribution to owners at

a. Carrying amount

b. Fair value less cost to distribute

c. Lower of carrying amount and fair value less cost to distribute

d. Fair value

7. The actual total amount of a cash dividend to be paid is determined on the date of

a. Record

b. Declaration

c. Declaration or date of record, whichever is earlier

d. Payment

8. A retained earnings appropriation is used to

a. Absorb a fire loss when an entity is self-insured

b. Provide for a contingent loss that is probable and measurable

c. Smooth periodic income

d. Restrict earnings available for dividends

9. A restriction of retained earnings is most likely to be required by

a. Purchase of property, plant and equipment

b. Purchase of treasury shares

c. Payment of last maturing series of a serial bond issue

d. Funding of past service cost

10. Which statement is true concerning appropriations of retained earnings?

a. Appropriations do not reduce total retained earnings

b. The only proper way to eliminate an appropriation of retained earnings after it has served its purpose is to

revert to the unappropriated retained earnings

c. When treasury shares are purchased, retained earnings must be appropriated equal to the cost of the

treasury shares

d. All of these statements are true concerning appropriations of retained earnings

You might also like

- OncaDocument6 pagesOncaVinylcoated ClipsNo ratings yet

- Chapter 18 Shareholders Equity - Docx-1Document14 pagesChapter 18 Shareholders Equity - Docx-1kanroji1923No ratings yet

- Act 6J03 - Comp2 - 1stsem05-06Document12 pagesAct 6J03 - Comp2 - 1stsem05-06ROMAR A. PIGANo ratings yet

- Investments 2Document2 pagesInvestments 2Alora Eu100% (1)

- Finals - Financial AccountingDocument6 pagesFinals - Financial AccountingAlyssa QuiambaoNo ratings yet

- Retained EarningsDocument72 pagesRetained EarningsItronix MohaliNo ratings yet

- Shareholders EquityDocument6 pagesShareholders EquityRianell Andrea AsumbradoNo ratings yet

- AFAR LumpSum LiquidationDocument1 pageAFAR LumpSum LiquidationCleofe Mae Piñero AseñasNo ratings yet

- Advance AccountingDocument18 pagesAdvance AccountingMarvin AquinoNo ratings yet

- Shareholders EquityDocument6 pagesShareholders EquityPauline Dela CruzNo ratings yet

- Act-6j03 Comp2 1stsem05-06Document12 pagesAct-6j03 Comp2 1stsem05-06RegenLudeveseNo ratings yet

- Basic Accounting - Theory ReviewerDocument5 pagesBasic Accounting - Theory Reviewersamitsu wpNo ratings yet

- Final ExamDocument13 pagesFinal ExamddddddaaaaeeeeNo ratings yet

- PAS 33 Test BankDocument4 pagesPAS 33 Test BankJake ScotNo ratings yet

- Pas33 1Document9 pagesPas33 1d.pagkatoytoyNo ratings yet

- Handout 3 Audit IntegDocument8 pagesHandout 3 Audit IntegCeage SJNo ratings yet

- English To Math and VocabDocument10 pagesEnglish To Math and VocabezaNo ratings yet

- 6 ACCT 2A&B C. OperationDocument10 pages6 ACCT 2A&B C. OperationShannon Mojica100% (1)

- AFAR Theories Reviewer For CPALEDocument25 pagesAFAR Theories Reviewer For CPALEColeen CunananNo ratings yet

- Afar ToaDocument19 pagesAfar ToaRicamae Mendiola100% (1)

- SHAREHOLDERSDocument6 pagesSHAREHOLDERSJoana MarieNo ratings yet

- Operation Arising From Its Effective PortionDocument14 pagesOperation Arising From Its Effective PortionShey INFTNo ratings yet

- PAS 28 - Investment in Associate,, Equity Method, Cost Method, DividendsDocument3 pagesPAS 28 - Investment in Associate,, Equity Method, Cost Method, Dividendsd.pagkatoytoyNo ratings yet

- TFAR2304 - Investment in Equity SecuritiesDocument3 pagesTFAR2304 - Investment in Equity SecuritiesBea GarciaNo ratings yet

- IA 3 ReviewerDocument23 pagesIA 3 ReviewerLarra NarcisoNo ratings yet

- RemovalDocument6 pagesRemovalJessa Mae BanseNo ratings yet

- 2-1 Accounting ReviewerDocument15 pages2-1 Accounting ReviewerJulienne S. RabagoNo ratings yet

- True or FalseDocument7 pagesTrue or FalseColline ZoletaNo ratings yet

- Mediocre Non-Profit OrganizationDocument12 pagesMediocre Non-Profit OrganizationveenaNo ratings yet

- Corporate Accounting Theory For First Unit-2Document9 pagesCorporate Accounting Theory For First Unit-2Rigved PrasadNo ratings yet

- Hoyle Chapter 10 Advanced Acct SolutionsDocument34 pagesHoyle Chapter 10 Advanced Acct SolutionsclevereuphemismNo ratings yet

- 1st Midterm Quiz QuestionnaireDocument11 pages1st Midterm Quiz QuestionnaireAthena Fatmah AmpuanNo ratings yet

- ECO 444 Investments Test Bank-No AnswersDocument17 pagesECO 444 Investments Test Bank-No AnswersAllan Genesis Romblon100% (1)

- Chapter 7 B-EconDocument14 pagesChapter 7 B-EconCathy Tapinit43% (7)

- Investment in Associates - Practice SetDocument4 pagesInvestment in Associates - Practice Setroseberrylacopia18No ratings yet

- ACCTG. 101 End - Term ExaminationDocument9 pagesACCTG. 101 End - Term ExaminationZAIL JEFF ALDEA DALENo ratings yet

- Wednesday, 10 November 2021 12:32 PM: INTACC2 Page 1Document3 pagesWednesday, 10 November 2021 12:32 PM: INTACC2 Page 1Luna CakesNo ratings yet

- Activity 2 Quiz QuestionsDocument2 pagesActivity 2 Quiz QuestionsRowena RogadoNo ratings yet

- Module 33 Retained Earnings TheoryDocument2 pagesModule 33 Retained Earnings TheoryThalia UyNo ratings yet

- Diluted Earnings Per ShareDocument15 pagesDiluted Earnings Per ShareHarvey Dienne Quiambao100% (1)

- Reviewer ToaDocument25 pagesReviewer ToaFlorence CuansoNo ratings yet

- Shareholder's Equity 1 Theory of AccountsDocument31 pagesShareholder's Equity 1 Theory of AccountsME ValleserNo ratings yet

- Investment Accounting W.R.T. As-13Document4 pagesInvestment Accounting W.R.T. As-13navin_khubchandaniNo ratings yet

- Finals Conceptual Framework and Accounting Standards AnswerkeyDocument7 pagesFinals Conceptual Framework and Accounting Standards AnswerkeyMay Anne MenesesNo ratings yet

- Toa 23 BVPS EpsDocument6 pagesToa 23 BVPS Epsmae tuazon0% (1)

- ACCOUNTING FOR CORPORATIONS-Retained EarningsDocument53 pagesACCOUNTING FOR CORPORATIONS-Retained EarningsMarriel Fate Cullano100% (3)

- PPE JeromeDocument3 pagesPPE Jeromemark_somNo ratings yet

- CF ReviewDocument17 pagesCF Reviewmohit_namanNo ratings yet

- AFAR MIDTERM EXAM REVIEWER - Part 2 (With Answers)Document7 pagesAFAR MIDTERM EXAM REVIEWER - Part 2 (With Answers)AuroraNo ratings yet

- Quiz in Fin Man AssetsDocument7 pagesQuiz in Fin Man AssetsCherseaLizetteRoyPicaNo ratings yet

- Chapter 16 Equity InvestmentsDocument19 pagesChapter 16 Equity InvestmentsBukhani MacabanganNo ratings yet

- Chin Figura - UNIT IV ASSESSMENT THEORIESDocument7 pagesChin Figura - UNIT IV ASSESSMENT THEORIEShot reddragon1123No ratings yet

- 23 PartnershiptheoryDocument10 pages23 PartnershiptheorySanjeev MiglaniNo ratings yet

- Compre ReviewerDocument33 pagesCompre Reviewermarinel pioquidNo ratings yet

- Fundamentals of Advanced Accounting Hoyle Doupnik 4th Edition Solutions ManualDocument44 pagesFundamentals of Advanced Accounting Hoyle Doupnik 4th Edition Solutions ManualCarolineAndersoneacmg100% (35)

- C. Both Statements Are FalseDocument12 pagesC. Both Statements Are FalseShaira Bagunas ObiasNo ratings yet

- Act-6j03 Comp1 1stsem05-06Document14 pagesAct-6j03 Comp1 1stsem05-06RegenLudeveseNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- Tongko V Manufacturers Life Insurance - GR 167622 - 640 SCRA 395Document18 pagesTongko V Manufacturers Life Insurance - GR 167622 - 640 SCRA 395Jeremiah ReynaldoNo ratings yet

- Christian - Spa Bureau of ImmigrationDocument2 pagesChristian - Spa Bureau of ImmigrationMark AbiloNo ratings yet

- Safety and Security of Guest and BelongingsDocument7 pagesSafety and Security of Guest and Belongingsstephen rrNo ratings yet

- Procurment Management Plan TemplateDocument15 pagesProcurment Management Plan TemplateMonil PatelNo ratings yet

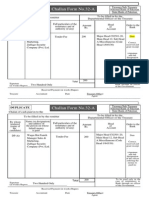

- Challan Form No.32-ADocument2 pagesChallan Form No.32-AWaqas Bin Faateh100% (7)

- 10NM60Document17 pages10NM60Jose Barroso GuerraNo ratings yet

- Chapter 18 Outline 7eDocument23 pagesChapter 18 Outline 7eGelyn CruzNo ratings yet

- Mind Map of Accounting ElementsDocument4 pagesMind Map of Accounting ElementsSapphire Au MartinNo ratings yet

- Asian Parliamentary Debate RulesDocument2 pagesAsian Parliamentary Debate RulesBabylen BahalaNo ratings yet

- Mi-W4 370050 7Document1 pageMi-W4 370050 7yaposiNo ratings yet

- Ake Claude. A Definition of Political StabilityDocument19 pagesAke Claude. A Definition of Political StabilityHenrry AllánNo ratings yet

- Checklist For Audit HSEMSDocument12 pagesChecklist For Audit HSEMSBalla BammouneNo ratings yet

- NDA - LTA SingaporeDocument5 pagesNDA - LTA Singapore2742481No ratings yet

- MBF14e Chap05 FX MarketsDocument20 pagesMBF14e Chap05 FX MarketsHaniyah Nadhira100% (1)

- pOLICY ANGOLA PDFDocument325 pagespOLICY ANGOLA PDFJuan TañamorNo ratings yet

- Hawkeye 360 Commercialising Space-Based Precision RF Detection and AnalyticsDocument13 pagesHawkeye 360 Commercialising Space-Based Precision RF Detection and AnalyticsCORAL ALONSONo ratings yet

- Assignment of Mortgage RegularNonMERS-1Document2 pagesAssignment of Mortgage RegularNonMERS-1Helpin HandNo ratings yet

- Rajiv Gandhi National University of Law, PunjabDocument2 pagesRajiv Gandhi National University of Law, PunjabShubham PandeyNo ratings yet

- Bobos in Paradise: The New Upper Class and How They Got ThereDocument16 pagesBobos in Paradise: The New Upper Class and How They Got ThereLaura NedelschiNo ratings yet

- Prosec ResolDocument4 pagesProsec ResolMary Anne Guanzon VitugNo ratings yet

- Manju Trade License Demand 2019-20Document2 pagesManju Trade License Demand 2019-20Raju SambheNo ratings yet

- Tax Planning With Reference To Financial Management: Presented byDocument32 pagesTax Planning With Reference To Financial Management: Presented byamitsingla19No ratings yet

- 4.2 F6 Cap AllowsDocument21 pages4.2 F6 Cap AllowsAnas KhalilNo ratings yet

- Forums: Discord:: Deadz - DEADZ#3976Document9 pagesForums: Discord:: Deadz - DEADZ#3976Jérémie BandakouassimoNo ratings yet

- Shame, Envy, Impasse and Hope: The Psychopolitics of Violence in South AfricaDocument23 pagesShame, Envy, Impasse and Hope: The Psychopolitics of Violence in South AfricazmotieeNo ratings yet

- Class XII Accountancy Paper For Half Yearly PDFDocument13 pagesClass XII Accountancy Paper For Half Yearly PDFJoshi DrcpNo ratings yet

- Sale Deed 1Document4 pagesSale Deed 1Tanvir AHMEDNo ratings yet

- Visual Occupations by Gil Z. HochbergDocument46 pagesVisual Occupations by Gil Z. HochbergDuke University Press100% (1)

- Section 87 of Juvenile Justice Act AbetmentDocument1 pageSection 87 of Juvenile Justice Act AbetmentMuhammedali KkNo ratings yet

- Investment CodeDocument23 pagesInvestment CodeMaricrisNo ratings yet