Professional Documents

Culture Documents

Negotiable Instruments - Midterms Examination

Uploaded by

Nikki BucatcatCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Negotiable Instruments - Midterms Examination

Uploaded by

Nikki BucatcatCopyright:

Available Formats

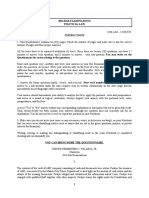

ABE International College of Business and Accountancy

Tacloban Campus, Tacloban City

NEGOTIABLE INSTRUMENT/ REGULATORY FRAMEWORK AND LEGAL ISSUES IN BUSINESS

MIDTERM

F / 8:00 – 9:00 am

PART 1. Explain or state briefly the rule or reason for your answers

1. A bill of exchange signed by W addressed to X states: “Please pay Y or order P10,000.” Is the bill

negotiable?

2. “I promise to pay X P10,000 within 10 days before I retire from government service.” Is the note

negotiable?

3. X obtains W’s signature for autograph purposes. Then X writes a negotiable instrument over it and

indorses it to Y, then Y to Z, then Z to A. Can the instrument be enforced by A against W?

4. W signs a bill of exchange in favor of X for P10,000. Give an instance when X may enforce payment

although W has not received any consideration from X for the bill.

5. State the liability of a maker of a promissory note when there is:

a. Absence of consideration;

b. Failure of consideration for the note.

Prepared by:

Nikki V. Bucatcat, CPA

Instructor

ABE International College of Business and Accountancy

Tacloban Campus, Tacloban City

NEGOTIABLE INSTRUMENT/ REGULATORY FRAMEWORK AND LEGAL ISSUES IN BUSINESS

MIDTERM

F / 8:00 – 9:00 am

PART 1. Explain or state briefly the rule or reason for your answers

6. A bill of exchange signed by W addressed to X states: “Please pay Y or order P10,000.” Is the bill

negotiable?

7. “I promise to pay X P10,000 within 10 days before I retire from government service.” Is the note

negotiable?

8. X obtains W’s signature for autograph purposes. Then X writes a negotiable instrument over it and

indorses it to Y, then Y to Z, then Z to A. Can the instrument be enforced by A against W?

9. W signs a bill of exchange in favor of X for P10,000. Give an instance when X may enforce payment

although W has not received any consideration from X for the bill.

10. State the liability of a maker of a promissory note when there is:

c. Absence of consideration;

d. Failure of consideration for the note.

Prepared by:

Nikki V. Bucatcat, CPA

Instructor

You might also like

- Conditional Acceptance GuidelinesDocument3 pagesConditional Acceptance GuidelinesKNOWLEDGE SOURCE100% (20)

- Request Banks To Follow UCC PROOF OF CLAIMDocument4 pagesRequest Banks To Follow UCC PROOF OF CLAIMZIONCREDITGROUP100% (19)

- Bill of ExchangeDocument3 pagesBill of Exchangegenaro201091% (11)

- Do This FirstDocument4 pagesDo This FirstYarod EL93% (15)

- Dispute The Debt LetterDocument4 pagesDispute The Debt Lettercamwills2100% (5)

- 40CW-2009!11!07 NTT Part B TranscriptDocument8 pages40CW-2009!11!07 NTT Part B TranscriptMe100% (2)

- Application For Withdrawal of Filed Form 668 (Y), Notice of Federal Tax LienDocument2 pagesApplication For Withdrawal of Filed Form 668 (Y), Notice of Federal Tax LienNotarys To GoNo ratings yet

- Affidavit of Fault and Opportunity To CureDocument3 pagesAffidavit of Fault and Opportunity To Curenell83% (6)

- Conditional Acceptance HowtoDocument5 pagesConditional Acceptance HowtoCharlton Butler100% (2)

- Dispute The Debt 1Document3 pagesDispute The Debt 1mlo356100% (6)

- Drafting Written Statements: An Essential Guide under Indian LawFrom EverandDrafting Written Statements: An Essential Guide under Indian LawNo ratings yet

- Contract-Agreement-Of - ForemanDocument1 pageContract-Agreement-Of - ForemanJerald-Edz Tam Abon100% (1)

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsFrom EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsRating: 5 out of 5 stars5/5 (1)

- Affidavit of Fault and Opportunity To Cur1Document3 pagesAffidavit of Fault and Opportunity To Cur1grace63% (8)

- 11 22 10Keating&ClarenceDocument4 pages11 22 10Keating&ClarenceEyeAm100% (4)

- The Financial Institutions Have Committed Fraud Against The American PeopleDocument49 pagesThe Financial Institutions Have Committed Fraud Against The American PeopleJoshua Sygnal Gutierrez100% (1)

- PALS Labor Law 2016 PDFDocument67 pagesPALS Labor Law 2016 PDFdemosrea100% (1)

- Drafting Legal Notices in India: A Guide to Understanding the Importance of Legal Notices, along with DraftsFrom EverandDrafting Legal Notices in India: A Guide to Understanding the Importance of Legal Notices, along with DraftsRating: 1 out of 5 stars1/5 (2)

- VAT Output TaxesDocument7 pagesVAT Output TaxesJocelyn Verbo-AyubanNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Contract To Sell BlankDocument3 pagesContract To Sell Blankmarc marcNo ratings yet

- Small Claims Court ProcedureDocument14 pagesSmall Claims Court ProcedureOfel TactacNo ratings yet

- Chattel MortgageDocument4 pagesChattel MortgageAngel UrbanoNo ratings yet

- Syllabus Persons CasesDocument21 pagesSyllabus Persons CasesMigoy DANo ratings yet

- Chapter 03 Gross EstateDocument16 pagesChapter 03 Gross EstateNikki Bucatcat0% (1)

- Co OwnershipDocument10 pagesCo OwnershipDaniel GalzoteNo ratings yet

- FORM 01 - SCC Statement of ClaimDocument10 pagesFORM 01 - SCC Statement of ClaimCallia DominiqueNo ratings yet

- 2016 BAR EXAMINATIONS With Suggested AnswersDocument16 pages2016 BAR EXAMINATIONS With Suggested AnswersEnriqueNo ratings yet

- Donors Tax PDFDocument7 pagesDonors Tax PDFRanel Clark D. Tabios50% (2)

- Notes - Common Provisions (Testate and Intestate Succession)Document14 pagesNotes - Common Provisions (Testate and Intestate Succession)sammieisthename2515No ratings yet

- Civrev Digested CasesDocument18 pagesCivrev Digested CaseshannaNo ratings yet

- Chapter 02 Transfer Taxes and Basic SuccessionDocument2 pagesChapter 02 Transfer Taxes and Basic SuccessionNikki Bucatcat100% (1)

- Motion For Reconsideration: Office of The City ProsecutorDocument8 pagesMotion For Reconsideration: Office of The City ProsecutorDanpatz Garcia100% (1)

- Chapter 06 Donor's TaxDocument16 pagesChapter 06 Donor's TaxNikki Bucatcat0% (2)

- Answer Accion PublicianaDocument4 pagesAnswer Accion PublicianaMichelle BasalNo ratings yet

- Chapter 04 Deductions From Gross EstateDocument19 pagesChapter 04 Deductions From Gross EstateNikki Bucatcat0% (1)

- Chapter 01 Introduction To Internal Revenue TaxesDocument12 pagesChapter 01 Introduction To Internal Revenue TaxesNikki BucatcatNo ratings yet

- Manila Banking Corporation vs. SilverioDocument3 pagesManila Banking Corporation vs. SilverioAlexander OchoaNo ratings yet

- Michelle C. Basal, Plaintiff, CIVIL CASE No. 98765 - versus-FOR: Unlawful Detainer Pia O. Worksback, Defendant. X - XDocument3 pagesMichelle C. Basal, Plaintiff, CIVIL CASE No. 98765 - versus-FOR: Unlawful Detainer Pia O. Worksback, Defendant. X - XMichelle BasalNo ratings yet

- Renewal of Fidelity BondDocument3 pagesRenewal of Fidelity BondHannah delos ReyesNo ratings yet

- Assignment #3Document2 pagesAssignment #3Dana IsabelleNo ratings yet

- Answer Accion PublicianaDocument3 pagesAnswer Accion PublicianaMichelle BasalNo ratings yet

- CRS-I Individual Self Cert Form LlenaDocument5 pagesCRS-I Individual Self Cert Form LlenaZaskya BenitezNo ratings yet

- August 20 2018 TranscriptDocument3 pagesAugust 20 2018 TranscriptJohn MarstonNo ratings yet

- Consideration CasesDocument2 pagesConsideration CasesFelip MatNo ratings yet

- Saln 1994 FormDocument3 pagesSaln 1994 FormJulius RarioNo ratings yet

- PNP Loan Application Form February 2021 16Document6 pagesPNP Loan Application Form February 2021 16Wilhelm RegaladoNo ratings yet

- BL 3 - Midterm ExamDocument2 pagesBL 3 - Midterm ExamNANNo ratings yet

- Form Coc 2018Document4 pagesForm Coc 2018Joshua SilasNo ratings yet

- Borang PermohonanDocument1 pageBorang PermohonanMohamad HilmiNo ratings yet

- Law On Business Organization Midterm ExamDocument1 pageLaw On Business Organization Midterm ExamNikki Bucatcat100% (1)

- ROLLON V NARAVALDocument1 pageROLLON V NARAVALChristin Jireh NabataNo ratings yet

- Q & A Mercantile LawDocument13 pagesQ & A Mercantile LawMelvin PernezNo ratings yet

- Request To Schedule A Call With JW MorrisDocument2 pagesRequest To Schedule A Call With JW MorrisJose Manuel Quiroz MarinNo ratings yet

- Second Division: Republic of The Philippines Court of Tax Appeals Quezon CityDocument17 pagesSecond Division: Republic of The Philippines Court of Tax Appeals Quezon CityGeorge Mitchell S. GuerreroNo ratings yet

- Philippine National Bank vs. CA: FactsDocument2 pagesPhilippine National Bank vs. CA: FactsEdrich Javier LavalleNo ratings yet

- Commodity Trading AccountDocument10 pagesCommodity Trading AccountSandeep TiwaryNo ratings yet

- LOG&SDDocument2 pagesLOG&SDAlexAhmadNo ratings yet

- General Form 58aDocument2 pagesGeneral Form 58aRodelLaborNo ratings yet

- Hornilla Vs SalunatDocument2 pagesHornilla Vs SalunatdarlynNo ratings yet

- Second Division: Republic of The Philippines Court of Tax Appeals Quezon CityDocument27 pagesSecond Division: Republic of The Philippines Court of Tax Appeals Quezon Cityjb13ruizNo ratings yet

- Sample NODDocument3 pagesSample NODSteve Mun GroupNo ratings yet

- AMAL Answer To Action For Rescission of Contracts Bedial PDFDocument4 pagesAMAL Answer To Action For Rescission of Contracts Bedial PDFشزغتحزع ىطشفم لشجخبهNo ratings yet

- Legal Ethics 2019 PDFDocument10 pagesLegal Ethics 2019 PDFRob BankyNo ratings yet

- Rivera, Lyka A. (3bsa5)Document2 pagesRivera, Lyka A. (3bsa5)Lysss EpssssNo ratings yet

- Fidelity Bond Application Form FBAFDocument2 pagesFidelity Bond Application Form FBAFARMIE JOY PALMARES CATUNAONo ratings yet

- Abayao-Worwor Furniture ShopDocument4 pagesAbayao-Worwor Furniture ShopBen Carlo RamosNo ratings yet

- Saln ManualDocument29 pagesSaln Manualscribe03No ratings yet

- Email: Tpbreview@Treasury - Gov.Au: Australian Institute of Conveyancers (Victorian Division) IncDocument2 pagesEmail: Tpbreview@Treasury - Gov.Au: Australian Institute of Conveyancers (Victorian Division) Incyariga8240No ratings yet

- Circular No. 4/2011 (F. No. 402/69/2010-Itcc), Dated 19-7-2011Document7 pagesCircular No. 4/2011 (F. No. 402/69/2010-Itcc), Dated 19-7-2011Satish JethvaniNo ratings yet

- Quo Warranto Opinion - J. CarpioDocument4 pagesQuo Warranto Opinion - J. Carpiogrimmjow890No ratings yet

- Residential Bonds Online Rbo - Information For Landlordsfc4bDocument2 pagesResidential Bonds Online Rbo - Information For Landlordsfc4bthomasdav26No ratings yet

- Chapter 1Document6 pagesChapter 1Andrei ArkovNo ratings yet

- Chapter 05 Estate TaxDocument14 pagesChapter 05 Estate TaxNikki BucatcatNo ratings yet

- 1.1-1.3 Sept 1Document18 pages1.1-1.3 Sept 1Nikki BucatcatNo ratings yet

- Estate TaxDocument15 pagesEstate TaxDustin PascuaNo ratings yet

- Law On Business Organization Midterm ExamDocument1 pageLaw On Business Organization Midterm ExamNikki Bucatcat100% (1)

- Managerial Accounting ProblemsDocument1 pageManagerial Accounting ProblemsNikki BucatcatNo ratings yet

- Conceptual FrameworkDocument1 pageConceptual FrameworkNikki BucatcatNo ratings yet

- SalesDocument2 pagesSalesNikki BucatcatNo ratings yet

- Lease Contract DalangDocument3 pagesLease Contract DalangJusan BorjaNo ratings yet

- LEASE DEED SampleDocument3 pagesLEASE DEED SampleMahidhar SethiNo ratings yet

- Introduction To Concept of Company and Company LawDocument17 pagesIntroduction To Concept of Company and Company LawMansangat Singh KohliNo ratings yet

- MCC Software Development Kit (SDK) - Version 2.0 - License AgreementDocument1 pageMCC Software Development Kit (SDK) - Version 2.0 - License AgreementNguyễnTrọngHoàngViệtNo ratings yet

- Currie V Misa: Jump To Navigationjump To SearchDocument3 pagesCurrie V Misa: Jump To Navigationjump To Searchpieret atek odong100% (1)

- Quiz 4 - Alternative, Joint, Solidary, Divisible, Indivisible, With Penal Clause ObligationsDocument1 pageQuiz 4 - Alternative, Joint, Solidary, Divisible, Indivisible, With Penal Clause ObligationsWally C. AranasNo ratings yet

- Civil Law Review II Syllabus 2019Document2 pagesCivil Law Review II Syllabus 2019Ma BelleNo ratings yet

- Company LawDocument11 pagesCompany Lawmima101050% (2)

- Memorandum Transfer of Ownership Feb16 A1107Document11 pagesMemorandum Transfer of Ownership Feb16 A1107RG CruzNo ratings yet

- Arbitration MootDocument14 pagesArbitration MootKanchi Singh RajputNo ratings yet

- PARCOR NotesDocument2 pagesPARCOR NotesCarl Joshua DayritNo ratings yet

- Standard Seos Mobile SDK License - Ver 1.1 Click ThroughDocument10 pagesStandard Seos Mobile SDK License - Ver 1.1 Click ThroughsdsadNo ratings yet

- Stephen HedleyDocument26 pagesStephen HedleyAneefa ZahirNo ratings yet

- Special Power of Attorney - Bus. RegDocument4 pagesSpecial Power of Attorney - Bus. RegSharon GenitaNo ratings yet

- Business Law QuizDocument2 pagesBusiness Law QuizDaniyal AliNo ratings yet

- Offer - Letter - Gitesh Tripathi - RemovedDocument2 pagesOffer - Letter - Gitesh Tripathi - Removeddidico7619No ratings yet

- Sales Notes Articles 1545 Conditions and WarrantiesDocument3 pagesSales Notes Articles 1545 Conditions and WarrantiesEnzo OfilanNo ratings yet

- LawofTorts EbookDocument31 pagesLawofTorts EbookAkhil AkhilNo ratings yet

- Registration - : Po Sun Tun vs. Price (G.R. No. 31346, Dec. 28, 1929, 54 Phil. 192)Document11 pagesRegistration - : Po Sun Tun vs. Price (G.R. No. 31346, Dec. 28, 1929, 54 Phil. 192)Mexi CalleNo ratings yet

- Akash Company IntroductionDocument16 pagesAkash Company IntroductionPujitNo ratings yet

- Zabkan Villas PropertiesDocument4 pagesZabkan Villas PropertiesSAMIA CYBER KAWANGWARE SOKONI ARCADE ROOM 25No ratings yet

- ArticleDocument6 pagesArticleteresita malanaNo ratings yet