Professional Documents

Culture Documents

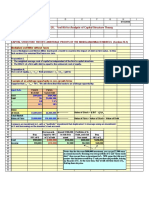

Payout Policy Quiz

Payout Policy Quiz

Uploaded by

Yashrajsing LuckkanaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Payout Policy Quiz

Payout Policy Quiz

Uploaded by

Yashrajsing LuckkanaCopyright:

Available Formats

Chapter 16

Payout Policy

Multiple Choice Questions

1. Firms can pay out cash to their shareholders in the following ways:

(I) Dividends

(II) Share repurchases

(III) Interest payments

A) I only

B) II only

C) III only

D) I and II only

Answer: D Type: Easy Page: 415

2. Dividends are decided by:

(I) The managers of a firm

(II) The government

(III) The board of directors

A) I only

B) II only

C) III only

D) I and II only

Answer: C Type: Easy Page: 416

3. Which of the following dividends is never in the form of cash?

(I) Regular dividend

(II) Special dividend

(III) Stock dividend

(IV) Liquidating dividend

A) I only

B) II only

C) III only

D) I, II, and IV only

Answer: C Type: Easy Page: 417

168 Test Bank, Chapter 16

4. Firms can repurchase shares in the following ways:

(I) Open market repurchase

(II) Through a tender offer

(III) Through a Dutch auction process

(IV) Through direct negotiation with a major shareholder

A) I only

B) II only

C) III only

D) I, II, III, and IV

Answer: D Type: Medium Page: 417

5. The par value of the outstanding shares is defined as:

A) Retained earnings

B) Legal capital

C) Book value of equity

D) None of the above

Answer: B Type: Medium Page: 417

6. Which of these dates occurs last in time (when arranged in the chronological order)?

A) Payment date

B) Ex-dividend date

C) Record date

D) Dividend declaration date

Answer: A Type: Easy Page: 417

7. Which of the following lists events in the chronological order from earliest to latest?

A) Record date, declaration date, ex-dividend date

B) Declaration date, record date, ex-dividend date

C) Declaration date, ex-dividend date, record date

D) None of the above

Answer: C Type: Medium Page: 417

8. The procedure where the firm states a series of prices at which it is prepared to repurchase stock.

Shareholders submit offers indicting how many shares they wish to sell at each price. The firm then

calculates the lowest price at which it is able to buy the desired number of shares. This procedure is

known as:

A) Open market transaction

B) Dutch auction

C) Green mail

D) None of the above

Answer: C Type: Medium Page: 417

Brealey/Myers/Allen, Principles of Corporate Finance, 8/e 169

9. The most important difference between stock repurchases and cash dividends is that they

(I) Benefit different groups

(II) Have different effects on corporate cash flow

(III) May have different tax consequences

A) I only

B) II only

C) III only

D) I, II, and III

Answer: B Type: Difficult Page: 417

10. Greenmail refers to the practice of a company purchasing its stock from:

A) Small shareholders who are unhappy with performance of the firm

B) A hostile shareholder who threatens to take over the firm

C) Large shareholders who are unhappy with performance of the firm

D) None of the above

Answer: B Type: Medium Page: 417

11. Which of the following is not true?

A) Firms have long-run target dividend payout ratios

B) Dividend changes follows shifts in long-term, sustainable earnings

C) Managers are reluctant to make dividend changes that might have to be reversed

D) All of the above

Answer: D Type: Medium Page: 418

12. Generally, firms resort to repurchase of stock because:

(I) Firms have accumulated large amount of excess cash

(II) Firms want to change their capital structure

(III) Firms want to substitute it for regular dividends

A) I only

B) II only

C) I and II only

D) III only

Answer: C Type: Medium Page: 418

13. Generally, the announcement of an increase in dividends is interpreted by the investors as:

A) Bad news and the stock price drops

B) Good news and the stock price increases

C) A non-event and does not affect the stock price

Answer: B Type: Easy Page: 420

14. Generally, a reduction in dividend is interpreted by investors as:

A) Bad news and the stock price drops

B) Good news and the stock price increases

C) A non-event and does not affect the stock prices

Answer: A Type: Easy Page: 420

170 Test Bank, Chapter 16

15. One key assumption of the Miller and Modigliani dividend irrelevance argument is that:

A) Future stock prices are certain

B) There are no capital gains taxes

C) All investments are risk-free

D) New shares are sold at a fair price

Answer: D Type: Medium Page: 422

16. The indifference proposition regarding dividend policy:

A) Assumes that tax rates increase at the same rate as inflation

B) Assumes that investors are indifferent about the timing of dividend payments

C) States that investors are indifferent between stock dividends and cash dividends

D) States that investors are indifferent between stock repurchase and cash dividends

Answer: B Type: Medium Page: 422

17. One key assumption of the Miller and Modigliani dividend irrelevance is that:

A) Future stock prices are certain

B) There are no capital gains taxes

C) Capital markets are efficient

D) All investments are risk-free

Answer: C Type: Medium Page: 422

18. The dividend-irrelevance proposition of Miller and Modigliani depends on the following

relationship between investment policy and dividend policy.

A) The level of investment does not influence or matter to the dividend decision

B) Once the dividend policy is set the investment decision can be made as desired

C) The investment policy is set before the dividend decision and not changed by dividend policy

D) None of the above

Answer: C Type: Medium Page: 425

19. Company X has 100 shares outstanding. It earns $1,000 per year and expects to pay all of it as

dividends. If the firm expects to maintain this dividend forever, calculate the stock price today. (the

required rate of return is 10%)

A) $110

B) $ 90

C) $100

D) None of the above

Answer: C Type: Easy Page: 425

Response: Dividends = 1000/100 =$10 ; P = 10/0.1 =$100

Brealey/Myers/Allen, Principles of Corporate Finance, 8/e 171

20. Company X has 100 shares outstanding. It earns $1,000 per year and expects to pay all of it as

dividends. If the firm expects to maintain this dividend forever, calculate the stock price after the

dividend payment. (The required rate of return is 10%)

A) $110

B) $ 90

C) $100

D) None of the above

Answer: B Type: Easy Page: 425

Response: Dividends = 1000/100 =$10 ; P = 10/0.1 =$100;

Price after dividend payment = $90

21. Company X has 100 shares outstanding. It earns $1,000 per year and expects repurchase its shares

in the open market instead of paying dividends. Calculate the number of shares outstanding at the end of

year-1, if the required rate of return is 10%.

A) 110

B) 90

C) 100

D) None of the above

Answer: B Type: Medium Page: 426

Response: Share price before repurchase = [1000/100]/ 0.1 = 100

Instead of paying dividends they can repurchase 10 shares

22. One possible reason that shareholders often insist on higher dividends is:

A) They agree with Miller and Modigliani

B) Tax consideration

C) The stock market is efficient

D) They do not trust managers to spend retained earnings wisely

Answer: D Type: Medium Page: 427

23. The rightist position is that the market will reward firms that:

A) Have high dividend yield.

B) Have low dividend yield

C) Are well managed, regardless of dividend yield

D) None of the above

Answer: A Type: Medium Page: 427

24. According to behavioral finance investors prefer dividends because:

A) investors prefer the discipline that comes from spending only the dividends

B) of the tax consideration

C) stock market is efficient

D) all of the above

Answer: A Type: Medium Page: 428

172 Test Bank, Chapter 16

25. If investors do not like dividends because of the additional taxes that they have to pay, how would

you expect stock prices to behave on the ex-dividend date?

A) Fall by more than the amount of the dividend

B) Fall exactly by the amount of the dividend

C) Fall by less than the amount of the dividend

D) Cannot be predicted

Answer: C Type: Medium Page: 430

26. If both dividends and capital gains are taxed at the same ordinary income tax rate, the effect of tax

is different because:

A) Capital gains are actually taxed, while dividends are taxed on paper only

B) Dividends are taxed when distributed while capital gains are deferred until the stock is sold

C) Both dividends and capital gains are taxed every year

D) Both A and C

Answer: B Type: Medium Page: 430

27. If dividends are taxed more heavily than capital gains, the investors:

A) Should b e willing to pay more for stocks with low dividend yields

B) Should be willing to pay more for high dividend yields

C) Should be willing to pay the same for stocks regardless of the dividend yields

D) Cannot be predicted as stock prices fluctuate randomly

Answer: A Type: Medium Page: 430

28. If investors have a marginal tax rate of 20% and a firm has announced a dividend of $5;

A) The price of stock should decrease by $4 on the ex-dividend date

B) The price of the stock should decrease by $5 on the ex-dividend date

C) The price of the stock should increase by $5 on the ex-dividend date

D) The price of the stock should increase by $4 on the ex-dividend date

Answer: A Type: Medium Page: 430

29. Two corporations A and B have exactly the same risk and both have a current stock price of $100.

Corporation A pays no dividend and will have a price of $120 one year from now. Corporation B pays

dividends and will have price of $113 one year from now after paying the dividend. The corporations pay

no taxes and investors pay no taxes on capital gains but pay a tax of 30% income tax on dividends.

What is the value of the dividend that investors expect corporation B to pay one year from today?

A) $7

B) $13

C) $10

D) None of the above

Answer: C Type: Medium Page: 430

Response: Dividend = (120-113)/ 0.7 = $10

Brealey/Myers/Allen, Principles of Corporate Finance, 8/e 173

30. Which of the following investors have the strongest tax reason to prefer dividends over capital

gains?

A) Pension funds

B) Financial institutions

C) Individuals

D) Corporations

Answer: D Type: Medium Page: 432

31. If the corporate tax rate is 35%, what is the maximum effective tax rate on dividends received by

another corporation?

A) 35%

B) 30%

C) 10.5%

D) None of the above

Answer: C Type: Medium Page: 433

Response: 70% of dividends received by another corporation is tax-exempt. Tax rate = (0.3)*(0.35) =

0.105 = 10.5%

32. According to middle-of-the-roaders, a firm's value is not affected by its dividend policy because:

A) of the clientele effect

B) of the tax loopholes available to wealthy stockholders

C) well-managed companies prefer to signal their worth by paying high dividends

D) All of the above

Answer: D Type: Difficult Page: 434

33. A firm in Australia earns a pretax profit of $A10 per share. It pays a corporate tax of $3 per share

(30% tax rate) in taxes. The firm pays the remaining $A7 in dividends to a shareholder in 30% tax

bracket. What is the amount of tax paid by the shareholder under the imputation tax system?

A) $A2.10

B) Zero

C) $3.00

D) None of the above

Answer: B Type: Medium Page: 435

34. A firm in Australia earns a pretax profit of $A10 per share. It pays a corporate tax of $3 per share

(30% tax rate) in taxes. The firm pays the remaining $A7 in dividends to a shareholder in 40% tax

bracket. What is the amount of tax paid by the shareholder under the imputation tax system?

A) $A1.00

B) Zero

C) $4.00

D) None of the above

Answer: A Type: Medium Page: 435

174 Test Bank, Chapter 16

True/False Questions

T F 35. If a dividend is unlikely to be repeated in the future, it is usually called a "special" or

"extra" dividend.

Answer: True Type: Easy Page: 417

T F 36. Because greenmail involves the repurchase of stock at a price higher than the market price, all

shareholders benefit.

Answer: False Type: Medium Page: 417

T F 37. Many companies have automatic dividend reinvestment plans (DRIPs).

Answer: True Type: Medium Page: 417

T F 38. An alternative to paying cash dividends is to repurchase stock.

Answer: True Type: Easy Page: 417

T F 39. Dividend payments are used to change the capital structure by replacing equity with debt.

Answer: False Type: Difficult Page: 418

T F 40. Firms have long-run target dividend payout ratios.

Answer: True Type: Medium Page: 418

T F 41. Managers are reluctant to make dividend changes that might have to be reversed.

Answer: True Type: Medium Page: 419

T F 42. Miller and Modigliani's argument for dividend irrelevance assumes an efficient market.

Answer: True Type: Medium Page: 423

T F 43. Australia follows the imputation tax system.

Answer: True Type: Easy Page: 434

Brealey/Myers/Allen, Principles of Corporate Finance, 8/e 175

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Test Bank For International Financial Management 8th Edition by EunDocument37 pagesTest Bank For International Financial Management 8th Edition by EunNgô Lan Tường100% (2)

- Test Bank For Principles of Corporate Finance 10th Edition Brealey, Myers, AllenDocument53 pagesTest Bank For Principles of Corporate Finance 10th Edition Brealey, Myers, Allena682182415100% (2)

- Capital Structure and Dividend PolicyDocument25 pagesCapital Structure and Dividend PolicySarah Mae SudayanNo ratings yet

- Solution Manual For Fundamentals of Corporate Finance 8th CanadianDocument11 pagesSolution Manual For Fundamentals of Corporate Finance 8th CanadianEvan Jordan29% (7)

- Chapter 10 - Common Stock ValuationDocument14 pagesChapter 10 - Common Stock ValuationNaweera Adnan100% (1)

- Corporate Finance Test Bank and Solutions ManualDocument8 pagesCorporate Finance Test Bank and Solutions Manualnaxipo18% (22)

- Principles of Corporate Finance 12th Edition Brealey Test BankDocument18 pagesPrinciples of Corporate Finance 12th Edition Brealey Test BankHassane AmadouNo ratings yet

- Brealey. Myers. Allen Chapter 17 SolutionDocument10 pagesBrealey. Myers. Allen Chapter 17 Solutionbharath_rath_2100% (1)

- Chapter 10 Lessons From Market History: Corporate Finance, 12e (Ross)Document35 pagesChapter 10 Lessons From Market History: Corporate Finance, 12e (Ross)EnciciNo ratings yet

- Ss11 646 Corporate FinanceDocument343 pagesSs11 646 Corporate Financed-fbuser-32825803100% (12)

- Answers To Practice Questions: How Much Should A Firm Borrow?Document8 pagesAnswers To Practice Questions: How Much Should A Firm Borrow?Cecilia MontessoroNo ratings yet

- Chapter 13 Test BankDocument53 pagesChapter 13 Test BankAnonymous JmeZ95P0100% (1)

- Past ExamDocument13 pagesPast ExamMinh TaNo ratings yet

- Brealey. Myers. Allen Chapter 33 TestDocument8 pagesBrealey. Myers. Allen Chapter 33 TestMskoala100% (2)

- Brealey. Myers. Allen Chapter 20 TestDocument11 pagesBrealey. Myers. Allen Chapter 20 TestSaleh Kattarwala100% (5)

- Chapter 4 - Fundamentals of Corporate Finance 9th Edition - Test BankDocument26 pagesChapter 4 - Fundamentals of Corporate Finance 9th Edition - Test BankKellyGibbons100% (2)

- TBChap 010Document42 pagesTBChap 010varun cyw100% (3)

- Ross. Westerfield Jaffe. Jordan Chapter 18 TestDocument23 pagesRoss. Westerfield Jaffe. Jordan Chapter 18 TestShayan Shahabi100% (4)

- CH 13Document9 pagesCH 13portia16100% (1)

- Solution of Corporate Finance Exams On 14th April Phuong Anh MDE10Document8 pagesSolution of Corporate Finance Exams On 14th April Phuong Anh MDE10api-3729903100% (1)

- Chapter 19 - Financing and ValuationDocument49 pagesChapter 19 - Financing and Valuationnormalno100% (1)

- Test Bank Financial Accounting 6E by Libby Chapter 02Document36 pagesTest Bank Financial Accounting 6E by Libby Chapter 02Ronald James Siruno Monis50% (2)

- ACCA F9 Workbook Questions & Solutions 1.1 PDFDocument251 pagesACCA F9 Workbook Questions & Solutions 1.1 PDFSide Al Rifat100% (6)

- Financial ManagementDocument97 pagesFinancial ManagementGuruKPO100% (17)

- F9FM-Session11 d08Document16 pagesF9FM-Session11 d08MuhammadAliNo ratings yet

- Brealey. Myers. Allen Chapter 17 TestDocument13 pagesBrealey. Myers. Allen Chapter 17 TestMarcelo Birolli100% (2)

- Brealey. Myers. Allen Chapter 32 TestDocument14 pagesBrealey. Myers. Allen Chapter 32 Testga_arn100% (2)

- Brealey. Myers. Allen Chapter 21 TestDocument15 pagesBrealey. Myers. Allen Chapter 21 TestSasha100% (1)

- Brealey. Myers. Allen Chapter 22 TestDocument11 pagesBrealey. Myers. Allen Chapter 22 TestShaikh Junaid100% (1)

- Test Bank Principles of Corporate Finance 9th Edition BrealeyDocument30 pagesTest Bank Principles of Corporate Finance 9th Edition BrealeyNgọc LêNo ratings yet

- Solutions ManualDocument5 pagesSolutions Manualinky766100% (2)

- Brealey. Myers. Allen Chapter 22 SolutionDocument8 pagesBrealey. Myers. Allen Chapter 22 SolutionPulkit Aggarwal100% (1)

- Chapter 11 Test Bank Test BankDocument25 pagesChapter 11 Test Bank Test BankAyesha BajwaNo ratings yet

- Chapter 16Document23 pagesChapter 16JJNo ratings yet

- Chap 005Document11 pagesChap 005Mohammed FahadNo ratings yet

- TB 18Document24 pagesTB 18Marc Raphael Ong100% (1)

- Chapter 3 - Fundamentals of Corporate Finance 9th Edition - Test BankDocument24 pagesChapter 3 - Fundamentals of Corporate Finance 9th Edition - Test BankKellyGibbons100% (4)

- Net Present Value and Other Investment CriteriaDocument50 pagesNet Present Value and Other Investment CriteriaQusai BassamNo ratings yet

- Finance Test BankDocument119 pagesFinance Test BankMiguelito Alcazar100% (6)

- Chapter 15Document33 pagesChapter 15Kad SaadNo ratings yet

- Chapter 3 Foundations of Financial Management 11th Canadian EditionDocument40 pagesChapter 3 Foundations of Financial Management 11th Canadian EditionNajiba RahmanNo ratings yet

- Fundamentals of Corporate Finance 8th Edition Brealey Test Bank PDFDocument79 pagesFundamentals of Corporate Finance 8th Edition Brealey Test Bank PDFa819334331No ratings yet

- Chapter 11 Testbank: StudentDocument71 pagesChapter 11 Testbank: StudentHoan Vu Dao KhacNo ratings yet

- Chap012 Quiz PDFDocument20 pagesChap012 Quiz PDFLê Chấn PhongNo ratings yet

- Payout Policy: Test Bank, Chapter 16 168Document31 pagesPayout Policy: Test Bank, Chapter 16 168HuyenKhanhNo ratings yet

- Payout Policy: Test Bank, Chapter 16 168Document11 pagesPayout Policy: Test Bank, Chapter 16 168AniKelbakianiNo ratings yet

- Chapter 16 - Payout PolicyDocument12 pagesChapter 16 - Payout PolicyTrinh VũNo ratings yet

- Corporate Finance Trial Questions 2Document11 pagesCorporate Finance Trial Questions 2Sylvia Nana Ama DurowaaNo ratings yet

- Chapter 10 Stock Valuation QuestionsDocument9 pagesChapter 10 Stock Valuation QuestionssaniyahNo ratings yet

- Fin202 Sem.2 2019 MCQ New QDocument31 pagesFin202 Sem.2 2019 MCQ New QEy B0ssNo ratings yet

- Concept Check - Chapter 17 - CleanDocument4 pagesConcept Check - Chapter 17 - CleanGrace Eva RosanaNo ratings yet

- Principles of Corporate Finance 10th Edition Brealey Test BankDocument38 pagesPrinciples of Corporate Finance 10th Edition Brealey Test Bankhoadieps44ki100% (25)

- Sample Exam 2 For International FinanceDocument9 pagesSample Exam 2 For International Financejohndoe1234567890000No ratings yet

- DividendsDocument28 pagesDividendsSamantha Islam100% (2)

- Answers To Midterm 3040ADocument12 pagesAnswers To Midterm 3040ApeaNo ratings yet

- Practicing Financial Planning For Professionals and CFP Aspirants 12Th Edition Mittra Test Bank Full Chapter PDFDocument36 pagesPracticing Financial Planning For Professionals and CFP Aspirants 12Th Edition Mittra Test Bank Full Chapter PDFtintiedraweropw9100% (9)

- Practicing Financial Planning For Professionals and CFP Aspirants 12th Edition Mittra Test BankDocument15 pagesPracticing Financial Planning For Professionals and CFP Aspirants 12th Edition Mittra Test Banktauriddiastyleon6100% (30)

- 804 MCQDocument15 pages804 MCQOlamilekan JuliusNo ratings yet

- Full Corporate Financial Management 5Th Edition Glen Arnold Test Bank Online PDF All ChapterDocument30 pagesFull Corporate Financial Management 5Th Edition Glen Arnold Test Bank Online PDF All Chaptergerianneaasy616100% (2)

- Sample Questions 2Document14 pagesSample Questions 2조서현No ratings yet

- Review FINAL EXAM - Business FinanceDocument10 pagesReview FINAL EXAM - Business FinanceUynn LêNo ratings yet

- Eastboro Case SolutionDocument22 pagesEastboro Case SolutionrifkiNo ratings yet

- Corporate Governance and FinanceDocument112 pagesCorporate Governance and FinanceNoemi CambrigliaNo ratings yet

- Cost of Capital and Firm Value Evidence From IndonDocument10 pagesCost of Capital and Firm Value Evidence From IndonkristinaNo ratings yet

- Factors Influencing Capital StructureDocument4 pagesFactors Influencing Capital StructureMani BhushanNo ratings yet

- Still Searching For Optimal Capital StructureDocument26 pagesStill Searching For Optimal Capital Structureserpent222No ratings yet

- Lewis Mutswatiwa...Document69 pagesLewis Mutswatiwa...LEWIS MUTSWATIWANo ratings yet

- ACCA FM TuitionExam CBE 2021-2022 Qs JG21Jan SPi15MarDocument14 pagesACCA FM TuitionExam CBE 2021-2022 Qs JG21Jan SPi15MarchimbanguraNo ratings yet

- AcknowledgementDocument82 pagesAcknowledgementrishu5384No ratings yet

- CH 14 Practice MCQ - S Financial Management by BrighamDocument63 pagesCH 14 Practice MCQ - S Financial Management by BrighamShahmir Ali100% (1)

- Hypothetical Capital Structure and Cost of Capital of Mahindra Finance Services LTDDocument25 pagesHypothetical Capital Structure and Cost of Capital of Mahindra Finance Services LTDlovels_agrawal6313No ratings yet

- Parrino Corp Fin 5e PPT Ch16Document51 pagesParrino Corp Fin 5e PPT Ch16kimkimberlyNo ratings yet

- Capital Structure Theory 2Document39 pagesCapital Structure Theory 2sanjupatel333No ratings yet

- Full Download Ebook PDF Corporate Finance Fourth Canadian Edition PDFDocument41 pagesFull Download Ebook PDF Corporate Finance Fourth Canadian Edition PDFsean.odell44097% (33)

- Capital Structure Unit 3Document9 pagesCapital Structure Unit 3Hardita DhameliaNo ratings yet

- Chapter 5 Financial Decisions Capital Structure-1Document33 pagesChapter 5 Financial Decisions Capital Structure-1Aejaz MohamedNo ratings yet

- Research Article On Capital Structure and Firm PerformanceDocument13 pagesResearch Article On Capital Structure and Firm PerformanceTariq ArmanNo ratings yet

- FINA3070 Lecture Notes v6Document215 pagesFINA3070 Lecture Notes v6aduiduiduio.oNo ratings yet

- Chapter 26. Tool Kit For Analysis of Capital Structure TheoryDocument11 pagesChapter 26. Tool Kit For Analysis of Capital Structure TheoryJITIN ARORANo ratings yet

- Keywords: Capital Structure Profitability Manufacturing Companies JEL Classifications: M1 M4: M41Document10 pagesKeywords: Capital Structure Profitability Manufacturing Companies JEL Classifications: M1 M4: M41somiyaNo ratings yet

- WorkingPaper 99Document46 pagesWorkingPaper 99atktaouNo ratings yet

- Dividend Theories and LimitationsDocument11 pagesDividend Theories and LimitationsPerah MemonNo ratings yet

- Lecture 1: Capital Structure: Lorenzo BretscherDocument76 pagesLecture 1: Capital Structure: Lorenzo BretscherKatarina SusaNo ratings yet

- Research Proposal Impact of Capital Structure On Firm's Performance FinalDocument28 pagesResearch Proposal Impact of Capital Structure On Firm's Performance FinalLidia SamuelNo ratings yet

- Reconciling DCF Valuation MethodologiesDocument13 pagesReconciling DCF Valuation MethodologiesFlory NelaNo ratings yet

- Managerial Economics An Analysis of Business IssuesDocument25 pagesManagerial Economics An Analysis of Business Issueslinda zyongweNo ratings yet

- Ebook PDF Corporate Finance 7th Canadian Edition by Stephen Ross PDFDocument41 pagesEbook PDF Corporate Finance 7th Canadian Edition by Stephen Ross PDFjennifer.browne345100% (36)

- 02 Capital StructureDocument28 pages02 Capital StructureSardonna FongNo ratings yet