Professional Documents

Culture Documents

Steps For Valuation

Uploaded by

DHRUV VIJOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Steps For Valuation

Uploaded by

DHRUV VIJCopyright:

Available Formats

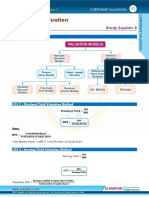

Valuation Steps

1. First Read the assumptions (it should include terminal growth rate, YOY growth rate (both

pre and post current year), Risk free rate, tax, interest, WACC %, Working Capital %).

Terminal growth rate varies if you are from buyer side or target company side, 0% or max %

growth rate assume depending on your position.

COGS is calculated = Opening stock +Purchases – Closing Stock. After this compute with sales

to find the %. Take average of % from all the year and then taking average of these to find

out the estimated % for the next estimated years.

Depreciation rate will be given or Calculate depreciation from SML method or Double

Declining Balance Method. Then % with sales and the proportions to find the estimated

years.

2. Once you know the YOY growth rate – both pre and post current year, you get predict the

sales and till EAT/PAT.

3. If working capital is not given as a percentage, use the formula, Total Current Assets- Total

Current Liabilities = Net Working Capital.

4. Find these for the estimated year as well.

5. After finding out the estimated year values, compute the FCFF. The formula for FCFF is

PAT+EBIT(1-Tax) - (Capital Expenditure-Depreciation & Ammonization) +/- Change in the

Working Capital.

𝐿𝑎𝑠𝑡 𝑦𝑒𝑎𝑟 𝑜𝑓 𝐹𝐶𝐹𝐹∗(1+𝑇𝐺𝑅)

6. Next Step is to find out the Terminal Value of FCFF. The formula is

(𝐶𝑂𝐸−𝑇𝐺𝑅)

𝑇𝑉

7. Next, Present Value of TV =

(1+𝐶𝑂𝐸)^5

𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝐶𝑎𝑠ℎ 𝐹𝑙𝑜𝑤

8. Present value of FCFF =

(1+𝐶𝑂𝐸)^5

9. Firm Value = step 7 +step 8

10. Enterprise value = PV of FCFF all the expected years.

11. Intrinsic value = Enterprise Value/ No. of Outstanding shares.

Why valuation is necessary?

Better knowledge about company’s assets.

o accurate business valuation assessment.

o Estimates are not acceptable

o Specific numbers are to be gained from valuation so that business owner know how

much to obtain proper insurance coverage, know how much to reinvest in a

company and how muxh to sell a company to make profit.

Understand of Company Resale Value

Obtain a True Company Value

Better During Mergers/Acquisitions

Access to More Investors

You might also like

- Strategic Capital Group Workshop #8: Cost of CapitalDocument30 pagesStrategic Capital Group Workshop #8: Cost of CapitalUniversity Securities Investment TeamNo ratings yet

- Chapter 7Document57 pagesChapter 7AnonymousNo ratings yet

- READING 8 Free Cashflow (Equity Valuation)Document25 pagesREADING 8 Free Cashflow (Equity Valuation)DandyNo ratings yet

- Discounted Cash Flow (DCF) : How To Use DCF Method For Stock Valuation? (Calculator)Document18 pagesDiscounted Cash Flow (DCF) : How To Use DCF Method For Stock Valuation? (Calculator)Jeet SinghNo ratings yet

- EconomyDocument3 pagesEconomyicarusNo ratings yet

- Corporate Finance SummaryDocument44 pagesCorporate Finance SummaryZoë BackbierNo ratings yet

- Valuation Concepts: 1 Free Cash Flow Estimation (FCF)Document3 pagesValuation Concepts: 1 Free Cash Flow Estimation (FCF)The GravityNo ratings yet

- Ch03 - Free Cash Flow ValuationDocument66 pagesCh03 - Free Cash Flow ValuationsalmanNo ratings yet

- Financial Management - Kendle QuesuestionsDocument4 pagesFinancial Management - Kendle QuesuestionsDr Rushen SinghNo ratings yet

- ACF Module 1 THEORY 29TH FebDocument10 pagesACF Module 1 THEORY 29TH FebRajesh KumarNo ratings yet

- Notes - An Introduction To Financ, Accouting, Modeling, and ValuationDocument8 pagesNotes - An Introduction To Financ, Accouting, Modeling, and ValuationperNo ratings yet

- Topic 3 FM Presentation1 Lidia'sDocument19 pagesTopic 3 FM Presentation1 Lidia'sLidia SamuelNo ratings yet

- LBO TrainingDocument18 pagesLBO TrainingCharles Levent100% (3)

- Business Valuation 1Document19 pagesBusiness Valuation 1Temmy AdegboyeNo ratings yet

- Valuation of FirmDocument13 pagesValuation of FirmLalitNo ratings yet

- DCF Cheat SheetDocument2 pagesDCF Cheat SheetManuel González ValleNo ratings yet

- DCF Method and Relative ValuationDocument40 pagesDCF Method and Relative ValuationMeghaNo ratings yet

- Solution - Problems and Solutions Chap 8Document8 pagesSolution - Problems and Solutions Chap 8Sabeeh100% (1)

- Financial Analysis - Sony and Apple - PT2Document16 pagesFinancial Analysis - Sony and Apple - PT2chuck martinNo ratings yet

- Financial Management Final Exam Solutions - F19401118 Jocelyn DarmawantyDocument11 pagesFinancial Management Final Exam Solutions - F19401118 Jocelyn DarmawantyJocelynNo ratings yet

- Valuations & Acquisitions CMDocument9 pagesValuations & Acquisitions CMnsnhemachenaNo ratings yet

- Midterm Review - Key ConceptsDocument10 pagesMidterm Review - Key ConceptsGurpreetNo ratings yet

- Kellogg Valuation HelpDocument56 pagesKellogg Valuation HelpJames WrightNo ratings yet

- Relative ValuationDocument1 pageRelative ValuationPrachi PawarNo ratings yet

- Chap 3 FCFHelenDocument66 pagesChap 3 FCFHelenarslanj123No ratings yet

- Stock Valuation: Answers To Concept Questions 1Document15 pagesStock Valuation: Answers To Concept Questions 1Sindhu JattNo ratings yet

- II. The Two-Stage FCFE ModelDocument7 pagesII. The Two-Stage FCFE ModelzZl3Ul2NNINGZzNo ratings yet

- Additional Funds Needed MasDocument22 pagesAdditional Funds Needed MasWilmer Mateo Bernardo100% (1)

- Leverages 1Document33 pagesLeverages 1mahato28No ratings yet

- Formulas #1: Future Value of A Single Cash FlowDocument4 pagesFormulas #1: Future Value of A Single Cash FlowVikram Sathish AsokanNo ratings yet

- Complex Valuation - AmazonDocument11 pagesComplex Valuation - AmazonCerqueira_GuilhermeNo ratings yet

- Chapter 4Document7 pagesChapter 4Hal kNo ratings yet

- Corporate ValuationDocument7 pagesCorporate ValuationVaibhav GandhiNo ratings yet

- Going Concern Asset Based ValuationDocument21 pagesGoing Concern Asset Based ValuationMae Angiela TansecoNo ratings yet

- Chapter 4Document50 pagesChapter 422GayeonNo ratings yet

- Slides - Session 5Document49 pagesSlides - Session 5Murte BolaNo ratings yet

- Corporate Finance Math SheetDocument19 pagesCorporate Finance Math Sheetmweaveruga100% (3)

- BUS 635 Quiz3 Sum15 AnswersDocument5 pagesBUS 635 Quiz3 Sum15 AnswershnoamanNo ratings yet

- Free Cash Flow ValuationDocument27 pagesFree Cash Flow ValuationShaikh Saifullah KhalidNo ratings yet

- Finance Material 3Document6 pagesFinance Material 3Akshay UdayNo ratings yet

- WK 8.1 - Stock ValuationDocument20 pagesWK 8.1 - Stock Valuationhfmansour.phdNo ratings yet

- How To Value Stocks - Part 1Document6 pagesHow To Value Stocks - Part 1vurublog100% (1)

- Business Valuation (FCFF)Document5 pagesBusiness Valuation (FCFF)Akshat JainNo ratings yet

- DCF in Depth Calculate The Revenue Growth Rate: Forecasting Free Cash FlowsDocument5 pagesDCF in Depth Calculate The Revenue Growth Rate: Forecasting Free Cash FlowsJustBNo ratings yet

- Financial Anlysis of FFC For InvestorsDocument7 pagesFinancial Anlysis of FFC For InvestorsAli KhanNo ratings yet

- INTERESTDocument25 pagesINTERESTabdiel50% (2)

- 10 CalculationsDocument4 pages10 Calculationsapi-5530062No ratings yet

- CFA Fin Round FormulasDocument1 pageCFA Fin Round FormulasgNo ratings yet

- FORMULAEDocument3 pagesFORMULAEmikaenonNo ratings yet

- Corporate Finance SummaryDocument17 pagesCorporate Finance SummaryJessyNo ratings yet

- Stock Valuation: Answers To Concepts Review and Critical Thinking Questions 1Document19 pagesStock Valuation: Answers To Concepts Review and Critical Thinking Questions 1Diệu QuỳnhNo ratings yet

- NOTES On Finma Mod 3 Stocks and Their ValuationDocument4 pagesNOTES On Finma Mod 3 Stocks and Their ValuationLeyanna Pauleen VillanuevaNo ratings yet

- Operation Leverage-Financial Leverage and Break Even PointDocument3 pagesOperation Leverage-Financial Leverage and Break Even PointAmar Stunts ManNo ratings yet

- Valuation of SharesDocument23 pagesValuation of SharesRuchi SharmaNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Pfmar SampleDocument15 pagesPfmar SampleJustin Briggs86% (7)

- Second Division: Republic of The Philippines Court of Tax Appeals Quezon CityDocument8 pagesSecond Division: Republic of The Philippines Court of Tax Appeals Quezon CityCamille CastilloNo ratings yet

- HP ELITEBOOK 8740W Inventec Armani 6050A2266501Document61 pagesHP ELITEBOOK 8740W Inventec Armani 6050A2266501Gerardo Mediabilla0% (2)

- Basic Details: Government Eprocurement SystemDocument4 pagesBasic Details: Government Eprocurement SystemNhai VijayawadaNo ratings yet

- Sparse ArrayDocument2 pagesSparse ArrayzulkoNo ratings yet

- WS-250 4BB 60 Cells 40mm DatasheetDocument2 pagesWS-250 4BB 60 Cells 40mm DatasheetTejash NaikNo ratings yet

- 50 Hotelierstalk MinDocument16 pages50 Hotelierstalk MinPadma SanthoshNo ratings yet

- Che 342 Practice Set I IDocument4 pagesChe 342 Practice Set I IDan McNo ratings yet

- Claim Age Pension FormDocument25 pagesClaim Age Pension FormMark LordNo ratings yet

- Glaciogenic: Hydrocarbon SystemsDocument2 pagesGlaciogenic: Hydrocarbon SystemsAHMEDNo ratings yet

- Mercantile Law Zaragoza Vs Tan GR. No. 225544Document3 pagesMercantile Law Zaragoza Vs Tan GR. No. 225544Ceasar Antonio100% (1)

- MIami Beach City Attorney's DenialDocument7 pagesMIami Beach City Attorney's DenialDavid Arthur WaltersNo ratings yet

- On The Backward Problem For Parabolic Equations With MemoryDocument19 pagesOn The Backward Problem For Parabolic Equations With MemorykamranNo ratings yet

- Digest of Ganila Vs CADocument1 pageDigest of Ganila Vs CAJohn Lester LantinNo ratings yet

- Pavement Design - (Rigid Flexible) DPWHDocument25 pagesPavement Design - (Rigid Flexible) DPWHrekcah ehtNo ratings yet

- 2 1 PDFDocument18 pages2 1 PDFالمهندسوليدالطويلNo ratings yet

- TC 9-237 Welding 1993Document680 pagesTC 9-237 Welding 1993enricoNo ratings yet

- Danais 150 ActuadoresDocument28 pagesDanais 150 Actuadoresedark2009No ratings yet

- Business Mathematics and Statistics: Fundamentals ofDocument468 pagesBusiness Mathematics and Statistics: Fundamentals ofSamirNo ratings yet

- PDFDocument18 pagesPDFDental LabNo ratings yet

- Basics Stats Ti NspireDocument7 pagesBasics Stats Ti NspirePanagiotis SotiropoulosNo ratings yet

- Ibm v3700 Storeage PDFDocument694 pagesIbm v3700 Storeage PDFJanakackvNo ratings yet

- CH 3 Revision Worksheet 2 Class 6 CSDocument1 pageCH 3 Revision Worksheet 2 Class 6 CSShreyank SinghNo ratings yet

- Lec05-Brute Force PDFDocument55 pagesLec05-Brute Force PDFHu D ANo ratings yet

- Millets: Future of Food & FarmingDocument16 pagesMillets: Future of Food & FarmingKIRAN100% (2)

- AMCHAM Press ReleaseDocument1 pageAMCHAM Press ReleaseAnonymous FnM14a0No ratings yet

- Computer Graphics Mini ProjectDocument25 pagesComputer Graphics Mini ProjectGautam Singh78% (81)

- (1895) Indianapolis Police ManualDocument122 pages(1895) Indianapolis Police ManualHerbert Hillary Booker 2ndNo ratings yet

- Firmware Upgrade To SP3 From SP2: 1. Download Necessary Drivers For The OMNIKEY 5427 CKDocument6 pagesFirmware Upgrade To SP3 From SP2: 1. Download Necessary Drivers For The OMNIKEY 5427 CKFilip Andru MorNo ratings yet

- Bemts-I (A) : Air Uni IsbDocument11 pagesBemts-I (A) : Air Uni IsbUmair AzizNo ratings yet