Professional Documents

Culture Documents

Bonds

Bonds

Uploaded by

Samah KamelCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bonds

Bonds

Uploaded by

Samah KamelCopyright:

Available Formats

What is the Bond?

A bond is a long-term contract under which a borrower agrees to make payments of

interest and principal, on specific dates, to the holders of the bond. In another word bond

represent a long term debt from issuer’s point of view and a security from holder’s point

of view.

The value of the bond is affected by the following:-

Face value: which will be repaid back at maturity date

Coupon Rate: interest rate of the bond and compared to market rate

Tenor : No. of Years till maturity

Illustrative Example:

On January, 2003, ABC co. borrowed $50 Million by issuing bonds over 10 years, Face

Value $1000 @ 6% coupon rates per annum. In exchange it promised to make annual

interest payments and to repay the $50 Million on a specified maturity date (January

2013, which is after 10 Years).

Bonds are classified into four main types: Treasury, corporate, municipal, and foreign.

1. Treasury Bonds

Treasury Bonds referred to government bonds since it’s issued by the U.S. federal

government. It is reasonable to assume that the federal government will make good on its

promised payments, so these bonds have no default risk. Because it is guaranteed by

federal government however Value of the bonds itself May be decline when interest rates

rise in the market.

2. Corporate Bonds

Corporate bonds indicate that bond is issued by corporations but corporate bonds are

exposed to default risk if the issuing company gets into trouble or Bankruptcy, it may be

unable to make the promised interest and principal payments. Different corporate bonds

have different levels of default risk, depending on the issuing company’s characteristics

and the terms of the specific bond. Default risk often is referred to as “Credit Risk” the

larger the default or credit risk, the higher the interest rate the issuer must pay.

Bonds & Bond Valuation Page 1

3. Municipal Bonds (Munis)

Municipal bonds are issued by state and local governments. Like corporate bonds, have

default risk. However, (Munis) offer one major advantage over all other bonds: the

interest earned on most municipal bonds is exempt from federal taxes and also from state

taxes if the holder is a resident of the issuing state consequently, municipal bonds carry

interest rates that are considerably lower than those on corporate bonds with the same

default risk.

4. Foreign Bonds

Foreign Bonds are issued by foreign governments or foreign corporations so foreign

corporate bonds are exposed to default risk, in addition to currency risk if the bonds are

denominated in a currency other than that of the investor’s home currency. For example,

if a U.S. investor purchases a corporate bond denominated in Japanese yen and the yen

subsequently falls relative to the dollar, then the investor will lose money, even if the

company doesn’t default on its bonds.

Key Features of a Bond

1. Par value: Face value of the bond i.e. amount that be paid at maturity date.

2. Coupon: Stated interest rate Multiply by face value to get dollars of interest

(Coupon could be Fixed or Floating but generally is fixed)

3. Maturity: Number of years until bond must be repaid back.

4. Issue date: Date when bond was issued.

5. Default Risk: When the issuer will not be able to pay interest payment (Coupon) or

Principal Payments.

6. Callable Bonds: when the interest rates decline in the market, the issuer may

payback the value of the bonds before its maturity, therefore, borrowers are willing to

pay more, and lenders require more, on callable bonds.

Bonds & Bond Valuation Page 2

7. Redeemable Bond

A redeemable bond gives the investor the right to sell the bond back to the issuing

company at a previously specified price. This is a useful feature (for investors) if

interest rates rise or if the company engages in unanticipated risky activities.

8. Convertible Bonds

Convertible bonds are convertible into shares of common stock, at a fixed price, at the

option of the bondholder. Convertibles have a lower coupon rate than non-convertible

bond, but they offer investors a chance for capital gains in exchange for the lower

coupon rate.

9. Call provision

Most corporate bonds contain a Call Provision, which gives the issuing corporation the

right to call the bonds for redemption. The call provision generally states that the

company must pay the bondholders an amount greater than the par value if they are

called. The additional sum, which is termed a Call Premium, is often set equal to one

year’s interest if the bonds are called during the first year, and the call premium decrease

at a constant rate annually.

10. Sinking Funds Provision

Sinking fund provision facilitates to buy back the issued Bonds through 2 ways:-

A. The company can call bonds for redemption at par value for a certain percentage

of the Bonds each year according to serial number of bonds or by a lottery

administered by the trustee. (Amortization).

B. The company may buy the required number of bonds on the open market.

Bonds & Bond Valuation Page 3

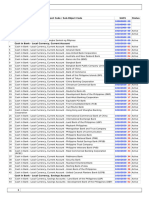

Bond Ratings Provide One Measure of Default Risk

Investment Grade Junk Bonds

Moody’s Aaa Aa A Baa Ba B Caa C

S&P AAA AA A BBB BB B CCC D

Bond Ratings and Bond Spreads

Long-Term Bonds Yield Spread

U.S. Treasury 5.25%

AAA 6.26 1.01%

AA 6.42 1.17

A 6.54 1.29

BBB 6.60 1.35

BB 7.80 2.55

B 8.42 3.17

CCC 10.53 5.28

Annuity

Annuity is a series of equal payments made at fixed intervals for a specified number of

periods. For example, $100 at the end of each of Month or year for the next three years,

and they can occur at either the Beginning or the End of each period.

A. Ordinary Annuity

If the payments occur at the end of each period, the annuity is called an ordinary, or

deferred, annuity.

B. Annuity due

If payments are made at the beginning of each period, the annuity is called an annuity

due.

Bonds & Bond Valuation Page 4

The Value of a Bond

The value of a bond is found as the present value of an annuity (the interest payments)

plus the present value of (the principal). The bond is evaluated at the appropriate periodic

interest rate over the number of periods for which interest payments are made.

Example (1)

ABC Company issued a bond with face value for $1000, paid annual 10% coupon and 3

years to maturity, what is the value of ABC bonds today if the required rate of return is

12%.

Answer:

Coupon = 1000x10%= $ 100

PV = 100 + 100 + 100 + 1000

2

(1.12)1 (1.12) (1.12)3 (1.12)3

Ordinary Annuity table PV table

Interest = 12% & N= 3 Interest = 12% & N= 3

PV = 100 X 2.40183 + 1000X 0.71178 =

PV= 240.18 + 711.78 = 951.96 ≈ $ 952

Suppose that maturity date is only 2 Years, what will be the value of ABC bond?

PV = 100 + 100 + 1000

(1.12)1 (1.12)2 (1.12)2

Ordinary Annuity Table PV Table

Interest = 12% & N= 2 Interest = 12% & N= 2

Bonds & Bond Valuation Page 5

PV = 100X 1.69005 + 1000X0.79719

PV = 169 + 797.19 = $ 966.19≈ $ 966

Suppose that maturity date is only 1 Year, what will be the value of ABC bond?

PV = 1100 = 982.14 ≈ 982

1.12

Suppose that maturity date is only 3 Years, but required rate of return is 8%, what will

be the value of ABC bond?

PV = 100 + 100 + 100 + 1000

(1.08)1 (1.08)2 (1.08)3 (1.08)3

Ordinary Annuity table PV table

Interest = 8% & N= 3 Interest = 8% & N= 3

PV = 100X2.57710 + 1000X0.79383

PV = 257.71 + 793.83 = $ 1051.54 ≈ 1052

Suppose that maturity date is only 2 Years, but required rate of return is 8%, what will

be the value of ABC bond?

PV = 100 + 100 + 1000

(1.08)1 (1.08)2 (1.08)2

Ordinary Annuity table PV table

Interest = 8% & N= 2 Interest = 8% & N= 2

PV= 100X1.78326 + 1000X 0.85734

PV = 178.33 + 857.34 = $ 1035.67 ≈ 1036

Bonds & Bond Valuation Page 6

Suppose that maturity date is only 1 Year, but required rate of return is 8%, what will

be the value of ABC bond?

PV = 1100 = $ 1018.52 ≈ 1019

1.08

When the RRR Decreased Value of the Bond Increased

Required Rate of Return RRR @ 12% RRR @ 8%

Years

3 952 1052

2 966 1036

1 982 (+) 1019 (-)

When we are approaching maturity date, The value of the bond will approach its Face Value

Example (2)

ABC Company issued a bond with face value for $1000, Zero coupon and 5 years to

maturity, what is the value of ABC bonds today if the required rate of return is 12%.

Answer:

PV = 1000 = 1000 X 0.56743 = $ 567.43

(1.12)5

Example (3)

ABC Company issued a bond with face value for $1000, 6% Semi Annual Coupon and

2 years to maturity, what is the value of ABC bonds today if the required rate of return is

8%.

Answer:

Coupon = 1000 X 6% X ½ = $ 30

RRR (Semi Annual) = 8÷2 = 4%

PV = 30 + 30 + 30 + 30 + 1000

(1.04)1 (1.04)2 (1.04)3 (1.04)4 (1.04)4

Ordinary Annuity Table PV Table

Interest = 4% & N= 4 Interest = 4% & N= 4

Bonds & Bond Valuation Page 7

PV = 30 X 3.62990 + 1000 X 0.85480

PV = 108.90 + 854.80 = $ 963.70

Bond Yield to Maturity (YTM)

YTM is the rate of return earned on a bond held to maturity. Also called “promised

yield.”

Example (4)

14 Years bond, 10% Coupon, $ 1000 par value, bond price at $1494.93 what is rate of

interest would you earn on your investment if you held the bond till maturity?

Answer:

1494.93 = 100 + 100 + …………… + 100 + 1000

(1+r) 1 (1+r) 2

(1+r) 14 (1+r) 14

We use trail & error or Financial Calculator we reach to 5%

To proof the Result

100 x 9.89864 + 1000 x 0.50507

989.86 + 505.07 = $ 1494.93 (Which is equal to bond price)

Bond Current Yield

It is the annual interest payment divided by the bond current value

Example (5)

A bond currently sells at $ 985 and pay a coupon 10% what is the current yield?

Answer:

Current yield = 100 x 100 = 10.15%

985

Example (6)

Heath Foods’ bonds have 7 years remaining to maturity. The bonds have a face value of

$1,000 and a yield to maturity of 8 percent. They pay interest annually and have a 9

percent coupon rate. What is their current yield?

Bonds & Bond Valuation Page 8

Answer:

PV = 90 + 90 +……………… + 90 + 1000

(1.08)1 (1.08)2 (1.08)7 (1.08)7

Ordinary Annuity Table PV Table

Interest =8% & N= 7 Interest = 8% & N= 7

PV = 90 X 5.20637 + 1000 X 0.58349

PV = 468.57 + 583.49 = $ 1052.06

Current Yield = 90 X 100 = 8.55%

1052.06

Example (7)

Callaghan Motors’ bonds have 12 years remaining to maturity. Interest is paid annually,

the bonds have a $1,000 par value, and the coupon interest rate is 8 Percent. The bonds

have a yield to maturity of 9 Percent. What is the current market price of these bonds?

Answer:

Coupon = 1000 x 8% = $ 80

PV = 80 + 80 +……………… + 80 + 1000

(1.09)1 (1.09)2 (1.09)12 (1.09)12

Ordinary Annuity Table PV Table

Interest = 9% & N= 12 Interest = 9% & N= 12

PV = 80 X 7.16073 + 1000 X 0.35553

PV = 572.86 + 355.53 = $ 928.39

Assignment: (5-1) & (5-3) & (5-7) & (5-9) & (5-14)

Bonds & Bond Valuation Page 9

Challenging Example (8)

Suppose Ford Motor Company sold an issue of bonds with a 10-year maturity, a $1,000

par value, a 10 percent coupon rate, and Semiannual interest payments.

A. Two years after the bonds were issued, the going rate of interest on bonds such as

these fell to 6 percent. At what price would the bonds sell?

B. Suppose that, 2 years after the initial offering, the going interest rate had risen to 12

percent. At what price would the bonds sell?

Answer:

Coupon = 1000 x 10% X ½ = $ 50

Remaining Years till Maturity = 10 – 2 = 8 years = 8x 2 = 16 period

Interest (Paid Semi Annual) = 6÷ 2 = 3 %

A)-

PV = 50 + 50 +……………… + 50 + 1000

(1.03)1 (1.03)2 (1.03)16 (1.03)16

Ordinary Annuity Table PV Table

Interest = 3% & N= 16 Interest = 3% & N= 16

PV = 50 X 12.56110 + 1000 X 0.62317

PV = 628.06 + 623.17 = $ 1251.23

B) - Interest (Paid Semi Annual) = 12÷ 2 = 6 %

PV = 50 + 50 +……………… + 50 + 1000

(1.06)1 (1.06)2 (1.06)16 (1.06)16

Ordinary Annuity Table PV Table

Interest = 6% & N= 16 Interest = 6% & N= 16

PV = 50 X 10.1059 + 1000 X 0.39365

PV = 505.30 + 393.65 = $ 898.95

Bonds & Bond Valuation Page 10

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter 6 Pilbeam Finance and Financial Markets 4th EditionDocument64 pagesChapter 6 Pilbeam Finance and Financial Markets 4th EditionJay100% (1)

- EFB201 Fixed Income and Equity Markets Part B TutDocument4 pagesEFB201 Fixed Income and Equity Markets Part B Tuthowunfung0705No ratings yet

- Midterm QuestionsDocument1 pageMidterm QuestionsJanviNo ratings yet

- Fundamentals of Derivatives Markets 1st Edition Mcdonald Test BankDocument6 pagesFundamentals of Derivatives Markets 1st Edition Mcdonald Test Bankanselmthangxu5eo0100% (33)

- AI and Financial MarketsDocument232 pagesAI and Financial MarketsPriscilla Philip WilliamNo ratings yet

- Economics of Money Banking and Financial Markets Business School Edition 4th Edition Mishkin Solutions ManualDocument18 pagesEconomics of Money Banking and Financial Markets Business School Edition 4th Edition Mishkin Solutions ManualBrianJimenezanco100% (57)

- Final Reviewer Mathematics InvestmentDocument2 pagesFinal Reviewer Mathematics InvestmentChello Ann AsuncionNo ratings yet

- Chart of AccountDocument31 pagesChart of Accountjerome.barco.0694No ratings yet

- Lecture1 - Nov 2021 - IntroDocument30 pagesLecture1 - Nov 2021 - IntroJoanNo ratings yet

- Warmup MockDocument58 pagesWarmup MockAviral Sao0% (1)

- Financial Markets and Institutions Mishkin 8th Edition Test BankDocument37 pagesFinancial Markets and Institutions Mishkin 8th Edition Test Bankannealingterreenr7u591100% (11)

- Recommendations of Narsimha CommitteeDocument10 pagesRecommendations of Narsimha CommitteePrathamesh DeoNo ratings yet

- An Assignment of Stock Exchange & Portfolio Management: Topic: - International Bond MarketDocument18 pagesAn Assignment of Stock Exchange & Portfolio Management: Topic: - International Bond MarketashishNo ratings yet

- Credit Suisse Global Investment Yearbook 2011Document56 pagesCredit Suisse Global Investment Yearbook 2011vibhavaidhyaNo ratings yet

- ReillyBrown IAPM 11e PPT Ch12Document68 pagesReillyBrown IAPM 11e PPT Ch12rocky wongNo ratings yet

- Bond and Bond Features and Its Example AssignmentDocument4 pagesBond and Bond Features and Its Example AssignmentWaqaarNo ratings yet

- HihiDocument20 pagesHihiCath OquialdaNo ratings yet

- Analyzing Hedging Strategies For Fixed Income Portfolios: A Bayesian Approach For Model SelectionDocument18 pagesAnalyzing Hedging Strategies For Fixed Income Portfolios: A Bayesian Approach For Model SelectionTitilianNo ratings yet

- 1 s2.0 S0040162522002414 MainDocument39 pages1 s2.0 S0040162522002414 MainKeamogetse MotlogeloaNo ratings yet

- White and Black Professional Magazine CoverDocument30 pagesWhite and Black Professional Magazine CovershubhamgaurNo ratings yet

- AR GB en IE00B8JFF067 YES 2022-04-30Document189 pagesAR GB en IE00B8JFF067 YES 2022-04-30richard87bNo ratings yet

- Ltcma Full ReportDocument136 pagesLtcma Full ReportSricharanNo ratings yet

- Daily Report: News & UpdatesDocument3 pagesDaily Report: News & UpdatesМөнхбат ДоржпүрэвNo ratings yet

- Fundamentals of Corporate Finance Canadian 3Rd Edition Berk Test Bank Full Chapter PDFDocument58 pagesFundamentals of Corporate Finance Canadian 3Rd Edition Berk Test Bank Full Chapter PDFRussellFischerqxcj100% (12)

- Ross12e Chapter27 TBDocument12 pagesRoss12e Chapter27 TBhi babyNo ratings yet

- Part 1. Multiple Choice Questions There Are 10 Questions in This Part. Answer ALL Questions. Give ONE Answer Only For EachDocument5 pagesPart 1. Multiple Choice Questions There Are 10 Questions in This Part. Answer ALL Questions. Give ONE Answer Only For EachDung ThùyNo ratings yet

- BMAK Lectures III Part2Document83 pagesBMAK Lectures III Part2theodoreNo ratings yet

- Statistical Measures For RiskDocument17 pagesStatistical Measures For RiskShyamal75% (4)

- Why Real Yields Matter - Pictet Asset ManagementDocument7 pagesWhy Real Yields Matter - Pictet Asset ManagementLOKE SENG ONNNo ratings yet

- Lecture 1Document39 pagesLecture 1TusharNo ratings yet