Professional Documents

Culture Documents

CIVIC Rate Sheets - Eli Marcus - Rental Program

Uploaded by

ankit0203Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CIVIC Rate Sheets - Eli Marcus - Rental Program

Uploaded by

ankit0203Copyright:

Available Formats

RENTAL

LOAN PROGRAM

RESIDENTIAL

Long-term financing for the aggregation of stabilized rental properties.

CIVIC delivers speed, leverage, and consistency to highly experienced and new real estate investors.

LOAN PROGRAM: 5/1 ARM 7/1 ARM 10/1 ARM

INTEREST RATE: 6.25%+ 6.50%+ 6.75%+

PREPAYMENT PENALTY: 3% - 2% - 1% 4% - 3% - 2% - 1% 5% - 4% - 3% - 2% - 1%

GENERAL GUIDELINES

� Portfolio or Single Asset loans � Non-owner occupied only

� 30 year loans, fixed for 5, 7, or 10 years � Stabilized rental properties (leased or soon-to-be leased)

� Interest only for fixed period � Bank Statements only / no personal income verification

� Min. FICO: 600 � No DTI requirements for borrower

1

� Max LTV : 75%-80% (Purchase, Rate & Term, Cash-Out) � Non-Recourse available

� Property Types: SFR, 2-4 units, Condos, PUD’s, Townhomes � Minimal DSCR requirements

� Loans to individuals or entities � Lender Fee: $1,195

� Lending in: AZ, CA, CO, FL, GA, HI, NC, NV, OR, SC, TN, TX, UT, VA, WA � No yield maintenance- sliding pre-pay only

PORTFOLIO SINGLE ASSET

NUMBER OF PROPERTIES: UP TO 10 PROPERTIES 1 PROPERTY

DSCR: 1.10 1.00

LOAN AMOUNTS: $100K-$10MM $75K-$2MM

1. 75-80% LTV available to well qualified borrowers on properties located in major metropolitan areas.

AGGREGATE RENTAL PROPERTIESWITH EASE.

LTV is subject to decrease based on property location, property condition and borrower qualifications.

Financing up to 90% of the purchase price, so long as not exceeding designated max LTV. DISCOVER THE CIVIC DIFFERENCE.

OPPORTUNITY UNLEASHED.

TM

ELI MARCUS

Account Executive

NMLS# 1099109

eli.marcus@civicfs.com

Direct (424) 336-7527

Mobile (310) 801-6493 www.elimarcus.civicfs.com

V.2_060519

You might also like

- Corinthian Newsletter (Feb 2010)Document1 pageCorinthian Newsletter (Feb 2010)austin1467No ratings yet

- Cogo Programs 2020Document2 pagesCogo Programs 2020Robert WinderNo ratings yet

- Conventional Bridge Loan FinancingDocument1 pageConventional Bridge Loan FinancingcambridgecapNo ratings yet

- Centex Funding: General InfoDocument1 pageCentex Funding: General InfoDarnellNo ratings yet

- Credit Builder ProductsDocument4 pagesCredit Builder ProductsOsborne StricklandNo ratings yet

- Presentation On Credit: Prepared byDocument32 pagesPresentation On Credit: Prepared bymoidulmktduNo ratings yet

- CMHC Newcomers: Mortgage Loan InsuranceDocument2 pagesCMHC Newcomers: Mortgage Loan Insurancemubarak5No ratings yet

- Bridge Loans: Summary of TermsDocument1 pageBridge Loans: Summary of Termstristan tongsonNo ratings yet

- Dbrs Rmbs Criteria 2004-12Document12 pagesDbrs Rmbs Criteria 2004-12janisnagobadsNo ratings yet

- Learnings from Financial DisastersDocument33 pagesLearnings from Financial DisastersChip choiNo ratings yet

- Loan Against Property for IndividualsDocument2 pagesLoan Against Property for IndividualsRohith RaoNo ratings yet

- Nomura Home Equity ABS BasicsDocument24 pagesNomura Home Equity ABS Basicsxckvhbxclu12No ratings yet

- CTA 401 (K) and 457 (B) Retirement Loan InformationDocument2 pagesCTA 401 (K) and 457 (B) Retirement Loan InformationChicago Transit Justice CoalitionNo ratings yet

- Scheme SummaryDocument16 pagesScheme SummarySuraj GorNo ratings yet

- Howard MarksDocument15 pagesHoward Marksa4agarwalNo ratings yet

- Personal Loans - MITCDocument2 pagesPersonal Loans - MITCVijay KumarNo ratings yet

- Flier Advertising Affordable Apartments at Herring Brook Hill in Norwell, Mass.Document1 pageFlier Advertising Affordable Apartments at Herring Brook Hill in Norwell, Mass.Michael D KaneNo ratings yet

- Multifamily Express: Real Estate Capital MarketsDocument1 pageMultifamily Express: Real Estate Capital MarketsbobNo ratings yet

- Ohana Hale Approved LendersDocument2 pagesOhana Hale Approved LendersJonathan PangNo ratings yet

- HDFC Credit Rating 'FAAA' & 'MAAADocument5 pagesHDFC Credit Rating 'FAAA' & 'MAAAmayurdjNo ratings yet

- Educational Loan RateDocument18 pagesEducational Loan RateRick VivekNo ratings yet

- Chap-17-Lending Policies and ProceduresDocument30 pagesChap-17-Lending Policies and ProceduresNazmul H. PalashNo ratings yet

- Flexible Mortgage Solutions For Extraordinary People: Multi-FamilyDocument8 pagesFlexible Mortgage Solutions For Extraordinary People: Multi-FamilyDarnellNo ratings yet

- Important Lending Regulations: Credmfi/FincredDocument11 pagesImportant Lending Regulations: Credmfi/FincredNina CruzNo ratings yet

- Safari - Jun 5, 2019 at 9:49 PMDocument1 pageSafari - Jun 5, 2019 at 9:49 PMamir.jahed50No ratings yet

- Interest Rates Union Bank of IndiaDocument1 pageInterest Rates Union Bank of IndiaNanki SNo ratings yet

- Freddie Mac: Small Balance Loan ProgramDocument1 pageFreddie Mac: Small Balance Loan ProgramJack GilbertNo ratings yet

- RealPoint CMBS Methodology DisclosureDocument19 pagesRealPoint CMBS Methodology DisclosureCarneadesNo ratings yet

- Capital Structure PDFDocument27 pagesCapital Structure PDFJoshua RansomNo ratings yet

- Broker Program NewDocument2 pagesBroker Program NewJuan P. TestaNo ratings yet

- Competitive Effects of Basel II On U.S. Bank Credit Card LendingDocument24 pagesCompetitive Effects of Basel II On U.S. Bank Credit Card Lending230128No ratings yet

- Grow Long Beach Fund Term SheetDocument1 pageGrow Long Beach Fund Term SheetCFANo ratings yet

- MSME PRIME PLUS Loan Parameters and EligibilityDocument2 pagesMSME PRIME PLUS Loan Parameters and Eligibilityomkar maharanaNo ratings yet

- A Securities-Based Line of Credit For Real Estate ProfessionalsDocument12 pagesA Securities-Based Line of Credit For Real Estate ProfessionalsJulesNo ratings yet

- 02.02.10 Home Loan RatesDocument2 pages02.02.10 Home Loan Ratesscottyj13No ratings yet

- Cred and BudgDocument26 pagesCred and BudgAndrea SesennaNo ratings yet

- Real Estate CDO and CDS LectureDocument25 pagesReal Estate CDO and CDS Lecturefunkchunk33No ratings yet

- VATRAININGPOWERPTDocument59 pagesVATRAININGPOWERPTboxxer01833100% (1)

- Prime: Prime at A GlanceDocument2 pagesPrime: Prime at A GlanceTanase BandaNo ratings yet

- Commercial HandoutDocument2 pagesCommercial HandoutFuji FlynnNo ratings yet

- 4 PM PST Cutoff Time. 3PM PST Cutoff For NON QM Rate Lock RequestDocument1 page4 PM PST Cutoff Time. 3PM PST Cutoff For NON QM Rate Lock RequestAnonymous Dxq7D7kN9No ratings yet

- EXp AffiliatedBusinessDisclosure DigiSignDocument3 pagesEXp AffiliatedBusinessDisclosure DigiSignMorenita ParelesNo ratings yet

- 3 Real Estate As An Asset Class PassuggDocument38 pages3 Real Estate As An Asset Class PassuggLeon M. EggerNo ratings yet

- Prepare Quiz 1Document11 pagesPrepare Quiz 1Fransiskus AdityaNo ratings yet

- Positioning Your Case For Success: Financial UnderwritingDocument3 pagesPositioning Your Case For Success: Financial UnderwritinganeeshNo ratings yet

- Dev Strischek SVP Credit Policy Officer SunTrust BankDocument46 pagesDev Strischek SVP Credit Policy Officer SunTrust Bankprash.rajuNo ratings yet

- Franchise Financing Scheme (FFS) Credit Guarantee Corporation - Powering Malaysian SMEs®Document2 pagesFranchise Financing Scheme (FFS) Credit Guarantee Corporation - Powering Malaysian SMEs®ydjnaxNo ratings yet

- Sbloc FlyerDocument1 pageSbloc Flyerapi-183669361No ratings yet

- Chapter 13: Commercial Bank Operations 3edDocument26 pagesChapter 13: Commercial Bank Operations 3edMarwa HassanNo ratings yet

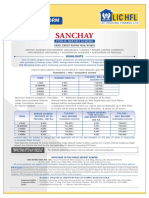

- LIC Housing Finance LTD FDDocument6 pagesLIC Housing Finance LTD FDBiswa Jyoti GuptaNo ratings yet

- Margin Calls: Overlooked Risk When Buying High-Priced PropertiesDocument12 pagesMargin Calls: Overlooked Risk When Buying High-Priced PropertiesYC TeoNo ratings yet

- Loan-Level Price Adjustment (LLPA) MatrixDocument8 pagesLoan-Level Price Adjustment (LLPA) MatrixLashon SpearsNo ratings yet

- Prudential Regulations For Consumer Financing: Important DefinitionsDocument4 pagesPrudential Regulations For Consumer Financing: Important DefinitionsKhalil ShaikhNo ratings yet

- BOI MCLR 8.35 % W.E.F. 10.08.2019 & RBLR 8.25 % W.E.F. 01.09.2019 (All Charges Are Exclusive of GST)Document5 pagesBOI MCLR 8.35 % W.E.F. 10.08.2019 & RBLR 8.25 % W.E.F. 01.09.2019 (All Charges Are Exclusive of GST)AvunNo ratings yet

- Ruff Spirits - Eportfoltio PresentationDocument13 pagesRuff Spirits - Eportfoltio Presentationapi-509845050No ratings yet

- MyLoanCare Loan Against Property Comparison Jammu and Kashmir Bank HDFC BankDocument1 pageMyLoanCare Loan Against Property Comparison Jammu and Kashmir Bank HDFC BankNikita GandotraNo ratings yet

- Understanding Tax Credit CommunitiesDocument3 pagesUnderstanding Tax Credit CommunitiesJosh KwonNo ratings yet

- Chapter 10 NOTES 2021Document8 pagesChapter 10 NOTES 2021giannimizrahi5No ratings yet

- Conforming Standard Balance 2Document7 pagesConforming Standard Balance 2dmaypark209No ratings yet

- Codename Westbay RERA CertificateDocument1 pageCodename Westbay RERA Certificateankit0203No ratings yet

- Habits 1674299129Document6 pagesHabits 1674299129ankit0203No ratings yet

- 19MY Jaguar XJ Spec Sheet - tcm635-641830Document2 pages19MY Jaguar XJ Spec Sheet - tcm635-641830ankit0203No ratings yet

- BRO Volvo-B11R Eu3-5 EN 2017Document7 pagesBRO Volvo-B11R Eu3-5 EN 2017ankit0203No ratings yet

- 2018 Nissan Micra Active Brochure WebDocument2 pages2018 Nissan Micra Active Brochure WebExclusively AmazingNo ratings yet

- Aveza Brochure 1Document20 pagesAveza Brochure 1ankit0203No ratings yet

- Career Change TheoryDocument29 pagesCareer Change TheoryPamela Joy SeriosaNo ratings yet

- GSDocument26 pagesGSkarinadegomaNo ratings yet

- Concrete Mix DesignDocument21 pagesConcrete Mix DesignIftikhar KamranNo ratings yet

- Concrete Creep PropertiesDocument49 pagesConcrete Creep PropertiesGurram VinayNo ratings yet

- The Nightingale and The RoseDocument23 pagesThe Nightingale and The RosesaimaNo ratings yet

- Practical Research 2: Quarter 4 - Module 4Document56 pagesPractical Research 2: Quarter 4 - Module 4Kenneth EncarnacionNo ratings yet

- 2018 AACPM Curricular Guide PDFDocument327 pages2018 AACPM Curricular Guide PDFddNo ratings yet

- Emotional Intelligence: Anuj JindalDocument19 pagesEmotional Intelligence: Anuj JindalSpoorthi MeruguNo ratings yet

- Animal Kingdom ScreenplayDocument115 pagesAnimal Kingdom ScreenplayAnonymous 9oQhdeNo ratings yet

- Montessori Practical Life ExercisesDocument3 pagesMontessori Practical Life ExercisesSiti ShalihaNo ratings yet

- Harry Potter Essay 1 OutlineDocument10 pagesHarry Potter Essay 1 OutlinevickaduzerNo ratings yet

- Hedge Fund Modelling and Analysis Using Excel and VBA: WorksheetsDocument6 pagesHedge Fund Modelling and Analysis Using Excel and VBA: WorksheetsmarcoNo ratings yet

- The Lack of Sports Facilities Leads To Unhealthy LIfestyle Among StudentsReportDocument22 pagesThe Lack of Sports Facilities Leads To Unhealthy LIfestyle Among StudentsReportans100% (3)

- UED102Document24 pagesUED102Nik Noor Aisyah Mohd DaudNo ratings yet

- Right Triangle Activity For Quiz #2 - RetakeDocument4 pagesRight Triangle Activity For Quiz #2 - Retakeapi-16147700No ratings yet

- The New McGuffey Fourth Reader by VariousDocument128 pagesThe New McGuffey Fourth Reader by VariousGutenberg.orgNo ratings yet

- Partial PulpotomyDocument5 pagesPartial PulpotomyLeena Losheene VijayakumarNo ratings yet

- A Review of the Literature on Job Stress and its Impact on Public and Private Sector Employees (39 charactersDocument13 pagesA Review of the Literature on Job Stress and its Impact on Public and Private Sector Employees (39 charactersNeethu DilverNo ratings yet

- Error of DispensationalismDocument3 pagesError of DispensationalismJesus Lives100% (1)

- HL-Series Service Manual 96-8710 English June 1998Document234 pagesHL-Series Service Manual 96-8710 English June 1998kumbrov100% (1)

- IN Contemporary World: Student's NameDocument9 pagesIN Contemporary World: Student's NameJessan Ybañez JoreNo ratings yet

- Engro HRMDocument31 pagesEngro HRMtommorvoloriddle88% (17)

- Contact Session Slides Rubber Manufacture, Processing and Value Addition - 2015Document27 pagesContact Session Slides Rubber Manufacture, Processing and Value Addition - 2015Chathura Thennakoon100% (1)

- CPIO Vs SUBHASH AGGARWALDocument2 pagesCPIO Vs SUBHASH AGGARWALvaibhav joshiNo ratings yet

- Introduction To Logics and Critical Thinking SlidesDocument14 pagesIntroduction To Logics and Critical Thinking SlidesMKNo ratings yet

- Merchant Banking Roles and FunctionsDocument18 pagesMerchant Banking Roles and Functionssunita prabhakarNo ratings yet

- Xploring FLN: Resource Pack On Foundational Literacy and Numeracy (FLN)Document119 pagesXploring FLN: Resource Pack On Foundational Literacy and Numeracy (FLN)rakeshahlNo ratings yet

- Mechatronics Definition:: Task 1 - P1Document7 pagesMechatronics Definition:: Task 1 - P1mrssahar100% (1)

- Candombe para JoseDocument1 pageCandombe para JosestatuhominisNo ratings yet

- Edu 2012 Spring Fsa BooksDocument6 pagesEdu 2012 Spring Fsa BooksSivi Almanaf Ali ShahabNo ratings yet