Professional Documents

Culture Documents

DLink BUY ICICI 16.05.17

DLink BUY ICICI 16.05.17

Uploaded by

Nabeel AKOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DLink BUY ICICI 16.05.17

DLink BUY ICICI 16.05.17

Uploaded by

Nabeel AKCopyright:

Available Formats

Company Update

May 16, 2017

Rating matrix

Rating : Buy D-Link India (DLILIM) | 105

Target : | 140

Target Period : 18-24 months

Potential Upside : 34%

Hit on technologically obsolete inventory in Q4FY17

What’s Changed?

• D-Link reported 15.6% YoY decline in total revenues to | 154.8 crore

Target Changed from | 150 to | 140

as the company took a corrective action of doing away with

EPS FY18E Changed from | 11.4 to | 9.5

technologically obsolete inventory in the ongoing shift from 3G to 4G

EPS FY19E Introduced at | 11.7

Rating Unchanged in India. It is a one-time impact. Sales should recover in the coming

quarters

Key Financials

• The hit on the inventory resulted in an increase in inventory as a

percentage of sales to 89.8% vs. the average run-rate of 82-83%

| Crore FY16 FY17 FY18E FY19E

Net Sales 721.3 715.9 788.8 919.0

leading to a loss at the EBITDA level to the tune of | 1.7 crore

EBITDA 38.1 26.8 47.5 60.6 • Losses at the operating level dragged down overall profitability, hence

PAT 24.4 17.6 31.3 39.9 resulting in a PAT loss of | 1.3 crore

EPS (in |) 6.9 5.0 8.8 11.2 FY17 impacted by one offs, FY18, FY19 to be better

The management took a conscious call of deferring some sales with a

Valuation summary longer credit cycle in Q1FY17, impacting revenues in Q1. In the current

FY16 FY17 FY18E FY19E quarter, the company took a hit on the technologically obsolete inventory

P/E 15.3 21.1 11.9 9.3

in the ongoing shift from 3G to 4G in India, resulting in 15.6% YoY decline

Target P/E 20.4 28.3 15.9 12.5

EV / EBITDA 9.4 14.2 7.6 5.7

in total revenues to | 154.8 crore. It is a one-time impact. Sales should

P/BV 2.4 2.1 1.8 1.6 recover in coming quarters. It continues to see good traction in both its

RoNW 15.6 10.1 15.5 16.7 active and passive product portfolio, which constitutes about 65% & 35%

RoCE 24.2 14.8 22.9 25.3 of total revenues, respectively. With the inventory hit, the company is well

prepared with updated inventory matching the 4G needs. D-Link has also

Price Chart prepared itself for the GST regime, which will lead to added benefits

owing to input tax credits it receives on its imports. D-link is expected to

10,000 300 benefit from the government’s vision of pan-India internet connectivity

9,000

8,000 250 and its contribution in the upcoming smart city projects. We expect

7,000 200

topline to grow at 13.3% CAGR over FY17-19E to | 919.0 crore.

6,000

5,000 150

Deal with Reliance Jio to boost TeamF1 performance

4,000 The company had acquired TeamF1 Networks, which is in the business of

3,000 100

providing services in relation to the Network Security Software, test new

2,000 50

1,000 applications/enhancements and provide maintenance support for existing

0 0 applications. TeamF1 had entered announced its partnership with

Apr-15 Sep-15 Feb-16 Jul-16 Dec-16 May-17 Reliance Jio for delivering a state-of-the-art home gateway solution, joint

Price (R.H.S) Nifty (L.H.S) reference solutions for seamless “connected-home” experience for

Media, Television (IPTV, STB), Telephone (VoIP), gaming and internet,

Research Analyst which will lead to incremental revenues for the subsidiary. We expect

Bhupendra Tiwary revenues from the subsidiary to grow at 7.0% CAGR in FY17-19E to | 22.1

Bhupendra.tiwary@icicisecurities.com crore. There could be an upside risk to our estimates depending upon

further deal wins. The segment has a better margin profile and is

Sneha Agarwal accretive to overall margins of the company.

sneha.agarwal@icicisecurities.com

Available at inexpensive valuations; maintain BUY; target price | 150

D-Link is well prepared for GST. We remain bullish on the company’s

fundamental performance as it would be a vital contributor to the

government’s vision of pan-India internet connectivity owing to its wide

product portfolio. The recent alliance with Reliance Jio would also result

in incremental benefits considering the aggression being shown by Jio in

the Indian telecom space, We have rolled our valuations to FY19E and

expect D-Link to post revenue, EBITDA and PAT growth of 13.3%, 50.4%

and 50.3% CAGR in FY17-19E to | 919.0 crore, | 60.6 crore and | 39.9

crore by FY19E, respectively. The stock continues to be available at an

attractive valuation of 8.8x FY19E EPS. We value the stock at 12.5x FY19E

EPS of | 11.2 and arrive at a revised target price of | 140. We maintain

BUY recommendation on the stock.

ICICI Securities Ltd | Retail Equity Research

Variance analysis

Q4FY17 Q4FY16 Q3FY17 YoY (%) QoQ (%) Comments

Revenue 154.8 183.3 187.1 -15.6 -17.3 Corrective action taken by the company to take a hit on technologically obsolete

inventory led to losses in revenues

Other Income 0.3 0.8 1.2 -61.5 -72.6

Raw Material Expenses 119.5 154.8 168.1 -22.8 -28.9

Employee Expenses 6.5 7.5 8.2 -13.6 -21.1

Administrative Expenses 11.0 14.4 11.9 -23.6 -7.4

Marketing Expenses 0.0 0.0 0.0 NA NA

Changes in inventories of traded good 19.4 -2.0 -14.2 -1,084.2 -236.4

Other expenses 0.0 -0.6 0.0 -100.0 NA

EBITDA -1.7 9.2 13.2 -118.4 -112.8 Lower operating leverage along to inventory losses led to losses at the EBITDA level

EBITDA Margin (%) -1.1 5.0 7.0 -611 bps -813 bps

Depreciation 0.3 0.3 0.3 -10.4 -2.0

Interest 0.1 0.2 0.1 -19.4 -1.1

Total Tax -0.5 3.3 4.8 -113.8 -109.4

PAT -1.3 6.3 9.1 -121.2 -114.7

Source: Company, ICICIdirect.com Research

Change in estimates

FY18E FY19E

(| Crore) Old New % Change Introduced Comments

Revenue 913.4 788.8 -13.6 919.0 We believe the major benefits from Smart Cities and Digital India initiative will flow in from

H2FY18E onwards. Hence, we have tweaked revenue estimates in H1 leading to decline in

estimates

EBITDA 58.3 47.5 -18.6 60.6

EBITDA Margin (%) 6.4 6.0 -36 bps 6.6

PAT 40.6 31.3 -22.8 39.9

EPS (|) 11.4 8.8 -22.5 11.2

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 2

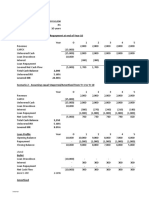

Financial summary

Profit and loss statement | Crore Cash flow statement | Crore

(Year-end March) FY16 FY17 FY18E FY19E (Year-end March) FY16 FY17E FY18E FY19E

Total operating Income 721.3 715.9 788.8 919.0 Profit after Tax 24.4 17.6 31.3 39.9

Growth (%) 12.6 -0.7 10.2 16.5 Add: Depreciation 1.7 1.5 1.7 1.7

Raw Material Expenses 604.5 566.4 634.2 738.2 Add: Interest Paid 0.4 0.5 0.8 0.8

Employee Expenses 43.4 42.3 32.3 37.7 (Inc)/dec in Current Assets -55.4 48.9 -20.1 -31.8

Administrative Expenses 53.3 51.7 56.8 63.7 Inc/(dec) in CL and Provisions 50.7 -89.0 8.9 15.9

Changes in inventories -17.9 28.7 0.0 0.0 CF from operating activities 21.7 -20.4 22.6 26.4

Total Operating Expenditure 683.3 689.2 741.3 858.4 (Inc)/dec in Fixed Assets -1.0 -0.9 -1.0 -1.0

EBITDA 38.1 26.8 47.5 60.6 Others -6.7 4.8 -12.0 -12.0

Growth (%) 12.5 -29.6 77.3 27.6 CF from investing activities -7.8 3.9 -13.0 -13.0

Depreciation 1.7 1.5 1.7 1.7 Dividend paid & dividend tax -3.0 -3.0 -3.0 -3.0

Interest 0.4 0.5 0.8 0.8 Interest Paid 0.4 0.5 0.8 0.8

Other Income 1.5 2.2 2.0 1.9 Others (3.0) 13.4 (6.6) (6.6)

PBT 37.5 27.0 47.0 60.0 CF from financing activities -5.6 11.0 -8.8 -8.8

Total Tax 13.1 9.3 15.7 20.2 Net Cash flow 8.3 -5.5 0.8 4.6

PAT 24.4 17.6 31.3 39.9 Opening Cash 0.9 9.2 3.7 4.5

Growth (%) 11.5 -27.6 77.7 27.2 Closing Cash 9.2 3.7 4.5 9.1

EPS (|) 6.9 5.0 8.8 11.2 Source: Company, ICICIdirect.com Research

Source: Company, ICICIdirect.com Research

Balance sheet | Crore Key ratios

(Year-end March) FY16 FY17 FY18E FY19E (Year-end March) FY16 FY17 FY18E FY19E

Liabilities Per share data (|)

Equity Capital 7.1 7.1 7.1 7.1 EPS 6.9 5.0 8.8 11.2

Reserve and Surplus 149.3 166.9 195.3 232.2 Cash EPS 7.3 5.4 9.3 11.7

Total Shareholders funds 156.4 174.0 202.4 239.3 BV 44.0 49.0 57.0 67.4

Total Debt 0.0 11.5 6.5 1.5 DPS 0.8 0.8 0.8 0.8

Deferred tax liability 0.0 0.0 0.0 0.0 Cash Per Share 2.4 2.8 3.3 3.8

Other Non Current Liabilities 0.1 0.1 0.1 0.1 Operating Ratios (%)

Total Liabilities 156.4 185.6 209.0 240.9 EBITDA Margin 5.3 3.7 6.0 6.6

EBIT / Total Operating income 5.0 3.5 5.8 6.4

Assets PAT Margin 3.4 2.5 4.0 4.3

Gross Block 27.7 28.6 29.6 30.6 Inventory days 50.4 35.4 35.4 35.4

Less: Acc Depreciation 8.5 10.0 11.7 13.4 Debtor days 86.9 78.7 77.1 73.3

Net Block 19.2 18.6 17.9 17.2 Creditor days 83.2 41.9 41.9 41.9

Capital WIP 0.0 0.0 0.0 0.0 Return Ratios (%)

Total Fixed Assets 19.2 18.6 17.9 17.2 RoE 15.6 10.1 15.5 16.7

Goodwill on consolidation 15.3 15.3 15.3 15.3 RoCE 24.2 14.8 22.9 25.3

Investments 5.0 - 12.0 24.0 RoIC 28.4 15.2 25.9 29.8

Inventory 99.7 69.4 76.4 89.1 Valuation Ratios (x)

Debtors 171.7 154.3 166.6 184.4 P/E 15.3 21.1 11.9 9.3

Loans and Advances 8.5 7.6 8.4 9.8 EV / EBITDA 9.4 14.2 7.6 5.7

Cash 9.2 3.7 4.5 9.1 EV / Net Sales 0.5 0.5 0.5 0.4

Other current assets 0.4 0.1 0.1 0.1 Market Cap / Sales 0.5 0.5 0.5 0.4

Total Current Assets 289.5 235.1 256.1 292.5 Price to Book Value 2.4 2.1 1.8 1.6

Creditors 164.4 82.2 90.5 105.5 Solvency Ratios

Provisions 6.9 1.7 1.9 2.2 Debt/EBITDA 0.0 0.4 0.1 0.0

Other current liabilities 5.1 3.6 3.9 4.6 Debt / Equity 0.0 0.1 0.0 0.0

Total Current Liabilities 176.5 87.5 96.4 112.3 Current Ratio 1.6 2.8 2.7 2.6

Net Current Assets 113.1 147.7 159.7 180.2 Quick Ratio 1.1 1.9 1.9 1.8

Other Non-Current assets 3.8 4.0 4.0 4.0 Source: Company, ICICIdirect.com Research

Application of Funds 156.4 185.6 209.0 240.9

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 3

RATING RATIONALE

ICICIdirect.com endeavours to provide objective opinions and recommendations. ICICIdirect.com assigns

ratings to its stocks according to their notional target price vs. current market price and then categorises them

as Strong Buy, Buy, Hold and Sell. The performance horizon is two years unless specified and the notional

target price is defined as the analysts' valuation for a stock.

Strong Buy: >15%/20% for large caps/midcaps, respectively, with high conviction;

Buy: >10%/15% for large caps/midcaps, respectively;

Hold: Up to +/-10%;

Sell: -10% or more;

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

ICICIdirect.com Research Desk,

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No 7, MIDC,

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

ICICI Securities Ltd | Retail Equity Research Page 4

ANALYST CERTIFICATION

We /I, Bhupendra Tiwary MBA, Sneha Agarwal, MBA Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately

reflect our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this

report.

Terms & conditions and other disclosures:

ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products. ICICI Securities

Limited is a Sebi registered Research Analyst with Sebi Registration Number – INH000000990. ICICI Securities is a wholly-owned subsidiary of ICICI Bank which is India’s largest private sector bank and has

its various subsidiaries engaged in businesses of housing finance, asset management, life insurance, general insurance, venture capital fund management, etc. (“associates”), the details in respect of which

are available on www.icicibank.com.

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment banking

and other business relationship with a significant percentage of companies covered by our Investment Research Department. ICICI Securities generally prohibits its analysts, persons reporting to analysts

and their relatives from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and

meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without

prior written consent of ICICI Securities. While we would endeavour to update the information herein on a reasonable basis, ICICI Securities is under no obligation to update or keep the information current.

Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended

temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where ICICI Securities might be acting in an advisory capacity to this

company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This

report and information herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial

instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their

receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific

circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment

objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate

the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities accepts no liabilities whatsoever for any

loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the

risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to

change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment

in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in

respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction.

ICICI Securities or its associates might have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the companies mentioned

in the report in the past twelve months.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did not receive any

compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI Securities nor Research Analysts

and their relatives have any material conflict of interest at the time of publication of this report.

It is confirmed that Bhupendra Tiwary MBA, Sneha Agarwal, MBA, Research Analysts of this report have not received any compensation from the companies mentioned in the report in the preceding

twelve months.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month

preceding the publication of the research report.

Since associates of ICICI Securities are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various companies including the subject

company/companies mentioned in this report.

It is confirmed that Bhupendra Tiwary MBA, Sneha Agarwal, MBA, Research Analysts do not serve as an officer, director or employee of the companies mentioned in the report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report.

We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution,

publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and

to observe such restriction.

ICICI Securities Ltd | Retail Equity Research Page 5

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Final Mock ExamDocument16 pagesFinal Mock Examsalome75% (4)

- Fundamentals of Water System Design ASHRAE PDFDocument350 pagesFundamentals of Water System Design ASHRAE PDFNabeel AK100% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter 3 Vertical & Horizontal AnalysisDocument21 pagesChapter 3 Vertical & Horizontal AnalysisWijdan Saleem EdwanNo ratings yet

- Bullet Vs AmortisationDocument4 pagesBullet Vs Amortisationsalih jaaparNo ratings yet

- 04-Samss-35 ValvesDocument28 pages04-Samss-35 ValvesNabeel AKNo ratings yet

- 14.sk-Calc14 Hydraulic Calculation - PipingDocument8 pages14.sk-Calc14 Hydraulic Calculation - PipingNabeel AKNo ratings yet

- 03.sk-Calc03 Calculation - HvacDocument128 pages03.sk-Calc03 Calculation - HvacNabeel AKNo ratings yet

- Suprajit Engineering 24112017Document6 pagesSuprajit Engineering 24112017Nabeel AKNo ratings yet

- The Shareholders Are General Agents of The Business. Pre-Emptive RightDocument20 pagesThe Shareholders Are General Agents of The Business. Pre-Emptive RightSaeym SegoviaNo ratings yet

- FABM2 Q1 Module 5 Analysis and Interpretation of Financial Statements - editEDDocument31 pagesFABM2 Q1 Module 5 Analysis and Interpretation of Financial Statements - editEDMecaila libaton100% (2)

- Members. - Corporators Are Those Who Compose A CorporationDocument9 pagesMembers. - Corporators Are Those Who Compose A CorporationchristineNo ratings yet

- Capital Budgeting - 2021Document7 pagesCapital Budgeting - 2021Mohamed ZaitoonNo ratings yet

- Midterm Exam DWCLDocument12 pagesMidterm Exam DWCLHakdog HatdogNo ratings yet

- CBK Test QuestionsDocument2 pagesCBK Test QuestionsMehul GuptaNo ratings yet

- Business LawDocument23 pagesBusiness LawCris EzechialNo ratings yet

- COSTING Chapter 2Document14 pagesCOSTING Chapter 2Raksha ShettyNo ratings yet

- Tata Power Company: Capital StructureDocument5 pagesTata Power Company: Capital Structureharsh kotNo ratings yet

- Antraweb Technologies PVT LTD FY 2018Document26 pagesAntraweb Technologies PVT LTD FY 2018Bhavin SagarNo ratings yet

- Chairman's Letter - 1981Document14 pagesChairman's Letter - 1981Dan-S. ErmicioiNo ratings yet

- Worldcom FraudDocument20 pagesWorldcom FraudAfdal SyarifNo ratings yet

- Chap 004Document95 pagesChap 004kwathom1100% (2)

- 空头交易 the sale of securities or commodities that the seller does not possess or has not contracted for at the time of the saleDocument4 pages空头交易 the sale of securities or commodities that the seller does not possess or has not contracted for at the time of the salepolkapolkapolkaNo ratings yet

- Chapter 1 Acct 2121Document39 pagesChapter 1 Acct 2121kirbydegay1028No ratings yet

- Corporation Law ReviewerDocument3 pagesCorporation Law ReviewerJada WilliamsNo ratings yet

- R30 Discounted Dividend Valuation Q Bank PDFDocument9 pagesR30 Discounted Dividend Valuation Q Bank PDFZidane KhanNo ratings yet

- CFAS Qualifying Exam ReviewerDocument15 pagesCFAS Qualifying Exam ReviewerJoyceNo ratings yet

- Homework For Debt & EquityDocument6 pagesHomework For Debt & EquityPetra100% (1)

- I. Before The Presentation Ex. 1. Study The Topical Vocabulary and Match Words or Phrases With Their Definitions: 1Document4 pagesI. Before The Presentation Ex. 1. Study The Topical Vocabulary and Match Words or Phrases With Their Definitions: 1Екатерина БелоусоваNo ratings yet

- Ey 2022 Practitioner Cost of Capital WaccDocument26 pagesEy 2022 Practitioner Cost of Capital WaccFrancescoNo ratings yet

- Term PaperDocument33 pagesTerm PaperSP Vet100% (1)

- Free Cash FlowDocument8 pagesFree Cash FlowSisila Agusti AnggrainiNo ratings yet

- Audit MCQ MapsDocument131 pagesAudit MCQ Mapslans100% (1)

- Presentation On Preferential Allotment' - by Mahavir LunawatDocument37 pagesPresentation On Preferential Allotment' - by Mahavir LunawatArunachalam SubramanianNo ratings yet

- Tata Metaliks Limited - R - 24112020 PDFDocument3 pagesTata Metaliks Limited - R - 24112020 PDFHitesh ModiNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasKate Crystel reyesNo ratings yet