Professional Documents

Culture Documents

Itr-V Indian Income Tax Return Verificat

Uploaded by

MOHD AslamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Itr-V Indian Income Tax Return Verificat

Uploaded by

MOHD AslamCopyright:

Available Formats

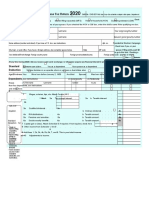

INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year

FORM 2018-19

ITR-V [Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3,

ITR-4(SUGAM), ITR-5, ITR-7 transmitted electronically without digital signature] .

(Please see Rule 12 of the Income-tax Rules, 1962)

Name PAN

MAHUA CHATTOPADHYAYA

PERSONAL INFORMATION AND THE

AOCPC8336F

Form No. which

DATE OF ELECTRONIC

Flat/Door/Block No Name Of Premises/Building/Village

has been ITR-3

TRANSMISSION

QUARTER NO. 41, UGC COLONY,

electronically

transmitted

Road/Street/Post Office Area/Locality

IIT(ISM) DHANBAD Individual

Status

Town/City/District State Pin/ZipCode Aadhaar Number/ Enrollment ID

DHANBAD

JHARKHAND 826004 XXXX XXXX 5338

Designation of AO (Ward / Circle) ITO WARD 2(4), DHANBAD Original or Revised ORIGINAL

E-filing Acknowledgement Number 814694920180718 Date(DD-MM-YYYY) 18-07-2018

1 Gross Total Income 1 471250

2 Deductions under Chapter-VI-A 2 150000

3 Total Income 3 321250

COMPUTATION OF INCOME

a Current Year loss, if any 3a 0

4

AND TAX THEREON

4 Net Tax Payable 1095

5 Interest and Fee Payable 5 0

6 Total Tax, Interest and Fee Payable 6 1095

7 Taxes Paid

a Advance Tax 7a 0

b TDS 7b 119

c TCS 7c 0

d Self Assessment Tax 7d 980

e Total Taxes Paid (7a+7b+7c +7d) 7e 1099

8 Tax Payable (6-7e) 8 0

9 Refund (7e-6) 9 0

10 Exempt Income Agriculture 0

10

Others 0 0

VERIFICATION

I, MAHUA CHATTOPADHYAYA son/ daughter of AJIT CHAKRABORTY , holding Permanent Account Number AOCPC8336F

solemnly declare to the best of my knowledge and belief, the information given in the return and the schedules thereto which have been transmitted

electronically by me vide acknowledgement number mentioned above is correct and complete and that the amount of total income and other particulars

shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to income-tax for

the previous year relevant to the assessment year 2018-19. I further declare that I am making this return in my capacity as

INDIVIDUAL and I am also competent to make this return and verify it.

Sign here Date 18-07-2018 Place KOLKATA

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below:

Identification No. of TRP Name of TRP Counter Signature of TRP

For Office Use Only

Receipt No Filed from IP address 115.96.158.183

Date

Seal and signature of AOCPC8336F03814694920180718BF89441EACB415481537AB853B93A2BCC653EE1F

receiving official

Please send the duly signed Form ITR-V to “Centralized Processing Centre, Income Tax Department, Bengaluru 560500”, by ORDINARY

POST OR SPEED POST ONLY, within 120 days from date of transmitting the data electronically. Form ITR-V shall not be received in any other

office of the Income-tax Department or in any other manner. The confirmation of receipt of this Form ITR-V at ITD-CPC will be sent to the e-mail

address SOMUISMU@GMAIL.COM

You might also like

- Total Spanish Course: Learn Spanish With The Michel Thomas Method: Beginner Spanish Audio Course - Michel ThomasDocument5 pagesTotal Spanish Course: Learn Spanish With The Michel Thomas Method: Beginner Spanish Audio Course - Michel Thomasguhofyki0% (1)

- Case Study 6Document6 pagesCase Study 6Shaikh BilalNo ratings yet

- 1120s PDFDocument5 pages1120s PDFBreann MorrisNo ratings yet

- Windward Fund's 2018 Tax FormsDocument49 pagesWindward Fund's 2018 Tax FormsJoe SchoffstallNo ratings yet

- Profit or Loss From Business: I I I I I I I IDocument1 pageProfit or Loss From Business: I I I I I I I Idolapo BalogunNo ratings yet

- Brooklyn Museum 2019 IRS Form 990Document64 pagesBrooklyn Museum 2019 IRS Form 990Lee Rosenbaum, CultureGrrlNo ratings yet

- Sarah Scaife Foundation 251113452 2005 02496419searchableDocument47 pagesSarah Scaife Foundation 251113452 2005 02496419searchablecmf8926No ratings yet

- CPR 2022 Tax ReturnDocument1 pageCPR 2022 Tax ReturnUmair MughalNo ratings yet

- NATH f1040Document2 pagesNATH f1040Spencer NathNo ratings yet

- Math10 q2 Week1 Module1 Polynomial-Functions For-ReproductionDocument32 pagesMath10 q2 Week1 Module1 Polynomial-Functions For-ReproductionChaz grant borromeo89% (9)

- Advance Strategic Marketing: Project Report of Nayatel.Document46 pagesAdvance Strategic Marketing: Project Report of Nayatel.Omer Abbasi60% (15)

- Theory Best Suited For: Learning Theory Comparison ChartDocument1 pageTheory Best Suited For: Learning Theory Comparison ChartDAVE HOWARDNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 409150350210720 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 409150350210720 Assessment Year: 2020-21Vasanth Kumar AllaNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 592798150280920 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 592798150280920 Assessment Year: 2020-21manishNo ratings yet

- ReturnDocument41 pagesReturnsamaadhuNo ratings yet

- Return of Organization Exempt From Income Tax: WWW - Irs.gov/form990 For Instructions and The Latest InformationDocument50 pagesReturn of Organization Exempt From Income Tax: WWW - Irs.gov/form990 For Instructions and The Latest InformationNBC MontanaNo ratings yet

- 2010 Income Tax ReturnDocument2 pages2010 Income Tax ReturnCkey ArNo ratings yet

- 2013 Tax Return (Shep-Ty DBA Embrace)Document24 pages2013 Tax Return (Shep-Ty DBA Embrace)Game ChangerNo ratings yet

- A218 DocumentDocument9 pagesA218 DocumentJose AlmonteNo ratings yet

- Eric Lesser & Alison Silber - 2013 Joint Tax ReturnDocument2 pagesEric Lesser & Alison Silber - 2013 Joint Tax ReturnSteeleMassLiveNo ratings yet

- ECDC 2009 Tax ReturnDocument27 pagesECDC 2009 Tax ReturnNC Policy WatchNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21Prérńã K K ŚhãhNo ratings yet

- Hong Thien PhuocBui2018Document6 pagesHong Thien PhuocBui2018Thien BaoNo ratings yet

- Think Computer Foundation 2009 Tax ReturnDocument10 pagesThink Computer Foundation 2009 Tax ReturnTaxManNo ratings yet

- Instructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDocument72 pagesInstructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDiego12001No ratings yet

- 2019 03 27 19 17 48 254 - DGCPK4360Q - 2018Document5 pages2019 03 27 19 17 48 254 - DGCPK4360Q - 2018TAX GURUNo ratings yet

- U.S. Individual Income Tax Return: Standard DeductionDocument3 pagesU.S. Individual Income Tax Return: Standard DeductionAkNo ratings yet

- Ivan Incisor CH 2 Tax Return - For - FilingDocument4 pagesIvan Incisor CH 2 Tax Return - For - FilingShakilaMissz-KyutieJenkins100% (1)

- Tax Return 2023Document2 pagesTax Return 2023jacksonleah313No ratings yet

- Tabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingDocument3 pagesTabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingJerikah Jec HernandezNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing Statusfelix angomasNo ratings yet

- Tax - 2020-2021 PDFDocument2 pagesTax - 2020-2021 PDFShanto ChowdhuryNo ratings yet

- ShowDocument2 pagesShowBrianna Jean-BaptisteNo ratings yet

- Concentrix Daksh Services India Private Limited Payslip For The Month of September - 2021Document1 pageConcentrix Daksh Services India Private Limited Payslip For The Month of September - 2021Prity PandeyNo ratings yet

- Request For Copy of Tax Return: Form (March 2019) Department of The Treasury Internal Revenue Service OMB No. 1545-0429Document2 pagesRequest For Copy of Tax Return: Form (March 2019) Department of The Treasury Internal Revenue Service OMB No. 1545-0429DrmookieNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2019-20Document6 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2019-20Rajesh KarunakaranNo ratings yet

- Payslip 725406 CIN Aug 2021Document1 pagePayslip 725406 CIN Aug 2021Guljeet TaxationNo ratings yet

- Kia Lopez Form 1040Document2 pagesKia Lopez Form 1040Stephanie RobinsonNo ratings yet

- Captura de Pantalla T 2023-05-28 A La(s) 22.18.24Document69 pagesCaptura de Pantalla T 2023-05-28 A La(s) 22.18.24rozaj519No ratings yet

- Hillside Children's Center, New York 2014 IRS ReportDocument76 pagesHillside Children's Center, New York 2014 IRS ReportBeverly TranNo ratings yet

- 2013 AgriSafe 990Document28 pages2013 AgriSafe 990AgriSafeNo ratings yet

- Statement For Recipients of Pandemic Unemployment Assistance (Pua) Payments PUA-1099GDocument1 pageStatement For Recipients of Pandemic Unemployment Assistance (Pua) Payments PUA-1099GClifton WilsonNo ratings yet

- 2011 Irs Tax Form 1040 A Individual Income Tax ReturnDocument3 pages2011 Irs Tax Form 1040 A Individual Income Tax ReturnscribddownloadedNo ratings yet

- 2016 Merrill Taxes PDFDocument8 pages2016 Merrill Taxes PDFholymolyNo ratings yet

- 540 FinalDocument5 pages540 Finalapi-350796322No ratings yet

- MLFA Form 990 - 2016Document25 pagesMLFA Form 990 - 2016MLFANo ratings yet

- Payroll Register PD01-31-13 PDFDocument26 pagesPayroll Register PD01-31-13 PDFJoseph ManriquezNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument3 pagesU.S. Individual Income Tax Return: Filing StatuspyatetskyNo ratings yet

- Rhonda TX RTNDocument18 pagesRhonda TX RTNobriens05No ratings yet

- Important Information About Form 1099-G: J Cruz 598 Courtlandt Av Apt 2B Bronx Ny 10451Document1 pageImportant Information About Form 1099-G: J Cruz 598 Courtlandt Av Apt 2B Bronx Ny 10451Victor ErazoNo ratings yet

- PDFDocument1 pagePDFharessh100% (1)

- 2021-2022 Tax ReturnDocument3 pages2021-2022 Tax ReturnMmmmmmmNo ratings yet

- Imigracion 2Document15 pagesImigracion 2erickNo ratings yet

- Advia Credit Union 2Document1 pageAdvia Credit Union 2kathyNo ratings yet

- Tax 10986Document2 pagesTax 10986Maikeru ShogunnateMusa MNo ratings yet

- Please To Do Not Use The Back ButtonDocument2 pagesPlease To Do Not Use The Back ButtonDavid MillerNo ratings yet

- 1098T17Document2 pages1098T17RegrubdiupsNo ratings yet

- Laura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyDocument144 pagesLaura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyGabe KaminskyNo ratings yet

- Gene Locke Tax Return, 2006Document25 pagesGene Locke Tax Return, 2006Lee Ann O'NealNo ratings yet

- 2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - RecordsDocument42 pages2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - Recordsellen guthrie100% (1)

- PDF 487599040240820Document1 pagePDF 487599040240820kotasrihariNo ratings yet

- 2018 08 22 17 18 09 004 - 1534938489004 - XXXPK5111X - ItrvDocument1 page2018 08 22 17 18 09 004 - 1534938489004 - XXXPK5111X - ItrvSooraj KanojiyaNo ratings yet

- 2019 03 29 18 20 50 494 - 1553863850494 - XXXPC3953X - ItrvDocument1 page2019 03 29 18 20 50 494 - 1553863850494 - XXXPC3953X - ItrvIshaan ChawlaNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Nida KhanNo ratings yet

- Entrepreneurship 1b Make Your Idea A Reality Unit 3 Critical Thinking QuestionsDocument8 pagesEntrepreneurship 1b Make Your Idea A Reality Unit 3 Critical Thinking QuestionsNastech ProductionNo ratings yet

- Design Guide For Overhead CranesDocument3 pagesDesign Guide For Overhead CranesralluinNo ratings yet

- Notifications Under The Motor Vehicles ActDocument33 pagesNotifications Under The Motor Vehicles ActSatyadip TeraiyaNo ratings yet

- Abu Quir Iii Start Up PDFDocument18 pagesAbu Quir Iii Start Up PDFAnonymous 1XHScfCI100% (1)

- FAME - Teachers' Material TDocument6 pagesFAME - Teachers' Material TBenny PalmieriNo ratings yet

- Government and BusinessDocument2 pagesGovernment and BusinessJoshua BrownNo ratings yet

- Phy Interface Pci Express Sata Usb31 Architectures Ver43 PDFDocument99 pagesPhy Interface Pci Express Sata Usb31 Architectures Ver43 PDFRaj Shekhar ReddyNo ratings yet

- Effects of Brainstorming On Students' Achievement in Senior Secondary ChemistryDocument8 pagesEffects of Brainstorming On Students' Achievement in Senior Secondary ChemistryzerufasNo ratings yet

- 777rsec3 PDFDocument36 pages777rsec3 PDFAlexander Ponce VelardeNo ratings yet

- C1036 16Document10 pagesC1036 16masoudNo ratings yet

- MarpleDocument10 pagesMarpleC.Auguste DupinNo ratings yet

- File Handling in Python PDFDocument25 pagesFile Handling in Python PDFNileshNo ratings yet

- Tutorial Set (Queing Model)Document5 pagesTutorial Set (Queing Model)Samuel kwateiNo ratings yet

- Leta 2022Document179 pagesLeta 2022Bigovic, MilosNo ratings yet

- Maintenance of Building ComponentsDocument4 pagesMaintenance of Building ComponentsIZIMBANo ratings yet

- DX-790-960-65-17.5i-M: Electrical PropertiesDocument2 pagesDX-790-960-65-17.5i-M: Electrical PropertiesАлександрNo ratings yet

- Name and Logo Design Contest For Public Wi-Fi Network Services Terms & ConditionsDocument2 pagesName and Logo Design Contest For Public Wi-Fi Network Services Terms & ConditionsAc RaviNo ratings yet

- Level 5 Part 1: Listening Comprehension (V.9) : Nro. de Control: ......Document16 pagesLevel 5 Part 1: Listening Comprehension (V.9) : Nro. de Control: ......Maco cacoseNo ratings yet

- Value For Money Analysis.5.10.12Document60 pagesValue For Money Analysis.5.10.12Jason SanchezNo ratings yet

- Cuadernillo de Ingles Grado 4 PrimariaDocument37 pagesCuadernillo de Ingles Grado 4 PrimariaMariaNo ratings yet

- Eligibility Conditions: Advertisement For Regular Commission in Pakistan Army Through 136 Pma Long CourseDocument5 pagesEligibility Conditions: Advertisement For Regular Commission in Pakistan Army Through 136 Pma Long CourseHusnain IshtiaqNo ratings yet

- SHAREHOLDERS EQUITY - ProblemsDocument3 pagesSHAREHOLDERS EQUITY - ProblemsGlen Javellana0% (2)

- Lecture 7Document9 pagesLecture 7ngyx-ab22No ratings yet