Professional Documents

Culture Documents

EN PMIRecruitment PDF

Uploaded by

aiaiyayaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EN PMIRecruitment PDF

Uploaded by

aiaiyayaCopyright:

Available Formats

Interpreting PMI data

Exploring the inter-relationships of selected economic indexes from the PMI surveys

Confidential | Copyright © 2017 IHS Markit Ltd

Interpreting PMI data

The boom-bust cycle

It helps to first consider a typical, albeit extremely simplified, pattern of events in a classic “boom-

bust” business cycle. During a period of economic expansion it is typical for employment to rise (and

unemployment to fall) and the demand for raw materials to increase. If employment and demand for

raw materials rise at suitably fast rates it is then common for skill shortages and supply-chain

bottlenecks to develop.

When demand exceeds supply, prices tend to rise. Wages and salaries and raw material prices will

therefore begin to increase. Retail price inflation may then pick up as higher costs are passed on to

the consumer.

The standard economic policy prescription for rising high street inflation is an increase in central bank

base rates which, by raising borrowing costs to business and the consumer, restrains demand. Prices

and economic growth then tend to grow at slower rates. When demand has slowed sufficiently,

interest rates may be lowered again, thus stimulating economic growth.

Diagram 1: Boom-bust cycle

Economic

Interest

growth

rates fall

stimulated

Increased

employment

Economic

and demand

growth slows

for raw

materials

Skill

shortages

Interest

and supply

rates rise

problems

develop

Inflation Staff wages

picks up as and

higher costs raw material

are passed prices rise

to customers

Confidential | Copyright © 2017 IHS Markit Ltd ` |2

Interpreting PMI data

PMI survey variables

The PMI surveys provide time-series variables relevant to a number of important stages in the above

cycle, allowing analysts to ascertain the pace of economic growth, to see whether demand and

supply imbalances are taking hold, and to see if prices are consequently rising. Most crucial is the

fact that the PMI survey variables are available well in advance of comparable official data.

Several of the indicators are directly comparable for both manufacturing and services. For example,

“business activity” in services is the direct equivalent of manufacturing “output” and “incoming new

business” for the service sector is the direct equivalent of manufacturing “new orders”. Some indexes,

on the other hand, are not produced for both sectors.

Many of these variables will of course be of importance not just to economic policy makers but also to

those monitoring corporate performance and profitability. The behaviour of the variables is analysed

on the following pages, with examples given for the eurozone manufacturing sector.

Manufacturing Services

Output Business Activity

New Orders Incoming New Business

Employment Employment

Input Costs Input Costs

Output Prices Prices Charged

Backlogs of Work Business Outstanding

Export Orders Business Expectations

Quantity of Purchases

Suppliers’ Delivery Times

Stocks of Purchases

Stocks of Finished Goods

Future Output

Confidential | Copyright © 2017 IHS Markit Ltd ` |3

Interpreting PMI data

Diagram 2: Boom-bust cycle with PMI survey variables identified

New Orders /

New Business

Output / Activity

Economic

Interest

growth

rates fall

stimulated

Employment

Increased

employment

Economic

and demand

growth slows

for raw

materials

Quantity of

Purchases

Skill

shortages

Interest

and supply

rates rise

problems Backlogs of

develop

Work / Business

Outstanding

Inflation Staff wages

picks up as and

higher costs raw material

are passed prices rise Suppliers'

to customers

Delivery Times

Output Prices /

Charges

Input Costs

Confidential | Copyright © 2017 IHS Markit Ltd ` |4

Interpreting PMI data

Output, new orders & backlogs

Changes in new orders generally drive growth of economic output. PMI data can also help identify

deviations in this relationship, such as leads and lags. These often occur due to delays in the

adjustment of production to demand, especially in the manufacturing sector.

In the service sector, output is measured by business activity and new orders are measured through

changes in incoming new business.

Chart 1: Eurozone Manufacturing

sa, 50 = no change on previous month

65

60

55

50

45

40

35

Output New Orders

30

25

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

Source: IHS Markit.

Backlogs of work/business outstanding vary according to the amount of new orders/incoming new

business received by manufacturing/service sector companies. When new orders/incoming new

business rises, supply imbalances can develop and backlogs of work/business outstanding

accumulates.

Chart 2: Eurozone Manufacturing

sa, 50 = no change on previous month

65

60

55

50

45

40

35

New Orders Backlogs of Work

30

25

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

Source: IHS Markit.

Confidential | Copyright © 2017 IHS Markit Ltd ` |5

Interpreting PMI data

New orders, purchasing and supply chains

The amount of goods bought by manufacturers for use in the production process varies directly with

the volume of incoming new business.

Chart 3: Eurozone Manufacturing

sa, 50 = no change on previous month

65

60

55

50

45

40

35

New Orders Quantity of Purchases

30

25

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

Source: IHS Markit.

Supplier performance varies according to the amount of goods bought by manufacturers for use in

the production process. When demand for inputs rises, capacity constraints develop and delivery

times lengthen (the delivery times index falls below 50), resulting in an inverse relationship between

purchasing and speed of supplier delivery.

Chart 4: Eurozone Manufacturing

sa, 50 = no change on previous month

65

60

55

50

45

40

35

30

Quantity of Purchases Suppliers' Delivery Times

25

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

Source: IHS Markit.

Confidential | Copyright © 2017 IHS Markit Ltd ` |6

Interpreting PMI data

Supply chains and input prices

When suppliers become busier and bottlenecks arise, demand exceeds supply and a “seller’s

market” results, driving up input prices.

Chart 5: Eurozone Manufacturing

sa, 50 = no change on previous month sa, 50 = no change on previous month

30 95

35 85

75

40

65

45

55

50

45

55

35

60 25

Suppliers' Delivery Times (LH) Input Prices (RH)

65 15

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

Source: IHS Markit.

A direct relationship therefore exists between manufacturing output and raw material (input) prices.

However, changes in input prices will lag changes in output.

Chart 6: Eurozone Manufacturing

sa, 50 = no change on previous month sa, 50 = no change on previous month

80 90

Output (LH) Input Prices (RH)

80

70

70

60 60

50 50

40

40

30

30 20

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

Source: IHS Markit.

Confidential | Copyright © 2017 IHS Markit Ltd ` |7

Interpreting PMI data

Input prices and output prices

A close relationship exists between input prices and output charges, as companies tend to raise the

prices charged for their goods/services when the average cost of their inputs increases.

The differential between output charge inflation and input price inflation can provide information on

firms’ ability to pass on higher costs to clients (pricing power).

The differential between output charge inflation and input cost inflation is also a ‘barometer’ of

pressure on profit margins in the manufacturing/service sectors.

Chart 7: Eurozone Manufacturing

sa, 50 = no change on previous month sa, 50 = no change on previous month

70 90

80

60

70

60

50

50

40

40

Output Prices (LH) Input Prices (RH) 30

30 20

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

Source: IHS Markit.

Confidential | Copyright © 2017 IHS Markit Ltd ` |8

Interpreting PMI data

Stocks of finished goods

Changes in stocks of finished goods lag changes in output…

Chart 8: Eurozone Manufacturing

sa, 50 = no change on previous month sa, 50 = no change on previous month

65 52

60 50

55

48

50

46

45

44

40

Output (LH) Stocks of Finished Goods (RH)

35 42

30 40

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

Source: IHS Markit.

…with output driven by changes in order books less changes in stock levels.

Chart 9: Eurozone Manufacturing

sa, 50 = no change on previous month Difference

65 20

15

60

10

55 5

50 0

-5

45 -10

40 -15

Output (LH) -20

35

-25

New orders minus stocks of finished goods (RH)

30 -30

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

Source: IHS Markit.

Confidential | Copyright © 2017 IHS Markit Ltd ` |9

Interpreting PMI data

Employment

Employment directly correlates with changes in output (or business activity in the service sector). Any

divergences in the relationship provide important information on capital:labour intensity and

productivity growth.

Over time, output will tend to grow at a faster pace than employment as industry becomes

increasingly capital intensive and reduces hours worked per unit of output. If employment grows at a

faster pace than output, productivity will decrease.

Chart 10: Eurozone Manufacturing

sa, 50 = no change on previous month sa, 50 = no change on previous month

65 60

60

55

55

50

50

45 45

40

40

35

Output (LH) Employment (RH) 35

30

25 30

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

Source: IHS Markit.

New orders and future output

New orders and output expectations are closely correlated. If new order growth strengthens, firms are

likely to become more optimistic regarding projected output levels, and vice versa.

Chart 11: Eurozone Manufacturing

sa, 50 = no change on previous month 50 = no change over next 12 months

60 75

70

55

65

60

50

55

50

45

New orders (LH) Future Output (RH) 45

40 40

2012

2013

2014

2015

2016

2017

Source: IHS Markit.

Confidential | Copyright © 2017 IHS Markit Ltd ` | 10

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- CM Storm Trooper Manual PDFDocument24 pagesCM Storm Trooper Manual PDFaiaiyayaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

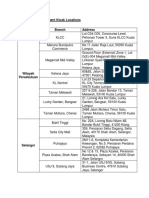

- Debit Card Replacement Kiosk Locations v2Document3 pagesDebit Card Replacement Kiosk Locations v2aiaiyaya33% (3)

- Growth Management Consultants: Finance ReportDocument4 pagesGrowth Management Consultants: Finance ReportNgọc VânNo ratings yet

- Metropolitan Bank Vs NWPC DigestDocument2 pagesMetropolitan Bank Vs NWPC DigestGui Esh100% (1)

- Interest Scheme BrochureDocument2 pagesInterest Scheme BrochureaiaiyayaNo ratings yet

- Viewnet Diy PricelistDocument2 pagesViewnet Diy PricelistaiaiyayaNo ratings yet

- Doa Tunang ArabDocument1 pageDoa Tunang ArabaiaiyayaNo ratings yet

- Associate Risk Analyst - Technology Risk - RSTSDocument4 pagesAssociate Risk Analyst - Technology Risk - RSTSaiaiyayaNo ratings yet

- Trading-the-Majors Ebook EN PDFDocument46 pagesTrading-the-Majors Ebook EN PDFaiaiyayaNo ratings yet

- JPN WN01C-minDocument7 pagesJPN WN01C-minaiaiyayaNo ratings yet

- SAP B1 Technical Consultant AdvertismentDocument2 pagesSAP B1 Technical Consultant AdvertismentaiaiyayaNo ratings yet

- No Name of Unauthorised Entities/individual Website Date Added To Alert ListDocument6 pagesNo Name of Unauthorised Entities/individual Website Date Added To Alert ListaiaiyayaNo ratings yet

- p00917 Datasheet 5151ecc832199c9Document1 pagep00917 Datasheet 5151ecc832199c9aiaiyayaNo ratings yet

- ARTERY NuggetX USER MANUALDocument2 pagesARTERY NuggetX USER MANUALaiaiyayaNo ratings yet

- Washington's Island Hospital Chooses D-Link Switches For High-Level Support at A Lower CostDocument2 pagesWashington's Island Hospital Chooses D-Link Switches For High-Level Support at A Lower CostaiaiyayaNo ratings yet

- Hyperlink HOWDocument1 pageHyperlink HOWaiaiyayaNo ratings yet

- LG Washing Machine - Cd1014smDocument44 pagesLG Washing Machine - Cd1014smaiaiyayaNo ratings yet

- IC 83 - Compressed-1Document50 pagesIC 83 - Compressed-1purnachandrashee1No ratings yet

- Tirpude Institute of Management EducationDocument44 pagesTirpude Institute of Management Educationshiv infotechNo ratings yet

- Performance Appraisal Fairness, Leader Member Exchange and Motivation ToDocument13 pagesPerformance Appraisal Fairness, Leader Member Exchange and Motivation ToIcuk HertantoNo ratings yet

- Soal Latihan Toeic Pembahasan ToeicDocument19 pagesSoal Latihan Toeic Pembahasan Toeicnur mutmainnahNo ratings yet

- A Study of HRD Climate in The Hospitals and Its Impact On Patient SatisfactionDocument86 pagesA Study of HRD Climate in The Hospitals and Its Impact On Patient SatisfactionMiteshNo ratings yet

- Ordinan Buruh (Sarawak)Document85 pagesOrdinan Buruh (Sarawak)Gomez Sulong100% (1)

- Practice Questions and Answers in AccounDocument100 pagesPractice Questions and Answers in Accounwalidabdo274No ratings yet

- 2782 FD3 Tourism Development PlanDocument73 pages2782 FD3 Tourism Development PlanUneil PabularNo ratings yet

- PD 851Document4 pagesPD 851Rodney S. ZamoraNo ratings yet

- DCWD PRIME-HRM-Best-PracticesDocument50 pagesDCWD PRIME-HRM-Best-PracticesAbraham Jr. De DiosNo ratings yet

- Steven R Dobbs: Marketing and Communications SpecialistDocument3 pagesSteven R Dobbs: Marketing and Communications SpecialistStevenNo ratings yet

- Ou - Tma 02Document11 pagesOu - Tma 02Mark O'NeillNo ratings yet

- Circular For Constitution of Expert Committee On Tunnel in Ministry Dated 4 February 2021Document12 pagesCircular For Constitution of Expert Committee On Tunnel in Ministry Dated 4 February 2021J. Kumar Infraprojects LtdNo ratings yet

- Midterm Exam - Tour 4Document2 pagesMidterm Exam - Tour 4Jason Yara100% (2)

- Models of Industrial RelationDocument17 pagesModels of Industrial RelationKoolest Pinky67% (15)

- What Is Human ResourceDocument9 pagesWhat Is Human ResourceMrudu PadteNo ratings yet

- Guru Nanak Mission HospitalDocument16 pagesGuru Nanak Mission HospitalAbhishek Singh Raghuvanshi100% (1)

- Project Work (HR)Document59 pagesProject Work (HR)MD.IMRAN ANSARINo ratings yet

- Orchestral OrganizationDocument5 pagesOrchestral OrganizationLucia MarinNo ratings yet

- Feasibility StudyDocument133 pagesFeasibility StudyDESIREE JOY BAUTISTA100% (1)

- The Manner in Which Stakeholders Employ Annual Reports of Companies Listed On The London Stock ExchangeDocument11 pagesThe Manner in Which Stakeholders Employ Annual Reports of Companies Listed On The London Stock ExchangeNastech ProductionNo ratings yet

- Breakthrough Elfren S. Cruz: Washington Post in The US and The London Times, Guardian, Financial Times in The UKDocument6 pagesBreakthrough Elfren S. Cruz: Washington Post in The US and The London Times, Guardian, Financial Times in The UKKay Tracey A. Urbiztondo100% (1)

- Moral Choices Facing EmployeesDocument29 pagesMoral Choices Facing EmployeesBlueMetal MilitiaNo ratings yet

- Quiz-2 2222287 Nafees Hasan ChowdhuryDocument3 pagesQuiz-2 2222287 Nafees Hasan ChowdhuryNafees Hasan ChowdhuryNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument7 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- Impact Appraisal of Organizational Culture On Employee'S PerformanceDocument13 pagesImpact Appraisal of Organizational Culture On Employee'S PerformanceAlexander DeckerNo ratings yet

- Zero-Hours Contracts - Factsheets - CIPDDocument6 pagesZero-Hours Contracts - Factsheets - CIPDMarvie GberevbieNo ratings yet

- A Study On Employee Welfare Measures in Arignar Anna Sugar MillsDocument7 pagesA Study On Employee Welfare Measures in Arignar Anna Sugar MillsthiruvenkatrajNo ratings yet