Professional Documents

Culture Documents

Po Confirmation Test-Model Test Paper - 2018

Uploaded by

kishan23Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Po Confirmation Test-Model Test Paper - 2018

Uploaded by

kishan23Copyright:

Available Formats

MODEL QUESTION PAPER

CONFIRMATION TEST OF PROBATIONARY OFFICERS

PREPARED BY V.V.SRINIVAS, CM(FACULTY), SBILD VIZIANAGARAM

1 The chairman of Insolvency and Bankruptcy Board of India

a) M.S.Sahoo b) Piyush Goyal

c) R.Venkatachalam d) M.K.Jain

2 The housing loan limits for eligibility under priority sector lending has been

revised to __ limits in metropolitan centres.

a) Rs.15 lakhs b) Rs.20 lakhs

c) Rs.30 lakhs d) Rs.35 lakhs

3 Select an odd man in the values of the Bank

a) Service b) Transparency

c) Ethics d) Promptness

4 No.of SBI branches as on 31.03.2018

a) 23612 b) 22414

c) 25213 d) 20717

5 Market share of advances of SBI as on 31.03.2018

a) 17.85% b) 19.92%

c) 20.44% d) 21.35%

6 In SBI, share of transactions on Alternate channels is

a) 72.5% b) 78.5%

c) 80% d) 82%

7 Capital Adequacy Ratio of SBI as per Basel III norms is

a) 11.80% b) 12.10%

c) 12.60% d) 12.90%

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

8 The SBI website which shows the approved projects to home buyers is

a) www.sbigrihatara.in b) www.sbirealty.in

c) www.sbihomerealty.in d) www.sbidreamhome.in

9 Full form of CEEP which is already introduced in SBI

a) Customer Excellence Experience b) Customer Experience Excellence

Project Project

c) Customer Efficiency Experience d) Customer Experience Efficiency

Project Project

10 With which entity, SBI signed MOU for sanction of largest long-term unsecured

loan?

a) NHAI b) NMDC

c) Reliance JIO d) None of these

11 The Central Accounts Office (CAO) of SBI was recently shifted to

a) New Delhi b) Mumbai

c) Kolkata d) Chennai

12 The full form of MOPAD, recently launched by SBI is

a) Multiple Opportunity Payment b) Multi Option Payment Acceptance

Acceptance Device Device

c) Management of Payment and d) Multi Option Premium Acceptance

devising Device

13 SBI and JIO have entered into joint venture for payment bank wherein SBI

holder how much % of share?

a) 50% b) 40%

c) 30% d) 25.00%

14 SBI is ranked as India’s most patriotic brand. Select the other brand which is

not in the list.

a) Tata Motors b) Patanjali

c) Reliance Jio d) TVS Motors

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

15 The present repo rate as per RBI policy w.e.f. 01.08.2018 is

a) 6% b) 6.25%

c) 6.5% d) 7%

16 Who is the chairman of SEBI

a) Ajay Tyagi b) Suresh Sethi

c) S.Marathe d) S.Gurumurthy

17 The latest country on which USA imposed sanctions

a) Syria b) Turkey

c) China d) Pakistan

18 10th edition of BRICS summit was recently held in

a) Johannesburg b) London

c) Beijing d) Mexico

19 Ikea, a home furnishing company started its first outlet in Hyderabad. The

company belongs to

a) Sweeden b) USA

c) UK d) Italy

20 Who won the FIFA football world cup 2018?

a) France b) Belgium

c) Croatia d) England

21 Which of the Banks did not get capital support from finance ministry?

a) PNB b) IOB

c) Andhra Bank d) Indian Bank

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

22 Which of the public sector banks earned the maximum profit during 2017-18?

a) Indian Bank b) Bank of India

c) Bank of Baroda d) Allahabad Bank

23 Which of the public sector banks faced the maximum loss during 2017-18

a) SBI b) Punjab National Bank

c) Andhra Bank d) Canara Bank

24 Which of the following states of India tops the list of “Ease of Doing Business”

for the year 2018?

a) Karnataka b) Andhra Pradesh

c) Haryana d) Maharashtra

25 IDBI Bank, a public sector bank with high NPAs is most likely to be acquired by

a) LIC of India b) General Insurance Corporation of

India

c) SBI d) HDFC Bank

26 Which of the Public Sector Banks suffered highest loss due to Bank frauds in

2017-18

a) State Bank of India b) Punjab National Bank

c) Bank of India d) Bank of Baroda

27 Who is appointed as Chairman of 15th Finance Commission?

a) N.K.Singh b) Ashok Lahiri

c) Ramesh Chand d) Anoop Singh

28 For categorization of micro enterprises in manufacturing sector, the

investment in P&M should not exceed

a) Rs.10 lakhs b) Rs.25 lakhs

c) Rs.100 lakhs d) Rs.5 crores

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

29 Who is the MD (Stressed assets, Risk, Compliance) of SBI?

a) Shri Parveen Kumar Gupta b) Shri Dinesh Kumar khara

c) Shri Arijit Basu d) Smt Anshula Kant

30 Who is appointed as MD & CEO of IDBI Bank for a temporary period of 3 months

a) B.Sriram b) Ch.Nageswar

c) J.Packirsamy d) Mrutunjay Mahapatra

31 What is the maximum age limit for a home loan borrower?

a) 60 years b) 65 years

c) 70 years d) 75 years

32 “Together we can” is a special home loan campaign wherein the Bank has

entered into a marketing arrangement with

a) Reliance jio b) SBI Card

c) Home Loan Councellors d) Marketing Associates

33 The following costs are not added for computation of project cost of a home

loan

a) Electricity/water board one time b) Township corpus fund

charges

c) Development charges d) Stamp duty/Registration charges

34 Minimum loan amount for Personal Loan against property (P-LAP) is

a) Rs.5 lakhs b) Rs.10 lakhs

c) Rs.15 lakhs d) Rs.20 lakhs

35 Which of the following home loan product is available through INB

a) Insta Home top up loan b) Smart Home top up loan

c) SBI Home Loan PAL d) SBI Suraksha

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

36 For a salaried employee availing vehicle loan under SBI Super Bike Loan

scheme, the net annual income should be

a) Rs.2.5 lakhs b) Rs.3 lakhs

c) Rs.4 lakhs d) Rs.6 lakhs

37 Which of the undernoted criteria is not considered for sanction of Smart Home

Top-up loan?

a) Fully disbursed home loan b) Minimum home loan limit of Rs.10

lakhs

c) Customer should not have any live d) CIBIL score of 550 or higher

home top-up or insta home top up

loan

38 The following auto loan schemes have been discontinued.

a) Overdraft facility b) Reimbursement of car purchased

out of own funds

c) Take over of auto loan d) All the above

39 Under which car loan scheme, loan is sanctioned to those who are engaged in

economic activity which gives them income but have no proof of income

a) SBI Car loan flexi b) SBI Car loan lite

c) SBI Combo loan d) None of these

40 In respect of loans to third parties against fixed deposits in the name of

individual customers, the following condition is not applicable

a) Third party loans will be b) Power of attorney holders will be

disbursed by home branches only allowed to sign on behalf of the

where deposits are held. NRI customers.

c) Loan will be disbursed only to KYC d) All of these statements are

complaint accounts of third correct

parties maintained at our Bank

41 For pursuing medical courses in India, the maximum loan eligibility is

a) Rs.10 lakhs b) Rs.20 lakhs

c) Rs.30 lakhs d) Total course fee less usual margin

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

42 In respect of “p” segment gold loans, customers can also pledge gold coins sold

by Banks with weight of coins not exceeding ___ grams per customer

a) 40 grams b) 50 grams

c) 100 grams d) No maximum stipulated

43 In respect of bullet repayment of gold loans, the following statement is true.

a) Interest to be serviced monthly b) Both interest and principal to be

and total outstanding to be repaid paid at the end of 36 months

within 12 months

c) The customer is free to repay the d) Both interest and principal to be

total outstanding within 24 paid at the end of 12 months

months term

44 Maximum loan that can be sanctioned against ‘P’ gold loans is

a) Rs.10 lakhs b) Rs.15 lakhs

c) Rs.20 lakhs d) No maximum stipulated

45 Under Global Edvantage loan, loan is sanctioned for pursuing full time courses

in institutions/universities of specific countries. Select the country which is not

identified for the scheme.

a) Canada b) Australia

c) Newzealand d) Hongkong

46 In respect of SBI Student Loan, maximum loan amount in respect of medical

course pursued abroad is

a) Rs.10 lakhs b) Rs.20 lakhs

c) Rs.25 lakhs d) Rs.30 lakhs

47 In respect of SBI Skill loan, where the loan amount is Rs.75000, the repayment

period is fixed at

a) 3 years b) 4 years

c) 5 years d) 7 years

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

48 For auto sweep in Savings Plus, the minimum threshold balance is

a) Rs.10000 b) Rs.25000

c) Rs.35000 d) Rs.40000

49 Which of the following statement is false in respect of BSBD account

a) No limit on number of deposits b) 25 cheque leaves can be issued

that can be made in a month free of cost to all BSBD account

holders

c) Maximum 4 withdrawals in a d) Only Rupay classic card will be

month permitted free of charge. issued free of cost

50 In respect of a Small account, aggregate of all credits in a financial year does

not exceed

a) Rs.10000 b) Rs.40000

c) Rs.50000 d) Rs.100000

51 Maximum period of Corporate Liquid Term Deposit is

a) 12 months b) 24 months

c) 36 months d) 60 months

52 Which of the following statement is True in respect of Pehli Udaan deposit a/c

a) Minor of any age can open the b) 4 cash transactions in a month are

account jointly with the offered free of charges

parent/guardian

c) Photo embossed ATM card issued d) PAI cover is offered for the parent

in the name of the minor with a

limit of Rs.5000

53 In respect of SAHAJ current account, which of the following statement is false

a) Low profile business community b) Number of cheque leaves to be

are eligible to open with a MAB of issued per financial year is

Rs.1000 restricted to 50.

c) Drawings per cheque is limited to d) No cash payment is made to third

Rs.15000 parties.

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

54 Which of the following statement is false in respect of Power POS facility

a) MAB is fixed at Rs.5000 b) Cash withdrawal in home branch

is unlimited and free

c) First 100 MCC are issued free. d) OD facility is available with loan

amount fixed at 20% of last 6

months transactions.

55 MAB in respect of Power Gain product is

a) Rs.20000 b) Rs.100000

c) Rs.200000 d) Rs.500000

56 Which of the following statement is false in respect of Power Base product

a) MAB is fixed at Rs.20000 b) Cash deposit upto Rs.25000 is free

per day

c) Business Debit card issued for the d) Normal charges are applicable for

deposit holders is “Premium” RTGS/NEFT

variant

57 Which of the following statement is false in respect of Power Pack product

a) Cash deposit in home branch is b) 500 cheque leaves issued free per

free upto Rs.60 lakhs month

c) Business Debit card of “Premium” d) All the statements are true

variant is issued

58 For domestic retail term deposits above Rs.5 lakhs but below Rs.1 crore, the

applicable penalty for premature closure is

a) 0.25% b) 0.5%

c) 1% d) 1.5%

59 In respect of SBI Flexi Deposit scheme, the maximum period of deposit is

a) 3 years b) 5 years

c) 7 years d) 10 years

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

60 Which of the following statement is true in respect of Annuity Deposit Scheme

a) Minimum amount of deposit is b) Loan facility upto 90% of the

Rs.10000 balance amount of annuity may

be granted on special cases.

c) The minimum tenure of the d) Premature payment permitted

scheme is 12 months only in case of death of depositor.

61 Which of the following statement is false in respect of Retail internet banking?

a) Power of Attorney holders can b) Jointly operated accounts can be

authorize agents to operate provided RINB provided all the

RINB. account holders sign the

application.

c) Minor accounts can be provided d) BSBD accounts are eligible for INB

INB facility with View/imited facility.

transaction rights.

62 In respect of Vistaar facility in CINB, how many minimum users are mandatory?

a) 2 b) 3

c) 4 d) 5

63 In respect of Vistaar facility in CINB, who is responsible to set overall profile of

the organization?

a) Administrator b) Regulator

c) Uploader d) Auditor

64 Aadhar enabled payment system (AEPS) is a payment service offered by

a) Government of India b) RBI

c) NPCI d) MUDRA

65 Which of the following facility is not available in SBI PAY

a) Payment using Aadhar card b) P2P pull functionality

c) Bar code based payment d) Facility of remitting funds abroad

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

66 Under Bharat QR, the transaction limit per day per user is

a) Rs.10000 b) Rs.25000

c) Rs.50000 d) Rs.100000

67 SBI Mingle is a

a) UPI initiative b) Payment system available through

POS machines

c) Social banking application d) None of these

68 Under SBI Mingle, users can transfer per day an amount of

a) Rs.5000 b) Rs.10000

c) Rs.25000 d) Rs.50000

69 State Bank collect is specially designed and developed for the benefit of

a) Schools, Colleges, educational b) Government Departments, PSUs

institutions

c) Hospitals, clubs, trusts d) All of these

70 Which of the following facility is the payment aggregator service provided by

SBI with connectivity with various banks and financial institutions on one hand

and merchants on the other.

a) SBI e pay b) SB MOPS

c) SBI Insta pay d) SBI Aadhar Pay

71 Full form of USSD is

a) Unified structural service data b) Unstructured Supplementary

Secured Data

c) Unstructured Supplementary d) Uniform Supplementary secured

service data data

72 Full form of AEPS is

a) Anytime Enabled payment system b) Aadhar enabled payment system

c) Alternate Enabled payment d) Aadhar enabled payment service

system

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

73 VPA stands for

a) Virtual payee address b) Virtual payment address

c) Verified payee address d) Verified payment address

74 The following facilities are available on YONO

a) Pre-approved personal loans b) OD against Fixed deposit

c) Funds transfer with UPI payments d) All the above

75 Which of the following product is not CIF based.

a) Khata plus b) Vyapaar

c) Vistaar d) Saral

76 Which of the following is not a category of Mudra loans.

a) Shishu b) Kishore

c) Varun d) Tarun

77 Loans upto Rs.50000 is covered under the following category of Mudra loans

a) Shishu b) Kishore

c) Tarun d) Varun

78 Stand up India scheme is to facilitate sanction of bank loans between

a) Rs.50000 to Rs.1 crore b) Rs.1 lakh to Rs.1 crore

c) Rs.10 lakhs to Rs.5 crores d) Rs.10 lakhs to Rs.1 crore

79 Maximum loan that can be sanctioned for housing loan purpose under DRI

scheme is

a) Rs.15000 b) Rs.20000

c) Rs.50000 d) Rs.100000

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

80 Minimum loan eligible under SBI Asset Backed Loan is

a) Above Rs.1 lakhs b) Above Rs.5 lakhs

c) Above Rs.10 lakhs d) Above Rs.20 lakhs

81 In respect of SBI ABL (CRE-CP), for fund based limits, the facility provided is

a) Demand Loan b) Overdraft

c) Term Loan d) Drop line Overdraft

82 Under Simplified Small Business Loan (SSBL), the maximum loan is

a) Less than 5 lakhs b) Less than 10 lakhs

c) Less than 25 lakhs d) Less than 50 lakhs

83 Maximum loan sanction under SME Credit Card is

a) Rs.5 lakhs b) Rs.10 lakhs

c) Rs.25 lakhs d) Rs.50 lakhs

84 Stock statements in respect of SME Credit card is to be obtained

a) Monthly once b) Quarterly once

c) Yearly once d) To be obtained only if the

account turns to SMA

85 In respect of SME Smart score, the quantum of loan for Trade & Services is

a) Rs.5 lakhs to 20 lakhs b) Rs.5 lakhs to Rs.25 lakhs

c) Rs.5 lakhs to Rs.50 lakhs d) Rs.5 lakhs to Rs.1 crore

86 In SME Credit plus, the maximum quantum of loan is

a) Rs.10 lakhs b) Rs.20 lakhs

c) Rs.25 lakhs d) Rs.50 lakhs

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

87 Which of the following scheme is sanctioned for nursing homes, diagnostic

centres?

a) Doctor Plus b) Medical Equipment Finance

scheme

c) Lease Rental discounting scheme d) Mortgage Dealer finance scheme

88 Which of the following scheme is provided to authorized exclusive

dealers/stockists/distributors/franchisees for purchase of inventory

a) Distributor Finance Scheme b) Medical Equipment Finance

Scheme

c) Lease Rental Discounting Scheme d) Mortgage Dealer Finance Scheme

89 E-VFS is a new SME scheme. The full form of the scheme is

a) Electronic Vehicle Financing b) Electronic Virtual financing

Scheme scheme

c) Electronic Voucher financing d) Electronic Vendor financing

scheme scheme

90 Under Taxi aggregator scheme, the Bank has no tie-up with the following one

a) OLA b) UBER

c) ECORRENTA d) YATRAGENIE

91 Maximum gold appraiser fees payable in RUSU branches is

a) Rs.200 b) Rs.300

c) Rs.500 d) Rs.600

92 The total auction process in respect of default gold loans should be completed

in

a) 30 days b) 45 days

c) 50 days d) 60 days

93 Aggregate limit of the gold loans for single borrower/CIF is restricted to

a) Rs.3 lakhs b) Rs.10 lakhs

c) Rs.20 lakhs d) Rs.25 lakhs

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

94 Which of the following document is an Arrangement letter for agri gold loans.

a) SIM GL1 b) SIM GL 2

c) SIM GL3 d) SIM GL 4

95 LTV ratio to be maintained for gold loans is

a) 65% b) 75%

c) 80% d) 90%

96 As per bank guidelines, in most of the circles, assessment of gold ornaments

should be done by approved gold appraiser for amounts above

a) Rs.25000 b) Rs.50000

c) Rs.1 lakh d) For all gold loans

97 Which gold purity testing method is applied to ornaments purportedly made

from solid gold with no extraneous matter.

a) Touch stone method b) Nitric Acid method

c) Specific gravity test method d) Any of these methods

98 Agri Gold loan processing fee is applicable for loans above

a) Rs.25000 b) Rs.50000

c) Rs.100000 d) No processing charges

99 Gold retention limit of the branches is reviewed by the controllers every year

in the month of

a) January b) April

c) June d) December

100 Insurance cover for gold held as per Gold retention limit at branches is taken

at

a) RBO level b) AO level

c) LHO level at State capital d) Mumbai

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

101 Branches should tally the gold loan bags with the CC/OD balance files at which

intervals?

a) Monthly b) Quarterly

c) Half yearly d) Yearly

102 Gold safe keeping charges in respect of agri gold loans to be recovered after

a) Crop due date b) Prescribed tenure of gold loan

c) 30 days after prescribed tenure of d) NIL charges

gold loans

103 Two appraisers are required to appraise the gold loans over limits of

a) Above Rs.3 lakhs b) Above Rs.4 lakhs

c) Above Rs.5 lakhs d) No such provision in

104 Maximum loan that can be sanctioned under Agri Gold Loan scheme is

a) Rs.10 lakhs b) Rs.20 lakhs

c) Rs.25 lakhs d) No maximum

105 In case of existing Agri gold loans, more than __ no.of accounts per borrower

should be referred to the next higher authority for approval before sanction.

a) 3 b) 4

c) 5 d) 10

106 In hilly and tribal dominated areas, the minimum size of SHG can be

a) 3 b) 5

c) 7 d) 9

107 In respect of credit linking of SHGs, KYC proofs of whom are to be taken

a) Group leaders b) Atleast 5 group members

c) All group members d) No separate KYC verification

required

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

108 Maximum LTV ratio for Agri ABL loan limit will be

a) 60% b) 65%

c) 70% d) 80%

109 The facility provided in Agri ABL scheme is

a) Cash Credit b) Overdraft

c) Term Loan d) Drop line OD

110 In respect of Agri ABL, self declaration from the borrower can be accepted

without insisting for the bills upto ___ loan limits disbursed.

a) Rs.1 lakh b) Rs.5 lakh

c) Rs.10 lakhs d) Rs.20 lakhs

111 In respect of KCC limits, 10% of the limits is sanctioned for

a) Household/consumption b) Post harvest expenses

requirements

c) Maintenance expenses d) A & B

112 In KCC limit fixation, MPL stands for

a) Maximum Produce Limit b) Maximum Permissible Loan

c) Maximum Permissible Limit d) Maximum Produce Loan

113 KCC limits are valid for

a) 1 year b) 3 years

c) 5 years d) 7 years

114 Margin in respect of crop loans is

a) 5% b) 10%

c) 15 to 20% d) No margin

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

115 In respect of tie-up arrangements, collateral security is waived for KCC limits

upto

a) 2 lakhs b) 3 lakhs

c) 4 lakhs d) 5 lakhs

116 PMFBY stands for

a) Prime Minister Farmer Benefit b) Prime Minister Farmer Bhima

Yojana Yojana

c) Prime Minister Fasal Bhima d) None of these

Yojana

117 Maximum loan limit under SBI Krishak Uthaan Yojana is

a) Rs.50000 b) Rs.1 lakh

c) Rs.2 lakh d) Rs.3 lakh

118 Maximum permissible loan limit under Produce Marketing Loan is

a) Rs.10 lakhs b) Rs.20 lakhs

c) Rs.25 lakhs d) Rs.50 lakhs

119 Under TATKAL tractor loan, margin fixed is

a) 10% b) 15%

c) 20% d) 25%

120 Maximum loan limit for Broiler Plus scheme is

a) Rs.5 lakhs b) Rs.9 lakhs

c) Rs.10 lakhs d) Rs.20 lakhs

121 In respect of non-home transactions, using withdrawal form, a non-home

customer can withdraw

a) Rs.1000 b) Rs.5000

c) Rs.10000 d) Non-home transactions permitted

only with cheque

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

122 The testing of fugitive ink must be carried out for payment of cheques for

value of

a) Rs.10000 and above b) Rs.20000 and above

c) Rs.25000 and above d) Rs.50000 and above

123 Tele-calling and getting confirmation from the drawer for suspicious cheques

and all non-home cheques is compulsory for above ____ amounts.

a) Rs.25000 b) Rs.50000

c) Rs.1 lakh d) Rs.2 lakhs

124 Production of Sureties may be not insisted upon while deceased settlement

upto

a) Rs.1 lakhs b) Rs.2 lakhs

c) Rs.5 lakhs d) Rs.10 lakhs

125 A locker rent is usually recovered every year on

a) 1st January b) Date of availing the locker

c) 31st March d) 2nd April

126 While sanction of lockers, a fixed deposit with following value is insisted.

a) Covering 1 year rental and break b) Covering 2 years rental and break

open charges open charges

c) Covering 3 years rental and break d) Fixed Deposit should not be

open charges insisted

127 Nomination rules are contained in

a) SBI Act b) Banking Regulation Act

c) RBI Act d) Negotiable Instruments Act

128 The overdraft facility for Diamond variant CSP account holder is

a) Rs.40000 b) Rs.75000

c) Rs.150000 d) Rs.200000

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

129 The OD facility for CSP accounts is restricted to __ months net monthly income

a) 1 month b) 2 months

c) 3 months d) 6 months

130 Maximum tenure for closure of OD in CSP account is

a) 3 months b) 6 months

c) 12 months d) 24 months

131 The scale of finance in respect of agriculture advances is fixed by

a) SLBC b) DLTC

c) NABARD d) Govt.of India

132 RABI crop season starts from

a) April b) June

c) October d) January

133 In respect of a short duration crop, the time frame is

a) 6 months b) 9 months

c) 12 months d) 18 months

134 Which document is obtained as guarantee deed for agricultural loans

a) AB2 b) AB3

c) AB4 d) AB5

135 In respect of mono crops, the repayment due date fixed by DLTC is

a) 31st March b) 31st January

c) 31st June d) 31st July

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

136 Which of the following are commercial test form organizations for approved

models of tractors?

a) CFMTTI, Budni b) FMTTI, Hissar

c) AMTTI, Rajkot d) A & B

137 In respect of change in name, a document shall be deemed to be an OVD if

supported by

a) Confirmation from Government b) Marriage Certificate

authority

c) Gazette notification d) B & C

138 Which of the following combination of KYC proofs are not acceptable

a) Aadhar & PAN b) Aadhar & Form 60

c) Aadhar & any other OVD d) Aadhar enrolment number & PAN

139 Where an individual who is not eligible to be enrolled for an Aadhar number or

who is not resident has applied for SB account, the following documents are to

be obtained

a) PAN or Form 60 b) One recent Photo

c) Certified copy of OVD containing d) All of these

identity and address

140 Where utility bill is accepted as document to evidence updated address, the

bill should not be more than

a) 1 month old b) 2 months old

c) 3 months old d) 6 months old

141 Customers who have not provided AAdhar/PAN or Form 60 at the time of

onboarding should submit the same within a period of __ months from

commencement of account based relationship.

a) 2 months b) 3 months

c) 6 months d) 12 months

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

142 Online Fire safety audit is conducted once in __ years

a) 1 b) 2

c) 3 d) 4

143 A power of attorney executed outside India must be stamped within __ months

of its receipt in India.

a) 3 months b) 6 months

c) 9 months d) 12 months

144 Demand notice under SARFAESI Act is issued for ___ days

a) 30 days b) 60 days

c) 45 days d) 90 days

145 Under RTI Act 2005, the supply of information if it concerns the life or liberty

of a person should be furnished in

a) Within 48 hours of receipt of b) Within 24 hours of receipt of

application application

c) Within 12 hours of receipt of the d) Within 72 hours of receipt of

application application

146 The amount to the credit of any account in India with any Bank which has not

been operated for a period of ___ years will be transferred to DEA fund.

a) 3 years b) 5 years

c) 7 years d) 10 years

147 Maximum compensation that can be awarded by Banking Ombudsman is

a) Rs.10 lac b) Rs.15 lac

c) Rs.20 lac d) Rs.25 lac

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

148 Banking Ombudsman is established as per ___ Act

a) BR Act b) RBI Act

c) NI Act d) Contract Act

149 The relationship between hirer of Bank locker and the Bank is that of

a) Debtor -Creditor b) Bailor-Bailee

c) Licensor-Licensee d) Principal-Agent

150 Minimum frequency of audit for Extremely High risk/High risk branches is as

per ___ committee guidelines

a) Rangarajan committee b) Sri Krishna Committee

c) Basant Seth d) Raghuram Rajan

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

DESCRIPTIVE PAPER

COMPREHENSION

Directions (1-15): Read the following passage carefully and answer these

questions. Certain words/phrases have been printed in bold to help you locate

them while answering some of the questions.

Rural India face serious shortages – power, water, health facilities, roads, etc. –

these are known and recognized. However, the role of technology in solving these

and other problems is barely acknowledged and the actual availability of

technology in rural areas is marginal. The backbone of the rural economy is

agriculture; which also provides sustenance to over half the country’s population.

The “Green Revolution” of the 1970s was, in fact, powered by the scientific work

in various agricultural research institutions. While there is some fault in the Green

Revolution for excessive exploitation of water and land resources through overuse

of fertilizers, it did bring about a wheat surplus and prosperity in certain pockets

of the country.

In rural India today, there is a dire inadequacy of both science (i.e. knowledge)

and technology (which derives from science and manifests itself in physical form).

The scope to apply technology to both farm and non-farm activities in rural areas

is huge, as are the potential benefits. In fact, crop yields are far lower than what

they are in demonstration farms, where science and technology are more fully

applied. Technologies that reduce power consumption of pumps are vital;

unfortunately, their use is minimal, since agricultural power is free or largely

subsidized. Similarly, there is little incentive to optimize-through technology or

otherwise-water use, especially in irrigated areas (a third of total arable land),

given employment and incomes, but at present deployment of technology is

marginal. Cold storage and cold-chains for transportation to market is of great

importance for many agricultural products-particularly, fruits and vegetables-but

are non-existent. These are clearly technologies with an immediate return on

investment, and benefits for all; the farmer, the end-consumer, the technology

provider. However, regulatory and structural barriers are holding back

investments.

Power is a key requirement in rural areas, for agricultural as well as domestic

uses. Technology can provide reliable power at comparatively low cost in a

decentralized manner. However this needs to be upgraded and scaled in a big

way, with emphasis on renewable and non-polluting technologies. Reliable and

low cost means of transporting goods and people is an essential need for rural

areas. The bullock-cart and the tractor-trailer are present vehicles of choice.

Surely, technology can provide a better, cheaper and more efficient solution?

Information related to commodity prices, agricultural practices, weather, etc.,

are crucial for the farmer. Technology can provide these through technology

mobile phones, which is a proven technology; however the challenge to ensure

connectivity remains. Thus there is a pressing need for technology as currently

economic growth-though skewed and iniquitous-has created an economically

attractive market in rural India.

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

Q1. According to the author, which of the following is/are the problem/s facing

India’s rural population?

(A) Unavailability of healthcare facilities.

(B) The technological advancements which have been borrowed from abroad have

not been suitably adapted to the Indian scenario.

(C) Lack of awareness about the importance of utilizing technology in the

agricultural sector.

(a) Only (A)

(b) Only (C)

(c) Both (A) & (B)

(d) Both (A) & (C)

(e) None of these

Q2. Which of the following is not an impact of the Green Revolution?

(a) Over utilization of water resources

(b) Application of scientific research only in demonstration farms

(c) Wealth creation restricted to certain areas

(d) Damage caused to land by inordinate use to fertilizers

(e) Supply of wheat surpassed demand

Q3. Why is there no motivation to reduce power consumption?

(a) Freely available renewable sources of energy

(b) Government will have to subsidize the cost technology required to reduce

power consumption.

(c) Power distribution has been decentralized.

(d) The cost of implementing power saving technology is exorbitant for the

customer.

(e) None of these

Q4. What effect will the implementation of post-harvest technologies such as

cold storages have?

(a) Regulatory procedures will have to be more stringent.

(b) Prices of commodities like fruits and vegetables will fall since there is no

wastage from spoilage.

(c) Incomes of rural population will fall.

(d) Pollution of the environment.

(e) None of these

Q5. The author’s main objective in writing the passage is to

(a) censure scientists for not undertaking research

(b) criticize farmers for not utilizing experimental, low cost post harvesting

technology

(c) exhort the government to subsidize the cost of utilizing technology

(d) promote a second green revolution

(e) advocate broadening the scope of research and use of technology in

agriculture.

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

Q6. Which of the following is not true in the context of the passage?

(A) In recent times the benefits of science and technology have not been felt in

agriculture.

(B) The current means of rural transportation are ideal i.e. low cost and non-

polluting.

(C) Agriculture provides livelihood to over 50 percent of the Indian population.

(a) Both (A) & (B)

(b) Only (B)

(c) Only (C)

(d) Both (A) & (C)

(e) None of these

Q7. What has hampered investment in post-harvest technologies?

(a) Cost of implementing such technology is higher than the returns

(b) No tangible benefits to technology suppliers

(c) Obstacles from statutory authorities

(d) Rapid economic growth has drawn investors away from agriculture to more

commercially viable sectors.

(e) None of these

Q8. What is the role of mobile technology in the rural economy?

(A) It will not play a large role since the technology is largely untested.

(B) It provides opportunities for farmers to manipulate commodity prices.

(C) It will largely be beneficial since such technology is cheap.

(a) Both (A) & (C)

(b) Only (A)

(c) Both (B) & (C)

(d) Only (B)

(e) None of these

Q9. Which of the following is currently not a threat to the rural economy?

(A) Inadequate rural infrastructure such as roads.

(B) Excessive utilization of technology.

(C) Fluctuating power supply.

(a) Only (C)

(b) Only (A)

(c) Both (B) & (C)

(d) Only (B)

(e) None of these

Q10. Which of the following is TRUE in the context of the passage?

(A) About 33 percent of arable land in India is irrigated.

(B) There is hardly any motivation to utilize technology to optimize water usage

among farmers.

(C) Climatic information can easily be made available to farmers.

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

(a) All (A), (B) & (C)

(b) Both (A) & (B)

(c) Only (A)

(d) Both (B) & (C)

(e) None of these

Directions (11-13): Choose the word which is most nearly the same in meaning

as the word printed in bold as used in the passage.

Q11. Marginal

(a) Austere

(b) Severe

(c) Detrimental

(d) Adverse

(e) Insignificant

Q12. Fault

(a) Defense

(b) Offend

(c) Imperfect

(d) Blame

(e) Sin

Q13. Dire

(a) Pessimistic

(b) Alarming

(c) Futile

(d) Frightened

(e) Fraudulent

Directions (14-15): Choose the word which is most opposite in meaning of the

word printed in bold as used in the passage.

Q14. Potential

(a) Unlikely

(b) Incapable

(c) Unable

(d) Ineffective

(e) Inherent

Q15. Iniquitous

(a) Immoral

(b) Godly

(c) Virtuous

(d) Right

(e) Just

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

BUSINESS CORRESPONDENCE

A Term deposit favoring Mr. Deceased for Rs.100,000/- is due for payment. The

deposit account has nomination in favor of Mr. Nominee. Today, you have received

a notice from an advocate of Mr. Claimant, claiming to be the son of the

deceased. The notice advises you to stop payment to the nominee, as the deposit

belongs to the Joint Hindu Family of the deceased. Please write a suitable reply.

RATIONALES

1. Safe keeping charges are recovered from Gold Loans.

2. Staff accounts scrutiny is to be mandatorily done by BM monthly.

3. State Bank Compensation policy is reviewed regularly by the Bank

4. RFIA is revamped with introduction of RADAR and RBOSA

5. No interest is applied on NPA accounts

6. Credit exposure norms are stipulated by the Bank

7. Fugitive ink testing is made compulsory for payment of cheques of Rs.25000

and above

8. Banks are insisting on insurance of stocks for the full value and not with

reference to limit or outstanding in the borrowal account.

9. Loan limits for students pursuing medical studies has been increased to Rs.30

lakhs.

10. Crossed cheques are not to be paid over the counter.

SITUATION ANALYSIS

1. The Branch Manager of ABC branch has received a letter from RBO calling for

explanation of why no action is initiated against 3 locker hirers where the

locker rent is not recovered for the last 3 years. The BM, a newly promoted

officer is worried on how to initiate the action. What is the procedure to be

followed for break open of the locker?

2. A customer has given a written complaint that he received 10 SMS messages

stating that amounts are debited to his account for various shopping done at

other countries. The total value of transactions is amounting to Rs.50000.

He threatened that if the amounts are not re-credited to his account, he

would contemplate action against the Bank with Banking Ombudsman and

Consumer Forum. How can you help the customer?

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

3. Under Department Connect, your branch conducted a meeting in a Central

Government office situated in your work place. The office is having 50

employees maintaining salary accounts with a private bank. The employees

complained that the private bank is not sanctioning personal loans and

requested if the loan could be sanctioned at our branch. Is there any product

under which the employees could be fit to sanction personal loans?

4. Smt.Sarita, who has completed engineering in IIT has approached your

branch with a project report. She wants to set up a manufacturing unit, the

project cost of which is Rs.50 lakhs. There is a ready market for the products

she wanted to manufacture. However the lady expressed her inability to

produce any collateral security and requested you to help her in setting up

the start up unit. As a BM,how could you help her in setting up the unit?

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

ANSWERS FOR MODEL QUESTION PAPER

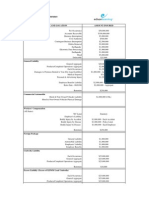

Q 1 2 3 4 5 6 7 8 9 10

ANS A D D B B C C B B A

Q 11 12 13 14 15 16 17 18 19 20

ANS B B C D C A B A A A

Q 21 22 23 24 25 26 27 28 29 30

ANS D A B B A B A D D B

Q 31 32 33 34 35 36 37 38 39 40

ANS C B D A A A B D B B

Q 41 42 43 44 45 46 47 48 49 50

ANS C B D C C B* C C B ** D

Q 51 52 53 54 55 56 57 58 59 60

ANS C C B D C C B C C D

Q 61 62 63 64 65 66 67 68 69 70

ANS B C B C D C C A D A

Q 71 72 73 74 75 76 77 78 79 80

ANS C B B D D C A D B C

Q 81 82 83 84 85 86 87 88 89 90

ANS D C B C B C B D D D

Q 91 92 93 94 95 96 97 98 99 100

ANS B B D D B B C A A D

Q 101 102 103 104 105 106 107 108 109 110

ANS D C C C C B D B D C

Q 111 112 113 114 115 116 117 118 119 120

ANS D C C D B C B D D B

Q 121 122 123 124 125 126 127 128 129 130

ANS B C D C D C B C B B

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

Q 131 132 133 134 135 136 137 138 139 140

ANS B C C A D D D C D B

Q 141 142 143 144 145 146 147 148 149 150

ANS C B A B A D A A C C

* For abroad studies in SBI Student loan, the maximum loan amount is Rs.20 lakhs

** 25 cheque leaves are issued in BSBD accounts only to Senior citizens and

Differently abled persons on request. Others are not eligible.

ANSWERS TO DESCRIPTIVE PAPER

COMPREHENSION

1. Ans.(d)

Both (A) & (C). According to the passage, the writer focuses on the healthcare

issues in rural areas and the importance of utilizing technology in the agricultural

sector.

2. Ans.(b)

According to the passage, “Application of scientific research only in demonstration

farms” is not an impact of the Green Revolution.

3. Ans.(a)

It is mentioned in the passage that there is no motivation to reduce power

consumption because of Freely available renewable sources of energy.

4. Ans.(e)

None of these. The effects mentioned in the options are not relevant.

5. Ans.(e)

According to the passage, the author’s main objective in writing the passage is to

"advocate broadening the scope of research and use of technology in agriculture."

6. Ans.(b)

Only (B). option B is irrelevant and nothing such is mentioned in the given

paragraph.

7. Ans.(c)

Obstacles from statutory authorities has been hampering the investment in post-

harvest technologies, according to the passage.

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

8. Ans.(e)

None of these. All the options given are irrelevant according to the passage.

9. Ans.(d)

Only (B). According to the passage, Excessive utilization of technology is currently

not a threat to the rural economy.

10. Ans.(e)

None of these. All the options given are irrelevant according to the passage.

11. Ans.(e)

Marginal-minor and not important; not central. Hence Insignificant and marginal

are close in meaning.

12. Ans.(d)

Fault-responsibility for an accident or misfortune. Hence, fault and blame are

close in meaning according to the usage in the given passage.

13. Ans.(b)

Dire-extremely serious or urgent. Hence Alarming and dire are close in meaning

according to the usage in the given passage.

14. Ans.(d)

Potential-having or showing the capacity to develop into something in the future.

Ineffective-not producing any significant or desired effect. Hence, potential and

ineffective are antonyms.

15. Ans.(c)

Iniquitous-grossly unfair and morally wrong. Virtuous-having or showing high moral

standards.

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

BUSINESS CORRESPONDENCE

STATE BANK OF INDIA

XXXXXX BRANCH

XXXXXXXX TOWN

To

Shri XXXXX

Advocate

XXXXXX town

F.20-XXX/2018-19 Date :

Dear Sir,

TERM DEPOSIT IN THE NAME OF Mr. DECEASED

With reference to your letter dated ______, we have to advise as under.

We have received an application for claim of the deceased term deposit by

Mr. Nominee, who is the nominee to the captioned deposit of Mr.Deceased,

since deceased on XXXXXX.

In terms of Nomination Rules under Section 45ZA of the Banking Regulation Act,

the Bank Is under agreement to make payment of the deposit to the nominee.

On our verification of the records, we found that the fixed deposit stands in the

individual name of the depositor who had made a valid nomination under the

above Section. According to your notice on behalf of your client, the deposit

belongs to the joint family and not to the deceased in his individual capacity.

This is a matter to be settled between him and the nominee. The Bank is not

part with the said Dispute and is under an obligation to pay the amount to the

nominee unless an order Issued by a competent court restraining payment to

the nominee is served on us. This is for your Kind information.

Yours faithfully,

Branch Manager.

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

RATIONALES

1. Safe keeping charges are recovered from Gold Loans.

a. To arrest income leakage as otherwise safekeeping in a locker would

attract usual charges.

b. This will deter unscrupulous customers against use of banking service in a

disguised mode, free of charge.

2. Staff accounts scrutiny is mandatorily done by BM monthly.

a. To ensure that the debit and credit transactions in a staff account are

commensurate with the known source of income.

b. To guard against insider frauds.

c. A preventive vigilance measure.

3. State Bank Compensation policy is reviewed regularly by the Bank

a. The policy is formulated on the basis of “Model compensation policy”

issued by IBA.

b. The objective of the policy is that the Bank compensates the customer for

deficiency in service on the part of the Bank or any act of omission or

commission, directly attributable to the Bank.

4. RFIA is revamped with introduction of RADAR and RBOSA

a. To make the internal audit processes more effective so that the audit

scoring system and the ratings derived from it adequately reflect the

quality & effectiveness of internal controls.

b. To harness technology and analytics to monitor controls at audit units.

5. No interest is applied on NPA accounts

a. The account ceases to generate income for the Bank

b. In order to avoid tax liabilities on non-recoverable income

c. As per RBI guidelines, income should be recognized on realization basis

but not on accrual basis.

6. Credit exposure norms are stipulated by the Bank

a. To avoid concentration of credit risk

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

b. Failure of single advance or advance to a single group will not affect the

capital stability of the Bank

c. It is a prudential control measure to minimize the credit risk for Banks.

7. Fugitive ink testing is made compulsory for payment of cheques of Rs.25000

and above

a. It has been observed that many frauds have been perpetrated through

encashment of fake cheques. In order to arrest the frauds, this testing is

introduced.

b. A security feature is in built in the background printing of the Bank’s

name and symbol with fugitive ink, which gets smeared in contact with

any liquid containing water.

8. Banks are insisting on insurance of stocks for the full value and not with

reference to limit or outstanding in the borrowal account.

a. If the stocks are not insured for full market value, in case of loss by fire

etc, the “Average clause’ will operate and the insurance company will

pay only a proportionately lower amount.

b. This is to safeguard the Bank’s interest as the limit/outstanding in the

account will invariably lower than the stock value against which drawings

are permitted.

9. Loan limits for students pursuing medical studies has been increased to Rs.30

lakhs

a. Taking approval of higher loan limits from appropriate authority at circle

level for each loan proposal is time consuming and results in increase of

TAT and sometimes loss of business opportunities. This can be reduced by

increase of limits.

b. With a view to finance higher loan requirements of students (fully secured

by tangible collateral) and to reduce the number of deviation cases

approved.

10. Crossed cheques are not to be paid over the counter.

crossed cheques are meant to be credited to the account of the beneficiary

as per the tenor of the cheque issued by the drawer.

b. It is a direction to the paying banker. If the amount of crossed cheque is

paid over the counter, it will not be a payment in due course and the paying

banker will not get protection under Sec.126 of NI Act.

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

SITUATION ANALYSIS

1. The Branch Manager of ABC branch has received a letter from RBO calling for

explanation of why no action is initiated against 3 locker hirers where the

locker rent is not recovered for the last 3 years. The BM, a newly promoted

officer is worried on how to initiate the action. What is the procedure to be

followed for break open of the locker?

Ans: Where the locker holders are neither paying rent for long time nor

vacating the locker resulting in arrears of locker rent, the following procedure

should be followed.

a. Notice to be sent on or before the due date regarding payment of locker

rent.

b. Reminder 1 to be sent one month after the due date

c. Reminder 2 on Cos 405 to be sent two months after the due date.

d. Final notice on COS 406 to be sent three months after due date giving one

month time to pay.

e. Approval from controlling authority should be obtained before break open of

the locker. Before break open, registered notice with Acknowledgement due

should be sent to the hirer.

f. Break open should be made in the presence of a committee consisting of

two officers of the branch and two independent witnesses.

g. After break open, an inventory of the articles should be made and the items

can be sold to recover the bank dues by taking a valuation from a

government valuer.

Q 2. A customer has given a written complaint that he received 10 SMS

messages stating that amounts are debited to his account for various shopping

done at other countries. The total value of transactions is amounting to

Rs.50000. He threatened that if the amounts are not re-credited to his account,

he would contemplate action against the Bank with Banking Ombudsman and

Consumer Forum. How can you help the customer?

Ans: The systems and procedures in the Bank has been designed to make

customer feel safe about carrying out electronic banking transactions. On

receipt of report of an unauthorized transaction from the customer, the branch

to take immediate steps to prevent further unauthorized transactions in the

account. As per RBI policy, the Bank has devised Zero liability of a customer.

This zero liability shall arise where the unauthorized transaction occurs on

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

account of either contributory fraud/deficiency on the part of the Bank/third

party breach where the deficiency lies neither with the Bank nor with the

customer but lies elsewhere in the system, and the customer notifies the Bank

within three working days of receiving the communication by SMS/email

regarding the unauthorized transaction.

On being notified by the customer, the Bank will credit (shadow reversal) the

amount involved in the unauthorized electronic transaction to the customer’s

account within 10 working days from the date of such notification by the customer

with value dated as of the date of unauthorized transaction.

3. Under Department Connect, your branch conducted a meeting in a Central

Government office situated in your work place. The office is having 50 employees

maintaining salary accounts with a private bank. The employees complained that

the private bank is not sanctioning personal loans and requested if the loan could

be sanctioned at our branch. Is there any product under which the employees

could be fit to sanction personal loans?

Ans : In respect of central government employees maintaining salary account with

other Bank, personal loan can be sanctioned under “Xpress Power”. The eligibility

criteria for sanction of loan is : a. Permanent employee with one year confirmed

service. B. Minimum gross monthly income of Rs.50000 c. 24 times NMI with a

minimum term loan of Rs.25000 and max of Rs.15 lakhs can be sanctioned. In case

of Overdraft, minimum loan amount is Rs.5 lakhs. d. EMI/NMI should be 50% e.

maximum repayment period is 60 months or residual service period whichever is

less. Minimum CIBIl score of 700 with satisfactory report with no default.

Q 4. Smt.Sarita, who has completed engineering in IIT has approached your branch

with a project report. She wants to set up a manufacturing unit, the project cost

of which is Rs.50 lakhs. There is a ready market for the products she wanted to

manufacture. However the lady expressed her inability to produce any collateral

security and requested you to help her in setting up the start up unit. As a BM,how

could you help her in setting up the unit?

Ans : To facilitate sanction of bank loans between Rs.10 lakhs and Rs.1 crore to

SC/ST/women borrowers for setting up a Greenfield enterprise, Stand Up India

scheme was introduced by the Government of India. The enterprise may be in

manufacturing, service, or the trading sector. However atleast 51% of

shareholding should be help by any of these target borrowers. A composite loan of

working capital/term loan is sanctioned with a repayment for term loans upto a

maximum of 7 years. The primary security will be hypothecation of stocks,

machinery, movables etc. purchased out of Bank’s finance. No collateral or third

party guarantee is to be taken for sanction of loan under Stand Up India scheme. A

credit guarantee for loans under the scheme is available.

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

**** ALL THE BEST IN YOUR CONFIRMATION TEST******

POST YOUR SUGGESTIONS/COMMENTS TO

vaddiparthy.v.srinivas@sbi.co.in

Prepared by V.V.Srinivas, CM(Faculty), SBILD VIZIANAGARAM

You might also like

- Statement September 2019Document6 pagesStatement September 2019Mike Schmoronoff100% (1)

- Hire Purchase Lease Financing - Part 2Document38 pagesHire Purchase Lease Financing - Part 2KomalNo ratings yet

- Important Banking Awareness PDFDocument193 pagesImportant Banking Awareness PDFsidNo ratings yet

- Recalled MCQs 2021 22Document16 pagesRecalled MCQs 2021 22Ghanshyam KumarNo ratings yet

- Risk Management Sample Questions by Murugan-Sep 2021 ExamsDocument189 pagesRisk Management Sample Questions by Murugan-Sep 2021 Examsbhargav100% (1)

- Recalled Questions - Promotion Test For Scale II To IIIDocument8 pagesRecalled Questions - Promotion Test For Scale II To IIIcandeva2007No ratings yet

- Test Supplement 11 ForexDocument21 pagesTest Supplement 11 ForexRaj NayakNo ratings yet

- Forex - Objective Type Qns Apr. 2006Document32 pagesForex - Objective Type Qns Apr. 2006Bhavik SolankiNo ratings yet

- Student Transcript Corporate Finance Institute®: Student No.: Student Name: Date of BirthDocument9 pagesStudent Transcript Corporate Finance Institute®: Student No.: Student Name: Date of BirthHarshit100% (2)

- Latest Recalled Questions - Bank Promotion - Oct 2022Document50 pagesLatest Recalled Questions - Bank Promotion - Oct 2022kgaurav001No ratings yet

- Study Material (1) .OdsDocument322 pagesStudy Material (1) .OdsmichelleNo ratings yet

- Jibo Question BankDocument43 pagesJibo Question Bankjyottsna27% (15)

- Sme Finance IibfDocument28 pagesSme Finance Iibftuniya4100% (4)

- Recollected QuestionsDocument138 pagesRecollected Questionssunil251No ratings yet

- Logic Mcq2020Document505 pagesLogic Mcq2020Neha Kanse WaghNo ratings yet

- Promotion Study Material - Clerk To JMG.s-1 - 2016Document403 pagesPromotion Study Material - Clerk To JMG.s-1 - 2016JitenNo ratings yet

- Msme Product-Baroda Academy KolkataDocument28 pagesMsme Product-Baroda Academy KolkataSAMBITPRIYADARSHI100% (1)

- MsmeDocument22 pagesMsmeAbhinandan Golchha100% (1)

- Model Paper - 4Document7 pagesModel Paper - 4Shiva DubeyNo ratings yet

- MargdarshniDocument185 pagesMargdarshniRahul Singh100% (1)

- Foreign Exchange ManagementDocument21 pagesForeign Exchange ManagementSreekanth GhilliNo ratings yet

- INTERVIEW STUDY MATERIAL FOR JIBO IBO 2019Document33 pagesINTERVIEW STUDY MATERIAL FOR JIBO IBO 2019jyottsna67% (3)

- 1001 Questions For Last Moment Banking PreparationsDocument35 pages1001 Questions For Last Moment Banking PreparationsAparajito SethNo ratings yet

- Att Final BillDocument1 pageAtt Final BillЕвгений АдлерNo ratings yet

- Objective Questions For Clerical To Officer Cadre Promotion TestDocument335 pagesObjective Questions For Clerical To Officer Cadre Promotion TestDeepu Nani83% (6)

- MCQ2Document27 pagesMCQ2rattan24No ratings yet

- Jan 2019 Exam Bank Question SolutionsDocument5 pagesJan 2019 Exam Bank Question Solutionsjitendra singhNo ratings yet

- Compliance QuizDocument49 pagesCompliance Quizsreenu naikNo ratings yet

- Promn Exam MCQs 23-01-2022 - 5470497Document17 pagesPromn Exam MCQs 23-01-2022 - 5470497Ghanshyam KumarNo ratings yet

- RECALLED QUESTIONS (2016-18) : (Ibps Different Banks Promotion Test)Document11 pagesRECALLED QUESTIONS (2016-18) : (Ibps Different Banks Promotion Test)Arun PrakashNo ratings yet

- Multiple Choice QuestionsDocument33 pagesMultiple Choice QuestionsSunil Kumar Gadwal100% (1)

- MCQ Banking, Finance and Economy TestDocument7 pagesMCQ Banking, Finance and Economy Testarun xornorNo ratings yet

- SBILD MODEL TEST PAPER FOR PROMOTION ASPIRANTSDocument16 pagesSBILD MODEL TEST PAPER FOR PROMOTION ASPIRANTSPRABHU JOTHNo ratings yet

- Mrunal Sir Latest 2020 Handout 3 PDFDocument19 pagesMrunal Sir Latest 2020 Handout 3 PDFdaljit singhNo ratings yet

- Vallabhi 2018 PDFDocument196 pagesVallabhi 2018 PDFSateesh KotyadaNo ratings yet

- MCQDocument6 pagesMCQArup Kumar DasNo ratings yet

- Jaiib-Ppb-Recollected QuestionsDocument23 pagesJaiib-Ppb-Recollected QuestionsAvijit GhoshNo ratings yet

- BASEL Norms MCQDocument15 pagesBASEL Norms MCQBiswajit Das100% (1)

- MCQ On IT 2Document8 pagesMCQ On IT 2udai_chakraborty5511No ratings yet

- Promotion Test 2021-22 KYC MCQs Study MaterialDocument4 pagesPromotion Test 2021-22 KYC MCQs Study Materialprashant singhNo ratings yet

- Promotion March2016 Final Updated Upto 24-02-2016Document147 pagesPromotion March2016 Final Updated Upto 24-02-2016pankaj gargNo ratings yet

- Handbook On Promotion 2021Document489 pagesHandbook On Promotion 2021GKT 1No ratings yet

- MCQ On Home Loans (A K Marandi, SBLC-Siliguri)Document4 pagesMCQ On Home Loans (A K Marandi, SBLC-Siliguri)Raghu Nayak100% (1)

- JAIIB Principles of Banking MCQ MOD BDocument4 pagesJAIIB Principles of Banking MCQ MOD BChandru Mba100% (1)

- 500 Banking Awareness MCQsDocument35 pages500 Banking Awareness MCQsTrishanu0% (1)

- Bank Promotion Exam Notes by Murugan-2019Document154 pagesBank Promotion Exam Notes by Murugan-2019Amit Beniwal100% (2)

- Principles and Practices of Banking - JAIIB: Timing: 3 HoursDocument20 pagesPrinciples and Practices of Banking - JAIIB: Timing: 3 HoursMallikarjuna RaoNo ratings yet

- MCQ - Government Sponsored SchemesDocument4 pagesMCQ - Government Sponsored SchemesClassicaverNo ratings yet

- Model Paper-I BFM Basel Framework Multiple Choice QuestionsDocument9 pagesModel Paper-I BFM Basel Framework Multiple Choice QuestionsHimanshuGururaniNo ratings yet

- SME Business Division: Question BankDocument26 pagesSME Business Division: Question BankKawoser AhammadNo ratings yet

- JAIIB-PPB-Free Mock Test - JAN 2022Document3 pagesJAIIB-PPB-Free Mock Test - JAN 2022kanarendranNo ratings yet

- Ans Test Set 2Document10 pagesAns Test Set 2vinayNo ratings yet

- Eom Ii - Test - 15-08-2021Document21 pagesEom Ii - Test - 15-08-2021Bithal PrasadNo ratings yet

- Questions On KCCDocument4 pagesQuestions On KCCvarunNo ratings yet

- Business Economics MCQDocument14 pagesBusiness Economics MCQPriti ParmarNo ratings yet

- CAIIB - Financial Management - ModuleDocument26 pagesCAIIB - Financial Management - ModuleSantosh100% (3)

- No Answer: Banking & FinanceDocument15 pagesNo Answer: Banking & FinanceKim Anh TrầnNo ratings yet

- Website: HTTPS://: Iibf - InfoDocument13 pagesWebsite: HTTPS://: Iibf - Infodubakoor dubakoorNo ratings yet

- Bank MCQSDocument27 pagesBank MCQSSanjeev SubediNo ratings yet

- MCQDocument4 pagesMCQAjaySharmaNo ratings yet

- IBPS Law Officer Study Material Banking LawDocument0 pagesIBPS Law Officer Study Material Banking Lawsagarrathod777No ratings yet

- Vikas 2016Document259 pagesVikas 2016chetankumarmrbt01No ratings yet

- Banking Quiz (Round 1) : InstructionsDocument10 pagesBanking Quiz (Round 1) : InstructionsRana JamalNo ratings yet

- Mock Test (2018-19) For Clerical To Trainee Officer and JMGS-IDocument15 pagesMock Test (2018-19) For Clerical To Trainee Officer and JMGS-IRamachandran MNo ratings yet

- North South University Summer Class AssignmentDocument15 pagesNorth South University Summer Class AssignmentMd.sabir 1831620030No ratings yet

- Networth Requirements for Trading MembersDocument6 pagesNetworth Requirements for Trading MembersPARTH PODANo ratings yet

- Bank StatementDocument11 pagesBank Statementpradeep kumarNo ratings yet

- Jawahar Vidya Mandir: OfficeDocument2 pagesJawahar Vidya Mandir: OfficeRavindra SahuNo ratings yet

- Accounting Principles and PracticesDocument10 pagesAccounting Principles and PracticesGaganpreet KaurNo ratings yet

- Circular & GO 2010Document260 pagesCircular & GO 2010kalkibookNo ratings yet

- 19th Lecture of M.Com 4thDocument14 pages19th Lecture of M.Com 4thMuhammad BasitNo ratings yet

- Simple Interest LessonsDocument18 pagesSimple Interest LessonsAnalie CabanlitNo ratings yet

- Resume - TDDocument2 pagesResume - TDapi-520963611No ratings yet

- Acctg 102Document52 pagesAcctg 102Yoonah KimNo ratings yet

- As of This Statement Date, We Have Not Yet Received Your Last Scheduled Payment in FullDocument2 pagesAs of This Statement Date, We Have Not Yet Received Your Last Scheduled Payment in FullThomas ChristianNo ratings yet

- Project Report ICICI PrudentialDocument102 pagesProject Report ICICI PrudentialBhavik PopliNo ratings yet

- Fin 1Document4 pagesFin 1tranminhkthNo ratings yet

- Group Accounts: IFRS 10 Consolidated Financial StatementsDocument9 pagesGroup Accounts: IFRS 10 Consolidated Financial StatementsHunairArshadNo ratings yet

- MBFI Quiz KeyDocument7 pagesMBFI Quiz Keypunitha_pNo ratings yet

- Arbor Final ReportDocument17 pagesArbor Final Reportapi-583299179No ratings yet

- Far 1 Past PapersDocument327 pagesFar 1 Past PapersTooba MaqboolNo ratings yet

- Time Value of Money: Present and Future ValueDocument29 pagesTime Value of Money: Present and Future ValuekateNo ratings yet

- Questions On Journal Entry For StudentsDocument8 pagesQuestions On Journal Entry For Studentsveraji3735No ratings yet

- Edisonlearning, Inc. 2013-2014 Schedule of Insurance: Coverage and Location Amount Insured PropertyDocument2 pagesEdisonlearning, Inc. 2013-2014 Schedule of Insurance: Coverage and Location Amount Insured PropertyYork Daily Record/Sunday NewsNo ratings yet

- Bank Lacked Proof of Standing in Foreclosure CaseDocument5 pagesBank Lacked Proof of Standing in Foreclosure CaseD. BushNo ratings yet

- Finmar Equity AssessmentDocument3 pagesFinmar Equity AssessmentChristen HerceNo ratings yet

- Pas 18 RevenueDocument1 pagePas 18 RevenuerandyNo ratings yet

- 3 - FINREP - EBA ITS - v2.8Document34 pages3 - FINREP - EBA ITS - v2.8Miguel Angel OrtizNo ratings yet

- Analyzing Consolidated Financial StatementsDocument3 pagesAnalyzing Consolidated Financial StatementsBryle Jay LapeNo ratings yet

- GrowwDocument2 pagesGrowwKate pNo ratings yet