Professional Documents

Culture Documents

Status Note On YSR 0 Vaddi Urban

Uploaded by

rangag1979Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Status Note On YSR 0 Vaddi Urban

Uploaded by

rangag1979Copyright:

Available Formats

Status Note on YSR “0” Vaddi :

Guidelines for Implementation of YSR “0” Vaddi for the FY 2019-20.

The Government of Andhra Pradesh with a view to encourage better

repayment culture and to reduce interest burden on the Urban poor on

SHG Bank loans decided to continue the interest Subvention programme,

rechristened as “YSR “0” Vaddi.

Background:

Honb’le Chief Minister of AP, during “Praja Sankalpa Yatra” interacted

with the SHG women in the state. SHG women informed their debt

burden to Honb’le Chief Minister during interactions. Honb’le CM took a

decision to reimburse the debt availed by the SHGs in the state of Andhra

Pradesh directly in four installments.

This measure will improve and reinforce the Women Empowerment efforts

and strengthen the economic development of 2.30 lakhs poor SHG women

in urban areas.

Hon’ble Finance Minister during budget speech on 12.07.2019 for the

financial year 2019-20 announced that “As a part of implementation of

Navaratnalu, through the YSR Aasara program, it is proposed to

reimburse the entire outstanding Bank Loan as on 11 April 2019 of

Rs.5627.54 crores, in four installments starting from next year”.

It is proposed to pay the interest portion for the FY 2019-20 on the bank

loan amount outstanding as on 11.04.2019 freezed under YSR Aasara

both Rural and Urban areas.

Operational guidelines

Eligibility:

The “YSR “0” Vaddi will be applicable for all outstanding SHG Bank

loans as on 11.04.2019 for the FY 2019-20.

All SHGs in urban areas are eligible under the scheme up to a bank

loan outstanding of Rs.5.00 Lakhs.

SHG loan accounts declared as Non Performing Assets as on

31.03.2019 as per the database maintained by MEPMA are not be

eligible for YSR “0” Vaddi.

Implementation process:

For the implementation of YSR “0” Vaddi, MEPMA has obtained

SHG wise Bank Loan outstanding details as on 11.04.2019 from all

banks operating in the state of Andhra Pradesh through SLBC of

AP.

The correctness of the data was reconciled at field level by the

bank branch manager and Self Help Group concerned and was

uploaded in the MEPMA website by the field staff.

The amount of eligible YSR “0” Vaddi will be calculated on the

outstanding bank loan amount up to Rs.5.00 lakhs as on

11.04.2019 multiplied by rate of interest charged by individual

bank excluding penal interest for a period of one year.

The YSR “0” Vaddi will be credited into the respective loan

accounts of SHGs.

Letter addressed by Hon’ble CM to SHGs along with receipt

containing details of YSR “0” Vaddi paid by the Government and

confirmed by the Branch Manager shall be handed over to the

groups in a function organized at Slum/Ward/ULB/constituency

level.

The Community Organizer in Urban should record the details of

“YSR “0” Vaddi received by the group in Minutes book of the SHGs.

Awareness to SHGs:

SHG Meetings at Slum Level Federation (SLF) level have been conducted

by the Project staff of MEPMA to explain the modalities of the scheme and

implementation process.

Budget Estimates for the FY 2019-20:

It is estimated that an amount of Rs.648.83 Cr pertaining to 1,66,727

SHGs on the bank loan outstanding balance of Rs. 5,190.66 Cr as on

11.04.2019 up to an amount of Rs. 5 lakhs are required for

implementation of “YSR “0” Vaddi for the FY 2019-2020 for Urban SHGs

and monthly requirement would be Rs.54 Crores.

The budget requirement for payment of “YSR “0” Vaddi for Six months

i.e., from April 2019 to September 2019 is estimated at Rs.324 Cr for

urban SHGs.

Budge Estimates Provision:

An allocation of Rs.648.00 Crores was made provision in the budget for

the FY 2019-20 for implementation of YSR “0” Vaddi scheme for Urban

SHGs.

Release of YSR “0” Vaddi Funds to SHGs under DBT mode through CFMS:

YSR “0” Vaddi funds will be released through CFMS mode directly

from PD account to concern SHG loan account.

For the purpose of one-rupee test check of payment under DBT

mode through CFMS, it is proposed to release an amount of

Rs.1.53 lakhs to eligible SHGs under YSR “0” Vaddi scheme.

After due verification and successful confirmation of the one rupee

test check of the payments by the CMM/TMC, the amount will be

released for the period April 2019 – Sep 2019 i.e for 6 months of

the FY 2019-20 towards YSR “0” Vaddi to the respective loan

accounts of the SHGs under DBT mode through CFMS.

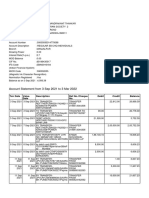

Estimated YSR "0" Vaddi for the FY 2019-20 up to Rs.5 Lakhs

SHG bank Loan outstanding - Urban

Rs in Crores

loan

Loan O/s

Sl. outstanding Total Financial

District Name up to 5 lakhs

No SHGs As on commitment

As on11.04. 2019

11.04.2019

1 Ananthapur 13203 368.99 46.12

2 Chittoor 11049 411.40 51.42

3 East Godavari 16410 549.75 68.72

4 Guntur 17161 516.22 64.53

5 GVMC 23370 650.03 81.25

6 Kadapa 11724 387.86 48.48

7 Krishna 7915 321.78 40.22

8 Kurnool 14801 380.36 47.55

9 Nellore 9761 298.07 37.26

10 Prakasam 8111 257.39 32.17

11 Srikakulam 4823 147.47 18.43

12 Visakhapatnam 1887 58.01 7.25

13 Vizianagaram 6946 212.08 26.51

14 VMC 10256 315.02 39.38

15 West Godavari 9310 316.23 39.53

Total 166727 5190.66 648.83

You might also like

- RRB Project ReportDocument13 pagesRRB Project ReportHetvi TankNo ratings yet

- Financial Inclusion Through Karad Urban Co Operative Bank, KaradDocument4 pagesFinancial Inclusion Through Karad Urban Co Operative Bank, KaradEditor IJTSRDNo ratings yet

- 1) KCC IntroductionDocument5 pages1) KCC IntroductionBHANUPRIYANo ratings yet

- Analisis Kinerja Keuangan Pada Pemerintah Daerah Kota Jambi Tahun Anggaran 2019-2021Document13 pagesAnalisis Kinerja Keuangan Pada Pemerintah Daerah Kota Jambi Tahun Anggaran 2019-2021eksajaya pajakNo ratings yet

- Jai Sri Gurudev - : Department of Mba Accounting For Managers (20mba13)Document4 pagesJai Sri Gurudev - : Department of Mba Accounting For Managers (20mba13)Meghana SushmaNo ratings yet

- Design Case Study 3Document14 pagesDesign Case Study 3mazoodsmithaNo ratings yet

- Bihar Budget-2023-24Document6 pagesBihar Budget-2023-24ankitNo ratings yet

- LR To District Collectors - Mapping of Bank Branches To Secretariats, Employees and Volunteers With User ManualDocument8 pagesLR To District Collectors - Mapping of Bank Branches To Secretariats, Employees and Volunteers With User ManualASHOKNo ratings yet

- Review of Barangay BudgetDocument39 pagesReview of Barangay BudgetSangguniangbayan ItogonNo ratings yet

- Kishan Credit Card SchemeDocument4 pagesKishan Credit Card SchemeHarmandeep JudgeNo ratings yet

- Suco 2018Document7 pagesSuco 2018PUNI67% (3)

- Suco 2018Document7 pagesSuco 2018PUNI100% (1)

- Joint Memorandum Circular (JMC) No. 1, S. 201 9 Date: January 23, 2019Document3 pagesJoint Memorandum Circular (JMC) No. 1, S. 201 9 Date: January 23, 2019Richard Tañada RosalesNo ratings yet

- Financial Inclusion in Eastern IndiaDocument14 pagesFinancial Inclusion in Eastern Indiapawan patelNo ratings yet

- Girdhar51 1603693312542 PDFDocument2 pagesGirdhar51 1603693312542 PDFjignesh parmarNo ratings yet

- School of Management Studies: Summer Internship Program 16Document13 pagesSchool of Management Studies: Summer Internship Program 16samalanuNo ratings yet

- Promotion Test 2021-22 MCQs Series-49Document6 pagesPromotion Test 2021-22 MCQs Series-49shyam krishnaNo ratings yet

- Finances and Financial Reporting Issues of Local Self-Government InstitutionsDocument16 pagesFinances and Financial Reporting Issues of Local Self-Government Institutionsrajeeshmp1No ratings yet

- Terms and ConditionsDocument2 pagesTerms and ConditionssajeevclubNo ratings yet

- Jumboloan 9526 PWD GMOH9526Document2 pagesJumboloan 9526 PWD GMOH9526Nizamuddin GhouseNo ratings yet

- Micro Finance in IndiaDocument16 pagesMicro Finance in Indiagouravsaikia24No ratings yet

- 1560239588575vK2jT68bxZZnz5kd PDFDocument1 page1560239588575vK2jT68bxZZnz5kd PDFChandu GoudNo ratings yet

- Non-Performing AssetsDocument20 pagesNon-Performing AssetsSagar PawarNo ratings yet

- Risk Management & Insurance Coverage For Animal Including Small AnimalsDocument3 pagesRisk Management & Insurance Coverage For Animal Including Small Animalskiran viratNo ratings yet

- MHADA INFORMATION BOOKLET ENGLISH Chap-16Document5 pagesMHADA INFORMATION BOOKLET ENGLISH Chap-16Joint Chief Officer, MB MHADANo ratings yet

- Risk Analysis of Rivertype Hydropower PlantDocument7 pagesRisk Analysis of Rivertype Hydropower PlantJhoni SitompulNo ratings yet

- S.No Name of The Bank DD No. Date AmountDocument2 pagesS.No Name of The Bank DD No. Date Amountsc BhagatNo ratings yet

- Lok Sabha Un-Starred Question No. 2311Document5 pagesLok Sabha Un-Starred Question No. 2311nafa nuksanNo ratings yet

- Tanggal Uraian Transaksi Nominal Transaksi SaldoDocument2 pagesTanggal Uraian Transaksi Nominal Transaksi SaldoHaekal MahargiasNo ratings yet

- LHXXXXXXXXXXXX24Document2 pagesLHXXXXXXXXXXXX24Dhananjay RambhatlaNo ratings yet

- BRGF 11-12 Addition Allocation - MurshidabadDocument8 pagesBRGF 11-12 Addition Allocation - MurshidabadBdo Bharatpur-iNo ratings yet

- Success of National Banks After NationalisationDocument2 pagesSuccess of National Banks After NationalisationGourab MondalNo ratings yet

- 10-DRT2019 Part2-Observations and RecommDocument31 pages10-DRT2019 Part2-Observations and RecommGiovanni MartinNo ratings yet

- LHXXXXXXXXXXXX24Document2 pagesLHXXXXXXXXXXXX24Dhananjay RambhatlaNo ratings yet

- Projected Rahul BansalDocument7 pagesProjected Rahul BansalSunil JainNo ratings yet

- Assignment of PMJY, PMMY and PMBSYDocument47 pagesAssignment of PMJY, PMMY and PMBSYPrakash Kumar HindujaNo ratings yet

- Assignment-1: Banking and InsuranceDocument17 pagesAssignment-1: Banking and Insuranceslachrummy4No ratings yet

- Lakki MarwatDocument118 pagesLakki MarwatRizwanUllahKhanNo ratings yet

- 2023-12-30-08-54-27Nov-23_121106Document5 pages2023-12-30-08-54-27Nov-23_121106bittubaghel6713No ratings yet

- Cooperative Society Shemes and LoansDocument10 pagesCooperative Society Shemes and LoansArun Kumar MNo ratings yet

- Issues of MSMEs in OdishaDocument3 pagesIssues of MSMEs in OdishaPriya RanjanNo ratings yet

- Sukanya Samriddhi Yojana Calculator - SSY Calculator OnlineDocument12 pagesSukanya Samriddhi Yojana Calculator - SSY Calculator OnlineAjmeerNo ratings yet

- HDFC Bank LTDDocument2 pagesHDFC Bank LTDAkshay PatilNo ratings yet

- Admission Schedule 1920Document13 pagesAdmission Schedule 1920Kallol Kumar DihingiaNo ratings yet

- DBM Dilg Nyc Joint Memorandum Circular No 2019 1 PDFDocument10 pagesDBM Dilg Nyc Joint Memorandum Circular No 2019 1 PDFRoselyn Holgado CelizNo ratings yet

- CooperativeDocument8 pagesCooperativeH1190506M2009No ratings yet

- Government Order Announces 2000 Panchayat Accounts Assistant PostsDocument5 pagesGovernment Order Announces 2000 Panchayat Accounts Assistant PostsSunil SharmaNo ratings yet

- Joint Letter To IBADocument2 pagesJoint Letter To IBAnirmalNo ratings yet

- HDFC Bank LTDDocument2 pagesHDFC Bank LTDMd SharidNo ratings yet

- CCE Current Affairs CapsuleDocument24 pagesCCE Current Affairs Capsulepawanteja tummalaNo ratings yet

- Value Date Post Date Remitter Branch Description Cheque No. Debit AmountDocument7 pagesValue Date Post Date Remitter Branch Description Cheque No. Debit AmountSai Malavika TuluguNo ratings yet

- NXJ V2 RQR Yqn Uyk 1Document6 pagesNXJ V2 RQR Yqn Uyk 1varaprasadNo ratings yet

- Edn - 74577 3Document2 pagesEdn - 74577 3narasimharao gorlaNo ratings yet

- Mr. VIRAL CHANDRAKANT THAKKAR Account StatementDocument8 pagesMr. VIRAL CHANDRAKANT THAKKAR Account StatementViral ThakkarNo ratings yet

- Altaf Shaikh - SOADocument2 pagesAltaf Shaikh - SOAGaurav GujrathiNo ratings yet

- TASK-17: Non-Performing Asset (NPA)Document11 pagesTASK-17: Non-Performing Asset (NPA)Ashish KattaNo ratings yet

- Non-Performing Assets: in Bank of IndiaDocument23 pagesNon-Performing Assets: in Bank of Indiaindhu yaluNo ratings yet

- 2023-SGLGB FAQsDocument11 pages2023-SGLGB FAQsMalipampang San Ildefonso100% (1)

- Asia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyNo ratings yet

- Financial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeFrom EverandFinancial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeNo ratings yet

- Dharmodaka VidhanamDocument15 pagesDharmodaka Vidhanamrangag1979No ratings yet

- MEPMA Note 30102019 EnglishDocument5 pagesMEPMA Note 30102019 Englishrangag1979No ratings yet

- Status Note On YSR 0 Vaddi UrbanDocument3 pagesStatus Note On YSR 0 Vaddi Urbanrangag1979No ratings yet

- Status Note On YSR 0 Vaddi UrbanDocument3 pagesStatus Note On YSR 0 Vaddi Urbanrangag1979No ratings yet

- MEPMA-27!08!2019 3 SlidesDocument3 pagesMEPMA-27!08!2019 3 Slidesrangag1979No ratings yet

- Director Financial Planning Analysis in New York NY Resume Howard SchierDocument2 pagesDirector Financial Planning Analysis in New York NY Resume Howard SchierHowardSchierNo ratings yet

- 4.budgetory ControlDocument66 pages4.budgetory ControlSrinivas ReddyNo ratings yet

- Strategic Cost ManagementDocument3 pagesStrategic Cost ManagementShubakar ReddyNo ratings yet

- Impact of Technology On Banking SectorDocument31 pagesImpact of Technology On Banking SectorVimaljeet KaurNo ratings yet

- BAF 3105 Performance Measurement & Control ExamDocument4 pagesBAF 3105 Performance Measurement & Control ExamJEFF SHIKALINo ratings yet

- Exim Policy 2002-2007 & Foreign Trade Policy 2004-2009Document18 pagesExim Policy 2002-2007 & Foreign Trade Policy 2004-2009Anubandh Patil0% (1)

- One Man Commission ReportDocument379 pagesOne Man Commission ReportAbraham Meshak100% (6)

- Construction of School Perimeter FenceDocument2 pagesConstruction of School Perimeter Fencejovito limotNo ratings yet

- ECC6 Report ListsDocument12 pagesECC6 Report Listsdienda1No ratings yet

- Professional Photography Quote Invoice DataDocument4 pagesProfessional Photography Quote Invoice DataAkmal SungkanahNo ratings yet

- Kunkle Blumer-Rasansky LetterDocument1 pageKunkle Blumer-Rasansky LettercityhallblogNo ratings yet

- Culinary ClubDocument5 pagesCulinary Clubsandeep singhNo ratings yet

- Capital RationingDocument2 pagesCapital Rationingvishesh_2211_1257207No ratings yet

- Kings smp5Document2 pagesKings smp5api-456426550No ratings yet

- Press Release - Kosmo - FY12-05 ResultsDocument2 pagesPress Release - Kosmo - FY12-05 ResultssafraNo ratings yet

- Finance SOP (Example - 1) (1553)Document4 pagesFinance SOP (Example - 1) (1553)Rindy Murti Dewi100% (1)

- Keynesian Model QuestionsDocument13 pagesKeynesian Model QuestionsLee AngelNo ratings yet

- School of Business & Economics Department of Accounting & FinanceDocument4 pagesSchool of Business & Economics Department of Accounting & FinanceMd JonaidNo ratings yet

- Parguez - Dallo Stato Sociale Allo Stato Predatore (Anteprima) PDFDocument187 pagesParguez - Dallo Stato Sociale Allo Stato Predatore (Anteprima) PDFGiovanni GrecoNo ratings yet

- Local Self Government Detailed Version 1Document34 pagesLocal Self Government Detailed Version 1Noel PannaNo ratings yet

- ReportDocument124 pagesReportRecordTrac - City of OaklandNo ratings yet

- Case Study Sap For Atlam: Group Member Name Matric NoDocument30 pagesCase Study Sap For Atlam: Group Member Name Matric NoKennedy NgNo ratings yet

- Monthly Report April 2017 - German Economy Gains Momentum on Strong Industrial ActivityDocument134 pagesMonthly Report April 2017 - German Economy Gains Momentum on Strong Industrial ActivitytexasbigNo ratings yet

- Accounting Systems of Local GovernmentDocument5 pagesAccounting Systems of Local GovernmentWasLiana JafarNo ratings yet

- 41 - Vol 5 - EpaperDocument32 pages41 - Vol 5 - EpaperThesouthasian TimesNo ratings yet

- Pork Barrel Scandal in the PhilippinesDocument33 pagesPork Barrel Scandal in the PhilippinesjennelleafricanoNo ratings yet

- Study of Cash Management at Standard Chartered BankDocument115 pagesStudy of Cash Management at Standard Chartered BankVishnu Prasad100% (2)

- Budjet Estimate, Performance BudjetDocument28 pagesBudjet Estimate, Performance BudjetYashoda SatputeNo ratings yet

- Budgetary Accounts and Systems ExplainedDocument4 pagesBudgetary Accounts and Systems ExplainedMoises A. Almendares0% (1)

- Responsibility Centers: Revenue and Expense Centers: Summary of Chapter 4-Assignment 2Document4 pagesResponsibility Centers: Revenue and Expense Centers: Summary of Chapter 4-Assignment 2Indah IndrianiNo ratings yet