Professional Documents

Culture Documents

Ifrs 7 PDF

Ifrs 7 PDF

Uploaded by

Ali RazaCopyright:

Available Formats

You might also like

- From Asset Swaps To Z SpreadsDocument20 pagesFrom Asset Swaps To Z SpreadsAudrey Lim100% (1)

- Certification: (Name) (Status)Document1 pageCertification: (Name) (Status)Rafael Renz DayaoNo ratings yet

- Ifrs at A Glance IFRS 7 Financial Instruments: DisclosuresDocument5 pagesIfrs at A Glance IFRS 7 Financial Instruments: DisclosuresNoor Ul Hussain MirzaNo ratings yet

- Financial Instruments - IFRS 7Document2 pagesFinancial Instruments - IFRS 7aubrey lomaadNo ratings yet

- Disclosures Under IFRS 9: What's The Aim?Document16 pagesDisclosures Under IFRS 9: What's The Aim?Ishtiaq AzamNo ratings yet

- Conceptual Framework QuizDocument31 pagesConceptual Framework QuizHannah RodulfoNo ratings yet

- PFRS 7 Financial Instruments DisclosuresDocument20 pagesPFRS 7 Financial Instruments DisclosureseiraNo ratings yet

- Pfrs 7 Financial Instruments DisclosuresDocument3 pagesPfrs 7 Financial Instruments DisclosuresR.A.No ratings yet

- Unit 1 - Tuts SolutionDocument3 pagesUnit 1 - Tuts SolutionhavengroupnaNo ratings yet

- 74910bos60524 cp11 U1Document25 pages74910bos60524 cp11 U1ankitsethioneNo ratings yet

- Class IV-FinanceDocument19 pagesClass IV-FinanceVinayak RaoNo ratings yet

- Fiinratings Corporate Credit Rating MethodologyDocument14 pagesFiinratings Corporate Credit Rating MethodologyVinitaNo ratings yet

- Financial Risk Management: BY S.LingeswariDocument26 pagesFinancial Risk Management: BY S.Lingeswarilvinoth5No ratings yet

- Managing Cash & Investment (EY)Document12 pagesManaging Cash & Investment (EY)Anil KumarNo ratings yet

- Topic - 1 Introduction To Financial System-SummaryDocument21 pagesTopic - 1 Introduction To Financial System-SummaryAnh NguyenNo ratings yet

- CCFA03 - S4 Financial Institution & Risk Management - Lecture OneDocument9 pagesCCFA03 - S4 Financial Institution & Risk Management - Lecture OnemonirNo ratings yet

- Snapshot - IFRS 9 - Financial Instruments - Hedge AccountingDocument1 pageSnapshot - IFRS 9 - Financial Instruments - Hedge AccountingottieNo ratings yet

- IFRS 9 FINANCIAL INSTRUMENTS-AddisDocument35 pagesIFRS 9 FINANCIAL INSTRUMENTS-Addisesulawyer2001No ratings yet

- SGAP Presentation MKT and Liquidity Risk ManagementDocument15 pagesSGAP Presentation MKT and Liquidity Risk ManagementDavid IbironkeNo ratings yet

- Hedge AccountingDocument8 pagesHedge AccountingSathisha KrishnappaNo ratings yet

- 41 As 30 31 32 FormattedDocument82 pages41 As 30 31 32 FormattedTarandeep Singh BhatiaNo ratings yet

- Unit 1Document25 pagesUnit 1Jayaprabhakannan V.P.S.No ratings yet

- Ifrs at A Glance: IAS 39 Financial InstrumentsDocument8 pagesIfrs at A Glance: IAS 39 Financial InstrumentsSamNo ratings yet

- IFRS News Supplement Oct06Document6 pagesIFRS News Supplement Oct06georgepNo ratings yet

- FIN303 - Chap 20Document58 pagesFIN303 - Chap 20Hoang Thanh HangNo ratings yet

- Financial Instruments: Ifrs 7Document26 pagesFinancial Instruments: Ifrs 7Diana PattnaikNo ratings yet

- IFRS 9 - ImpairmentDocument14 pagesIFRS 9 - ImpairmentIris SarigumbaNo ratings yet

- Analyst Prep Foundn 2024Document340 pagesAnalyst Prep Foundn 2024Useless IdNo ratings yet

- Presented By: Viraf Badha 101 Saurabh Bahuwala 102 Subodh Bhave 103 Sonia Bose 105 Hashveen Chadha 106 Preeti Deshpande 107 Priya Deshpande 108Document31 pagesPresented By: Viraf Badha 101 Saurabh Bahuwala 102 Subodh Bhave 103 Sonia Bose 105 Hashveen Chadha 106 Preeti Deshpande 107 Priya Deshpande 108Lalitha RamaswamyNo ratings yet

- Adobe Scan 03 Aug 2023Document3 pagesAdobe Scan 03 Aug 2023Amedorme WisdomNo ratings yet

- Summary of ChaptersDocument15 pagesSummary of ChaptersSakariyeNo ratings yet

- Pfrs 9 Financial Instruments Summary Financial Assets Financial Liabilities and Equity InstrumentsDocument6 pagesPfrs 9 Financial Instruments Summary Financial Assets Financial Liabilities and Equity InstrumentsSHARON SAMSONNo ratings yet

- AT - Materiality and RisksDocument7 pagesAT - Materiality and RisksRey Joyce AbuelNo ratings yet

- Financial Intrumenst SLIDESDocument12 pagesFinancial Intrumenst SLIDESjanarthan kogilavaniNo ratings yet

- Financial Risk ManagementDocument90 pagesFinancial Risk Managementmorrisonkaniu8283No ratings yet

- AFA 2021 Lecture 9B Financial Instruments DisclosureDocument11 pagesAFA 2021 Lecture 9B Financial Instruments DisclosureEge YüNo ratings yet

- IFRS 17 - Understanding The Requirements For Life Insurers: Abdul Moid Ahmed Khan, ASADocument32 pagesIFRS 17 - Understanding The Requirements For Life Insurers: Abdul Moid Ahmed Khan, ASAkamrangulNo ratings yet

- Indian Accounting Standard (Ind AS) 107: Financial Instruments: DisclosuresDocument45 pagesIndian Accounting Standard (Ind AS) 107: Financial Instruments: DisclosuresUbaid DarNo ratings yet

- IAS 32, IFRS 7dataDocument3 pagesIAS 32, IFRS 7dataShafaq QureshiNo ratings yet

- AFA 4e PPT Chap01Document55 pagesAFA 4e PPT Chap01فهد التويجريNo ratings yet

- ICRA Complexity Indicator, May 2021Document6 pagesICRA Complexity Indicator, May 2021finaarthikaNo ratings yet

- Risk Management in The Banking SectorDocument47 pagesRisk Management in The Banking SectorGaurEeshNo ratings yet

- Solvency IIDocument28 pagesSolvency IIamingwaniNo ratings yet

- Allowance For Risk in Market Consistent Embedded Value (MCEV)Document12 pagesAllowance For Risk in Market Consistent Embedded Value (MCEV)apluNo ratings yet

- BFSM Unit-IiiDocument13 pagesBFSM Unit-IiiAbhinayaa SNo ratings yet

- Unit 7: Hedge Accounting: Accounting and Reporting of Financial InstrumentsDocument8 pagesUnit 7: Hedge Accounting: Accounting and Reporting of Financial Instrumentsdevanshi jainNo ratings yet

- B3 - Helen CooperDocument13 pagesB3 - Helen CooperdouglasNo ratings yet

- Deloitte WS FCAB AgendaDocument75 pagesDeloitte WS FCAB Agendaanto anteNo ratings yet

- EY Applying FV April 2014Document18 pagesEY Applying FV April 2014Elias JuniorNo ratings yet

- Lecture 5 Financial InstrumentsDocument31 pagesLecture 5 Financial InstrumentsBrenden KapoNo ratings yet

- Bsais 2c-Group 5Document17 pagesBsais 2c-Group 5Queeny Mae Cantre ReutaNo ratings yet

- Ind AS 109Document47 pagesInd AS 109Savin Avaran SajanNo ratings yet

- Commercial Bank Project: Annual Report 2018 Credit Libanais SAL & Bank of BeirutDocument10 pagesCommercial Bank Project: Annual Report 2018 Credit Libanais SAL & Bank of BeirutNaja NaddafNo ratings yet

- 201.06 Accounting For Insurance Companies (IAS-1, IfRS-4)Document6 pages201.06 Accounting For Insurance Companies (IAS-1, IfRS-4)Biplob K. SannyasiNo ratings yet

- 6 - Unit IV - Financial IntrumentsDocument21 pages6 - Unit IV - Financial IntrumentsMichael RosquitaNo ratings yet

- IAI - ICAEW IFRS 9 - 12 Aug 19Document47 pagesIAI - ICAEW IFRS 9 - 12 Aug 19Jay horayNo ratings yet

- PFRS 7Document22 pagesPFRS 7Princess Jullyn ClaudioNo ratings yet

- Risk Mgt.Document20 pagesRisk Mgt.shiv sindhuNo ratings yet

- Online Test Series: Jaiib Caiib Mock Test & Study Materias PageDocument83 pagesOnline Test Series: Jaiib Caiib Mock Test & Study Materias PageabhiNo ratings yet

- Bdo - Ifrs 9Document8 pagesBdo - Ifrs 9fildzah dessyanaNo ratings yet

- Financial Management: Reference Book Study Guide ACCA CPA CA CIMA BBA MBA: A Comprehensive GuideFrom EverandFinancial Management: Reference Book Study Guide ACCA CPA CA CIMA BBA MBA: A Comprehensive GuideNo ratings yet

- MCQs - RFBT - Obligations (General Principles)Document15 pagesMCQs - RFBT - Obligations (General Principles)Rafael Renz DayaoNo ratings yet

- Module 33.1 - MAS - Management AccountingDocument39 pagesModule 33.1 - MAS - Management AccountingRafael Renz DayaoNo ratings yet

- Jeth 1Document1 pageJeth 1Rafael Renz DayaoNo ratings yet

- Problems CCEDocument10 pagesProblems CCERafael Renz DayaoNo ratings yet

- MCQs For Law On ContractsDocument8 pagesMCQs For Law On ContractsRafael Renz Dayao100% (1)

- Are You Kidding MeDocument1 pageAre You Kidding MeRafael Renz DayaoNo ratings yet

- Document A002Document1 pageDocument A002Rafael Renz DayaoNo ratings yet

- Rules in The Determination of Corporate NationalityDocument7 pagesRules in The Determination of Corporate NationalityRafael Renz DayaoNo ratings yet

- Characteristics of ContractsDocument4 pagesCharacteristics of ContractsRafael Renz Dayao100% (2)

- Types of Credit Transactions As To Their ConsiderationDocument3 pagesTypes of Credit Transactions As To Their ConsiderationRafael Renz DayaoNo ratings yet

- Auditing Theory - Day 01Document3 pagesAuditing Theory - Day 01Rafael Renz DayaoNo ratings yet

- Auditing TheoryDocument86 pagesAuditing TheoryRafael Renz DayaoNo ratings yet

- Auditing TheoryDocument86 pagesAuditing TheoryRafael Renz DayaoNo ratings yet

- Far 01 Introduction To AccountingDocument11 pagesFar 01 Introduction To AccountingRafael Renz DayaoNo ratings yet

- Ifrs at A GlanceDocument8 pagesIfrs at A GlanceRafael Renz DayaoNo ratings yet

- Multiphase Pump DataDocument1 pageMultiphase Pump DataUmar Ijaz KhanNo ratings yet

- Full Issue PDF Volume 88 Supplement 1Document202 pagesFull Issue PDF Volume 88 Supplement 1Arie AnggaNo ratings yet

- Imaging of Skull Base: Pictorial Essay: M - S - H NDocument12 pagesImaging of Skull Base: Pictorial Essay: M - S - H NGeorge Harrison Jr.No ratings yet

- Pipe & Pipe Fitting Guide For Oil & Gas CareerDocument208 pagesPipe & Pipe Fitting Guide For Oil & Gas Careervarun156750% (4)

- Work Instruction/ Standard Operating ProcedureDocument2 pagesWork Instruction/ Standard Operating Procedurewaziri maulidiNo ratings yet

- Hard Discounters & Soft Discounters OverviewDocument7 pagesHard Discounters & Soft Discounters OverviewAaron Chio100% (1)

- 01 Abrasive EbookDocument63 pages01 Abrasive Ebooksamba134No ratings yet

- M12FIWP12-0 - Product ManualDocument8 pagesM12FIWP12-0 - Product ManualjeanyoperNo ratings yet

- Pork Chop and Salad Recipes From P. Allen Smith's Seasonal Recipes From The GardenDocument9 pagesPork Chop and Salad Recipes From P. Allen Smith's Seasonal Recipes From The GardenThe Recipe Club50% (2)

- Gue Gub Junction BoxesDocument5 pagesGue Gub Junction BoxesAlexis Michel Cabrera AntonioNo ratings yet

- Plastic Molding TutorialDocument32 pagesPlastic Molding TutorialSergio RodriguezNo ratings yet

- Manual Geo PDFDocument242 pagesManual Geo PDFGustavo HuertasNo ratings yet

- Draft - Model Chandigarh Rules Under RPWD Act, 2016Document32 pagesDraft - Model Chandigarh Rules Under RPWD Act, 2016Disability Rights AllianceNo ratings yet

- Alamine 304 052523Document7 pagesAlamine 304 052523Loisse GrimaldoNo ratings yet

- NM Self/Participant Direction Employee Employment PacketDocument34 pagesNM Self/Participant Direction Employee Employment PacketShellyJacksonNo ratings yet

- Advice and Safe Practice For MicropigmentationDocument41 pagesAdvice and Safe Practice For MicropigmentationAlina PiscanuNo ratings yet

- Universitas Muhammadiyah Ponorogo Health Sciences JournalDocument5 pagesUniversitas Muhammadiyah Ponorogo Health Sciences JournalAndriz LallendiNo ratings yet

- ILS SB2 U07 Test ScriptDocument2 pagesILS SB2 U07 Test ScriptLâm DuyNo ratings yet

- Rei Vol IDocument297 pagesRei Vol IDineshNo ratings yet

- Health and FitnessDocument56 pagesHealth and FitnessVISHNU KNo ratings yet

- DNA ActivationDocument5 pagesDNA ActivationEnoch Gandhislilbrother AbrahamNo ratings yet

- FWN Magazine 2005 - Evelyn DilsaverDocument28 pagesFWN Magazine 2005 - Evelyn DilsaverFilipina Women's NetworkNo ratings yet

- Opening & Healing (v2) - 1Document26 pagesOpening & Healing (v2) - 1paulineNo ratings yet

- Pa Auk Sayadaw - Teaching and TrainingDocument56 pagesPa Auk Sayadaw - Teaching and TrainingMarkus Ananda AsgeirNo ratings yet

- Measuring Delinquency: Types of Offenders and Trends: Jenner P. PandanDocument17 pagesMeasuring Delinquency: Types of Offenders and Trends: Jenner P. PandanRuruni Kenchin BatusaiNo ratings yet

- Cranial Nerve Disorders: Ernest E. WangDocument13 pagesCranial Nerve Disorders: Ernest E. Wangirsyad tsaniNo ratings yet

- Did It Work? Reflections and Five Humble Questions To Guide AssessmentDocument4 pagesDid It Work? Reflections and Five Humble Questions To Guide AssessmentJennaNo ratings yet

- Ethanol Process FundamentalsDocument86 pagesEthanol Process FundamentalsEric NelsonNo ratings yet

- Atest Za Aluminijumski ProfilDocument5 pagesAtest Za Aluminijumski ProfilVlada VlaNo ratings yet

Ifrs 7 PDF

Ifrs 7 PDF

Uploaded by

Ali RazaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ifrs 7 PDF

Ifrs 7 PDF

Uploaded by

Ali RazaCopyright:

Available Formats

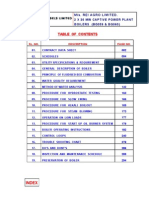

IFRS AT A GLANCE

IFRS 7 Financial Instruments:

Disclosures

As at 1 January 2016

IFRS 7 Financial Instruments: Disclosures

Effective Date

Periods beginning on or after 1 January 2007

DISCLOSURE REQUIREMENTS: SIGNIFICANCE OF FINANCIAL INSTRUMENTS DISCLOSURE REQUIREMENTS: NATURE AND EXTENT OF RISKS ARISING FROM FINANCIAL

IN TERMS OF THE FINANCIAL POSITION AND PERFORMANCE INSTRUMENTS AND HOW THE RISKS ARE MANAGED

Qualitative disclosure Quantitative disclosure

STATEMENT OF FINANCIAL POSITION OTHER · Exposure to risk and how it arises · Summary of quantitative data about exposure to risk based on

· Objectives, policies and processes for information given to key management

· Total carrying value of each category of financial assets Accounting policies: managing risk and method used to measure · Concentrations of risks.

and liabilities on face of the statement of financial · All relevant accounting risk.

position or in the notes policies. Include

· Information on fair value of loans and receivables measurement basis.

· Financial liabilities designated as at fair value through SPECIFIC QUANTITATIVE DISCLOSURE REQUIREMENTS

profit and loss Hedge accounting:

· Financial assets reclassified · Description of hedge,

Specific quantitative disclosure requirements: description and fair value of

· Financial assets that do not qualify for derecognition LIQUIDITY RISK CREDIT RISK MARKET RISK

· Details of financial assets pledged as collateral & hedged instrument and type

collateral held of risk hedged Definition: Definition: Definition:

· Reconciliation of allowance account for credit losses. · Details of cash flow hedges, The risk that an entity will encounter The risk that one party to a The risk that the fair value or future

· Compound financial instruments with embedded fair value hedges and hedge difficulty in meeting obligations financial instrument will cause cash flows of a financial instrument will

derivatives of net investment in foreign associated with financial liabilities. a financial loss for the other fluctuate due to changes in market

· Details of defaults and breaches of loans payable. operations. party by failing to discharge an prices. Market risk comprises three

obligation. types of risk: currency risk, interest rate

Fair value: risk and other price risk.

· Maturity analysis for financial

STATEMENT OF COMPREHENSIVE INCOME · Fair value for each class of liabilities that shows the

financial asset and liability remaining contractual maturities –

· Gain or loss for each category of financial assets and liabilities · Disclose method and Appendix B10A – B11F · Maximum exposure to credit · A sensitivity analysis (including

in the statement of comprehensive income or in the notes relevant assumptions to · Time bands and increment are risk without taking into methods and assumptions used) for

· Total interest income and interest expense (effective interest calculate fair value based on the entities’ judgement account collateral each type of market risk exposed,

method) · Disclose if fair value cannot · How liquidity risk is managed. · Collateral held as security showing impact on profit or loss and

· Fee income and expense be determined. and other credit equity

· Interest on impaired financial assets enhancements or

· Amount of impairment loss for each financial asset. · Information of financial · If a sensitivity analysis is prepared by

assets that are either past an entity, showing interdependencies

due (when a counterparty between risk variables and it is used

SCOPE has failed to make a to manage financial risks, it can be

FAIR VALUE (FV) HIERARCHY used in place of the above sensitivity

payment when contractually

IFRS 7 applies to all recognised and due) or impaired analysis.

All financial instruments measured at fair value must be classified into the levels below (that

unrecognised financial instruments (including reflect how fair value has been determined): · Information about collateral

contracts to buy or sell non-financial assets) and other credit

except: · Level 1: Quoted prices, in active markets enhancements obtained.

· Level 2: Level 1 quoted prices are not available but fair value is based on observable market

· Interests in subsidiaries, associates or joint

data

ventures, where IAS 27/28 or IFRS 10/11

permit accounting in accordance with IAS · Level 3: Inputs that are not based on observable market data. TRANSFER OF FINACIAL ASSETS

39/IFRS 9

A financial Instrument will be categorised based on the lowest level of any one of the inputs Information for transferred assets that are and that are not derecognised

· Assets and liabilities resulting from IAS 19

used for its valuation. in their entirety:

· Insurance contracts in accordance with

IFRS 4 (excluding embedded derivatives in The following disclosures are also required: · Information to understand the relationship between financial assets and

these contracts if IAS 39/IFRS 9 require · Significant transfers of financial instruments between each category – and reasons why associated liabilities that are not derecognised in their entirety

separate accounting) · For level 3, a reconciliation between opening and closing balances, incorporating; · Information to evaluate the nature and risk associated with the entities

· Financial instruments, contracts and gains/losses, purchases/sales/settlements, transfers continuing involvement in derecognised assets (IFRS 7.42A-G).

obligations under IFRS 2, except contracts · Amount of gains/losses and where they are included in profit and loss

within the scope of IAS 39/IFRS 9 · For level 3, if changing one or more inputs to a reasonably possible alternative would result

· Puttable instruments (IAS 32.16A-D). in a significant change in FV, disclose this fact.

For further information about how BDO can assist you and your organisation, please get in touch with one of our key contacts listed below.

Alternatively, please visit www.bdointernational.com/Services/Audit/IFRS/IFRS Country Leaders where you can find full lists of regional and

country contacts.

Europe

Caroline Allouët France caroline.allouet@bdo.fr

Jens Freiberg Germany jens.freiberg@bdo.de

Teresa Morahan Ireland tmorahan@bdo.ie

Ehud Greenberg Israel ehudg@bdo.co.il

Ruud Vergoossen Netherlands ruud.vergoossen@bdo.nl

Reidar Jensen Norway reidar.jensen@bdo.no

Maria Sukonkina Russia m.sukonkina@bdo.ru

René Krügel Switzerland rene.kruegel@bdo.ch

Brian Creighton United Kingdom brian.creighton@bdo.co.uk

Asia Pacific

Wayne Basford Australia wayne.basford@bdo.com.au

Zheng Xian Hong China zheng.xianhong@bdo.com.cn

Fanny Hsiang Hong Kong fannyhsiang@bdo.com.hk

Khoon Yeow Tan Malaysia tanky@bdo.my

Latin America

Marcelo Canetti Argentina mcanetti@bdoargentina.com

Luis Pierrend Peru lpierrend@bdo.com.pe

Ernesto Bartesaghi Uruguay ebartesaghi@bdo.com.uy

North America & Caribbean

Armand Capisciolto Canada acapisciolto@bdo.ca

Wendy Hambleton USA whambleton@bdo.com

Middle East

Arshad Gadit Bahrain arshad.gadit@bdo.bh

Antoine Gholam Lebanon agholam@bdo-lb.com

Sub Saharan Africa

Nigel Griffith South Africa ngriffith@bdo.co.za

This publication has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. The publication cannot be relied

upon to cover specific situations and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional

advice. Please contact your respective BDO member firm to discuss these matters in the context of your particular circumstances. Neither BDO IFR Advisory

Limited, Brussels Worldwide Services BVBA, BDO International Limited and/or BDO member firms, nor their respective partners, employees and/or agents accept

or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this publication or for any

decision based on it.

Service provision within the international BDO network of independent member firms (‘the BDO network’) in connection with IFRS (comprising International

Financial Reporting Standards, International Accounting Standards, and Interpretations developed by the IFRS Interpretations Committee and the former Standing

Interpretations Committee), and other documents, as issued by the International Accounting Standards Board, is provided by BDO IFR Advisory Limited, a UK

registered company limited by guarantee. Service provision within the BDO network is coordinated by Brussels Worldwide Services BVBA, a limited liability

company incorporated in Belgium with its statutory seat in Brussels.

Each of BDO International Limited (the governing entity of the BDO network), Brussels Worldwide Services BVBA, BDO IFR Advisory Limited and the member

firms is a separate legal entity and has no liability for another such entity’s acts or omissions. Nothing in the arrangements or rules of the BDO network shall

constitute or imply an agency relationship or a partnership between BDO International Limited, Brussels Worldwide Services BVBA, BDO IFR Advisory Limited and/

or the member firms of the BDO network.

BDO is the brand name for the BDO network and for each of the BDO member firms.

© 2016 BDO IFR Advisory Limited, a UK registered company limited by guarantee. All rights reserved.

www.bdointernational.com

You might also like

- From Asset Swaps To Z SpreadsDocument20 pagesFrom Asset Swaps To Z SpreadsAudrey Lim100% (1)

- Certification: (Name) (Status)Document1 pageCertification: (Name) (Status)Rafael Renz DayaoNo ratings yet

- Ifrs at A Glance IFRS 7 Financial Instruments: DisclosuresDocument5 pagesIfrs at A Glance IFRS 7 Financial Instruments: DisclosuresNoor Ul Hussain MirzaNo ratings yet

- Financial Instruments - IFRS 7Document2 pagesFinancial Instruments - IFRS 7aubrey lomaadNo ratings yet

- Disclosures Under IFRS 9: What's The Aim?Document16 pagesDisclosures Under IFRS 9: What's The Aim?Ishtiaq AzamNo ratings yet

- Conceptual Framework QuizDocument31 pagesConceptual Framework QuizHannah RodulfoNo ratings yet

- PFRS 7 Financial Instruments DisclosuresDocument20 pagesPFRS 7 Financial Instruments DisclosureseiraNo ratings yet

- Pfrs 7 Financial Instruments DisclosuresDocument3 pagesPfrs 7 Financial Instruments DisclosuresR.A.No ratings yet

- Unit 1 - Tuts SolutionDocument3 pagesUnit 1 - Tuts SolutionhavengroupnaNo ratings yet

- 74910bos60524 cp11 U1Document25 pages74910bos60524 cp11 U1ankitsethioneNo ratings yet

- Class IV-FinanceDocument19 pagesClass IV-FinanceVinayak RaoNo ratings yet

- Fiinratings Corporate Credit Rating MethodologyDocument14 pagesFiinratings Corporate Credit Rating MethodologyVinitaNo ratings yet

- Financial Risk Management: BY S.LingeswariDocument26 pagesFinancial Risk Management: BY S.Lingeswarilvinoth5No ratings yet

- Managing Cash & Investment (EY)Document12 pagesManaging Cash & Investment (EY)Anil KumarNo ratings yet

- Topic - 1 Introduction To Financial System-SummaryDocument21 pagesTopic - 1 Introduction To Financial System-SummaryAnh NguyenNo ratings yet

- CCFA03 - S4 Financial Institution & Risk Management - Lecture OneDocument9 pagesCCFA03 - S4 Financial Institution & Risk Management - Lecture OnemonirNo ratings yet

- Snapshot - IFRS 9 - Financial Instruments - Hedge AccountingDocument1 pageSnapshot - IFRS 9 - Financial Instruments - Hedge AccountingottieNo ratings yet

- IFRS 9 FINANCIAL INSTRUMENTS-AddisDocument35 pagesIFRS 9 FINANCIAL INSTRUMENTS-Addisesulawyer2001No ratings yet

- SGAP Presentation MKT and Liquidity Risk ManagementDocument15 pagesSGAP Presentation MKT and Liquidity Risk ManagementDavid IbironkeNo ratings yet

- Hedge AccountingDocument8 pagesHedge AccountingSathisha KrishnappaNo ratings yet

- 41 As 30 31 32 FormattedDocument82 pages41 As 30 31 32 FormattedTarandeep Singh BhatiaNo ratings yet

- Unit 1Document25 pagesUnit 1Jayaprabhakannan V.P.S.No ratings yet

- Ifrs at A Glance: IAS 39 Financial InstrumentsDocument8 pagesIfrs at A Glance: IAS 39 Financial InstrumentsSamNo ratings yet

- IFRS News Supplement Oct06Document6 pagesIFRS News Supplement Oct06georgepNo ratings yet

- FIN303 - Chap 20Document58 pagesFIN303 - Chap 20Hoang Thanh HangNo ratings yet

- Financial Instruments: Ifrs 7Document26 pagesFinancial Instruments: Ifrs 7Diana PattnaikNo ratings yet

- IFRS 9 - ImpairmentDocument14 pagesIFRS 9 - ImpairmentIris SarigumbaNo ratings yet

- Analyst Prep Foundn 2024Document340 pagesAnalyst Prep Foundn 2024Useless IdNo ratings yet

- Presented By: Viraf Badha 101 Saurabh Bahuwala 102 Subodh Bhave 103 Sonia Bose 105 Hashveen Chadha 106 Preeti Deshpande 107 Priya Deshpande 108Document31 pagesPresented By: Viraf Badha 101 Saurabh Bahuwala 102 Subodh Bhave 103 Sonia Bose 105 Hashveen Chadha 106 Preeti Deshpande 107 Priya Deshpande 108Lalitha RamaswamyNo ratings yet

- Adobe Scan 03 Aug 2023Document3 pagesAdobe Scan 03 Aug 2023Amedorme WisdomNo ratings yet

- Summary of ChaptersDocument15 pagesSummary of ChaptersSakariyeNo ratings yet

- Pfrs 9 Financial Instruments Summary Financial Assets Financial Liabilities and Equity InstrumentsDocument6 pagesPfrs 9 Financial Instruments Summary Financial Assets Financial Liabilities and Equity InstrumentsSHARON SAMSONNo ratings yet

- AT - Materiality and RisksDocument7 pagesAT - Materiality and RisksRey Joyce AbuelNo ratings yet

- Financial Intrumenst SLIDESDocument12 pagesFinancial Intrumenst SLIDESjanarthan kogilavaniNo ratings yet

- Financial Risk ManagementDocument90 pagesFinancial Risk Managementmorrisonkaniu8283No ratings yet

- AFA 2021 Lecture 9B Financial Instruments DisclosureDocument11 pagesAFA 2021 Lecture 9B Financial Instruments DisclosureEge YüNo ratings yet

- IFRS 17 - Understanding The Requirements For Life Insurers: Abdul Moid Ahmed Khan, ASADocument32 pagesIFRS 17 - Understanding The Requirements For Life Insurers: Abdul Moid Ahmed Khan, ASAkamrangulNo ratings yet

- Indian Accounting Standard (Ind AS) 107: Financial Instruments: DisclosuresDocument45 pagesIndian Accounting Standard (Ind AS) 107: Financial Instruments: DisclosuresUbaid DarNo ratings yet

- IAS 32, IFRS 7dataDocument3 pagesIAS 32, IFRS 7dataShafaq QureshiNo ratings yet

- AFA 4e PPT Chap01Document55 pagesAFA 4e PPT Chap01فهد التويجريNo ratings yet

- ICRA Complexity Indicator, May 2021Document6 pagesICRA Complexity Indicator, May 2021finaarthikaNo ratings yet

- Risk Management in The Banking SectorDocument47 pagesRisk Management in The Banking SectorGaurEeshNo ratings yet

- Solvency IIDocument28 pagesSolvency IIamingwaniNo ratings yet

- Allowance For Risk in Market Consistent Embedded Value (MCEV)Document12 pagesAllowance For Risk in Market Consistent Embedded Value (MCEV)apluNo ratings yet

- BFSM Unit-IiiDocument13 pagesBFSM Unit-IiiAbhinayaa SNo ratings yet

- Unit 7: Hedge Accounting: Accounting and Reporting of Financial InstrumentsDocument8 pagesUnit 7: Hedge Accounting: Accounting and Reporting of Financial Instrumentsdevanshi jainNo ratings yet

- B3 - Helen CooperDocument13 pagesB3 - Helen CooperdouglasNo ratings yet

- Deloitte WS FCAB AgendaDocument75 pagesDeloitte WS FCAB Agendaanto anteNo ratings yet

- EY Applying FV April 2014Document18 pagesEY Applying FV April 2014Elias JuniorNo ratings yet

- Lecture 5 Financial InstrumentsDocument31 pagesLecture 5 Financial InstrumentsBrenden KapoNo ratings yet

- Bsais 2c-Group 5Document17 pagesBsais 2c-Group 5Queeny Mae Cantre ReutaNo ratings yet

- Ind AS 109Document47 pagesInd AS 109Savin Avaran SajanNo ratings yet

- Commercial Bank Project: Annual Report 2018 Credit Libanais SAL & Bank of BeirutDocument10 pagesCommercial Bank Project: Annual Report 2018 Credit Libanais SAL & Bank of BeirutNaja NaddafNo ratings yet

- 201.06 Accounting For Insurance Companies (IAS-1, IfRS-4)Document6 pages201.06 Accounting For Insurance Companies (IAS-1, IfRS-4)Biplob K. SannyasiNo ratings yet

- 6 - Unit IV - Financial IntrumentsDocument21 pages6 - Unit IV - Financial IntrumentsMichael RosquitaNo ratings yet

- IAI - ICAEW IFRS 9 - 12 Aug 19Document47 pagesIAI - ICAEW IFRS 9 - 12 Aug 19Jay horayNo ratings yet

- PFRS 7Document22 pagesPFRS 7Princess Jullyn ClaudioNo ratings yet

- Risk Mgt.Document20 pagesRisk Mgt.shiv sindhuNo ratings yet

- Online Test Series: Jaiib Caiib Mock Test & Study Materias PageDocument83 pagesOnline Test Series: Jaiib Caiib Mock Test & Study Materias PageabhiNo ratings yet

- Bdo - Ifrs 9Document8 pagesBdo - Ifrs 9fildzah dessyanaNo ratings yet

- Financial Management: Reference Book Study Guide ACCA CPA CA CIMA BBA MBA: A Comprehensive GuideFrom EverandFinancial Management: Reference Book Study Guide ACCA CPA CA CIMA BBA MBA: A Comprehensive GuideNo ratings yet

- MCQs - RFBT - Obligations (General Principles)Document15 pagesMCQs - RFBT - Obligations (General Principles)Rafael Renz DayaoNo ratings yet

- Module 33.1 - MAS - Management AccountingDocument39 pagesModule 33.1 - MAS - Management AccountingRafael Renz DayaoNo ratings yet

- Jeth 1Document1 pageJeth 1Rafael Renz DayaoNo ratings yet

- Problems CCEDocument10 pagesProblems CCERafael Renz DayaoNo ratings yet

- MCQs For Law On ContractsDocument8 pagesMCQs For Law On ContractsRafael Renz Dayao100% (1)

- Are You Kidding MeDocument1 pageAre You Kidding MeRafael Renz DayaoNo ratings yet

- Document A002Document1 pageDocument A002Rafael Renz DayaoNo ratings yet

- Rules in The Determination of Corporate NationalityDocument7 pagesRules in The Determination of Corporate NationalityRafael Renz DayaoNo ratings yet

- Characteristics of ContractsDocument4 pagesCharacteristics of ContractsRafael Renz Dayao100% (2)

- Types of Credit Transactions As To Their ConsiderationDocument3 pagesTypes of Credit Transactions As To Their ConsiderationRafael Renz DayaoNo ratings yet

- Auditing Theory - Day 01Document3 pagesAuditing Theory - Day 01Rafael Renz DayaoNo ratings yet

- Auditing TheoryDocument86 pagesAuditing TheoryRafael Renz DayaoNo ratings yet

- Auditing TheoryDocument86 pagesAuditing TheoryRafael Renz DayaoNo ratings yet

- Far 01 Introduction To AccountingDocument11 pagesFar 01 Introduction To AccountingRafael Renz DayaoNo ratings yet

- Ifrs at A GlanceDocument8 pagesIfrs at A GlanceRafael Renz DayaoNo ratings yet

- Multiphase Pump DataDocument1 pageMultiphase Pump DataUmar Ijaz KhanNo ratings yet

- Full Issue PDF Volume 88 Supplement 1Document202 pagesFull Issue PDF Volume 88 Supplement 1Arie AnggaNo ratings yet

- Imaging of Skull Base: Pictorial Essay: M - S - H NDocument12 pagesImaging of Skull Base: Pictorial Essay: M - S - H NGeorge Harrison Jr.No ratings yet

- Pipe & Pipe Fitting Guide For Oil & Gas CareerDocument208 pagesPipe & Pipe Fitting Guide For Oil & Gas Careervarun156750% (4)

- Work Instruction/ Standard Operating ProcedureDocument2 pagesWork Instruction/ Standard Operating Procedurewaziri maulidiNo ratings yet

- Hard Discounters & Soft Discounters OverviewDocument7 pagesHard Discounters & Soft Discounters OverviewAaron Chio100% (1)

- 01 Abrasive EbookDocument63 pages01 Abrasive Ebooksamba134No ratings yet

- M12FIWP12-0 - Product ManualDocument8 pagesM12FIWP12-0 - Product ManualjeanyoperNo ratings yet

- Pork Chop and Salad Recipes From P. Allen Smith's Seasonal Recipes From The GardenDocument9 pagesPork Chop and Salad Recipes From P. Allen Smith's Seasonal Recipes From The GardenThe Recipe Club50% (2)

- Gue Gub Junction BoxesDocument5 pagesGue Gub Junction BoxesAlexis Michel Cabrera AntonioNo ratings yet

- Plastic Molding TutorialDocument32 pagesPlastic Molding TutorialSergio RodriguezNo ratings yet

- Manual Geo PDFDocument242 pagesManual Geo PDFGustavo HuertasNo ratings yet

- Draft - Model Chandigarh Rules Under RPWD Act, 2016Document32 pagesDraft - Model Chandigarh Rules Under RPWD Act, 2016Disability Rights AllianceNo ratings yet

- Alamine 304 052523Document7 pagesAlamine 304 052523Loisse GrimaldoNo ratings yet

- NM Self/Participant Direction Employee Employment PacketDocument34 pagesNM Self/Participant Direction Employee Employment PacketShellyJacksonNo ratings yet

- Advice and Safe Practice For MicropigmentationDocument41 pagesAdvice and Safe Practice For MicropigmentationAlina PiscanuNo ratings yet

- Universitas Muhammadiyah Ponorogo Health Sciences JournalDocument5 pagesUniversitas Muhammadiyah Ponorogo Health Sciences JournalAndriz LallendiNo ratings yet

- ILS SB2 U07 Test ScriptDocument2 pagesILS SB2 U07 Test ScriptLâm DuyNo ratings yet

- Rei Vol IDocument297 pagesRei Vol IDineshNo ratings yet

- Health and FitnessDocument56 pagesHealth and FitnessVISHNU KNo ratings yet

- DNA ActivationDocument5 pagesDNA ActivationEnoch Gandhislilbrother AbrahamNo ratings yet

- FWN Magazine 2005 - Evelyn DilsaverDocument28 pagesFWN Magazine 2005 - Evelyn DilsaverFilipina Women's NetworkNo ratings yet

- Opening & Healing (v2) - 1Document26 pagesOpening & Healing (v2) - 1paulineNo ratings yet

- Pa Auk Sayadaw - Teaching and TrainingDocument56 pagesPa Auk Sayadaw - Teaching and TrainingMarkus Ananda AsgeirNo ratings yet

- Measuring Delinquency: Types of Offenders and Trends: Jenner P. PandanDocument17 pagesMeasuring Delinquency: Types of Offenders and Trends: Jenner P. PandanRuruni Kenchin BatusaiNo ratings yet

- Cranial Nerve Disorders: Ernest E. WangDocument13 pagesCranial Nerve Disorders: Ernest E. Wangirsyad tsaniNo ratings yet

- Did It Work? Reflections and Five Humble Questions To Guide AssessmentDocument4 pagesDid It Work? Reflections and Five Humble Questions To Guide AssessmentJennaNo ratings yet

- Ethanol Process FundamentalsDocument86 pagesEthanol Process FundamentalsEric NelsonNo ratings yet

- Atest Za Aluminijumski ProfilDocument5 pagesAtest Za Aluminijumski ProfilVlada VlaNo ratings yet