Professional Documents

Culture Documents

Amber Enterprises LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Broking

Uploaded by

moisha sharmaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Amber Enterprises LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Broking

Uploaded by

moisha sharmaCopyright:

Available Formats

3QFY2019 Result Update | Consumer Durable

February 16, 2019

Amber Enterprises India Ltd BUY

CMP `637

Performance Update Target Price `910

(` cr) 3QFY19 3QFY18 % yoy 2QFY19 % qoq Investment Period 12 months

Revenue 388.8 338.4 14.9 226.3 71.8

EBITDA Stock Info

22.1 24.1 (8.2) 8.9 148.9

OPM (%) Sector Consumer Durable

5.7% 7.1% 3.9%

Market Cap (` cr) 2,002

Reported PAT 3.9 0.1 3123 -1.8 (320.0)

Net Debt (` cr) -62.0

Source: Company, Angel Research

Beta 0.9

For 3QFY2019, Amber Enterprises Ltd (Amber) posted a decent set of numbers 52 Week High / Low 1200/630

given muted demand environment and significant cost pressures. Revenue grew Avg. Daily Volume 12,500

by 14.9% yoy to `338.8cr. On the bottom-line front, Amber reported PAT of Face Value (`) 2

`3.9cr against `0.1cr despite cost pressures. BSE Sensex 35,809

Nifty 10,724

Growth led by AC Components Division: The company’s top-line grew by 14.9% Reuters Code AMBER.BO

yoy to `338.8cr on the back of strong volume growth. Growth was led by strong Bloomberg Code AMBER.IN

performance of the AC Components division which accounted for 8.8% of

revenues in Q4FY19 as compared to 5.9% of revenues in Q3FY18. Growth in the Shareholding Pattern (%)

air conditioner segment was sluggish due to weakness in overall demand and Promoters 44

therefore its contribution dropped to 78.4% of revenues from 80.9%. Non AC MF / Banks / Indian 33

components contributed to 12.8% of revenues as compared to 13.2% of revenues FII / NRIs / OCBs 11

Indian Public/Others 12

in Q3FY18.

Margins Impacted Due to Cost Pressures: On the operating front, the company’s Abs.(%) 3m 1yr 3yr

gross margins declined by 160bps to 14.1% due to cost pressures. EBITDA Sensex 1.6 4.4 52.0

margins also declined by 130bps yoy to 5.7%. However lower interest outgo an Amber (25.9) (44.6) -

stable tax rates led to increase in PAT from Rs. 0.1cr to Rs. 3.9cr.

Outlook and Valuation: We expect Amber Ltd. to report net profit (reported)

CAGR of ~35.5% to ~`114.4cr over FY2018-20E on the back of topline growth

of 19.4% in the same period. Post the 3QFY19 numbers, we maintain BUY on the

stock with a revised target Price of `910 (25xFY20E).

Historical share price chart

Key Financials

1,400

Y/E March (` cr) FY2017 FY2018 FY2019E FY2020E 1,200

Net sales 1,651.9 2,128.1 2,500.5 3,034.7 1,000

800

% chg 51.7 28.8 17.5 21.4

600

Adj. Net profit 25.2 62.3 89.1 114.4

400

% chg 4.5 147.4 43.1 28.4 200

EBITDA margin (%) 7.9 8.6 7.5 7.5 0

Jul-18

Mar-18

Apr-18

Oct-18

Dec-18

Jan-18

Feb-18

May-18

Jun-18

Aug-18

Sep-18

Nov-18

Jan-19

EPS (`) 8.0 19.8 28.3 36.4

P/E (x) 79.5 32.1 22.5 17.5

P/BV (x) 6.0 2.2 2.1 1.9 Source: Company, Angel Research

RoE (%) 7.5 7.0 9.2 10.8

RoCE (%) 13.3 13.5 12.8 14.9 Amarjeet S Maurya

EV/Sales (x) 1.4 0.9 0.7 0.6 022-40003600 Ext: 6831

EV/EBITDA (x) 17.5 10.4 9.6 7.8 amarjeet.maurya@angelbroking.com

Source: Company, Angel Research Note

Please refer to important disclosures at the end of this report 1

Amber Enterprises India| 3QFY2019 Result Update

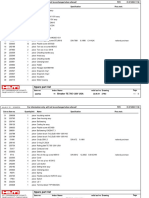

Exhibit 1: 3QFY2019 Performance

Y/E March (` cr) 3QFY19 3QFY18 % chg. (yoy) 2QFY19 % chg. (qoq) 9MFY19 9MFY18 % chg

Net Sales 389 338 15 226 71.8 1,217 1,231 (1.1)

Net raw material 334.0 285.3 17.1 186.1 79.5 1022 1034 (1.2)

(% of Sales) 85.9 84.3 161 82.2 368 84.0 84.0

Employee Cost 10 9 5.4 10 1.2 29 28 6.0

(% of Sales) 2.5 2.8 (23) 4.3 (176) 2.4 2.2

Other Expenses 23 20 15.9 22 5.7 80 67 19.6

(% of Sales) 5.9 5.8 5 9.6 (368) 6.5 5.4

Total Expenditure 367 314 16.7 217 68.7 1,131 1,129 0.2

Operating Profit 22 24 (8.2) 9 148.8 86 102 (16.1)

OPM (%) 5.7 7.1 (143) 3.9 176 7.1 8.3 (126)

Interest 3 17 (79.2) 3 5.5 9.6 39.4 (75.6)

Depreciation 12 11 11.3 12 (0.8) 36.5 31.9 14.6

Other Income 0 4 (93.0) 3 (89.9) 4.1 7.8 (47.3)

PBT before exceptional 7 0 1,352.2 (4) (269.1) 44 39 12.5

(% of Sales) 1.7 0.1 (1.7) 3.6 3.2

Exceptional Items -

PBT 7 0 1,352.2 (4) (269.1) 44 39 12.5

Tax 3 0 708.6 (2) (228.6) 12.9 10.8 19.2

(% of PBT) 42.4 76.1 55.7 29.4 27.8

Reported PAT 4 0 3,400.0 (2) (320.0) 31 28 10.0

PATM 1.0 0.0 (0.8) 2.5 2.3

Extra-ordinary Items

Adj PAT 3.85 0.11 3,400.0 (1.75) (320.0) 31 28 10.0

Source: Company, Angel Research

February 16, 2019 2

Amber Enterprises India| 3QFY2019 Result Update

Profit & Loss Statement

Y/E March (` cr) FY2016 FY2017 FY2018 FY2019E FY2020E

Total operating income 1,089.0 1,651.9 2,128.1 2,500.5 3,034.7

% chg -11.5 51.7 28.8 17.5 21.4

Total Expenditure 975.3 1,521.3 1,944.5 2,313.0 2,807.1

Raw Material 858.5 1,371.2 1,768.8 2,125.4 2,579.5

Personnel 36.5 43.7 49.8 50.0 60.7

Others Expenses 80.3 106.5 125.9 137.5 166.9

EBITDA 113.7 130.5 183.5 187.5 227.6

% chg 10.9 14.8 40.6 2.2 21.4

(% of Net Sales) 10.4 7.9 8.6 7.5 7.5

Depreciation& Amortisation 30.9 40.1 49.0 51.2 54.3

EBIT 82.9 90.4 134.5 136.3 173.3

% chg 7.6 9.1 48.8 1.3 27.2

(% of Net Sales) 7.6 5.5 6.3 5.5 5.7

Interest & other Charges 53.2 63.5 53.8 18.8 21.7

Other Income 3.1 8.8 8.7 10.5 12.6

(% of Sales) 0.3 0.5 0.4 0.4 0.4

Extraordinary Items - - - - -

Share in profit of Associates - - - - -

Recurring PBT 32.7 35.7 89.4 127.9 164.2

% chg -19.0 9.2 150.4 43.1 28.4

Tax 8.6 10.5 27.1 38.8 49.8

PAT (reported) 24.1 25.2 62.3 89.1 114.4

% chg -13.5 4.5 147.4 43.1 28.4

(% of Net Sales) 2.2 1.5 2.9 3.6 3.8

Basic & Fully Diluted EPS (Rs) 7.7 8.0 19.8 28.3 36.4

% chg -13.5 4.5 147.4 43.1 28.4

February 16, 2019 3

Amber Enterprises India| 3QFY2019 Result Update

Balance Sheet

Y/E March (` cr) FY2016 FY2017 FY2018 FY2019E FY2020E

SOURCES OF FUNDS

Equity Share Capital 21.7 23.8 31.4 31.4 31.4

Reserves& Surplus 240.9 311.1 861.3 936.5 1,033.0

Shareholders Funds 262.6 334.9 892.8 968.0 1,064.5

Minority Interest - - - - -

Total Loans 326.6 344.9 105.5 100.0 100.0

Other Liab & Prov 80.8 46.8 64.4 75.7 91.9

Total Liabilities 670.0 726.6 1,062.7 1,143.7 1,256.4

APPLICATION OF FUNDS

Net Block 536.1 577.5 739.8 789.8 839.8

Capital Work-in-Progress 2.0 3.0 4.0 5.0 6.0

Investments - - 5.7 55.7 105.7

Current Assets 533.6 650.4 964.0 1,081.6 1,259.7

Inventories 225.8 267.7 395.6 411.0 498.9

Sundry Debtors 247.9 310.4 378.6 411.0 498.9

Cash 18.4 34.7 133.8 176.3 161.5

Loans & Advances 40.6 37.1 28.3 50.0 60.7

Other Assets 1.0 0.5 27.6 33.1 39.8

Current liabilities 445.0 560.0 665.8 782.3 949.5

Net Current Assets 88.6 90.4 298.2 299.2 310.2

Other Non Current Asset 45.3 58.6 19.1 19.1 20.8

Total Assets 670.0 726.6 1,062.7 1,143.7 1,256.4

February 16, 2019 4

Amber Enterprises India| 3QFY2019 Result Update

Cashflow Statement

Y/E March (`cr) FY2016 FY2017 FY2018 FY2019E FY2020E

Profit before tax 32.7 38.4 89.4 127.9 164.2

Depreciation 30.9 39.7 49.0 51.2 54.3

Change in Working Capital 42.9 (23.3) (67.7) (13.7) (84.8)

Interest / Dividend (Net) - - - - -

Direct taxes paid (10.5) (9.0) (27.1) (38.8) (49.8)

Others (56.2) (52.7) (38.8) (5.4) 9.1

Cash Flow from Operations 152.2 98.5 82.4 132.1 74.8

(Inc.)/ Dec. in Fixed Assets (101.2) (82.0) (162.2) (50.0) (50.0)

(Inc.)/ Dec. in Investments 1.4 0.8 - - -

Cash Flow from Investing (83.9) (89.7) (162.2) (50.0) (50.0)

Issue of Equity - 50.0 505.3 - -

Inc./(Dec.) in loans 150.6 46.4 (239.4) (5.5) -

Others 218.5 97.6 63.6 32.8 39.6

Cash Flow from Financing (67.9) (1.2) 202.3 (38.3) (39.6)

Inc./(Dec.) in Cash 0.4 7.6 122.5 43.8 (14.8)

Opening Cash balances 2.0 2.4 10.0 132.5 176.3

Closing Cash balances 2.4 10.0 132.5 176.3 161.5

February 16, 2019 5

Amber Enterprises India| 3QFY2019 Result Update

Key Ratio

Y/E March FY16 FY17 FY18E FY19E FY20E

Valuation Ratio (x)

P/E (on FDEPS) 83.1 79.5 32.1 22.5 17.5

P/CEPS 18.8 16.8 8.2 6.0 4.8

P/BV 7.6 6.0 2.2 2.1 1.9

Dividend yield (%) - - - -

EV/Sales 2.1 1.4 0.9 0.7 0.6

EV/EBITDA 20.0 17.5 10.4 9.6 7.8

EV / Total Assets 3.4 3.1 1.8 1.6 1.4

Per Share Data (`)

EPS (Basic) 7.7 8.0 19.8 28.3 36.4

EPS (fully diluted) 7.7 8.0 19.8 28.3 36.4

Cash EPS 33.9 37.9 77.9 105.4 131.7

Book Value 83.5 106.5 283.9 307.8 338.5

Returns (%)

ROCE 14.1 13.3 13.5 12.8 14.9

Angel ROIC (Pre-tax) 13.7 13.9 15.9 16.3 19.0

ROE 9.2 7.5 7.0 9.2 10.8

Turnover ratios (x)

Asset Turnover (Gross Block) 2.3 2.9 3.8 4.1 4.6

Inventory / Sales (days) 76 59 68 60 60

Receivables (days) 83 69 65 60 60

Payables (days) 95 99 98 98 98

Working capital cycle (ex-cash) (days) 64 29 35 22 22

Source: Company, Angel Research

February 16, 2019 6

Amber Enterprises India| 3QFY2019 Result Update

Research Team Tel: 022 - 39357800 E-mail: research@angelbroking.com Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement Amber Enterprises India

1. Financial interest of research analyst or Angel or his Associate or his relative No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives No

3. Served as an officer, director or employee of the company covered under Research No

4. Broking relationship with company covered under Research No

Ratings (Returns): Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%)

Reduce (-5% to -15%) Sell (< -15%)

February 16, 2019 7

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Incoming Passenger Card Australia EditableDocument2 pagesIncoming Passenger Card Australia EditableINDERPREETNo ratings yet

- Anti-Piracy ManualDocument37 pagesAnti-Piracy ManualAsian Dredgers LtdNo ratings yet

- Coal India LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument2 pagesCoal India LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Update On Government Stimulus Package - Part 1 - Size of Economic Package, Stock Recommendations, Total Stimulus Etc - Angel BrokingDocument4 pagesUpdate On Government Stimulus Package - Part 1 - Size of Economic Package, Stock Recommendations, Total Stimulus Etc - Angel Brokingmoisha sharmaNo ratings yet

- Aurobindo Pharma LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument10 pagesAurobindo Pharma LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Avenue Supermarts LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument8 pagesAvenue Supermarts LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Vindhya Telelinks LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument2 pagesVindhya Telelinks LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Nestle India LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument4 pagesNestle India LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Reliance Industries Rights Issue Update - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument2 pagesReliance Industries Rights Issue Update - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- KEI Industries LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument8 pagesKEI Industries LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Auto - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument6 pagesAuto - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Bata India LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument8 pagesBata India LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- AngelTopPicks (April 2020) - List of Company Profiles, Performance Report, Stock Info & Key Financials - Angel BrokingDocument10 pagesAngelTopPicks (April 2020) - List of Company Profiles, Performance Report, Stock Info & Key Financials - Angel Brokingmoisha sharmaNo ratings yet

- Sun Pharmaceuticals Industries LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument6 pagesSun Pharmaceuticals Industries LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- V I P Industries LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument4 pagesV I P Industries LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Parag Milk Foods LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument8 pagesParag Milk Foods LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Mahindra & Mahindra LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument8 pagesMahindra & Mahindra LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Axis Bank LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument7 pagesAxis Bank LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Inox Wind LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument7 pagesInox Wind LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- ICICI Bank LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument6 pagesICICI Bank LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Amber Enterprises India LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument7 pagesAmber Enterprises India LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Blue Star LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument9 pagesBlue Star LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Maruti Suzuki India LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument8 pagesMaruti Suzuki India LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Ashok Leyland LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument8 pagesAshok Leyland LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Affle (India) LTD - Company Profile, Issue Details, Balance Sheet & Key Ratios - Angel BrokingDocument8 pagesAffle (India) LTD - Company Profile, Issue Details, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Sterling & Wilson Solar LTD - Company Profile, Issue Details, Balance Sheet & Key Ratios - Angel BrokingDocument6 pagesSterling & Wilson Solar LTD - Company Profile, Issue Details, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- IRCTC - Company Profile, Issue Details, Balance Sheet & Key Ratios - Angel BrokingDocument8 pagesIRCTC - Company Profile, Issue Details, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Spandana Sphoorty Financial Limited - Company Profile, Issue Details, Balance Sheet & Key Ratios - Angel BrokingDocument7 pagesSpandana Sphoorty Financial Limited - Company Profile, Issue Details, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Safari Industries (India) LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument8 pagesSafari Industries (India) LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- CSB Bank - Company Profile, Issue Details, Balance Sheet & Key Ratios - Angel BrokingDocument7 pagesCSB Bank - Company Profile, Issue Details, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Prince Pipes & Fittings Limited - Company Profile, Issue Details, Balance Sheet & Key Ratios - Angel BrokingDocument8 pagesPrince Pipes & Fittings Limited - Company Profile, Issue Details, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Ujjivan Small Finance Bank - Company Profile, Issue Details, Balance Sheet & Key Ratios - Angel BrokingDocument7 pagesUjjivan Small Finance Bank - Company Profile, Issue Details, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Cariño v. Insular GovernmentDocument5 pagesCariño v. Insular GovernmentJuris PrudenceNo ratings yet

- PNB Vs CA (83 SCRA 237)Document1 pagePNB Vs CA (83 SCRA 237)sherrylmelgarNo ratings yet

- Crash Course: Wolf Girl 7 by Anh Do Chapter SamplerDocument10 pagesCrash Course: Wolf Girl 7 by Anh Do Chapter SamplerAllen & UnwinNo ratings yet

- TR 101968 T1V1Document128 pagesTR 101968 T1V1euric82No ratings yet

- Kitzur Shulchan Aruch - Notes 1Document5 pagesKitzur Shulchan Aruch - Notes 1Daville BulmerNo ratings yet

- Best Judgment TC05266Document7 pagesBest Judgment TC05266SifuOktarNo ratings yet

- Rem2 Case Digests on Provisional Remedies Rules 57 to 61Document8 pagesRem2 Case Digests on Provisional Remedies Rules 57 to 61Vince AbucejoNo ratings yet

- EASFTemplateDocument20 pagesEASFTemplatefuckoffNo ratings yet

- Esys Vs NtanDocument3 pagesEsys Vs Ntantonmoy619No ratings yet

- Ar 135-178 Enlisted Administrative SeparationsDocument111 pagesAr 135-178 Enlisted Administrative SeparationsMark CheneyNo ratings yet

- NA To SS en 1993-1!1!2010 - PreviewDocument8 pagesNA To SS en 1993-1!1!2010 - Previewiniyan 1998No ratings yet

- 4 - Is Democracy A FailureDocument8 pages4 - Is Democracy A FailureSaqib Shuhab SNo ratings yet

- Noli Me Tangere Buod NG Buong KwentoDocument11 pagesNoli Me Tangere Buod NG Buong KwentoLian B. Insigne67% (3)

- Red670 1.2Document1,232 pagesRed670 1.2André SuzukiNo ratings yet

- Thefold64 Fractal Pyramid Ikegami 0Document15 pagesThefold64 Fractal Pyramid Ikegami 0kevybNo ratings yet

- Latin Words N MaximsDocument38 pagesLatin Words N MaximsJoly_M_Hubilla_2759No ratings yet

- Elastic Deformation PresentationDocument13 pagesElastic Deformation PresentationHiba AbeerNo ratings yet

- Subsea Connectivity Leaders GatherDocument7 pagesSubsea Connectivity Leaders GatherAnonymous TVdKmkNo ratings yet

- Spare Part List: Breaker TE 705 120V USADocument7 pagesSpare Part List: Breaker TE 705 120V USAJoseLuisCarrilloMenaNo ratings yet

- Queen Elizabeth II: A Life of Service and DutyDocument3 pagesQueen Elizabeth II: A Life of Service and DutyDenisa NeagoeNo ratings yet

- Araling Panlipunan Key Words DebateDocument5 pagesAraling Panlipunan Key Words DebateJohn Paul SandovalNo ratings yet

- About The Canon - Encyclopaedia Judaica (Vol. III)Document17 pagesAbout The Canon - Encyclopaedia Judaica (Vol. III)Arllington R. F. da CostaNo ratings yet

- Canoreco v. Torres GR 127249 2-27-1998Document10 pagesCanoreco v. Torres GR 127249 2-27-1998HjktdmhmNo ratings yet

- Dulalia vs. CruzDocument6 pagesDulalia vs. CruzAdrianne BenignoNo ratings yet

- SHS LESSON 6 Ownership and OrganizationDocument9 pagesSHS LESSON 6 Ownership and OrganizationPaul AnteNo ratings yet

- Registration Form CRO0601096-IPCDocument2 pagesRegistration Form CRO0601096-IPCHimanshi VohraNo ratings yet

- Memorials of The RespondentDocument25 pagesMemorials of The RespondentBhavesh BhattNo ratings yet

- Far Beyond Defensive TacticsDocument203 pagesFar Beyond Defensive Tacticslesuts100% (4)